North Carolina's position as the second-largest banking center in the United States demands specialized background screening protocols that go far beyond standard employment checks. Financial institutions operating in Charlotte's banking corridor and throughout the state must navigate complex FDIC requirements, FCRA compliance standards, and fiduciary responsibilities while maintaining efficient hiring processes in one of the nation's most competitive talent markets.

Key Takeaways

- North Carolina hosts over 170 financial institutions as the second-largest U.S. banking hub, creating heightened regulatory scrutiny for employment screening.

- Financial background checks must comply with FDIC Section 19, which prohibits hiring individuals with certain criminal convictions without prior written consent.

- Charlotte banking employment screening includes seven-year criminal history searches, credit reports, employment verification, and specialized regulatory database checks.

- Credit union hiring checks require adherence to both federal regulations and state-specific standards that differ from general employment screening.

- Background verification processes average 5-10 business days but can extend to 3-4 weeks when regulatory approvals or international checks are required.

- Large institution screenings often include continuous monitoring programs beyond initial pre-employment verification.

- Non-compliance with screening requirements can result in penalties ranging from $10,000 to $1 million per violation under FDIC regulations.

- Employers must balance thorough screening with fair hiring practices under the state's evolving approach to criminal history inquiries.

Why Financial Background Checks in North Carolina Require Specialized Approaches

North Carolina's financial services sector generates over $54 billion in annual economic impact while employing more than 120,000 professionals. The concentration of major institutions in Charlotte—including Bank of America's global headquarters and Truist Financial—creates a unique employment landscape where screening standards exceed typical requirements. Meanwhile, unemployment in financial services roles consistently remains below 2.5%, intensifying competition for qualified talent.

A single bad hire in a fiduciary role can expose institutions to fraud losses averaging $150,000 per incident. Moreover, these hiring mistakes risk regulatory fines, reputational damage, and potential loss of FDIC insurance coverage. Therefore, North Carolina financial background checks must address multiple risk factors including criminal history, financial integrity indicators, regulatory sanctions, and industry-specific concerns that general employment screening overlooks.

The Regulatory Landscape for Financial Services Screening

Federal banking regulations establish the foundation for financial sector pre-employment screening nationwide. Specifically, FDIC Section 19 prohibits insured financial institutions from hiring individuals convicted of crimes involving dishonesty, breach of trust, or money laundering without obtaining prior written FDIC consent. Consequently, this regulation differentiates financial background checks from standard employment screening by requiring institutions to identify disqualifying convictions and navigate formal waiver processes.

Additionally, the Bank Secrecy Act and USA PATRIOT Act impose screening obligations related to anti-money laundering compliance. Financial institutions must verify that prospective employees don't appear on OFAC sanctions lists, aren't connected to terrorist organizations, and don't present money laundering risks. Furthermore, North Carolina's state banking commission adds another oversight layer for state-chartered institutions.

Charlotte's Unique Position in Financial Services Hiring

Charlotte's emergence as a premier banking center creates distinct hiring challenges that impact background screening approaches. The city's financial corridor employs over 65,000 banking professionals, with major institutions competing for the same talent pool. As a result, this competitive environment demands efficient verification processes that don't create candidate drop-off during extended screening periods.

Moreover, the concentration of financial services companies means many candidates have previous employment at competitor institutions. In these situations, background verification requires careful coordination since former employers may have legitimate confidentiality concerns. Accordingly, Charlotte banking employment screening has evolved to balance thorough investigation with reasonable turnaround expectations in a market where top talent typically entertains multiple offers simultaneously.

Core Components of North Carolina Financial Background Checks

Financial services background verification encompasses multiple elements that work together to provide comprehensive candidate assessment. Each component addresses specific risk categories relevant to financial institutions, while the combination creates a multi-layered approach that identifies concerns no single check would reveal.

The scope varies based on position level, system access, and fiduciary responsibilities. Entry-level positions with limited access may require fewer verification elements than executive roles. Nevertheless, all financial services positions require baseline screening that exceeds general employment standards due to regulatory environment and fraud risk exposure.

