Texas agricultural employers face a complex regulatory landscape where federal immigration enforcement intersects with state labor laws. This creates heightened documentation requirements for farm worker background checks—particularly in border counties where scrutiny intensifies. Unlike traditional employment sectors, agricultural operations must balance E-Verify mandates, I-9 compliance, and sector-specific screening protocols while managing seasonal workforce fluctuations. Rural hiring infrastructure limitations add practical challenges to maintaining legal compliance.

Key Takeaways

- Texas farm worker background checks require coordination between federal immigration verification (E-Verify/I-9), criminal history screening, and agricultural-specific compliance measures that vary significantly between border and interior counties.

- Border region agricultural employers face enhanced scrutiny from Immigration and Customs Enforcement (ICE) and must implement more rigorous documentation protocols than operations in non-border areas.

- Ranch operations with fewer than 50 employees often qualify for different compliance thresholds than large commercial farms, though both must meet baseline federal immigration verification requirements.

- Seasonal agricultural workers (H-2A visa holders) require specialized background verification that includes consular processing documentation, employer attestations, and country-of-origin records validation.

- Criminal background checks for agricultural positions must comply with FCRA guidelines and Texas Labor Code provisions, with special consideration for Ban the Box restrictions effective since 2020.

- E-Verify participation is mandatory for Texas employers with state contracts and strongly recommended for agricultural operations in border counties due to increased enforcement activity.

- Rural hiring challenges—including limited internet connectivity, language barriers, and distance from screening service providers—require alternative verification strategies that maintain legal compliance.

- Agricultural staffing agencies serving Texas farms must carry additional liability insurance and maintain enhanced record-keeping systems to satisfy both client requirements and regulatory audits.

Understanding Texas Agricultural Employment Verification Requirements

Texas agricultural employers operate under a dual regulatory framework. Federal immigration law combines with state-specific labor provisions to create comprehensive compliance obligations. The federal Immigration Reform and Control Act (IRCA) establishes baseline requirements for all U.S. employers. This includes mandatory Form I-9 completion for every hire and prohibition of employing unauthorized workers.

The U.S. Department of Homeland Security designates the entire Texas-Mexico border region as an enhanced enforcement zone. Immigration checkpoints, worksite inspections, and documentation audits occur with greater frequency in these areas. Agricultural employers in Cameron, Hidalgo, Webb, El Paso, and other border counties report ICE worksite enforcement actions at rates approximately 340% higher than interior Texas counties according to 2024 data. This geographic reality makes thorough Texas farm worker background checks not merely a legal formality but an operational necessity.

Federal Baseline Requirements for All Agricultural Employers

Every agricultural employer hiring in Texas must complete Form I-9 within three days of an employee's start date. This process requires examining original documents that establish both identity and employment authorization. Acceptable documents include U.S. passports, permanent resident cards, or combinations from Lists B and C. The verification process requires physical examination of original documents—photocopies alone don't satisfy legal requirements.

E-Verify participation adds an electronic layer to this process. The system cross-references employee information against Department of Homeland Security and Social Security Administration databases. While E-Verify remains voluntary for most private employers, Texas Government Code §2264.053 mandates participation for state contractors and subcontractors. Agricultural operations receiving state grants, holding state service contracts, or participating in certain assistance programs fall under this requirement. Voluntary enrollment is increasingly common among border region employers seeking to demonstrate good-faith compliance efforts.

Texas-Specific Agricultural Labor Provisions

Texas Labor Code Chapter 91 establishes employer obligations specific to the state. These include payment timing requirements, wage statement provisions, and documentation retention standards. Agricultural employers must maintain comprehensive records that exceed general business timelines:

| Record Type | Retention Period | Regulatory Basis |

| Payroll records | 3 years minimum | Texas Labor Code |

| Employment applications | 1 year from creation | State statute |

| I-9 forms | 3 years after hire OR 1 year after termination (whichever is later) | Federal IRCA requirements |

| Background check reports | 3+ years (per FCRA notice) | Fair Credit Reporting Act |

The Texas Workforce Commission enforces state wage and hour provisions while coordinating with federal agencies on immigration-related matters. Documentation gaps discovered during a TWC wage investigation can trigger referrals to ICE. Smart employers implement redundant verification systems that satisfy both state labor audits and federal immigration reviews simultaneously.

