Seasonal hiring surges expose businesses to disproportionate financial and legal risks when background screening processes are rushed or bypassed, with internal and external theft representing significant annual losses for U.S. businesses according to retail industry research. Implementing FCRA-compliant seasonal employee background checks may help mitigate liability exposure, support workplace safety efforts, and maintain regulatory compliance across federal and state-specific employment laws.

Key Takeaways Outline

- Seasonal hiring creates concentrated risk periods where compressed timelines often lead businesses to skip or abbreviate background screening, resulting in theft, workplace violence, and costly litigation that may result in substantial settlements when negligent hiring claims arise.

- Federal law requires identical FCRA compliance standards for seasonal workers as permanent employees, meaning abbreviated screening processes that violate disclosure, authorization, or adverse action requirements expose employers to regulatory penalties that can reach $1,000 or more per violation.

- Statistical evidence demonstrates that unscreened seasonal workers present measurably higher risk, with industry data showing temporary employees account for disproportionate percentages of internal theft, workers' compensation fraud, and customer data breaches during peak seasons.

- State-specific regulations create additional compliance complexity for seasonal screening, as ban-the-box laws, salary history restrictions, and cannabis employment protections vary significantly across jurisdictions where businesses operate temporary locations or distribution centers.

- Negligent hiring liability extends fully to seasonal employees despite their temporary status, with legal precedent establishing that employers maintain identical duty-of-care obligations regardless of employment duration or classification.

- Effective seasonal screening requires advance planning and scalable processes that balance speed with thoroughness, including pre-approved candidate pools, conditional offer frameworks, and technology solutions that compress turnaround times without compromising compliance.

- Third-party screening services provide specialized infrastructure to handle volume surges while maintaining FCRA compliance, offering faster results through optimized court access and database networks that internal HR teams typically cannot replicate during compressed hiring windows.

- Post-hire monitoring and clear termination protocols protect businesses from ongoing liability throughout seasonal employment periods, particularly when combined with proper documentation practices that demonstrate reasonable care in hiring decisions.

The Hidden Cost of Seasonal Hiring Shortcuts

Financial Impact of Inadequate Seasonal Screening

The retail, hospitality, and logistics sectors face concentrated vulnerability during seasonal hiring surges when workforce demands can increase by 40-60% within weeks. This pressure creates dangerous incentives to abbreviate or eliminate background screening processes. Consequently, businesses expose themselves to quantifiable financial consequences that far exceed screening costs.

Internal theft statistics reveal the scope of this vulnerability. The Association of Certified Fraud Examiners reports that businesses lose approximately 5% of annual revenue to occupational fraud. Temporary and seasonal workers may represent elevated risk during abbreviated employment periods when screening processes are compressed or bypassed entirely.

Beyond direct theft, inadequate screening creates liability exposure through negligent hiring claims. Legal settlements in negligent hiring cases can result in substantial financial liability, with some cases resulting in multi-million dollar judgments when employers failed to conduct reasonable pre-employment screening. Seasonal employees involved in workplace violence, customer assault, or data breach incidents trigger identical legal standards as permanent workforce claims.

Regulatory Compliance Remains Non-Negotiable

The compressed timelines of seasonal hiring do not modify federal compliance requirements under the Fair Credit Reporting Act. Employers must provide identical written disclosures, obtain proper authorization, and follow complete adverse action procedures for seasonal candidates as for permanent positions. The Consumer Financial Protection Bureau can impose civil penalties for FCRA non-compliance, with statutory damages available under the Act's private right of action provisions.

Equal Employment Opportunity Commission guidance explicitly confirms that seasonal workers receive full protection under federal anti-discrimination laws. Background screening policies that apply different standards to temporary workers create disparate impact liability when those policies disproportionately affect protected classes. Different standards might include broader criminal history exclusions or abbreviated verification processes.

Understanding the Potential Costs of Inadequate Screening

Consider a hypothetical scenario where a retail organization hires several hundred seasonal workers without background screening during a holiday rush. If one employee with an undisclosed history of financial fraud gains access to customer payment systems, the potential financial exposure could include multiple cost categories that compound rapidly.

