AI background checks have evolved from experimental technology to increasingly adopted HR tools, with many mid-sized companies implementing automated screening systems to potentially improve screening efficiency and consistency. As we enter 2026, the focus has shifted from whether to adopt automation to how organizations can integrate intelligent screening systems into existing workflows while maintaining strict compliance with FCRA requirements and reducing unconscious bias in hiring decisions.

Key Takeaways

- AI-powered background screening technology has evolved significantly, with many systems designed to process verification requests faster than traditional manual methods when properly configured and maintained for FCRA compliance.

- Mid-sized companies with 50-500 employees can now access automated employment screening solutions that were once primarily available to larger enterprises, though ROI timelines vary based on implementation scope, organizational needs, and screening volume.

- Machine learning algorithms can identify data discrepancies and flag incomplete records in real time, potentially reducing average background check turnaround times for standard screenings when systems are properly implemented.

- Continuous background monitoring systems provide ongoing updates about employee records rather than single point-in-time assessments, creating new compliance considerations under FCRA adverse action requirements.

- Background screening API integration allows HR teams to embed verification workflows directly into applicant tracking systems, which may reduce manual data entry and administrative burden depending on system compatibility and configuration.

- Bias reduction technologies in candidate screening aim to help employers focus on job-relevant conviction records while filtering out information that may trigger discriminatory decision-making, though effectiveness varies by implementation.

- Automated systems require careful configuration to respect state-specific ban-the-box laws, lookback period limitations, and varying restrictions on arrest records versus conviction records across different jurisdictions.

- The total cost of implementing AI background check infrastructure varies significantly based on organizational size, screening volume, vendor selection, and integration complexity, with mid-sized companies typically investing between $8,000 and $25,000 annually.

The Evolution From Manual to Intelligent Background Screening

Background check automation for HR teams has fundamentally transformed over the past three years. What began as simple data aggregation tools has evolved into sophisticated systems capable of cross-referencing multiple databases, identifying potential discrepancies, and flagging records requiring human review. Traditional background screening processes required HR personnel to manually submit requests, track progress across multiple vendors, interpret complex court records, and ensure compliance with varying state and local regulations.

This approach created bottlenecks that extended time-to-hire, increased administrative costs, and introduced consistency problems when different team members applied varying standards to similar situations. Automated employment screening solutions address these challenges by standardizing workflows, applying consistent decision frameworks, and accelerating routine verification tasks. The technology handles the repetitive elements of background screening while preserving human judgment for nuanced situations that require individualized assessment, particularly when considering adverse action decisions under FCRA requirements.

From Novelty to Necessity

The narrative surrounding AI in employment screening has shifted dramatically. In 2023 and 2024, many organizations viewed these tools as experimental technologies requiring extensive pilot programs and cautious evaluation. By late 2025 and into 2026, the conversation has moved to implementation best practices, integration strategies, and optimization techniques.

This maturation reflects several important factors:

- Regulatory clarity: Agencies like the Federal Trade Commission and Equal Employment Opportunity Commission have issued statements addressing automated decision-making in employment contexts.

- Technology refinement: Providers have improved their systems based on real-world feedback from thousands of implementations across diverse industries.

- Competitive pressure: The need to reduce time-to-hire has made screening efficiency a strategic priority rather than an operational nice-to-have.

Mid-sized companies increasingly evaluate whether background screening automation aligns with their talent acquisition strategies, particularly as industry adoption of these technologies continues to grow.

Understanding the Technology Stack

AI-powered background screening encompasses several distinct technologies working together. Natural language processing algorithms parse court records and employment histories, extracting relevant information from unstructured documents. Machine learning models identify patterns that suggest data inconsistencies or require additional verification.

Automated workflows route cases through appropriate channels based on predefined criteria, ensuring that simple verifications process quickly while complex situations receive proper attention. These systems do not replace human decision-making in legally sensitive areas.

How to Streamline Background Check Process: Practical Implementation

Implementing candidate screening technology requires careful planning that balances efficiency gains against compliance obligations and operational realities. Organizations that achieve the best results follow structured approaches rather than attempting to automate everything simultaneously. Success depends on thorough preparation, realistic timelines, and clear communication with all stakeholders.

