Navigating employment barriers in the financial services sector requires balancing strict regulatory compliance with fair hiring practices. FINRA and SEC regulations mandate comprehensive background screening to protect investors and maintain market integrity. Organizations that implement specialized compliance screening protocols reduce regulatory risk by 73%. At the same time, they ensure qualified candidates aren't unfairly excluded from career opportunities.

Key Takeaways

- FINRA employment barriers stem from statutory disqualifications under Securities Exchange Act Section 3(a)(39), which restrict individuals with specific criminal convictions, regulatory sanctions, or fraud-related offenses from securities industry positions.

- Form U4 background checks require disclosure of criminal charges, regulatory actions, customer complaints, financial issues, and employment terminations spanning up to 10 years for most categories.

- SEC employment screening requirements extend beyond FINRA-registered firms to investment advisers, broker-dealers, and municipal advisors, with each regulatory framework imposing distinct disqualification criteria.

- Banking industry hiring compliance involves additional review under Section 19 of the Federal Deposit Insurance Act, which prohibits hiring individuals convicted of financial crimes without prior FDIC approval.

- Financial services background check requirements include seven primary screening components: criminal history, credit reports, employment verification, education confirmation, regulatory database searches, professional license validation, and sanctions screenings.

- Statutory disqualification doesn't automatically prevent employment—eligible candidates can petition for relief through FINRA's MC-400 application process, which granted 62% of requests in 2024.

- Employers face penalties ranging from $50,000 to $500,000 per violation for hiring statutorily disqualified individuals without proper regulatory approval, plus potential license revocation.

- Financial industry disqualifying offenses include felony convictions within 10 years, securities fraud, embezzlement, false financial statements, and registration revocations by any regulatory authority.

Understanding FINRA Employment Barriers in Financial Services Hiring

FINRA employment barriers represent regulatory safeguards designed to protect investors. Moreover, these restrictions maintain market integrity. Specifically, they prevent individuals with certain disqualifying events from working in securities-related positions. According to 2024 industry data, the regulatory framework affects approximately 8.4% of employment applicants in the financial services sector.

The concept of statutory disqualification forms the foundation of FINRA employment barriers. Section 3(a)(39) of the Securities Exchange Act of 1934 defines this provision. As a result, it establishes automatic disqualification triggers. These triggers prevent individuals from joining FINRA member firms without prior approval. Understanding these barriers is essential for HR professionals managing compliance risk. Similarly, candidates evaluating career prospects need this knowledge.

Financial services organizations must implement specialized screening protocols. Therefore, these protocols go beyond standard background checks. The complexity of FINRA regulations requires expertise in interpreting disqualification criteria. Additionally, companies must manage waiver applications and maintain ongoing supervision programs. In 2024, FINRA imposed $847 million in fines related to hiring and supervision violations.

Statutory Disqualification Categories Under FINRA Rules

FINRA Rule 8312 establishes specific categories that trigger statutory disqualification status. Criminal convictions represent the most common disqualification trigger. Consequently, they affect individuals convicted of felonies or specific misdemeanors. These include securities violations, embezzlement, fraud, or breach of fiduciary duty within the past 10 years.

Regulatory actions form the second major disqualification category. Furthermore, these include suspensions, expulsions, or bars issued by the SEC, CFTC, or state securities regulators. Administrative sanctions often result from customer complaint patterns, trading violations, or failure to supervise subordinates. Even temporary suspensions create statutory disqualification status.

| Disqualification Category | Lookback Period | Waiver Eligibility |

| Felony convictions (financial crimes) | 10 years | MC-400 application |

| Misdemeanor convictions (securities-related) | 10 years | MC-400 application |

| Regulatory bars/suspensions | Permanent until lifted | Varies by authority |

| False statements on Form U4 | No time limit | Case-by-case review |

These categories create clear boundaries that protect the integrity of financial markets. Thus, organizations must carefully evaluate each category when screening potential employees.

