Continuous monitoring has become an operational standard across regulated industries by 2026, but it introduces complex procedural obligations under the Fair Credit Reporting Act that differ significantly from one-time background checks. Organizations must navigate disclosure requirements, adverse action procedures triggered by real-time alerts, accuracy standards for automated data feeds, and state-specific regulations that modify or expand federal requirements.

Key Takeaways

- FCRA continuous monitoring requirements apply whenever a consumer reporting agency provides ongoing criminal record updates throughout the employment relationship.

- Organizations must obtain clear, standalone written authorization before initiating continuous monitoring programs, though courts remain divided on whether periodic re-authorization is required.

- Each alert from a continuous monitoring system that may lead to adverse employment action triggers the full two-step FCRA adverse action process.

- Consumer reporting agencies operating continuous monitoring programs bear heightened accuracy obligations due to the real-time nature of data feeds and the prevalence of arrest records requiring verification.

- State laws in California, New York, Illinois, and other jurisdictions impose additional disclosure, timing, and procedural requirements that override less protective federal standards.

- Employers must implement individualized assessment procedures that evaluate the nature, timing, and job-relatedness of criminal conduct identified through monitoring alerts.

- Written policies documenting the scope, purpose, and procedures of continuous monitoring programs serve as both operational guidance and evidence of compliance intent.

- Common compliance failures include using stale authorizations, skipping adverse action procedures when acting on alerts, and conflating arrest records with verified convictions.

Understanding Continuous Monitoring Models and FCRA Jurisdiction

Continuous criminal monitoring operates across several distinct models, each carrying different procedural and compliance implications under federal and state law. The threshold distinction involves whether the organization receives ongoing automated alerts from a consumer reporting agency or conducts periodic manual re-screening at defined intervals.

| Monitoring Model | Alert Frequency | FCRA Compliance Complexity |

| Event-Driven | Real-time or daily | High (multiple alerts, arrest records, verification challenges) |

| Periodic Re-Screening | Quarterly, semi-annual, or annual | Moderate (discrete reports, clearer authorization cycles) |

| Hybrid | Variable by record type | Highest (multiple procedures, differentiated workflows) |

Each model creates distinct procedural pathways that determine how disclosure, authorization, and adverse action requirements apply throughout the employment relationship.

Event-Driven Continuous Monitoring

Event-driven continuous monitoring systems generate alerts in real time or near-real time when new criminal records matching an employee's identity appear in monitored databases. These systems typically search court records, arrest logs, incarceration databases, and sex offender registries on a daily or weekly basis. When a potential match occurs, the consumer reporting agency sends an automated notification to the employer, often before the underlying charge reaches adjudication.

This model creates the most complex compliance environment because alerts may involve arrests without charges, charges without convictions, or records requiring jurisdictional verification. The FCRA applies to each alert that constitutes a consumer report, which means employers cannot act on the information without following statutory procedures.

Periodic Re-Screening Programs

Some organizations implement what they term continuous monitoring but operationally conduct scheduled background checks at quarterly, semi-annual, or annual intervals. Each re-screen functions as a new consumer report requiring fresh disclosure and authorization under most interpretations of FCRA requirements for ongoing employee monitoring.

Periodic re-screening reduces the volume of alerts compared to event-driven systems but may miss time-sensitive incidents that occur between scheduled checks. Organizations in industries with regulatory mandates for monitoring frequency must verify that their chosen interval satisfies both FCRA procedural requirements and sector-specific standards.

Hybrid Monitoring Structures

Hybrid approaches combine event-driven monitoring for specific high-risk record types with periodic comprehensive re-screening that captures misdemeanors and civil infractions. FCRA continuous monitoring compliance becomes more complex in hybrid models because different alerts may trigger different procedural pathways. Organizations must train personnel to distinguish between alert types and apply appropriate disclosure, authorization, and adverse action protocols based on the information source and timing.

