Florida background check requirements combine federal protections under the Fair Credit Reporting Act with state-specific screening limitations and county-level procedural variations. Employers operating across multiple Florida jurisdictions must navigate evolving compliance obligations that vary by location, applicant category, and screening methodology to mitigate legal exposure effectively.

Key Takeaways

- Florida employers must comply with both federal FCRA requirements and state-specific screening regulations that restrict certain types of background inquiries.

- County-level variations in record access, processing timelines, and data availability create operational complexity for multi-jurisdictional hiring strategies.

- State law imposes specific limitations on the use of credit history, criminal records, and protected personal information in employment decisions.

- Individualized assessments are increasingly required when adverse employment decisions involve criminal history information.

- Consent and disclosure obligations extend beyond federal minimums in certain Florida screening contexts, requiring careful documentation protocols.

- Remote workforce considerations introduce additional compliance variables when applicants reside in different Florida counties or work across jurisdictional boundaries.

- Technology-assisted screening tools must be validated against Florida-specific legal standards to ensure compliant data sourcing and interpretation.

- Regular compliance audits addressing jurisdiction-specific requirements help organizations identify and correct procedural gaps before they result in legal claims.

Understanding the Florida Background Screening Compliance Landscape

Florida background check requirements operate within a multi-layered regulatory framework that combines federal baseline protections with state statutory limitations and county-level procedural variations. Employers conducting pre-employment screening in Florida encounter compliance obligations that differ based on geographic location, industry sector, position type, and screening methodology employed.

The Fair Credit Reporting Act establishes minimum federal standards when employers obtain consumer reports from consumer reporting agencies for employment decisions, including requirements for written authorization, adverse action procedures, and dispute resolution protocols. These federal protections apply uniformly across all Florida jurisdictions but represent only the foundation of a compliant screening program.

Florida state law supplements federal requirements with additional restrictions on specific types of screening inquiries and uses of background information. These state-level provisions address areas such as credit history limitations, sealed or expunged record restrictions, and specific disclosure obligations that extend beyond federal minimums. Employers must integrate both federal and state requirements into cohesive compliance workflows.

EXPERT INSIGHT: As someone who works in HR, I’ve learned that conducting background checks in Florida is never a simple matter. While it might look like a straightforward issue on the surface, it’s ultimately a decision that depends on a variety of factors. The best background check programs are based on a series of thoughtful decisions that are well-documented. When we are successful in this effort, compliance is not just good for the company; it’s a reflection of how we value trust, consistency, and the dignity of the people we serve. - Charm Paz, CHRP

