E-commerce background checks have become essential for online retailers as remote work creates unique security vulnerabilities and hiring challenges that traditional screening methods often miss. Comprehensive remote retail screening programs can reduce employee-related fraud by up to 75% while ensuring FCRA compliance in virtual hiring environments.

Key Takeaways

- E-commerce background checks require specialized screening approaches that address remote work risks, data access concerns, and virtual onboarding challenges specific to online retail operations.

- Financial background verification becomes critical for e-commerce roles involving payment processing, inventory management, and customer data handling due to increased fraud exposure.

- Remote retail screening must include enhanced identity verification processes since traditional in-person verification methods are not feasible for distributed teams.

- FCRA compliance in e-commerce hiring requires digital consent processes, secure data transmission, and proper adverse action procedures adapted for virtual environments.

- Technology-enabled screening solutions can streamline the e-commerce hiring process while maintaining thoroughness through automated reference checks and digital verification tools.

- Cost-effective screening strategies for online retailers should focus on risk-based approaches that scale screening intensity based on role responsibilities and data access levels.

Why E-commerce Background Checks Are Critical for Online Retailers

The rapid growth of e-commerce has fundamentally changed retail employment landscapes. Online retailers face unique security challenges that traditional brick-and-mortar stores never encountered. Remote employees often have direct access to customer payment information, inventory systems, and proprietary business data without physical oversight.

E-commerce fraud losses reached $48 billion globally in 2024, with insider threats accounting for nearly 30% of security breaches in online retail. Companies implementing comprehensive ecommerce background checks report 67% fewer incidents of employee-related fraud compared to those using basic screening methods. The distributed nature of remote retail teams makes thorough vetting essential for protecting both company assets and customer trust.

Modern online retailers must balance hiring speed with security thoroughness. The average e-commerce company processes over 15,000 transactions daily in 2025, making employee reliability crucial for operational continuity. Background screening helps identify candidates who may pose risks to payment processing systems, customer databases, or intellectual property protection.

Additionally, remote retail screening addresses unique vulnerabilities that emerge from virtual work environments. Traditional supervision methods become ineffective when employees work from home offices or shared spaces. Therefore, thorough background verification serves as the primary defense against hiring individuals who might compromise sensitive customer data or proprietary business information.

Consumer trust remains paramount in e-commerce success, with 89% of online shoppers expressing concerns about data security in 2024. Retailers who experience security breaches involving employee negligence or misconduct face average reputation recovery periods of 18-24 months. Consequently, comprehensive background screening serves as both a protective measure and a competitive advantage in maintaining customer confidence.

Essential Components of Remote Retail Screening

Remote hiring environments create complex verification challenges that require specialized approaches. Digital identity verification has become the cornerstone of effective remote retail screening programs. Advanced verification systems now use multi-factor authentication, document analysis, and biometric matching to confirm candidate identities with 99.4% accuracy in 2025.

Employment history verification takes on increased importance in ecommerce hiring process roles where candidates may exaggerate technical skills or customer service experience. Third-party verification services can confirm previous employment details, job responsibilities, and performance metrics within 24-48 hours. This rapid verification supports the fast-paced hiring needs of growing online retailers while maintaining screening quality.

Furthermore, remote screening must address the challenge of virtual reference checks and skills validation. Traditional face-to-face interviews cannot fully assess candidate capabilities for complex e-commerce roles. Consequently, comprehensive screening programs incorporate multiple verification touchpoints to ensure candidate authenticity and qualifications align with position requirements.

Identity and Employment Verification

Remote work environments significantly increase opportunities for identity fraud during the hiring process. Sophisticated verification protocols now combine document authentication with live video verification sessions. These enhanced measures help prevent identity theft and ensure the person applying is actually the individual being hired.

Employment verification requires deeper investigation for remote positions involving sensitive data access. Screening providers now offer enhanced employment checks that verify not only job titles and dates but also specific responsibilities and access levels. This detailed verification helps employers understand candidates' previous experience with confidential information handling.

Modern verification systems also cross-reference candidate information across multiple databases to identify potential inconsistencies. Social security number verification, address history confirmation, and education credential validation provide additional layers of identity assurance. These comprehensive checks become especially important when hiring for positions involving financial transactions or customer data management.

Financial Background Assessments

E-commerce employees frequently handle sensitive financial information and payment processing systems. Credit history reviews help identify candidates with financial stressors that might increase temptation for fraud or theft. However, FCRA regulations require that credit checks only be conducted when directly relevant to job responsibilities.

