Effective tenant screening in 2026 requires landlords to balance thoroughness with efficiency while navigating evolving compliance requirements. This tenant background check guide presents a strategic framework for designing proportionate screening processes that calibrate risk assessment methods to property type, market conditions, and regulatory obligations rather than applying uniform maximum verification protocols.

Key Takeaways

- Strategic tenant screening balances thoroughness with application speed to remain competitive in high-volume rental markets.

- Credit evaluations, criminal history reviews, and reference verification each serve distinct risk assessment functions requiring different interpretation frameworks.

- Federal Fair Credit Reporting Act requirements mandate specific disclosures and adverse action procedures when using consumer reports.

- State and local regulations impose varying restrictions on lookback periods, permissible inquiry types, and disqualification criteria.

- Proportionate screening design matches verification depth to legitimate risk factors rather than implementing maximum checks universally.

- Remote verification methods and technology-assisted tools require evaluation criteria focused on accuracy, compliance, and false-positive rates.

- Documentation practices must support defensible decision-making while respecting applicant privacy and data protection obligations.

- Rental screening best practices prioritize consistent application of clearly defined criteria across all applicants to avoid discrimination claims.

Understanding the Strategic Purpose of Tenant Background Checks

Tenant screening functions as a risk calibration system rather than a simple approval gateway. Landlords face distinct risk categories that require different information sources and evaluation methods. Financial risk assessment examines payment capacity and history, while property damage risk evaluation considers past rental conduct and behavioral indicators. Legal compliance risk involves understanding regulatory obligations that vary by jurisdiction and property type.

The strategic value of a tenant background check guide emerges from matching verification methods to specific risk questions. A landlord managing single-family homes in suburban markets faces different risk profiles than one operating multi-unit buildings in urban centers with rent control regulations. Screening intensity should reflect actual risk exposure rather than maximizing information collection.

Modern rental markets present volume challenges that demand efficiency optimization. In competitive markets where qualified applicants consider multiple properties simultaneously, delayed screening decisions result in lost leasing opportunities. This creates tension between thoroughness and speed that landlords must resolve through process design rather than simply accelerating existing methods.

Defining Proportionate Screening Frameworks

Proportionate screening matches verification depth to legitimate business needs and regulatory requirements. Maximum screening approaches that apply identical extensive checks to all applicants regardless of property type or rent level create unnecessary costs, delays, and potential compliance exposure without corresponding risk reduction benefits.

Landlords should identify which risk factors genuinely affect their decision-making for specific properties. Studio apartments with monthly rents below market median may warrant different credit score thresholds than luxury units. Properties in jurisdictions with strong tenant protection laws may require more detailed rental history verification because eviction processes involve greater time and cost.

Essential Components of Comprehensive Tenant Screening

A complete tenant screening checklist addresses multiple risk dimensions through complementary verification methods. Each component generates distinct information types that serve different analytical purposes in the overall decision framework.

| Screening Component | Primary Function | Key Information Provided |

| Credit Reports | Financial behavior assessment | Payment history, current obligations, public records |

| Criminal Background | Safety and risk evaluation | Conviction records, case dispositions, offense details |

| Employment Verification | Income capacity confirmation | Employment status, position, tenure, compensation |

| Rental History | Behavioral pattern analysis | Payment timeliness, lease compliance, property care |

These components work together to create a comprehensive risk profile that informs decision-making while remaining compliant with applicable regulations.

Tenant Credit Check Requirements and Interpretation

Credit reports provide financial behavior history and current obligation status. Tenant credit check requirements under the Fair Credit Reporting Act necessitate written authorization from applicants before obtaining consumer reports from credit bureaus. This authorization must be provided in a clear, standalone document separate from the rental application. Landlords must provide specific disclosures informing applicants that credit information may be used in rental decisions.

Credit score interpretation requires understanding what the numbers measure and their limitations. Scores reflect statistical default probability based on past payment behavior but do not capture current income, employment stability, or rent-to-income ratios directly. An applicant with a moderate credit score but stable employment and appropriate income may present lower actual risk than a higher-scored applicant with recent job changes and marginal rent-to-income ratio.

Criminal History Screening Considerations

Criminal background checks raise complex legal and practical considerations. While landlords have legitimate interests in resident safety and property protection, federal fair housing guidance and numerous state laws restrict how criminal history information may be used in tenant selection.

