Healthcare background screening costs in 2026 range from $50 to $500+ per candidate depending on verification depth, state requirements, and technology integration, with multi-facility health systems averaging $180-$280 per hire when factoring in credentialing, continuous monitoring, and compliance documentation. As CMS refines enforcement priorities and state-level mandates expand, healthcare administrators must approach screening expenses as strategic workforce quality investments that directly impact patient safety outcomes, regulatory standing, and organizational liability exposure.

Key Takeaways

- Basic healthcare background checks start at $50-$75 per candidate, while comprehensive screenings with credentialing verification typically cost $150-$350 depending on licensure complexity and multi-state requirements.

- Continuous monitoring programs add $15-$40 per employee annually but reduce re-screening costs and provide real-time alerts on license changes or criminal activity.

- State-specific mandates significantly impact total screening costs, with some high-requirement jurisdictions incurring substantially higher expenses due to additional registry checks and compliance documentation requirements.

- Technology integration costs (API connections, ATS integration, automated workflows) represent 15-25% of total screening budgets but deliver measurable ROI through reduced administrative time and faster hiring cycles.

- Multi-facility health systems can negotiate volume pricing that reduces per-screen costs by 20-35% compared to single-location pricing structures.

- Credentialing verification for advanced practitioners and specialists may add $100-$200 or more per candidate depending on primary source verification requirements and specialized database access needs.

- Hidden costs including dispute resolution, compliance auditing, and staff training typically add 10-18% to base screening expenses but are essential for FCRA compliance and defensible hiring practices.

- Risk-based screening tiers that match verification depth to role sensitivity can optimize spending while maintaining compliance, potentially reducing overall screening budgets by 15-25% without compromising patient safety standards.

Understanding Healthcare Background Screening Cost Components in 2026

Healthcare facilities planning 2026-2027 screening budgets must account for multiple cost layers that extend beyond basic criminal history checks. The fundamental expense structure includes database access fees, verification labor, compliance documentation, and technology infrastructure. Each component responds to distinct regulatory and operational pressures.

Base Screening Package Costs

Standard healthcare background checks typically include county criminal searches, national criminal database queries, sex offender registry checks, and Office of Inspector General (OIG) exclusion list verification. These foundational elements often range from $50-$100 per candidate, though actual costs vary by provider, geographic scope, and specific service requirements. Price variation depends primarily on database refresh frequency and turnaround time requirements.

Facilities should recognize that advertised base prices may not reflect total actual costs. Additional expenses emerge from multi-jurisdiction searches for candidates with residential history spanning multiple counties or states. Re-verification requirements when initial results are inconclusive add further costs, as do expedited processing fees when hiring timelines compress due to staffing emergencies.

Credentialing and License Verification Expenses

Medical license verification represents a distinct cost category that significantly impacts total screening budgets for clinical positions. Primary source verification, required by most accreditation bodies and state regulations, involves direct contact with licensing boards, educational institutions, and certification organizations. These verifications typically add $30-$80 per source to screening costs.

The following cost ranges are general estimates based on industry observations and may vary significantly based on provider, location, verification complexity, and specific organizational requirements:

| Clinical Role Type | Typical Verification Components | Cost Range Per Candidate |

| Physicians | Medical license (multi-state), board certification, DEA registration, medical education, hospital privileges, malpractice history | $200-$500 |

| Nurse Practitioners/PAs | State license, national certification, prescriptive authority, controlled substance license | $150-$300 |

| Registered Nurses | State license, specialty certifications, compact license verification | $100-$175 |

| Allied Health Professionals | State/national license or certification, specialty credentials | $80-$150 |

| Non-Clinical Staff | Basic background check, OIG exclusion list | $50-$85 |

Advanced practitioners with multiple state licenses, board certifications, and specialized credentials can generate verification costs exceeding $200 per candidate. Budget planners typically allocate higher per-screen costs for roles that may require Drug Enforcement Administration (DEA) registration verification, controlled substance license checks, and malpractice claims history research.