Companies must clearly document the business justification for financial background checks to maintain legal compliance while protecting their operations. Modern screening platforms provide risk assessment tools that help employers determine appropriate financial screening levels based on role requirements and regulatory compliance needs.

Financial screening extends beyond credit reports to include bankruptcy searches, civil judgment reviews, and lien investigations. These comprehensive financial assessments help employers understand candidates' financial stability and potential vulnerabilities that could impact job performance or security decisions.

Technology Solutions for E-commerce Hiring Process

Digital transformation has revolutionized how online retailers conduct background screenings. Cloud-based platforms now integrate directly with applicant tracking systems, enabling seamless workflow management from application to hire. These solutions reduce screening turnaround times by an average of 40% while improving accuracy through automated data verification.

| Technology Solution | Key Benefits | Implementation Time |

| AI-powered screening platforms | 40% faster processing, automated red flag detection | 2-4 weeks |

| Mobile verification apps | Improved candidate experience, real-time updates | 1-2 weeks |

| Integrated ATS systems | Seamless workflow, reduced manual data entry | 3-6 weeks |

These technological advances support the growing demand for efficient online retail employment screening while maintaining thoroughness and compliance standards.

Artificial Intelligence and Automation

Artificial intelligence enhances screening efficiency by flagging potential red flags and inconsistencies in candidate information. Machine learning algorithms can identify patterns in application data that might indicate fraudulent submissions or misrepresented qualifications. However, human oversight remains essential to ensure fair and compliant hiring decisions.

AI-powered systems also streamline reference checking through automated phone calls and email verification. These tools can process basic employment verification automatically while flagging cases that require human investigation. This automation allows hiring teams to focus on complex screening decisions while routine verifications proceed automatically.

Advanced AI systems can now analyze speech patterns during phone interviews and detect potential deception indicators. Natural language processing capabilities help evaluate written responses for consistency and authenticity. These sophisticated tools provide additional data points for hiring decisions while maintaining compliance with fair hiring practices.

Mobile-Optimized Platforms

Mobile-optimized screening platforms accommodate the preferences of modern job seekers while supporting remote onboarding processes. Candidates can complete consent forms, provide documentation, and track screening progress through smartphone applications. This accessibility improves candidate experience while maintaining thorough screening standards.

Real-time reporting dashboards give hiring managers immediate visibility into screening progress and results. Integration with popular HR platforms like Workday, BambooHR, and ADP streamlines data management while ensuring secure information handling throughout the screening process.

Mobile platforms also enable document capture and verification through smartphone cameras, allowing candidates to submit required documentation instantly. Optical character recognition technology automatically extracts relevant information while maintaining document security through encrypted transmission protocols.

FCRA Compliance in Virtual Hiring Environments

Fair Credit Reporting Act compliance becomes more complex in remote hiring scenarios where traditional paper-based processes aren't practical. Digital consent mechanisms must meet the same legal standards as physical signatures while providing clear disclosure of screening activities. Electronic consent platforms now offer legally compliant solutions that streamline the authorization process for remote candidates.