Border Region Agricultural Employment Screening Challenges

The Texas-Mexico border region presents unique complexities for agricultural hiring. Approximately 68% of Texas agricultural production occurs in counties within 150 miles of the international boundary, according to Texas A&M AgriLife Research data from 2024. This geographic concentration places the majority of Texas farm worker background checks under enhanced federal scrutiny. Border county agricultural employers typically draw from labor pools with higher percentages of recent immigrants, naturalized citizens, lawful permanent residents, and authorized non-immigrants compared to interior regions.

Enhanced Enforcement Zone Considerations

The Department of Homeland Security maintains permanent immigration checkpoints on major highways leading north from border counties. These checkpoints effectively create a secondary enforcement boundary 25-75 miles inland from the actual border. Agricultural operations within this enforcement zone experience regular contact with border patrol agents. "Roving patrols" may enter agricultural land, and transportation verification stops can intercept farm vehicles.

Border region employment screening must account for this reality by implementing verification protocols that exceed minimum legal requirements. Best practices include several critical measures:

- E-Verify enrollment: Conduct secondary document verification through E-Verify even when not legally mandated to demonstrate compliance commitment.

- Enhanced documentation: Maintain digitized copies of all I-9 supporting documents despite regulations not requiring retention for defensible audit responses.

- Quarterly self-audits: Implement regular internal reviews that identify documentation weaknesses before government inspections occur.

- Staff training: Ensure all personnel involved in hiring understand document types, verification procedures, and red flags indicating potential issues.

These enhanced measures provide defensible documentation trails when enforcement actions occur. They also demonstrate good-faith compliance efforts that can mitigate penalties during government audits.

Cross-Border Commuter Workforce Considerations

A significant portion of Texas border agriculture relies on lawful cross-border commuters. These workers reside in Mexican border cities but possess valid authorization to work in the United States. They typically hold border crossing cards (B1/B2 visitor visas) combined with separate employment authorization, or they possess green cards while maintaining primary residences abroad.

Verification requires careful examination to ensure documents actually authorize employment rather than merely permitting border crossing. Agricultural staffing compliance for cross-border commuters involves tracking visa expiration dates and ensuring continuous authorization throughout employment periods. Unlike U.S. citizen employees whose work authorization never expires, commuter workers may have documents requiring renewal every 1-10 years depending on document type. Smart employers implement automated tracking systems that flag upcoming expirations 90 days in advance.

Seasonal Worker Background Verification Protocols

Seasonal agricultural labor creates cyclical hiring patterns that challenge traditional background verification systems. Texas farms employ approximately 180,000 seasonal workers during peak harvest periods (spring through fall) compared to roughly 45,000 year-round agricultural employees, based on 2024 Texas Workforce Commission data. This 400% seasonal workforce expansion creates compressed hiring timelines where verification shortcuts tempt employers facing labor shortages.

The H-2A Temporary Agricultural Worker Program provides legal channels for seasonal foreign worker employment when domestic labor proves insufficient. Texas leads the nation in H-2A certifications, with approximately 28,000 positions certified in fiscal year 2024. These workers arrive with employment authorization documents already processed through U.S. consulates abroad. However, domestic employers retain verification responsibilities and must conduct agricultural employee screening that satisfies both program requirements and general employment law.

H-2A Worker Documentation Requirements

H-2A workers present specialized documentation that differs from typical employment verification. These employees arrive with visa stamps in foreign passports, Form I-94 arrival records indicating H-2A classification, and USCIS approval notices specifying authorized employers and employment periods. Border county agricultural screening staff must verify that the employer listed on authorization documents matches the actual hiring entity.

