Hospitality operators face unique compliance challenges when conducting restaurant employee background checks. Balancing rapid hiring demands with strict FCRA regulations becomes critical, as penalties reach up to $1,000 per violation. This guide translates federal background check requirements into actionable protocols for restaurants, hotels, and food service businesses.

Key Takeaways

- The FCRA mandates specific written disclosures and authorizations before conducting restaurant employee background checks, with standalone documents required separate from employment applications.

- Hospitality employers must provide pre-adverse action notices with background check copies before making hiring decisions based on criminal records, credit history, or other screening results.

- Restaurant businesses face average settlement costs of $85,000-$500,000 for FCRA violations, making compliant screening processes essential business protection.

- Ban-the-box laws in 37 states and 150+ cities require hospitality employers to delay criminal history questions until specific hiring stages.

- FCRA compliance actually accelerates hiring timelines by establishing clear workflows that prevent costly decision delays and litigation risks.

- Food service employers must maintain background check records separately from personnel files for specific retention periods dictated by federal and state regulations.

- Adverse action procedures require 5-10 business days between pre-adverse and final adverse action notices, allowing applicants to dispute inaccurate information.

- Hospitality-specific screening protocols should address position-specific risks while maintaining consistent application across all hiring locations and franchise operations.

Why FCRA Compliance Matters for Restaurant and Hotel Operations

The hospitality industry's operational reality creates a perfect storm for compliance violations. When you're short-staffed during peak season, the temptation to cut corners on background screening becomes overwhelming. Yet FCRA violations have cost restaurant chains millions in settlements. For instance, Bloomin' Brands settled for $3.35 million in 2021. Regional operators have faced class-action lawsuits involving thousands of applicants.

FCRA compliance for restaurants isn't administrative overhead—it's strategic risk management. Employment litigation now represents 15% of all hospitality industry lawsuits. Moreover, background check violations rank among the fastest-growing categories. Non-compliant screening processes create evidentiary problems when defending termination decisions. Additionally, many general liability insurance policies now exclude coverage for FCRA violations. As a result, settlements come directly from operating capital.

The hospitality background check laws landscape has fundamentally shifted since 2020. Remote hiring, expanded state-level privacy regulations, and increased regulatory enforcement have transformed background screening. Consequently, for operations managers and HR directors overseeing multiple locations, understanding these requirements is foundational to sustainable hiring operations.

