Background check red flags require careful evaluation through structured adjudication processes that balance legal compliance with organizational risk management. Effective screening decisions depend on understanding the severity, relevance, and recency of findings while maintaining FCRA compliance and avoiding discriminatory practices.

Key Takeaways

- Criminal convictions older than seven years may still pose risks for positions involving financial responsibility or vulnerable populations

- Multiple minor offenses can indicate pattern behavior that warrants closer scrutiny than single serious incidents

- Employment gaps accompanied by undisclosed criminal activity represent higher risk than transparent disclosure of past mistakes

- Geographic discrepancies between reported addresses and criminal records often signal incomplete or deceptive application information

- Professional license suspensions or revocations typically constitute automatic disqualifiers for roles requiring active certification

- Identity verification failures combined with other red flags suggest potential fraud requiring immediate investigation

Understanding Background Check Red Flags in Employment Screening

Background check red flags are specific findings that indicate potential risks to workplace safety, security, or organizational reputation. These warnings emerge during pre-employment screening processes and require careful adjudication to determine candidate suitability. Modern employers must navigate complex legal requirements while protecting their businesses from preventable risks.

The Fair Credit Reporting Act (FCRA) mandates that employers follow specific procedures when adverse information influences hiring decisions. Criminal history red flags don't automatically disqualify candidates, but they trigger additional review processes. Employment screening warnings help organizations identify patterns of behavior that could impact job performance or workplace safety.

Risk assessment methodology involves evaluating multiple factors simultaneously rather than making decisions based on isolated incidents. This comprehensive approach ensures fair treatment while protecting business interests. Effective adjudication considers the nature of the offense, time elapsed, job relevance, and rehabilitation evidence. Therefore, organizations must develop systematic frameworks for consistent decision-making across all screening situations.

Criminal History Red Flags and Severity Assessment

Criminal record adjudication guidelines categorize offenses by severity, recency, and job relevance. Felony convictions typically receive heightened scrutiny, especially for positions involving financial responsibility or customer interaction. Violent crimes warrant careful evaluation regardless of the role, while property crimes may be more relevant for positions handling valuable inventory or equipment.

Additionally, the frequency of offenses often matters more than individual incidents when assessing risk patterns. Multiple misdemeanors within a short timeframe suggest behavioral issues that could affect workplace performance. Consequently, employers must examine both the specific nature of crimes and the overall pattern of criminal behavior.

High-Risk Criminal Indicators

Certain criminal patterns present immediate concerns requiring thorough investigation. Sexual offenses, particularly those involving minors, generally constitute disqualification for educational or childcare positions. Financial crimes like embezzlement or fraud raise serious questions for roles involving money handling or fiduciary responsibility.

Violence indicators demand comprehensive review processes that extend beyond basic criminal checks. Employers must evaluate rehabilitation efforts, counseling completion, and character references to make informed decisions. Furthermore, recent violent offenses pose greater risks than older incidents with demonstrated rehabilitation efforts.

Property and Financial Crime Patterns

Property crimes create specific concerns based on job responsibilities and access levels. Theft convictions raise questions about trustworthiness, while fraud indicates deceptive behavior patterns. Multiple property-related offenses suggest persistent issues requiring careful evaluation.

| Crime Category | Evaluation Period | Job Impact Level |

| Embezzlement | 10+ years | High for financial roles |

| Identity theft | 7-10 years | Critical for data access |

| Shoplifting | 3-5 years | Moderate for retail positions |

| Burglary | 7-10 years | High for security positions |

Financial crime patterns often indicate sophisticated deception skills that could impact various workplace situations. These red flags require extensive reference checks and probationary period considerations.