Continuous Monitoring and Ongoing Screening Costs

Continuous monitoring programs that provide real-time alerts about license changes, criminal arrests, or exclusion list additions have become standard practice at healthcare facilities committed to maintaining workforce integrity between formal re-screening cycles. These monitoring services typically cost $15-40 per monitored employee annually. This represents a significant line item for large healthcare systems with thousands of clinical staff members.

The value proposition for continuous monitoring centers on risk mitigation and cost avoidance. Facilities that identify licensing lapses or criminal activity immediately can take swift corrective action before patient safety incidents occur or regulatory auditors discover compliance gaps. This proactive approach often prevents the substantial costs associated with sentinel events, regulatory fines, and reputation damage that can result from employing individuals who no longer meet qualification standards.

State-Specific Requirements That Impact Screening Budgets

Geographic location dramatically influences healthcare background screening costs due to varying state-level mandates, registry access requirements, and compliance documentation standards. Facilities operating in multiple states must budget for the most stringent requirements applicable to any jurisdiction where they employ healthcare workers. Understanding these variations is essential for accurate budget forecasting.

High-Cost Compliance Jurisdictions

California healthcare facilities typically face comprehensive screening requirements, which may include background checks through the California Department of Justice, FBI fingerprint processing, and look-back period requirements. Facilities should consult current California regulations and qualified legal counsel for specific compliance obligations. These additional requirements may increase per-candidate screening costs, with impacts varying based on specific verification needs and provider pricing.

New York's Healthcare Worker Background Check Program typically involves checks of registries such as the Statewide Central Register of Child Abuse and Maltreatment and the Staff Exclusion List. Facilities should verify current requirements with state authorities or legal counsel. Massachusetts healthcare employers may be required to conduct checks of registries such as the Sex Offender Registry Board and Department of Mental Health Employment Verification, creating additional verification layers that can impact both cost and turnaround time. Specific requirements depend on facility type and applicable regulations.

Multi-State Licensing and Telehealth Considerations

The expansion of telehealth services and interstate compacts like the Nurse Licensure Compact (NLC) and Interstate Medical Licensure Compact (IMLC) has complicated credentialing cost structures. Healthcare workers providing services across state lines may require license verification in multiple jurisdictions. Each jurisdiction has distinct primary source verification fees and processing timelines.

Budget planners may find that telehealth-enabled positions generate higher credentialing costs compared to traditional single-state roles due to multi-jurisdictional verification requirements. This cost differential reflects the need to verify good standing in multiple states. Monitoring continuing education compliance across different jurisdictions adds complexity, as does maintaining documentation that satisfies the most stringent applicable state requirements.

Local Registry and Database Requirements

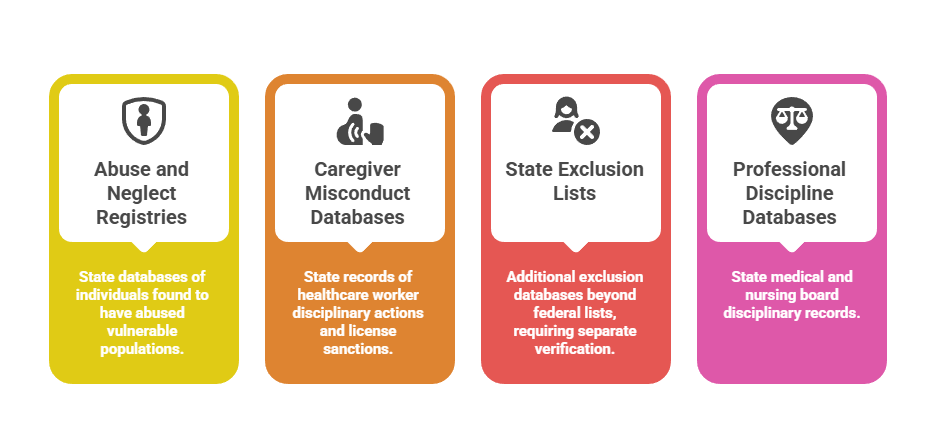

Certain states and municipalities maintain specialized registries that healthcare facilities must check before hiring or allowing patient contact. Registry types include:

- Abuse and neglect registries: State-maintained databases of individuals found to have abused, neglected, or exploited vulnerable populations, typically adding $10-$20 per check.