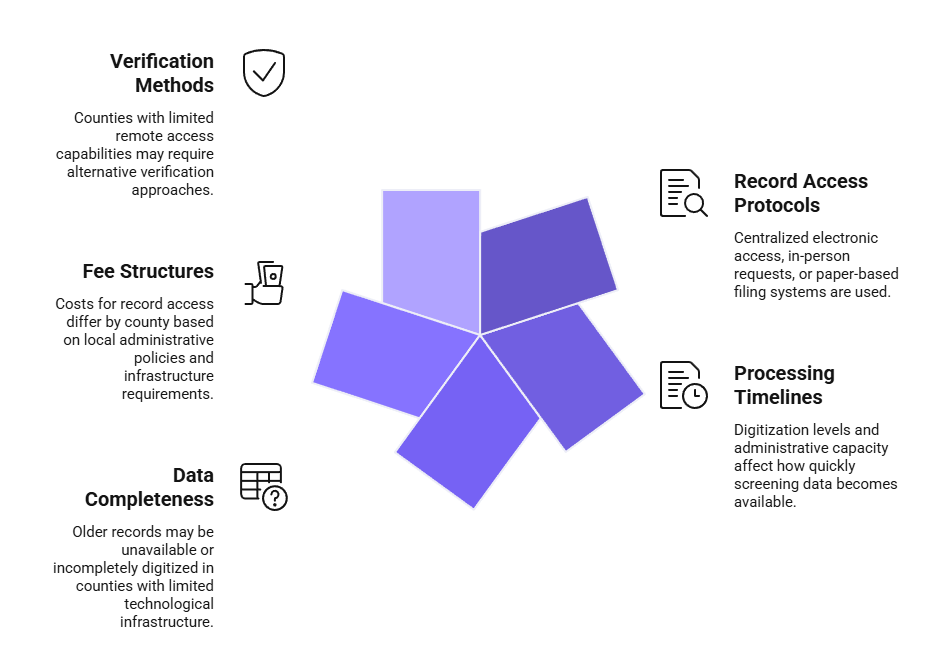

County-Level Jurisdictional Variations

Florida's 67 counties maintain independent court systems and record-keeping infrastructures that introduce significant operational variations in background screening processes. These infrastructure differences directly impact screening timelines, data completeness, and verification accuracy for applicants with residential or employment history spanning multiple counties.

Key operational variations across Florida counties include:

- Record Access Protocols: Some counties provide centralized electronic access through integrated systems, while others require in-person requests or maintain paper-based filing systems

- Processing Timelines: Digitization levels and administrative capacity vary substantially, affecting how quickly screening data becomes available

- Data Completeness: Older records may be unavailable or incompletely digitized in counties with limited technological infrastructure

- Fee Structures: Costs for record access differ by county based on local administrative policies and infrastructure requirements

- Verification Methods: Counties with limited remote access capabilities may require alternative verification approaches

Employers developing scalable screening programs must account for these jurisdictional variations through flexible workflows that adapt to county-specific access methods, processing timelines, and data availability constraints.

Industry-Specific Screening Mandates

Certain Florida industries face mandatory background screening requirements that exceed general employment screening standards. Healthcare facilities, childcare providers, educational institutions, financial services organizations, and security services companies encounter sector-specific screening obligations defined by state licensure requirements and regulatory oversight bodies.

| Industry Sector | Typical Mandatory Screening Components | Regulatory Authority |

| Healthcare | Criminal history, professional licensure, exclusion list checks | Florida Agency for Health Care Administration |

| Childcare Services | Level 2 background screening, abuse registry checks | Department of Children and Families |

| Education | Criminal history, professional certification verification | Department of Education |

| Financial Services | Criminal history, credit checks (position-specific) | Office of Financial Regulation |

| Security Services | Criminal history, fingerprinting, weapons eligibility | Department of Agriculture and Consumer Services |

The interaction between industry-specific mandates and general employment screening restrictions creates complex compliance scenarios. Employers in regulated sectors must integrate mandatory screening elements while maintaining compliance with broader employment screening limitations that apply to all Florida employers.

Federal and State Legal Framework Integration

Compliant Florida background screening programs require seamless integration of federal FCRA requirements with state-specific legal provisions that modify, supplement, or expand baseline federal protections.

FCRA Baseline Requirements

The Fair Credit Reporting Act establishes foundational requirements for any background screening process that involves a consumer reporting agency. Clear written disclosure must be provided in a standalone document separate from employment applications or other materials. Written authorization from the applicant or employee must be secured before requesting any consumer report.

When background screening information contributes to an adverse employment decision, employers must follow specific pre-adverse action and final adverse action procedures. These include providing the individual with a copy of the consumer report, a written summary of rights under FCRA, and reasonable opportunity to dispute inaccurate information before finalizing the adverse decision.

Florida State Statutory Provisions

Florida law supplements federal requirements with additional restrictions on certain types of employment screening inquiries and uses of background information. Credit history information faces usage restrictions for most employment decisions in Florida. Employers may consider credit information when positions involve specific financial responsibilities, access to confidential financial information, fiduciary duties, or other circumstances defined by applicable law.

Sealed, expunged, or otherwise restricted criminal records receive specific protections under Florida law. Employers generally cannot require applicants to disclose criminal history information that has been legally sealed or expunged, and such records should not be considered in employment decisions even if obtained through screening processes.