Customer reimbursement and credit monitoring services represent immediate direct costs following a data breach. Payment Card Industry compliance penalties and required forensic investigations add substantial regulatory expenses. Legal defense costs for customer lawsuits can escalate quickly when negligent hiring becomes part of the claim. Regulatory response requirements and breach notification expenses create additional financial burden that continues long after the initial incident.

The long-term consequences often exceed immediate costs. Insurance carriers may increase liability premiums significantly following security breaches or theft incidents. Some insurers impose mandatory screening requirements for all future hires regardless of employment duration as a condition of continued coverage. This hypothetical illustrates why organizations should maintain consistent screening standards regardless of hiring timeline pressures or employment duration.

Understanding Seasonal Employee Background Checks

What Constitutes a Seasonal Employee Background Check

Seasonal employee background checks encompass the same verification and screening components applied to permanent workforce candidates, adapted to the specific risk profile and job responsibilities of temporary positions. These checks typically include criminal record searches at county and potentially federal levels. Employment verification for recent positions and education confirmation when relevant to job requirements also form part of comprehensive screening.

The scope of appropriate screening varies based on position-specific risk factors rather than employment duration. Seasonal employees with financial transaction access, vulnerable population contact, or sensitive data handling require identical screening depth as permanent employees in comparable roles. A temporary warehouse associate handling inventory requires different screening components than a seasonal customer service representative processing payment information.

| Screening Component | When Required |

| Criminal background check | Positions with financial access, vulnerable populations, security responsibilities |

| Employment verification | All positions above entry-level or with specialized skills claims |

| Education verification | Positions requiring specific degrees or certifications |

| Motor vehicle records | Any driving responsibilities, including occasional vehicle use |

| Drug screening | Safety-sensitive positions, federally regulated roles, positions operating equipment |

FCRA-compliant seasonal screening must include specific documentation. Employers need a standalone written disclosure document that clearly identifies the background check, separate written authorization from the candidate, and complete adverse action procedures if screening results lead to withdrawal of a conditional job offer.

Federal Legal Framework for Temporary Worker Screening

The Fair Credit Reporting Act establishes the primary federal compliance framework for seasonal employee background checks. Requirements remain identical to permanent employee screening. Employers must provide clear disclosure before obtaining a background report, secure written authorization from candidates, and follow a two-step adverse action process if screening information contributes to hiring decisions.

The adverse action process requires employers to provide a pre-adverse action notice including a copy of the background report and a Summary of Rights document. A reasonable waiting period (typically 5-7 business days) must follow before finalizing the decision. Final adverse action requires written notice identifying the screening company, explaining the candidate's right to dispute information, and providing contact information for the reporting agency.

Title VII of the Civil Rights Act applies comprehensive anti-discrimination protections to seasonal workers through EEOC enforcement guidance. Background screening policies must demonstrate job-related business necessity when criminal history information influences hiring decisions. Individualized assessment requirements apply before categorical exclusions. The EEOC's 2012 enforcement guidance on criminal records explicitly addresses temporary workers, confirming identical standards regardless of employment duration.