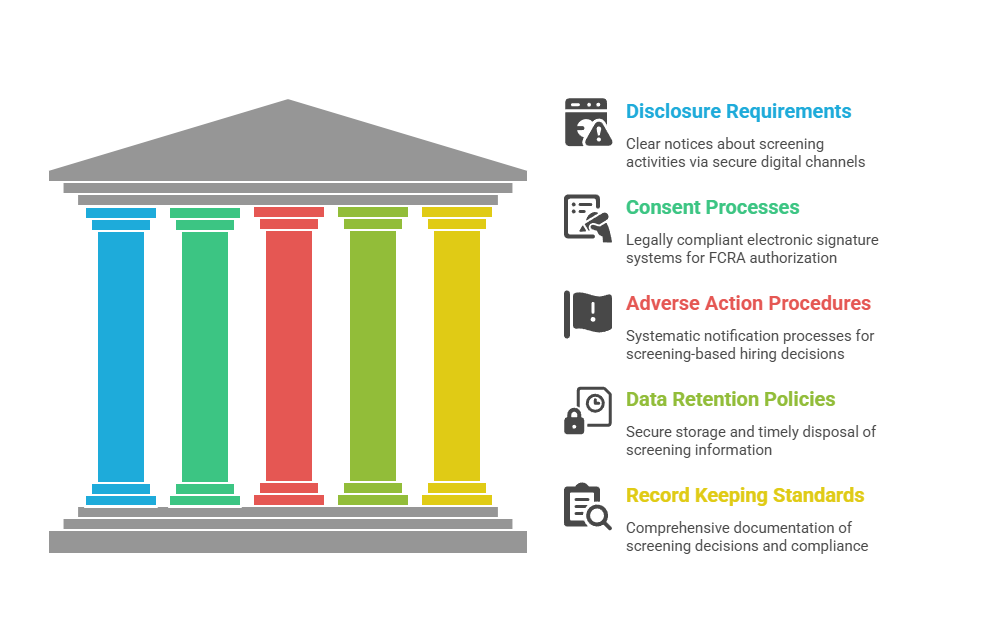

- Proper Disclosure Requirements: Clear, conspicuous notices about background screening activities delivered through secure digital channels

- Candidate Consent Processes: Legally compliant electronic signature systems that meet FCRA authorization standards

- Adverse Action Procedures: Systematic notification processes for screening-based hiring decisions with proper documentation

- Data Retention Policies: Secure storage and timely disposal of screening information according to federal and state requirements

- Record Keeping Standards: Comprehensive documentation of screening decisions and compliance activities for potential audits

Staying current with evolving FCRA interpretations and state-specific requirements ensures sustainable screening practices that protect both employers and candidates.

Digital Consent and Documentation

Adverse action procedures require careful adaptation for virtual environments. Employers must provide pre-adverse and final adverse action notices through secure digital channels while maintaining proper documentation. Email delivery systems with read receipts and secure portals help ensure compliance with notification requirements.

Data security protocols must address the unique risks of processing sensitive background information in cloud environments. Encryption standards, access controls, and audit trails become critical components of compliant screening programs. Regular security assessments help identify and address vulnerabilities before they impact screening operations.

Digital consent systems must also accommodate candidates with limited technology access or digital literacy. Alternative consent methods, such as phone-based authorization or mailed documentation, ensure inclusive hiring practices while maintaining compliance standards.

State and Federal Regulatory Updates

Recent regulatory changes have impacted how employers conduct remote screening activities. Several states have updated their ban-the-box legislation to address virtual hiring scenarios, requiring modified timing for criminal history inquiries. Additionally, new data privacy regulations affect how screening information can be collected, stored, and transmitted across state lines.

Federal agencies continue updating guidance on acceptable virtual verification methods for I-9 compliance and other employment eligibility requirements. Remote hiring practices must evolve to meet these changing standards while maintaining operational efficiency and candidate satisfaction.

Role-Specific Screening Requirements

Different e-commerce positions require varying levels of background verification based on their access to sensitive information and systems. Customer service representatives need basic criminal and employment checks, while payment processors require comprehensive financial screening. Understanding these distinctions helps companies allocate screening resources effectively while maintaining appropriate security levels.

Senior management positions in online retail demand the most thorough screening protocols. These roles typically involve strategic decision-making, financial oversight, and access to proprietary business information. Consequently, comprehensive screening for executive positions should include detailed financial history, professional references, and reputation verification.

Mid-level positions such as inventory managers, marketing specialists, and IT support staff require moderate screening approaches. These roles often involve access to customer data or operational systems but with limited financial authority. Therefore, screening should focus on criminal history, employment verification, and relevant skills confirmation.

| Position Level | Criminal Check | Employment Verification | Financial Screening | Education Verification | Reference Checks |

| Entry Level | ✓ | ✓ | Limited | Basic | 1-2 References |

| Mid-Level | ✓ | ✓ | Moderate | ✓ | 2-3 References |

| Senior/Executive | ✓ | ✓ | Comprehensive | ✓ | 3-5 References |

This tiered approach ensures appropriate screening depth while managing costs effectively across different organizational levels.

Technical Role Specializations

IT professionals and software developers working in e-commerce environments require specialized screening approaches. These positions often involve access to source code, customer databases, and security systems that could be vulnerable to insider threats. Technical screening should include verification of certifications, previous project experience, and any history of intellectual property violations.

Cybersecurity professionals demand even more rigorous screening due to their elevated access privileges and knowledge of system vulnerabilities. These roles require comprehensive background investigations that may include polygraph examinations, detailed financial reviews, and extensive reference checks with former colleagues and supervisors.