The U.S. Department of Housing and Urban Development has issued guidance indicating that blanket policies excluding all applicants with any criminal history may violate Fair Housing Act protections against discriminatory effects. Individualized assessments should consider the nature and severity of criminal conduct, time elapsed since the offense or completion of sentence, and evidence of rehabilitation or mitigating circumstances.

Many jurisdictions have implemented ban-the-box laws restricting when and how landlords may inquire about criminal history. Some prohibit questions on initial applications, requiring landlords to conduct criminal background checks only after preliminary screening. Others impose lookback period limitations, preventing consideration of offenses beyond specified timeframes such as seven years.

Arrest records require particularly careful handling. Arrests without convictions should not form the basis for adverse decisions, as arrests indicate accusation rather than proven conduct. Many states and localities explicitly prohibit consideration of arrest records in housing decisions. Landlords should consult applicable laws in their jurisdiction before considering any arrest information, as using such records creates substantial fair housing liability risk.

Employment and Income Verification Methods

Employment and income verification establishes payment capacity. Traditional methods involve contacting employers directly to confirm employment status, position, tenure, and income. However, modern employment arrangements including gig economy work, remote employment, and contract positions often complicate standard verification approaches.

Landlords should establish clear income requirements expressed as rent-to-income ratios. Standards vary by market and rent levels, though ratios typically require gross monthly income to exceed monthly rent by a specified multiple. Higher ratios provide greater margin for error but may unnecessarily restrict applicant pools in expensive markets where qualified renters routinely spend larger income portions on housing. Documentation methods include recent pay stubs, tax returns, bank statements, and employer verification letters. Each document type has strengths and limitations that affect verification reliability.

Tenant Reference Check Questions and Practices

Rental history verification through previous landlord contact provides behavioral information not captured in credit reports or criminal records. However, reference checks involve methodological challenges that affect information reliability.

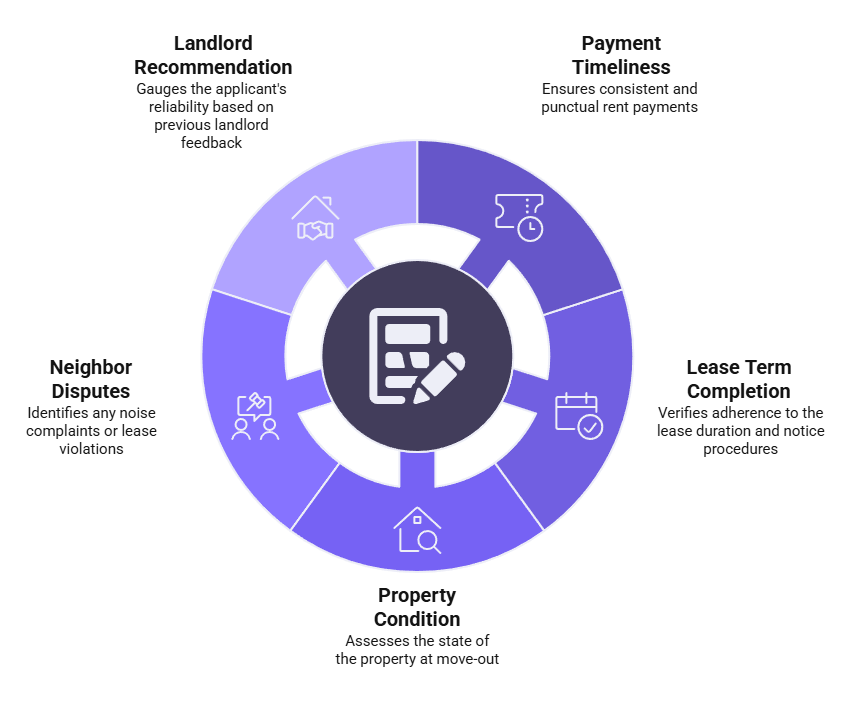

Effective tenant reference check questions focus on:

- Payment timeliness and consistency throughout the lease term

- Lease term completion and proper notice procedures followed

- Property condition at move-out and any damage beyond normal wear

- Noise complaints, neighbor disputes, or lease violation notices received

- Whether the previous landlord would rent to the applicant again

Reference reliability varies based on the reference source relationship to the applicant. Current landlords may provide negative information more readily than references selected by applicants. Verification of reference authenticity through independent confirmation of landlord identity and property ownership reduces fraud risk.

How to Screen Tenants Effectively in High-Volume Markets

Effective tenant screening in competitive rental markets requires process efficiency without compromising decision quality. Landlords facing multiple applications for single units must make timely decisions while maintaining compliance and consistency.