- Caregiver misconduct databases: State-specific records of healthcare worker disciplinary actions and license sanctions, generally costing $8-$15 per query.

- State exclusion lists: Additional exclusion databases beyond federal OIG and GSA lists, requiring separate verification at $5-$12 per check.

- Professional discipline databases: State medical board and nursing board disciplinary records, often included in license verification but sometimes requiring separate access.

Access to these registries often requires separate vendor relationships, manual verification processes, or direct facility registration with state agencies. Turnaround times extend by one to three business days for each additional registry check.

Technology Integration and Automation Cost Factors

Modern healthcare screening programs increasingly rely on technology platforms that integrate with applicant tracking systems, human resources information systems, and compliance management tools. These integrations deliver operational efficiencies but represent distinct budget categories that administrators must account for during fiscal planning. Technology investments may generate positive ROI through labor savings and error reduction, with timeframes varying based on organization size, implementation efficiency, and screening volume.

Platform and Integration Setup Costs

Initial integration between screening providers and healthcare facility systems typically involves one-time setup fees ranging from $500 to $5,000 depending on system complexity, data flow requirements, and custom reporting needs. Larger health systems with multiple electronic health record platforms, centralized HR systems, and facility-specific applicant tracking tools may face integration costs exceeding $10,000. Implementation timelines generally span four to twelve weeks.

These upfront investments deliver long-term value through reduced manual data entry, faster candidate processing, and improved compliance documentation. Facilities should evaluate integration costs as capital expenditures amortized over multiple years rather than recurring operational expenses. Standard return on investment calculations should account for administrative time savings and error reduction.

API Access and Transaction Fees

Many screening technology platforms charge per-transaction API fees when systems automatically exchange data or trigger verification processes. Fee structures typically include:

- Basic API calls: $0.50-$1.50 per transaction for simple data exchanges like status updates or report retrieval.

- Complex verification triggers: $1.50-$3.00 per transaction for automated screening initiation or multi-step workflow activation.

- Real-time monitoring alerts: $0.25-$0.75 per alert notification pushed to HR systems or compliance dashboards.

Healthcare facilities with high turnover rates in nursing, allied health, and support services positions should carefully model API transaction volumes when evaluating technology-enabled screening solutions. A 500-bed hospital with 25% annual turnover might generate 3,000-4,000 screening-related API transactions annually, translating to $1,500-$12,000 in fees that many administrators overlook during initial cost comparisons.

Automated Workflow and Compliance Documentation Tools

Advanced screening platforms offer automated adverse action workflows, electronic consent management, candidate communication portals, and audit-ready compliance documentation. These features typically command premium pricing, with comprehensive platforms costing $3,000-$15,000 annually in software licensing fees plus per-user or per-screen transaction costs.

The value proposition for automation-focused platforms centers on FCRA compliance risk reduction and administrative efficiency gains. Facilities that manually manage pre-adverse action notices, candidate disputes, and regulatory documentation face substantial labor costs and heightened liability exposure. Automated systems that enforce compliant processes and maintain detailed audit trails often justify their expense through reduced legal risk and lower administrative overhead.

Volume-Based Pricing and Multi-Facility Considerations

Healthcare organizations with multiple locations, high hiring volumes, or system-wide standardization initiatives can often negotiate favorable pricing structures. Volume commitments significantly reduce per-screen costs compared to published rate cards. Strategic procurement approaches can generate substantial savings while improving service quality and vendor accountability.

Enterprise Agreement Structures

Large health systems screening 2,000+ candidates annually may qualify for enterprise pricing structures that can reduce base screening costs through volume commitments, with actual savings varying by provider and contract terms. Benefits often include:

- Tiered volume discounts: Progressive price reductions as monthly or annual screening volumes increase across predetermined thresholds.

