California casino employee background screening follows distinct regulatory pathways. State-licensed card rooms operate under California Gambling Control Commission oversight. Tribally operated gaming facilities function under federal Indian Gaming Regulatory Act provisions and Tribal-State Gaming Compacts that recognize tribal sovereignty. Employers must navigate multi-jurisdictional verification challenges, extended timelines, and evolving fair chance hiring considerations. Compliance requires understanding both gaming-specific regulations and broader employment law frameworks.

Key Takeaways

- California casino background checks include criminal history, financial integrity assessments, regulatory database searches, and character evaluations mandated by the California Gambling Control Commission.

- State-licensed gaming establishments follow CGCC procedures. Tribal casinos operate under Tribal-State Gaming Compacts with sovereign screening protocols that may differ significantly.

- Disqualifying factors include specific felony convictions, gaming-related offenses, financial crimes, regulatory violations, and findings of moral character deficiencies as defined by state gaming regulations.

- Verification timelines typically range from four to twelve weeks. Timeframes depend on applicant history complexity, multi-state record searches, and regulatory agency processing capacity.

- Fair chance hiring principles apply to California casino employment with important exceptions. These exceptions cover positions directly involving gaming operations, cash handling, and regulatory oversight responsibilities.

- Employers must obtain proper written authorization, provide required disclosures, and follow adverse action protocols. These processes must align with both FCRA requirements and California-specific employment screening laws.

- Multi-jurisdictional challenges arise frequently due to the transient nature of hospitality workforces. Verification systems must efficiently process out-of-state and international records.

- Continuous compliance monitoring includes ongoing suitability assessments, periodic re-screening requirements, and immediate reporting obligations when employees face new criminal charges or regulatory issues.

Understanding California's Dual Gaming Regulatory Framework

California operates a unique dual-structure gaming industry. This creates distinct compliance pathways for background screening. State-licensed card rooms and certain other gaming operations fall under direct California Gambling Control Commission jurisdiction. Tribal gaming facilities operate under federal Indian Gaming Regulatory Act provisions combined with negotiated Tribal-State Gaming Compacts. This fundamental division shapes every aspect of employment screening strategy.

State-Licensed Gaming Establishment Requirements

Card rooms, certain charitable gaming operations, and state-licensed facilities must follow comprehensive CGCC background investigation standards. These requirements extend beyond typical employment screening. They include financial solvency verification, association analysis, and character assessments. These assessments examine an applicant's entire personal and professional history. Gaming regulatory licensing processes require demonstrated suitability. However, employment decisions remain subject to applicable fair chance hiring laws, anti-discrimination protections, and other employment legal frameworks.

Employers at state-licensed facilities must submit applications and supporting documentation through official CGCC channels for key employees. They must also maintain independent screening programs for non-licensed positions. These programs still meet elevated standards appropriate to the gaming environment. This dual approach requires sophisticated compliance infrastructure. The infrastructure must track multiple approval pathways simultaneously. The CGCC maintains authority to deny, suspend, or revoke employment eligibility based on findings that emerge during initial screening or subsequent monitoring periods.

Tribal Gaming Sovereignty and Compact Provisions

Tribal gaming operations exercise sovereign authority over employment matters. This authority operates within the framework established by their specific Tribal-State Gaming Compact. These compacts vary significantly across California's numerous tribal gaming properties. This creates a fragmented regulatory landscape that resists simple standardization.