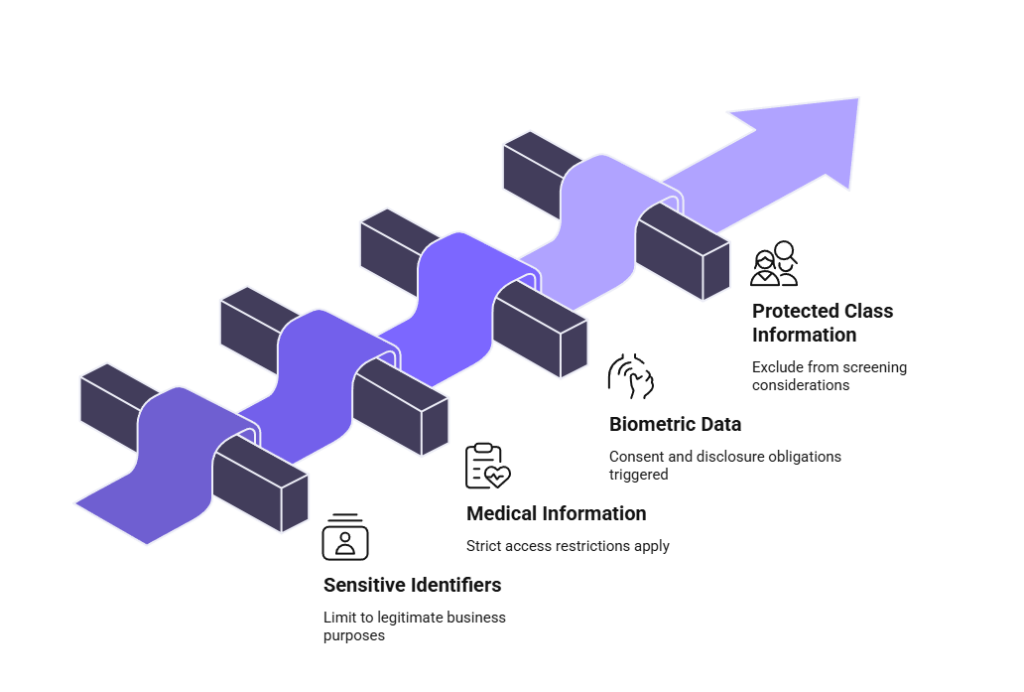

Protected Information and Privacy Considerations

Florida law restricts employer access to and use of certain categories of protected personal information in employment screening contexts. The following categories require particular attention:

- Sensitive Identifiers: Social Security numbers, dates of birth, and similar identifiers must be limited to legitimate business purposes

- Medical Information: Health records, genetic data, and disability-related information face stringent access restrictions except in narrowly defined circumstances

- Biometric Data: Fingerprints, facial recognition data, and other biometric identifiers trigger specific consent and disclosure obligations

- Protected Class Information: Information related to race, religion, national origin, or other protected characteristics must be excluded from screening considerations

Employers implementing technology-assisted screening tools that collect biometric identifiers must ensure that data collection, storage, and use practices comply with applicable privacy protections.

Developing Jurisdiction-Specific Compliance Workflows

Effective compliance with Florida background check requirements demands operational workflows that adapt to the specific jurisdictional contexts in which an organization conducts hiring activities.

Multi-County Hiring Decision Trees

Organizations hiring across multiple Florida counties benefit from decision tree frameworks that guide screening personnel through jurisdiction-specific compliance variables. These decision tools help ensure that screening procedures adapt appropriately to the county in which an applicant resides, previously worked, or will be employed.

Decision tree frameworks should address key jurisdictional variables including record access methods, processing timeline expectations, data completeness considerations, and verification protocols appropriate for each county's infrastructure. This approach enables consistent compliance standards while accommodating legitimate operational variations across jurisdictions.