Establishing Clear Screening Criteria in Advance

Pre-defined screening criteria serve multiple functions. They accelerate decisions by providing clear evaluation frameworks, promote consistency across applicants to reduce discrimination risk, and create transparency that helps qualified applicants self-assess fit before applying.

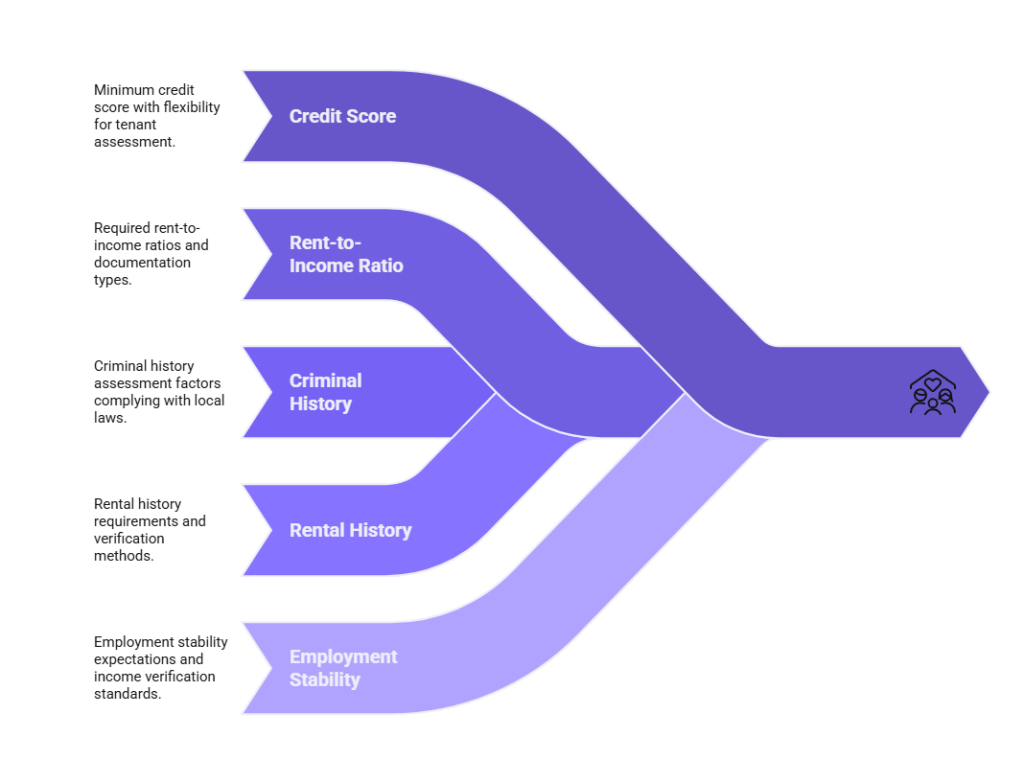

Key criteria elements include:

- Minimum credit score thresholds with contextual flexibility

- Required rent-to-income ratios and acceptable documentation types

- Criminal history assessment factors complying with local laws

- Rental history requirements and verification methods

- Employment stability expectations and income verification standards

Written policies documenting screening criteria provide legal protection and operational consistency, particularly for landlords managing multiple properties or working with property managers. Policies ensure that all applicants receive evaluation under identical standards regardless of which staff member processes applications.

Evaluating Technology-Assisted Screening Tools

Technology platforms offering automated tenant screening have proliferated, presenting both opportunities and evaluation challenges for landlords. These tools promise efficiency through rapid report generation and standardized processes but vary significantly in accuracy, compliance features, and cost structures.

| Evaluation Factor | What to Assess | Why It Matters |

| Data Source Quality | Database comprehensiveness and accuracy | Determines report reliability and completeness |

| Compliance Features | FCRA disclosures, state-specific restrictions | Ensures legal requirement fulfillment |

| Turnaround Time | Report generation speed | Affects competitiveness in fast markets |

| Cost Structure | Landlord-paid vs. applicant-paid models | Impacts operating costs and applicant experience |

| False-Positive Rate | Accuracy of identity matching | Prevents erroneous disqualifications |

Landlords evaluating screening technology should assess data source quality, though comprehensive databases do not guarantee accuracy. Systems accessing major credit bureaus and criminal record repositories generally provide broader coverage than limited sources, but criminal record databases particularly are known to contain incomplete disposition information, identity matching errors, and outdated records. Landlords should verify concerning findings through primary sources such as court records before making adverse decisions.

