Financial sector background checks in 2026 reflect an evolving intersection of regulatory expectations, emerging fraud patterns, and workforce transformation. Organizations must balance thoroughness with candidate experience while adapting screening protocols for remote teams, fintech contractors, and continuous monitoring requirements.

Key Takeaways

- Financial institutions face layered screening obligations shaped by federal regulators, state authorities, and self-regulatory organizations.

- Traditional background checks now integrate continuous monitoring to address insider threats and evolving risk profiles.

- Remote hiring and non-traditional roles require adapted verification methods that maintain compliance without sacrificing candidate experience.

- Multi-jurisdictional screening remains complex due to varying state laws governing lookback periods, arrest records, and disclosure requirements.

- Identity verification has become more sophisticated in response to synthetic identity fraud and deepfake technology.

- Third-party risk extends beyond employees to vendors, contractors, and service providers with system access.

- Credit history screening faces heightened scrutiny under state-specific restrictions and fair chance hiring laws.

- Documentation and audit trails serve dual purposes: regulatory compliance and litigation defense in adverse action disputes.

Understanding the Financial Sector Screening Environment

Financial sector background checks operate within a regulatory framework distinct from other industries. Banks, credit unions, investment firms, and payment processors handle sensitive financial data, maintain fiduciary responsibilities, and operate under heightened public trust expectations.

The landscape in 2025 and 2026 reflects several converging pressures:

- Regulators have increased focus on operational resilience and insider threat prevention following high-profile data breaches

- Labor markets favor candidates, creating tension between thorough vetting and efficient hiring processes

- Workforce changes include remote employees who may never visit physical branches

- Contract workers are increasingly embedded in core operations

Organizations must navigate this balance while addressing workforce transformation and maintaining compliance across multiple jurisdictions.

Regulatory Layers and Jurisdictional Complexity

Financial services employers operate under overlapping authority structures. Federal agencies establish baseline requirements, while state laws impose additional restrictions that vary significantly by jurisdiction. Some states limit criminal record lookback periods or prohibit consideration of certain offense types. Others require specific disclosure language or mandate individualized assessments before adverse employment decisions.

Self-regulatory organizations add another compliance layer for specific roles. Securities industry positions trigger distinct obligations, while lending functions may require verification of bonding eligibility. Insurance-licensed roles carry separate screening standards.

Seasonal hiring is a quick process, but compliance and workforce quality are always a concern. One thing I always suggest to HR departments is to take a step back and consider how their process is actually aligned to the level of responsibility for each position, rather than taking a one-size-fits-all approach to verification depth. When verification depth is commensurate with the level of risk, you're protecting your organization without creating undue barriers for applicants. It is also essential to consider a realistic timeframe to ensure that speed is not a barrier to fairness. A sound verification strategy is essential to balancing efficiency and trust in the hiring process.

The Shift Toward Continuous Monitoring

Traditional point-in-time background checks provide a snapshot at hiring but leave employers blind to subsequent developments. An employee might face criminal charges, lose professional licenses, or appear on sanctions lists months or years after onboarding.

| Monitoring Approach | Timing | Primary Use Case |

| Point-in-time checks | Pre-employment only | Initial hiring decisions |

| Periodic re-screening | Annual or biennial intervals | License renewal, promotion reviews |

| Continuous monitoring | Ongoing automated alerts | Real-time risk identification |

Financial institutions increasingly adopt continuous monitoring to identify changes in near real-time. This shift creates new implementation challenges. Organizations must establish protocols for reviewing alerts, determining materiality, and taking appropriate action when adverse information surfaces mid-employment. Privacy laws may restrict monitoring that extends beyond purely public records, and some forms of employee monitoring require specific consent, notice, or may be prohibited depending on jurisdiction and information type.

Background Check Requirements for Financial Services Organizations

Financial sector employee screening standards incorporate multiple verification components, each serving specific risk mitigation objectives. Requirements vary based on role responsibilities, regulatory jurisdiction, and organizational risk appetite.

Identity and Employment Verification

Confirming candidate identity establishes the foundation for all subsequent checks. Financial services organizations face elevated identity fraud risks due to the sensitive nature of accessible data and systems. Synthetic identity fraud, where fabricated identities combine real and fictitious information, has grown substantially.

