Navigating the world of government contracting in Virginia comes with its fair share of regulations and standards. One crucial aspect to address is ensuring your business and personnel align with the necessary security and compliance checks. This guide delves deep into the intricacies of Virginia government contractor checks, particularly focusing on the Department of Defenseâs auditing arm known as the Defense Contract Audit Agency (DCAA) compliance. Whether you're a seasoned contractor or new to the government sector, this outline will equip you with essential knowledge.

Key Takeaways

- Background checks for government contractors in Virginia are essential to ensure that those dealing with sensitive information are trustworthy and reliable.

- The Defense Contract Audit Agency (DCAA) plays a critical role in Virginia by ensuring financial compliance and trustworthiness in government contracts.

- Obtaining the appropriate security clearance is mandatory for government contractors in Virginia who work with classified information.

- Adhering to both state and federal regulations is crucial for maintaining compliance as a Virginia government contractor.

- Leveraging modern technology can streamline and enhance the efficiency of your screening and auditing processes.

Introduction

Background checks for government contractors in Virginia aren't just routine; they're essential. These checks ensure that contractors engage with sensitive projects securely and responsibly. In the world of federal contracts, alignment with compliance standards like those set by the Department of Defense is non-negotiable.

The Defense Contract Audit Agency (DCAA) plays a crucial role here. It enforces financial compliance and prevents fraud. By holding contractors to federal standards, the DCAA ensures that only trusted parties participate in government projects.

This guide focuses on equipping you with essential insights. It covers background checks specific to Virginia along with DCAA compliance. Whether stepping into government contracting or refining your approach, you'll find practical advice to stay compliant and secure.

Understanding Virginia Government Contractor Checks

Virginia government contractor checks involve a detailed review of individuals and businesses seeking to work with government agencies. These checks are not just red tape but a vital tool for ensuring that contractors possess the integrity and trustworthiness needed in sensitive roles. As someone with 20 years in employment background checks, Iâve seen the difference thorough vetting makes.

Definition and Process

A Virginia government contractor check scrutinizes a range of personal and professional details. You can expect identity verification, where official documents confirm an individualâs identity, combined with checks on criminal records to flag any past missteps. Credit checks are also common, providing insights into financial responsibility. These steps collectively paint a full picture of who you are bringing onboard.

Key Elements

The process kicks off with identity verification. This simply ensures a person's legitimacy, confirming they are who they claim to be. Criminal history checks are indispensable in environments that demand the utmost trust. Minor infractions might not disqualify someone, but a pattern of concerning behavior can be a deal breaker. Credit checks, while they might feel intrusive, are crucial in roles that handle financial data. They reveal not just debt levels but financial behavior over time.

Purpose and Importance

Why insist on such comprehensive checks? National security is one major reason. Contractors often access sensitive information pivotal to governmental operations. Ensuring that only reliable individuals fill these positions keeps the security chain intact. Another key reason for these checks is to establish trustworthy business relationships. By vetting each potential partner, government agencies protect their projects from fraud and incompetence.

Are you confident in the integrity of your team? Thorough background checks underpin that assurance, laying the groundwork for secure and seamless government operations in Virginia. By understanding and complying with these checks, you position your company as a trustworthy contender in the government contracting arena.

The Role of DCAA in Virginia Government Contracting

The Defense Contract Audit Agency (DCAA) ensures that government contractors comply with federal financial regulations. Primarily, the DCAA conducts audits and provides financial advisory services to the Department of Defense and other government entities. Their oversight covers cost accounting standards, contract regulations, and the management of government funds. This agency acts as a watchdog, safeguarding taxpayer money from fraud and misuse.

DCAA compliance demands strict adherence to financial practices and internal controls. For Virginia contractors, this involves implementing systems that accurately record costs associated with government projects. Itâs about aligning your accounting and operational procedures with federal standards. You can find comprehensive guidelines on the DCAA website, a vital resource for understanding compliance requirements.

Why does DCAA compliance matter for contractors in Virginia? Without it, securing government contracts becomes difficult, if not impossible. Contracts might be terminated, and you could face financial penalties. Moreover, non-compliance can impede security clearance processes. Properly managed financial practices instill confidence in your ability to handle sensitive government tasks.