State-Specific Considerations for Seasonal Hiring Compliance

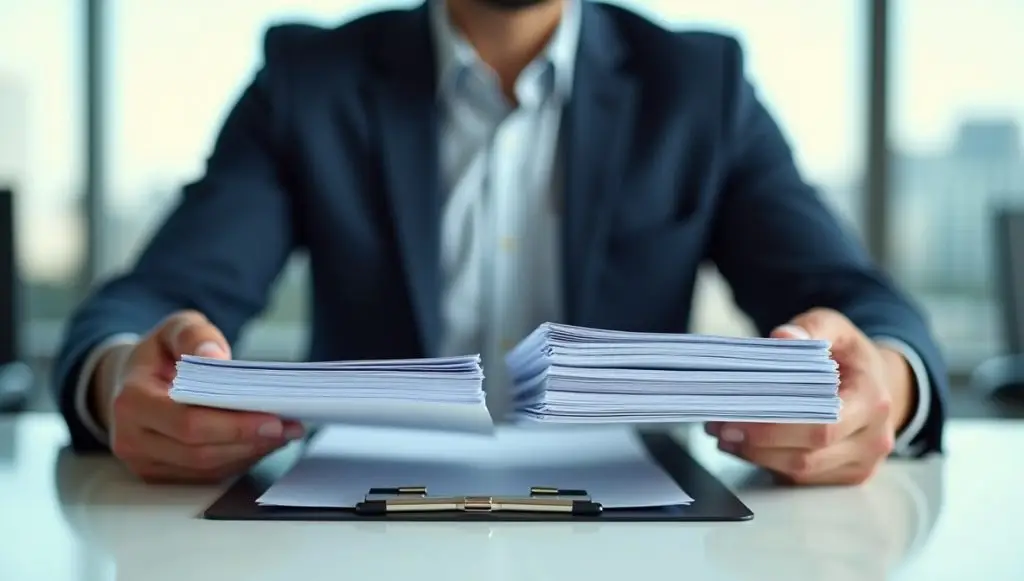

State-level regulations create significant complexity for seasonal hiring background screening. This complexity intensifies for businesses operating across multiple jurisdictions or hiring temporary workers for geographically distributed operations. Ban-the-box laws in 37 states and over 150 municipalities restrict when employers can inquire about criminal history. Many require delay until after conditional offers for all positions including seasonal roles.

Key state requirements affecting seasonal screening include:

- California Fair Chance Act: Prohibits criminal history inquiries before conditional job offers and requires individualized assessment before adverse decisions, with specific documentation requirements and candidate rights that apply universally to temporary workers.

- New York Article 23-A: Requires employers to consider eight specific factors before denying employment based on criminal convictions, including the relationship between the offense and job responsibilities, time elapsed since the conviction, and evidence of rehabilitation.

- Massachusetts CORI requirements: Mandates specific notice before obtaining criminal history information and restricts consideration of certain conviction types and timeframes for all positions including seasonal roles.

- Cannabis protections: Several states including Nevada, New Jersey, and New York have enacted protections for lawful cannabis use outside the workplace, prohibiting employment decisions based on positive marijuana tests except for safety-sensitive positions or federally regulated roles.

These protections extend explicitly to seasonal workers. Compliance considerations affect industries with traditional drug screening policies, requiring careful review of job descriptions to determine safety-sensitive status.

Risk Assessment and Liability Exposure

Quantifying Seasonal Workforce Vulnerabilities

Statistical analysis reveals measurable risk differentials associated with temporary and seasonal workforces across multiple threat categories. The National Association for Shoplifting Prevention identified employee theft as the source of 33% of retail inventory shrinkage, with concentrated risk during high-volume seasonal periods when screening may be abbreviated.

Insurance industry analyses suggest that temporary workers may file workers' compensation claims at elevated rates compared to permanent employees in comparable positions. A subset of these claims involves fraudulent or exaggerated injuries. Background screening that includes employment verification can identify patterns of repeated short-term employment with workers' compensation claims that may indicate fraud risk.

| Risk Category | Seasonal Worker Impact | Mitigation Through Screening |

| Internal theft | 33% of retail shrinkage; concentrated seasonal risk | Criminal background checks for theft, fraud, embezzlement |

| Workplace violence | Thousands of annual workplace assault injuries | Criminal screening for violent offenses relevant to position |

| Data breaches | Multi-million dollar average costs; insider threats significant | Background checks for fraud, identity theft, computer crimes |

| Workers' comp concerns | Elevated claim rates for some temporary worker categories | Employment verification revealing claim patterns |

Data breach liability creates particular exposure in seasonal hiring contexts where temporary workers gain system access during compressed onboarding. Data breach costs can be substantial, with industry research indicating average breach costs in the millions of dollars when accounting for investigation, notification, remediation, and legal expenses. Insider threats (including employees and contractors) represent significant incident sources.

Negligent Hiring Doctrine and Seasonal Workers

Legal precedent consistently establishes that employers maintain identical duty-of-care obligations for seasonal employees as permanent workforce members under negligent hiring doctrine. Courts evaluate whether employers conducted reasonable investigation into candidates' backgrounds proportionate to the position's responsibilities and foreseeable risks. Employment duration remains irrelevant to this analysis.

The elements of negligent hiring claims require plaintiffs to demonstrate four key factors. First, the employer hired an employee. Second, the employee was unfit or incompetent. Third, the employer knew or should have known of the unfitness. Fourth, the employee's unfitness proximately caused the plaintiff's injury. The "should have known" standard creates liability when reasonable background screening would have revealed disqualifying information, regardless of whether the employer actually conducted such screening.