Criminal History Searches for Financial Positions

Criminal background checks for financial services roles must identify convictions that trigger FDIC Section 19 prohibitions. These include crimes involving dishonesty such as fraud, embezzlement, and identity theft, plus breach of trust including fiduciary violations. Importantly, North Carolina's seven-year lookback limitation doesn't apply to financial institutions when Section 19 crimes are involved—these convictions remain permanently disqualifying without FDIC approval.

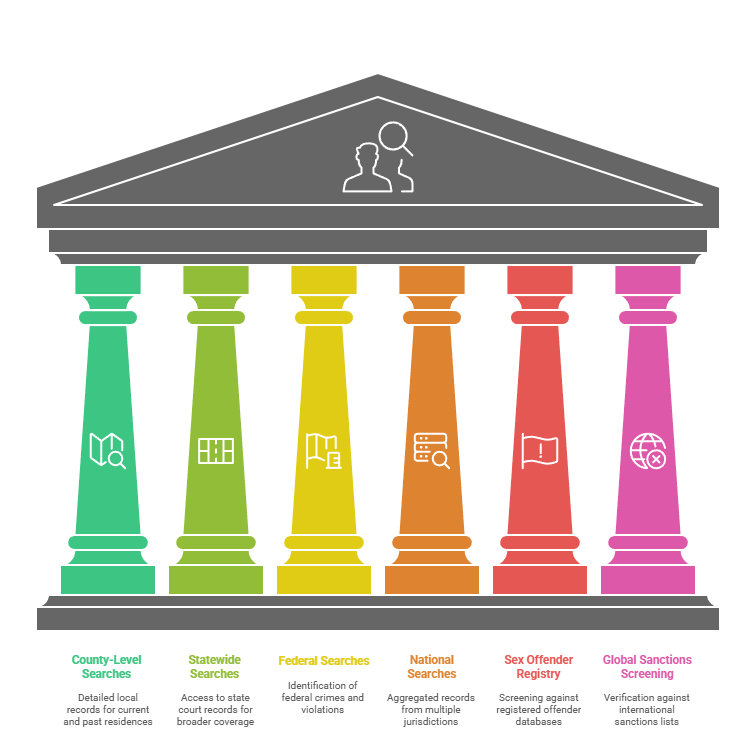

Comprehensive criminal searches for financial positions encompass multiple search types, with each serving a specific purpose in building a complete picture of a candidate's history:

- County-level criminal record searches: Provide the most detailed and current information from each county where the candidate has lived

- Statewide criminal database searches: Access the North Carolina Administrative Office of the Courts for searchable records

- Federal criminal record searches: Identify interstate fraud, RICO violations, tax crimes, and other federal offenses

- National criminal database searches: Aggregate records from multiple jurisdictions to identify locations requiring thorough investigation

- Sex offender registry searches: Check registered databases to identify risks traditional checks might miss

- Global sanctions screening: Screen candidates with international responsibilities against OFAC and other sanctions lists

Consequently, these specialized searches identify risks that traditional criminal background checks might miss, particularly for candidates with international experience.

Credit Report Analysis for Financial Integrity

Credit reports provide insight into candidates' financial management practices and potential vulnerability to financial crimes. While using credit information for employment decisions requires strict FCRA compliance, financial institutions have legitimate business reasons for evaluating financial history. Therefore, North Carolina credit union hiring checks and bank screening protocols typically include credit review for any position with financial access or authority.

| Credit Factor | Risk Indicators | Mitigation Considerations |

| Account Management | Multiple charged-off accounts, collections, or judgments | Recent pattern versus older resolved issues; evidence of recovery |

| Public Records | Bankruptcies, tax liens, or civil judgments | Time since filing; completion of bankruptcy plan |

| Payment Patterns | Consistently late payments across multiple accounts | Current situation; explanations for difficulties |

| Debt Levels | High utilization or debt-to-income ratios | Factors beyond control; trajectory of debt reduction |

Importantly, credit checks require providing candidates with pre-adverse action notices before making negative employment decisions. Financial institutions must also maintain consistent standards and document how credit factors relate to specific job responsibilities.