Balancing Thoroughness With Application Speed

The tension between comprehensive screening and rapid decisions represents a central challenge in competitive rental markets. Qualified applicants considering multiple properties may accept offers from landlords who make faster decisions, even if slower landlords ultimately would have approved them under more thorough screening.

Optimization strategies include:

- Front-loading information collection through detailed applications

- Parallel processing of multiple verification activities simultaneously

- Clear communication about timeline expectations to manage applicant patience

- Conditional approval methods for low-risk pending verifications

- Prioritization of critical screening elements over nice-to-have information

Conditional approval methods allow landlords to extend offers pending final verification completion for specific, clearly defined items. For example, if credit and criminal checks return acceptable results but employment verification remains pending due to employer responsiveness delays, conditional approval subject to satisfactory employment confirmation may be appropriate. Landlords using conditional approvals should ensure conditions are applied uniformly across all applicants, document the specific pending verification clearly, and understand that withdrawing conditional approval based on subsequently obtained information still requires full FCRA adverse action procedures.

Compliance Considerations in Tenant Screening

Legal compliance in tenant screening involves multiple overlapping regulatory frameworks at federal, state, and local levels. Requirements vary by jurisdiction and continue evolving, requiring landlords to maintain current knowledge and adapt practices accordingly.

Fair Credit Reporting Act Requirements

The Fair Credit Reporting Act establishes foundational requirements when landlords use consumer reports for tenant screening. Consumer reports include credit reports, criminal background checks, and eviction history reports obtained from consumer reporting agencies.

Landlords must obtain written authorization from applicants before procuring consumer reports. Authorization forms should clearly explain what types of reports will be obtained and how information may be used in rental decisions. Authorizations must be standalone documents rather than buried in general application forms.

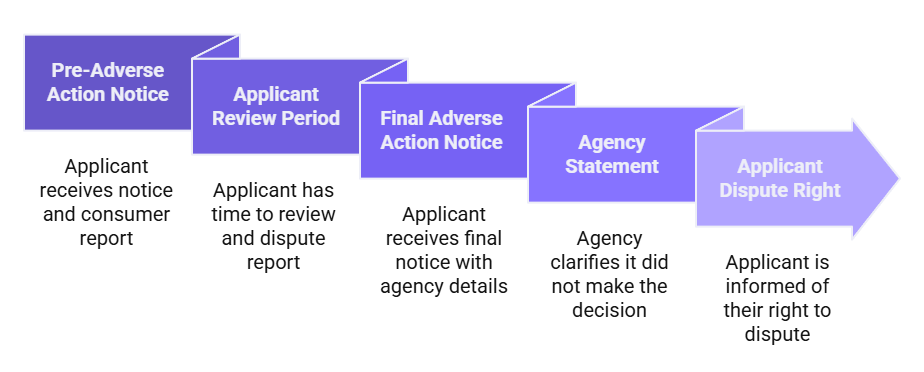

FCRA adverse action procedures require:

- Pre-adverse action notice before final decisions, including a copy of the consumer report and summary of FCRA rights

- Reasonable time (typically at least several business days) for the applicant to review and dispute report accuracy

- Final adverse action notice after the waiting period, identifying the consumer reporting agency's name and contact information

- Statement in the final notice that the agency did not make the adverse decision

- Notification of the applicant's right to dispute report accuracy with the agency

These procedural requirements apply regardless of whether other factors also contributed to the adverse decision.

State and Local Screening Restrictions

State and local laws increasingly regulate specific aspects of tenant screening beyond federal baseline requirements. These regulations vary significantly by jurisdiction, creating complexity for landlords operating in multiple markets.

Ban-the-box laws restrict timing and methods of criminal history inquiries. Some jurisdictions prohibit criminal history questions on initial applications, requiring landlords to wait until later screening stages. Others mandate individualized assessment considerations or prohibit certain types of disqualifications. Landlords must understand requirements in their specific jurisdictions.

Lookback period limitations restrict how far into an applicant's history landlords may consider certain information. Requirements vary significantly by jurisdiction. Some areas impose seven-year lookback periods for criminal convictions and eviction records, while others mandate shorter periods, establish different timeframes for different offense categories, or prohibit consideration of certain records entirely. Landlords must verify the specific requirements applicable to their location.

Fair Housing and Anti-Discrimination Principles

Fair housing laws prohibit discrimination based on protected characteristics including race, color, religion, sex, national origin, familial status, and disability. Many state and local laws add additional protected classes such as sexual orientation, gender identity, or source of income.