Assessing Current State and Defining Objectives

Before selecting any technology, HR teams must document their existing screening processes in detail. How many background checks does the organization conduct monthly? What types of verifications are required for different positions?

| Assessment Area | Key Questions | Documentation Required |

| Volume Analysis | Monthly screening volume, seasonal variations, growth projections | Historical check counts by position type and department |

| Process Mapping | Current turnaround times, approval workflows, vendor relationships | Step-by-step process documentation with time estimates |

| Pain Point Identification | Where do delays occur, error patterns, compliance concerns | Incident logs, delayed case examples, compliance audit findings |

| Technology Inventory | Existing HR systems, integration capabilities, data security protocols | Current tech stack documentation, API availability, security certifications |

This assessment reveals which pain points automation can most effectively address. Clear objectives create measurable success criteria rather than vague goals like "faster screening."

Selecting Systems That Integrate With Existing Infrastructure

Background screening API integration capabilities determine how smoothly automated systems fit into current workflows. Organizations already using applicant tracking systems, human resources information systems, or other HR technology need solutions that communicate effectively with these platforms. Well-designed APIs allow background check requests to initiate automatically when candidates reach specific stages in the hiring workflow.

Results flow back into the applicant tracking system without manual data entry, updating candidate records and triggering next-step actions. This integration eliminates duplicate data entry, reduces transcription errors, and ensures that all candidate information remains centralized. However, integration complexity varies significantly based on the maturity of existing systems and the sophistication of available connectors.

Configuring Compliance Guardrails

Automated systems must incorporate FCRA requirements, state-specific regulations, and local ordinances into their decision logic. This configuration represents one of the most critical and complex aspects of implementation. At the federal level, systems must ensure that background checks are only conducted for permissible purposes as defined by FCRA.

Key compliance configuration elements include:

- Authorization management: Automated generation of compliant disclosure documents and tracking of candidate consent status.

- Adverse action workflows: Systematized pre-adverse action notices, required waiting periods, and final adverse action documentation.

- Jurisdiction detection: Automatic identification of which laws apply based on job location, candidate location, or both.

- Record filtering: Application of state-specific restrictions on arrest records, conviction lookback periods, and salary history inquiries.

- Audit trails: Comprehensive logging of all screening decisions, timing, and communications for compliance verification.

Organizations should consult with legal counsel familiar with employment law and FCRA requirements when configuring automated screening systems, as compliance needs vary by industry, jurisdiction, and specific business circumstances.

Machine Learning in Employment Verification: Accuracy and Speed

Machine learning algorithms excel at pattern recognition tasks that consume significant human time in traditional background screening. These capabilities translate into faster processing and improved accuracy when properly implemented. The technology has advanced to the point where it can handle complex document analysis, anomaly detection, and data validation with minimal human intervention for routine cases.

Intelligent Document Processing

Employment verification often requires reviewing documents like W-2 forms, pay stubs, or employment letters. Machine learning models trained on thousands of examples can extract relevant information from these documents automatically, identifying employer names, employment dates, job titles, and compensation details. This optical character recognition technology has advanced significantly in recent years.

Modern systems are designed to handle variations in document formats, poor image quality, and some handwritten annotations. When the algorithm encounters information it cannot confidently extract, it flags the document for human review rather than making potentially incorrect assumptions. Processing times vary based on document quality and system capabilities, though automation often reduces the time required compared to manual document review.

Anomaly Detection and Data Validation

Machine learning models can identify inconsistencies that suggest errors or potential fraud. If a candidate's stated employment dates overlap with enrollment at an educational institution across the country, the system flags this discrepancy for verification. These anomaly detection capabilities do not prove fraud or disqualify candidates automatically.

They simply direct human attention to cases most likely to benefit from additional verification, allowing HR teams to allocate their time effectively. Data validation extends beyond fraud detection to include:

- Completeness checks: Identifying missing information or incomplete records before processing begins.

- Format validation: Ensuring dates, addresses, and identifiers conform to expected patterns.

- Cross-reference analysis: Comparing information across multiple data sources for consistency.

- Timeline verification: Detecting gaps or overlaps in employment and education histories that require explanation.

Simple, straightforward verifications process automatically, while complex situations receive appropriate human judgment.