DCAA compliance isn't just a hurdle; itâs a pathway to establishing trust with the government. When you engage in federal contracts, the question isn't if you'll be audited but when. Audits ensure transparency and accountability, which are critical components in government contracting. Are your processes ready for such scrutiny?

Security Clearance in Virginia

Security clearances are a critical part of working as a government contractor in Virginia. They safeguard sensitive information and ensure only authorized personnel have access. If you're working on contracts involving classified details, obtaining the right clearance is mandatory.

The security clearance process starts with a thorough background investigation. This includes financial reviews, criminal history checks, and interviews with personal and professional references. Each step ensures only reliable candidates receive clearance.

Clearances come in three levels: Confidential, Secret, and Top Secret. Confidential clearances cover information that could harm national security if disclosed. Secret clearances are for information that could cause serious damage. Top Secret clearances handle information that could cause grave damage. The higher the clearance, the more rigorous the investigation.

Keeping a security clearance current is crucial. Regular updates and reinvestigations are required, and any changes in personal circumstances such as financial issues or arrests need to be reported. Being proactive and honest helps maintain your eligibility.

It's essential to manage your digital footprint and financial records carefully. Use these tips and best practices to ensure your clearance remains valid. Always report significant life changes to the appropriate authorities. Regularly check your credit report and resolve any discrepancies quickly. This vigilance keeps your clearance secure and your professional path clear.

Federal Contractor Screening Processes

Background checks are a crucial component of the federal contractor screening process. In Virginia, these screenings are designed to ensure both compliance and security. They typically include identity verification, criminal history, and credit checks. Each aspect of the process is crucial for safeguarding sensitive information and maintaining trustworthiness.

Navigating the specifics of Virginia's requirements can be challenging. However, a clear understanding of the necessary procedures helps. A thorough background check mitigates the risks involved in handling government contracts, protecting both your business and the sensitive data you encounter.