Employment History and Reference Red Flags

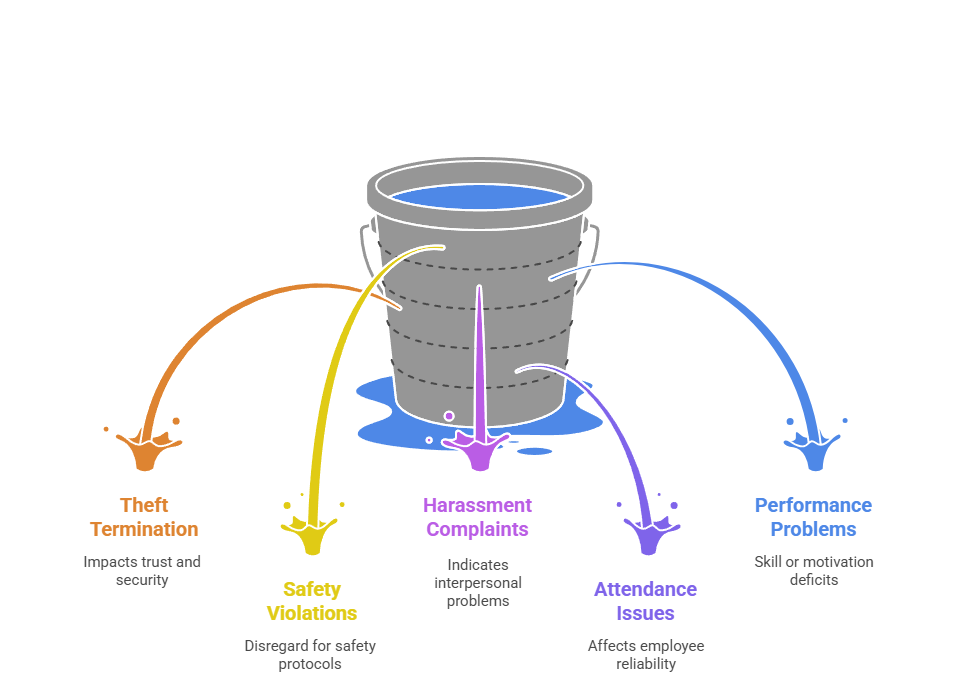

Employment screening warnings extend beyond criminal records to include professional conduct issues. Gap periods without reasonable explanation suggest potential undisclosed problems or incarceration periods. Reference checks that reveal performance issues, attendance problems, or termination for cause indicate behavioral patterns worth investigating.

- Termination for theft: Direct relevance to trustworthiness and organizational security

- Safety violations: Repeated incidents indicating disregard for workplace protocols

- Harassment complaints: Multiple allegations suggesting interpersonal problems

- Attendance issues: Chronic tardiness or absenteeism patterns affecting reliability

- Performance problems: Consistent poor evaluations indicating skill or motivation deficits

Professional misconduct complaints, even without formal discipline, create concerns for certain positions. These employment screening warnings help predict future job performance and workplace compatibility.

Identity Verification and Documentation Issues

Identity discrepancies represent serious red flags requiring immediate investigation. Social Security number mismatches, address inconsistencies, or name variations without supporting documentation suggest potential fraud. These issues often accompany other concerning findings, creating compound risk factors.

Document authenticity problems indicate deceptive behavior that extends beyond simple errors. Falsified education credentials, employment dates, or professional licenses demonstrate intentional misrepresentation. Immigration status discrepancies create legal compliance concerns requiring careful handling to avoid discrimination issues.

Geographic inconsistencies between reported residences and criminal records often indicate incomplete disclosure. Candidates who fail to report addresses where offenses occurred may be attempting to hide relevant information. These patterns require extended background searches and additional verification efforts. Moreover, intentional omissions suggest ongoing deception that could affect workplace integrity.

Professional License and Certification Red Flags

Professional credential issues create immediate concerns for regulated industries. License suspensions, revocations, or disciplinary actions indicate serious professional misconduct requiring thorough evaluation. Healthcare professionals with malpractice claims, attorneys with bar discipline, or financial advisors with regulatory sanctions need careful assessment.

| License Status | Risk Assessment | Required Action |

| Active/Current | Low risk | Routine verification |

| Lapsed/Expired | Moderate risk | Renewal timeline review |

| Suspended/Revoked | High risk | Comprehensive investigation |

Regulatory agencies maintain detailed records of professional misconduct that employers must review for relevant positions. These databases provide insights into character and competence that supplement criminal history information.

Regulatory Discipline Patterns

Professional discipline records often reveal behavioral patterns not captured in criminal background checks. Medical license suspensions for substance abuse, legal license discipline for client fund misappropriation, or engineering license issues for safety violations indicate professional judgment problems. These regulatory actions frequently precede criminal charges and provide early warning signs of character issues.

Multiple regulatory issues across different jurisdictions suggest persistent problems requiring careful evaluation. Additionally, recent disciplinary actions carry more weight than older incidents with demonstrated rehabilitation efforts.

