Managing costs is essential in running a successful staffing firm, and one significant area of expenditure is background checks. These checks are crucial for verifying the qualifications and reliability of potential hires. However, their costs can quickly add up, especially when dealing with high volumes of candidates. In this guide, we explore various strategies to manage and control staffing background check costs effectively.

Key Takeaways

- Use volume discounts to negotiate better rates on background checks and manage costs efficiently.

- Implementing ATS integration can streamline your hiring process, reduce errors, and save on labor costs.

- Automated adverse action processes help you comply with regulations while cutting down on time and errors.

- Regularly review your budgeting strategies using past data to predict future costs and ensure compliance.

- Stay informed about technology advancements and legal changes to maintain a cost-effective and thorough background check process.

Introduction

Background checks are a fundamental part of the hiring process for staffing firms. They help ensure that candidates are honest and qualified, which in turn builds trust with clients and protects the reputation of the firm. By verifying a candidate’s criminal history, education, and employment background, you reduce the risk of hiring someone unfit for the role. Clients expect consulting firms to deliver not only top talent but also candidates with verified credentials. A good background check process is part of delivering on that promise.

Yet, the financial burden of background checks can be substantial. When you're processing large numbers of applicants, these costs can escalate quickly. Each check involves various individual expenses—fees for different types of searches, such as criminal record checks, education verification, and past employment confirmation. It's imperative to balance thorough verification with keeping the budget in check. How can you maintain rigorous checks while managing costs effectively? This is the heart of the challenge that staffing firms face today.

It's a challenge that many staffing companies face—maintaining high standards and operational efficiency. It's completely possible, with the right approach, to manage screening costs without sacrificing the quality or integrity of the hires.

EXPERT INSIGHT: I've been in staffing for a long time, so I know that each hire matters, both in quality and in cost. Background screening is one of those unavoidable investments that can either safeguard your company or insidiously erode your margins. Over time, I’ve learned that managing screening costs isn’t about cutting corners—it’s about being intentional, strategic, and transparent with both your team and your clients. If you make cost control part of your quality commitment, rather than a concession, you create a healthier staffing practice. Efficiency with integrity—that's the objective. - Charm Paz, CHRP

Understanding Background Check Costs

Every background check includes several cost components. These often encompass criminal records, education verification, and employment history. Each element carries its own price tag. For instance, criminal record checks might vary between local, state, and federal levels. Education verification could involve contacting various institutions. Employment history checks frequently require reaching out to past employers.

Several factors influence these costs. The depth of the check is a primary one. A comprehensive scan that covers multiple facets will cost more than a basic check. Geographical location is another factor. Checks conducted in regions with higher living costs often require higher fees. In addition, turnaround time matters. Faster services generally come with a premium.

Understanding these elements is crucial for managing expenses. By knowing what you're paying for, you can make informed decisions. Are all parts of the check necessary, or can some be streamlined? Making savvy choices here can help trim your budget significantly.

Volume Discount Background Screening

Leveraging high volumes can be a game-changer for staffing firms looking to cut down on background check costs. When you handle a large number of candidates, you gain negotiating power with background check providers. This can help you secure better rates and save significantly over time.

The key is choosing the right provider. Look for vendors who specialize in high-volume screening and offer competitive pricing. They should understand the demands of a staffing firm and be willing to tailor solutions to your needs. It's worth taking the time to compare different options and ensure you're getting the best deal.

Consider a staffing firm that managed to slash costs by strategically using volume discounts. They approached several background check services, discussed their high candidate volume, and negotiated a pricing arrangement that reduced per-check costs by 30%. This allowed them to reinvest savings into other essential areas of their business.

Are you leveraging your candidate volume effectively? If not, now might be the time to explore these cost-saving opportunities and strengthen your partnerships with background check providers.

ATS Integration Cost Savings

Applicant Tracking System (ATS) integration is a process where your hiring system connects directly with a background screening provider. This alignment is essential for efficient handling of candidate data and streamlining the hiring workflow.

By integrating an ATS, you can cut down on manual data entry and reduce errors. This efficiency translates into lower labor costs. Imagine your staff no longer having to input candidate information manually; instead, the data flows automatically from the ATS to the background check provider and back. This process saves time, allowing your team to focus on other priority tasks.

To get started with ATS integration, choose a system that is compatible with your background check provider. Engage your IT team early to address any technical challenges that might arise. It's also wise to train your recruitment team to use the new system effectively, ensuring a smooth transition.

While initial setup may require investment, integration can lead to substantial long-term savings. By minimizing manual labor, reducing turnaround time, and lowering errors, your firm can significantly cut background check expenses. Consider if your current practices could benefit from such efficiency improvements.