Customer-Facing Role Considerations

Customer service representatives and account managers represent the company's public face in digital interactions. While these positions may have limited access to sensitive systems, they handle customer complaints, process returns, and manage account information. Screening should focus on communication skills verification, customer service experience validation, and any history of harassment or inappropriate behavior.

Sales professionals in e-commerce environments often work with high-value accounts and confidential business strategies. Background screening should verify sales achievements, professional reputation, and any non-compete or confidentiality agreement violations that could create legal complications.

Cost-Effective Screening Strategies for Online Retailers

Budget constraints often challenge small and medium-sized e-commerce businesses seeking comprehensive screening solutions. Risk-based screening approaches allow companies to allocate resources efficiently by adjusting screening depth based on role requirements and potential impact. Entry-level positions might require basic criminal and identity checks, while senior roles demand comprehensive financial and reference verification.

Tiered screening packages help online retailers balance thoroughness with cost considerations. Basic packages typically cost $18-30 per candidate and include criminal history, identity verification, and employment confirmation. Comprehensive packages ranging from $55-85 provide additional financial checks, education verification, and professional reference calls in 2025 pricing.

Volume discounts and annual contracts often provide significant savings for growing e-commerce companies. Many screening providers offer reduced per-check pricing for companies processing 50+ background checks monthly. Automated screening workflows also reduce administrative costs by eliminating manual data entry and follow-up tasks.

Return on Investment Analysis

Return on investment calculations should consider both direct fraud prevention and indirect benefits like improved employee retention and reduced hiring mistakes. Companies implementing comprehensive screening programs report average savings of $4.20 for every dollar invested in background verification. These savings result from reduced theft, improved customer service quality, and decreased employee turnover.

Furthermore, effective screening programs protect brand reputation by preventing high-profile security breaches or customer service failures. The reputational damage from a single security incident involving an inadequately screened employee can far exceed the cost of comprehensive screening programs.

Quantifiable benefits extend beyond fraud prevention to include reduced insurance premiums, lower legal liability, and improved regulatory compliance scores. Many insurance providers offer discounts for companies demonstrating robust hiring practices, while regulatory audits typically proceed more smoothly for organizations with documented screening procedures.

Bulk Screening Negotiations

Companies anticipating significant hiring growth can negotiate favorable pricing through bulk screening agreements. These contracts typically guarantee minimum annual volumes in exchange for reduced per-check costs and priority service levels. Seasonal e-commerce businesses can benefit from flexible agreements that accommodate hiring surges during peak periods.

Partnership arrangements with screening providers may include additional services such as training programs, compliance updates, and dedicated account management. These value-added services help smaller companies access enterprise-level screening capabilities without corresponding cost increases.

Industry-Specific Screening Requirements

Different e-commerce verticals face varying regulatory requirements and risk profiles that influence screening needs. Fashion and general merchandise retailers typically focus on theft prevention and customer service reliability. However, specialized industries require additional verification protocols based on their unique regulatory environments.

Financial services and fintech companies operating e-commerce platforms must comply with additional banking regulations and enhanced due diligence requirements. These organizations need specialized screening that includes:

- Enhanced Financial History: Detailed credit reports, bankruptcy searches, and financial judgment reviews for all employees handling monetary transactions

- Regulatory Compliance Checks: Verification against industry exclusion lists and regulatory databases specific to financial services

- Professional License Verification: Confirmation of required certifications and licenses for employees providing financial advice or services

- Ongoing Monitoring Programs: Continuous screening for changes in financial status or regulatory standing throughout employment

Healthcare e-commerce businesses face HIPAA compliance obligations that extend to employee screening and data handling practices.

International Compliance Considerations

International e-commerce operations complicate screening requirements due to varying privacy laws and data transfer restrictions. The General Data Protection Regulation (GDPR) in Europe and similar privacy frameworks worldwide require careful consideration of cross-border screening activities. Companies must balance comprehensive screening with local privacy requirements and cultural expectations.

Data localization requirements in certain countries may prevent traditional background screening methods. Alternative verification approaches must be developed for international hires while maintaining security standards. Local screening partners often provide compliant solutions that respect regional privacy laws while meeting corporate security requirements.

Cross-border employment verification becomes particularly challenging when candidates have worked in multiple countries. Screening providers with international capabilities can navigate these complexities while ensuring comprehensive verification of work history and qualifications.