Employment and Education Verification Standards

Verification of employment history and educational credentials serves multiple purposes in financial background checks. Specifically, employment verification confirms experience claims, identifies unexplained gaps, and may reveal patterns suggesting performance issues. Similarly, educational verification ensures candidates possess claimed degrees or certifications, particularly for positions requiring specific credentials.

Professional license verification is critical for financial services positions requiring securities licenses, CPA certifications, or other regulated credentials. In particular, FINRA's BrokerCheck system provides comprehensive information on securities professionals' employment history, licensing status, and regulatory actions—serving as an essential resource for investment services hiring.

Bank of America Contractor Background Checks and Large Institution Standards

Major financial institutions operating in North Carolina maintain screening standards that often exceed regulatory minimums. For instance, Bank of America contractor background checks and similar large-institution protocols reflect both regulatory obligations and corporate risk management strategies developed through decades of experience.

Large financial institutions typically implement three-tiered screening protocols based on position risk classification. High-risk positions undergo the most comprehensive screening, while medium-risk positions receive standard financial services screening. Even low-risk positions undergo baseline checks exceeding general employment standards due to reputational considerations.

Continuous Monitoring Programs

Initial background screening provides a point-in-time assessment, but financial integrity risks can emerge anytime during employment. Consequently, Bank of America and other major institutions have implemented continuous monitoring programs that alert HR and security teams to criminal charges, credit events, or regulatory actions involving current employees.

Implementing continuous monitoring requires careful attention to privacy considerations and legal requirements. Notably, employees must receive notice that ongoing monitoring will occur, typically through acknowledgment forms during onboarding. Additionally, institutions must establish clear protocols ensuring employees receive opportunity to address flagged issues before adverse employment actions are taken.

Third-Party Risk Management in Background Screening

Financial institutions increasingly rely on third-party background screening providers to conduct comprehensive checks efficiently. However, regulatory guidance emphasizes that institutions cannot outsource compliance responsibility—they remain accountable for ensuring screening meets all regulatory requirements.

Selecting background screening providers requires evaluating capabilities beyond those needed for general employment checks. Providers must demonstrate expertise in FCRA compliance, ability to conduct searches meeting FDIC standards, and experience with financial services regulatory requirements. Furthermore, due diligence should include reviewing sample reports, evaluating accuracy of data sources, and assessing turnaround times.

FCRA Compliance Requirements for Financial Sector Pre-Employment Screening

The Fair Credit Reporting Act establishes the legal framework governing employment background checks across all industries. However, financial institutions face heightened compliance scrutiny due to their role as regular consumer report users. Notably, FCRA violations can result in actual damages, statutory damages up to $1,000 per violation, punitive damages in cases of willful noncompliance, and attorney fees.

FCRA compliance begins before requesting any background check. Specifically, employers must obtain written authorization from candidates on a standalone document that clearly states background checks will be conducted and must be signed before any consumer report is requested.

Pre-Adverse Action Requirements

When background check information suggests a candidate shouldn't be hired, FCRA mandates a specific pre-adverse action process before making final decisions. This requirement protects candidates' rights to dispute inaccurate information and provides opportunity to explain circumstances that might otherwise result in disqualification.

The pre-adverse action process requires providing candidates with three essential elements. First, institutions must provide a copy of the complete background check report. Second, they must provide an FCRA summary of rights explaining candidates' rights to dispute inaccurate information. Third, institutions must allow reasonable time to respond, typically 5-7 business days.

Only after completing pre-adverse action procedures can institutions proceed with adverse action. Final adverse action requires providing an adverse action notice stating the candidate wasn't hired based on background check information, identifying the screening company, and explaining the candidate's rights. Importantly, these procedural requirements apply even when disqualifying information is obviously accurate.

Ban-the-Box and Fair Chance Hiring Considerations

North Carolina does not have a statewide ban-the-box law restricting when employers can inquire about criminal history. Nevertheless, financial institutions must consider federal guidance on considering criminal records in employment decisions. The EEOC's enforcement guidance suggests that blanket exclusions may violate Title VII if they disproportionately impact protected classes.