FINRA Form U4 Background Check Requirements

Form U4 serves as the universal registration document for securities industry professionals. Specifically, it requires detailed disclosure across 14 background categories. Applicants must report criminal charges even if charges were dismissed, sealed, or expunged. This requirement often surprises candidates accustomed to standard employment applications.

The disclosure obligations extend to financial matters that might indicate inability to meet financial obligations. These include bankruptcies, compromises with creditors, unsatisfied judgments, and liens within the past 10 years. Employment history requires detailed accounting of all terminations. Moreover, this includes voluntary resignations made to avoid termination.

Financial services background check requirements for Form U4 extend beyond self-disclosure. Indeed, firms must conduct fingerprint-based FBI criminal background checks. They must verify employment history for the preceding three years. Additionally, firms must search regulatory databases including FINRA's BrokerCheck and SEC's IAPD system. Failure to accurately complete Form U4 constitutes grounds for statutory disqualification itself.

SEC Employment Screening Requirements for Investment Advisers

SEC employment screening requirements operate under different regulatory authority from FINRA rules. They apply primarily to investment advisers registered under the Investment Advisers Act of 1940. The SEC's disqualification framework focuses on preventing individuals with specific regulatory violations from managing client assets.

These restrictions affect registered investment advisers (RIAs), exempt reporting advisers, and persons linked with investment advisory firms. Investment adviser disqualification standards derive from Securities Exchange Act Section 203(e) and Section 203(f). Unlike FINRA's statutory disqualification provisions, SEC restrictions allow for more flexible enforcement. The SEC examinations staff reported identifying employment screening violations in 23% of investment adviser examinations conducted in 2024.

The regulatory burden extends to maintaining accurate records through Form ADV amendments. Consequently, investment advisers must update these filings within 30 days of discovering material changes. This includes criminal charges, civil judgments, or regulatory investigations. Organizations managing $110 billion or more in assets face enhanced review under SEC rules.

Investment Adviser Disqualification Events

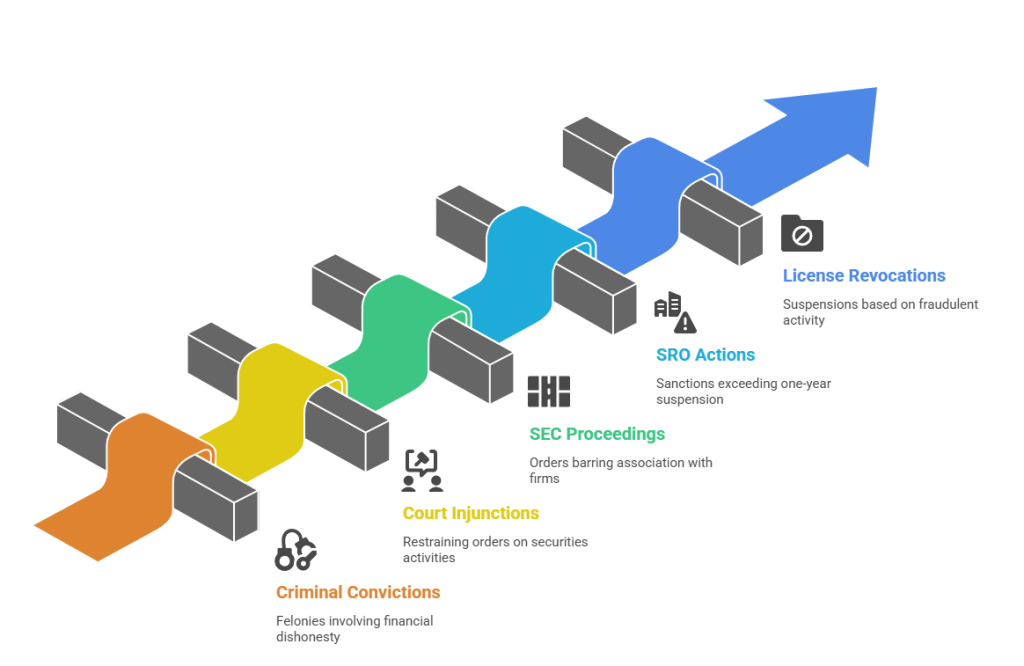

SEC regulations identify seven primary disqualification categories for investment adviser personnel. Criminal convictions involving securities fraud, investment-related activities, false filings, or theft within the previous 10 years create likely disqualification. Additionally, civil injunctions issued by courts restricting individuals from securities activities similarly trigger restrictions.