Regulated Industry Requirements

Pharmaceutical e-commerce companies must verify employee eligibility to handle controlled substances and comply with Drug Enforcement Administration regulations. These requirements extend beyond traditional background checks to include specialized training verification and ongoing monitoring throughout employment.

Food and beverage e-commerce operations may require health department clearances and food safety certification verification. These industry-specific requirements must be integrated into standard screening workflows to ensure comprehensive compliance.

Red Flags and Warning Signs in E-commerce Candidates

Experienced hiring managers recognize patterns that may indicate problematic candidates during the screening process. Employment gaps without reasonable explanations often signal potential issues, particularly in customer-facing or financial roles. Frequent job changes in retail or customer service positions may indicate performance problems or difficulty adapting to company cultures.

Inconsistencies between application information and background verification results require careful investigation. Discrepancies in employment dates, job titles, or educational credentials may indicate intentional misrepresentation or simple errors. Professional screening services help distinguish between minor inconsistencies and serious red flags that warrant hiring decision reconsideration.

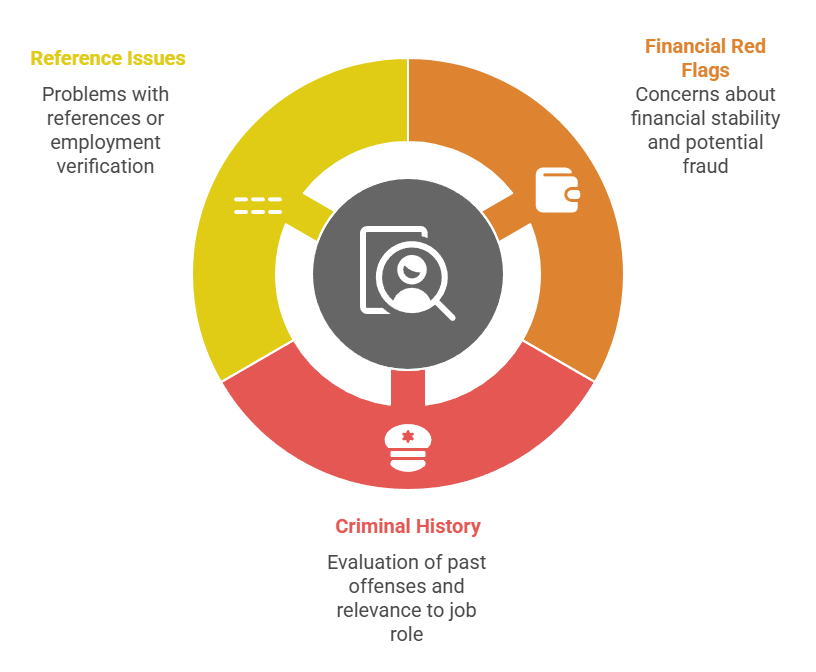

Financial Red Flags

Financial red flags become particularly concerning for e-commerce roles involving payment processing or inventory management. Recent bankruptcies may indicate financial stress that could influence decision-making in roles involving company assets or customer payments. Multiple judgments or liens suggest ongoing financial difficulties that might create temptation for fraudulent activities.

Identity theft history could indicate either victimization or perpetration, requiring careful evaluation for roles accessing customer data. Excessive debt-to-income ratios may create financial pressure leading to poor judgment in handling company resources or customer information. However, financial difficulties don't automatically disqualify candidates, and companies must evaluate each situation individually while maintaining FCRA compliance and fair hiring practices.

Unusual credit inquiry patterns might suggest financial instability or potential fraud involvement. Multiple recent credit applications could indicate desperate financial circumstances that might compromise job performance or ethical decision-making.

Criminal History Considerations

Criminal background evaluation requires nuanced approaches that consider offense relevance, timing, and rehabilitation evidence. Minor infractions from several years ago may have little bearing on e-commerce job performance, while recent financial crimes raise significant concerns for roles involving money handling or data access.

Ban-the-box legislation in many jurisdictions requires employers to delay criminal history inquiries until after initial screening or conditional job offers. This approach promotes fair hiring while still allowing companies to make informed decisions about candidate suitability for specific roles. Individualized assessments help ensure compliance with Equal Employment Opportunity Commission guidelines while protecting business interests.

Property crimes such as theft or fraud require careful consideration for any e-commerce position, given the nature of online retail operations. Violence-related offenses may be less relevant for remote positions but could impact customer-facing roles or positions requiring travel to company facilities.