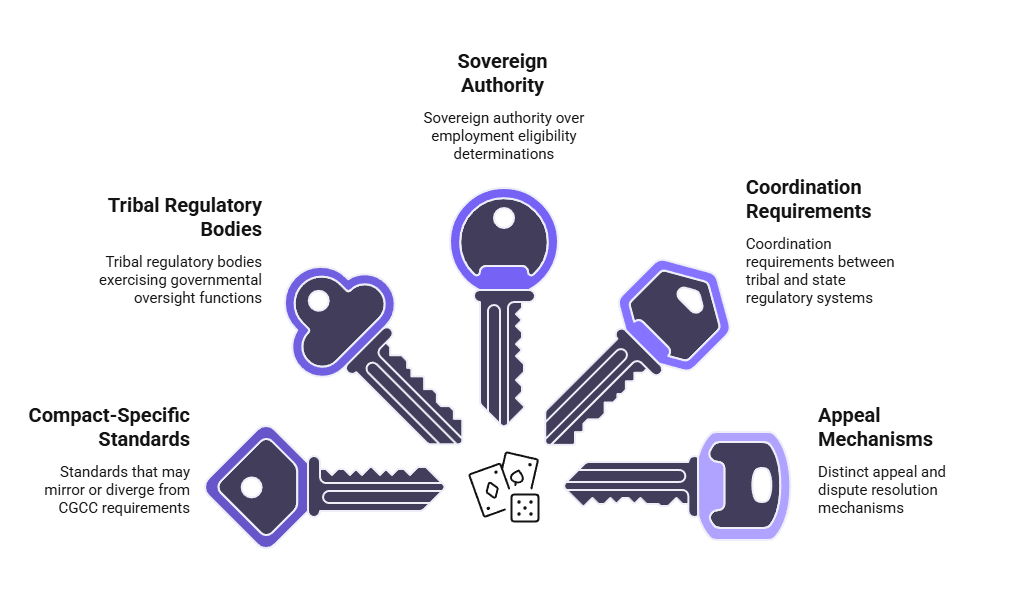

Key differences in tribal gaming screening include:

- Compact-specific standards that may mirror or diverge from CGCC requirements

- Tribal regulatory bodies exercising governmental oversight functions

- Sovereign authority over employment eligibility determinations

- Coordination requirements between tribal and state regulatory systems

- Distinct appeal and dispute resolution mechanisms

The interplay between tribal sovereignty, federal gaming law, and state compact provisions creates complexity. This affects background check vendor selection, dispute resolution, and applicant appeal rights. Employers should verify that their screening processes align with both the specific compact requirements and any additional standards established by tribal gaming commissions or regulatory departments.

Mandatory Screening Components for Casino Employment

California casino employee background checks include multiple verification layers. These are designed to assess criminal history, financial integrity, regulatory compliance history, and overall character suitability. The specific components required vary based on position classification. However, comprehensive screening protocols generally include consistent core elements across gaming employment categories.

Criminal History Verification Standards

Criminal background screening for California gaming employment includes conviction records. In some circumstances, it may involve regulatory access to arrest records or pending charges. This occurs where specifically authorized by gaming regulations and consistent with applicable employment laws. Employers should verify the permissible scope of record access with legal counsel before using arrest or non-conviction data in employment decisions.

Multi-jurisdictional criminal searches present particular challenges. California's hospitality workforce is highly transient. Applicants frequently present employment histories spanning multiple states and sometimes international jurisdictions. This requires verification systems capable of accessing diverse record repositories. These repositories have varying response timelines and data formatting standards. Employers must distinguish between disqualifying convictions, convictions requiring individual assessment, and records that should not influence employment decisions under fair chance hiring provisions.

Financial Background and Credit Assessment

Financial integrity screening examines bankruptcy history, outstanding judgments, tax liens, and patterns of financial irresponsibility. It also looks for indicators of vulnerability to theft or corruption. Gaming regulators view financial distress as a potential risk factor for employee misconduct. This is particularly true for positions involving cash handling, chip management, or access to gaming revenue.

| Assessment Component | Purpose | Typical Scope |

| Credit Report Review | Identify financial distress patterns | 7-year history standard |

| Bankruptcy Records | Assess financial management capability | Federal court records |

| Civil Judgments | Detect unpaid obligations | County and state court systems |

| Tax Liens | Verify tax compliance | Federal and state databases |

| Financial Disclosure | Verify income source legitimacy | Position-dependent requirement |

Financial assessments focus on patterns and circumstances rather than isolated incidents or credit scores alone. Evaluators consider context, timeframe, and evidence of financial rehabilitation when assessing overall suitability. Certain gaming positions involving direct access to financial information, cash handling, or fiduciary responsibilities may qualify for employment credit checks under California law's limited exceptions. Employers must verify that specific positions meet legal requirements before conducting credit checks. They must provide required disclosures and follow compliant procedures.