Best practices for criminal history evaluation include developing position-specific criteria documenting which offenses are disqualifying, implementing individualized assessment processes for borderline cases, applying standards uniformly across candidates, and maintaining detailed records. Additionally, institutions should monitor local ordinances as some municipalities have adopted fair chance hiring policies that may influence future regulations.

Specialized Screening Requirements for Different Financial Services Sectors

North Carolina's diverse financial services landscape encompasses traditional banking, credit unions, investment services, insurance companies, fintech startups, and payment processors. Each sector faces specific regulatory requirements that influence background screening protocols accordingly.

Credit Union Hiring Checks and Community Financial Institution Standards

North Carolina credit union hiring checks must address federal requirements while recognizing credit unions' unique characteristics as member-owned cooperative institutions. The NCUA maintains authority similar to the FDIC regarding criminal history restrictions, requiring credit unions to request prohibition waivers from NCUA regional offices—a process that can take 60-90 days.

Credit unions often emphasize cultural fit and commitment to cooperative principles alongside technical qualifications. Therefore, background screening should extend beyond criminal and credit checks to verify candidates' understanding of credit union philosophy. Meanwhile, community banks and smaller institutions face unique screening challenges, as limited HR resources mean they often rely more heavily on background screening vendors for expertise.

Investment Services and Securities Industry Screening

Charlotte banking employment screening for investment services positions involves specialized requirements extending beyond general financial services checks. Specifically, FINRA rules require registered representatives to file Form U4 disclosing comprehensive background information including criminal history, financial settlements, regulatory actions, and terminations.

Background checks for investment services positions should include several specialized verification elements addressing specific regulatory requirements:

- FINRA BrokerCheck searches: Verify licensing history, examinations passed, employment timeline, and customer complaints

- SEC Investment Adviser Public Disclosure: Check disclosure history revealing regulatory actions and customer complaints

- State securities regulator searches: Verify state-level licensing and check for state regulatory actions

- Civil litigation history: Review cases alleging financial impropriety or breach of fiduciary duty

- Conflicts of interest screening: Identify board memberships or ownership interests creating potential conflicts

- Outside business activities verification: Check for activities that could compromise fiduciary obligations

Consequently, investment firms must screen beyond criminal history to encompass whether candidates can fulfill fiduciary obligations to clients.

Fintech and Payment Processing Industry Considerations

North Carolina's growing fintech sector presents unique background screening challenges. While fintech companies may not fall under traditional banking regulation depending on their business models, they nevertheless handle customer financial data requiring similar security consciousness.

Fintech background screening should emphasize technology security alongside financial integrity. Specifically, positions with system and customer data access require evaluation of candidates' digital security awareness and history. Additionally, fintech companies must navigate the intersection of multiple regulatory frameworks, incorporating elements required across relevant frameworks.

Building Efficient Background Check Processes for Competitive Talent Markets

Charlotte's competitive financial services hiring environment demands screening processes balancing thoroughness with efficiency. Top candidates typically receive multiple offers and will accept positions at institutions that move decisively through hiring stages. Therefore, financial institutions that allow background screening to create weeks-long delays risk losing preferred candidates.

Efficient screening begins with clear position-level requirements documented before recruiting begins. Creating position classification frameworks with defined screening protocols for each level enables consistent, efficient processing. Moreover, technology integration significantly impacts screening efficiency, as background check platforms that integrate with applicant tracking systems eliminate manual data entry and provide hiring managers with real-time status visibility.

Vendor Selection and Management

Choosing background screening providers capable of meeting financial services requirements affects both compliance and efficiency. Vendors serving financial institutions should demonstrate several key capabilities essential for successful partnerships:

- FCRA compliance expertise: Training programs, PBSA accreditation, audit history, ongoing compliance updates

- Financial services experience: Client roster in banking sector, understanding of Section 19 requirements

- Comprehensive search coverage: Database access depth, county search protocols, international verification capabilities

- Competitive turnaround times: Average completion times by search type, rush processing availability

- Robust technology platforms: ATS integration, API capabilities, mobile access, customizable reporting tools

- Responsive customer support: Dedicated account management, extended support hours, clear escalation procedures

Furthermore, due diligence should include requesting proposals from multiple vendors, checking references with similar institutions, and reviewing sample reports. Ongoing vendor management ensures continued performance through quarterly business reviews and annual audits.