FCRA Applicability to Post-Hire Monitoring Programs

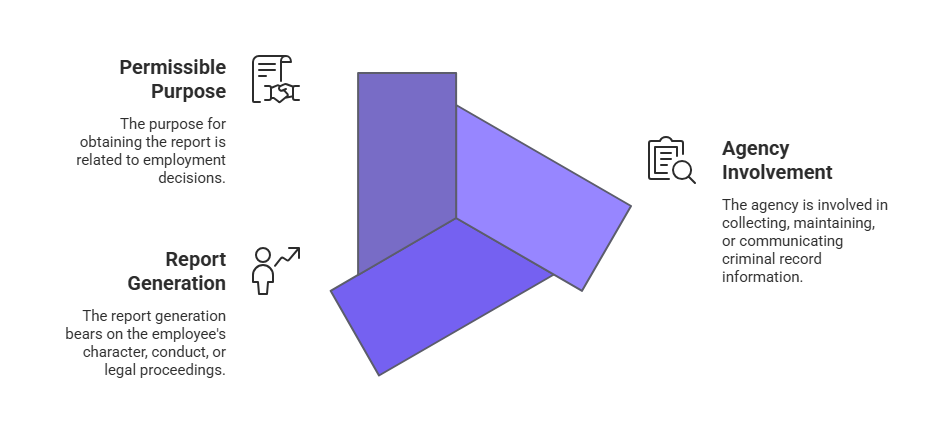

The Fair Credit Reporting Act governs any background screening conducted by a consumer reporting agency for employment purposes, whether that screening occurs before hire, during employment, or as part of a promotion or transfer decision. Continuous criminal monitoring compliance falls within FCRA jurisdiction when three conditions exist simultaneously:

- Consumer reporting agency involvement in collecting, maintaining, or communicating criminal record information

- Consumer report generation that bears on the employee's character, conduct, or legal proceedings

- Permissible purpose for obtaining the report related to employment decisions

Each requirement must be satisfied for FCRA obligations to apply to specific monitoring activities.

Consumer Reporting Agency Involvement

A consumer reporting agency, as defined by 15 U.S.C. § 1681a(f), is any entity that regularly assembles or evaluates consumer credit or other information on consumers for the purpose of furnishing consumer reports to third parties. Organizations that outsource continuous monitoring to third-party vendors almost always meet this definition because the vendor collects, maintains, and communicates criminal record information to the employer.

Employers who conduct internal monitoring by directly accessing public court databases without intermediary involvement may fall outside FCRA jurisdiction for that specific activity. However, they remain subject to state background check laws, privacy statutes, and constitutional limitations on the use of criminal records in employment decisions.

Consumer Report Generation

Each alert or notification from a continuous monitoring system constitutes a consumer report if it bears on the employee's character, general reputation, personal characteristics, or mode of living and is used for employment purposes. Criminal record alerts clearly satisfy this definition because they communicate information about conduct, legal proceedings, and custodial status.

The ongoing nature of continuous monitoring does not exempt subsequent reports from FCRA coverage. Each new alert represents a distinct consumer report that may trigger disclosure, authorization, and adverse action obligations depending on how the employer uses the information.

Permissible Purpose Doctrine

FCRA requirements for ongoing employee monitoring hinge on the employer's permissible purpose for obtaining the consumer report. Under 15 U.S.C. § 1681b(a)(3)(B), employers have permissible purposes when they intend to use the report for employment purposes, including decisions about hiring, retention, promotion, or reassignment. Continuous monitoring alerts obtained for legitimate employment risk management satisfy this requirement.

Disclosure and Authorization Requirements for Ongoing Programs

The FCRA's disclosure and authorization requirements, codified at 15 U.S.C. § 1681b(b)(2), create specific obligations before an employer may obtain a consumer report for employment purposes.

Standalone Written Disclosure Mandate

Federal law requires employers to provide applicants and employees with a clear and conspicuous written disclosure, in a document consisting solely of the disclosure, that a consumer report may be obtained for employment purposes. The standalone requirement prohibits embedding the disclosure within employment applications, handbooks, arbitration agreements, or other multi-purpose documents.