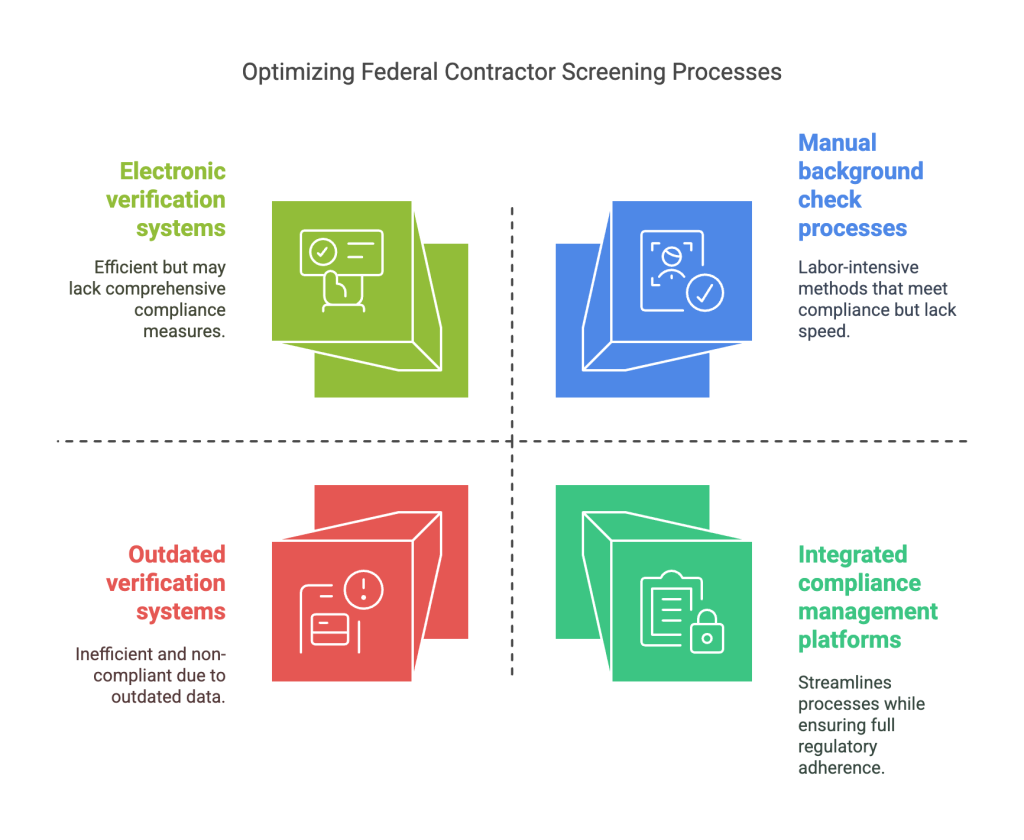

Technology offers solutions that make these processes more efficient. Modern tools simplify background checks by automating steps that once required labor-intensive work. Software like electronic verification systems and integrated compliance management platforms streamline the process, reducing both errors and time spent on screenings.

Common challenges in background checks include gathering accurate data and respecting privacy laws. Misinformation or outdated records can lead to false rejections, complicating the process. Maintaining a careful balance between thorough screening and legal compliance is essential to successfully navigate these challenges.

Effective screening is not just a regulatory requirement; it's a strategic measure to minimize risk and uphold your company's reputation as a reliable government contractor. By leveraging technology and understanding the challenges, you can enhance your processes, ensuring compliance and positioning your business for success in the federal contracting space.

Ensuring DCAA Compliance in Virginia

Getting your business DCAA compliant involves a few critical steps. First, ensure financial records are accurate and well-organized. The DCAA focuses heavily on cost accounting standards, so aligning your accounting practices with federal requirements is essential. Regular internal audits can help identify potential discrepancies before an official audit.

Next, document everything. Maintain thorough records of all transactions, contracts, and communications. This practice not only facilitates smooth audits but also demonstrates transparency and reliability. Ensure that all your accounting software is up-to-date and capable of generating detailed reports as needed.

Prepare your team for audits by providing training on DCAA standards and expectations. Knowledgeable staff are better equipped to manage compliance-related tasks and address any questions during an audit.

Non-compliance can lead to significant consequences. You might face contract delays, financial penalties, or even disqualification from future contracting opportunities. Understanding the financial implicationsâlike recovery of overpaid fundsâis crucial.

Being proactive about compliance isn't just about meeting requirements; it enhances your credibility as a contractor. By taking these steps, you position your business to thrive in the competitive world of government contracting in Virginia.

Legal Framework and Regulations

In Virginia, government contractors must adhere to both state and federal regulations. At the state level, Virginia has specific compliance requirements to ensure that contractors maintain ethical standards and security guidelines. These include background checks and access to secure information.

Federal guidelines also play a significant role. The Equal Employment Opportunity Commission (EEOC) provides guidance on background checks through their guide for employers, which outlines how to legally conduct checks while respecting discrimination laws. For contractors, navigating between these overlapping regulations requires careful attention to both sets of standards.

Staying compliant with these legal requirements can be daunting. Yet, having a clear understanding of both Virginia-specific regulations and federal guidelines is crucial. Documentation and consistent policy review will help your business stay aligned with legal expectations. Balancing these aspects enables contractors to manage legal challenges effectively and continue operations smoothly.

Best Practices for Virginia Government Contractors

If you're a government contractor in Virginia, crafting solid internal policies should be your first move. These policies act as a blueprint for your team's operations, ensuring alignment with compliance and security requirements. Start by defining clear responsibilities related to compliance, designating roles for oversight, and establishing communication protocols. Make sure policies are accessible and regularly updated to reflect changes in legal or contractual obligations.

Training isn't just a one-time task. Regular education sessions help keep your team informed about compliance expectations. These sessions should cover the fundamentals of DCAA compliance, security clearance protocols, and any other relevant regulatory requirements. Encourage open dialogue during these sessions so employees can ask questions and discuss real-world scenarios. By making training an ongoing part of your company culture, you build a knowledgeable workforce prepared to tackle compliance challenges.

Continuous monitoring and improvement are pivotal. Schedule regular audits of your compliance practices to identify areas needing attention. Implement corrective actions as necessary and document these changes for accountability. This proactive approach not only safeguards your company but also positions you as a reliable partner in the eyes of federal agencies. Staying vigilant and responsive to changes will reinforce your efforts in maintaining compliance.