Courts have consistently held that employers maintain duty-of-care obligations for seasonal employees equivalent to permanent workforce members. In negligent hiring cases, courts evaluate whether employers conducted reasonable investigation into candidates' backgrounds proportionate to foreseeable risks, with employment duration deemed irrelevant to this analysis. Failure to conduct appropriate screening when such screening would have revealed relevant criminal history has resulted in substantial liability in various jurisdictions.

Industry-Specific Risk Profiles

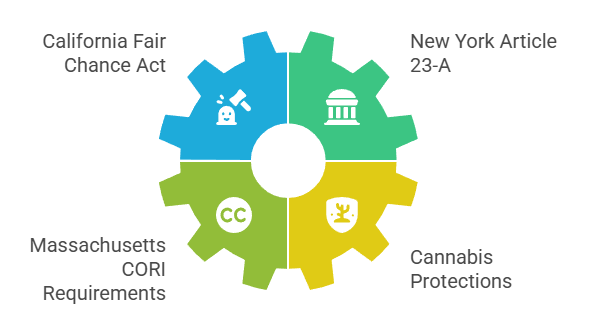

Different industries face distinct seasonal screening challenges with documented financial consequences:

- Retail operations: The National Retail Federation's annual survey identifies employee theft and fraud as persistent inventory shrinkage sources, with seasonal hiring periods creating elevated vulnerability. Point-of-sale access, cash handling, and inventory management responsibilities justify criminal background screening focused on theft, fraud, and financial crimes for all seasonal retail positions.

- Hospitality sector: Seasonal hiring presents distinct risk categories including guest safety, property access, and alcohol service responsibilities. Hospitality sector employers face particular duty-of-care obligations given guest safety responsibilities and property access provided to seasonal workers. Background screening for positions with guest contact or access to private areas should address relevant criminal history based on specific job duties and foreseeable risks.

- Logistics and warehousing: Seasonal surges create screening requirements addressing theft risk, equipment operation safety, and access to commercial driver credentials. The Federal Motor Carrier Safety Administration mandates specific background check requirements for commercial drivers including driving record review and drug/alcohol testing, with violations carrying federal penalties.

Each industry requires tailored screening approaches that address position-specific risks. Generic screening programs fail to capture relevant risk factors while potentially over-screening low-risk positions.

Building an Effective Seasonal Screening Program

Advance Planning and Scalable Processes

Successful seasonal employee background screening requires advance planning that begins weeks or months before hiring needs materialize. Organizations that initiate screening program design during off-peak periods can establish streamlined processes, vendor relationships, and compliance frameworks. These preparations prevent bottlenecks during urgent hiring surges.

Creating pre-approved candidate pools represents an effective strategy for positions with predictable seasonal demand. Employers can conduct background screening on interested candidates before immediate openings exist. This maintains a roster of pre-cleared individuals available for rapid onboarding when seasonal needs arise. Clear communication about the conditional nature of screening and time limitations on background check validity (typically 6-12 months depending on position risk and organizational policy) remains essential.

Technology integration streamlines high-volume seasonal screening through multiple mechanisms:

- Applicant tracking system connections: Automated workflow triggers reduce manual processing time

- Electronic disclosure/authorization: Digital consent processes eliminate paper delays

- Automated status updates: Real-time candidate communication improves experience

- Compliance audit trails: Documentation systems prove regulatory adherence

Digital systems can significantly reduce processing time compared to paper-based approaches. They also create audit trails that document compliance with disclosure, authorization, and adverse action requirements.

Position-Specific Screening Calibration

Risk-based screening approaches match background check scope to specific job responsibilities rather than applying uniform processes to all seasonal positions. This calibration improves efficiency while ensuring thorough screening for high-risk roles. It also avoids unnecessary costs for low-risk positions.

| Position Type | Core Screening Components | Risk Justification |

| Cashiers, payment processors | Criminal checks (theft, fraud, embezzlement); employment verification | Direct financial access; POS system control |

| Youth programs, senior care | Criminal checks (violent, sex offenses); sex offender registry; reference checks | Vulnerable population contact; enhanced duty of care |

| Delivery drivers, mobile workers | Motor vehicle records; criminal checks (DUI, reckless driving) | Vicarious liability from employee driving |

| General warehouse, stocking | Identity verification; I-9 compliance; limited criminal screening | Lower risk absent financial/security access |

Financial access positions including cashiers, payment processors, and workers handling deposits require criminal background screening emphasizing theft, fraud, embezzlement, and financial crimes. Employment verification for recent positions may reveal patterns of short tenure combined with inventory discrepancies. Terminations for cause indicate risk even without criminal convictions.