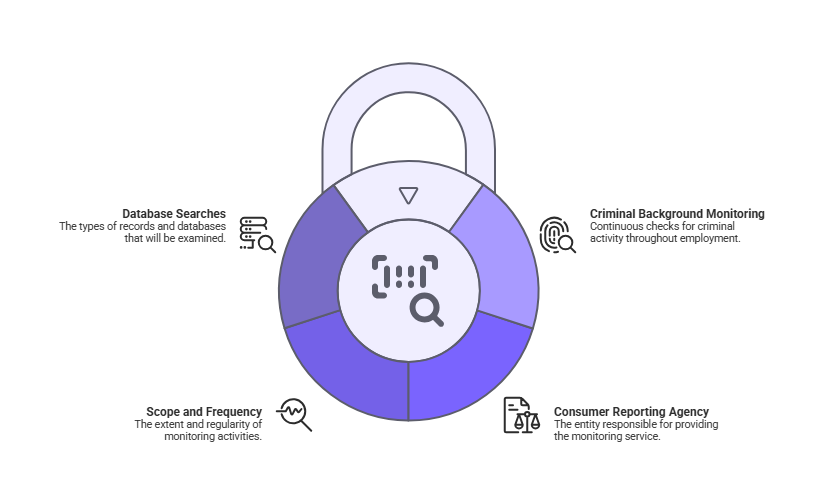

Continuous monitoring programs must satisfy this standalone disclosure requirement before the monitoring begins. The disclosure document should clearly communicate:

- That the employer will conduct ongoing criminal background monitoring throughout the employment relationship

- The identity of the consumer reporting agency providing the service

- The general scope and frequency of monitoring activities

- The types of databases and records that will be searched

Disclosure language should avoid vague references to future background checks and instead explicitly state that monitoring is continuous, automated, and will generate alerts when new criminal records appear in searched databases.

Written Authorization Standards

After receiving the standalone disclosure, the employee must provide written authorization before the employer may obtain consumer reports through continuous monitoring. The authorization must be voluntary, informed, and specific to the continuous monitoring program.

Court interpretations differ on whether a single authorization obtained at hire can lawfully cover continuous monitoring throughout employment or whether employers must obtain periodic re-authorization. Organizations should consult legal counsel to determine which approach aligns with their risk tolerance and the specific jurisdictions in which they operate, as requirements may vary by state and continue to evolve through case law.

Authorization forms should include language allowing employees to revoke consent to continuous monitoring at any time, with clear instructions for the revocation process. Employers must have procedures in place to cease monitoring promptly upon receiving revocation and to address the employment consequences if continued monitoring is a job requirement.

Employee Consent Continuous Background Check Revocation

Employees who revoke consent to continuous monitoring create a compliance decision point for employers. If continuous monitoring is a mandatory condition of employment due to regulatory requirements, client contractual obligations, or legitimate business necessity, the employer may need to implement adverse action procedures based on the employee's refusal to continue participating in the program rather than based on criminal record information.

Adverse Action Procedures Triggered by Monitoring Alerts

Continuous monitoring systems generate alerts that may reveal disqualifying criminal conduct occurring after hire. When an employer intends to take adverse employment action based on information in a monitoring alert, the FCRA's two-step adverse action process applies with the same force as in pre-employment screening contexts.

| Adverse Action Stage | Required Elements | Typical Timeline |

| Pre-Adverse Action Notice | Copy of consumer report + FCRA rights summary | Before any final action |

| Waiting Period | Reasonable time for employee to dispute | 5–7 business days (common practice requiring verification) |

| Final Adverse Action Notice | CRA contact information + dispute rights + free report notice | After decision is finalized |

Each stage must be completed in sequence, with no exceptions for offense severity or urgency.

Pre-Adverse Action Notice Requirements

Before taking adverse action based on a continuous monitoring alert, the employer must provide the employee with a pre-adverse action notice that includes a copy of the consumer report containing the disqualifying information and a copy of the Federal Trade Commission's Summary of Consumer Rights under the FCRA. This notice must occur before the adverse action becomes final.

The timing of pre-adverse action notice is critical in continuous monitoring contexts because alerts may involve serious safety concerns requiring immediate action. Employers may place employees on paid administrative leave while the adverse action process proceeds, but they may not terminate, suspend without pay, or demote the employee until the process completes.

Criminal records discovered through continuous monitoring alerts often involve arrests or charges rather than convictions. Employers who act on arrest information must understand that arrests alone carry limited evidentiary weight under Equal Employment Opportunity Commission guidance and many state laws.

Reasonable Waiting Period

After providing the pre-adverse action notice, employers must allow a reasonable period for the employee to review the report and dispute inaccurate or incomplete information before finalizing the adverse action. While the FCRA does not specify a minimum waiting period, many employers provide five to seven business days based on guidance suggesting this timeframe provides meaningful opportunity for employee response. Organizations should verify that their chosen waiting period satisfies both reasonableness standards and any applicable state-specific requirements.