- Waived setup fees: Elimination of integration costs, platform access fees, and initial configuration charges worth $2,000-$10,000.

- Preferential service levels: Guaranteed turnaround times, priority customer support, and expedited processing at no additional cost.

- Dedicated account management: Assigned relationship managers who provide strategic guidance, compliance updates, and optimization recommendations.

Enterprise agreements frequently employ tiered pricing structures where per-screen costs decrease as monthly or annual volume thresholds are exceeded. Budget planners should model these tier structures carefully, as seasonal hiring fluctuations and unexpected turnover can impact actual realized pricing.

Standardization Cost Benefits and Challenges

Implementing standardized screening protocols across multiple facilities generates cost efficiencies through simplified vendor management, consolidated training programs, and unified compliance frameworks. Centralized procurement enables better contract negotiations and more consistent quality oversight. However, standardization initiatives often require compromises that can increase costs at some locations to achieve system-wide consistency.

A health system operating in both low-cost and high-cost compliance jurisdictions might adopt screening packages that meet the most stringent state requirements across all facilities. This approach applies even where less comprehensive checks would satisfy local mandates. Simplified administration and reduced complexity are benefits, but overall screening expenditures typically increase by 10-20% compared to location-optimized approaches.

Shared Services and Credentialing Hub Models

Some large healthcare organizations establish centralized credentialing hubs that manage background screening, license verification, and ongoing monitoring for all system facilities. This consolidation can generate economies of scale through specialized staff expertise, vendor negotiation leverage, and technology investment amortization across larger employee populations.

The following figures represent general industry observations and should not be considered definitive benchmarks. Actual screening budgets vary significantly based on turnover rates, position mix, state requirements, and organizational screening policies.

| Organization Size | Hub Model Potential Applicability | Typical Implementation Cost | Annual Operating Savings |

| 5,000+ employees across 10+ facilities | Often Viable | $150,000-$300,000 | $200,000-$500,000 |

| 2,500-5,000 employees across 5-10 facilities | May Be Viable | $75,000-$150,000 | $100,000-$250,000 |

| 1,000-2,500 employees across 3-5 facilities | Situationally Viable | $40,000-$75,000 | $50,000-$125,000 |

| Under 1,000 employees | Less Commonly Viable | $25,000-$50,000 | $20,000-$60,000 |

Credentialing hub models typically demonstrate measurable ROI for health systems employing 2,500+ clinical staff members across multiple facilities. Smaller organizations may find that shared services overhead costs offset vendor pricing benefits, particularly when geographic dispersion requires hub staff to navigate diverse state requirements.

Hidden Costs and Budget Planning Blind Spots

Experienced healthcare administrators recognize that published screening prices represent only a portion of total program costs. Comprehensive budget planning must account for ancillary expenses, operational overhead, and contingency reserves for unexpected complications. These hidden cost categories often add 25-40% to base vendor fees.

Dispute Resolution and Adverse Action Processing

FCRA regulations establish specific procedural requirements when background check results may lead to adverse employment decisions. Employers should consult FCRA guidelines and legal counsel to ensure compliant adverse action processes, which typically include pre-adverse action notices, provision of report copies and rights summaries, reasonable dispute periods, and final adverse action notices. The administrative labor, legal review, and documentation associated with these processes typically costs $75-$200 per disputed case.

Healthcare facilities averaging 500 screens annually may encounter disputes requiring formal adverse action procedures, with actual volumes and associated costs varying based on position types, screening criteria, and applicant populations. Organizations without dedicated compliance staff or in-house legal counsel may incur higher expenses when external attorneys review adverse action documentation and dispute responses.

Re-Screening and Periodic Verification Costs

Many healthcare accreditation standards and state regulations require periodic re-screening of existing employees at intervals ranging from one to five years. These ongoing costs often catch administrators off-guard during budget cycles. Large cohorts of employees hired during expansion phases reaching re-screening milestones simultaneously create budget spikes.

