Consumer report background checks typically take 1-5 business days to complete, though instant results are available for basic searches while comprehensive employment screenings can extend to 10 days or longer. The actual turnaround time depends on multiple factors including the depth of search, county court systems, verification methods, and whether any discrepancies require manual review.

Key Takeaways

- Standard background checks take 2-4 business days for most employment screenings, with instant options available for limited searches.

- County-level criminal history searches represent the most time-consuming component, often requiring 3-7 days due to manual courthouse record retrieval.

- Instant background checks provide immediate results but only search limited databases and may miss critical information from primary sources.

- Employment and education verification adds 2-5 days to the process depending on third-party response times and institutional verification procedures.

- Federal and state-level searches generally process faster (1-3 days) than county court searches because they maintain centralized digital databases.

- Delays occur most frequently due to common names requiring additional verification, incomplete applicant information, court system backlogs, and records requiring manual research.

Understanding Consumer Report Background Checks

A consumer report background check is a comprehensive review of an individual's history compiled by consumer reporting agencies under the Fair Credit Reporting Act (FCRA). These reports aggregate information from multiple sources including criminal records, employment history, credit data, driving records, and educational credentials. This information helps employers make informed hiring decisions.

The FCRA governs how these reports are obtained, used, and disputed. Employers must obtain written consent before conducting checks and provide applicants with adverse action notices if findings affect employment decisions. Consumer reporting agencies must follow strict accuracy and privacy standards when compiling these reports to protect applicants from inaccurate information that could harm employment opportunities.

Understanding what goes into your background check helps set realistic expectations from authorization to final report delivery. The process involves multiple verification steps that ensure accuracy and compliance with federal regulations. Each component serves a specific purpose in helping employers assess candidate suitability while protecting applicant rights throughout the screening process.

Average Timeline by Background Check Type

Different types of consumer reports require varying amounts of time based on the sources checked and verification methods used. The complexity of each search determines how quickly results become available. Some searches access digital databases instantly while others require manual research at physical locations.

| Background Check Type | Average Turnaround Time | Key Factors Affecting Speed |

| Instant/National Database Search | Immediate - 24 hours | Database accessibility, data freshness |

| County Criminal Search | 3-7 business days | Court system technology, manual retrieval requirements |

| Federal Criminal Search | 1-3 business days | Centralized digital records |

| State Criminal Repository | 1-3 business days | State database infrastructure |

| Employment Verification | 2-5 business days | Previous employer responsiveness |

| Education Verification | 2-7 business days | Institution verification procedures, degree mill checks |

| Professional License Verification | 1-3 business days | State licensing board accessibility |

| Credit Report Check | 1-2 business days | Credit bureau API integration |

| Driving Record (MVR) | 1-5 business days | State DMV processing times |

| Comprehensive Pre-Employment Screening | 5-10 business days | Combined components, verification complexity |

Understanding these variations helps you plan accordingly when undergoing employment screening. Standard employment background checks combining county criminal searches, employment verification, and education confirmation typically complete within one business week for applicants with straightforward histories.

What Happens During the Background Check Process

Information Submission and Verification

The background check timeline begins the moment you authorize the screening and submit your personal information. Consumer reporting agencies immediately validate the data you've provided, checking for completeness, consistency, and accuracy across all fields including your full legal name, Social Security number, date of birth, and addresses from the past 7-10 years. Automated systems flag missing information, name discrepancies, or formatting issues that could impede accurate record retrieval.

Once initial validation completes, the screening company determines which jurisdictions, databases, and verification sources to search based on your residential and employment history. This planning phase typically occurs within the first few hours and sets the foundation for your entire criminal history search timeline. Researchers create a customized search strategy to ensure comprehensive coverage while minimizing unnecessary delays from irrelevant jurisdictions.

Database and Court Record Searches

Database searches execute first because they provide immediate or near-immediate results from aggregated records. National criminal databases, sex offender registries, terrorist watch lists, and federal court records typically return results within minutes to 24 hours through direct API connections. However, these databases serve only as initial screening tools and often contain incomplete or outdated information that requires verification at the source level.