Employees may dispute the accuracy of continuous monitoring alerts by contacting the consumer reporting agency directly, providing documentation to the employer, or both. During the waiting period, employers should designate personnel responsible for receiving and evaluating employee responses and establish clear procedures for extending the period when employees provide evidence of pending disputes with the consumer reporting agency.

Final Adverse Action Notice

If the employer decides to proceed with adverse action after the waiting period expires, the employer must provide a final adverse action notice. This notice must identify which specific criminal record or alert triggered the adverse action, particularly when employees are subject to ongoing monitoring that may have generated multiple alerts over time.

Individualized Assessment Requirements

Beyond FCRA adverse action procedures, employers must conduct individualized assessments that evaluate the nature of the criminal conduct, the time elapsed since the offense and completion of sentence, and the relationship between the conduct and the job's responsibilities. This requirement derives from Equal Employment Opportunity Commission enforcement guidance and numerous state laws that prohibit blanket disqualification policies.

Post-hire background check legal requirements in many jurisdictions demand that employers consider rehabilitation evidence, the employee's work performance since hire, and whether the specific criminal conduct creates genuine risk relevant to the position.

Accuracy and Dispute Resolution in Continuous Monitoring

Consumer reporting agencies bear a statutory obligation under 15 U.S.C. § 1681e(b) to follow reasonable procedures to assure maximum possible accuracy when preparing consumer reports. This accuracy standard creates heightened compliance challenges in continuous monitoring programs that rely on automated data feeds from courts, law enforcement agencies, and correctional systems with varying data quality practices.

Automated Alert Verification Requirements

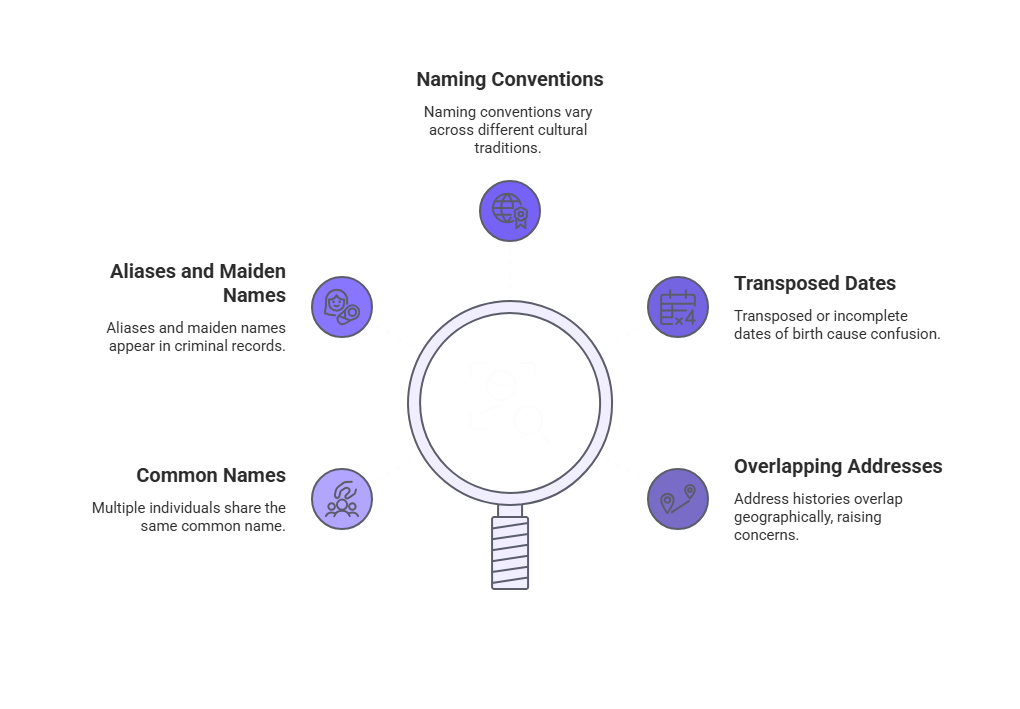

Continuous monitoring systems that generate alerts based on name matching algorithms without human review create elevated risk of misidentification. Common sources of false positive alerts include:

- Common names shared by multiple individuals

- Aliases and maiden names in criminal records

- Naming conventions in different cultural traditions

- Transposed or incomplete dates of birth

- Address histories that overlap geographically

Consumer reporting agencies operating FCRA continuous monitoring programs must implement verification procedures that go beyond simple name matching. Reasonable accuracy procedures include comparing dates of birth, Social Security numbers when available, address histories, physical descriptions in booking records, and photographic matching before reporting criminal records to employer clients.