Credit History and Financial Responsibility Red Flags

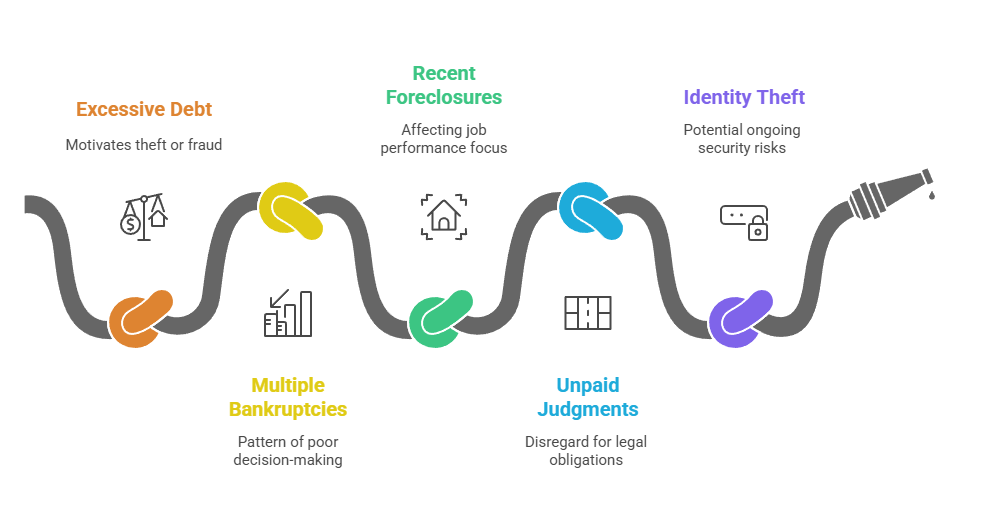

Financial background screening reveals patterns of responsibility and decision-making relevant to many positions. Excessive debt, bankruptcy history, or payment delinquencies may indicate financial stress that could motivate workplace theft or fraud. However, economic hardship alone shouldn't disqualify candidates without job-related justification.

Pre-employment screening adjudication decisions involving credit information must comply with FCRA requirements and consider economic factors beyond individual control. Medical bankruptcies, divorce-related financial difficulties, or unemployment periods require different evaluation than spending irresponsibility or fraud-related financial problems. Recent financial difficulties accompanied by criminal activity create compound concerns requiring careful assessment.

- Excessive debt-to-income ratios: Financial pressure that could motivate theft or fraud

- Multiple bankruptcies: Pattern of financial irresponsibility or poor decision-making

- Recent foreclosures: Current financial stress affecting job performance focus

- Unpaid judgments: Disregard for legal obligations and financial commitments

- Identity theft victimization: Potential ongoing security risks requiring monitoring

Multiple credit-related issues combined with employment gaps suggest potential desperation that could influence workplace behavior. These patterns warrant enhanced monitoring during initial employment periods.

Social Media and Digital Footprint Red Flags

Modern background investigations increasingly include social media screening for public posts revealing character concerns. Discriminatory comments, illegal activity documentation, or unprofessional behavior patterns create reputational risks for employers. However, social media screening must avoid protected class information and focus on job-relevant conduct.

Digital footprint analysis reveals communication styles, judgment patterns, and value systems that predict workplace behavior. Public posts celebrating illegal activities, expressing violent tendencies, or demonstrating poor judgment require careful evaluation. These findings supplement traditional background check information with current behavioral indicators.

Social media red flags require careful documentation and legal review to ensure compliance with privacy laws and employment regulations. Public information may be considered, but private account access or password requests violate candidate privacy rights. Furthermore, employers must distinguish between personal opinions and conduct that directly affects job performance or workplace safety.