County criminal record searches consume the most time in the background check process because they require direct contact with clerk of court offices or courthouse visits. The United States has over 3,100 counties, and each maintains its own record-keeping system with varying degrees of technological sophistication. Some modern courts provide electronic access to criminal records, returning results within 1-2 days, while others require researchers to physically visit courthouses or submit written requests, extending the process to 5-7 business days or longer.

Employment and Education Confirmation

Third-party verification for employment and education credentials happens simultaneously with criminal record searches to optimize the overall timeline. Verification specialists contact previous employers, educational institutions, and professional licensing boards through phone, email, fax, or online verification systems. Response times vary dramatically based on the organization's size, verification procedures, and current workload.

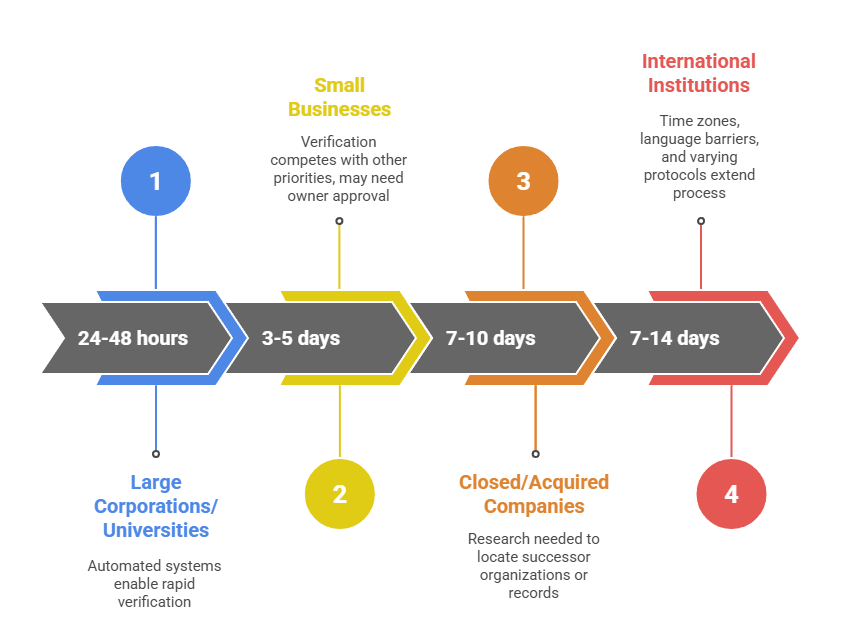

The verification process follows predictable patterns based on organization type:

- Large corporations and universities: Often maintain dedicated verification departments with 24-48 hour response times through automated systems

- Small businesses: Frequently take 3-5 days as verification requests compete with other priorities and may require owner approval

- Closed or acquired companies: Can extend verification to 7-10 days as researchers locate successor organizations or business records

- International institutions: May require 7-14 days due to time zones, language barriers, and varying verification protocols

Background check companies make multiple contact attempts before marking a verification as unable to confirm. Most employment verifications confirm dates of employment and job titles, while education verifications validate degree type, major, and graduation date directly with registrar offices. When direct verification proves impossible, researchers may use alternative methods including reviewing W-2 forms, pay stubs, or official transcripts that applicants provide.

Factors That Affect Background Check Speed

Multiple variables influence how quickly your consumer report completes, ranging from personal history complexity to external system limitations. Understanding these factors helps you anticipate potential delays and take proactive steps to expedite the process. The background check turnaround time depends significantly on elements both within and outside your control.