Real-Time Data Feed Limitations

Many continuous monitoring systems pull data from real-time arrest feeds and booking databases that contain information about individuals taken into custody but not yet charged, charged but not yet arraigned, or charged with offenses that are later dismissed, reduced, or diverted. These databases rarely update in real time to reflect case dispositions, charge amendments, or expungements.

Consumer reporting agencies relying on automated data feeds must implement procedures to verify current case status before reporting criminal records to employers. Reasonable procedures include checking court dockets for dispositions, allowing sufficient time after arrest for charging decisions, and excluding records where no formal charges appear within jurisdiction-specific timeframes.

Employee Dispute Rights and Procedures

Employees who receive pre-adverse action notices based on continuous monitoring alerts have the right to dispute inaccurate information with the consumer reporting agency. Upon receiving a dispute directly from the employee, the consumer reporting agency must conduct a reasonable reinvestigation within 30 days under 15 U.S.C. § 1681i. Employers should account for this statutory timeline when establishing their own adverse action procedures and may need to extend waiting periods when employees initiate formal disputes with the consumer reporting agency.

Employers should pause adverse action procedures when employees provide credible evidence that a continuous monitoring alert contains inaccurate information. Evidence of inaccuracy may include court documentation showing case dismissal, identity documents demonstrating mistaken identity, or sealed or expunged records that should not appear in background reports under applicable law.

State-Specific Requirements Affecting Continuous Monitoring

Federal FCRA compliance provides the baseline framework for continuous monitoring programs, but employers must also navigate state statutes that impose additional restrictions, procedural requirements, or substantive limitations on the use of criminal records in employment decisions. When federal and state requirements conflict, employers must follow the law that provides greater protection to employees. Requirements vary significantly by jurisdiction and may change through legislation or regulatory interpretation.

The following examples illustrate how selected states modify or expand federal FCRA requirements. These examples are not exhaustive, and many other states and municipalities impose restrictions on continuous monitoring, criminal record consideration, or background check procedures. Employers must research the specific requirements applicable to each jurisdiction where they employ monitored individuals and should not assume that states not discussed here lack relevant restrictions.

| State/City | Key Restrictions | Continuous Monitoring Impact |

| California | ICRAA disclosure requirements, CCPA data access rights | Enhanced authorization procedures, employee access requests |

| New York | Article 23-A individualized assessment, Fair Chance Act arrest restrictions | Eight-factor evaluation, arrest alert limitations |

| Illinois | Ban on arrest records without convictions, sealed record prohibitions | Alert filtering requirements, CRA configuration |

| Massachusetts | CORI access restrictions, misdemeanor exclusions | Felony-only reporting for most employers |

Employers operating across multiple jurisdictions must implement compliance matrices that account for the most protective requirements in each location.

California ICRAA and CCPA Intersection

California's Investigative Consumer Reporting Agencies Act applies to background checks that include interviews, public record searches, or database checks beyond basic criminal record verification. Continuous monitoring programs that incorporate court record monitoring, incarceration database checks, or sex offender registry searches likely constitute investigative consumer reports requiring compliance with ICRAA's enhanced disclosure and authorization procedures.

The California Consumer Privacy Act creates additional obligations for employers who maintain databases of continuous monitoring alerts. Employees have rights to request disclosure of what personal information the employer has collected about them through monitoring, the sources of that information, and whether the information has been shared with third parties.

New York Article 23-A and Fair Chance Requirements

New York Correction Law Article 23-A prohibits employers from denying employment based on criminal convictions unless the employer can demonstrate a direct relationship between the conviction and the specific employment or an unreasonable risk to property or to the safety or welfare of specific individuals or the general public. This individualized assessment requirement applies to continuous monitoring alerts that surface convictions occurring during employment.

