If you're a business owner, HR professional, recruiter, or job seeker in industries like staffing agencies, healthcare, transportation, tenant screening, non-profit, retail, technology, or hospitality, understanding the Fair Credit Reporting Act (FCRA) is essential. Compliance with FCRA guidelines is crucial for conducting legal and ethical background checks. This guide will take you through the critical aspects of FCRA compliance, ensuring you are well-informed about credit reporting laws and consumer rights.

Key Takeaways

- Understanding the Fair Credit Reporting Act (FCRA) is crucial for employers to ensure transparency and fairness in the hiring process.

- Employers must comply with key elements of FCRA compliance, such as obtaining proper disclosures and authorizations and following a stringent adverse action process.

- Different industries face unique challenges and require tailored FCRA compliance practices to navigate background checks lawfully.

- Non-compliance with FCRA guidelines can result in severe financial penalties, lawsuits, and significant damage to a company’s reputation.

- Resources like the FTC and EEOC guides can help employers maintain FCRA compliance and foster an ethical hiring process.

Introduction

Picture this—you've spent weeks finding the perfect candidate. They're qualified, personable, and ready to hit the ground running. But, if you overlook FCRA compliance, all your efforts can go down the drain faster than you can say "adverse action." For employers and job seekers alike, understanding the Fair Credit Reporting Act (FCRA) isn’t just bureaucratic red tape; it's a critical safeguard ensuring transparency and fairness in employment.

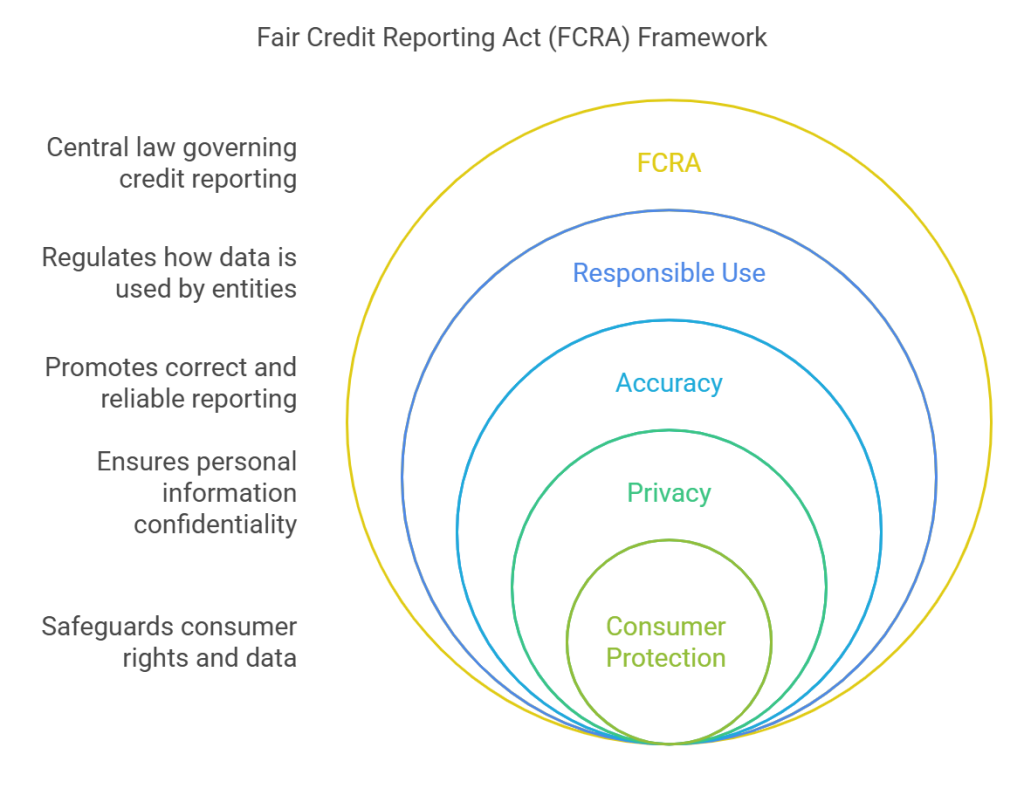

The FCRA is a federal law governing how consumer report information can be used and disclosed. Established to promote the accuracy, fairness, and privacy of information collected by consumer reporting agencies, the FCRA outlines specific requirements for employers who seek to use these reports for employment purposes. Industries like healthcare, transportation, retail, and even non-profits must all comply with the FCRA to avoid stiff penalties and lawsuits.