Regulatory Database and Excluded Parties Screening

Gaming-specific background checks include searches of regulatory databases maintained by gaming authorities across multiple jurisdictions. These databases track individuals excluded from gaming establishments. They also track those with revoked gaming licenses in other jurisdictions. Additionally, they include persons identified as unsuitable for gaming employment or patronage by regulatory agencies.

The National Indian Gaming Commission maintains databases relevant to tribal gaming employment. State gaming regulatory bodies across the country track licensing actions and exclusions. International gaming jurisdictions may maintain similar records. These become relevant when screening applicants with overseas gaming industry experience. Employers should implement screening protocols that search relevant databases at initial hire. They should also establish monitoring systems that alert to new regulatory actions affecting current employees.

Identity Verification and Employment Eligibility

Identity verification in gaming employment extends beyond standard Form I-9 employment eligibility confirmation. Enhanced verification includes validation of identity documents and Social Security number authentication. It also involves cross-referencing biographical information across multiple data sources. This heightened scrutiny protects against identity fraud, synthetic identity schemes, and applicants concealing disqualifying history under false credentials.

Biometric verification, document authentication technology, and database cross-referencing supplement visual document inspection. Together, these create layered identity assurance appropriate to gaming environment risks. Employers must balance thorough identity verification against privacy considerations. They must also comply with laws governing collection and storage of biometric data and sensitive personal identifiers.

Position-Specific Screening Requirements and Classifications

California gaming regulations establish tiered licensing and screening requirements based on position responsibilities and access levels.

| Classification | Typical Positions | Processing Time | Screening Depth |

| Key Employee License | Executives, gaming managers, security directors | 8-12 weeks | Comprehensive regulatory investigation |

| Gaming Employee Registration | Dealers, cage cashiers, slot technicians | 4-8 weeks | Enhanced background check |

| Non-Gaming Support | Restaurant staff, maintenance, housekeeping | 2-4 weeks | Elevated employment screening |

Understanding these classifications helps employers design efficient screening workflows. This applies appropriate scrutiny without imposing unnecessary burdens on lower-risk positions.

Key Employee and Gaming License Classifications

Key employees in gaming operations typically include executives, gaming managers, security directors, and surveillance personnel. The category also covers others with significant decision-making authority or access to sensitive operations. These positions generally require individual gaming licenses issued directly by regulatory authorities. This follows comprehensive background investigations that may take several months.

The licensing process for key employees involves detailed application packages, fingerprint submissions, and financial disclosures. It requires personal history statements covering extended timeframes. Documentation of previous employment and residence is also necessary. Applicants may face interviews with regulatory investigators. They must authorize access to records that would remain private in standard employment contexts. Employers should advise key employee candidates about licensing timelines and requirements before extending conditional offers.

Gaming Employee Certifications and Registrations

Non-key gaming employees typically require work permits, registrations, or certifications rather than full gaming licenses. This includes dealers, slot technicians, cage cashiers, and count room personnel. These intermediate classifications involve background checks less extensive than key employee investigations. However, they remain more thorough than standard employment screening.

Processing times for gaming employee registrations generally range from two to six weeks. This depends on applicant history complexity and regulatory agency workload. Employers commonly hire conditionally pending registration approval. However, they must maintain clear policies governing conditional employee access to gaming areas and gaming-related duties. Some jurisdictions allow temporary or conditional work permits. These authorize limited gaming duties while full background checks remain pending.

Non-Gaming Support Position Standards

Employees without direct gaming duties may not require gaming-specific licenses or registrations. This includes restaurant staff, hotel personnel, maintenance workers, and administrative employees not involved in gaming operations. However, employers typically apply elevated background screening standards across all casino property employees. This reflects the integrated nature of modern gaming resort operations.

Support position screening generally focuses on criminal history relevant to workplace safety, theft prevention, and property access security. It emphasizes these areas rather than gaming-specific regulatory criteria. Financial background checks may receive less emphasis for positions without cash handling or financial system access. Employers should clearly identify which positions fall outside gaming employee classification. They should document the rationale for applying different screening standards.