Understanding FCRA Requirements for Hospitality Hiring

The Core FCRA Obligations Every Restaurant Employer Must Follow

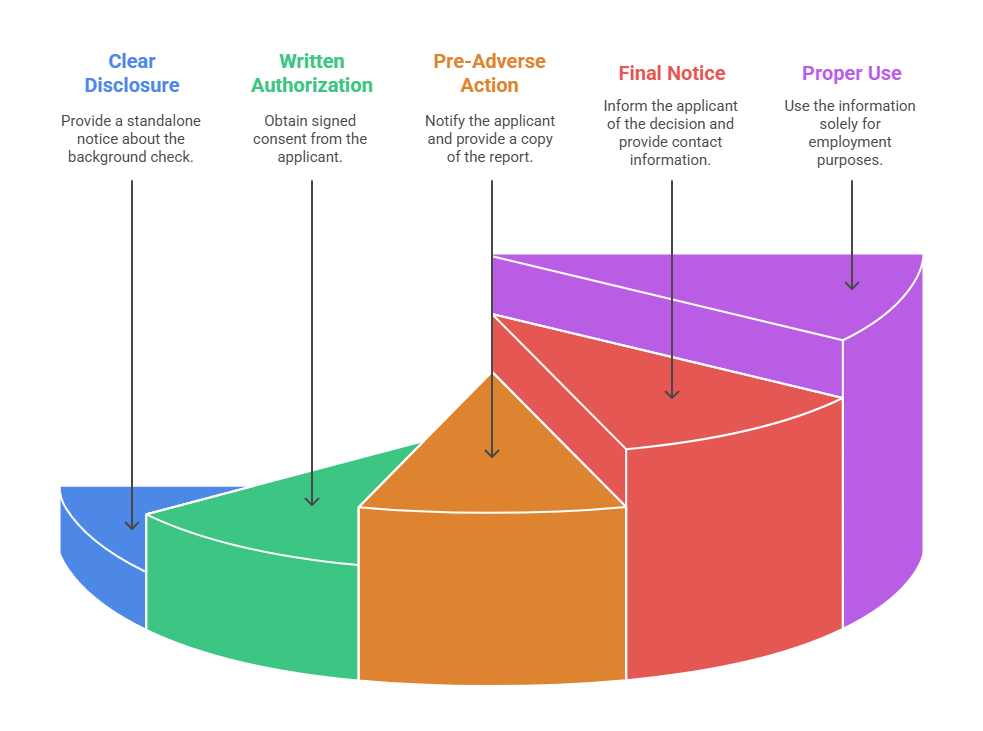

The Fair Credit Reporting Act establishes five non-negotiable requirements when conducting restaurant employee background checks. These obligations apply equally to single-location independent restaurants and multinational hotel chains. Furthermore, there are no exemptions for business size or hiring volume.

- Clear Written Disclosure: Provide standalone notice that a background check will be conducted, separate from your employment application

- Written Authorization: Obtain signed consent before initiating any screening, without liability waivers or broad release language

- Pre-Adverse Action Process: Deliver specific notifications with background report copies before making negative hiring decisions

- Final Adverse Action Notice: Provide formal written notice after deciding not to hire, including screening company contact information

- Proper Information Use: Use background check information solely for employment purposes with appropriate confidentiality protections

These requirements create a compliance timeline of 7-12 business days minimum from authorization to final hiring decision. Many hospitality operators view this as incompatible with rapid hiring needs. However, proper workflow design actually streamlines decisions by creating clear decision points and documentation trails.

EXPERT INSIGHT: Hiring is one of those moments that has a domino effect throughout the whole company based on one hire. I’ve discovered that background checks are not about catching someone within the act of doing something dishonest, but it’s about creating clarity even before the first day. By doing the diligence that comes with thorough background checks, we protect not just the company but the employees who will be working alongside that individual on a daily basis. It’s not about being perfect; it’s about being responsible. This whole process affects the individual going through it as well as the group that the new individual will now be part of. - Charm Paz, CHRP

What Constitutes a Background Check Under FCRA

The restaurant hiring compliance requirements extend beyond traditional criminal record checks. Under FCRA definitions, any information obtained from third-party consumer reporting agencies triggers compliance obligations. This creates broader coverage than most hospitality operators realize.

FCRA-covered screening activities include criminal history reports and credit checks for management positions. Additionally, they cover employment verification, education confirmation, and driving records for delivery drivers. Reference checks conducted by third parties fall under FCRA requirements. Similarly, social media screening through vendors and eviction records also trigger obligations. Even seemingly informal screening methods require compliance when conducted through external vendors.

Industry-Specific Risk Factors That Demand Compliant Screening

Food service employee screening processes must address position-specific risk profiles while maintaining legally defensible consistency. Hospitality roles involve unique vulnerabilities that justify thorough screening. Employees have access to guest rooms and personal belongings. In addition, they carry alcohol service responsibilities and interact with vulnerable populations. They handle cash at high transaction volumes. Finally, they have food safety obligations creating potential liability exposure.

These operational realities justify thorough background screening but simultaneously increase litigation risk. A compliant approach requires documented business necessity for each screening component. For example, criminal background checks for roles with room access make defensible business sense. However, identical screening for back-of-house positions with no guest contact may face legal challenges.

Building FCRA-Compliant Background Check Workflows

Creating Proper Disclosure and Authorization Documents

Restaurant employee background checks begin with legally sufficient disclosure and authorization paperwork. The CFPB and FTC have issued specific guidance requiring standalone disclosure documents. Consequently, you cannot bury background check notices in multi-page application packets or employee handbooks.

