When running a staffing agency or handling recruitment processes, you may often encounter unique screening requirements from clients. These needs could stem from specific industry regulations, corporate policies, or even the unique nature of the role being filled. Understanding and addressing these unusual requests is crucial for maintaining compliance and ensuring client satisfaction.

This guide will explore the landscape of uncommon client screening demands, provide insights into accommodating these requests effectively, and discuss the legal and ethical implications of their fulfillment. By the end, you'll be better prepared to tackle quirky client screening requirements without compromising on compliance or quality.

Key Takeaways

- Client screening aligns the right candidates with the right roles while respecting the needs of both the client and the candidate.

- Some screening requests are unusual and may require specific expertise, industry knowledge, or tailored approaches.

- Adhering to compliance and privacy laws is crucial to avoid legal issues during the screening process.

- Leveraging the right tools and resources can streamline your processes and enhance efficiency.

- Clear communication and thorough documentation build trust and help tailor your approach to meet client needs effectively.

Introduction

Client screening is a critical part of the recruitment process. At its core, it's about matching the right people with the right roles while protecting the interests of both parties. This involves understanding the specific screening requirements each client demands. Sometimes these requests fall outside the norm, setting the stage for a deeper dive into what makes a screening request unusual and how to handle it.

Unusual requests go beyond the standard background checks. They're characterized by the need for additional scrutiny due to sector-specific regulations, particular company policies, or the sensitive nature of a job. For instance, a financial firm may ask for detailed credit checks, while a tech company may want extensive social media checks. Understanding these needs boils down to comprehension and communication between you, the staffing professional, and your client.

The purpose of this guide is to equip you with the tools to navigate these intricacies. We will explore how to meet the expectations of these complex requests without stumbling on compliance issues. Ultimately, you'll gain insights into handling quirky screening demands, ensuring your staffing processes are both compliant and aligned with client needs.

EXPERT INSIGHT: Not all background check inquiries are created equal, and I have learned that over time working as a Human Resources professional. Clients from various fields have requested screening procedures I've never had to deal with before. It may be difficult at times, but that’s where recruiting truly takes place: by listening, assisting, as well as having regard for the client’s trust and the applicant’s dignity. These encounters make me believe that recruiting isn’t merely about hiring, but about relationship building. We must refrain from breaking rules, demonstrate compassion, as well as ask questions. When we experience issues involving dishonesty, we don’t merely staff positions—we build long-lasting relationships founded on trust. - Charm Paz, CHRP

Understanding Client Screening Requirements

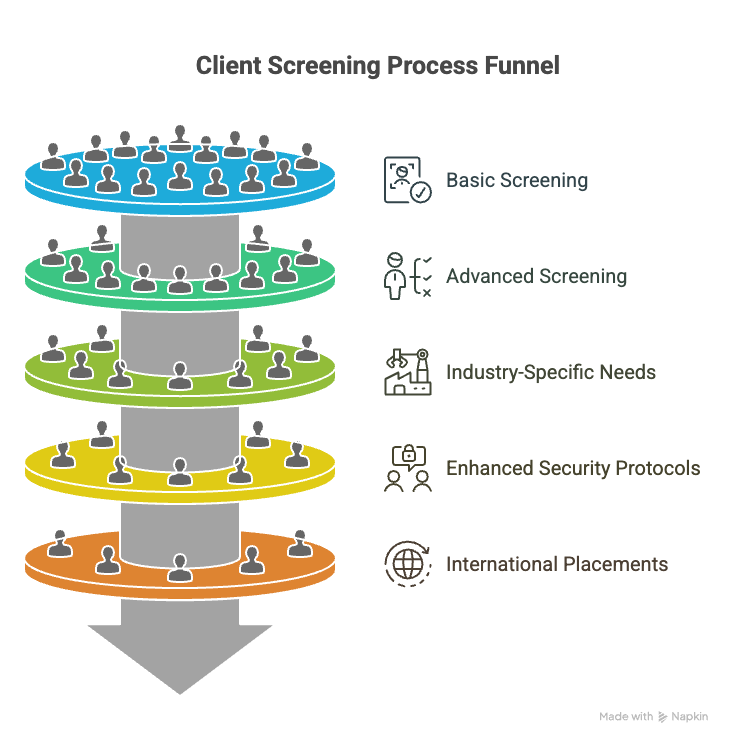

Managing client screening requirements involves distinguishing between basic and advanced screening processes. Most organizations start with baseline checks: verifying identity, education, previous employment, and criminal records. These serve as the foundation for most hire-related decisions.