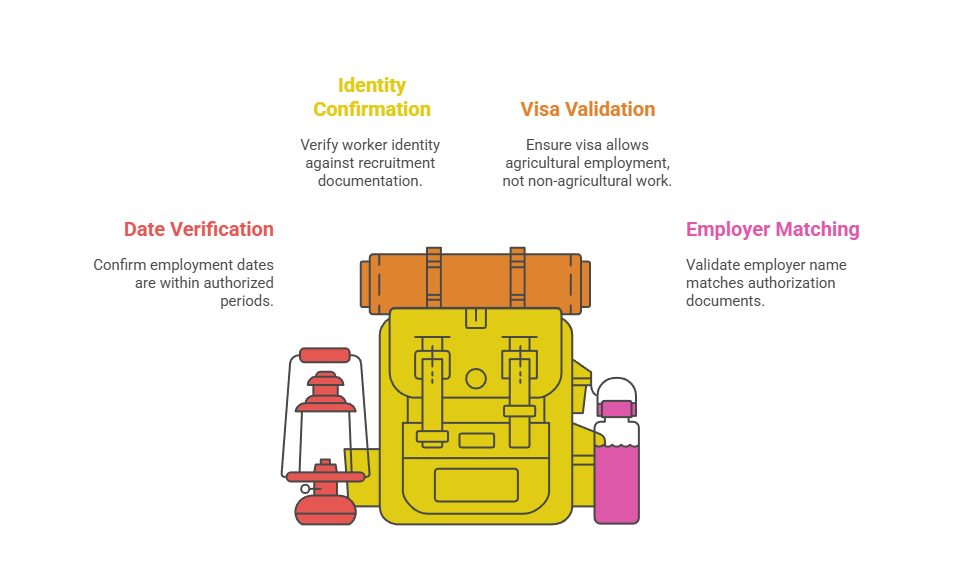

Background verification for H-2A workers should include several critical elements:

- Identity confirmation: Verify that worker identity matches recruitment documentation provided during the application process.

- Visa classification validation: Ensure visa classifications allow agricultural employment specifically, as H-2B visas cover non-agricultural temporary work and don't satisfy H-2A positions.

- Employment date verification: Confirm that employment dates fall within authorized periods specified on approval documents.

- Employer matching: Validate that the employer name on all authorization documents matches the hiring entity, as H-2A workers cannot legally transfer between employers without USDOL approval.

The Department of Labor conducts random audits of approximately 15% of H-2A employers annually. These examinations scrutinize hiring documentation, wage records, and housing compliance with particular attention to detail.

Domestic Seasonal Worker Verification

Domestic seasonal workers—U.S. citizens and authorized non-citizens not entering through H-2A programs—require the same I-9 and background verification as permanent employees. Compressed hiring timelines create practical challenges for thorough screening. Agricultural operations hiring dozens or hundreds of workers within short windows often establish mobile verification stations at labor camps, processing centers, or field sites.

Ranch employee background verification for seasonal domestic workers should include criminal history screening appropriate to job duties. This is particularly important for positions involving equipment operation, livestock handling, or access to agricultural chemicals. Texas law doesn't prohibit considering criminal history in agricultural hiring decisions. However, employers must comply with FCRA requirements including providing pre-adverse action notices before rejecting applicants based on background reports.

Criminal Background Checks for Agricultural Positions

Agricultural employee screening extends beyond immigration verification to include criminal history review. The scope and application of background checks varies significantly by operation size, job duties, and employer risk tolerance. Unlike positions in healthcare, education, or financial services where statutes mandate specific background checks, Texas law generally doesn't require criminal screening for farm or ranch employment.

The Fair Credit Reporting Act governs employment-related background checks obtained through third-party screening companies. FCRA requires written authorization before checks occur, disclosure before adverse employment actions based on reports, and opportunity for applicants to dispute inaccurate information. Texas adopted additional protections through Labor Code §91.001 and local ordinances in Austin and other cities implementing "Ban the Box" restrictions. These regulations delay criminal history inquiries until after conditional job offers. Agricultural employers must navigate this compliance landscape while making practical hiring decisions in time-sensitive seasonal contexts.

FCRA Compliance in Agricultural Hiring

Farm owners conducting Texas farm worker background checks through consumer reporting agencies must provide clear written disclosure. This disclosure must appear on a standalone document without extraneous information and state that background checks may occur. Applicants must provide written authorization before checks proceed.

When background information contributes to employment denial, specific procedural steps apply:

- Pre-adverse action notice: Provide notification including a copy of the background report and FCRA rights summary before making final rejection decisions.

- Reasonable waiting period: Allow adequate time (typically 5-7 business days) for applicants to review reports and dispute inaccuracies.

- Adverse action notice: Send final notification if rejection proceeds, including contact information for the screening company and statement of applicant rights.

- Documentation retention: Maintain all authorization forms, reports, and correspondence for compliance with retention requirements.

These procedural requirements create timing challenges for seasonal agricultural hiring where labor demands may require immediate staffing. Some large operations address this by maintaining pre-screened applicant pools.