Drug Testing and Substance Abuse Indicators

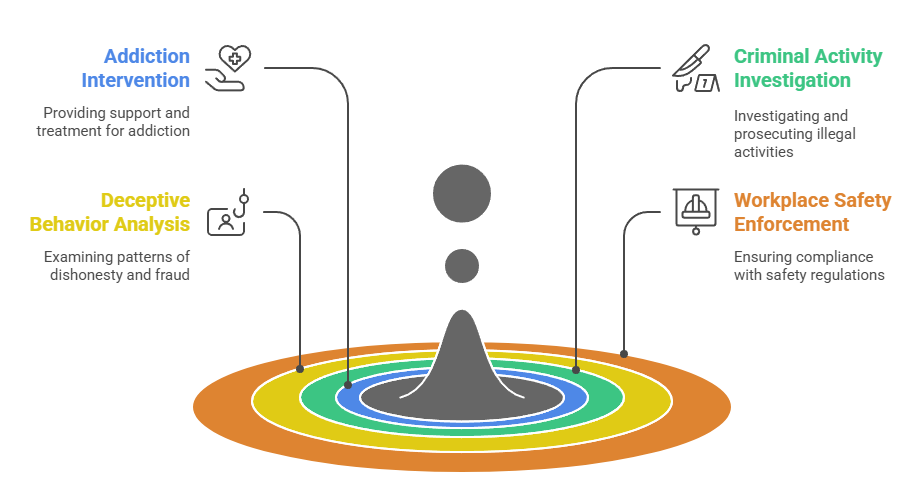

Substance abuse red flags extend beyond failed drug tests to include related criminal charges and employment terminations. DUI convictions, drug possession charges, or termination for substance policy violations indicate potential workplace safety risks. These indicators require evaluation of treatment completion, sobriety duration, and ongoing support systems.

- Multiple DUI convictions: Pattern behavior indicating addiction issues requiring intervention

- Drug trafficking charges: Serious criminal activity suggesting ongoing illegal involvement

- Prescription fraud: Deceptive behavior combining substance abuse with dishonesty patterns

- Work-related substance incidents: Previous workplace safety violations or policy breaches

Treatment program completion and sustained sobriety demonstrate rehabilitation efforts that may mitigate concerns. However, recent incidents or lack of treatment participation increase risk levels significantly.

Rehabilitation and Recovery Assessment

Substance abuse recovery involves ongoing processes that require careful evaluation beyond initial treatment completion. Length of sobriety, support system strength, and continued program participation indicate commitment to recovery. Additionally, professional counseling recommendations and medical clearances provide objective assessment tools.

Recovery assessment must balance second-chance employment opportunities with workplace safety requirements. Safety-sensitive positions may require higher recovery standards than office-based roles.

Risk Assessment Methodology for Adjudication Decisions

Background check disqualification adjudication requires systematic evaluation frameworks that ensure consistent, legally compliant decisions. Risk assessment methodology considers offense severity, job relevance, time elapsed, and rehabilitation evidence. This structured approach reduces discrimination risks while protecting organizational interests.

Screening results adjudication best practices include documentation requirements, appeal processes, and periodic policy reviews. Decision-making frameworks should include multiple reviewers, standardized criteria, and legal consultation for complex cases. These procedures ensure fair treatment while maintaining defensible hiring decisions.

| Risk Factor | Weight Score | Assessment Criteria | Decision Impact |

| Offense severity | 1-5 points | Misdemeanor to felony scale | Primary consideration |

| Time elapsed | 1-5 points | Recent to 10+ years | Rehabilitation indicator |

| Job relevance | 1-5 points | No relation to direct impact | Practical risk assessment |

Quantitative assessment tools help standardize adjudication decisions across different reviewers and time periods. Point-based systems assign values to various risk factors, creating objective evaluation criteria.

Documentation and Legal Compliance

Adjudication decisions require thorough documentation supporting the reasoning and evidence considered. FCRA compliance mandates specific procedures for adverse actions, including pre-adverse action notices and dispute resolution processes. Legal requirements vary by jurisdiction, necessitating regular policy updates and training programs.

Documentation should include all information considered, individuals consulted, and reasoning for final decisions. This comprehensive record-keeping protects against discrimination claims and ensures consistent application of company policies. Regular legal review ensures ongoing compliance with evolving regulations and court decisions.

Appeals and Second Review Processes

Effective adjudication systems include appeals mechanisms allowing candidates to provide additional context or corrective information. Second review processes involving senior management or legal counsel ensure complex cases receive appropriate attention. Additionally, time-based review policies allow reconsideration of older decisions when circumstances change.

Appeals documentation should track additional information provided, verification efforts completed, and final decision rationales. These processes demonstrate fair treatment while maintaining organizational risk management standards.