New York City's Fair Chance Act imposes additional restrictions, including prohibitions on making employment decisions based solely on pending arrests or criminal accusations without convictions. Continuous monitoring alerts involving New York City employees require careful legal analysis before initiating adverse action procedures.

Illinois and Massachusetts Restrictions

Illinois law prohibits employers from asking about or considering arrest records that did not lead to convictions, participation in diversion or deferral programs resulting in dismissal, or convictions that have been sealed or expunged. Continuous monitoring programs must filter alerts involving these categories before reporting to employers.

Massachusetts restricts employer access to Criminal Offender Record Information and prohibits discrimination based on misdemeanor convictions or sealed records. Continuous monitoring programs covering Massachusetts employees may only report felony convictions and must exclude misdemeanors after initial disposition.

Common Compliance Failures and Risk Exposure

Organizations implementing continuous monitoring programs repeatedly encounter predictable compliance failures that create legal exposure under the FCRA, state background check laws, and anti-discrimination statutes.

Using Outdated or Non-Specific Authorizations

The most common continuous monitoring compliance failure involves relying on general background check authorizations obtained at hire that do not specifically address ongoing monitoring. Authorization language stating that the employer "may obtain background checks during your employment" creates ambiguity about whether the employee understood and consented to continuous automated monitoring versus periodic re-screening at the employer's discretion.

Courts examining FCRA authorization adequacy apply strict standards requiring clear, conspicuous, and specific disclosure of what the employee authorized. Employers implementing continuous monitoring after hire using only original hire authorizations that did not explicitly reference continuous monitoring face elevated risk that authorization will be deemed inadequate if challenged.

Bypassing Adverse Action Procedures for Serious Alerts

Organizations sometimes terminate employees immediately upon receiving continuous monitoring alerts involving serious offenses such as violent felonies, sex crimes, or conduct directly contradicting job responsibilities. This approach violates FCRA adverse action requirements even when the underlying conduct clearly warrants termination.

The adverse action process is not discretionary or subject to a severity exception. Employees must receive pre-adverse action notice, an opportunity to dispute the information, and final adverse action notice regardless of how serious or clearly documented the criminal conduct appears.

Conflating Arrests With Convictions

Continuous monitoring systems generate many alerts based on arrest records, booking information, or criminal charges that have not reached adjudication. Employers who treat arrest alerts as evidence of disqualifying conduct and initiate adverse action without verifying case disposition violate both accuracy standards and anti-discrimination principles.

Federal civil rights guidance emphasizes that arrests without convictions have limited evidentiary value because they represent accusations rather than proven conduct. Many state laws explicitly prohibit employment decisions based on arrests that did not lead to convictions.

Inadequate Individualized Assessment

Blanket disqualification policies that automatically terminate employees based on categories of criminal convictions without individualized assessment violate Equal Employment Opportunity Commission guidance and numerous state laws. Continuous monitoring programs must incorporate individualized assessment procedures that evaluate each alert based on the specific facts, employee circumstances, and job requirements.

Implementation Decision Framework

Organizations considering continuous monitoring programs should complete structured readiness assessments before implementation to identify legal, operational, and resource gaps that could undermine compliance or program effectiveness.

Policy Development and Business Necessity Documentation

The first implementation step involves documenting the business necessity justifying continuous monitoring for specific employee populations. Business necessity analysis should identify the job-related risks that ongoing monitoring addresses, such as:

- Regulatory requirements in healthcare or financial services

- Safety-sensitive positions with access to vulnerable populations

- Roles with fiduciary responsibilities where criminal conduct would create liability exposure

- Client contractual obligations mandating ongoing screening

- Industry standards for risk management in specific sectors

Written policies should define which employee populations are subject to continuous monitoring, the criteria used to determine monitoring necessity, the types of criminal records included in monitoring scope, the frequency of database searches, and the procedures for responding to alerts.

Consumer Reporting Agency Selection Criteria

Organizations should evaluate consumer reporting agencies offering continuous monitoring services based on their data source coverage, matching accuracy and verification procedures, compliance expertise, alert delivery and case management systems, and dispute resolution capabilities.

Consumer reporting agencies should provide transparency about their alert accuracy rates, false positive rates for identity matching, and average timeframes for disposition verification on arrest alerts. Service level agreements should specify performance standards for alert delivery timing, accuracy verification, and dispute resolution.