A 1,000-employee healthcare facility with three-year re-screening requirements will process approximately 333 re-screens annually in steady state. This generates $16,650-$33,300 in recurring costs at standard screening rates. Organizations transitioning from paper-based legacy processes to formal re-screening programs should budget for "catch-up" expenses as they establish compliant verification cycles for existing workforce populations.

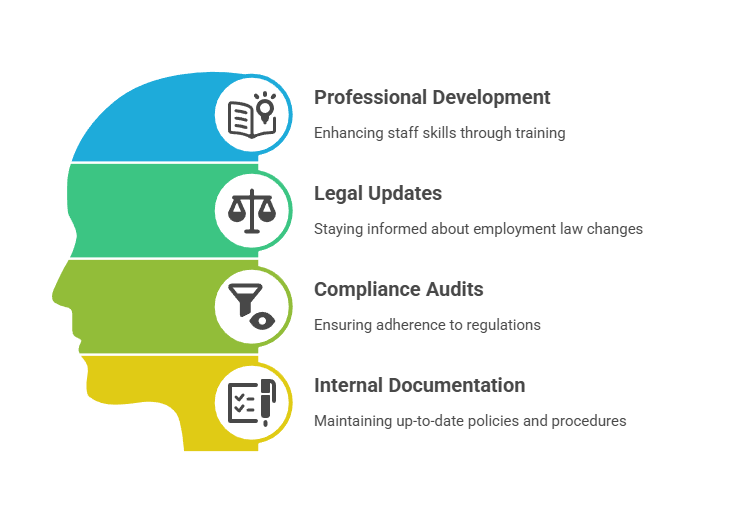

Training, Audit Preparation, and Compliance Maintenance

Staff members responsible for screening program administration require ongoing training on FCRA requirements, state-specific mandates, and emerging compliance obligations. Annual training investment typically includes:

- Professional development programs: $300-$1,200 per staff member for workshops, webinars, and certification courses on employment screening compliance.

- Legal updates and advisory services: $1,500-$5,000 annually for subscriptions to employment law update services and compliance alert platforms.

- Compliance audit preparation: $3,000-$10,000 for external consultants who review screening documentation and identify process gaps.

- Internal process documentation: 40-80 hours of staff time annually to update policies, procedures, and training materials reflecting regulatory changes.

Facilities should also budget for periodic compliance audits that review screening documentation, assess adverse action procedures, and identify process gaps that could generate regulatory exposure. External compliance consultants provide objective assessments and defensible documentation of good-faith compliance efforts.

Risk-Based Screening Strategies for Cost Optimization

Progressive healthcare organizations increasingly adopt risk-based screening approaches that match verification depth and expense to position requirements, patient contact levels, and safety considerations. These tiered strategies can reduce overall screening costs by 15-25% while maintaining appropriate safeguards. Successful implementation requires careful risk assessment and clear documentation of classification rationale.

Position Risk Classification Frameworks

Risk-based screening begins with systematic position classification that considers patient contact frequency, vulnerable population exposure, medication access, financial authority, and independent decision-making scope. Positions are typically categorized into three to five risk tiers. Each tier has specific screening requirements and corresponding cost profiles.

Important Notice: The following framework represents general considerations for risk-based screening approaches. Actual screening requirements vary significantly by state, facility type, accreditation standards, and specific position duties. Healthcare organizations should consult qualified legal counsel and review all applicable federal, state, and local regulations before implementing any risk-based screening program. This framework does not constitute legal or compliance advice.

| Risk Tier | Position Examples | Common Screening Considerations | Typical Cost |

| High Risk | Physicians, NPs, pharmacists, behavioral health clinicians | Comprehensive criminal search, license verification, DEA check, malpractice research, continuous monitoring | $200-$350 |

| Moderate Risk | RNs, respiratory therapists, medical technologists, radiology techs | Standard criminal search, license verification, OIG check, state registries | $100-$175 |

| Standard Risk | LPNs, CNAs, phlebotomists, patient transport | Basic criminal search, certification verification, OIG check, abuse registry | $75-$125 |

| Lower Risk | Administrative staff with patient data access | Criminal search, OIG check, identity verification | $60-$90 |

| Minimal Risk | Facilities maintenance, food service, general administration | Basic criminal search, OIG check | $50-$85 |

Actual screening components must align with applicable regulations, accreditation requirements, and organizational policies. Consult legal counsel before finalizing screening protocols.