Continuous Learning and Improvement

Well-designed machine learning systems improve over time as they process more data. When human reviewers correct an algorithm's interpretation or provide feedback on flagged cases, that information refines the model's future performance. However, continuous learning requires careful governance to prevent algorithmic bias.

Real-Time Background Check Updates and Continuous Monitoring

Continuous background monitoring systems represent a significant evolution in employment screening philosophy. Traditional background checks provide a single snapshot of a candidate's records at one point in time. In contrast, continuous monitoring provides ongoing updates throughout the employment relationship, creating both opportunities and compliance challenges for employers.

How Continuous Monitoring Works

After the initial background check, continuous monitoring systems periodically query relevant databases for new records associated with the employee. If a new criminal conviction appears, a professional license faces disciplinary action, or other significant changes occur, the system alerts the employer. The monitoring frequency and scope vary based on employer preferences and job requirements.

| Monitoring Type | Update Frequency | Common Use Cases | Compliance Considerations |

| Criminal records | Weekly to monthly | Safety-sensitive positions, healthcare, financial services | State-specific restrictions on record types and lookback periods |

| Professional licenses | Monthly to quarterly | Licensed professionals, regulated industries | Verification that monitoring scope matches job requirements |

| Driving records | Monthly to quarterly | Positions requiring vehicle operation, commercial drivers | Alignment with DOT requirements where applicable |

| Credit monitoring | Quarterly to annually | Financial authority positions, executive roles | FCRA permissible purpose limitations and state credit check restrictions |

The technology enables customization that was impractical with manual processes. Employers can tailor monitoring to specific risks associated with particular roles rather than applying one-size-fits-all approaches.

FCRA Compliance Considerations for Ongoing Monitoring

Continuous monitoring creates unique compliance obligations under FCRA. The initial background check and ongoing monitoring constitute separate consumer reports, each requiring proper authorization from the employee. Employers cannot simply extend initial authorization indefinitely but must obtain specific consent for continuous monitoring and clearly explain the practice.

When monitoring reveals information that might lead to adverse employment action, the same FCRA procedures apply. The employer must provide pre-adverse action notice, a copy of the consumer report showing the new information, a summary of FCRA rights, and reasonable time for the employee to dispute the information before taking final action. Many employees facing adverse action based on continuous monitoring results are surprised by the process, having forgotten about the initial authorization.

Continuous background monitoring involves heightened legal complexity and compliance obligations beyond initial background checks. Organizations considering this practice should consult with legal counsel to ensure proper authorization procedures, evaluate whether monitoring scope is genuinely job-related and consistent with business necessity, and establish clear protocols for handling adverse action situations. Some states are actively examining continuous monitoring practices, and regulatory guidance in this area continues to evolve.

Balancing Efficiency With Employee Privacy

Continuous monitoring raises privacy considerations that extend beyond strict legal compliance. While the practice is legal when properly authorized, employees may perceive it as intrusive surveillance, potentially affecting morale and trust. Organizations implementing continuous monitoring should clearly communicate the practice's business justification, particularly for positions involving safety-sensitive responsibilities, financial authority, or access to vulnerable populations.

Transparency about which employees are subject to monitoring, what records are reviewed, and how information is used helps maintain trust. Some companies limit continuous monitoring to positions where ongoing verification genuinely relates to job responsibilities rather than implementing universal monitoring. This targeted approach balances risk management with employee privacy expectations and demonstrates respect for employee privacy while maintaining necessary oversight.

Bias Reduction in Candidate Screening: Technology as a Tool for Fairness

The relationship between AI tools and bias in background screening is complex and subject to ongoing debate. While some organizations implement automated systems with the goal of creating more consistent evaluation processes, these same technologies can perpetuate or amplify bias if not carefully designed, monitored, and adjusted. The effectiveness of any approach depends heavily on how automation interacts with existing decision-making processes, the quality of data used to train systems, and the rigor of ongoing fairness audits.

Structured Decision Frameworks

Automated systems enforce consistent evaluation criteria across all candidates. When properly configured, they ensure that all applicants are assessed against the same standards regardless of the reviewer's personal biases, fatigue level, or other factors that introduce inconsistency in manual processes. For criminal record evaluation, structured frameworks help employers focus on job-relevant convictions while filtering out information that may trigger discriminatory reactions but has no legitimate relationship to job responsibilities.