Multi-county screening workflows should incorporate contingency protocols for situations where county-specific constraints affect screening completeness or timelines. Clear procedures for documenting jurisdictional limitations, communicating delays to hiring managers, and making appropriately calibrated decisions based on available information help maintain both compliance and operational effectiveness.

Position-Specific Screening Calibration

Not all positions require identical screening depth or scope. Compliant screening programs calibrate background check components to position-specific risk factors, responsibilities, and access levels. Position analysis should identify specific risk factors including financial authority, access to sensitive information, unsupervised contact with vulnerable populations, security responsibilities, or regulatory licensing requirements.

| Risk Factor Category | Screening Components to Consider | Documentation Requirements |

| Financial Authority | Criminal history, employment verification, financial background verification (where legally permissible) | Business necessity justification, individualized assessment records |

| Sensitive Information Access | Criminal history, reference checks, identity verification | Access level determination, position-specific risk analysis |

| Vulnerable Population Contact | Comprehensive criminal history, abuse registry checks, reference verification | Regulatory compliance documentation, enhanced monitoring protocols |

| Security Responsibilities | Criminal history, previous employment verification, professional references | Clearance level requirements, ongoing monitoring procedures |

| Regulatory Licensing | Professional license verification, disciplinary action checks, education verification | Licensure authority confirmation, continuing education validation |

Documentation of the position analysis and screening calibration rationale provides important defensibility if screening decisions face legal challenge.

Remote Workforce Compliance Considerations

Remote work arrangements introduce additional compliance variables when employees reside in different Florida counties or work across jurisdictional boundaries. Screening programs must address which jurisdiction's specific requirements apply when an employee's residence, work location, and employer location differ.

For remote employees, compliance best practices typically involve applying the most protective standard among relevant jurisdictions. Changes in employee residence or work location may trigger different compliance obligations for subsequent screening activities, requiring flexible procedures that can adapt to evolving jurisdictional contexts throughout the employment relationship.

Criminal History Screening and Individualized Assessments

Criminal history information represents one of the most legally complex and operationally challenging components of Florida background screening. Employers must navigate federal guidance on consideration of criminal records, state-specific restrictions on use of certain criminal history information, and evolving legal standards requiring individualized assessments.

Permissible Scope of Criminal History Inquiries

Florida employers have broad authority to inquire about criminal history information for most positions, subject to specific limitations on sealed or expunged records and certain categories of restricted information. However, the permissibility of asking about criminal history does not automatically translate into permissibility of using that information as a basis for adverse employment decisions.

The timing of criminal history inquiries varies based on position type and industry context. While Florida does not impose general statewide restrictions on when in the application process employers may inquire about criminal history, employers should verify whether specific local ordinances apply in their jurisdiction that may affect inquiry timing. Employers should carefully consider which categories of criminal history information are genuinely relevant to specific position requirements.

Individualized Assessment Requirements

Federal guidance and developing case law increasingly require employers to conduct individualized assessments when criminal history information contributes to adverse employment decisions. Blanket disqualification policies that automatically exclude all applicants with certain types of criminal history face heightened legal scrutiny and may violate anti-discrimination protections.

An effective individualized assessment evaluates three core factors:

- Nature and Gravity of Offense: The specific criminal conduct and its severity in relation to job responsibilities

- Time Elapsed: Period since the offense occurred or sentence was completed, including evidence of rehabilitation

- Position-Specific Risk: Whether the particular criminal history creates unacceptable risk in the context of specific job duties

Providing applicants with meaningful opportunity to present mitigating information strengthens individualized assessment processes. Context about rehabilitation efforts, changed circumstances, errors in records, or explanations of underlying events may substantially affect risk evaluation.

Documentation and Defensibility

Thorough documentation of criminal history screening decisions provides essential legal defensibility. Records should demonstrate that decisions were based on individualized assessments of job-relatedness rather than categorical exclusions, and that consideration was given to relevant mitigating factors presented by applicants.

Documentation should capture the specific factors considered in the individualized assessment, the rationale for determining that particular criminal history created unacceptable risk for the specific position, and evidence that less restrictive alternatives were considered. Consistency in decision-making across similar positions and applicants with comparable criminal histories strengthens legal defensibility.