High-risk positions such as physicians, nurse practitioners, pharmacists, and behavioral health clinicians typically warrant comprehensive screening packages. Extensive verifications may cost $200-$350 per candidate but are appropriate given the patient safety implications and regulatory expectations for clinical roles.

Balancing Cost Reduction with Compliance Obligations

Healthcare administrators implementing risk-based screening strategies must carefully navigate regulatory requirements that mandate specific checks regardless of position classification. Federal requirements typically mandate exclusion list screening for individuals in organizations receiving federal healthcare program reimbursement. Healthcare organizations should consult OIG guidance and qualified legal counsel regarding specific applicability and monitoring requirements.

State-specific mandates may require particular registry checks or background verification elements for all healthcare facility employees. These requirements eliminate opportunities to reduce screening scope for lower-risk positions. Healthcare organizations must review applicable state laws, accreditation standards, and consult qualified legal counsel before implementing any tiered screening approach to ensure full compliance with all regulatory obligations.

Continuous Monitoring as Risk Mitigation Investment

While continuous monitoring represents an ongoing expense, risk-based frameworks often concentrate monitoring investments on high-risk positions where license lapses or criminal activity create the greatest patient safety and liability exposure. A healthcare facility might implement continuous monitoring for all clinical staff with prescribing authority, controlled substance access, or independent practice privileges. Traditional periodic re-screening may apply to administrative and support positions.

This selective monitoring approach can reduce overall program costs by 30-40% compared to universal monitoring while focusing resources on positions where real-time alerts deliver the greatest protective value. A 500-employee organization might continuously monitor 150 high-risk clinical staff at $25 per person annually ($3,750) rather than monitoring all employees ($12,500), generating $8,750 in annual savings.

Emerging Trends Impacting 2026 Healthcare Screening Costs

Healthcare background screening continues evolving in response to technological capabilities, regulatory developments, and workforce dynamics. Organizations planning 2026-2027 budgets should account for emerging trends that may impact screening costs and program requirements. Early adopters of new technologies and approaches may gain competitive advantages in talent acquisition and compliance efficiency.

Portable Credentialing and Credential Verification Organizations

Industry initiatives exploring portable credentialing models aim to create verified credential repositories that healthcare workers can carry between employers. These models potentially reduce redundant verification costs and accelerate hiring processes. Credential Verification Organizations (CVOs) that maintain continuously updated professional qualification data represent one implementation approach gaining traction within large health systems.

While portable credentialing may offer long-term cost reduction potential, implementation requires investment in technology integration, process redesign, and inter-organizational data sharing agreements. Healthcare facilities should monitor portable credentialing developments during 2026 but may not realize significant budget impacts until these models achieve broader industry adoption.

Artificial Intelligence and Automated Verification Technologies

Screening providers increasingly deploy artificial intelligence and machine learning technologies that automate data extraction from public records, identify verification discrepancies, and flag high-risk indicators requiring human review. Technology benefits include:

- Faster turnaround times: Automated data extraction reduces manual research time by 40-60% for common verification tasks.

- Improved accuracy: Machine learning algorithms detect data inconsistencies and potential fraud indicators that human reviewers might miss.

- Reduced labor costs: Automation handles routine verification steps, allowing human specialists to focus on complex cases requiring judgment.

Healthcare facilities evaluating AI-powered screening tools should consider accuracy validation, potential algorithmic bias, and evolving regulatory guidance regarding appropriate use in employment decisions.

Enhanced Monitoring for Expanded Compliance Obligations

Regulatory agencies continue expanding background check requirements and monitoring expectations for healthcare organizations. The Department of Health and Human Services Office of Inspector General maintains the List of Excluded Individuals and Entities (LEIE). Healthcare facilities receiving federal funding should consult OIG guidance and legal counsel regarding checking frequency requirements, which often include monthly verification. Some states maintain similar requirements for state-specific exclusion lists and abuse registries.