Your disclosure document must appear on a separate page. It should contain only information about the background check. Effective disclosure statements identify that a background check will be conducted. Furthermore, they name the consumer reporting agency performing the screening and explain that the information will inform hiring decisions. Simple language matters for applicants with limited English proficiency or lower literacy levels.

| Document Component | Compliant Approach | Common Violation |

| Disclosure Format | Standalone single-purpose document | Combined with application |

| Authorization Language | Simple consent to conduct check | Overly broad releases included |

| Summary of Rights | CFPB-approved "Summary of Your Rights" attached | Missing rights summary |

| State-Specific Notices | Additional state disclosures for CA, NY, MA, WA | One-size-fits-all forms |

| Language Accessibility | Available in Spanish and other languages | English-only documents |

The authorization document obtains consent to conduct the background check. However, it cannot contain waiver language releasing your restaurant from liability. Many template forms include prohibited clauses that void the entire authorization. This exposes your business to technical FCRA violations even with applicant consent.

Implementing the Pre-Adverse Action Process

The pre-adverse action requirement represents the most challenging FCRA compliance element for hospitality hiring. When background check results reveal potentially disqualifying information, you must pause the hiring process. Subsequently, you need to provide specific notifications before making a final decision.

Pre-adverse action procedures require delivering three documents simultaneously. First, provide a pre-adverse action notice explaining potential denial. Second, include a complete copy of the consumer report from your screening vendor. Third, add the CFPB's "Summary of Your Rights Under the FCRA" document. Importantly, you must allow sufficient time—typically 5-10 business days—for the applicant to review and dispute inaccurate information.

This waiting period conflicts with hospitality's operational urgency. When you need a line cook immediately, waiting 10 days feels impossible. However, the pre-adverse action period protects your business from bad hiring decisions. Consumer reports contain error rates of 20-30% according to FTC studies. Therefore, rushed decisions frequently screen out qualified candidates based on mistaken identity or outdated records.

Managing Final Adverse Action Notices and Documentation

After the pre-adverse action waiting period expires, you may proceed with a final adverse action. The final adverse action notice must be in writing and include specific required elements. Specifically, you need a statement that the applicant was not hired based on the background report. Include the name, address, and phone number of the consumer reporting agency. State that the screening company didn't make the hiring decision. Finally, provide notice of the applicant's right to dispute the report's accuracy.

Documentation requirements extend beyond the adverse action notices themselves. FCRA compliance demands maintaining records demonstrating consistent screening processes. Your documentation should include dated copies of disclosure and authorization forms. Additionally, keep records of when reports were received and reviewed. Show evidence that pre-adverse action documents were provided with proper timing. Document business justification for adverse decisions tied to job-specific requirements.

Navigating State and Local Background Check Restrictions

Ban-the-Box Laws and Fair Chance Hiring Ordinances

Beyond federal FCRA requirements, state and local laws impose additional restrictions. These vary dramatically by operating location. Currently, ban-the-box legislation covers 37 states and more than 150 cities. These laws prohibit asking about criminal history on initial applications.

California's Fair Chance Act prohibits criminal history questions until after a conditional offer. Moreover, it requires specific assessment of conviction relevance to job duties. New York City's Fair Chance Act creates similar restrictions with different procedural requirements. Philadelphia's ban-the-box ordinance prohibits criminal history consideration entirely for many positions.

Critical State-Specific Variations:

- California: Requires assessment considering conviction nature, time elapsed, and job duties before adverse decisions

- New York: Mandates Article 23-A analysis demonstrating direct relationship between conviction and employment or unreasonable risk

- Illinois: Requires employers to consider rehabilitation evidence and prohibits questions about sealed or expunged records

- Massachusetts: Limits criminal history questions to convictions within past seven years under CORI laws

The operational challenge involves maintaining compliant hiring workflows across jurisdictions with conflicting requirements. Many hospitality operators adopt the most restrictive jurisdiction's standards enterprise-wide. This approach simplifies training and reduces violation risks across all locations.