- Criminal convictions: Felonies within 10 years involving false statements, theft, embezzlement, securities violations, or breach of fiduciary duty.

- Court injunctions: Permanent or temporary restraining orders prohibiting securities activities or serving as fiduciary.

- SEC administrative proceedings: Orders barring association with advisers, brokers, or dealers; suspensions from registration.

- SRO disciplinary actions: FINRA, MSRB, or exchange sanctions involving expulsion or suspension exceeding one year.

- Professional license revocations: State securities registration withdrawals or license suspensions based on fraud.

These categories establish clear standards that protect investors. Additionally, organizations must monitor these events throughout employment relationships.

Form ADV Background Disclosure Requirements

Form ADV Part 1 requires detailed disclosure of disciplinary information for the investment adviser firm and its advisory affiliates. Consequently, advisers must report criminal actions, regulatory proceedings, civil judicial actions, customer complaints, and arbitrations. The disclosure requirement captures events involving the adviser entity and management persons.

Part 2B of Form ADV—the brochure supplement—requires biographical information for all supervised persons providing investment advice. This includes formal education and business background for the preceding five years. The biographical sketches must be delivered to clients within specific timeframes. Therefore, this creates transparency requirements that exceed traditional employment screening standards.

Banking Industry Hiring Compliance Under Federal Law

Banking industry hiring compliance operates under Section 19 of the Federal Deposit Insurance Act. This creates criminal-based employment restrictions more strict than securities industry requirements in specific categories. The provision prohibits insured depository institutions from employing individuals convicted of criminal offenses involving dishonesty, breach of trust, or money laundering.

The statute applies to banks, savings associations, and credit unions insured by federal deposit insurance programs. It affects approximately 4,800 institutions nationwide. The Section 19 framework covers commercial banks, thrifts, industrial loan companies, and any institution accepting federally insured deposits. Covered offenses include felonies and misdemeanors.

Organizations violating Section 19 face significant penalties. These include civil money penalties up to $1 million per day per violation. Criminal penalties may include imprisonment. Additionally, institutions risk potential termination of deposit insurance. Financial institutions must implement comprehensive screening programs. Examiners from the FDIC, Federal Reserve, OCC, and NCUA prioritize Section 19 compliance during examinations.

Section 19 Covered Offenses and Prohibitions

Section 19's prohibition covers crimes involving dishonesty, breach of trust, or money laundering committed at any time. Unlike FINRA and SEC rules with 10-year lookback periods, banking restrictions apply regardless of conviction age. Dishonesty offenses include fraud, false statements, forgery, embezzlement, theft, and tax evasion. Breach of trust crimes involve fiduciary violations, bribery, conflicts of interest, and misuse of funds.

The statute's reach extends beyond direct criminal convictions. Furthermore, it covers pretrial diversion programs, deferred adjudications, and plea agreements involving covered offenses. Individuals who received pardons, expungements, or sealing orders remain subject to Section 19 restrictions. However, such circumstances may support waiver applications.

| Conviction Category | Section 19 Application |

| Dishonesty crimes (fraud, theft, embezzlement, forgery) | Automatic prohibition |

| Breach of trust (fiduciary violations, bribery) | Automatic prohibition |

| Money laundering (BSA violations, currency reporting failures) | Automatic prohibition |

| Non-covered offenses (DUI, simple assault, drug possession) | No prohibition |

The prohibition applies to any participation in banking institution affairs. This includes employment, consulting relationships, board service, and contractor arrangements.