Employment history verification confirms resume accuracy and identifies unexplained gaps that might warrant discussion:

- Candidates may omit previous financial services employment that ended unfavorably

- Some exaggerate responsibilities in prior roles

- Verification processes should confirm dates of employment, job titles, and when possible, reasons for separation

- Performance or rehire eligibility inquiries may be included, though former employers increasingly limit disclosures to dates and titles only

Educational credential verification addresses diploma mills and fraudulent degrees. Professional certifications and licenses require verification directly with issuing bodies, as candidates may maintain expired or disciplined credentials on resumes.

Criminal Record Searches and Compliance Considerations

Most financial institutions conduct multi-jurisdictional criminal record searches, though specific scope varies by role and location. Federal law creates restrictions on employing individuals with certain convictions in roles involving fiduciary responsibilities or access to financial systems. These restrictions generally prohibit employment unless the individual obtains a formal waiver or written consent from the appropriate regulatory agency. Requirements vary by regulatory authority and may involve demonstrating rehabilitation and minimal risk.

| Jurisdiction Type | Typical Requirements | Compliance Considerations |

| Federal | Restrictions on certain convictions | Case-by-case evaluation or waiver processes |

| State | Lookback periods, arrest vs. conviction rules | Varies by location, may require individualized assessment |

| Local | Fair chance hiring ordinances | Ban-the-box timing, disclosure restrictions |

State and local fair chance hiring laws increasingly limit how employers may consider criminal records. Organizations must design criminal record screening processes that satisfy federal requirements while respecting state-specific restrictions. Documentation becomes critical to demonstrate compliance with individualized assessment requirements when adverse decisions occur based on criminal history.

Financial History and Credit Reporting

Credit history screening in financial services contexts serves multiple purposes. Organizations assess whether candidates demonstrate responsible personal financial management, evaluate vulnerability to fraud or bribery, and identify undisclosed bankruptcies or liens. However, banking industry screening best practices increasingly recognize that credit history correlates imperfectly with job performance and may introduce discriminatory impacts.

Growing numbers of states restrict or prohibit employment-related credit checks except for specific roles. Where permitted, organizations must comply with Fair Credit Reporting Act requirements, including providing pre-adverse action notices, copies of reports, and summaries of rights before taking negative employment actions based on credit information. Some states impose additional notice requirements, extended waiting periods, or specific disclosure language beyond federal minimums.

Organizations should establish clear, documented criteria for which positions warrant credit checks and what findings trigger concern. Job descriptions should explicitly identify financial responsibilities that justify credit review.

Professional Licenses and Regulatory Registrations

Many financial services roles require active professional licenses or registrations with regulatory bodies:

- Securities representatives must maintain appropriate registrations

- Mortgage loan originators require state and federal licensing

- Insurance producers need active state licenses

- Compliance officers increasingly pursue professional certifications

Background screening processes should verify these credentials directly with issuing authorities rather than relying on candidate-provided documentation. License verification extends beyond confirming active status. Organizations should review disciplinary histories, restrictions, and conditions attached to credentials.

References and Professional Background Inquiry

Reference checks serve different purposes than verification processes. While verifications confirm factual accuracy, references provide qualitative insights into work style, interpersonal skills, and performance patterns. Financial institutions should establish structured reference inquiry protocols that pose consistent questions while allowing follow-up on role-specific concerns.

Former employers increasingly limit reference information due to litigation concerns, often confirming only dates and titles. Professional background inquiries may extend beyond traditional employment references. Industry contacts, professional association involvement, and reputational research provide additional data points.

FINRA Background Check Requirements and Securities Industry Obligations

Securities industry positions trigger specific obligations under Financial Industry Regulatory Authority rules. FINRA background check requirements establish minimum standards for registered representatives and associated persons who have access to customer accounts, confidential information, or trading systems.

Form U4 and Registration Requirements

Individuals seeking securities industry registration must complete Form U4, which includes extensive personal and professional history disclosures:

- Criminal charges and convictions

- Regulatory investigations

- Customer complaints

- Civil litigation

- Bankruptcies and compromises with creditors

Organizations must verify this information before submitting registration applications. Form U4 creates ongoing disclosure obligations rather than one-time reporting. Registered individuals must amend filings within specified timeframes when reportable events occur.

FINRA conducts its own background review as part of registration processing. However, this review does not eliminate employer responsibility to conduct independent due diligence.

