Navigating the employment screening for highly regulated industries can be a complex and daunting task. Whether you're in staffing or HR, understanding the nuances of industry-specific background checks is crucial for compliance and safety.

This comprehensive guide aims to demystify the screening processes required for staffing in highly regulated industries. We will explore key components such as OIG exclusion screening, the e-QIP process, and SAM.gov verification. By the end, you'll have a solid foundation to streamline your screening process, ensure compliance, and mitigate risks.

Key Takeaways

- Tailored screening in regulated sectors like healthcare, finance, and government is crucial to ensure compliance and safety.

- Industry-specific checks, such as OIG exclusion lists in healthcare and financial crime checks in finance, protect organizations and maintain regulatory standards.

- Implementing precise screening processes like OIG exclusion screening and e-QIP for government roles is necessary to avoid fines and legal issues.

- Using technologies for efficient screenings and keeping updated with regulatory changes ensures compliance and enhances operational accuracy.

- Thorough screening practices safeguard company reputation and compliance, avoiding risks and maintaining trust in your industry.

Introduction

Tailored screening in regulated industries is essential. It helps maintain compliance and safety. Whether you're in healthcare, finance, or government, understanding industry-specific checks is crucial. Different sectors have varied requirements, and a one-size-fits-all approach won't work.

Screening processes ensure that candidates meet the standards set by regulatory bodies. This reduces risk and upholds quality within the workplace. A thorough screening method also protects your organization and enhances your reputation.

Regulated industries demand precision. Compliance isn't just about ticking boxes; it's about implementing processes that align with legal standards. Establishing a rigorous screening protocol is vital for safeguarding your operations and ensuring you hire qualified candidates.

What are we at risk of missing if we get one step out of sync in a background screening? In highly regulated fields, the answer might be lives, trust, or millions. That's why I also think screenings are not a choice: they're protection. The question isnâÂÂt should we invest in rigorous checks, but how do we design them to serve both compliance and people?

Understanding Industry-Specific Checks

Industry-specific checks are background screenings tailored to the unique requirements of certain fields. These checks go beyond standard background verifications to address specific compliance and safety needs, dictated by regulatory bodies. For example, in healthcare, verifying a candidate against the Office of Inspector General's (OIG) exclusion list is crucial to ensure they have not been sanctioned for fraudulent activities. In finance, background checks might focus on financial crimes and credit histories to maintain trust and security in financial operations.

The significance of these specialized screenings cannot be overstated. They are vital in managing risks and ensuring that organizations comply with industry regulations. Failure to conduct these checks accurately can result in fines, legal repercussions, and damage to reputation. By performing these thorough screenings, you protect your organization from potential harm and maintain the trust of clients and stakeholders.

Industries often requiring specific checks include healthcare, finance, and government. Each of these sectors faces unique challenges and legal requirements that demand tailored screening approaches. By understanding the specific screening processes relevant to your field, you streamline operations, mitigate risks, and uphold the standards expected in highly regulated environments.

Screening Processes

OIG Exclusion Screening for Staffing

OIG exclusion screening is an essential part of hiring in the healthcare industry. The Office of Inspector General (OIG) keeps a list of individuals and entities excluded from participating in federally funded healthcare programs. This list identifies those who are prohibited due to convictions related to healthcare fraud, patient abuse, or license loss, among other reasons.

Conducting OIG exclusion screening helps ensure that potential hires are eligible to work in environments funded by federal healthcare programs. Failure to perform these checks could result in hefty fines and significant legal consequences.

To perform an OIG exclusion screening, access the OIG's online database. Search for the applicant's name and confirm they are not listed. Regular checks are advisable, as the list is updated monthly. Keeping this process consistent shields your organization from compliance risks and helps maintain trust within the industry.

e-QIP Process for Staffing

The e-QIP, or Electronic Questionnaires for Investigations Processing, is a system used for government background checks. This system is essential for positions requiring security clearance. Understanding the e-QIP process is crucial if you're staffing for government roles.

Applicants must submit detailed personal history through the e-QIP, including employment, education, and residence. This information is necessary for security clearance processing. Ensure that applicants have access to required documents and understand the details the form requires.

Common challenges with e-QIP involve incomplete information and delays in document provision. Ensure clear communication with candidates about the importance of complete data submission. Offer assistance in navigating the system, as needed, to streamline the process.

SAM.gov Verification

SAM.gov verification checks whether individuals or businesses are eligible to receive government contracts. This step is essential if your staffing agency supplies contractors to the government.