Disqualifying Factors and Character Assessment Criteria

Gaming regulatory authorities identify certain conviction categories that create strong presumptions against employment eligibility. However, specific disqualification standards vary by regulatory body, position classification, and applicable fair chance hiring requirements.

Automatic Disqualification Offenses

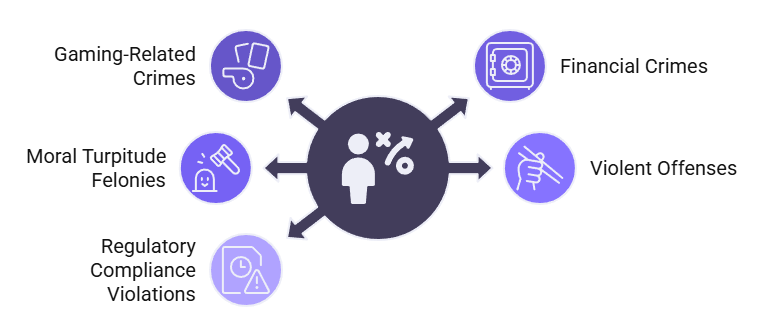

Conviction categories that typically create strong suitability concerns and may result in employment ineligibility include the following. These remain subject to regulatory authority determination and individual assessment where legally required:

- Gaming-related crimes, including illegal gambling operation, cheating schemes, and gaming fraud

- Financial crimes such as embezzlement, money laundering, and fraud

- Felony convictions involving moral turpitude

- Violent offenses and crimes against vulnerable populations

- Regulatory compliance violations in previous gaming employment

Gaming-related crimes typically raise substantial suitability concerns. These include illegal gambling operation, cheating schemes, and gaming fraud. Employers should verify applicable disqualification standards with their regulatory authority and legal counsel. They must conduct individual assessments where required by law. Creating exceptions or inconsistent application undermines compliance program integrity. It may also expose organizations to regulatory sanctions or discrimination claims.

Individualized Assessment Requirements

California fair chance hiring laws require individual assessment of criminal history in employment decisions. Assessments must consider offense nature, time elapsed, evidence of rehabilitation, and relationship between conviction and job duties. These requirements apply to casino employment with important limitations for positions directly involving gaming operations.

The individual assessment framework examines whether specific convictions relate directly to essential job functions. It determines if they create unacceptable risk given the position's duties. A theft conviction carries obvious relevance for cash handling positions. However, it may warrant different consideration for maintenance or food service roles. Similarly, timeframe matters significantly. Recent offenses generate greater concern than decades-old convictions followed by clean records.

Ongoing Suitability and Character Monitoring

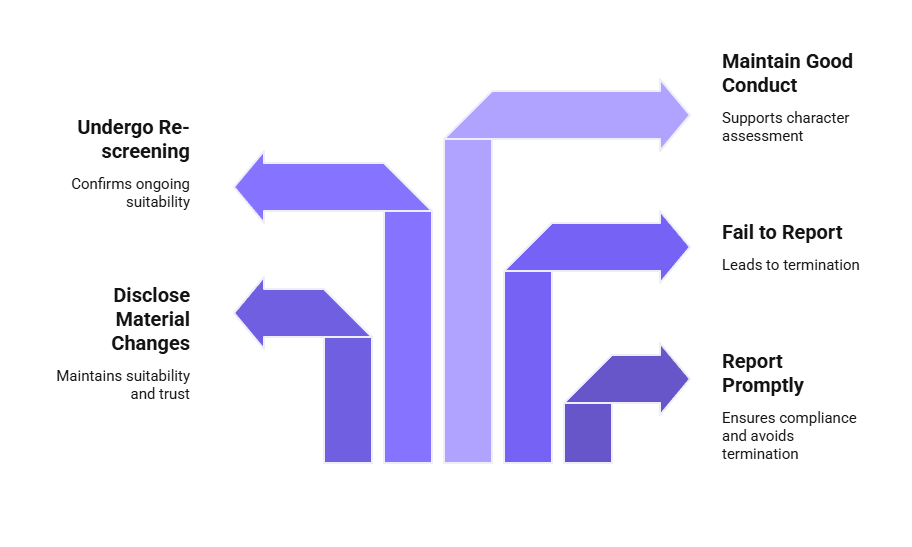

Gaming employment suitability extends beyond initial hire to include ongoing monitoring and periodic reassessment:

- Employees must report arrests, criminal charges, and regulatory actions promptly

- Material changes in circumstances affecting suitability require immediate disclosure

- Failure to report developments typically constitutes independent termination grounds

- Periodic re-screening protocols may repeat background checks at defined intervals

- Character assessment considers associations, lifestyle consistency, and conduct patterns

Employers should establish clear reporting policies and provide multiple confidential reporting channels. They should train employees on their ongoing obligations. Character assessment considers associations with unsuitable persons and lifestyle inconsistent with reported income. It also examines patterns of dishonesty and conduct suggesting poor judgment even if not criminal.

Compliance Procedures and Legal Requirements

California casino employee background screening must satisfy both gaming-specific regulatory requirements and general employment law obligations. This includes FCRA provisions, California Consumer Credit Reporting Agencies Act standards, and state fair chance hiring laws.

Authorization and Disclosure Obligations

Employers must obtain clear written authorization before procuring background reports. They must provide standalone disclosure documents that meet FCRA requirements. California law imposes additional disclosure obligations regarding the scope of background checks and applicant rights. This requires careful attention to state-specific form requirements.

Gaming employment screening involves both regulatory investigations conducted by licensing authorities and background reports procured by employers. When employers obtain consumer reports for employment purposes, FCRA authorization, disclosure, and adverse action requirements apply. The interplay between regulatory investigations and employer-initiated screening requires careful analysis. Employers should consult legal counsel to ensure all applicable consumer protection law obligations are satisfied.

Authorization forms should clearly describe the comprehensive nature of gaming employment screening. This includes financial background review, regulatory database searches, and extended criminal history verification. Broad authorizations help ensure screening activities remain within authorized scope. They also avoid the need for supplemental authorization requests.

Adverse Action Protocols

When background check findings will result in employment denial or termination, employers must follow adverse action procedures. These include pre-adverse action notice, opportunity to respond, copy of the background report, summary of rights, and final adverse action notice. California law establishes specific timing requirements and content mandates for these notices.

Gaming regulatory denials present unique adverse action considerations. The disqualifying decision originates with a regulatory agency rather than the employer. Employers should clarify in adverse action communications when regulatory authorities have denied licensing or registration. They must still provide required notices and information about the background screening process. Applicants should receive meaningful opportunity to dispute inaccurate information and provide context regarding identified issues. They should also present evidence of rehabilitation or mitigating circumstances.

Record Retention and Privacy Protection

Background check records containing sensitive personal information, financial data, and criminal history require secure storage, access limitations, and compliant retention periods.

| Data Category | Retention Requirement | Security Measures |

| Licensing files | Per regulatory mandate | Encryption, access controls |

| Background reports | Legitimate business need period | Audit logging, secure disposal |

| Financial disclosures | Position-dependent | Enhanced access restrictions |

| Biometric data | Minimal necessary retention | Specialized encryption protocols |

| Regulatory correspondence | Compliance documentation period | Segregated secure storage |

Electronic storage systems should include encryption, access controls, and audit logging. They need other security measures appropriate to the sensitivity of background screening data. Vendors processing background check information must demonstrate adequate data security capabilities. They must also contractually commit to compliant data handling practices.

Multi-Jurisdictional Verification Challenges and Solutions

California's hospitality and gaming workforce exhibits high mobility. Employees frequently present work histories spanning multiple states and international jurisdictions.

Out-of-State Criminal Record Access

Obtaining comprehensive criminal records from other states involves navigating fifty different state record systems. These have varying access rules, processing procedures, and technology platforms. Some states provide rapid electronic record access. Others require manual searches with extended turnaround times measured in weeks.