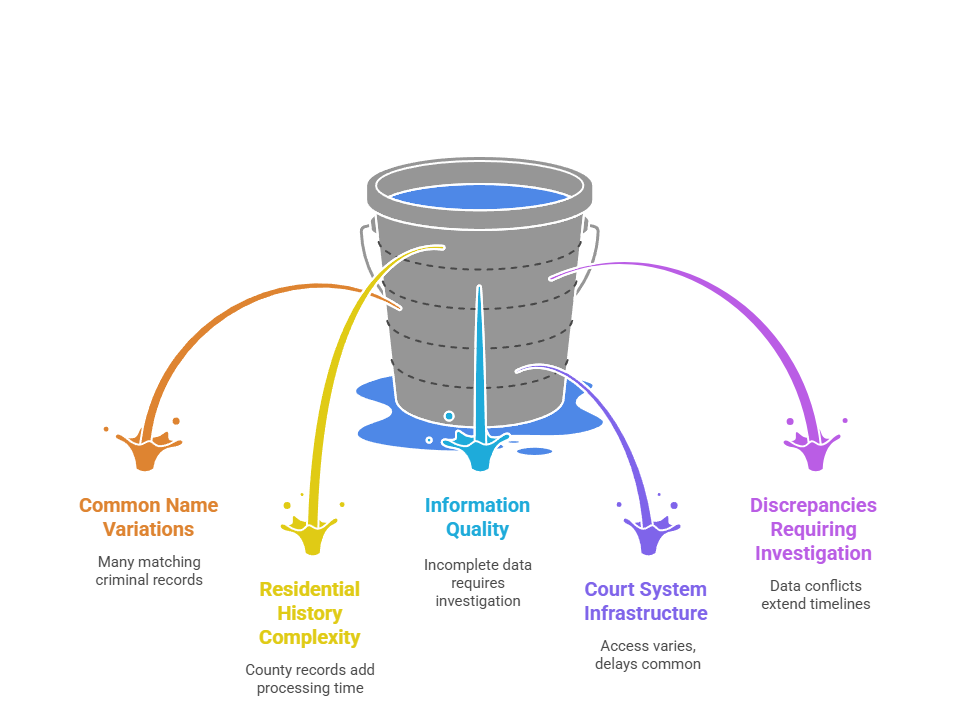

Key factors that commonly extend processing times include:

- Common name variations: Create additional verification requirements that extend processing time by 2-5 days when your name matches thousands of others in criminal databases

- Residential history complexity: Directly impacts timeline because criminal records are maintained at the county level where offenses occurred, with each county adding 3-7 days

- Information quality: Incomplete addresses, missing employment dates, or incorrect Social Security numbers force researchers to conduct additional investigative work adding 1-3 days per issue

- Court system infrastructure: Varies wildly across jurisdictions, with some courts offering instant electronic access while others maintain paper-based systems requiring 5-7 days

- Discrepancies requiring investigation: Automatically extend timelines by 2-7 days as researchers work to resolve contradictions between data sources

The quality and completeness of information you provide determines whether searches proceed smoothly or encounter delays. Each missing or inaccurate piece of information can add time as verification specialists attempt to reconcile discrepancies and ensure accurate reporting. Providing thorough, accurate information from the start represents the most effective way to minimize your background check timeline.

Instant Background Checks vs. Comprehensive Screening

The term "instant background check" attracts attention but often creates unrealistic expectations about thoroughness and accuracy. True instant background checks deliver results within minutes by searching only pre-compiled databases of public records aggregated from various sources. These searches provide a preliminary overview but frequently miss current information, contain outdated data, and lack the source verification required for FCRA-compliant employment decisions.

Instant background check services typically search national criminal databases, sex offender registries, and commercially compiled record collections. While these searches happen quickly, they suffer from significant limitations including records that may be months or years out of date, incomplete coverage of county-level courts, missing dispositions or case outcomes, and no verification that identified records actually belong to the subject. Employment attorneys generally advise against making hiring decisions based solely on instant searches because their accuracy cannot be guaranteed and they may violate FCRA standards.