Mastering FCRA guidelines isn't just a good-to-have; it’s a need-to-have. Failing to adhere to these rules can lead to legal headaches and tarnished reputations—no employer wants to step on landmines. Knowing the ins and outs of FCRA compliance ensures that you protect your organization and the rights of the individuals you aim to hire.

EXPERT INSIGHT: As HR specialists, we help to develop workplaces of the future by establishing a foundation of diversity, ethics, and openness. Gaining an understanding of the Fair Credit Reporting Act (FCRA) is a first step in achieving it since it involves establishing credibility with both employers and applicants. By ensuring that every background check conforms with FCRA rules, we uphold the dignity of individuals who entrust us with their personal information. By implementing these initiatives, we promote ethical and law-abiding workplaces that benefits the employer and the employees. - Charm Paz, CHRP

What is the Fair Credit Reporting Act?

The Fair Credit Reporting Act (FCRA) is a federal law that governs how consumer credit information is collected, accessed, and used. Enacted in 1970, the FCRA aims to enhance the accuracy, fairness, and privacy of consumer information maintained by credit reporting agencies. This legislation ensures that consumer reports, which include credit histories and background checks, are used responsibly by businesses and employers.

The history of the FCRA begins amid growing concerns over privacy and the accuracy of credit information during the late 1960s. As credit bureaus and reporting agencies became more influential in economic decisions, lawmakers recognized the need to regulate these entities to protect consumers from inaccuracies and unfair practices. Thus, the FCRA was born, marking a significant step towards consumer protection in the United States.

The primary purpose of the FCRA is to promote accuracy in consumer reporting, to ensure the privacy of personal information, and to protect consumers from the misuse of their data. By mandating that credit reporting agencies and businesses adhere to strict guidelines, the FCRA seeks to create a balanced environment where consumer rights are safeguarded without stifling the essential functions of the credit reporting industry.

Key Elements of FCRA Compliance

Navigating FCRA compliance starts with understanding its fundamental components. These key elements ensure that background checks are conducted lawfully while respecting consumer rights.

Permissible Purpose

The FCRA defines when and why you can access a consumer report. A "permissible purpose" includes hiring decisions, credit approvals, tenant screenings, etc. You're treading on thin ice if your reason doesn’t fall under these categories. Stick to the permissible purposes, and you’ll avoid major legal headaches.

Disclosure and Authorization

Before obtaining a consumer report, you must notify the candidate. This isn't just a quick note in an email—FCRA requires a clear and conspicuous disclosure, separate from other documents, explaining that you plan to use their information. Additionally, you must get the candidate’s written authorization. Inform and get consent upfront—this protects both parties and keeps the process transparent.

The FCRA requires employers to obtain written permission from job applicants before conducting background checks. This study highlights the importance of compliance with this requirement to avoid legal issues.