Name-based searches in states where applicants previously resided or worked provide broader coverage than FBI fingerprint checks. FBI fingerprint checks capture only records submitted to federal databases. Comprehensive multi-state screening typically combines FBI fingerprint results with direct searches of state repositories in jurisdictions connected to applicant history. Employers should implement screening protocols that identify relevant search jurisdictions through residential and employment history verification. This is better than limiting searches to current residence.

International Background Verification

Applicants with international residence or employment history require verification approaches adapted to foreign record access limitations. These must account for data protection laws and varying governmental transparency:

- Certificate of good conduct documents from foreign authorities

- Professional reference verification through international contacts

- International regulatory and sanctions database searches

- Educational credential authentication services

- Employment verification through alternative documentation methods

International verification often relies on documents obtained by applicants from foreign governmental authorities. It also uses professional reference verification and database searches of international regulatory and sanctions lists. Employers should establish reasonable timeframes for applicants to obtain international verification documents. They should maintain flexibility regarding documentation formats given varying international governmental procedures.

Employment and Education Verification Across Jurisdictions

Verifying previous employment at out-of-state or international employers presents challenges. This occurs when former employers have closed or maintained limited verification procedures. It also happens when they operate in jurisdictions with data protection laws restricting reference information. Educational credential verification faces similar obstacles. This is particularly true for international degrees requiring evaluation and authentication.

Employment verification strategies should include multiple contact attempts through different communication channels. They should include searches for successor entities when previous employers have closed. Alternative documentation such as tax records or pay stubs can help when direct employer verification proves impossible. Educational credential verification services can authenticate international degrees. They provide equivalency assessments that translate foreign educational credentials into U.S. framework equivalents.

Technology-Assisted Screening Approaches

Background screening technology has evolved substantially. It now incorporates automation, artificial intelligence, database integration, and continuous monitoring capabilities.

Automated Database Screening Systems

Integrated database platforms aggregate criminal records, regulatory lists, sanctions databases, and other relevant sources into unified search interfaces. These systems can simultaneously query hundreds of data sources. This reduces manual search requirements and accelerates initial screening phases.

Database screening systems vary substantially in coverage quality, update frequency, and accuracy. Employers should evaluate database platforms carefully. They should understand specific sources included, update protocols, and limitations in coverage. No database system provides truly comprehensive coverage. This makes supplemental verification through primary sources important for thorough screening. Automated systems may generate high volumes of potential matches requiring manual review. This determines whether records actually pertain to applicants or represent false positives involving different individuals with similar names.

Artificial Intelligence and Pattern Recognition

AI-powered screening tools can analyze patterns across multiple data sources. They identify relationships and associations, assess risk indicators, and flag anomalies warranting further investigation:

- Identity inconsistency detection

- Employment history gap analysis

- Financial anomaly recognition

- Criminal activity correlation identification

- Relationship and association mapping

Pattern recognition algorithms may detect identity inconsistencies and employment history gaps. They identify other data anomalies that benefit from comprehensive analysis. AI screening tools require careful validation. This ensures they do not perpetuate bias, rely on improper factors, or generate discriminatory outcomes. Employers should understand the data sources, algorithms, and logic underlying AI screening tools. They must ensure human review of AI-generated findings before making employment decisions.

Continuous Monitoring and Alert Systems

Continuous monitoring services track employees after hire. They provide alerts when new criminal charges, regulatory actions, or other relevant events occur. This ongoing surveillance helps employers identify suitability issues promptly. It works better than discovering problems only through self-reporting or periodic re-screening.

Continuous monitoring typically relies on database searches and public record monitoring rather than comprehensive periodic background checks. Coverage limitations mean monitoring services may miss records not captured in monitored databases. This requires employers to maintain reporting requirements and periodic re-screening as complementary risk management tools. Legal frameworks governing continuous monitoring continue evolving. Questions regarding authorization scope, disclosure obligations, and adverse action procedures remain under development.

Operational Timeline Planning and Workflow Optimization

Casino background screening timelines substantially exceed standard employment verification periods. This requires operational planning that accommodates extended decision cycles. Employers must maintain staffing level requirements and candidate engagement throughout the process.