Internal Workflow Design and Training

Continuous monitoring programs generate alerts requiring prompt review, legal evaluation, and action decisions. Organizations must design workflows that route alerts to appropriate personnel, track alert review and disposition, initiate adverse action procedures when required, and document individualized assessments and final decisions.

Human resources staff, managers with termination authority, and legal or compliance personnel involved in continuous monitoring programs require training on FCRA adverse action procedures, individualized assessment requirements, state law variations, and organizational policies for alert evaluation.

Conclusion

Continuous criminal monitoring compliance requires organizations to implement procedural frameworks that satisfy FCRA disclosure, authorization, and adverse action requirements while navigating state-specific legal variations. Organizations must select consumer reporting agencies with robust accuracy verification procedures, train personnel to execute individualized assessments and proper adverse action protocols, and maintain documentation demonstrating compliance with evolving legal requirements.

Frequently Asked Questions

Do FCRA rules apply to continuous monitoring of current employees?

Yes, the Fair Credit Reporting Act applies to continuous criminal monitoring when a consumer reporting agency provides ongoing reports about current employees for employment purposes. Each alert generated by a continuous monitoring system constitutes a consumer report subject to FCRA requirements including disclosure, authorization, and adverse action procedures.

Can a single authorization signed at hire cover continuous monitoring throughout employment?

Employers may obtain authorization for continuous monitoring at hire if the disclosure and authorization documents clearly and specifically describe ongoing monitoring rather than one-time background checks. The authorization should state that monitoring will continue throughout employment and explain the general scope and nature of monitoring activities.

What adverse action procedures are required when a monitoring alert reveals a new criminal record?

Employers must provide pre-adverse action notice including a copy of the consumer report containing the criminal record and a summary of FCRA rights, allow a reasonable period for the employee to dispute inaccurate information, and provide final adverse action notice if proceeding with termination or other adverse action.

How often must employers notify employees that continuous monitoring is active?

The FCRA requires disclosure and authorization before continuous monitoring begins but does not mandate periodic re-notification during employment. However, transparency best practices suggest providing annual reminders that monitoring remains active, particularly in organizations with high employee turnover or where monitoring is not universally applied to all positions.

Are employers required to notify employees of every monitoring alert received?

Federal law does not require employers to notify employees of monitoring alerts unless the employer intends to take adverse action based on the information, at which point pre-adverse action notice is mandatory. Some organizations voluntarily notify employees of all alerts to support transparency and allow employees to identify and correct inaccuracies.

What criminal records can be included in continuous monitoring programs?

The permissible scope of criminal records in continuous monitoring depends on federal FCRA standards and state-specific limitations. Many states prohibit use of arrest records that did not lead to convictions, sealed or expunged records, and minor offenses beyond specified lookback periods.

Does continuous monitoring require individualized assessment of criminal records discovered after hire?

Yes, employers must conduct individualized assessments that evaluate the nature of the criminal conduct, the time elapsed since the offense, the relationship between the conduct and job responsibilities, and evidence of rehabilitation before taking adverse action.

What happens if an employee revokes consent to continuous monitoring?

Employees may revoke consent to continuous monitoring at any time unless monitoring is a mandatory condition of employment due to regulatory requirements or documented business necessity. Employers must cease monitoring upon receiving revocation but may need to address employment consequences if continued monitoring is job-required.

Additional Resources

- Fair Credit Reporting Act Full Text and Official Interpretations

https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act - Using Consumer Reports for Employment Purposes (FTC Guidance)

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-employment-purposes - EEOC Enforcement Guidance on the Consideration of Arrest and Conviction Records

https://www.eeoc.gov/laws/guidance/enforcement-guidance-consideration-arrest-and-conviction-records-employment - California Investigative Consumer Reporting Agencies Act

https://leginfo.legislature.ca.gov/faces/codes_displayText.xhtml?lawCode=CIV&division=3.&title=1.81. - New York Correction Law Article 23-A (Employment of Persons with Criminal Convictions)

https://www.nysenate.gov/legislation/laws/COR/A23-A - Consumer Financial Protection Bureau FCRA Resources and Compliance Guides

https://www.consumerfinance.gov/compliance/compliance-resources/other-applicable-requirements/fair-credit-reporting-act/

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.