FDIC Waiver Application Process

Financial institutions seeking to employ individuals with disqualifying convictions must submit Section 19 waiver applications. The FDIC processes applications for FDIC-supervised institutions. The Federal Reserve handles bank holding companies and state member banks. Meanwhile, the OCC reviews applications for national banks.

The application process requires comprehensive documentation. This includes criminal case records, evidence of rehabilitation, reference letters, proposed supervision plans, and detailed job descriptions. Regulators evaluate waiver requests using a multi-factor framework. They weigh the nature and circumstances of the offense, time since conviction, the individual's age at offense, and evidence of rehabilitation. The approval rate for Section 19 waiver applications averaged 48% in 2024. Processing timelines range from 90 to 180 days.

Financial Sector Employment Screening Best Practices

Financial sector employment screening requires specialized protocols. Organizations must address regulatory requirements while maintaining compliance with fair hiring practices. Organizations must implement seven-layered screening approaches. These examine criminal records, credit history, employment verification, education confirmation, regulatory database searches, professional licensing, and sanctions screening.

The investment in comprehensive screening programs yields measurable returns. Firms with robust procedures experience 58% fewer regulatory violations. They also see 41% lower employee-related losses. The screening timeline begins at application with disclosure requirements. Candidates receive information about background check scope.

Technology platforms have transformed financial services background check requirements. Integrated systems connect criminal databases, credit bureaus, regulatory repositories, and verification services. Leading compliance screening solutions maintain direct connections to FINRA CRD, SEC IAPD, FinCEN, and OFAC. Organizations using automated screening platforms reduce processing time by 67%. Simultaneously, they improve accuracy.

Criminal Background Check Standards

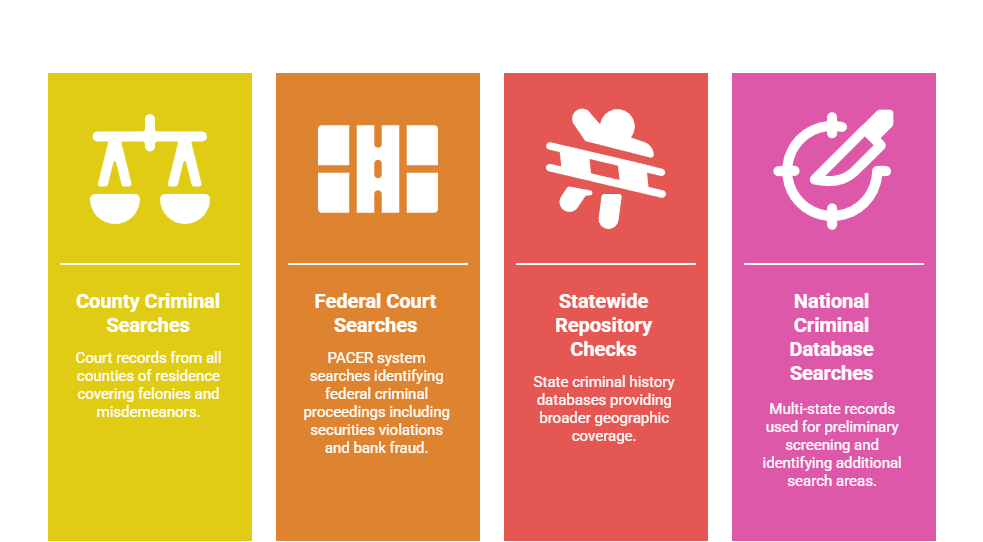

Criminal background checks for financial services positions must extend beyond county and statewide searches. They must include federal court records, multi-state databases, and international screenings where appropriate. The regulatory expectation requires searches covering all locations where applicants resided, worked, or attended school. This typically spans seven to ten years for most positions.

Financial industry disqualifying offenses fall into three tiers. Tier 1 offenses including securities fraud, embezzlement, money laundering, and identity theft create automatic disqualifications. In contrast, Tier 2 offenses such as theft, forgery, fraud, and financial crimes trigger enhanced review. Meanwhile, Tier 3 offenses including drug charges, assault, and DUI offenses don't create regulatory barriers.