The System for Award Management (SAM) consolidates federal procurement systems. Verifying through SAM.gov ensures your candidate or the company isn't barred from federal contracts due to past performance issues or legal restrictions.

To verify, search the SAM.gov database with the candidate's details. This verification should become part of your standard screening process. Missing this step could risk placing an ineligible candidate, leading to complications with contract awards or renewals. Keeping thorough records of each verification step ensures compliance and supports accountability.

Best Practices for Conducting Industry-Specific Checks

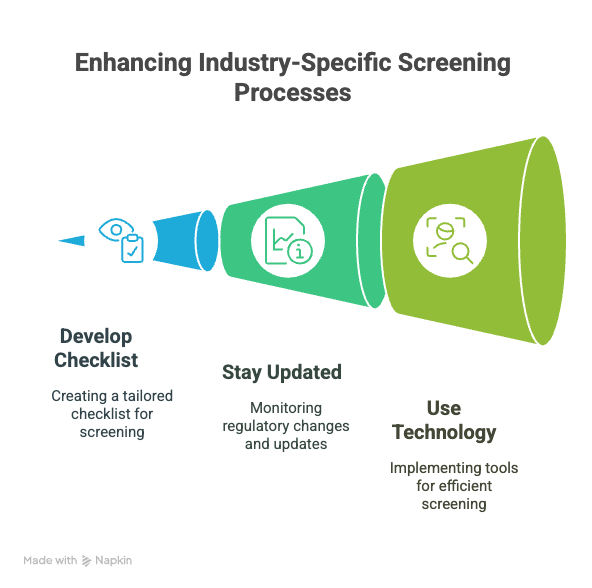

Develop a checklist that caters specifically to the requirements of the industry youâÂÂre hiring for. This will ensure you cover all necessary screenings without missing key steps. Start by identifying the unique compliance needs and potential risks within the sector. For example, in healthcare, include OIG exclusion lists and credential verifications. In finance, prioritize credit checks and qualification verifications.

Stay updated on regulatory changes. Regulations can shift, impacting what checks are necessary or how they should be conducted. Subscribe to industry publications or set alerts for changes in laws that might affect your screening processes. Keeping informed helps ensure your background checks remain compliant.

Use technology to streamline and manage screenings efficiently. There are several tools that automate parts of the screening process, reducing human error and saving time. Look for platforms that integrate with your HR systems and offer comprehensive features tailored to your industry needs. Implementing these technologies can significantly reduce the burden on your HR team and improve accuracy.

By following these practices, you can enhance your screening process, maintain compliance, and reduce the risk of hiring unsuitable candidates.

Legal Considerations and Compliance

Navigating the legal landscape of background checks requires precision. The Federal Trade Commission (FTC) provides guidelines to help you comply. It's crucial to follow these rules to avoid legal troubles. Make sure you review the FTC's guidelines for conducting background checks to stay within the law.

Data privacy is another key area. Safeguard sensitive information diligently. Mishandling data can lead to privacy breaches and hefty fines. Only collect information that is necessary. Ensure your data storage systems are secure and access is restricted to authorized personnel only.

Record keeping is not just a formality; itâÂÂs a compliance requirement. Keep detailed records of all screenings. Documentation should include consent forms and any communications with candidates. Clear record-keeping aids in audits and legal inquiries, providing you a cushion against potential disputes.

Common Pitfalls and How to Avoid Them

Failing to conduct comprehensive background checks is not just a missed step; it's a risk to your company. For example, failing to verify a nurse's exclusion status can lead to non-compliance with Medicaid and Medicare, resulting in penalties. To prevent this, always conduct detailed screenings specific to the industry you operate in.

Information gets outdated. Guidelines change. If you rely on old data, you're inviting trouble. Keep your processes current. Schedule regular reviews of your screening procedures and ensure your team stays informed about regulatory changes.

Ignoring red flags during screening can be costly. If a candidate has inconsistencies in their employment history, don't brush it off. Investigate further. Addressing these issues head-on can save you from bigger problems down the line. It's about protecting your organizationâÂÂs reputation and maintaining integrity in your hiring practices.

Conclusion

Thorough and industry-specific background checks are essential. They safeguard your organization from compliance breaches and mitigate potential risks. Ensuring that your screening processes align with industry demands is non-negotiable. Implement tailored checks to adhere to regulations and protect your company. Each diligent screening reflects your commitment to safety and integrity. Keep processes updated and consistently address red flags. By doing so, you maintain both compliance and trust in your industry.