| Feature | Instant Background Check | Comprehensive Screening |

| Turnaround Time | Immediate - 24 hours | 5-10 business days |

| Data Source | Aggregated databases | Direct courthouse/source verification |

| Record Currency | Often 6-12+ months old | Current within 30 days |

| County Coverage | Limited, varies by database | All relevant jurisdictions searched |

| FCRA Compliance | Often insufficient for employment | Fully compliant with strict standards |

| Accuracy Rate | 60-80% (industry estimates) | 95%+ with proper verification |

| Cost | $10-$30 | $30-$150 depending on scope |

Comprehensive background screenings take longer but provide verified, current information directly from authoritative sources. These screenings include county courthouse searches conducted within the past 30 days, employment verification directly with previous employers, education confirmation from institutional registrars, and careful matching protocols to ensure records belong to the correct individual. The additional 3-7 days required for comprehensive screening significantly reduces the risk of negligent hiring claims, wrongful termination lawsuits, and FCRA violations that can cost employers hundreds of thousands in damages.

How to Speed Up Your Background Check

While you cannot control court processing times or third-party verification response rates, several proactive steps can minimize delays and help your consumer report complete as quickly as possible. Accurate information submission remains the single most important factor within your control that affects overall turnaround time. Taking time to carefully complete authorization forms with precise details prevents 90% of common delays that extend the background check process.

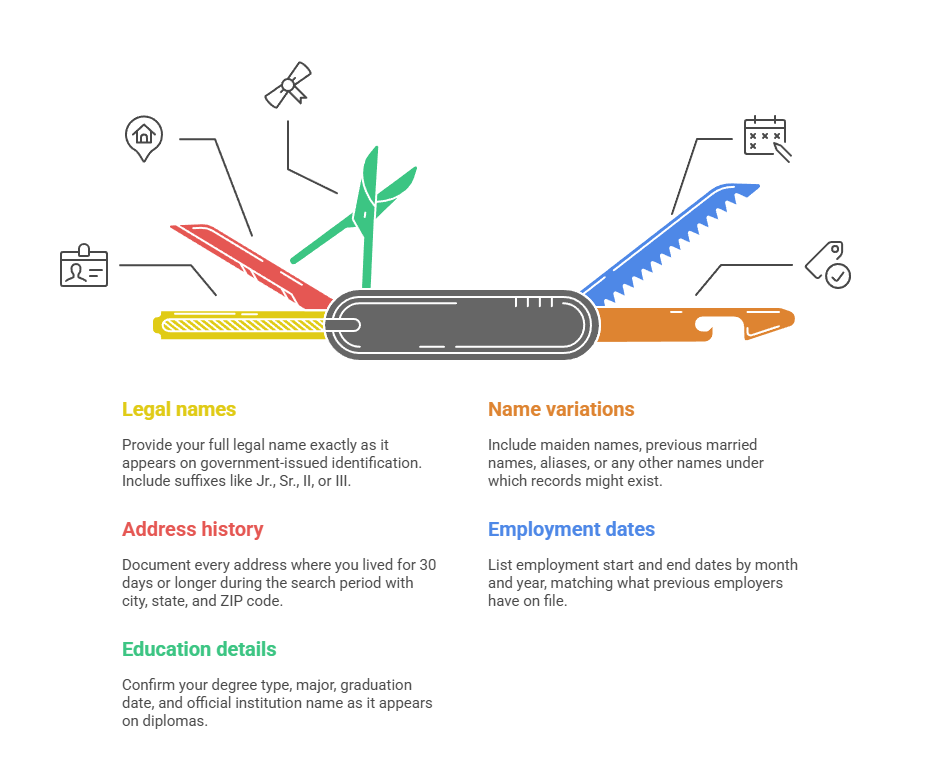

Essential steps to expedite your background check include:

- Use complete legal names: Provide your full legal name exactly as it appears on government-issued identification, including suffixes like Jr., Sr., II, or III

- List all name variations: Include maiden names, previous married names, aliases, or any other names under which records might exist

- Provide complete address history: Document every address where you lived for 30 days or longer during the search period with city, state, and ZIP code

- Include accurate employment dates: List employment start and end dates by month and year, matching what previous employers have on file

- Verify education details: Confirm your degree type, major, graduation date, and official institution name as it appears on diplomas

Respond immediately to any requests for clarification or additional information from the background check company. Delays of even one day in responding can extend your overall timeline by 2-3 days as your file moves out of priority queue and researchers shift to other cases. Consumer reporting agencies typically process files in the order they become complete, so prompt responses to information requests keep your file moving through the queue efficiently.