Technology-Assisted Screening and Validation Requirements

Technology platforms, automated screening tools, and artificial intelligence applications increasingly support or replace manual background screening processes. These technological approaches offer efficiency and scalability benefits but introduce distinct compliance considerations that Florida employers must address.

Data Source Verification and Accuracy

Technology-assisted screening tools aggregate data from numerous sources with varying accuracy, completeness, and currency characteristics. Validation of technology platform data sources requires understanding where information originates, how frequently sources are updated, and what quality control processes ensure accuracy.

Screening tools that compile information from secondary databases rather than authoritative primary sources may introduce accuracy risks that affect compliance with FCRA requirements. Procedures for verifying uncertain or potentially inaccurate information become particularly important when using automated screening tools. Technology platforms may flag records that require human review to determine whether they actually relate to the applicant, reflect current legal status, or contain errors requiring correction.

Algorithm Transparency and Disparate Impact

Screening tools that use algorithms, predictive models, or artificial intelligence to analyze background information or generate risk assessments face heightened scrutiny regarding potential disparate impact on protected groups. Algorithm transparency enables employers to evaluate whether automated screening tools apply job-related, consistent-with-business-necessity criteria.

| Algorithm Risk Area | Compliance Evaluation Requirement | Mitigation Strategy |

| Opaque Decision Logic | Vendor explanation of scoring methodology and weighting factors | Require algorithm documentation and periodic validation testing |

| Disparate Impact Potential | Statistical analysis of pass rates and risk scores by protected groups | Conduct adverse impact analysis and adjust thresholds if disparate impact identified |

| Data Source Bias | Review of underlying training data and source databases for demographic skew | Validate data sources and supplement with primary record verification |

| Proxy Discrimination | Assessment of whether neutral factors correlate with protected characteristics | Evaluate business necessity of factors showing protected-group correlation |

Employers using technology-assisted screening tools cannot delegate their compliance obligations to vendors. Legal accountability for FCRA compliance, anti-discrimination protections, and state-specific screening restrictions remains with the employer regardless of vendor involvement.

Vendor Management and Compliance Accountability

Effective vendor management includes due diligence on vendor compliance practices, contractual allocation of compliance responsibilities, and ongoing monitoring of vendor performance. Vendor contracts should clearly specify accuracy standards, data source requirements, update frequencies, and compliance validation procedures.

Adverse Action Procedures and Applicant Rights

When background screening information contributes to an adverse employment decision, employers must follow specific procedural requirements designed to protect applicant rights and ensure decision accuracy.

Pre-Adverse Action Notice Requirements

Before taking adverse action based on information in a consumer report, employers must provide the affected individual with a pre-adverse action notice. This notice must include a copy of the consumer report and a written summary of rights under FCRA. This pre-adverse action notice creates an opportunity for individuals to identify and dispute inaccurate information before decisions become final.

The pre-adverse action notice should clearly communicate that adverse action is being considered, identify the specific background screening information contributing to the decision, and explain the process for disputing inaccurate information. Reasonable time periods for pre-adverse action response commonly range from five to ten business days based on industry practice, though specific circumstances may warrant longer periods depending on the complexity of potential disputes.