Position-Specific Screening Limitations and Protected Information

Restaurant hiring compliance requirements increasingly restrict what information employers can consider for specific positions. Salary history bans in 21 states prohibit inquiring about previous pay. Similarly, credit check restrictions in 11 states limit credit history screening to positions with specific financial responsibilities.

Protected information categories create additional complexity. Bankruptcy information cannot be used in hiring decisions under federal law. Furthermore, arrest records without convictions receive protection in many states. California, Hawaii, and Massachusetts explicitly prohibit considering arrests not leading to conviction. Expunged, sealed, and pardoned convictions cannot be considered in most jurisdictions. However, these records often appear on background reports, requiring HR staff to recognize and disregard protected information.

Selecting and Managing Background Screening Vendors

FCRA Compliance Requirements for Consumer Reporting Agencies

The food service employee screening process depends heavily on your chosen consumer reporting agency. Yet vendor selection receives insufficient attention from many hospitality operators. Under FCRA, both employers and screening companies share compliance obligations. Therefore, vendor violations can create employer liability.

Compliant consumer reporting agencies must maintain reasonable procedures to ensure maximum possible accuracy. Additionally, they must follow strict permissible purpose requirements before releasing reports and implement appropriate security measures protecting applicant information. When evaluating screening vendors, request evidence of FCRA compliance programs. Ask about PBSA certification and request explanation of accuracy verification procedures. Finally, verify data security certifications such as SOC 2 Type II compliance.

| Vendor Qualification | Compliance Indicator | Red Flag |

| Industry Accreditation | PBSA certified | No association membership |

| Accuracy Procedures | Multi-source verification explained | "Instant" limited database checks |

| Adverse Action Support | Document generation included | Employer handles all notices |

| Dispute Resolution | Clear procedures with timelines | No documented process |

| State Law Compliance | Location-specific reporting | National one-size reports |

Price-driven vendor selection often leads to low-cost providers using insufficient data sources. Bargain background checks frequently rely on limited database searches. Consequently, these incomplete reports create false negatives and expose your business to negligent hiring liability when problems emerge post-hire.

Establishing Service Level Agreements That Support Hiring Timelines

Restaurant employee background checks must balance thoroughness with operational urgency. Service level agreements with screening vendors should specify turnaround time commitments. Criminal searches typically take 48-72 hours for most jurisdictions. Meanwhile, employment verification requires 3-5 business days, and education verification needs 5-7 business days. Professional license verification takes 24-48 hours through primary source databases.

Understanding reporting delays helps set realistic hiring timeline expectations. County criminal searches require courthouse staff to physically pull records in many jurisdictions. Similarly, employment verification for hospitality workers with multiple short-tenure positions requires contacting numerous prior employers. International background checks for immigrant workers involve foreign data sources with substantially longer processing times.

Training Hiring Managers and Maintaining Compliance Programs

Building Location-Level FCRA Compliance Competency

Comprehensive restaurant hiring compliance requirements mean nothing if general managers conducting interviews don't understand their obligations. Decentralized hiring authority creates compliance vulnerabilities when location-level staff make screening decisions without proper training.

Effective compliance training for hospitality hiring managers covers several critical areas. First, they need to recognize what triggers FCRA obligations. Second, they must understand proper completion of disclosure documents. Third, they should know prohibited questions during interviews. Finally, they need to apply screening criteria consistently across all candidates. Training must occur before managers participate in hiring decisions, with annual refreshers addressing rule changes and common violation patterns.

Essential Training Components:

- Prohibited Pre-Screen Questions: Managers cannot ask about criminal history before conditional offers in ban-the-box jurisdictions

- Consistent Screening Application: All candidates for the same position must undergo identical background checks

- Proper Adverse Action Procedures: Managers cannot make final decisions immediately upon receiving unfavorable reports

- Confidentiality Requirements: Background check information requires restricted access and secure storage

- Protected Information Recognition: Managers must identify and disregard expunged records and arrests without convictions

Role-specific training acknowledges different compliance obligations across your organization. Corporate HR teams need deep technical knowledge of FCRA procedures. Meanwhile, regional managers require understanding of location-specific laws, and general managers need practical decision-making guidance within compliant frameworks. This tiered approach ensures everyone understands their specific obligations.