By focusing on robust policies, persistent training, and constant improvement, you strengthen your company's ability to meet Virginia's rigorous standards. These best practices not only help avoid pitfalls but also reinforce your reputation as a trustworthy and competent government contractor.

Virginia government contracting involves a unique combination of compliance, security, and operational know-how. As we bring this guide to a close, it's crucial to remember the core insights discussed: understanding the importance of thorough background checks, ensuring DCAA compliance, and navigating the specifics of security clearance.

Conclusion

Stay proactive. Keep your internal policies strong and aligned with both state and federal regulations. Regularly updating and refining these practices will not only aid compliance but also demonstrate your commitment to maintaining secure, trustworthy partnerships.

Training can't be overlooked. Ensure your team is well-versed in the latest rules and procedures. This fosters a culture of compliance and helps avoid potential pitfalls.

Technology is your ally. Utilize contemporary tools to streamline checks and audits, making the process cheaper, faster, and less prone to error.

You are part of a critical sector responsible for partnering with the federal government. Staying informed and vigilant is not just necessary; it's mandatory for success. Implement the best practices shared here, and remain up-to-date with evolving regulations to safeguard and elevate your business relationships.

Frequently Asked Questions (FAQs)

What disqualifies you from government contracting in VA?

Criminal convictions related to fraud, embezzlement, or bribery can disqualify you. Past performance issues and safety violations may also affect eligibility.

How long do security clearances take in Virginia?

Security clearances can take 4 to 12 months, depending on the level required and your personal history.

Can a misdemeanor affect DCAA compliance?

A misdemeanor does not typically affect DCAA compliance, which focuses on financial and accounting systems. However, legal issues could affect overall contract eligibility.

Does Virginia require FBI checks for contractors?

Yes, many contracts require an FBI background check, particularly for roles involving sensitive information or security.

How to appeal a failed clearance in VA?

To appeal, you should request a review from the agency that denied the clearance. Provide additional information or documentation to support your case.

Are expunged records visible to federal contractors?

Expunged records are usually not visible to federal contractors, but certain government positions may still have access.

Whatâs the cost of DCAA-compliant checks in VA?

Costs vary based on the scope of the audit. Smaller companies may face fees in the thousands, while larger firms might see higher costs.

Do subcontractors need background checks in Virginia?

Yes, subcontractors typically undergo background checks, especially if they access sensitive information or secure facilities.

Can non-US citizens get VA government contracts?

Non-US citizens can obtain contracts, but they may face additional scrutiny or limitations, depending on security needs and the nature of the work.

How often are contractor checks renewed in VA?

Contractor checks are generally renewed every five years, but this can vary based on contract terms and security clearance requirements.

What types of government contracts are available in Virginia?

Virginia offers contracts in defense, technology, healthcare, and infrastructure with federal, state, and local agencies.

How can you find Virginia government contracting opportunities?

Opportunities are listed on platforms like SAM.gov, eVA (Virginia's eProcurement portal), and agency-specific websites.

What are the typical requirements for a bid proposal in VA?

Requirements include a business plan, financial statements, compliance history, and technical ability relevant to the contract.

Why is DCAA compliance important for government contracts?

DCAA compliance ensures that your financial systems meet federal standards, which is crucial for securing and maintaining contracts.

Definitions

Background Checks

Background checks verify a personâs history before hiring or approving them for a government contract. These checks typically include identity verification, criminal records, and credit history. In government contracting, they help assess reliability and security risks.

Security Clearance

A security clearance allows an individual to access classified government information. The process includes financial reviews, criminal history checks, and interviews with personal and professional references. Clearances come in three levels: Confidential, Secret, and Top Secret.

Compliance

Compliance refers to following laws, regulations, and policies required for government contracting. Contractors must meet financial, security, and operational standards set by agencies like the Defense Contract Audit Agency (DCAA). Failure to comply can result in penalties or lost contracts.

Screening

Screening involves evaluating candidates or businesses before they are approved for government work. It includes reviewing identity, criminal records, and financial history. Effective screening reduces the risk of fraud or security breaches.

Audit

An audit is a detailed review of a contractorâs financial records and practices. The Defense Contract Audit Agency (DCAA) performs these to ensure compliance with government requirements. Regular audits help maintain transparency and prevent fraud.

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.