Adverse Action Process

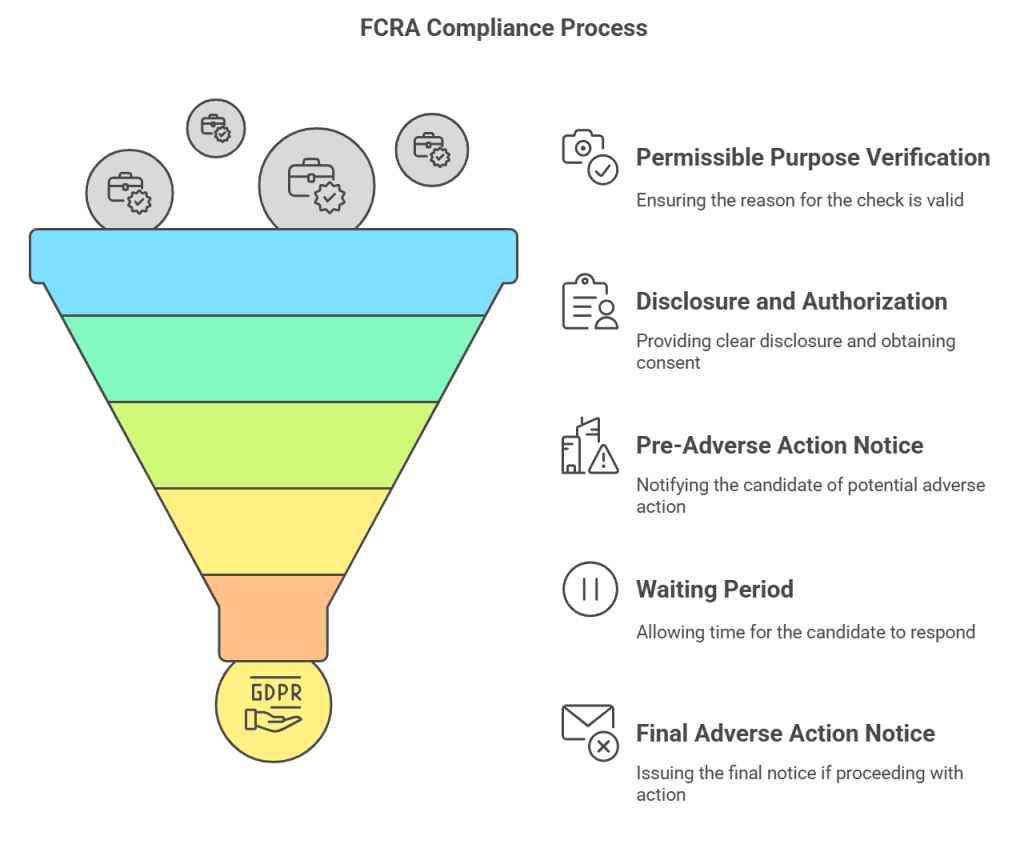

If you decide to take adverse action based on the information in the consumer report, you must follow a specific process.

- Pre-Adverse Action Notice: Inform the candidate that an adverse action is under consideration. Provide them with a copy of the consumer report and a summary of their rights under the FCRA. This gives them a chance to review and dispute any inaccuracies.

- Waiting Period: Allow a reasonable time for the candidate to respond. There’s no fixed duration, but five business days is typically standard before proceeding to the final step.

- Final Adverse Action Notice: If you proceed with the adverse action, you must send another notice confirming this. Include details such as the name and contact information of the consumer reporting agency that provided the report. Emphasize that the agency didn’t make the decision and won’t be able to explain why the adverse action was taken. Finally, remind the candidate of their right to dispute the information in the report.

Adhering to these steps isn’t just a formality; it’s a legal requirement. Skipping them exposes your business to significant penalties and potential lawsuits. Following the adverse action process shows respect for the candidate’s rights and upholds the integrity of your hiring practice.

FCRA Guidelines for Employers

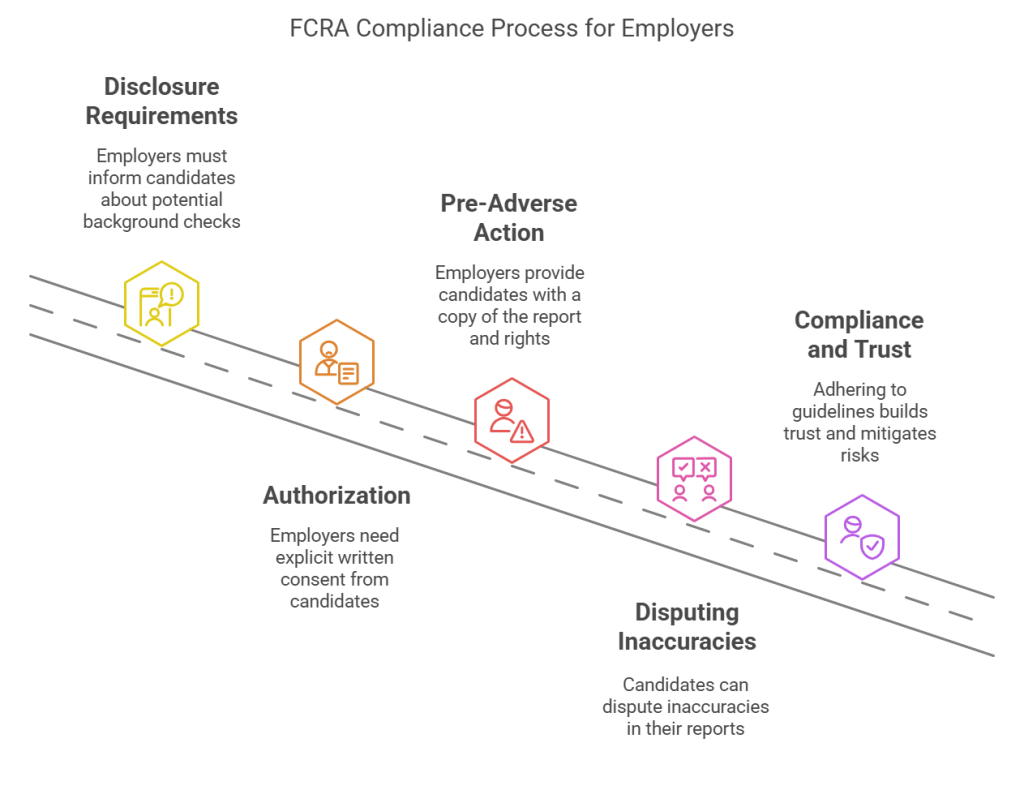

When it comes to FCRA compliance, employers must meticulously follow several key steps to ensure they are not infringing on the rights of their candidates. Let's break down the essential guidelines:

Disclosure Requirements

First and foremost, employers are required to clearly and conspicuously disclose to candidates that a consumer report may be obtained for employment purposes. This disclosure must stand alone, not buried within an employment application or another document. It's about being upfront; candidates should understand that their background information will be checked and why it's happening.

Authorization

Next, written authorization from the candidate is non-negotiable. Before conducting any background check, employers need to get explicit written consent from the individual. This can't be a vague formality; it has to be a clear, separate document where the candidate acknowledges that they agree to the background check.

Pre-Adverse Action

In cases where the information gathered from a consumer report leads to a potentially negative employment decision (like not hiring or promoting someone), the employer must follow the pre-adverse action process. This involves:

- Giving the candidate a copy of the consumer report.

- A summary of their rights under the FCRA outlines their entitlements and the procedures they can follow if they find any inaccuracies.

The pre-adverse action notice allows the candidate to review the report and dispute any errors before the final decision is made.

Disputing Inaccuracies

Candidates have the right to dispute inaccuracies in their consumer reports. Employers must inform candidates about this right and be prepared to handle disputes efficiently. If a candidate believes there’s incorrect information in their report, they should have the chance to rectify it before it influences the employer's decision.

By adhering to these guidelines, employers comply with the FCRA and promote fairness and transparency in their hiring processes. This helps build trust with potential employees and mitigate legal risks.

Consumer Rights Under the FCRA

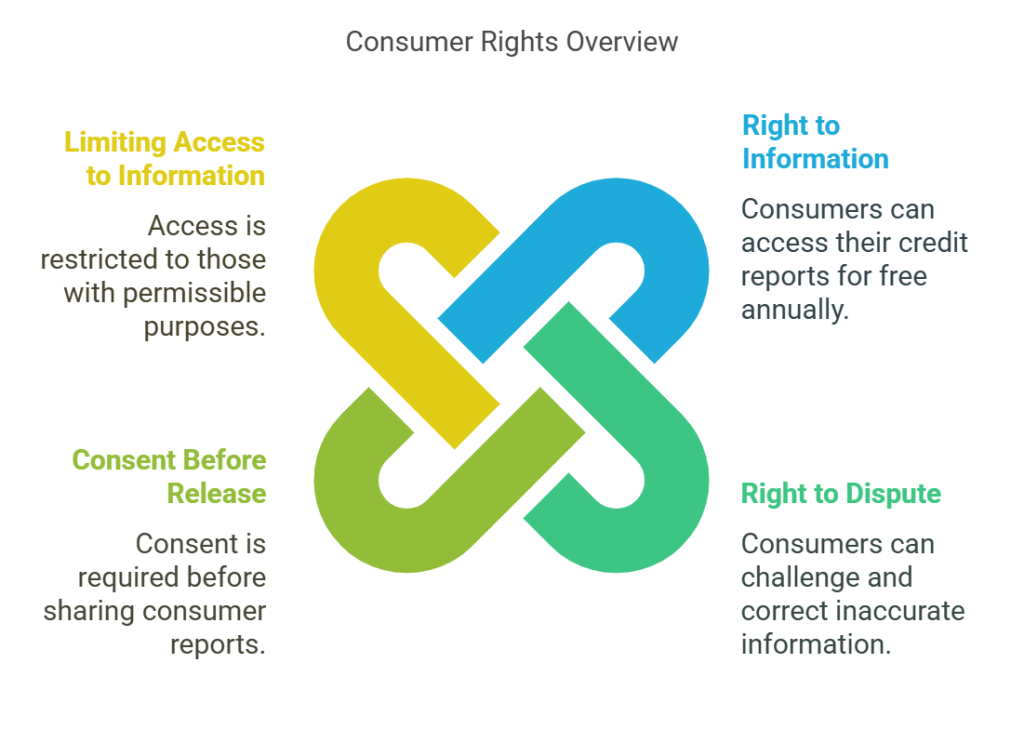

Consumers have several critical rights under the Fair Credit Reporting Act (FCRA), designed to ensure the protection and accuracy of their personal information. Here’s a straightforward breakdown of these rights:

Right to Information

Consumers have the right to know what information is in their files at consumer reporting agencies. This means individuals can request and receive a full disclosure of their report, allowing them to be fully aware of what employers, landlords, or other entities see. Annual credit reports are free from major credit reporting agencies like Equifax, Experian, and TransUnion.