For further guidance, explore more on our blog. Find comprehensive insights into effective and compliant screening practices tailored to your specific industry needs. At the end of the day, compliance is about more than staying out of penalties; it is ultimately about building trust with the people and communities you work with. Every screening choice you make today helps build your organization's future reputation and resilience.

Frequently Asked Questions (FAQs)

What background checks are required for healthcare staffing agencies?

Healthcare staffing agencies typically need to check criminal records, verify education and professional licenses, and assess employment history. Given the sensitive nature of healthcare work, agencies may also conduct drug testing and check for any history of malpractice or professional misconduct.

How does FINRA compliance affect staffing agencies?

FINRA compliance is crucial for staffing agencies providing candidates to the financial industry. Agencies must ensure that candidates for roles requiring securities licenses have a clean financial background. This includes screening for any criminal records related to fraud or financial misconduct. Agencies need to stay current with FINRA regulations to ensure seamless placements.

Can staffing agencies run continuous background checks?

Yes, some staffing agencies choose to conduct continuous background checks to monitor their candidates' records over time. This can be crucial for industries where maintaining a clean record is necessary. Continuous checks allow agencies to quickly address any changes in a candidate's background.

What disqualifies a candidate in government staffing?

Candidates for government positions may be disqualified for reasons like criminal convictions, falsification of application information, or failing security clearance requirements. Any affiliations that could pose a conflict of interest with government responsibilities might also lead to disqualification.

Who pays for specialized screenings in regulated industries?

Typically, the client company pays for specialized screenings. However, this can vary based on agreements between the agency and the client. Some agencies cover the costs to enhance service offerings and ensure candidate readiness.

What are key considerations for staffing in education settings?

When staffing in educational settings, agencies should run extensive background checks for criminal history, verify educational credentials, and ensure candidates have the necessary certifications. It's important to comply with local and national regulations regarding child safety and teacher qualifications.

Are social media checks part of the background screening process?

Yes, some staffing agencies include social media checks as part of their background screening process. They assess public posts and profiles to ensure candidates maintain a professional online presence, which can be essential for certain roles.

How are international candidates vetted for staffing positions?

International candidates undergo similar checks as domestic ones, such as criminal and employment background checks. However, additional steps may include verifying work visas, translations of credentials, and understanding the candidateâÂÂs legal status to work in the country.

What should companies expect regarding the timing of background checks?

The timing of background checks can vary. It often depends on the depth of the screening required and the candidate's history. Generally, checks take anywhere from a few days to a couple of weeks. Clear communication with the staffing agency can help manage expectations.

Definitions

OIG Exclusion Screening

OIG exclusion screening checks whether a candidate is on the Office of Inspector GeneralâÂÂs List of Excluded Individuals/Entities (LEIE). This list includes people barred from participating in federally funded healthcare programs due to offenses like fraud or license revocation. Hiring someone on this list can lead to financial penalties and legal issues. Use the public OIG database, updated monthly, to verify that candidates are eligible for employment in healthcare settings receiving federal funds.

e-QIP Process

The Electronic Questionnaires for Investigations Processing (e-QIP) system is used for collecting background information from individuals applying for security clearance in government roles. Candidates submit personal history, including employment, education, and foreign contacts. Incomplete or inaccurate data can delay or jeopardize the clearance. If youâÂÂre hiring for government positions, guide candidates through e-QIP thoroughly to prevent unnecessary setbacks.

SAM.gov Verification

SAM.gov verification checks a business or individualâÂÂs eligibility to work on federal contracts. The System for Award Management (SAM) tracks companies and individuals blocked from receiving federal funds due to legal or performance issues. Search the SAM.gov database using contractor or candidate details. Skipping this step can risk contract cancellations or disqualification from future bids.

Compliance

Compliance means following the specific laws and regulations that apply to your industry during the hiring process. In healthcare, for example, that might include checking exclusion lists. In finance, it could involve credit checks or anti-fraud measures. Failing to meet compliance standards can lead to fines, audits, or reputational harm. Build your screening procedures around up-to-date legal requirements.

Background Checks

Background checks verify a candidateâÂÂs history, including employment, education, criminal records, or credit information, depending on the job role. They help confirm qualifications and reduce the risk of hiring individuals who may pose security or legal concerns. Customize these checks to the role and industry. For example, healthcare may require license verifications, while finance may need credit screening.

References

- First Advantage 2021 Trends Report

- Comprehensive Analysis of Background Screening Impact on Employee Experience and Organizational Outcomes

- Background Screening Solutions Market Report

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.