Industry-Specific Timeline Variations

Different industries maintain varying standards for background check depth and thoroughness, directly impacting how long the screening process takes. Highly regulated sectors including healthcare, financial services, education, and government contracting require more extensive checks with additional components beyond standard employment screening. These enhanced requirements often double or triple the standard timeline, with comprehensive checks taking 10-15 business days or longer.

Healthcare organizations conducting checks for positions with patient access typically include state and national sex offender registries, Office of Inspector General exclusion lists, and state healthcare professional sanctions beyond standard criminal searches. These specialized database searches add 2-4 days to the process. Healthcare facilities also verify professional licenses and certifications, check abuse registries, and confirm that candidates haven't been excluded from participating in federal healthcare programs.

Financial services companies hiring for positions with fiduciary responsibilities conduct credit checks, regulatory action searches, and sometimes fingerprint-based FBI checks that can extend timelines to 7-14 days when fingerprint processing is required. Education sector screenings for teachers, administrators, and anyone with child access include enhanced child abuse and neglect registry searches, fingerprint checks in many states, and thorough employment verification with a focus on gaps or termination circumstances. Transportation and logistics companies requiring DOT drug testing and driving record checks typically complete within 3-5 days since MVR records process relatively quickly through state DMV systems.

What to Do If Your Background Check Is Delayed

When your background check exceeds the estimated timeline provided by the employer or screening company, several legitimate reasons may explain the delay before you need to take action. Court systems experiencing backlogs, previous employers slow to respond to verification requests, or complex residential histories requiring extensive searches all commonly extend processing times beyond initial estimates. Most delays resolve within 2-3 additional business days without intervention as routine follow-up procedures work through standard obstacles.

Contact the employer or screening company after the estimated completion date passes to request a status update. Under the FCRA, you have the right to know what's causing delays and approximately when you can expect results. The screening company can identify which specific component is pending—whether a particular county hasn't returned criminal search results, an employer hasn't responded to verification attempts, or a university is processing education confirmation during a busy period.

If delays stem from previous employer or educational institution unresponsiveness, proactively offer alternative verification methods. You can provide W-2 forms, pay stubs, tax returns, or official transcripts directly to the background check company to supplement their verification efforts. While most consumer reporting agencies prefer direct third-party verification, documentation you provide can help expedite the process when standard methods encounter obstacles. Some screening companies will accept this documentation with a signed affidavit confirming its accuracy while they continue attempting direct verification simultaneously.

Your Rights During the Background Check Process

The Fair Credit Reporting Act provides specific protections governing how employers and consumer reporting agencies conduct background checks and use the information discovered. You must receive clear written disclosure that a background check will be conducted as a standalone document, not buried within application materials or employment agreements. This disclosure requirement ensures you understand that a third-party consumer reporting agency will compile information about your history and provide it to the employer for decision-making purposes.

After disclosure, you must provide written authorization before any screening begins, giving you the opportunity to decline participation if you choose not to proceed with that employment opportunity. No background check can legally begin without your explicit permission documented through signature or electronic authorization. This consent requirement protects your privacy and gives you control over who accesses your personal information, criminal records, credit history, and other sensitive data.

Your rights throughout the process include:

- Pre-adverse action notification: If background check findings may lead to denial of employment, the employer must provide you with a copy of the report and a summary of your rights before taking adverse action

- Opportunity to dispute: You have time to review the report, identify any inaccuracies, and submit disputes directly to the consumer reporting agency before final employment decisions occur

- Formal adverse action notice: If the employer ultimately decides not to hire you based on background check findings, they must provide formal notice including the screening company's contact information

- Free report copy: You can request a free copy of your background check report from the consumer reporting agency for up to 60 days after receiving adverse action notice

- Investigation requirement: Consumer reporting agencies must investigate any disputed information and correct or remove inaccurate records within 30 days of receiving your dispute

State and local laws often provide additional protections beyond federal FCRA requirements, particularly regarding which types of records employers can consider. Understanding your rights prevents illegal discrimination and ensures accurate reporting.