Conducting Regular Compliance Audits and Process Reviews

FCRA compliance for restaurants requires ongoing monitoring rather than one-time implementation. Regular compliance audits identify procedural drift and documentation gaps before they become litigation triggers. Quarterly reviews of background check files from each location reveal common problems and training needs.

Audit protocols should verify several key elements. Check that disclosure forms are standalone documents. Additionally, confirm that authorization forms contain required elements and verify that pre-adverse action timing meets minimum waiting period requirements. Ensure that final adverse action notices include all required information. Document these reviews with findings reports and corrective action plans.

Responding to Applicant Disputes and CFPB Complaints

Managing Applicant Challenges to Background Report Accuracy

Background reports sometimes contain errors requiring dispute resolution procedures. When applicants invoke their FCRA rights to challenge report accuracy, hospitality employers must pause hiring decisions. Subsequently, they need to coordinate reinvestigation through their screening vendor.

The reinvestigation process follows a specific timeline. Within 5 business days of receiving an applicant dispute, your screening vendor must notify data furnishers. Data furnishers have 30 days to investigate and report findings. Your screening vendor must provide results within 5 business days of completing the investigation. Importantly, you cannot finalize an adverse hiring decision while reinvestigation remains pending.

Common accuracy issues include mistaken identity, especially for applicants with common names. Incomplete criminal record disposition information shows arrests but not dismissals. Additionally, outdated information exceeds reporting period limits, and records that should be sealed or expunged appear on reports. Training hiring managers to recognize these problems prevents decisions based on inaccurate information.

Addressing CFPB Complaints and Investigation Responses

The Consumer Financial Protection Bureau actively enforces FCRA compliance through complaint investigation. When applicants file CFPB complaints alleging FCRA violations, the bureau investigates. Violations may include improper disclosure procedures or missing pre-adverse action notifications. Consequently, the bureau may require detailed response with supporting documentation.

CFPB complaint responses require producing all documents related to the specific hiring decision. Specifically, you need disclosure and authorization forms with dates and must provide the background report as received from your vendor. You need pre-adverse action documentation with delivery proof. Missing documentation or procedural gaps may result in consent orders, civil money penalties, and applicant pay.

Integrating Background Checks Into Modern Hiring Technology

Applicant Tracking System Integration and Compliance Workflows

Modern restaurant hiring compliance requirements benefit substantially from technology integration. Applicant tracking systems with built-in background check workflows automate compliance steps. This reduces human error and documentation gaps. Moreover, proper integration ensures that disclosure documents generate automatically at appropriate hiring stages.

ATS integration creates compliance advantages through automated timing tracking. Systems can monitor pre-adverse action waiting periods. Additionally, they send reminders when final adverse action deadlines approach and flag files where required steps remain incomplete. This automation prevents the most common compliance failure—proceeding to final decisions without completing the mandatory waiting period.

However, technology creates new compliance risks when improperly set up. ATS systems programmed to automatically decline applicants based on specific criteria may violate rules. For instance, automatic rejection for any criminal record or credit scores below thresholds can violate EEOC guidelines. Technology should help human decision-making within compliant frameworks, not replace careful assessment.

Mobile-Friendly Disclosure and Authorization for On-Demand Hiring

Hospitality's increasing reliance on mobile-first hiring creates unique FCRA compliance challenges. When applicants complete background check authorization on smartphones, disclosure documents must meet technical requirements. Specifically, they need a standalone presentation and clear appearance on small screens. Multi-page PDF forms requiring scrolling may not adequately convey the separate nature required under CFPB guidance.

Mobile-friendly disclosure workflows should present background check notices on dedicated screens. Additionally, they should require active interaction confirming the applicant read and understood disclosure. They need to generate time-stamped authorization documents with IP address information. These technical implementations provide stronger evidence of proper disclosure than paper forms.