Realistic Timeline Expectations by Position Type

| Position Classification | Standard Timeline | Complex Case Extension | Primary Variables |

| Key Employee License | 8-12 weeks | Up to 6 months | Regulatory workload, history complexity |

| Gaming Employee Registration | 4-8 weeks | 10-16 weeks | Multi-state searches, application completeness |

| Enhanced Non-Gaming Screening | 2-4 weeks | 6-8 weeks | Jurisdiction quantity, reference responsiveness |

Multiple variables affect processing speed. These include regulatory agency workload, applicant history complexity, and number of jurisdictions requiring record searches. Responsiveness of previous employers and references also matters. Completeness of initial application submissions plays a significant role. Incomplete applications, missing documentation, and inaccurate information create the most common sources of processing delays.

Conditional Hiring and Interim Work Arrangements

Many employers extend conditional offers and begin onboarding processes while background checks remain pending. This allows productive preparation activities. These activities position new hires for faster operational integration once screening completes. Conditional arrangements require clear documentation. Employment must remain contingent on satisfactory background check completion and regulatory approval.

Where permitted by applicable gaming regulations, interim work arrangements may allow conditional employees to perform limited non-gaming duties or attend training while awaiting registration. Employers must verify that their regulatory authority permits conditional work arrangements. They must clearly define permissible activities, supervision requirements, and access restrictions. These arrangements help maintain candidate engagement and accelerate operational readiness. They also respect regulatory restrictions on uncleared personnel performing gaming functions.

High-Volume Hiring Workflow Design

Seasonal staffing demands, property openings, and expansion projects may require processing large applicant volumes simultaneously. High-volume scenarios benefit from workflow standardization, batched processing, and dedicated screening staff. Technology leverage increases throughput without sacrificing quality.

Standardized screening packages defined by position classification eliminate case-by-case scope decisions. They enable efficient batch processing of similar applications. Template communications, automated status tracking, and workflow management systems reduce administrative overhead. They help maintain consistent processing speed. Vendor partnerships can provide surge capacity during high-volume periods when internal resources face temporary overload.

Conclusion

California casino employee background screening operates at the intersection of gaming regulatory requirements, employment law compliance, and operational workforce needs. Success requires understanding the dual regulatory structure affecting state-licensed and tribal gaming operations. Employers must implement comprehensive verification protocols addressing criminal, financial, and character assessment requirements. They must design operational workflows that accommodate extended timelines while maintaining compliant procedures throughout the employment lifecycle.

Frequently Asked Questions

What specific criminal convictions automatically disqualify someone from California casino employment?

Gaming regulatory authorities identify certain conviction categories that create strong presumptions against employment eligibility. However, specific disqualification standards vary by regulatory body, position classification, and applicable fair chance hiring requirements. Gaming-related crimes typically raise substantial suitability concerns. These include illegal gambling operations, cheating schemes, and gaming fraud. Employers should verify applicable disqualification standards with their regulatory authority and legal counsel. They must conduct individual assessments where required by law.

How long does the California casino background check process typically take?

Processing timelines vary significantly based on position classification and applicant history complexity. Key employee gaming licenses typically require eight to twelve weeks. Gaming employee registrations generally process within four to eight weeks. Enhanced screening for non-gaming positions may complete within two to four weeks. Multi-jurisdictional record searches, incomplete applications, and complex employment histories can extend these baseline timelines substantially. Some complicated cases reach six months.

Do tribal casinos follow the same background check requirements as state-licensed card rooms?

Tribal gaming operations exercise sovereign regulatory authority within frameworks established by Tribal-State Gaming Compacts and federal Indian Gaming Regulatory Act provisions. Many compacts incorporate standards similar to California Gambling Control Commission requirements. However, specific procedures, criteria, and oversight mechanisms vary across different tribal properties. Applicants and employers at tribal facilities must understand the particular compact and tribal regulatory requirements applicable to their specific property. They should not assume uniform statewide standards.

Can someone with a previous felony conviction work in a California casino?