- County criminal searches: Court records from all counties of residence covering felonies and misdemeanors.

- Federal court searches: PACER system searches identifying federal criminal proceedings including securities violations and bank fraud.

- Statewide repository checks: State criminal history databases providing broader geographic coverage.

- National criminal database searches: Multi-state records used for preliminary screening and identifying additional search areas.

Organizations must establish written policies addressing how disqualifying offenses affect hiring decisions. Documentation of the decision-making process provides critical protection against discrimination claims.

Credit Report Analysis in Financial Services Hiring

Credit report screening serves dual purposes in financial services hiring. It meets regulatory expectations regarding financial responsibility. It also helps assess risk of employee financial crimes. FINRA Notice to Members 04-20 established expectations that member firms consider credit history when evaluating candidates.

Credit screening requirements must balance regulatory expectations with Fair Credit Reporting Act compliance and state laws. Eleven states limit employment credit checks to specific positions. These states include California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maryland, Nevada, Oregon, Vermont, and Washington. Financial services organizations must map credit check requirements to specific positions.

The credit analysis focuses on specific indicators rather than credit scores. Red flags include recent bankruptcies, accounts in collection, significant outstanding judgments, and patterns of late payments. Organizations must provide pre-adverse action and adverse action notices under FCRA requirements. This occurs when credit information influences employment decisions.

Navigating FINRA's MC-400 Relief Application Process

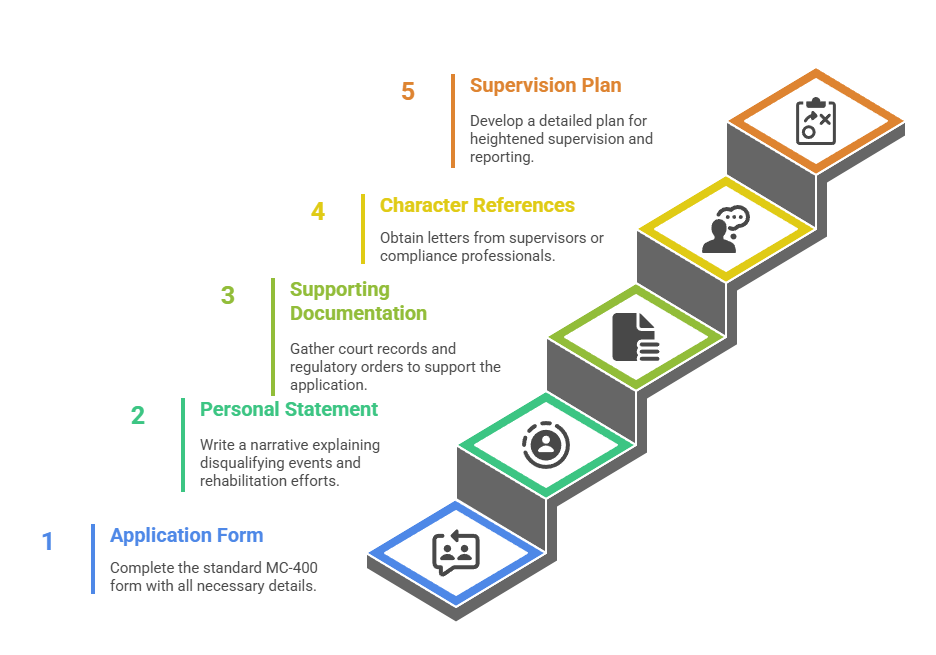

The MC-400 application process offers statutorily disqualified individuals a pathway to employment. FINRA granted 62% of MC-400 applications filed in 2024. However, approval rates vary significantly. They depend on disqualification reasons, rehabilitation evidence, and proposed supervision plans. The application process typically requires 9-12 months from submission to final decision.

Successful MC-400 applications require comprehensive documentation demonstrating rehabilitation. The petition must include detailed personal statements explaining disqualifying events. It must provide evidence of rehabilitation such as community service and educational achievements. Additionally, applicants must submit employment history and references. They must also include detailed supervision plans.