Statutory Disqualification Provisions

Federal securities laws establish "statutory disqualification" provisions that create presumptive bars to registration for individuals with certain criminal convictions, regulatory sanctions, or disciplinary histories.

| Disqualifying Event Category | Examples | Waiver Availability |

| Criminal convictions | Felonies, securities-related misdemeanors | Case-by-case through application process |

| Regulatory actions | Bars, suspensions, censures | Depends on severity and time elapsed |

| False statements | Material misrepresentations to regulators | Limited, requires rehabilitation demonstration |

Statutory disqualification is not an absolute permanent bar in all cases. Individuals may apply for eligibility relief through formal waiver or consent processes administered by regulatory authorities. Approval is discretionary and typically requires substantial evidence of rehabilitation, demonstration that employment poses minimal risk, and enhanced supervisory arrangements. The process can be lengthy and outcomes vary.

Fingerprint-Based Criminal Background Checks

Securities industry employers must submit fingerprints to the Federal Bureau of Investigation and appropriate state authorities for criminal history record checks. This requirement applies to registered representatives, certain supervisory personnel, and individuals with access to sensitive systems or customer information.

Fingerprint-based checks access more comprehensive criminal records than name-based searches, including records that may not appear in county or state databases. Organizations must establish processes for collecting fingerprints, submitting them to appropriate authorities through approved channels, and maintaining documentation of compliance.

Practical Implementation Challenges in Modern Financial Services

Background check requirements for financial services create implementation complexities that extend beyond policy documentation. Organizations face practical challenges balancing thoroughness, efficiency, candidate experience, and resource constraints while maintaining compliance across multiple jurisdictions.

Remote Workforce Verification Complications

Remote hiring eliminates traditional identity verification touchpoints where candidates appear in person with original documents. Organizations must adapt processes to verify identity and credentials remotely while maintaining confidence in authenticity.

Key challenges include:

- Digital document verification tools remain vulnerable to sophisticated forgery

- Remote employees may reside in jurisdictions where the employer lacks physical presence

- State-specific screening requirements create complications when employee location differs from company registration

- Multi-state remote workforces require jurisdiction-specific screening workflows

Organizations must determine which state laws apply based on multiple factors, including employee work location, employer business presence, and specific statutory jurisdictional language. This analysis may require legal review, as different employment laws use different tests for determining which jurisdiction's rules control.

Background screening for remote positions may warrant enhanced focus on identity verification, employment history confirmation, and reference checks to compensate for reduced in-person interaction.

Balancing Thoroughness with Candidate Experience

Comprehensive financial sector background checks can extend hiring timelines significantly, particularly when verifying international credentials, resolving record discrepancies, or awaiting fingerprint processing. Lengthy delays frustrate candidates who may accept competing offers while awaiting screening completion.

Strategies to accelerate screening without compromising thoroughness include:

- Initiating background checks at conditional offer rather than final stage

- Using technology to automate verification tasks

- Maintaining clear candidate communication about expected timelines

- Conducting preliminary screens for disqualifying factors before investing in comprehensive reviews

Transparency with candidates about screening scope and timeline expectations improves experience even when processes require significant time.

Third-Party Risk and Vendor Screening

Financial sector employee screening standards increasingly extend beyond direct employees to contractors, consultants, vendors, and service providers. Third parties with network access, customer data exposure, or operational responsibilities present risks similar to employees but may escape comparable scrutiny.

| Third-Party Category | Risk Level | Recommended Screening |

| Technology vendors with system access | High | Contractual screening requirements, vendor certification of personnel checks, continuous monitoring where feasible |

| Call center operators handling customer data | High | Criminal history, identity verification, reference checks |

| Professional services (consulting, legal) | Medium | Credential verification, disciplinary history review |

| Facilities and administrative support | Low to Medium | Basic criminal history, identity verification |

Vendor risk management programs should incorporate personnel screening requirements into service agreements. Contracts should specify minimum background check standards, continuous monitoring expectations, and audit rights to verify compliance.

Integrating Continuous Monitoring into Ongoing Employment

Implementing continuous monitoring creates workflow challenges beyond initial technology deployment:

- Organizations must establish protocols for reviewing alerts and assessing materiality

- Not every criminal charge or civil lawsuit warrants employment consequences

- Judgment is required about job relevance and risk levels

- Privacy considerations affect monitoring scope and disclosure

Organizations should clearly communicate monitoring practices during onboarding and document acknowledgments. Continuous monitoring generates alert volumes that can overwhelm compliance teams if not properly managed. Service level agreements should define maximum response times for investigating and resolving alerts.

Addressing Non-Traditional Financial Roles

Fintech growth, digital banking expansion, and technology integration create financial services roles that differ from traditional positions. Software engineers, data scientists, UX designers, and digital marketing specialists now work alongside conventional bankers and advisors.