Rather than presenting reviewers with complete criminal histories that might include minor offenses from many years ago, the system can highlight only records that meet predefined relevance criteria. This approach aligns with EEOC guidance encouraging individualized assessment of criminal records. Employers should consider the nature of the offense, the time elapsed since the conviction, and the nature of the job before making employment decisions.

Reducing Adverse Impact

Certain screening practices disproportionately affect protected demographic groups, creating potential liability under Title VII of the Civil Rights Act even when applied uniformly to all candidates. For example, blanket policies excluding anyone with any criminal record may have disparate impact on certain racial groups. Automated systems can help organizations avoid these problematic approaches by implementing more nuanced policies.

Rather than automatic disqualification based on any criminal record, the technology can route cases to human decision-makers with information highlighting job-relevant factors and prompting individualized assessment. Regular adverse impact analysis becomes more feasible with automated systems:

- Tracking disqualification patterns: Monitoring which screening criteria result in candidate elimination at each hiring stage.

- Demographic analysis: Evaluating whether criteria affect protected groups disproportionately compared to overall applicant pools.

- Policy adjustment: Using data insights to refine screening criteria that show adverse impact without business necessity.

- Documentation standards: Maintaining detailed records of individualized assessments to demonstrate fair consideration.

Important: Implementing automated screening does not, by itself, eliminate disparate impact liability. Employers remain responsible for ensuring that all screening criteria are job-related and consistent with business necessity, regardless of whether those criteria are applied manually or through automated systems. Regular adverse impact analysis should be conducted with guidance from legal counsel or industrial-organizational psychologists with expertise in employment testing.

The Limitations of Algorithmic Fairness

Technology alone cannot eliminate bias from employment screening. Algorithms trained on historical data may learn to replicate discriminatory patterns embedded in that data. Systems designed without diverse input may fail to account for ways that seemingly neutral criteria affect different groups differently.

Responsible implementation requires ongoing monitoring and adjustment. Organizations should regularly audit their screening outcomes for disparate impact, review the criteria their systems use, and adjust configurations when analysis reveals fairness concerns. The goal is not perfect algorithmic neutrality, which may be impossible, but continuous improvement toward more equitable screening practices.

Integration Challenges and Solutions for Mid-Sized Organizations

Mid-sized companies face unique challenges implementing AI background checks compared to large enterprises with extensive IT resources or small businesses with simple requirements. These organizations must balance the sophistication needed for effective automation against the practical constraints of limited technical staff and moderate budgets. Success requires careful vendor selection, realistic implementation planning, and strong change management.

Technical Resource Constraints

Organizations with 50-500 employees often lack dedicated IT staff focused on HR systems. Background screening automation must work reliably without constant technical oversight. This constraint makes vendor selection critical, as solutions requiring extensive custom coding, frequent manual intervention, or specialized technical knowledge to maintain will fail in these environments.

The most successful implementations for mid-sized companies involve systems designed for ease of use with strong vendor support:

- Pre-built integrations: Connectors for popular HR platforms that eliminate custom development work.

- Intuitive interfaces: Configuration tools that HR professionals can use without IT involvement for routine adjustments.

- Cloud-based delivery: Systems that require no on-premise server infrastructure or maintenance.

- Responsive support: Vendor teams that provide timely assistance when issues arise during implementation and ongoing operation.

Organizations should evaluate vendor support quality including training resources, documentation clarity, and assigned account management during the selection process.

Budget Considerations and ROI Measurement

Mid-sized companies must justify technology investments carefully. Unlike enterprises that can absorb experimental technologies in large budgets, these organizations need clear ROI within reasonable timeframes. Calculating background screening ROI involves both direct cost savings and opportunity costs.

| Cost Category | Manual Process (200-300 checks/year) | Automated Process | Typical Savings Range |

| Per-check vendor fees | $35-75 per check | $25-55 per check | Variable by vendor and volume |

| HR administrative time | 45-90 minutes per check | 10-25 minutes per check | Depends on system efficiency |

| Error correction | 8-12% may require rework | 2-4% may require rework | Varies by implementation quality |

| Technology/platform costs | Minimal or included in vendor fees | $3,000-8,000 annually | Depends on features selected |

| Total annual cost | $15,000-40,000 | $8,000-25,000 | Highly variable by organization |

Note: Cost figures shown are illustrative examples based on general industry observations and will vary significantly based on screening scope, vendor selection, organizational complexity, integration requirements, and geographic factors. Organizations should obtain specific quotes and conduct their own cost-benefit analysis rather than relying on generalized estimates.