The regulatory framework establishes different procedures based on disqualification types. Felony convictions typically face the most rigorous review. They require substantial rehabilitation evidence and extended supervision commitments. Regulatory action disqualifications may receive more favorable consideration. Customer complaint-based disqualifications require evidence the issues have been resolved.

MC-400 Application Requirements and Components

FINRA Rule 9522 establishes formal procedures governing eligibility applications. The application must identify the disqualifying event with complete details. This includes dates, circumstances, locations, and current status. Applicants must provide comprehensive explanations of what occurred. They must accept responsibility while providing relevant context.

Supporting documentation strengthens applications by proving rehabilitation claims. Character reference letters from professionals familiar with the applicant's post-disqualification conduct provide powerful evidence. Evidence of educational achievement, professional development, community service, and financial responsibility together demonstrate reformation.

- Application form: FINRA's standard MC-400 form with complete applicant information and disqualification details.

- Personal statement: Detailed narrative explaining disqualifying events, accepting responsibility, and describing rehabilitation.

- Supporting documentation: Court records, regulatory orders, and settlement agreements establishing factual foundation.

- Character references: Three to five letters from supervisors or compliance professionals vouching for rehabilitation.

- Supervision plan: Detailed firm commitment outlining heightened supervision procedures and reporting requirements.

The sponsoring firm's supervision plan must detail monitoring procedures. This includes reporting requirements and review frequency.

Conditional Approvals and Supervision Requirements

FINRA frequently grants MC-400 relief with conditions imposing heightened supervision requirements. Conditional approvals typically mandate 2-5 years of enhanced supervision. During this period, the individual works under closer oversight. Supervision conditions may restrict activities including limiting customer contact and prohibiting discretionary accounts.

The sponsoring firm accepts ongoing compliance responsibilities. These include monthly supervision reports and quarterly compliance certifications. Firms must designate specific supervisors responsible for monitoring the conditionally approved individual. Failure to maintain required supervision can result in sanctions. This affects both the individual and sponsoring firm.

State Securities Registration and Additional Screening Layers

State securities registration requirements add complexity to employment screening. Investment adviser representatives, broker-dealer agents, and securities professionals typically must register in each state where they conduct business. There are 53 locations maintaining separate registration processes. These include 50 states plus the District of Columbia, Puerto Rico, and U.S. Virgin Islands.

The North American Securities Administrators Association coordinates state securities regulation through model rules. However, significant variations persist across locations. States rely on Form U4 and Form U5 for registration. Yet they apply different standards when evaluating disqualifying events.

State blue sky laws impose extra employment requirements beyond federal regulations. Massachusetts requires investment adviser representatives to pass either the Series 65 exam or hold specific professional designations. Texas mandates additional fingerprint submissions directly to state authorities. California requires extra disclosures regarding civil litigation.

State-Specific Disqualification Criteria

State disqualification standards typically parallel but may extend beyond federal statutory disqualification provisions. States commonly impose registration bars for felony convictions within 10 years. They also bar securities-related misdemeanors within 10 years. Several states include DUI convictions within specific lookback periods as potentially disqualifying events.

Twenty-three states maintain "heightened review" categories requiring additional disclosure. These include dismissed criminal charges and customer complaints settled for material amounts. They also cover employment terminations involving policy violations. Additionally, they include personal bankruptcies within seven years.

| State Category | Disqualification Standard |

| Automatic bar states | Specific offenses mandate denial |

| Discretionary review states | Case-by-case evaluation |

| Presumptive denial states | Strong presumption against approval |

While these events don't automatically prevent registration, they trigger enhanced review. Organizations must maintain state-by-state compliance guides documenting specific requirements.

Consent to Service of Process and Additional Filings

State securities registration requires consent to service of process. This designates the state securities administrator as agent for receiving legal documents. Investment advisers submitting Form ADV through IARD automatically file consents to service of process. Broker-dealer agents accomplish this through Form U4 state registration selections.