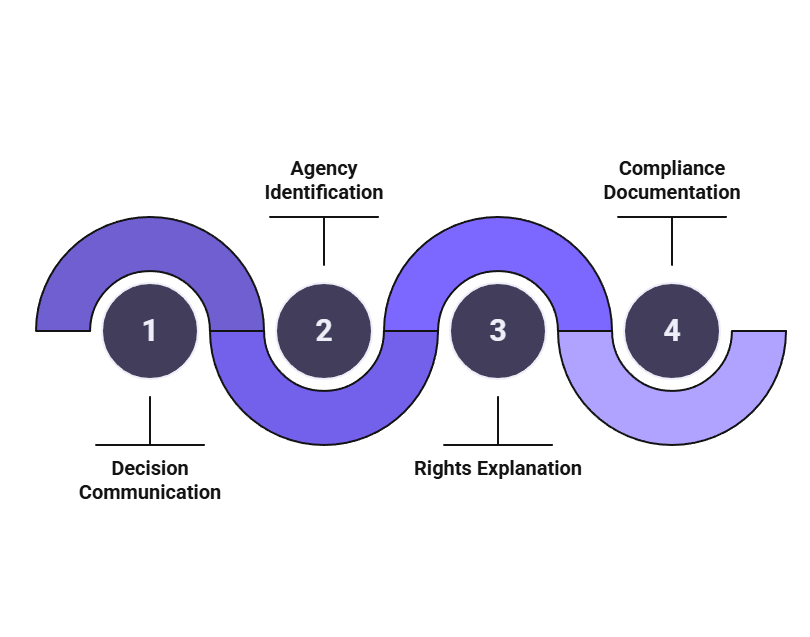

Final Adverse Action Notice and Documentation

After completing the pre-adverse action process and determining to proceed with the adverse decision, employers must provide final adverse action notice. This notice serves several critical functions:

- Decision Communication: Informs the individual that adverse action has been taken

- Agency Identification: Names the consumer reporting agency that provided the report

- Rights Explanation: Details the individual's rights to obtain additional report copies and dispute information directly with the consumer reporting agency

- Compliance Documentation: Creates record of procedural requirement completion

Retention of adverse action documentation according to applicable record-keeping requirements preserves evidence of compliance. Records should include copies of notices provided, evidence of delivery method and timing, any responses or additional information received from individuals, and rationale for final decisions.

Dispute Resolution and Reinvestigation

Individuals who dispute the accuracy or completeness of background screening information trigger reinvestigation obligations for consumer reporting agencies. Employers should have clear procedures for addressing situations where disputes identify errors in information that contributed to adverse decisions.

When reinvestigation reveals that adverse action was based on inaccurate information, employers should have protocols for reconsidering the employment decision based on corrected information. Clear communication with affected individuals throughout dispute and reinvestigation processes demonstrates good faith compliance efforts.

Building Dynamic Compliance Infrastructure

Florida background check requirements continue evolving through legislative amendments, regulatory guidance updates, and judicial interpretations that refine compliance obligations. Effective compliance programs incorporate dynamic elements that enable adaptation to changing legal standards without requiring complete operational overhauls.

Regular Compliance Audits and Gap Analysis

Periodic compliance audits examine whether current screening practices align with applicable legal requirements and identify gaps requiring corrective action. These audits should address federal FCRA compliance, Florida state statutory requirements, county-level procedural considerations, and industry-specific mandates relevant to the organization.

Compliance audits should review documentation of authorization and disclosure practices, adverse action procedures, individualized assessment processes, vendor management controls, and data security measures. Gap analysis following compliance audits prioritizes identified deficiencies based on legal risk severity and implementation complexity.

Training and Accountability Mechanisms

Individuals involved in hiring and screening decisions require regular training on applicable compliance requirements and organizational procedures designed to satisfy those requirements. Training should be tailored to specific roles, addressing the compliance considerations most relevant to each participant's responsibilities in screening processes.

Training content should address both the specific procedural requirements of compliant screening and the underlying legal principles that inform those requirements. Understanding why certain procedures are required helps personnel make better judgments when encountering scenarios not explicitly addressed by documented procedures.

Accountability mechanisms ensure that compliance procedures are consistently followed and that deviations are identified and corrected promptly. Regular monitoring, spot-check audits, and periodic recertification requirements help maintain compliance focus and identify training needs or procedural refinements that could strengthen compliance outcomes.

Regulatory Monitoring and Adaptive Protocols

Staying current with changes in applicable laws, regulations, and enforcement guidance requires systematic regulatory monitoring. Organizations should designate responsibility for tracking legal developments affecting background screening compliance and establishing processes for evaluating how changes affect current practices.