However, some roles or companies demand more tailored, advanced screening. These requests may include in-depth financial history, deep-dive security clearances, or specific skill verifications. Understanding why these requests occur can arm you for conversations with your clients.

One reason for unusual requests is niche industry needs. A tech firm might want a rigorous review of a candidate’s coding expertise. An airline might require extensive background checks due to regulatory demands. Enhanced security protocols are another driver. Positions involving sensitive information or critical infrastructure demand an extra layer of scrutiny.

Next, there’s the matter of international placements. Global roles require checks that comply with the legal frameworks of multiple countries. This can involve navigating through maze-like regulations. Understanding these intricacies helps in executing a seamless screening process.

Consider your response when faced with these unique demands: Are you ready to adjust your methods to meet client needs, or do you need additional preparation? Understanding these differences prepares you to offer informed, comprehensive screening aligned with client expectations.

Types of Unusual Screening Requests

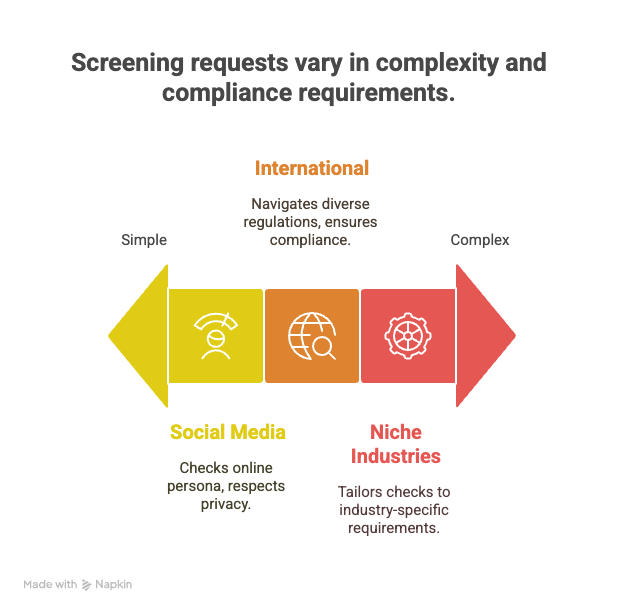

Social media screening can be a tricky area. Many employers want to understand candidates' online personas, but treading lightly is crucial. Does a candidate’s weekend activities reflect on their professional capabilities? Perhaps, but always ensure the process respects privacy laws and EEOC guidelines.

International background checks come with their own hurdles. Different countries have different regulations about what checks are permissible. For example, European countries have stricter data protection laws than many other regions. Understanding these nuances can save time and prevent legal issues. A candidate from France might require different documentation and verification than one from India. Always check local laws and consult reliable resources.

Industries like aviation, healthcare, or finance often demand niche verifications. In aviation, you might need proof of specific technical certifications. In healthcare, verifying medical licenses and malpractice history is imperative. The finance sector may focus on credit checks and past regulatory violations. Knowing these specific needs helps you tailor the screening process appropriately.

Have you dealt with these types of requests before? If not, consider connecting with industry experts or legal advisors to navigate these checks effectively. Each request might seem daunting at first, but with the right approach, it can become a manageable part of your recruitment toolkit.

Tools and Resources

In the fast-paced world of employment background checks, having the right tools is half the battle. Software platforms can streamline your screening processes, making them more efficient and reliable. For instance, platforms like Checkr or GoodHire offer comprehensive background check services, supporting everything from criminal records to education verification. They integrate seamlessly into your existing systems, reducing manual effort and ensuring compliance with relevant laws.