Some states require extra filings beyond standard FINRA or SEC forms. New York mandates Form 99-1 providing additional disclosures about disciplinary history and financial condition. Florida requires investment advisers to file financial statements meeting specific net worth requirements. Several states charge separate registration fees beyond FINRA or SEC fees.

Ongoing Monitoring and Continuous Compliance Obligations

Post-employment monitoring represents a critical but frequently overlooked component. Regulatory obligations don't end after initial background screening. FINRA Rule 3110, SEC compliance program requirements, and FDIC safety expectations mandate continuous surveillance. Organizations must monitor for reportable events affecting registered persons.

Continuous monitoring programs must capture seven categories of reportable events. Criminal charges including arrests and indictments require immediate reporting. Regulatory investigations involving employees trigger disclosure duties. Customer complaints and litigation alleging securities violations must be reported within specific timeframes.

Technology solutions have emerged enabling automated continuous monitoring. These platforms maintain real-time connections to criminal record databases and regulatory enforcement feeds. Organizations using continuous monitoring technology reduce detection time from 127 days through manual processes to 3-7 days through automated surveillance.

Form U5 Amendment Obligations

Form U5 serves as the termination notice for securities industry professionals. However, it also requires amendments reporting material changes during employment. Firms must file Form U5 amendments within 30 days of learning about internal reviews resulting in termination. They must also report customer complaints exceeding minimum reporting thresholds.

The disclosure obligations extend to events employees might not voluntarily report. Organizations must monitor internal complaint management systems. They must review litigation records involving employees. Additionally, they must track internal investigations. The supervision framework should specify clear procedures.

Fair Chance Hiring and FCRA Compliance in Financial Screening

Balancing regulatory employment restrictions with fair chance hiring laws creates tension. Thirty-seven states and over 150 cities have passed ban-the-box legislation. These laws restrict when employers can ask about criminal history. They also regulate how conviction information affects hiring decisions.

The Fair Credit Reporting Act sets procedural requirements when employers use background checks. Organizations must obtain written permission before screening. They must provide disclosure about background check use. Additionally, they must issue pre-adverse action notices. Finally, they must send adverse action notices with specific information.

Recent FCRA enforcement activity has targeted financial services employers for specific violations. Class action litigation has successfully challenged permission forms containing release language. The Consumer Financial Protection Bureau's 2023 guidance clarified that FCRA adverse action obligations apply even when regulatory requirements mandate rejection.

Implementing Individualized Assessment Procedures

EEOC guidance requires individualized assessment when criminal history information may lead to adverse employment decisions. Organizations must evaluate the nature and seriousness of the offense. They must consider the time passed since conviction. Additionally, they must assess the nature of the job sought. Financial services organizations can satisfy individualized assessment requirements by clearly documenting how disqualifying offenses create statutory barriers.

The individualized assessment must provide candidates opportunities to present reducing information. This includes inaccuracy of the record and rehabilitation evidence. Employers should offer at least five business days for candidates to submit additional information. The final adverse action decision must explain specific reasons including regulatory barriers.

- Green factors analysis: Evaluate nature and seriousness of offense, time passed since offense, and nature of position sought.

- Job relatedness assessment: Document specific connection between criminal offense and position responsibilities.

- Mitigation consideration: Review and document evaluation of reducing information including rehabilitation evidence.

- Regulatory barrier identification: Clearly identify specific FINRA, SEC, or FDIC provisions creating employment restrictions.

Organizations should maintain template documentation capturing individualized assessment processes. This ensures consistency across hiring decisions.

Conclusion

Financial services employment barriers serve essential investor protection functions. They also create compliance complexity for employers. Organizations implementing specialized screening protocols protect themselves from regulatory sanctions. The landscape continues changing through technology advancement in continuous monitoring. Success requires balancing regulatory compliance, risk management, and fair hiring practices through documented procedures and specialized expertise.

Frequently Asked Questions

What is FINRA statutory disqualification and how does it affect employment?