Relevant Criminal History Considerations

Agricultural positions involve varied duties with different risk profiles that should inform background check scope. Equipment operators handling tractors, combines, or irrigation systems create different liability exposures than manual harvest workers. Ranch employees managing livestock may access veterinary pharmaceuticals requiring DEA registration. Workers entering employer-provided housing raise safety concerns for other occupants.

Texas law doesn't prescribe lookback periods or specify which offenses justify employment denial in agricultural contexts. These determinations remain subject to employer judgment within FCRA constraints. Practical considerations should include offense severity, time elapsed since conviction, evidence of rehabilitation, and relationship between criminal history and specific job duties. Criminal history screening policies should be documented, applied consistently, and reviewed by employment counsel.

Ranch Operations vs. Commercial Farm Compliance Differences

Texas agricultural operations span enormous diversity—from 50,000-acre corporate cotton farms employing hundreds to family ranches running cattle with two full-time workers. This operational variety creates compliance obligation differences that affect background verification requirements and practical screening approaches. Understanding which regulations apply to specific operation types prevents both over-compliance that wastes resources and under-compliance that creates legal exposure.

| Operation Type | Typical Size | Primary Compliance Focus | Verification Depth |

| Family ranches | 1-10 employees | I-9 completion, basic screening | Moderate |

| Mid-size farms | 11-49 employees | I-9, E-Verify (recommended), criminal checks | Enhanced |

| Large commercial operations | 50+ employees | Full MSPA, mandatory policies, comprehensive screening | Maximum |

The Migrant and Seasonal Agricultural Worker Protection Act (MSPA) establishes enhanced protections for specific categories of agricultural workers. The law requires certain employers to register with the Department of Labor, provide written wage disclosures, and meet transportation and housing standards. Farm labor contractors—entities that recruit, solicit, hire, employ, furnish, or transport migrant or seasonal agricultural workers—face the strictest MSPA requirements.

Small Ranch Compliance Thresholds

Texas ranch operations structured as family businesses employing immediate family members face minimal federal oversight under agricultural labor law exceptions. The Fair Labor Standards Act exempts small farms from minimum wage requirements under specific conditions. However, this exemption doesn't extend to immigration verification—all employers regardless of size must complete I-9 forms.

Ranches employing non-family workers year-round in non-seasonal capacities may fall outside MSPA seasonal/migrant worker protections. This potentially reduces documentation requirements while still maintaining I-9 obligations. These operations should consult agricultural employment counsel to determine exact obligations. Even exempt small ranches should implement basic Texas farm worker background checks to establish negligent hiring defenses.

Large Commercial Operation Requirements

Commercial farms operating with corporate structures, multi-county footprints, and seasonal workforces exceeding 50 employees face full regulatory scrutiny. These operations cannot claim small business exemptions and must implement comprehensive agricultural staffing compliance programs. Coverage areas include immigration verification, wage and hour compliance, workplace safety, housing standards (when provided), and transportation requirements (when furnished).

Border county agricultural screening for large operations should include formal written policies documenting verification procedures. Designated compliance personnel trained in current regulations provide essential oversight. Regular third-party audits identify gaps before government enforcement actions occur. Many large Texas agricultural employers retain specialized agricultural employment counsel who review hiring procedures annually.

Agricultural Staffing Agency Compliance Requirements

Agricultural staffing agencies—businesses that recruit, hire, and assign workers to farms and ranches—operate under enhanced regulatory requirements. These entities combine farm labor contractor obligations with general staffing industry standards. Agencies serve important functions in Texas agriculture by maintaining pre-screened worker pools, handling compliance administration, managing payroll and benefits, and absorbing certain liability exposures.

The Department of Labor requires farm labor contractor registration for entities meeting statutory definitions. This includes businesses that recruit or hire workers and then provide those workers to agricultural employers. Registration requirements include passing written examinations on MSPA provisions, maintaining vehicle insurance when transporting workers, and posting bonds or securing insurance ranging from $5,000 to $50,000 depending on activities performed.

Agency Background Verification Obligations

Staffing agencies conducting Texas farm worker background checks for client placement carry heightened verification responsibilities. Both the agency and the client can face liability for inadequate screening. Agencies should implement two-tier verification: baseline checks satisfying minimum legal requirements for all placements, plus enhanced screening matching specific client risk profiles.