Reference and Employment Red Flags

Reluctance to provide references or unusual reference arrangements may indicate performance issues or problematic departures from previous positions. References who seem unfamiliar with the candidate's work or provide vague responses require further investigation. Conversely, overly rehearsed or unrealistic praise might suggest coached references.

Employment verification difficulties such as companies that cannot be contacted or human resources departments with no record of the candidate raise serious concerns. These situations could indicate fabricated work history or positions at companies that may not have existed.

Salary history inconsistencies, where reported compensation significantly exceeds typical ranges for claimed positions, may suggest exaggerated responsibilities or fraudulent claims. However, geographic differences and industry variations must be considered before drawing conclusions.

Implementing Effective Screening Programs

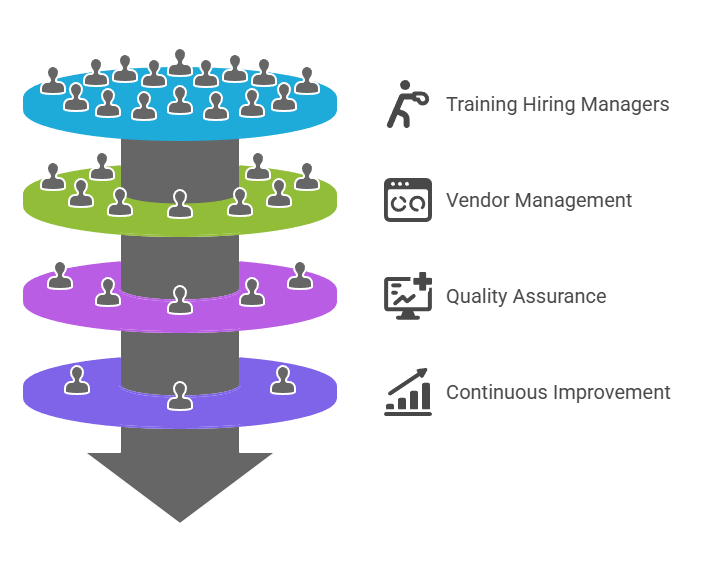

Successful remote retail screening programs require systematic approaches that integrate seamlessly with existing hiring workflows. Clear policies and procedures ensure consistent application across all positions while maintaining legal compliance and candidate satisfaction. Training hiring managers on proper screening protocols reduces errors and improves decision-making quality.

Documentation standards become critical for defending hiring decisions and demonstrating compliance with employment regulations. Systematic record-keeping helps companies track screening effectiveness, identify improvement opportunities, and prepare for potential legal challenges. Regular program audits ensure ongoing compliance with evolving regulations and industry best practices.

Communication protocols with screening providers should establish clear expectations for turnaround times, reporting formats, and escalation procedures. Service level agreements help ensure reliable screening support during peak hiring periods while maintaining consistent quality standards. Regular performance reviews with screening vendors optimize cost-effectiveness and service quality.

Training and Quality Assurance

Candidate communication throughout the screening process improves experience and reduces dropout rates. Automated status updates, clear timelines, and responsive support channels demonstrate professionalism while managing candidate expectations. Transparent screening processes build trust and reflect positively on company culture.

Quality assurance programs should include regular reviews of screening decisions and outcomes. Tracking metrics such as screening accuracy, time-to-hire, and candidate satisfaction helps identify areas for improvement. Additionally, monitoring post-hire performance can validate screening effectiveness and guide program refinements.

Training programs for hiring managers should cover legal requirements, bias prevention, and proper interpretation of screening results. Regular updates ensure staff remain current with changing regulations and best practices. Role-playing exercises and case studies help managers develop skills for handling complex screening situations.

Vendor Management and Oversight

Effective vendor management ensures consistent screening quality and regulatory compliance. Regular performance reviews should evaluate turnaround times, accuracy rates, customer service quality, and compliance standards. Benchmark comparisons with alternative providers help identify opportunities for improvement or cost savings.

Contract negotiations should include provisions for regulatory updates, technology enhancements, and service level guarantees. Penalty clauses for missed deadlines or accuracy failures protect company interests while incentivizing vendor performance. Regular business reviews provide opportunities to discuss emerging needs and service improvements.

Data security assessments of screening providers become critical given the sensitive nature of background information. Vendor compliance certifications, encryption standards, and breach notification procedures should be regularly reviewed and updated to meet evolving security requirements.