Screening criteria that appear neutral but disproportionately affect protected classes can violate fair housing laws through disparate impact theory even without discriminatory intent. Landlords should ensure screening criteria are necessary to achieve legitimate business purposes and do not create unnecessary discriminatory effects.

Consistent application of screening criteria across all applicants is essential. Selective application, stricter standards for certain applicants, or inconsistent verification practices create discrimination liability even if the criteria themselves are lawful. Documentation of uniform application provides important evidence in disputes.

Building an Effective Tenant Screening Process

Systematic screening processes produce more consistent results, reduce legal risk, and improve operational efficiency compared to ad-hoc approaches that vary by property or application timing.

Designing Screening Workflows

Effective screening workflows define each process step, responsible parties, timing requirements, and decision criteria. Written workflows ensure consistent execution across properties and staff members while identifying efficiency bottlenecks.

Workflows should specify application requirements including what documentation applicants must submit initially versus what landlords will independently verify. Decision-making authority should be clearly assigned to prevent delays and ensure appropriate expertise applies to decisions. Documentation requirements within workflows serve both operational and legal purposes by creating evidence supporting non-discriminatory practices.

Creating Compliant Screening Policies

Written screening policies document the criteria and procedures landlords apply in tenant selection. Comprehensive policies address each screening component, specify minimum qualifications and evaluation methods, and explain procedures for individualized assessments when required by law.

Effective policies include:

- Specific qualification criteria for each screening component

- Evaluation methods and weighting of different factors

- Procedures for individualized assessment when legally required

- Documentation requirements and retention periods

- Review and update schedules to maintain legal compliance

Accessibility and transparency of screening policies benefit both landlords and applicants. Making policies available to prospective applicants allows self-assessment of qualification likelihood before application submission, reducing unqualified application volume.

Managing Applicant Data Securely

Tenant applications contain sensitive personal information including Social Security numbers, financial data, and potentially criminal history or medical information related to reasonable accommodation requests. Data protection obligations arise from multiple sources including state privacy laws, federal requirements, and general tort liability for negligent data handling.

| Data Lifecycle Stage | Security Practices | Compliance Purpose |

| Collection | Collect only necessary information | Privacy law compliance, minimization principle |

| Storage | Physical security and encryption | Unauthorized access prevention |

| Retention | Time-limited based on legal requirements | Balance operational needs with privacy |

| Disposal | Shredding and permanent electronic deletion | Prevent unauthorized recovery |

Landlords should establish data security practices covering collection, storage, retention, and disposal. Information should be collected only when necessary for legitimate screening purposes, as required by many state privacy laws. Storage methods must protect against unauthorized access through both physical security for paper documents and cybersecurity measures for electronic data. Encryption of electronic files containing sensitive personal identifiers provides important protection and may be legally required in some jurisdictions. Landlords should verify whether state-specific data security and privacy laws apply to their operations.

Retention policies should balance operational needs against privacy principles. Applications and screening documentation for accepted tenants become part of rental records maintained during tenancy and for periods after move-out as required by applicable recordkeeping laws.

Rental Screening Best Practices for Decision Quality

High-quality screening decisions accurately predict rental performance while maintaining legal compliance and operational efficiency. Best practices focus on information quality, consistent evaluation, and continuous improvement.

Verifying Information Accuracy

Information accuracy determines decision quality. Screening based on erroneous data produces wrong outcomes regardless of how sophisticated the evaluation methodology. Landlords should implement verification practices that confirm information reliability before using it in decisions.

Credit report accuracy issues are well documented, with studies indicating significant error rates. Applicants should have opportunity to review reports and dispute inaccuracies before adverse decisions become final. Criminal record databases vary in completeness and currency, and records may reflect charges that were dismissed, contain incorrect identity matches, or fail to reflect case dispositions.

Reference information reliability depends on authenticating reference providers and asking specific verifiable questions. General character references provide less useful information than specific behavioral questions about payment history, lease compliance, and property condition.

Implementing Consistent Evaluation Standards

Consistency in applying screening criteria is essential for both fair housing compliance and decision quality. Inconsistent application introduces subjective judgment that may reflect conscious or unconscious bias and creates discrimination liability.

Consistency mechanisms include:

- Standardized scoring systems assigning points to screening elements

- Documentation of decision rationale for all applications

- Multiple decision-maker review for borderline cases

- Regular audits of decision patterns across protected classes

- Training for all personnel involved in screening decisions

These practices reduce subjective variation while maintaining flexibility for individualized assessment where legally required.