These expanding monitoring obligations create ongoing operational costs that compound annually as healthcare organizations grow their workforces. A facility that manually checks OIG exclusion lists monthly for 1,000 employees might spend 40-60 hours annually in administrative labor. This translates to $1,500-$3,000 in costs that automated monitoring solutions can eliminate while improving compliance reliability.

Building Defensible Budget Proposals for Healthcare Screening Programs

Healthcare administrators must often justify screening expenditures to finance officers and executive leadership who view background checks as cost centers rather than strategic investments. Effective budget proposals frame screening costs within broader risk management, quality assurance, and regulatory compliance contexts. Data-driven presentations that quantify risk avoidance value and operational benefits significantly improve funding approval rates.

Calculating Total Cost of Ownership

Comprehensive screening program budgets should present total cost of ownership that includes vendor fees, internal administrative labor, technology infrastructure, training expenses, and compliance maintenance activities. Cost category breakdown typically reveals:

- Vendor screening fees: 60-70% of total program costs for background checks, verifications, and monitoring services.

- Internal administrative labor: 15-20% for program management, candidate communication, dispute resolution, and compliance documentation.

- Technology and integration: 8-12% for platform fees, API charges, system maintenance, and software licensing.

- Training and professional development: 3-5% for staff education, legal updates, and compliance certification programs.

- Audit and consulting services: 3-5% for external reviews, legal counsel, and expert guidance on complex compliance matters.

A healthcare facility processing 800 screens annually at $150 per screen ($120,000) might incur an additional $30,000-$40,000 in internal costs for program administration. Budget proposals that acknowledge these ancillary expenses demonstrate sophisticated cost understanding and establish realistic funding expectations.

Return on Investment and Risk Avoidance Framing

Effective screening program justifications emphasize risk mitigation value, compliance protection, and quality assurance benefits rather than focusing exclusively on costs. A comprehensive screening program that identifies an excluded provider before employment can help organizations avoid potentially significant regulatory penalties and sanctions that may substantially exceed annual program costs.

Similarly, credentialing verification that detects license falsification or qualification misrepresentation before employment prevents potential patient safety incidents, medical errors, and liability claims. These incidents could cost millions in damages, settlements, and reputation harm. Budget proposals should quantify these risk avoidance benefits using historical incident data, industry benchmarks, and regulatory penalty schedules.

Benchmarking Against Industry Standards

Healthcare administrators can strengthen budget proposals by demonstrating that recommended screening expenditures align with industry standards and peer organization practices. Professional associations, accreditation bodies, and specialized consulting firms publish benchmarking data on healthcare screening costs. Data covers program structures and investment levels relative to organizational size and complexity.

The following figures represent general industry observations and should not be considered definitive benchmarks. Actual screening budgets vary significantly based on turnover rates, position mix, state requirements, and organizational screening policies.

| Healthcare Organization Type | Average Annual Screening Budget | Per-Employee Annual Cost | Per-New-Hire Cost |

| Large hospital system (5,000+ employees) | $450,000-$850,000 | $90-$170 | $180-$280 |

| Mid-size hospital (1,000-5,000 employees) | $120,000-$350,000 | $120-$220 | $200-$350 |

| Small hospital or clinic (250-1,000 employees) | $35,000-$110,000 | $140-$240 | $225-$400 |

| Ambulatory care center (under 250 employees) | $12,000-$35,000 | $150-$280 | $240-$450 |

A proposal showing that recommended per-screen costs of $175 fall within the $150-$200 range typical for similar-sized healthcare facilities provides valuable context. Benchmarking data also identifies areas where proposed spending exceeds industry norms, prompting constructive discussions about whether enhanced verification requirements justify premium costs.