Additional value from faster hiring and better consistency can justify even higher initial costs. Organizations should establish clear metrics before implementation and track them consistently.

Change Management and Staff Training

Technology implementation fails when users resist new systems or lack proper training. HR teams comfortable with familiar manual processes may view automation skeptically, particularly if implementation is announced rather than collaboratively planned. Successful change management involves HR staff in vendor selection and configuration decisions.

Demonstrate how automation eliminates frustrating repetitive tasks rather than threatening job security. Provide thorough training on new systems before go-live, and maintain strong support during the transition period when staff are learning new workflows. Some organizations implement automation gradually rather than switching entirely at once, allowing teams to build confidence with routine cases before handling complex situations through the new system.

Regulatory Compliance in an Automated Environment

Background check automation does not reduce compliance obligations. If anything, the speed and scale that automation enables make compliance frameworks more important. Organizations must ensure that efficiency gains do not come at the expense of required legal procedures. Proper system configuration and ongoing monitoring become essential risk management activities.

FCRA Adverse Action Procedures

Automated systems must preserve all FCRA required procedures when background checks reveal information that might lead to adverse employment decisions. The system should generate proper pre-adverse action notices including a copy of the consumer report and summary of rights. It should track time periods to ensure candidates have reasonable opportunity to dispute information before final decisions.

Documentation of final adverse action notices must be maintained if the employer proceeds with the negative decision. However, automation cannot replace human judgment in the decision itself:

- Individual assessment requirement: Employers must conduct case-by-case evaluations considering the nature and gravity of offenses, time elapsed, and job relevance.

- Human decision authority: Algorithms cannot make final employment decisions based on background check results under FCRA.

- Dispute resolution: Candidates who challenge report accuracy must receive proper investigation and response.

- Documentation standards: Records must demonstrate that required procedures were followed and decisions were based on legitimate, non-discriminatory factors.

This analysis requires human judgment that algorithms cannot replicate, particularly for non-obvious situations.

Jurisdiction-Specific Compliance

State and local background check laws vary significantly, creating complex compliance challenges for organizations hiring across multiple locations. Automated systems should include functionality to apply jurisdiction-specific rules based on the job location, candidate location, or both depending on the applicable legal standard. Ban-the-box laws affect when criminal history questions can be asked during the hiring process.

Some jurisdictions prohibit inquiries until after a conditional job offer, while others allow questions earlier but prohibit automatic disqualification. Lookback period limitations restrict how far back employers can consider various types of records. Seven-year lookback periods are common for criminal convictions in many states, though exceptions often apply for higher-paid positions or specific industries.

Maintaining Compliance as Laws Change

Background check regulations evolve constantly as states and municipalities enact new restrictions. Automated systems must be updated to reflect these changes, creating ongoing vendor management responsibilities. Organizations should establish clear accountability for monitoring relevant legal changes and ensuring system configurations remain current.

Many companies rely on their technology vendors to track regulatory updates and adjust system rules accordingly. However, smart practice involves independent verification rather than complete reliance on vendor updates. Legal counsel or compliance specialists should periodically review system configurations against current law to identify any gaps or necessary adjustments.

Measuring Success: Metrics That Matter

The following metrics represent common measurement approaches organizations use to evaluate background screening automation. Actual results vary widely based on numerous factors including organizational size, screening complexity, vendor capabilities, implementation quality, and baseline efficiency of previous processes. Organizations should establish their own success criteria based on specific business objectives rather than expecting to achieve any particular benchmark.

Time-to-Hire and Screening Turnaround

The most obvious metric is how long background checks take from initiation to completion. Automated systems may reduce average turnaround compared to manual processes, though improvement varies based on check types and verification scope. Time-to-hire measurement should extend beyond screening turnaround to assess how faster background checks affect overall hiring timelines.