Right to Dispute

If consumers discover inaccurate or incomplete information in their report, they can dispute it. The consumer reporting agency must investigate the dispute within 30 days and correct or delete any incorrect, incomplete, or unverifiable information. This process ensures that only accurate data is evaluated by potential employers or other entities.

Consent Before Release

Consumer reports cannot be legally obtained and shared without the individual’s consent. For employers, this means they must get written authorization from the candidate or employee before initiating a background check. This consent ensures that consumers are aware of and agree to the gathering and distributing of their personal information.

Limiting Access to Information

Employers must also limit access to consumer reports strictly to those with a permissible purpose for obtaining the information. This typically includes hiring managers or others directly involved in the employment process. By restricting access, the FCRA aims to protect individuals' sensitive information from unnecessary exposure and potential misuse.

Understanding these rights helps consumers monitor and protect their personal information and encourages employers to follow ethical and legal practices in their background check procedures. By adhering to FCRA guidelines, both parties can maintain a transparent and fair process.

Common Pitfalls and How to Avoid Them

Even minor oversights in FCRA compliance can lead to major headaches. Here are some common pitfalls and tips on how to dodge them.

Improper Disclosure

A common mistake is blending the disclosure document with other paperwork. To comply with FCRA, you're required to provide a “standalone” disclosure. Mixing this critical information with other consent forms, employment applications, or onboarding materials might seem efficient, but it's a violation. Always give a separate, clear, and conspicuous disclosure focused solely on the background check.

Lack of Authorization

Another frequent error is failing to get explicit written consent. Just having a verbal agreement or an implied acknowledgment isn't enough. Collect written authorization from the candidate before you pull their consumer report. Ensure they understand what specific information you’ll be checking and why. Doing this upfront can save you legal trouble down the road.

Ignoring Dispute Rights

Candidates have the right to dispute inaccuracies in their consumer reports. If you dismiss these rights or fail to inform the candidate of their options for disputing findings, you're asking for trouble. Be transparent and provide clear instructions for disputes as required by the FCRA. Respecting these rights keeps you compliant and builds trust with potential hires.

Non-Compliance with Adverse Action

Not following the adverse action process correctly can be a costly misstep. Follow a two-step process if you decide to take adverse action based on a consumer report. First, provide a pre-adverse action notice, a copy of the report, and a summary of rights. This gives the candidate a chance to review and dispute any discrepancies. Only after you've taken these steps should you issue a final adverse action notice. Bypassing or short-cutting this process could result in penalties and lawsuits.

Avoid these pitfalls by staying vigilant and ensuring your processes align with FCRA requirements. When in doubt, consult with legal counsel to guarantee that your practices are up to par.

Industry-Specific Advice

Following broad standards is only one aspect of navigating FCRA compliance. Due to operational demands and regulatory restrictions, every industry has different background check requirements and obstacles. Understanding these particular intricacies is crucial for everything from managing high turnover in retail to ensuring patient safety in healthcare. In addition to following FCRA guidelines, employers also need to follow industry-specific rules and best practices regarding background checks. This customized strategy guarantees stakeholder and employee trust in addition to compliance.

Staffing Agencies

Staffing agencies often deal with high volumes of temporary workers, making quick and efficient background checks necessary. To ensure FCRA compliance, it’s vital to:

- Maintain clear, standalone disclosure documents.

- Obtain written authorizations without merging consent forms with other documents.

- Follow the pre-adverse and adverse action processes to the letter, even for short-term assignments.

Healthcare

For positions involving sensitive roles or access to confidential patient information, healthcare employers should take additional care. Specific steps include:

- Consult legal counsel to ensure compliance with FCRA and healthcare-specific regulations like HIPAA.

- Provide detailed disclosures and obtain explicit written consent before conducting background checks.

- Ensuring all parties handling the consumer reports understand healthcare's security and confidentiality requirements.

Transportation

In the transportation industry, checking driving records is a common necessity, and it must conform to FCRA guidelines. Transportation companies should:

- Verify the permissible purposes for accessing driving records.