Industry-Specific Red Flag Considerations

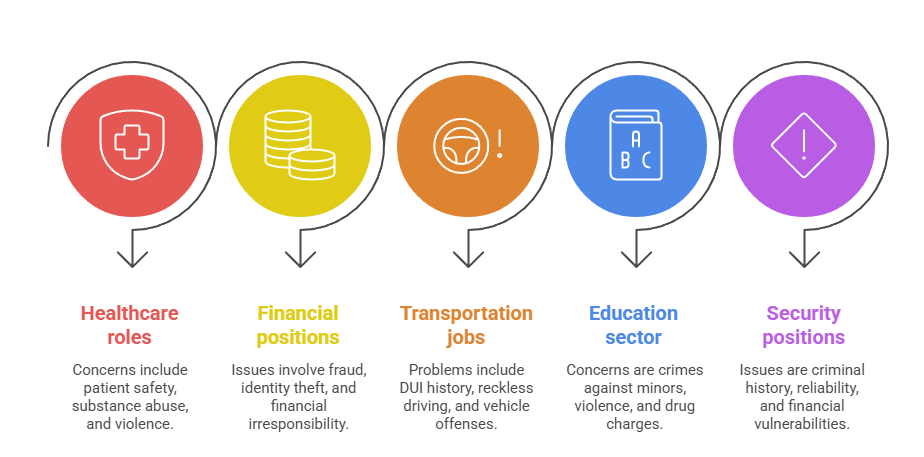

Different industries prioritize various risk factors based on regulatory requirements and operational needs. Healthcare organizations focus heavily on patient safety issues, while financial institutions emphasize fraud prevention and regulatory compliance. Transportation companies prioritize driving records and substance abuse history.

Educational institutions require enhanced scrutiny of offenses involving minors or violence on school property. Additionally, positions involving vulnerable populations such as elderly care or disability services warrant specialized evaluation criteria. Government contractors must consider security clearance requirements and national security implications.

- Healthcare roles: Patient safety violations, substance abuse, violent behavior

- Financial positions: Fraud convictions, identity theft, financial irresponsibility

- Transportation jobs: DUI history, reckless driving, vehicle-related offenses

- Education sector: Crimes against minors, violence, drug-related charges

- Security positions: Criminal history, reliability issues, financial vulnerabilities

Industry-specific regulations often mandate certain disqualification criteria while allowing flexibility in other areas. Employers must balance regulatory compliance with fair hiring practices.

Regulatory Compliance Requirements

Specific industries face mandatory background check requirements that limit employer discretion in hiring decisions. Banking regulations prohibit employing individuals with certain financial crimes convictions. Healthcare licensing boards restrict employment based on patient safety violations.

Regulatory compliance requires understanding both federal and state-level requirements that may conflict or create additional obligations. Legal consultation ensures proper interpretation of complex regulatory frameworks affecting hiring decisions.

Technology and Automation in Red Flag Detection

Advanced background screening technology increasingly automates initial red flag identification while preserving human judgment for adjudication decisions. Artificial intelligence systems can flag patterns and inconsistencies that might escape manual review. However, final hiring decisions must involve human evaluation to ensure fair treatment and legal compliance.

Automated systems excel at identifying discrepancies across multiple databases and flagging potential identity issues. Technology can also track policy compliance and ensure proper documentation of decision-making processes. Nevertheless, automation must supplement rather than replace careful human analysis of individual circumstances.

| Technology Application | Benefit | Limitation | Best Practice |

| AI pattern recognition | Identifies complex patterns | Lacks context understanding | Human review required |

| Database cross-referencing | Comprehensive searches | Data accuracy variations | Multiple source verification |

| Compliance tracking | Consistent procedures | Rigid application | Flexibility for unique cases |

Technology integration requires ongoing training and system updates to maintain effectiveness and legal compliance. Additionally, data security considerations become paramount when handling sensitive personal information through automated systems.

Training and Development for Screening Personnel

Effective background check adjudication requires trained personnel who understand legal requirements, risk assessment principles, and organizational policies. Regular training updates ensure compliance with evolving regulations and court decisions. Additionally, specialized training for different industries or position types enhances decision-making quality.

Training programs should cover FCRA compliance, anti-discrimination laws, risk assessment methodologies, and documentation requirements. Role-playing exercises and case studies help personnel practice applying policies to real-world situations. Furthermore, ongoing education ensures awareness of emerging trends and legal developments.