Automated Adverse Action Processes

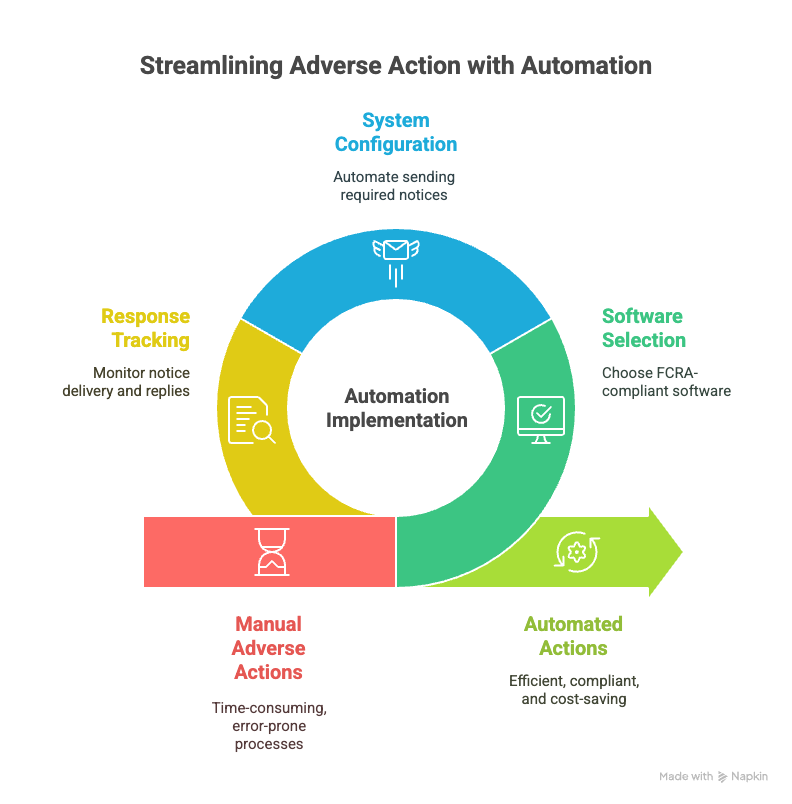

Adverse action is a key component of the background check process. It refers to the steps you must take if you decide not to hire someone based on their background check results. It's a matter of compliance with federal regulations, specifically the Fair Credit Reporting Act (FCRA). But managing these actions manually can be time-consuming and prone to human error.

Automation offers a way to streamline adverse action processes. By automating these steps, staffing firms can cut down on administrative time and reduce errors that might lead to compliance issues. This, in turn, translates to cost savings.

To set up automated adverse action workflows, start by selecting a software that aligns with your existing background screening system. Ensure it supports FCRA compliance and provides clear documentation at each stage of the process. Next, configure the system to automatically send pre-adverse and adverse action notices, along with required documentation, to candidates. Make sure there's a mechanism for tracking when notices are sent and for receiving candidate responses.

Automating these workflows removes bottlenecks and ensures timely communication with candidates, allowing your team to focus on other important tasks. Are your current processes efficient enough, or are you spending too much time on manual tasks that can be automated?

Resources

Using the right resources can streamline your background check process. First, tap into existing tools and guides that simplify complex information. For a deeper understanding of background checks, check out articles like Understanding the Employment Background Check Process. Practical insights from such resources can enhance your team's efficiency.

Compliance is non-negotiable. Familiarize yourself with the Fair Credit Reporting Act (FCRA) and stay updated with legal obligations. The FTC's guidance is invaluable for ensuring compliance. It offers clear directions to avoid costly penalties and maintain trust with clients and candidates.

You can also make use of in-house expertise. If you have a legal or HR team, involve them in routine training sessions. This keeps everyone aligned and aware of current regulations. External consultants can also provide a fresh perspective and uncover cost-saving opportunities you might miss.

Consider technology partners who specialize in HR tools. They can introduce software that automates mundane tasks. Automation not only speeds up processes but also reduces the likelihood of human error, saving time and money.

By strategically leveraging these resources, you position your staffing firm to run more efficiently and cut unnecessary costs. What resources could you start using today for better cost management?

Effective Budgeting and Planning

Setting a budget for background checks can feel overwhelming, but it's crucial for maintaining financial stability. Start by analyzing your current spending. Look at past invoices and identify patterns in costs. This will give you a clear picture of what you typically spend.

Next, set realistic limits. Determine what portion of your overall budget can go toward background checks without impacting other areas. Adjust as needed, but avoid cutting corners. Quality background checks protect your firm from risks, so don't sacrifice thoroughness for savings.

Forecasting future costs involves strategic planning. Use historical data as a guide. Are there trends in candidate volume that might affect your spending? Consider potential changes in the job market or regulatory requirements. By anticipating these shifts, you can plan your budget more accurately.

Engage your team in budgeting discussions. Their insights might reveal overlooked areas where you can trim costs. For instance, consolidating vendor services or embracing technology could lead to savings.

Always revisit your budget. Quarterly reviews will help you spot discrepancies or inefficiencies. This ongoing adjustment process ensures your budget evolves with your needs.

By carefully setting and adjusting your budget, you'll control spending while maintaining the quality and integrity of your background check process.

Challenges and Solutions

Background check costs can be a tough hurdle. You may find fluctuating candidate volumes a real issue. More hires mean more checks, and costs can spiral. A solution? Implement a flexible pricing model with your vendor. This way, costs align with actual demand. Negotiate a tiered pricing system if possible. It helps in managing expenses effectively.