Learning From Outcomes to Refine Criteria

Screening criteria should be treated as hypotheses about risk factors subject to testing against actual outcomes. Landlords should track whether screening predictions accurately identify successful versus problematic tenancies and adjust criteria based on performance data.

Key performance indicators include payment delinquency rates, eviction frequency, early lease terminations, and property damage at move-out for tenants across different screening score ranges. If tenants marginally meeting screening standards perform as well as those comfortably exceeding them, criteria may be unnecessarily restrictive. Market conditions affect optimal screening criteria, and adjustments should reflect current demand dynamics.

Conclusion

Strategic tenant screening in 2026 requires landlords to design proportionate processes matching verification depth to legitimate risk factors and regulatory requirements rather than maximizing information collection uniformly. Effective screening balances thoroughness with competitive speed, implements compliance obligations across federal and jurisdiction-specific frameworks, and continuously improves decision quality through outcome-based criteria refinement.

Frequently Asked Questions

What are the most important elements in a tenant background check guide?

A comprehensive tenant background check guide addresses credit evaluation to assess financial capacity, rental history verification for behavioral patterns, income documentation to confirm payment ability, and criminal background screening where legally appropriate. Each component serves distinct analytical purposes and requires specific verification methods and compliance procedures under applicable regulations.

How long should a complete tenant screening process take?

Screening timelines typically range from two to seven days depending on verification complexity and information source responsiveness. Competitive markets demand faster processing, achievable through parallel verification activities and front-loading documentation requirements. Landlords should communicate expected timelines clearly to manage applicant expectations while maintaining thoroughness.

What credit score is required for rental applications?

No universal credit score threshold exists for rental approval. Landlords establish requirements based on their risk tolerance and market conditions. Score thresholds vary widely depending on property type, local market dynamics, and applicant pool characteristics. Credit scores represent only one factor among multiple screening elements, and individualized assessment considering overall financial patterns provides more accurate risk evaluation than rigid score cutoffs.

Can landlords deny applications based on criminal history?

Criminal history use in tenant screening is legally complex and heavily regulated. Federal guidance and many state laws prohibit blanket exclusions, requiring individualized assessments considering offense nature, elapsed time, rehabilitation evidence, and relationship to tenancy risks. Many jurisdictions impose lookback period limits and procedural requirements. Landlords must understand specific rules in their location and conduct individualized reviews.

What tenant reference check questions are most effective?

Effective reference questions focus on verifiable behavior rather than subjective opinions. Questions should address rent payment timeliness, lease term completion, notice requirements followed, property condition at move-out, noise or neighbor complaints received, and whether the landlord would rent to the applicant again. Verifying reference authenticity through independent confirmation of landlord identity improves information reliability.

Are tenant screening services legally compliant?

Tenant screening service compliance varies significantly among providers. Landlords should verify that services obtain proper applicant authorization, provide required FCRA disclosures and notices, maintain current legal requirements including state-specific restrictions, and support individualized assessment where required. Platform evaluation should address data source quality, accuracy, turnaround time, and whether features facilitate legal compliance obligations.

How should landlords handle incomplete screening information?

Incomplete screening information requires strategic decisions balancing risk assessment needs against competitive timing pressures. Options include requesting information directly from applicants with specified deadlines, proceeding with conditional approval pending final verification for low-risk gaps, or declining applications when critical information remains unavailable after reasonable efforts. The appropriate approach depends on market conditions and what information is missing.

What documentation should landlords maintain from the screening process?

Landlords should retain applications, authorization forms, consumer reports obtained, verification documentation, decision rationale notes, and all communications with applicants regarding screening. Documentation from accepted tenants becomes part of ongoing rental records. Materials from rejected applicants should typically be maintained for periods sufficient to defend potential discrimination claims under applicable statutes of limitations, then securely destroyed to protect applicant privacy.

Additional Resources

- The Fair Credit Reporting Act

https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act - HUD Guidance on Application of Fair Housing Act Standards to the Use of Criminal Records

https://www.hud.gov/sites/documents/HUD_OGCGUIDAPPFHASTANDCR.PDF - Consumer Financial Protection Bureau: Tenant Screening Reports

https://www.consumerfinance.gov/consumer-tools/tenant-screening-reports/ - National Consumer Law Center: Tenant Screening

https://www.nclc.org/issues/tenant-screening.html - Federal Trade Commission: Using Consumer Reports for Credit Decisions

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-credit-decisions-what-know

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.