Positions without financial access, vulnerable population contact, or security responsibilities may require only identity verification and employment eligibility confirmation through I-9 processes. Over-screening for low-risk positions wastes resources while potentially creating disparate impact liability if screening criteria lack job-related business necessity.

Third-Party Screening Services for Seasonal Volume Management

Professional background screening services provide specialized infrastructure that addresses seasonal hiring challenges through scalable technology, expanded data access, and compliance expertise. Internal HR teams typically cannot replicate these capabilities during compressed timeframes.

Third-party screening companies typically maintain direct electronic access to court systems, national criminal databases, and proprietary data sources, which may accelerate turnaround times compared to manual searches. Infrastructure advantages may provide value during seasonal hiring when internal staff lack capacity to request records from multiple jurisdictions and verify information across databases.

FCRA-compliant screening services assume legal responsibility for data accuracy, dispute resolution, and regulatory compliance under the Act's definition of "consumer reporting agencies." This transfers significant liability exposure from employers to specialized vendors with errors and omissions insurance. Compliance systems and legal expertise specifically address background screening regulations.

Benefits of outsourcing seasonal background checks include:

- Potentially faster turnaround times: Direct court access and optimized processes may compress results delivery for most searches

- Scalability: Volume surge handling capability without quality degradation or compliance shortcuts

- Compliance support: Adverse action guidance, template provision, and documentation assistance

- HR resource preservation: Allows hiring teams to focus on candidate evaluation rather than screening administration

When evaluating third-party screening providers for seasonal hiring needs, organizations should confirm FCRA compliance certifications and data security standards including encryption and access controls. Average turnaround times for relevant search types and scalability to handle volume fluctuations require verification. Establishing relationships with screening vendors before seasonal surges begin prevents delays and ensures smooth process implementation during critical hiring periods.

Implementation Best Practices

Creating Compliant Authorization and Disclosure Documents

FCRA compliance begins with proper disclosure and authorization documentation that meets specific regulatory requirements while remaining accessible to seasonal candidates. The disclosure must appear as a standalone document exclusively addressing the background check. It should remain separate from employment applications or other hiring materials.

The disclosure document should clearly identify that a background report may be obtained for employment purposes. Use plain language appropriate for general audiences. Avoid legal terminology or complex sentence structures that obscure meaning, as courts evaluate disclosure adequacy based on reasonable consumer understanding.

Authorization language must secure affirmative written consent from candidates before obtaining background reports. Electronic signatures through applicant tracking systems satisfy FCRA requirements when systems verify candidate identity and intent, maintain records, and provide candidates with copies of signed documents. State-specific addenda address additional disclosure and authorization requirements in jurisdictions with enhanced protections.

Adverse Action Procedures for Seasonal Candidates

The FCRA's adverse action process applies identically to seasonal hiring decisions as permanent employment. Careful procedural compliance becomes essential, as many employers violate requirements during rushed seasonal hiring. Non-compliance with adverse action timing and documentation requirements creates liability regardless of whether the underlying screening information justified the hiring decision.

Pre-adverse action notice initiates when background screening information contributes to a decision to withdraw a conditional job offer or deny employment. The employer must provide the candidate with a copy of the background report, the FCRA Summary of Consumer Rights, and written notice of the potential adverse decision before finalizing it. The waiting period between pre-adverse action notice and final decision must allow reasonable time for candidates to review information and dispute inaccuracies.

Adverse action timeline requirements:

- Day 1: Send pre-adverse action notice with background report copy and Summary of Rights

- Days 2-7: Reasonable waiting period (typically 5-7 business days based on CFPB guidance)

- Day 8+: Final adverse action notice if proceeding with negative decision

- Ongoing: 60-day dispute window for candidates to challenge information accuracy

Documentation of adverse action procedures protects employers in regulatory investigations and candidate disputes. Maintain records showing the date and method of pre-adverse action delivery, the specific waiting period before final decision, and final adverse action notice transmission.