Staying informed is equally critical. Following industry blogs and updates from reputable sources, such as those found on the General blog, can offer valuable insights and trends. These resources help you stay ahead with updates on legal changes, new screening technologies, and emerging best practices.

Leveraging these tools and insights not only enhances efficiency but also helps you maintain a sharp edge in addressing and managing complex screening demands. Are you utilizing the most effective tools and resources in your current process? If not, consider exploring these options to bolster your screening operations.

Best Practices for Managing Unusual Requests

Clear communication with your clients is non-negotiable. You need to fully grasp their screening needs to meet expectations without legal missteps. Start by asking questions. What are their motivations? Are they managing risks linked to security, or aiming to conform to industry standards? Engaging in dialogue helps clarify their needs and sets the groundwork for a harmonious professional relationship.

Balancing flexibility with structure is your next task. While you may need to tailor your process to fit strange requests, don't abandon your methods entirely. Maintain some core elements of your screening process to help manage complexity. For instance, you might integrate a unique check but use the same robust reporting practices you normally would. This approach makes adaptation smoother while retaining control over your processes.

Documentation and reporting are your safety nets. If a dispute arises, you'll need evidence to show why you followed certain procedures. Always document the rationale behind special requests and note every step in the screening process. This not only protects you legally but also helps in auditing and refining your practices. Keep these records accessible yet secure, considering data protection norms.

These practices work together to keep your operations smooth and compliant. They also foster trust with clients, ensuring they know you can handle their unique needs professionally. After all, managing unusual screening requests isn't just about completing a checklist. It's about building strong, reliable partnerships with your clients.

Case Studies

Let's dive into some real-world scenarios to see how companies have effectively navigated unusual screening requests.

Case Study 1: Aviation Industry's Demand for Comprehensive Background Checks

An aviation company needed to fill a crucial position for a pilot, demanding not just typical background checks but very specific verifications. They required checks on international flight logs, stringent medical history reviews, and deep dives into any past incidents logged with global aviation authorities.

How they handled it: The staffing agency collaborated closely with aviation regulatory bodies across different countries. They created a custom checklist to ensure all relevant aspects were covered. The solution was a mix of direct communication with foreign agencies and using specialized software that tracks global aviation certifications.

Key takeaway: Tailoring your approach can be essential when industry standards vary significantly across borders. It demonstrates thoroughness and respects industry-specific protocols, which boosts client trust.

Case Study 2: Tech Company and Social Media Scrutiny

A tech firm requested an in-depth analysis of a candidate's social media presence, aiming to uncover any potential reputation risks. However, the request raised ethical and legal concerns, especially regarding privacy.

How they handled it: The agency set clear boundaries for what could be assessed, focusing only on publicly available information while ensuring compliance with EEOC guidelines. They avoided subjective judgments by using an objective third-party service that specializes in social media screening.

Key takeaway: Clearly define the scope of what will be examined and ensure it doesn’t invade personal privacy. Transparent agreements with clients about ethical boundaries protect both the agency and the candidate.

Case Study 3: Financial Sector's Push for Detailed Credit History

A company in the financial sector required candidates to undergo exhaustive credit checks due to the sensitive nature of the roles. This request added layers of complexity due to the varying credit reporting standards across states.

How they handled it: The agency partnered with a credit reporting agency well-versed in state laws, ensuring all checks were compliant with the Fair Credit Reporting Act (FCRA). Candidates were informed upfront of the credit check requirement and consented to the process.

Key takeaway: Partner with expertise that can navigate the legal landscape effectively. It helps mitigate risk for your agency and protects candidate interests by ensuring compliance.

These case studies underline the importance of adapting your techniques to meet specific client needs without compromising ethical or legal standards. How will you tailor your approach to ensure that you meet both client expectations and your professional obligations?

Conclusion

Summarizing what makes handling unusual client screening requests doable involves revisiting key insights you might have missed. Remember, communication with clients is non-negotiable. Understanding their unique needs from the get-go sets the tone. Knowing the distinction between basic and advanced screening processes is crucial, as unusual requests often demand tailored approaches.