Conclusion

Healthcare background screening costs in 2026 reflect complex interactions between regulatory requirements, technology capabilities, and organizational risk tolerance. Comprehensive programs typically represent 0.3-0.8% of total compensation expenses for newly hired employees. Administrators who approach screening as a strategic workforce quality investment rather than a compliance checkbox are better positioned to optimize spending while maintaining patient safety standards and regulatory compliance. Given the complexity of applicable regulations and significant variation across jurisdictions, healthcare organizations should engage qualified legal counsel and compliance professionals when designing and implementing screening programs.

Frequently Asked Questions

What is the average cost of a healthcare background check in 2026?

Healthcare background checks typically cost between $100 and $250 per candidate for standard packages that include criminal history verification, license checks, and federal exclusion list screening. Comprehensive screenings with extensive credentialing verification for physicians and advanced practitioners may cost $300-$500 depending on license complexity. Basic checks for non-clinical positions with limited patient contact generally cost $50-$85 per candidate.

How much do continuous monitoring services add to annual screening budgets?

Continuous monitoring programs that provide real-time alerts about license changes, criminal activity, and exclusion list additions typically cost $15-$40 per monitored employee annually. A 1,000-employee healthcare facility implementing universal monitoring would incur $15,000-$40,000 in annual monitoring costs. Risk-based approaches that concentrate monitoring on high-risk clinical positions can reduce expenses while maintaining appropriate oversight.

Do state requirements significantly impact healthcare screening costs?

Yes, state-specific mandates can significantly impact screening costs, with some high-requirement jurisdictions incurring substantially higher expenses due to additional registry checks, fingerprint processing requirements, state-specific database access fees, and other verification requirements. Cost impacts vary by state and facility type. Healthcare facilities operating in multiple states should consult legal counsel to understand applicable requirements and budget accordingly.

What hidden costs should healthcare facilities include in screening budgets?

Beyond vendor screening fees, healthcare facilities should budget for adverse action processing and dispute resolution ($75-$200 per disputed case), periodic re-screening of existing employees (typically required every 1-5 years), staff training on FCRA compliance and screening procedures ($500-$2,000 per staff member annually), and compliance auditing ($3,000-$10,000 for external reviews). Technology integration and maintenance costs represent an additional 15-25% of total screening budgets.

How can healthcare organizations reduce screening costs without compromising compliance?

Risk-based screening strategies that appropriately match verification depth to position requirements may offer cost optimization opportunities when designed in compliance with all applicable regulations. Volume-based enterprise agreements with screening providers can generate savings for organizations processing 2,000+ screens annually. Automated workflows and integrated technology platforms reduce administrative labor costs while ensuring compliant processes.

What should healthcare facilities budget for physician credentialing verification?

Physician credentialing typically costs $200-$500 per candidate due to extensive requirements including medical license verification across multiple states, board certification confirmation, DEA registration checks, hospital privileges verification, medical education confirmation, malpractice claims history research, and National Practitioner Data Bank queries. Physicians with multi-state licenses and multiple board certifications represent the high end of this cost range.

Do telehealth positions increase background screening and credentialing costs?

Yes, telehealth-enabled positions may generate higher credentialing costs compared to traditional single-state roles because healthcare workers providing services across state lines require license verification in multiple jurisdictions. Each state verification involves distinct primary source verification fees, database access charges, and processing requirements. Organizations expanding telehealth services should budget for increased credentialing expenses and longer verification timelines.

How often should healthcare facilities re-screen existing employees?

Re-screening frequency depends on accreditation standards, state regulations, and organizational policies. Healthcare facilities should consult applicable requirements to establish compliant re-screening schedules. Continuous monitoring programs can extend traditional re-screening intervals by providing real-time alerts between formal verification cycles.

Additional Resources

- Office of Inspector General List of Excluded Individuals and Entities

https://oig.hhs.gov/exclusions/ - Federal Trade Commission FCRA Guidance for Employers

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-employers-need-know - Centers for Medicare and Medicaid Services Conditions of Participation

https://www.cms.gov/medicare/health-safety-standards/quality-safety-oversight-general-information/conditions-of-participation-cops - National Practitioner Data Bank Information

https://www.npdb.hrsa.gov/ - Nurse Licensure Compact Overview

https://www.nursecompact.com/

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.