When legal requirements change, organizations need protocols for assessing impact on current screening procedures, determining necessary modifications, implementing procedural changes, updating training materials, and communicating changes to relevant personnel. Documentation of regulatory changes and organizational responses provides evidence of good faith compliance efforts.

Conclusion

Florida background check requirements demand integration of federal baseline protections with state-specific statutory provisions and county-level procedural variations into cohesive compliance workflows. Organizations that develop dynamic, jurisdiction-aware screening frameworks position themselves to maintain compliance as legal standards evolve while supporting effective risk management in employment decisions.

Frequently Asked Questions

The questions that are answered in the following section are those that Florida employers most often face in the design and application of their background screening programs. This section, which is often referred to as an FAQ, translates complex legal requirements into practical answers that can be understood and applied in the context of federal, state, and county law.

What background checks are legal in Florida for employment purposes?

Florida employers may generally conduct criminal history checks, employment verification, education verification, professional license verification, and certain other background screening components, subject to FCRA requirements and state-specific restrictions on credit checks, sealed records, and protected personal information. Specific permissibility depends on position requirements and industry context.

Do Florida background check requirements vary by county?

While substantive legal requirements apply statewide, operational factors including record access methods, processing timelines, data availability, and court system procedures vary significantly across Florida's 67 counties. Organizations hiring in multiple counties must adapt workflows to jurisdiction-specific operational constraints while maintaining consistent compliance standards.

How long can criminal history be considered in Florida employment decisions?

Florida law does not impose specific lookback period limitations for criminal history consideration in most employment contexts. However, employers must conduct individualized assessments that consider time elapsed since offenses and evidence of rehabilitation. Consideration of very old offenses with no subsequent issues may be difficult to justify as job-related.

What are pre-adverse action requirements for Florida employers?

Before taking adverse action based on background screening information, Florida employers must provide applicants with copies of consumer reports, written summaries of FCRA rights, and reasonable opportunity to dispute inaccurate information. Final adverse action notices must be provided after completing this process and include information about applicant rights to obtain additional report copies.

Can Florida employers use artificial intelligence in background screening?

Florida employers may use technology-assisted screening tools including artificial intelligence applications, provided these tools comply with FCRA accuracy requirements, do not create unlawful disparate impact, and maintain data privacy protections. Employers remain accountable for compliance regardless of vendor involvement in screening processes.

Are individualized assessments required for criminal history in Florida?

While Florida does not explicitly mandate individualized assessments by statute, federal guidance and anti-discrimination principles increasingly require case-by-case evaluation of criminal history relevance rather than categorical exclusions. Individualized assessments consider offense nature, time elapsed, and position-specific risk factors to determine job-relatedness.

How do remote work arrangements affect Florida background screening compliance?

Remote work introduces complexity when employee residence, work location, and employer location span different Florida counties with varying procedural requirements. Best practices involve applying the most protective standard among relevant jurisdictions and adapting compliance procedures when employee locations change during employment.

What documentation should Florida employers maintain for background screening compliance?

Employers should retain authorization forms, disclosure documents, copies of consumer reports, pre-adverse and final adverse action notices, documentation of individualized assessments, records of information disputed and corrected, and evidence of vendor due diligence. Retention periods should align with applicable record-keeping requirements and potential statute of limitations considerations.

Additional Resources

- Fair Credit Reporting Act Full Text and Official Interpretations

https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act - Federal Trade Commission FCRA Compliance Guidance

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-employers-need-know - Equal Employment Opportunity Commission Guidance on Arrest and Conviction Records

https://www.eeoc.gov/laws/guidance/arrest-and-conviction-records - Florida Statutes Title XXXI Labor (Employment Screening Provisions)

http://www.leg.state.fl.us/Statutes/ - Consumer Financial Protection Bureau Summary of Consumer Rights Under FCRA

https://www.consumerfinance.gov/consumer-tools/credit-reports-and-scores/

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.