- Keep transparent records of all disclosures, authorizations, and adverse actions taken.

- Regularly review their compliance processes to adapt to changing legal requirements in transportation and consumer reporting laws.

Tenant Screening

Tenant screening requires strict adherence to FCRA when evaluating potential renters. Key practices include:

- Providing prospective tenants with clear and conspicuous written disclosures.

- Securing written consent before obtaining a consumer report.

- Following a thorough adverse action process by giving tenants notices, copies of their reports, and time to dispute inaccuracies before final actions.

Non-profit

Non-profit organizations often rely on volunteers who fall under FCRA protection when conducting background checks. Non-profits should:

- Adhere to the same disclosure and authorization rules applicable to employee background checks.

- Provide volunteers with copies of their reports and an opportunity to dispute errors, mirroring the adverse action process for paid staff.

- Maintain transparency and build trust by clearly communicating the purposes and procedures of background checks to potential volunteers.

Retail and Hospitality

Background checks in retail and hospitality frequently involve seasonal and part-time workers. Compliance here means:

- Ensuring candidates are fully informed, and consent is obtained for each hiring cycle, especially for returning seasonal staff.

- Treating any adverse actions with the same rigor as permanent hires, including providing all required notifications and rights to dispute.

- Training hiring managers and seasonal recruiters on FCRA requirements to avoid lapses during peak hiring seasons.

Technology

Tech companies handle vast amounts of sensitive data, necessitating stringent FCRA compliance as part of their data protection framework. Steps include:

- Safeguarding consumer data obtained through background checks with robust security measures.

- Limiting access to consumer reports to individuals with a legitimate, permissible reason to review the information.

- Regularly updating privacy policies and compliance protocols to stay ahead of technological and legal developments.

Understanding and implementing these tailored practices helps employers in each sector conduct lawful and ethical background checks, preserve consumer rights, and avoid costly FCRA violations.

Legal Implications of Non-Compliance

Regarding the Fair Credit Reporting Act (FCRA), ignorance is not bliss. Failing to adhere to FCRA guidelines can lead to significant legal and financial repercussions that no employer wants to face. Here’s a quick rundown of what’s at stake if you don’t comply:

Penalties

First, the financial hit. Non-compliance with the FCRA can carry hefty penalties. Civil penalties can reach up to $1,000 per violation—this quickly adds up if multiple infractions occur. Punitive damages may be added to the mix for willful non-compliance. Beyond federal penalties, some states have consumer protection laws, which can result in additional fines.

Lawsuits

Next, let’s talk about lawsuits. If consumers feel their rights under the FCRA have been violated, they can take legal action. Class action lawsuits are particularly concerning, as they can encompass dozens, hundreds, or thousands of affected individuals, amplifying the potential financial liability. Even if you win the case, the legal fees alone can be crippling for many businesses.

Reputation Damage

Finally, there’s the backlash you can’t measure in dollars and cents. Reputation damage. News spreads fast, and in today’s digital age, it travels at the speed of a click. A lawsuit or a publicized instance of non-compliance can severely tarnish your company’s reputation, undermining the trust you’ve built with customers, clients, and employees. Repairing this damage can take years and divert attention from core business activities.

In summary, the penalties for not adhering to FCRA guidelines are steep—financially, legally, and reputationally. Investing the time and resources necessary to ensure full compliance is crucial, thereby safeguarding your business from these significant risks.

Conclusion

Adhering to the Fair Credit Reporting Act (FCRA) is not just a legal requirement; it’s a cornerstone of ethical and transparent hiring practices. Proper FCRA compliance ensures that both the rights of the consumers and the interests of the employers are safeguarded.

We’ve covered the essentials—from understanding what constitutes a permissible purpose to the importance of clear disclosure and obtaining written authorization from candidates. We've delved into the nuances of the adverse action process and highlighted the importance of allowing candidates to dispute inaccuracies in their reports.

Compliance is an ongoing process. Employers must regularly review and update their background check procedures to stay aligned with FCRA guidelines. This reduces potential legal risks and builds a foundation of trust and integrity within hiring practices.

Stay informed and proactive. Regularly consult legal experts and use reputable resources like the FTC and EEOC guides to ensure that your practices remain current and compliant. By doing so, you're not just protecting your organization from potential lawsuits and penalties but also enhancing the overall transparency and fairness of your hiring process.

By embracing FCRA guidelines, you can navigate the complexities of background checks with confidence and integrity, ultimately contributing to your organization's success and reputation.