Continuous Improvement Processes

Feedback collection from hiring managers, candidates, and screening providers identifies opportunities for process improvement. Exit interviews with candidates who withdraw during screening can reveal friction points or communication issues that impact candidate experience.

Technology upgrades and integration improvements should be evaluated annually to ensure screening systems remain current with organizational needs. Migration planning for system changes helps minimize disruptions while capturing benefits from enhanced capabilities.

Legal compliance reviews with employment attorneys ensure screening practices remain current with changing regulations and court decisions. Proactive compliance management prevents costly legal challenges while maintaining effective screening standards.

Conclusion

E-commerce background checks represent a critical investment in operational security and long-term business success for online retailers. The unique challenges of remote retail screening require specialized approaches that balance thoroughness with efficiency while maintaining strict compliance standards. Technology solutions continue evolving to support comprehensive screening programs that protect both company assets and customer trust. Implementing effective screening strategies helps e-commerce businesses build reliable teams capable of delivering exceptional customer experiences while safeguarding sensitive data and financial systems.

Frequently Asked Questions

How long do e-commerce background checks typically take to complete?

Most e-commerce background checks take 2-5 business days, depending on the screening components requested. Basic criminal and identity verification can often be completed within 24-48 hours, while comprehensive packages including employment verification and reference checks may require 3-5 days. International screening or education verification may extend timelines to 7-10 days.

What background check components are most important for remote e-commerce employees?

Essential components include criminal history checks, identity verification, employment history confirmation, and reference checks. For roles involving financial responsibilities or customer data access, credit history reviews and enhanced identity verification become critical. The specific combination should align with job responsibilities and company risk tolerance.

How much do comprehensive e-commerce background screening programs cost?

Costs typically range from $18-85 per candidate depending on screening depth and components. Basic packages for entry-level positions average $18-30, while comprehensive screening for management or financial roles ranges $55-85. Volume discounts and annual contracts can reduce per-check costs by 15-30% for companies with regular hiring needs.

Are there special FCRA requirements for remote hiring and digital background checks?

Yes, remote hiring requires adapted FCRA compliance procedures including digital consent mechanisms, secure electronic delivery of required notices, and proper adverse action procedures for virtual environments. Companies must ensure electronic consent systems meet legal standards while maintaining secure data handling throughout the digital screening process.

Can e-commerce companies conduct background checks on international remote employees?

International background screening is possible but requires compliance with local privacy laws and data protection regulations like GDPR. Screening requirements, available information, and legal procedures vary significantly by country. Companies should work with screening providers experienced in international compliance to navigate these complex requirements effectively.

How often should e-commerce companies update their employee screening policies?

Screening policies should be reviewed annually and updated whenever regulations change, business risks evolve, or operational needs shift. Major e-commerce expansions, new service offerings, or regulatory updates may trigger immediate policy reviews. Regular audits help ensure ongoing compliance and effectiveness of screening programs.

What red flags should e-commerce employers watch for during background screening?

Key warning signs include employment gaps without explanations, frequent job changes, financial stress indicators like recent bankruptcies or excessive debt, criminal history involving theft or fraud, and inconsistencies between application information and verification results. However, all red flags should be evaluated individually considering job relevance and legal compliance requirements.

How can small e-commerce businesses afford comprehensive background screening?

Small businesses can use tiered screening approaches, focusing comprehensive checks on high-risk positions while using basic screening for entry-level roles. Volume discounts, annual contracts, and automated screening platforms help reduce costs. The return on investment typically justifies screening expenses through reduced fraud, improved retention, and enhanced security.

Additional Resources

- FCRA Compliance Guide for Digital Hiring Processes

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-employers-need-know - EEOC Guidelines on Criminal Background Screening

https://www.eeoc.gov/laws/guidance/enforcement-guidance-consideration-arrest-and-conviction-records-employment - E-commerce Security Best Practices for Employee Access

https://www.cisa.gov/topics/cybersecurity-best-practices/online-safety-and-security - State-by-State Background Check Requirements Database

https://www.shrm.org/resourcesandtools/hr-topics/talent-acquisition/pages/background-check-laws-state.aspx - Remote Work Security Framework for Retail Operations

https://www.nist.gov/itl/smallbusinesscyber/guidance-topic/remote-work - Digital Identity Verification Standards and Technologies

https://www.iso.org/standard/77582.html