Compliance regulations are another challenge. They change, and keeping up can be daunting. But non-compliance can be costly. Stay updated through regular training and subscribe to legal updates. For instance, partnering with a knowledgeable legal advisor can keep you informed and compliant.

Efficiency is crucial. Time delays in background checks disrupt hiring timelines. Streamline processes with technology. Invest in reliable background check software that integrates with your existing systems. This reduces manual errors and speeds up processing time.

Ever faced unexpected, hidden fees from vendors? You’re not alone. Read contracts thoroughly to identify any potential extra charges. A transparent agreement lays the groundwork for a clearer budgeting path.

Tracking and evaluating background check performance is vital. Regular audits of your processes will help highlight inefficiencies. Use this insight to adjust strategies proactively, staying ahead of cost challenges.

These solutions have helped many staffing firms navigate background check cost management effectively. Apply these strategies to steer your firm towards a more stable financial footing.

Conclusion

Controlling background check costs is a vital part of maintaining efficiency in a staffing firm. By focusing on strategies that manage these expenses, you can ensure the integrity and reliability of your hires without exceeding your budget. Summarize the key approaches: leverage volume discounts for better rates, choose vendors wisely, and implement ATS integration to streamline operations. Automate adverse action processes to cut down on errors and save time.

Regularly revisit and refine your budgeting and planning strategies. Use historical data to predict future costs effectively and always adhere to compliance regulations. This consistent effort will not only control expenses but also improve the quality of your background checks over time.

Looking forward, stay informed on trends that could influence costs, such as advancements in technology or changes in legal requirements. Preparing for these changes today ensures a robust and cost-effective process tomorrow. By staying proactive, you're setting your firm up for sustainable success without sacrificing the thoroughness of your background screenings.

Frequently Asked Questions (FAQs)

How much do background checks cost for staffing agencies?

Background check costs vary based on the depth and type of check. Basic checks start at around $20 to $50, while more comprehensive searches can cost $100 or more. Volume and frequency can influence pricing.

What’s the cheapest FCRA-compliant background check?

The cheapest options often cover basic criminal checks and employment verifications. Prices may hover around $20 to $40. Ensure it meets FCRA standards to avoid legal implications.

How to negotiate background check volume discounts?

Reach out to multiple providers and inquire about their pricing structures. Highlight your potential volume and long-term partnership. Some providers offer discounts for high volume or multi-year agreements.

Can staffing agencies reuse background checks?

While possible, it's not typical. Background checks reflect a point in time. Changes in legal status or new offenses could occur after an initial check. Always verify compliance with your clients' policies.

What are the benefits of comprehensive background checks?

Comprehensive checks provide a detailed view of a candidate's history, reducing the risk of negligent hiring. They often include criminal records, credit checks, and education verification.

What is the average turnaround time for background checks?

Most background checks take between 1 to 5 business days. The timeframe can extend based on the scope of the check or if manual processes are involved, such as contacting previous employers.

Are international background checks more expensive?

Yes, international checks typically cost more due to the complexity and time needed to access overseas data. Costs also vary by country.

How often should staffing agencies update background checks?

Many agencies update them annually or when there's a significant role change. Staying in line with industry standards and client expectations is crucial to maintaining trust.

Definitions

Background Check

A background check is a process used by employers to confirm a candidate’s identity, qualifications, and history. It typically includes verifying criminal records, past employment, and education history. Staffing firms depend on these checks to confirm that candidates meet role requirements and present no hidden risks. Clear results build client trust. Are you confident your checks cover all necessary areas?

Fair Credit Reporting Act (FCRA)

The FCRA is a federal law that regulates how consumer information, including background checks, is used by employers. It ensures that candidates are treated fairly, requiring employers to notify individuals when background information influences hiring decisions. You must also give candidates the chance to dispute any inaccurate findings. Are your current hiring processes compliant with this law?

Applicant Tracking System (ATS)

An ATS is software that helps manage the hiring process, from receiving applications to onboarding. When integrated with background screening services, it automates data sharing—reducing errors and saving time. It also allows your team to spend less time on administrative tasks. Does your ATS work smoothly with your background check provider?

Adverse Action

Adverse action refers to when an employer decides not to hire a candidate based on results from a background check. The FCRA requires a specific process, including notifying the candidate, providing a copy of the report, and allowing time to respond. Automating this process helps avoid legal missteps and shortens hiring delays. How reliable is your current adverse action process?

Volume Discount

A volume discount is a pricing reduction offered when purchasing a service in large quantities. Staffing firms checking backgrounds for many candidates can negotiate lower per-check rates with vendors. This strategy lowers total screening costs. Are you making the most of your candidate volume to reduce expenses?

References

- Shortlister's Background Check Statistics: https://www.myshortlister.com/insights/background-check-statistics

- Vericor HR's article on slow background check impacts: https://www.vericorphr.com/the-hidden-costs-of-a-slow-background-check-how-delays-impact-hiring

- GCheck's guide on background check costs: https://gcheck.com/blog/how-much-does-a-background-check-cost/

- Verified Credentials' budget justification article: https://blog.verifiedcredentials.com/3-ways-to-justify-your-background-check-budget-for-2025

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.