Individualized Assessment Requirements

EEOC guidance on criminal records requires individualized assessment before making employment decisions based on conviction history. Requirements extend fully to seasonal positions. Categorical exclusions based on criminal records without individual consideration create disparate impact liability when those policies disproportionately affect protected classes.

The individualized assessment process requires employers to consider three key factors established in EEOC enforcement guidance. First, evaluate the nature and gravity of the offense or conduct. Second, assess the time that has elapsed since the conviction or completion of sentence. Third, examine the nature of the job held or sought and its relationship to the criminal conduct.

Employers should provide candidates an opportunity to demonstrate mitigating circumstances including rehabilitation evidence, employment history since the conviction, or contextual information about the offense. Written documentation of individualized assessments protects employers from discrimination claims while demonstrating reasonable decision-making. Record the specific factors considered, how the conviction relates to job responsibilities, and the basis for concluding that the criminal history creates unacceptable risk for the particular position.

Ongoing Compliance and Post-Hire Considerations

Documentation Practices and Record Retention

Comprehensive documentation of seasonal employee background screening processes protects employers in regulatory investigations, discrimination claims, and negligent hiring litigation. Maintain complete records including background check reports, disclosure and authorization documents, adverse action notices if applicable, and documentation of individualized assessments for criminal history.

The Fair Credit Reporting Act requires employers to retain records demonstrating compliance with disclosure, authorization, and adverse action procedures for positions where screening influenced decisions. These records prove particularly important for seasonal hiring given the high volume of candidates and compressed timelines that increase procedural error risk. The Equal Employment Opportunity Commission requires retention of employment records including background screening documentation for one year from the record creation date or the personnel action date, whichever is later.

State laws may impose longer retention requirements beyond federal minimums. California requires employment records maintenance for three years from the termination date. New York mandates retention of employment applications and related documents for four years. Illinois requires three-year retention of personnel records. Electronic recordkeeping systems ensure consistent retention while facilitating quick retrieval during investigations or litigation.

Off-Boarding and Termination Protocols

Structured off-boarding procedures for seasonal employees conclude employment relationships while protecting employers from ongoing liability and ensuring proper asset recovery. These processes prove particularly important given the temporary nature of seasonal work and the volume of simultaneous terminations when seasonal periods end.

Access termination represents the most critical off-boarding component. This applies particularly for positions involving computer systems, buildings, or sensitive areas. Coordinate background screening and IT security protocols so that employees whose screening revealed concerns receive heightened attention during off-boarding to ensure complete credential deactivation.

Key off-boarding elements include:

- System access revocation: Deactivate all credentials, building access, and computer accounts on the final work day

- Asset recovery: Collect uniforms, equipment, keys, badges, and company property with documented inventory

- Exit interviews: Assess potential concerns including knowledge of policy violations by other seasonal workers

- Final pay compliance: Follow state-specific timing requirements that vary significantly across jurisdictions

- Reference policy communication: Clarify how the organization will respond to future employment verification requests

Final pay and benefits processing must comply with state-specific timing requirements that vary significantly across jurisdictions. Several states including California and Colorado require immediate final pay upon termination, while others allow longer periods. Non-compliance with wage payment timing creates statutory penalties exceeding the underlying wages in many states.

Conclusion

Seasonal employee background checks represent essential risk management rather than optional processes, with documented financial and legal consequences when hiring shortcuts compromise screening thoroughness. FCRA-compliant screening programs scaled to seasonal volume may help protect businesses from theft, workplace violence, and negligent hiring liability while supporting regulatory compliance across federal and state requirements. Strategic planning, position-specific risk calibration, and professional screening services enable organizations to balance hiring speed with liability protection during critical seasonal periods. Even more, such processes also communicate to seasonal employees the fact that they have been given real levels of responsibility, rather than seeing them simply as liabilities. Where the screening processes are done with careful consideration, the results improve accountability, regardless of the pressure to fill the positions.

Frequently Asked Questions

Do seasonal employees require the same background checks as permanent employees?