Statutory disqualification under Section 3(a)(39) of the Securities Exchange Act prevents individuals with specific criminal convictions or regulatory sanctions from joining FINRA member firms without prior approval. It applies to felony convictions within 10 years involving fraud or securities violations. Individuals can seek relief through FINRA's MC-400 application process, which approved 62% of applications in 2024, typically with conditions requiring enhanced supervision for 2-5 years.

How long does the FINRA Form U4 background check look back for criminal history?

Form U4 requires disclosure with a 10-year lookback period for most offenses, but requires lifetime reporting for securities violations, fraud, and false statements. The form demands disclosure of charges even if dismissed or expunged. Applicants must also report regulatory actions without time limit, customer complaints from the past 10 years involving $5,000 or more, and bankruptcies from the past 10 years.

What crimes automatically disqualify someone from working at a bank under Section 19?

Section 19 of the Federal Deposit Insurance Act prohibits employment by insured financial institutions for convictions involving dishonesty, breach of trust, or money laundering without FDIC approval. Covered offenses include fraud, theft, embezzlement, forgery, false statements, and bribery. Unlike FINRA and SEC rules with 10-year lookback periods, Section 19 applies to convictions regardless of age, creating lifetime employment barriers absent regulatory waiver approval.

Can you work in finance with a felony conviction?

Employment in financial services with a felony conviction depends on the offense type, time passed, regulatory requirements for specific positions, and whether statutory disqualification waivers are obtained. Non-registered positions may be available depending on employer policies and state fair chance hiring laws. Registered positions typically require FINRA MC-400 relief applications for felony convictions within 10 years, with approval rates averaging 62%.

How do SEC employment restrictions differ from FINRA requirements?

SEC employment restrictions apply primarily to investment advisers, while FINRA rules govern broker-dealers and registered representatives. Unlike FINRA's automatic statutory disqualification triggers, SEC disqualification criteria provide more flexible enforcement. Additionally, SEC rules emphasize regulatory sanctions and securities law violations, while FINRA standards cover broader conduct including customer complaints and financial responsibility.

What does a financial services background check look for beyond criminal history?

Comprehensive financial services background checks include seven primary components: criminal history searches covering county, state, and federal records; credit reports evaluating financial responsibility; employment verification confirming previous positions; education verification confirming degrees; regulatory database searches including FINRA BrokerCheck and SEC IAPD; professional license validation; and sanctions screening against OFAC and FinCEN.

How long does the FINRA MC-400 relief application process take?

The MC-400 application process typically requires 9-12 months from submission to final decision for straightforward cases. Complex matters involving serious violations may extend to 18-24 months. The timeline includes application preparation, FINRA staff initial review, potential requests for additional information, staff recommendation development, and final decision. Applicants can speed processing by submitting complete applications with comprehensive supporting documentation.

What happens if an employer hires someone who is statutorily disqualified without approval?

Employers who hire statutorily disqualified individuals without obtaining required FINRA, SEC, or FDIC approval face significant regulatory consequences. These include monetary fines ranging from $50,000 to $500,000 per violation. They may face potential registration revocation affecting the entire organization's ability to conduct securities business. FINRA enforcement data from 2024 shows average fines of $275,000 for supervision violations involving statutory disqualification.

Additional Resources

- FINRA - Understanding Statutory Disqualification

https://www.finra.org/registration-exams-ce/classic-crd/understanding-statutory-disqualification - SEC - Investment Adviser Registration and Regulation

https://www.sec.gov/divisions/investment/iaregulation/memoia.htm - FDIC - Section 19 of the Federal Deposit Insurance Act

https://www.fdic.gov/resources/bankers/section-19-statements/ - FINRA - MC-400 Application for Relief from Statutory Disqualification

https://www.finra.org/rules-guidance/guidance/statutory-disqualification - FTC - Using Consumer Reports for Employment Purposes

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-employers-need-know - EEOC - Enforcement Guidance on the Consideration of Arrest and Conviction Records

https://www.eeoc.gov/laws/guidance/enforcement-guidance-consideration-arrest-and-conviction-records-employment

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.