- Legal compliance training: FCRA requirements, discrimination prevention, documentation standards

- Risk assessment skills: Pattern recognition, severity evaluation, job relevance analysis

- Industry-specific knowledge: Regulatory requirements, specialized risk factors, compliance obligations

- Technology utilization: System operation, data interpretation, quality assurance processes

Cross-training multiple personnel ensures continuity and provides backup coverage for complex cases requiring additional review. Certification programs from professional organizations enhance credibility and expertise levels.

Quality Assurance and Audit Processes

Regular audits of adjudication decisions help identify inconsistencies, training needs, and policy improvement opportunities. Quality assurance reviews should examine both individual decisions and overall pattern compliance. Additionally, external legal audits provide objective assessment of policy effectiveness and legal compliance.

Audit findings should result in corrective actions, additional training, or policy modifications as needed. Documentation of audit processes and corrective measures demonstrates commitment to continuous improvement and legal compliance.

Conclusion

Effective background check red flag evaluation requires balancing risk management with legal compliance and fair treatment. Systematic adjudication processes help organizations make consistent, defensible hiring decisions while avoiding discriminatory practices. Regular policy reviews and staff training ensure ongoing compliance with evolving legal requirements. Success depends on understanding that background check red flags indicate areas requiring further investigation rather than automatic disqualification, promoting both organizational safety and candidate fairness.

Frequently Asked Questions

What background check findings automatically disqualify candidates from employment?

Very few background check findings create automatic disqualification requirements under federal law. Most states prohibit blanket exclusion policies, requiring individualized assessment of criminal history relevance to specific job duties. Only direct job-related concerns, such as financial crimes for banking positions or violent offenses for childcare roles, may justify automatic disqualification policies.

How long should employers wait after criminal convictions before considering candidates?

The appropriate waiting period depends on offense severity, job requirements, and state regulations. Minor misdemeanors may warrant 2-3 year consideration periods, while serious felonies might require 5-7 years or longer. Some positions involving vulnerable populations or high security requirements may justify longer exclusion periods, but decisions must be job-related and consistently applied.

Can employers reject candidates based on arrests without convictions?

Generally, arrest records without convictions shouldn't be used for employment decisions under EEOC guidance. However, employers may consider pending charges that are directly job-related, such as theft charges for cash-handling positions. State laws vary significantly on arrest record usage, with some states prohibiting consideration entirely while others allow limited evaluation.

What documentation is required when rejecting candidates due to background check findings?

FCRA requires employers to provide pre-adverse action notices including copies of background reports and consumer rights summaries. After final decisions, adverse action notices must identify the reporting agency and explain dispute rights. Additional state requirements may include specific waiting periods, individualized assessment documentation, or appeal process notifications.

How should employers handle background check discrepancies or disputes?

When candidates dispute background check accuracy, employers should pause adverse actions and allow reasonable investigation time. Reporting agencies must investigate disputes within 30 days under FCRA requirements. Employers should document dispute processes and may request additional verification or alternative screening methods while investigations proceed.

What are the best practices for social media screening in background checks?

Social media screening should focus on publicly available information relevant to job performance or workplace safety. Employers should avoid requesting passwords, accessing private accounts, or considering protected class information. Consistent policies, trained reviewers, and clear documentation help ensure legal compliance while gathering relevant character information about potential employees.

Additional Resources

- EEOC Enforcement Guidance on Consideration of Arrest and Conviction Records

https://www.eeoc.gov/laws/guidance/enforcement-guidance-consideration-arrest-and-conviction-records-employment-decisions - FTC Fair Credit Reporting Act Compliance Guide

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-employers-need-know - National Association of Professional Background Screeners (NAPBS) Standards

https://www.napbs.com/resources/background-screening-standards - Society for Human Resource Management (SHRM) Background Check Guidelines

https://www.shrm.org/resourcesandtools/tools-and-samples/toolkits/pages/backgroundchecks.aspx - State-by-State Background Check Law Summary

https://www.nolo.com/legal-encyclopedia/state-laws-use-arrest-conviction-records-employment-decisions.html - Ban the Box and Fair Chance Employment Resources

https://www.nelp.org/campaign/ensuring-fair-chance-work/

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.