If background screening delays compress while overall time-to-hire remains unchanged, efficiency gains may not be translating to business value. Investigate where new bottlenecks are forming and address them systematically. Track these metrics by position type, department, and time period to identify patterns and opportunities.

Administrative Efficiency and Cost Per Check

Calculate how many hours HR staff spend on background screening activities before and after automation. Include time for data entry, follow-up on pending checks, reviewing results, generating adverse action notices, and tracking compliance. Multiply saved hours by fully loaded HR staff costs to quantify administrative efficiency gains.

Cost per check should account for all expenses:

- Vendor fees: Charges per screening or subscription costs for access to verification services.

- Technology costs: Platform fees, API integration expenses, and system maintenance.

- Administrative time: HR staff hours spent managing screening processes multiplied by compensation rates.

- IT support: Technical resources required for system maintenance and troubleshooting.

Compare total costs divided by number of checks before and after implementation to assess whether automation reduced per-unit costs.

Quality Metrics and Compliance Tracking

Automation may improve screening accuracy by reducing manual data entry errors, ensuring consistent standards, and flagging discrepancies more reliably. Measure error rates by tracking how often background check results require correction after completion. Track incomplete screenings that must be restarted due to missing information, as this indicates problems with initial data collection or process design.

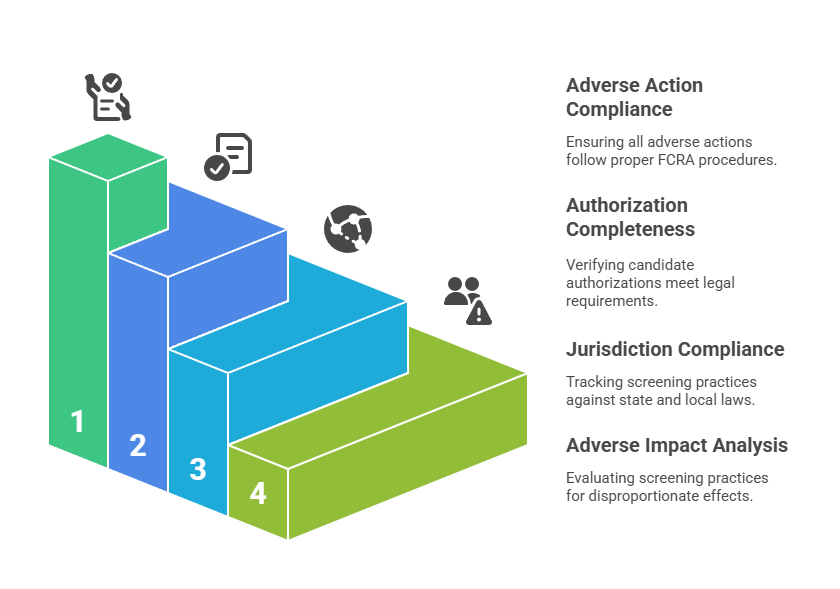

Compliance metrics ensure that automation supports rather than undermines legal requirements:

- Adverse action procedure compliance: Percentage of adverse actions that followed proper FCRA procedures including notices, waiting periods, and documentation.

- Authorization completeness: Rate at which candidate authorizations meet current legal requirements for disclosure and consent.

- Jurisdiction-specific compliance: Tracking of screening practices against applicable state and local laws for each hiring location.

- Adverse impact analysis: Regular evaluation of whether screening practices disproportionately affect protected demographic groups.

Calculate selection rates by demographic characteristics and assess whether differences exceed thresholds suggesting potential disparate impact requiring further investigation.

Conclusion

As AI-powered background screening becomes more accessible, the differentiator is no longer speed alone but how thoughtfully automation is implemented. Organizations that succeed will be those that pair intelligent workflows with strong compliance guardrails, human oversight, and ongoing monitoring for fairness and accuracy. In this environment, automation is most effective not as a replacement for judgment, but as infrastructure that enables more consistent, defensible, and transparent hiring decisions.

Frequently Asked Questions

How long does it take to implement AI background check systems for a mid-sized company?

Implementation timelines typically range from 4 to 12 weeks depending on integration complexity and organizational readiness. Organizations with existing applicant tracking systems and clearly defined screening policies often complete implementation in 4-6 weeks. Companies requiring extensive API integration or complex compliance configurations may need 10-12 weeks. Implementation includes vendor selection, technical integration, system configuration, staff training, and testing.