Internal Process Optimization

Financial institutions can improve screening efficiency through internal process refinements regardless of vendor capabilities. Centralizing background check administration through dedicated HR specialists ensures consistent execution since these specialists develop deep knowledge of FCRA requirements and can resolve issues more quickly.

Conditional offer processes allow background screening to occur simultaneously with final interview stages rather than sequentially. As a result, this parallel processing can reduce time-to-hire by 5-10 business days, providing competitive advantage when pursuing in-demand candidates.

Addressing Common Challenges in Financial Background Screening

Even well-designed screening programs encounter challenges requiring careful navigation. Financial institutions must develop protocols for handling scenarios that don't fit standard processes while maintaining compliance and fairness.

International Background Screening Complexities

Charlotte's diverse talent pool includes many candidates with significant international work history or education. Verifying records from foreign countries presents logistical and legal challenges that extend screening timelines and increase costs since different countries maintain varying records systems and privacy laws.

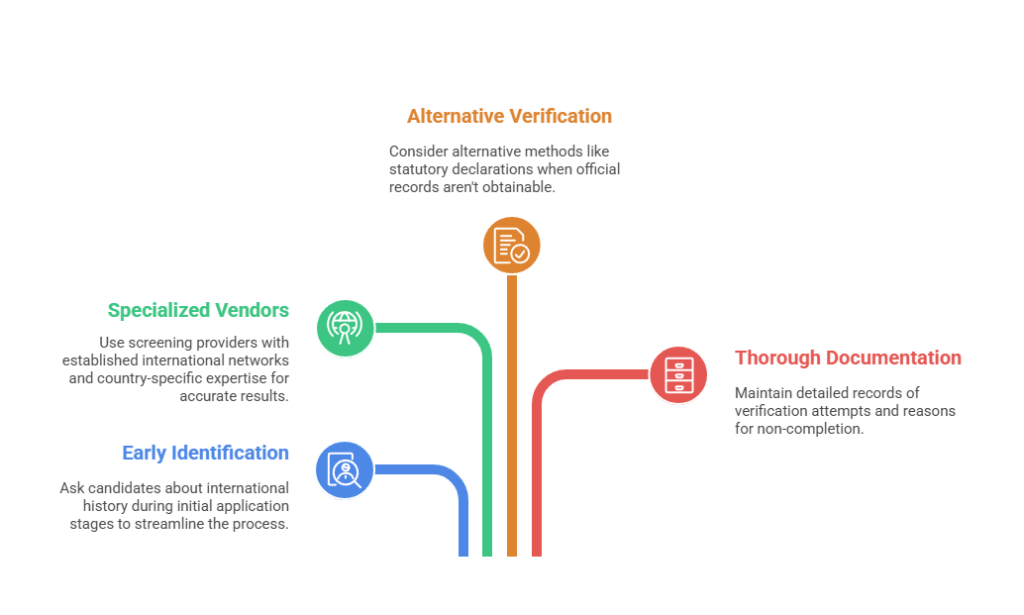

International background screening best practices help navigate these complexities effectively:

- Early identification: Ask candidates about international history during initial application stages

- Specialized vendors: Use screening providers with established international networks and country-specific expertise

- Alternative verification: Consider alternative methods like statutory declarations when official records aren't obtainable

- Thorough documentation: Maintain detailed records of verification attempts and reasons certain verifications couldn't be completed

Additionally, financial institutions should establish clear policies regarding positions requiring complete domestic history versus those where international gaps may be acceptable.