Best practice agency verification includes these critical elements:

- E-Verify participation: Enroll regardless of legal mandate to provide maximum immigration compliance assurance to client farms.

- Criminal background checks: Implement screenings with 7-10 year lookback periods covering all counties where applicants resided.

- Motor vehicle records: Obtain MVR checks for positions involving driving duties or farm equipment operation.

- Employment reference verification: Confirm prior agricultural experience when claimed on applications or during interviews.

- Annual updates: Refresh verifications yearly or when material changes occur, providing certification of completion to client operations.

Agencies should maintain these records in applicant files separate from client placements. This documentation creates audit trails demonstrating compliance efforts during government reviews or client inquiries.

Client Farm Compliance Responsibilities

Agricultural operations using staffing agencies cannot completely outsource compliance obligations. Client farms retain joint employment responsibilities and must verify that agencies maintain proper registration, insurance, and verification procedures. Smart farm owners request copies of agency DOL registration certificates, current insurance certificates, and written policies documenting background verification procedures before engaging services.

Joint employment doctrine holds that workers may legally be employees of both the staffing agency and the client farm simultaneously. This creates shared liability for wage violations, safety issues, and discrimination claims. Clear written agreements should specify which entity handles I-9 completion (agencies typically manage this), which performs criminal background checks (should be documented explicitly), and how compliance documentation flows between parties.

Practical Implementation Strategies for Rural Agricultural Employers

Texas agricultural operations face practical challenges implementing compliant background verification in rural contexts. Traditional screening infrastructure may be limited in remote areas. Internet connectivity required for E-Verify participation remains inconsistent in many ranch locations. Third-party background check providers may lack local offices for in-person document verification. Multilingual verification staff capable of reviewing foreign documents may be unavailable within reasonable distances.

Successful agricultural employee screening in rural Texas combines technology investments, strategic partnerships, and procedure adaptations. Large farms may justify dedicated HR staff positions focused on compliance administration. Smaller ranches might share compliance resources through cooperative arrangements with neighboring operations or industry associations providing centralized services.

Technology Solutions for Remote Verification

Cloud-based human resources platforms now offer agricultural-specific modules that facilitate compliance in remote settings. These systems provide mobile I-9 completion with photo document capture allowing remote workers to complete Section 1 on personal devices. Authorized personnel review documents via secure connections from any location. E-Verify integration functions wherever internet connectivity exists—even if intermittent, as submissions queue and process when connection restores.

Texas farm worker background checks can leverage these platforms to centralize verification across multiple ranch locations. The systems create audit trails documenting when and how verification occurred. Automated credential tracking flags upcoming expirations for work authorization documents requiring renewal. Initial implementation requires investment in devices (tablets or smartphones with cameras), reliable internet connectivity (possibly through cellular hotspots if landlines prove inadequate), and staff training on platform navigation.

Partnership Approaches to Compliance

Agricultural employers without resources for dedicated compliance staff can leverage external partnerships that provide specialized expertise. Regional agricultural associations increasingly offer compliance services as member benefits. These include group training sessions on current verification requirements, template policy documents customizable to specific operations, and hotline access to employment counsel for urgent questions.

Texas and Southwestern Cattle Raisers Association, Texas Farm Bureau, and regional grower cooperatives maintain programs addressing member compliance needs. Third-party compliance firms specializing in agricultural employment can provide comprehensive services:

- I-9 completion and audits: Professional review of forms, identification of errors, and correction guidance

- E-Verify management: System enrollment, case processing, and tentative non-confirmation resolution

- Criminal background check coordination: Screening arrangement, FCRA compliance management, and adverse action administration

- MSPA compliance assistance: Registration support, housing inspection coordination, and transportation documentation

These arrangements work particularly well for seasonal operations where year-round HR staffing isn't justified. Ranch employee background verification through qualified third parties establishes defensible compliance even when internal expertise is limited.

Conclusion

Texas agricultural employers must navigate complex intersections of federal immigration law, state labor provisions, and practical operational constraints when conducting farm worker background checks. Border region operations face heightened scrutiny requiring enhanced verification procedures. Ranch size, seasonal workforce patterns, and staffing approaches determine specific compliance obligations. Successful agricultural employee screening balances thorough verification that protects against enforcement actions and negligent hiring liability with practical implementation appropriate to operational resources. As immigration enforcement priorities evolve and agricultural labor markets tighten, investment in robust, compliant verification systems protects both immediate operational needs and long-term business viability for Texas farms and ranches.