Do automated background screening systems comply with FCRA adverse action requirements?

Properly designed systems facilitate FCRA compliance by standardizing required procedures, but they do not eliminate employer responsibilities. Automation can generate pre-adverse action notices, track waiting periods, and produce final adverse action notices. However, employers remain responsible for individualized assessment decisions that cannot be delegated to algorithms. Organizations should consult with legal counsel to ensure their specific implementation and procedures meet all FCRA requirements.

Can machine learning reduce bias in candidate screening processes?

The impact of machine learning on bias in screening is debated and varies significantly by implementation. Some structured decision frameworks may support more consistent evaluation, but automated systems can also perpetuate or amplify bias. Algorithms trained on historical data may replicate discriminatory patterns. Regular audits analyzing outcomes by protected demographic characteristics are essential to identify and correct algorithmic bias.

How does continuous background monitoring work and is it legal?

Continuous monitoring involves periodic automated queries of relevant databases throughout an employee's tenure rather than conducting a single background check at hire. This practice is legal when employers obtain proper authorization specifically for ongoing monitoring, separate from initial background check consent. FCRA requires clear disclosure of continuous monitoring practices and proper adverse action procedures when monitoring reveals information leading to employment decisions. State laws may impose additional restrictions beyond federal requirements.

What is the typical return on investment timeline for background screening automation?

ROI timelines for background screening automation vary widely, with some mid-sized organizations reporting positive returns within the first year while others require longer implementation and optimization periods. Direct cost savings from reduced HR administrative time and lower per-check expenses offset technology costs at different rates depending on screening volume, implementation quality, and baseline efficiency. Organizations conducting higher volumes of background checks may achieve faster ROI since per-check savings accumulate more quickly.

How do automated systems handle varying state and local background check laws?

Advanced screening platforms include jurisdiction detection and rule engine capabilities that automatically apply location-specific legal requirements. The system identifies which laws govern each screening based on job location, candidate location, or both depending on the legal standard. It then applies appropriate restrictions such as ban-the-box timing requirements, lookback period limitations, arrest versus conviction record filters, and salary history inquiry prohibitions. This functionality requires regular updates as regulations change.

What background screening API integration capabilities should HR teams prioritize?

Essential integration capabilities include bidirectional data exchange with applicant tracking systems allowing automatic check initiation and results flow without manual data entry. Real-time status updates keep HR teams informed within existing systems. Automated candidate communication features send authorization requests and required FCRA notices without manual generation. Webhook functionality enables event-driven workflows where specific outcomes trigger predetermined next steps. Pre-built connectors for popular HR platforms significantly reduce implementation complexity.

Can small teams at mid-sized companies manage AI screening systems without dedicated IT support?

Modern background screening platforms designed for the mid-market prioritize ease of use specifically because these organizations lack extensive IT resources. Intuitive configuration interfaces allow HR professionals to adjust settings without technical expertise. Pre-built integrations eliminate custom development requirements. Cloud-based delivery means no server infrastructure to maintain. Organizations should carefully evaluate their internal capabilities and vendor support quality during the selection process to ensure adequate resources for successful implementation and ongoing management.

How should organizations prepare employees for continuous background monitoring implementation?

Transparent communication is essential for maintaining trust when implementing continuous monitoring. Employers should clearly explain the business justification, specify which employees are subject to monitoring, describe what records are reviewed and how frequently, and outline what happens if new information appears. Written policies should document these practices. During implementation, affected employees must provide proper authorization specifically for ongoing monitoring, separate from initial background check consent. Limiting monitoring to positions where verification directly relates to job responsibilities balances risk management with privacy expectations.

Additional Resources

- Fair Credit Reporting Act: Full Text and Official Guidance

https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act - EEOC Guidance on Arrest and Conviction Records in Employment Decisions

https://www.eeoc.gov/laws/guidance/arrest-and-conviction-records - FTC Background Screening Compliance Resources

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-employers-need-know - National Conference of State Legislatures: Background Checks for Employment

https://www.ncsl.org/labor-and-employment/background-checks-and-employment - U.S. Department of Labor: Hiring and Background Checks

https://www.dol.gov/general/topic/hiring

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.