Felony convictions do not create absolute permanent bars for all casino positions. However, gaming-related, financial, and violent felonies create substantial obstacles. Gaming regulatory authorities retain discretion to deny licenses or registrations based on conviction history. Such denials may prevent employment regardless of employer willingness to hire. California fair chance hiring laws require individual assessment. This considers offense nature, time elapsed since conviction, rehabilitation evidence, and relationship between the conviction and specific job duties.

Are casino employees subject to ongoing background monitoring after hire?

Gaming employment involves continuing suitability obligations beyond initial screening. Employees must promptly report new criminal charges, regulatory actions, and other material circumstances affecting suitability. Many employers implement continuous monitoring systems that alert new criminal records or regulatory actions. Some positions require periodic re-screening at defined intervals. Failure to report required information typically constitutes independent grounds for termination. This applies regardless of the underlying conduct's severity.

What privacy protections apply to background check information for casino employees?

Casino background screening must comply with FCRA provisions, California Consumer Credit Reporting Agencies Act requirements, and state privacy laws governing personal information protection. Employers must obtain proper authorization and provide required disclosures. They must follow adverse action procedures and implement appropriate data security measures. They must limit access to authorized personnel, comply with retention requirements, and protect records against unauthorized disclosure. Gaming regulatory investigations may access information beyond typical employment screening scope. However, employers retain obligations to protect records they maintain.

How do California casino background checks handle gaps in employment history?

Employment history gaps receive scrutiny during character assessment. This is particularly true when gaps are unexplained or correspond with periods of incarceration or other concerning circumstances. Applicants should provide honest explanations for gaps. These may include unemployment periods, family caregiving, education, medical issues, or other legitimate reasons. Unexplained gaps may trigger additional investigation. This determines activities during those periods and assesses whether they raise suitability concerns.

What happens if errors appear in a casino employment background check report?

Applicants who identify inaccurate information should promptly notify the employer. They should dispute errors through procedures required by consumer protection laws. Employers must provide pre-adverse action notice and opportunity to respond. They must allow reasonable time for applicants to correct inaccuracies before finalizing negative decisions. Background check providers must investigate disputes and correct verified errors. Gaming regulatory agencies typically allow applicants to submit clarifying information and documentation addressing issues identified during licensing investigations.

Additional Resources

- California Gambling Control Commission

https://www.cgcc.ca.gov/ - National Indian Gaming Commission

https://www.nigc.gov/ - Federal Trade Commission - Background Checks

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-employers-need-know - California Department of Fair Employment and Housing - Fair Chance Act

https://www.dfeh.ca.gov/ - Consumer Financial Protection Bureau - Background Screening

https://www.consumerfinance.gov/consumer-tools/background-screening/

Still have questions?

Get in touch with our team today for a personalized demo and discover how our tailored volume pricing and packages can drive results for your business!

How useful was this page?*

Note: your comments are anonymous. We use them to improve the website. Do not include any personal details.

Visit our FCRA Compliance Tool or leave a message here if you need a response.

From the blog Explore the GCheck Content Hub

Pharmaceutical Industry Hiring Compliance: A 2026 Guide to Risk-Intelligent Screening

20 Jan, 2026 • 19 min read

How to Background Check Substitute Teachers: 2026 Strategic Framework

19 Jan, 2026 • 18 min read

California Casino Employee Background Check Requirements: 2026 Compliance Guide

19 Jan, 2026 • 22 min readThe information provided in this article is for general informational and educational purposes only and should not be construed as legal advice or a substitute for consultation with qualified legal counsel. While we strive to ensure accuracy, employment screening laws and regulations—including but not limited to the Fair Credit Reporting Act (FCRA), Equal Employment Opportunity Commission (EEOC) guidelines, state and local ban-the-box laws, industry-specific requirements, and other applicable federal, state, and local statutes—are subject to frequent changes, varying interpretations, and jurisdiction-specific applications that may affect their implementation in your organization. Employers and screening decision-makers are solely responsible for ensuring their background check policies, procedures, and practices comply with all applicable laws and regulations relevant to their specific industry, location, and circumstances. We strongly recommend consulting with qualified employment law attorneys and compliance professionals before making hiring, tenant screening, or other decisions based on background check information.