Common Mistakes That Extend Background Check Timelines

Many applicants unknowingly delay their own background checks by making preventable errors during the authorization and information submission process. These mistakes force screening companies to pause research, request clarification, and verify conflicting information. Understanding common pitfalls helps you avoid unnecessary extensions to your timeline.

Providing nicknames instead of legal names creates immediate verification problems. If your driver's license shows "Robert" but you list "Bob" on your background check form, researchers must confirm these refer to the same person, adding 1-2 days to the process. Similarly, failing to disclose name changes from marriage, divorce, or legal proceedings means criminal records or employment history under previous names may be missed initially, requiring the screening company to circle back once the discrepancy is discovered.

Common errors that cause delays include:

- Incomplete address histories: Many applicants forget short-term residences, temporary housing during transitions, or addresses where they received mail but didn't officially reside

- Incorrect employer contact information: If a company has been acquired, renamed, or closed, listing the old name without noting the successor organization creates verification obstacles

- Missing employment gaps: Unexplained periods between jobs require additional verification and may trigger questions about undisclosed employment

- Inconsistent dates: Employment or education dates that don't match official records require reconciliation before the report can be completed

Creating a comprehensive timeline of your residences and employment history before starting the background check process prevents these delays. Research your employment history to ensure you have current contact details for verification purposes.

Understanding Background Check Costs and Turnaround Relationships

The cost of a background check often correlates directly with turnaround time and thoroughness, creating important trade-offs that employers must consider. Budget-friendly screening packages typically rely more heavily on database searches with limited verification, completing faster but sacrificing accuracy and comprehensiveness. Premium screening services invest in direct source verification, manual research, and thorough documentation review, extending timelines but dramatically improving accuracy.

Employers must balance cost, speed, and accuracy based on position requirements and risk tolerance. High-volume hiring for entry-level positions often uses streamlined background checks costing $20-40 that complete in 2-4 days, typically including county criminal searches for current residence, national database searches, and Social Security verification. Executive positions, roles with financial authority, and positions requiring professional licenses justify comprehensive screenings costing $100-200 that take 7-14 days but provide verified employment history, education credentials, credit reports, and multi-jurisdictional criminal searches.

Some screening companies offer tiered pricing with expedited options for additional fees. Rush processing typically costs 25-50% more than standard screening and prioritizes your file for immediate research attention. However, even expedited processing cannot accelerate third-party verification response times—if a previous employer takes five days to respond to employment verification, rush processing won't reduce that timeline. Understanding these limitations prevents unrealistic expectations about what expedited services can deliver.

State and Local Variations in Background Check Requirements

Different states and municipalities have enacted varying laws that affect what information can be included in background checks and how far back searches can extend. These regulations directly impact processing timelines because screening companies must tailor their searches to comply with location-specific requirements. Understanding these variations helps explain why identical background checks may take different amounts of time depending on where you live or where the employer is located.

Some states limit criminal background checks to seven years for non-conviction records, while others allow indefinite reporting of convictions. California, for example, prohibits reporting of most criminal convictions after seven years for positions paying less than $75,000 annually. New York and other states require individualized assessments before employers can deny employment based on criminal history, adding review time to the decision-making process.

Ban-the-box laws in over 35 states and 150+ cities prohibit employers from asking about criminal history on initial job applications. These laws don't affect background check timelines directly but change when in the hiring process checks can occur. Fair chance hiring laws require employers to consider the nature of the offense, time elapsed since conviction, and relevance to job duties before making adverse decisions. This individualized assessment process can add 2-5 business days beyond background check completion as employers evaluate findings against legal standards.