Frequently Asked Questions

Are Texas farmers required to use E-Verify for all employees?

E-Verify is mandatory only for Texas employers with state government contracts or receiving certain state benefits per Texas Government Code §2264.053. Private agricultural employers without state contracts may voluntarily participate. However, border region agricultural operations increasingly adopt E-Verify voluntarily to demonstrate good-faith compliance efforts during ICE audits. All agricultural employers must complete Form I-9 for every employee regardless of E-Verify participation.

How far back should criminal background checks go for ranch employees?

Texas law doesn't specify lookback periods for agricultural employment criminal background checks. The FCRA allows reporting of criminal convictions indefinitely, while arrests without conviction generally can't be reported beyond seven years. Most agricultural employers use 7-10 year lookback periods balancing reasonable screening depth with practical relevance. Background check scope should reflect specific job duties and operational risk factors.

What documents can H-2A seasonal workers present during I-9 verification?

H-2A workers typically present foreign passports containing H-2A visa stamps along with Form I-94 arrival/departure records showing H-2A classification and authorized employment periods. These documents satisfy both identity verification (List A documents under I-9 guidelines) and work authorization. Employers must verify that the employer name on USCIS approval notices matches the hiring entity, as H-2A authorization is employer-specific.

Do small family ranches need to conduct background checks on employees?

Federal and Texas law don't mandate criminal background checks for most agricultural positions, though all employers regardless of size must complete I-9 immigration verification. Small ranches should assess specific risk factors including whether employees operate equipment, access chemicals or pharmaceuticals, work with vulnerable populations, or enter occupied residences. Even when not legally required, basic background verification provides negligent hiring defenses if employees later cause harm.

How do border proximity and immigration enforcement affect agricultural hiring compliance?

Border region agricultural employers experience ICE worksite enforcement, immigration checkpoint encounters, and documentation audits at significantly higher rates than interior Texas operations. Enhanced enforcement zones extend approximately 100 miles inland from the international boundary, covering most major Texas agricultural areas. Employers in these regions should implement verification procedures exceeding minimum legal requirements, including voluntary E-Verify participation and regular self-audits.

What are the compliance differences between using staffing agencies versus hiring farm workers directly?

Agricultural staffing agencies handle certain compliance functions including I-9 completion, E-Verify submission, payroll processing, and background verification, but client farms retain joint employment responsibilities. Direct hiring gives employers complete control over verification processes and worker relationships but requires internal compliance expertise. Written agreements should clearly specify which party handles each compliance obligation to prevent gaps where both parties assume the other manages specific requirements.

Can Texas agricultural employers reject applicants based on criminal history?

Texas law generally allows agricultural employers to consider criminal history in hiring decisions. However, employers must comply with FCRA requirements including providing pre-adverse action notices with report copies before rejecting applicants based on background checks. Rejection decisions should consider offense relevance to job duties, time elapsed since conviction, and rehabilitation evidence while documenting business justifications for defensibility.

What records must Texas farms maintain for background check compliance?

Agricultural employers must retain I-9 forms for three years after hire or one year after termination (whichever is later), background check authorization forms and reports for timeframes specified in FCRA notices (typically at least three years), and payroll records for three years under Texas Labor Code provisions. E-Verify records should be maintained alongside corresponding I-9 forms. Employers using H-2A workers must retain recruitment documentation, wage records, housing inspection reports, and transportation records for three years.

Additional Resources

- U.S. Citizenship and Immigration Services: I-9 Central

https://www.uscis.gov/i-9-central - U.S. Department of Homeland Security: E-Verify

https://www.e-verify.gov - U.S. Department of Labor: H-2A Temporary Agricultural Program

https://www.dol.gov/agencies/eta/foreign-labor/programs/h-2a - U.S. Department of Labor: Migrant and Seasonal Agricultural Worker Protection Act

https://www.dol.gov/agencies/whd/agriculture/mspa - Federal Trade Commission: Background Checks and FCRA Compliance

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-employers-need-know - Texas A&M AgriLife Extension: Agricultural Labor Management

https://agrilifeextension.tamu.edu - Texas Department of Agriculture: Resources for Texas Farmers and Ranchers

https://www.texasagriculture.gov

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.