Being adaptable to industry-specific verifications, while staying anchored in legal compliance, not only saves time but also builds trust. Armed with the right tech tools and resources, you can streamline complex checks efficiently. Documentation of all processes is vital—it serves as a safety net against potential issues.

Keeping an ear to the ground for ongoing learning ensures you stay ahead of legal updates and market changes. This continuous learning fosters competence and readiness. Being well-prepared means enhanced client relationships and satisfactory outcomes in staffing solutions. You're equipped to meet even the quirkiest client requests with confidence, enhancing agency reputation and client satisfaction.

Frequently Asked Questions (FAQs)

Do you have questions about special screening requests? Relax, you are not alone. Following are some of the common issues that recruiters ponder over when they conductorough background checks, such as legal issues and best practices. If you are bound by rules or exploring new technologies, you'll find the following FAQs handy to ensure that you do feel secure, ready, and on the same page as your clients as well as applicants.

Can staffing agencies perform social media checks legally?

Yes, but ensure compliance with privacy laws. Always inform candidates about the check and obtain their consent. Keep checks focused on professional, job-related content.

What are the risks of international background checks?

International checks pose challenges like varied laws and language barriers. Partnering with local experts can help ensure accuracy and compliance.

How to handle client requests for credit checks on non-finance roles?

Discuss the necessity and relevance with the client. Credit checks should relate directly to job duties. Consider alternative assessments if uncertain.

Are lifestyle inquiries legal in candidate screenings?

Generally, no. Focus on skills, experience, and job-related qualifications. Avoid questions about personal lifestyle choices to prevent discrimination.

What tools help manage unusual screening requests?

Consider specialized software that automates compliance checks and simplifies complex screening processes. Tools like GoodHire and Checkr offer customizable screening options.

Are there specific legal requirements for conducting background checks?

Yes, follow the Fair Credit Reporting Act (FCRA) in the US, which mandates disclosure and candidate consent. Research local guidelines for international checks.

How should I handle discrepancies in a candidate's background report?

Communicate directly with the candidate for clarification. Give them a chance to explain discrepancies before making any decisions.

What is the best way to inform candidates about their background check results?

Communicate results clearly and professionally. If adverse actions are needed, provide a copy of the report and inform candidates of their rights for dispute.

How can you ensure the accuracy of background checks?

Use reliable, experienced background screening firms. Regularly review and update screening processes for compliance and accuracy. Cross-verify information whenever possible.

Still have questions?

Get in touch with our team today for a personalized demo and discover how our tailored volume pricing and packages can drive results for your business!

How useful was this page?*

Note: your comments are anonymous. We use them to improve the website. Do not include any personal details.

Visit our FCRA Compliance Tool or leave a message here if you need a response.

From the blog Explore the GCheck Content Hub

Background Screening for Remote Employees: A 2026 Operational Guide

27 Jan, 2026 • 16 min read

What Drugs Does a 10 Panel Test Detect? 2026 Guide for Workplace Screening

27 Jan, 2026 • 21 min read

Level 1 vs Level 2 Background Checks: A Strategic Framework for 2026 Hiring Decisions

27 Jan, 2026 • 19 min readThe information provided in this article is for general informational and educational purposes only and should not be construed as legal advice or a substitute for consultation with qualified legal counsel. While we strive to ensure accuracy, employment screening laws and regulations—including but not limited to the Fair Credit Reporting Act (FCRA), Equal Employment Opportunity Commission (EEOC) guidelines, state and local ban-the-box laws, industry-specific requirements, and other applicable federal, state, and local statutes—are subject to frequent changes, varying interpretations, and jurisdiction-specific applications that may affect their implementation in your organization. Employers and screening decision-makers are solely responsible for ensuring their background check policies, procedures, and practices comply with all applicable laws and regulations relevant to their specific industry, location, and circumstances. We strongly recommend consulting with qualified employment law attorneys and compliance professionals before making hiring, tenant screening, or other decisions based on background check information.