Conclusion

FCRA compliance for hospitality operations transforms from regulatory burden into competitive advantage when properly implemented. Restaurant employee background checks conducted within comprehensive compliance frameworks accelerate defensible hiring decisions. Moreover, they protect your business from costly litigation and support workforce quality objectives. The investment in proper disclosure documentation, vendor selection, staff training, and process auditing pays returns through reduced legal exposure. For operations managers navigating rapid hiring cycles, compliance begins with recognizing that shortcuts create greater delays than following proper procedures from the start.

Frequently Asked Questions

How long does a compliant restaurant background check take from start to finish?

A fully FCRA-compliant background check timeline spans 7-12 business days. This includes 2-3 days for screening completion and 5-10 business days for the mandatory pre-adverse action waiting period if negative information appears. Employers can shorten timelines by running background checks on larger applicant pools simultaneously earlier in the hiring process.

Can restaurants ask about criminal history during the initial interview?

Criminal history questions during interviews depend entirely on your operating jurisdiction. In the 37 states and 150+ cities with ban-the-box laws, employers cannot inquire about criminal history until after conditional offers. Best practice involves reserving all criminal history consideration for formal background check procedures to ensure consistent documentation.

What happens if an applicant disputes information in their background report?

When applicants dispute background report accuracy, employers must pause the hiring process and coordinate reinvestigation. The consumer reporting agency has 30 days to investigate disputed information. You cannot finalize an adverse hiring decision while reinvestigation remains pending. If investigation reveals inaccurate information, you must base your hiring decision on the corrected report.

Do FCRA requirements apply when hiring for temporary or seasonal positions?

Yes, FCRA compliance obligations apply equally to all hiring when you use third-party consumer reporting agencies. The nature and duration of employment don't determine FCRA applicability. Some hospitality operators mistakenly believe shortened employment duration exempts them from full procedures, but this creates substantial violation liability.

Can hotels and restaurants use instant online background checks?

Instant background checks using limited databases rarely provide comprehensive coverage and frequently contain accuracy problems. Most criminal records exist at county courthouses rather than centralized national databases. Industry best practice involves comprehensive county-level criminal searches through accredited agencies, accepting the 48-72 hour turnaround.

What criminal records can legally disqualify restaurant applicants?

Criminal record consideration must demonstrate business necessity and comply with EEOC guidance. For hospitality positions, defensible disqualifications typically include theft convictions for cash handling roles and violent offenses for guest interaction positions. Many jurisdictions now require careful assessment considering offense severity, time elapsed, and rehabilitation evidence.

How should restaurants handle background check information for employees who transfer between locations?

Employee transfers within the same company generally don't require new background checks unless substantial time has passed or the position involves materially different responsibilities. If you conduct supplemental checks for transferred employees, full FCRA compliance applies. Multi-location businesses should establish clear policies on background check refresh timing.

What documentation should restaurants keep from the background check process?

Maintain comprehensive documentation proving FCRA compliance for at least five years. Essential records include signed disclosure and authorization forms, complete background reports, pre-adverse action notice with delivery confirmation, and final adverse action notices. Store these documents separately from general personnel files with restricted access.

Additional Resources

- A Summary of Your Rights Under the Fair Credit Reporting Act (CFPB Official Document)

https://www.consumerfinance.gov/learnmore/ - Using Consumer Reports: What Employers Need to Know (FTC Business Guidance)

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-employers-need-know - Background Checks and Employment: What Employers Need to Know (EEOC Technical Assistance)

https://www.eeoc.gov/laws/guidance/background-checks-and-employment-what-employers-need-know - Professional Background Screening Association Accreditation Standards

https://www.pbsa.org/accreditation - Ban-the-Box Laws: State and Local Guide (National Employment Law Project)

https://www.nelp.org/publication/ban-the-box-fair-chance-hiring-state-and-local-guide/

Gcheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.