Yes, federal law requires identical FCRA compliance for seasonal and permanent employees, including proper disclosure, written authorization, and complete adverse action procedures. The scope of appropriate screening depends on job responsibilities and risk factors rather than employment duration. Seasonal positions with financial access, vulnerable population contact, or security responsibilities require the same thoroughness as permanent roles with similar duties.

How long does a seasonal employee background check take?

Standard criminal background checks typically return results within 2-5 business days, though timelines vary based on the jurisdictions searched and whether manual court research is necessary. Third-party screening services may provide faster turnaround through direct court system access and optimized data networks. This capability may provide value during seasonal hiring surges when internal processing capacity becomes strained.

Can employers use different background check criteria for temporary workers?

Employers must apply consistent screening criteria to all candidates for similar positions regardless of employment classification, as different standards for seasonal workers create disparate impact liability under EEOC guidance. The appropriate screening scope should reflect job-specific risk factors such as financial access or vulnerable population contact rather than employment duration. Position responsibilities determine screening depth, not employment classification.

What happens if a seasonal employee's background check reveals a criminal record?

Employers must conduct individualized assessment considering the nature and gravity of the offense, time elapsed since the conviction, and relationship to the specific job responsibilities before making adverse employment decisions based on criminal history. The complete FCRA adverse action process applies, including pre-adverse action notice, reasonable waiting period, and final adverse action notice with dispute rights. Seasonal hiring urgency does not modify these requirements.

Are there positions where seasonal employees don't need background checks?

While FCRA doesn't mandate background checks, negligent hiring liability creates risk whenever reasonable screening would reveal information relevant to foreseeable job-related dangers. Low-risk positions without financial access, vulnerable population contact, driving responsibilities, or unsupervised work may not require criminal screening. Identity verification and employment eligibility confirmation through I-9 remain universally necessary regardless of risk level.

How should employers handle background check costs for seasonal hiring?

Federal law generally permits employers to pass reasonable background check costs to applicants in most states, though some jurisdictions including California prohibit charging candidates for legally required screening. Cost-sharing approaches must apply consistently to all candidates for similar positions regardless of employment classification to avoid discrimination claims.

Do ban-the-box laws apply to seasonal positions?

Yes, state and local ban-the-box regulations that restrict criminal history inquiries until specific hiring stages apply equally to seasonal and permanent positions. Employers must comply with timing restrictions, individualized assessment requirements, and candidate notification obligations in all jurisdictions where they recruit or hire seasonal workers. Employment duration does not exempt employers from ban-the-box compliance.

Can employers conduct background checks on returning seasonal employees?

Employers should conduct updated background checks annually for returning seasonal workers rather than relying on previous screening results, as criminal records, license statuses, and employment history change over time. Updated screening requires new FCRA disclosure and authorization documents even for workers who authorized checks in previous seasons. Background check information becomes outdated after 6-12 months depending on position risk.

What background check components matter most for seasonal retail positions?

Seasonal retail positions typically warrant criminal background screening focused on theft, fraud, and financial crimes given point-of-sale access and inventory handling responsibilities. Employment verification for recent positions may reveal patterns indicating risk. Positions involving customer data access justify screening for identity theft and computer crimes to address data breach liability.

How do employers balance screening thoroughness with seasonal hiring speed?

Advance planning including pre-approved candidate pools, established vendor relationships, and conditional offer frameworks allows thorough screening within compressed seasonal timelines. Third-party screening services may provide infrastructure and data access that accelerates turnaround compared to internal processing. Risk-based screening approaches focus resources on positions with elevated liability exposure while streamlining checks for lower-risk roles.

Additional Resources

- Fair Credit Reporting Act – Full Text and Official Statute

https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act - EEOC Enforcement Guidance on Criminal Records in Employment Decisions

https://www.eeoc.gov/laws/guidance/consideration-arrest-and-conviction-records-employment-decisions-under-title-vii - Consumer Financial Protection Bureau – Background Screening Guidance

https://www.consumerfinance.gov/compliance/compliance-resources/other-applicable-requirements/background-screening/ - U.S. Department of Labor – Fair Labor Standards Act Advisor

https://www.dol.gov/agencies/whd/flsa - National Conference of State Legislatures – Ban the Box Overview

https://www.ncsl.org/labor-and-employment/ban-the-box-resources

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.