Conclusion

Consumer report background checks typically complete within 5-7 business days for standard employment screening, though timelines range from instant database searches to comprehensive 10-14 day investigations. The turnaround time depends primarily on verification depth, court system efficiency, residential history, and information accuracy you provide during authorization. Understanding what affects background check speed helps you set realistic expectations and take proactive steps to minimize delays. Your rights under the FCRA ensure fair treatment throughout the process, including opportunities to review and dispute findings before adverse employment decisions occur.

Frequently Asked Questions

How long does a basic consumer report background check take?

A basic consumer report background check combining county criminal records and employment verification typically takes 3-5 business days to complete. This timeline assumes you've lived in one or two jurisdictions with modern electronic court systems. It also assumes that previous employers respond promptly to verification requests. More complex histories with multiple residential locations or hard-to-verify employment can extend the basic check to 7 business days.

Can you really get instant background check results?

Instant background checks provide preliminary results within minutes by searching pre-compiled databases, but these searches lack the thoroughness and accuracy required for employment decisions. True instant checks only search aggregated databases that may be months out of date. They miss county-level criminal records not included in national systems. For FCRA-compliant employment screening, comprehensive checks taking 5-10 days that verify information directly from courthouses and other primary sources are necessary.

What causes background checks to take longer than expected?

Background checks take longer than expected due to county court system delays and previous employers who are slow to respond to verification requests. Complex residential histories requiring multiple jurisdiction searches extend timelines. Common names needing additional identity verification add time. Incomplete applicant information requiring clarification creates delays. Discrepancies between data sources that need investigation also extend the process. Each of these factors can add 2-5 days to the standard timeline depending on severity.

How far back do consumer report background checks go?

Consumer report background checks typically search 7 years of history for most components including criminal records, employment, and residency under FCRA guidelines. However, criminal convictions may be reported indefinitely. Some states prohibit reporting of arrests that didn't lead to conviction after 7 years. Credit checks follow separate timeframes. Most negative information drops off after 7 years except bankruptcies which remain for 10 years.

Do weekends and holidays affect background check timelines?

Weekends and holidays significantly affect background check timelines because county courthouses, educational institutions, and many employer HR departments close during these periods. This halts record retrieval and verification activities. A background check initiated on Thursday may not see substantial progress until the following Monday. Holiday weeks can extend typical 5-day checks to 7-10 days due to limited business days for third-party verification and court access.

What should I do if I find errors in my background check report?

If you find errors in your background check report, immediately submit a written dispute to the consumer reporting agency identifying the specific inaccurate information. Provide documentation supporting your claim. The agency must investigate within 30 days, contact the information source, and correct or remove inaccurate data. You should also notify the employer considering the report about the dispute. Request they pause any adverse action decisions until the investigation completes and corrections are made.

Can employers conduct background checks without telling you?

No, employers cannot legally conduct background checks without telling you under FCRA regulations. They must provide clear written disclosure as a standalone document separate from job applications. You must then provide written authorization before any screening begins. Employers who conduct background checks without proper disclosure and consent violate federal law. They expose themselves to significant legal liability including statutory damages and attorney fees.

Why do some background checks come back quickly while others take weeks?

Background checks come back quickly when they rely primarily on electronic databases, cover limited jurisdictions, and verify information through automated systems. They take weeks when they require manual courthouse research across multiple counties, involve unresponsive employers or schools, need international verification, or encounter discrepancies requiring investigation. The specific components included, your residential and employment history complexity, and court system infrastructure in relevant jurisdictions all determine whether your check completes in days or weeks.

Additional Resources

- Fair Credit Reporting Act (FCRA) Full Text and Compliance Guide

https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act - Consumer Financial Protection Bureau - Background Checks and Your Rights

https://www.consumerfinance.gov/consumer-tools/background-checks/ - EEOC Guidance on Arrest and Conviction Records in Employment

https://www.eeoc.gov/laws/guidance/enforcement-guidance-consideration-arrest-and-conviction-records-employment - National Association of Professional Background Screeners (NAPBS) - Industry Standards

https://www.napbs.com/ - Federal Trade Commission - Employment Background Checks

https://consumer.ftc.gov/articles/employment-background-checks

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.