Managing Disclosure Inconsistencies and Red Flags

Background checks sometimes reveal information contradicting candidate disclosures on applications or during interviews. How institutions respond affects both hiring outcomes and legal exposure since automatically disqualifying all inconsistencies eliminates potentially excellent candidates who made innocent errors, while ignoring red flags exposes institutions to fraud risks.

A structured approach includes assessing whether inconsistencies involve material information relevant to job duties, investigating circumstances by contacting candidates before making assumptions, and considering whether patterns suggest dishonesty versus isolated errors. Criminal record discrepancies deserve particular attention as institutions must determine whether non-disclosure reflects confusion, intentional concealment, or legitimate belief that records were sealed.

Conclusion

Financial background checks in North Carolina require specialized expertise recognizing the state's unique position in American banking and the complex regulatory environment governing financial services hiring. As financial services continue evolving with fintech innovation and changing regulatory expectations, screening programs must adapt while maintaining the fundamental purpose of protecting institutions, customers, and the financial system. Success requires balancing regulatory compliance, operational efficiency, candidate experience, and risk management into cohesive screening protocols that serve institutions' hiring objectives while meeting all legal obligations.

Frequently Asked Questions

How long do financial background checks take in North Carolina?

Standard checks take 5-10 business days for straightforward histories. However, complex scenarios involving multiple states or FDIC prohibition waivers can extend timelines to 3-4 weeks. Institutions can expedite screening by collecting information early and using vendors with comprehensive database access.

What disqualifies someone from working at a bank in North Carolina?

FDIC Section 19 prohibits hiring individuals convicted of crimes involving dishonesty, breach of trust, or money laundering without prior written FDIC consent. Disqualifying offenses include fraud, embezzlement, theft, and forgery. The prohibition applies regardless of when the conviction occurred.

Do credit unions check credit for employment in North Carolina?

Yes, most credit unions check credit reports for positions involving money handling or account access. Credit unions must follow strict FCRA procedures including written authorization and pre-adverse action notices. Credit evaluation focuses on patterns indicating financial instability.

How far back do criminal background checks go for financial services jobs?

While North Carolina's seven-year lookback applies to most employment checks, financial institutions must review criminal history without time limitations for FDIC Section 19 violations. County searches typically reveal records from the past 7-10 years.

Can financial institutions in Charlotte conduct continuous monitoring of employees?

Yes, institutions can implement continuous monitoring programs tracking criminal charges and regulatory actions affecting current employees. Monitoring requires providing employees clear notice and procedures for addressing alerts that respect employee rights.

What happens if a background check reveals information after someone is already hired?

Institutions must follow the same FCRA procedures required for pre-employment adverse actions, including providing copies of reports and allowing time to dispute information. For Section 19 violations, institutions must separate the employee but may request FDIC approval for reinstatement.

Are Bank of America contractor background checks the same as employee checks?

Major institutions typically require contractors to undergo screening comparable to employees in similar roles. Contractor screening standards are maintained in vendor agreements, with some institutions independently verifying results.

How do North Carolina financial institutions handle candidates with sealed or expunged records?

North Carolina law prohibits sealed records from appearing in background checks. However, FDIC Section 19 requirements don't recognize expungement for covered convictions—the prohibition remains in effect regardless of state-level record sealing.

Additional Resources

- FDIC Section 19 Prohibition - Understanding Criminal Conviction Restrictions

https://www.fdic.gov/regulations/laws/rules/5000-3550.html - Federal Trade Commission FCRA Guidance for Employment Screening

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-employers-need-know - FINRA BrokerCheck - Verify Securities Industry Professional Backgrounds

https://brokercheck.finra.org/ - North Carolina Administrative Office of the Courts - Criminal Records Access

https://www.nccourts.gov/services/criminal-records-checks - Professional Background Screening Association - Industry Standards and Accreditation

https://www.pbsa.org/ - EEOC Enforcement Guidance on Criminal Records in Employment Decisions

https://www.eeoc.gov/laws/guidance/enforcement-guidance-consideration-arrest-and-conviction-records-employment - National Credit Union Administration - Prohibition Authority for Credit Unions

https://www.ncua.gov/regulation-supervision/regulatory-compliance-resources/prohibition

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.