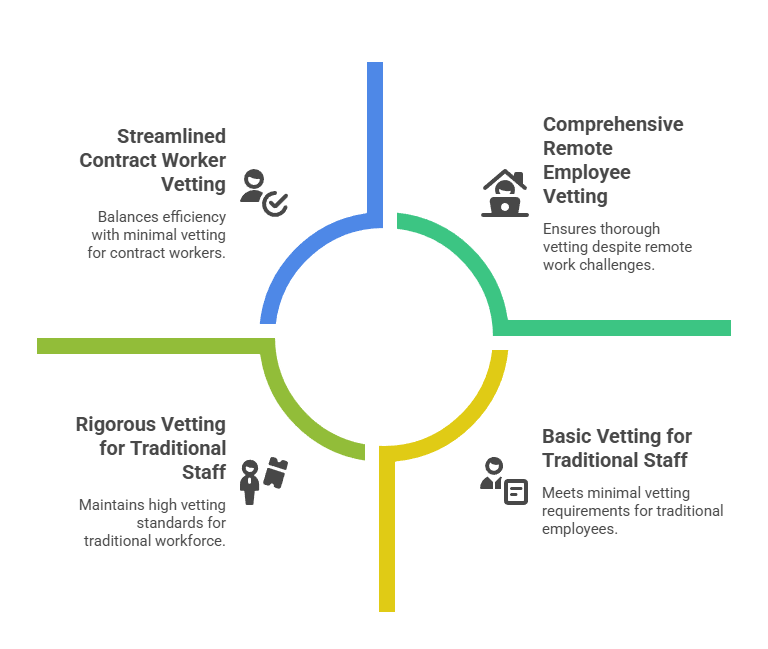

Organizations must determine appropriate screening scope for technology and operational roles. Role-based screening matrices should reflect actual risk exposure rather than defaulting to maximum scrutiny for all positions. Contract workers and gig economy participants present additional complications. Screening processes should scale appropriately to engagement duration and risk levels.

Emerging Considerations for 2025-2026

The financial services screening landscape continues evolving in response to regulatory developments, fraud pattern changes, and workforce trends. Organizations should monitor several emerging areas that may require process adaptations in the near term.

Artificial Intelligence and Automated Decision-Making

Background screening vendors increasingly incorporate artificial intelligence and machine learning into their platforms. These technologies promise efficiency gains through automated record searches, intelligent alert prioritization, and risk scoring. However, algorithmic decision-making raises fairness concerns and potential discriminatory impacts.

Regulatory scrutiny of employment algorithms has increased, with enforcement agencies investigating whether automated systems create disparate impacts on protected groups:

- Organizations using AI-enhanced screening tools should understand how algorithms function

- Vendors should have conducted bias testing

- Maintaining human review and override capability provides important safeguards

- Documentation of algorithm logic and decision factors becomes important for demonstrating compliance

Regulatory frameworks addressing automated employment decision-making continue to evolve. Organizations using algorithmic screening tools should monitor legal developments and assess whether their practices may trigger emerging compliance requirements.

Sanctions Screening and Global Watchlist Monitoring

Financial institutions maintain obligations to screen employees, customers, and vendors against government sanctions lists, terrorism watchlists, and specially designated nationals registries. These requirements extend beyond initial hiring to ongoing monitoring throughout employment.

| List Type | Issuing Authority | Update Frequency | Screening Priority |

| OFAC SDN List | U.S. Department of Treasury | Near real-time | Critical |

| FBI Most Wanted | Federal Bureau of Investigation | As events occur | High |

| State-specific registries | Varies by jurisdiction | Varies | Medium to High |

| International sanctions | UN, EU, other bodies | Varies | Depends on operations |

Global operations create complexity as different jurisdictions maintain separate watchlists with varying update frequencies. Technology solutions have improved sanctions screening efficiency, but organizations must establish clear escalation protocols when potential matches occur.

Social Media and Digital Footprint Analysis

Employer use of social media and internet research in hiring decisions remains legally uncertain. Some jurisdictions restrict consideration of lawful off-duty conduct or prohibit discrimination based on political affiliation and other protected activities.

Organizations that conduct social media screening should establish clear protocols limiting searches to professional platforms, preventing disclosure of protected characteristics before hiring decisions, and documenting legitimate business justifications for adverse actions. The line between professional background research and privacy invasion continues shifting as digital footprints expand.

Mental Health and Wellness Considerations

Financial services organizations increasingly recognize mental health's importance to operational resilience and employee wellbeing. However, background screening processes should not inquire into mental health history or conditions, as these inquiries may violate disability discrimination laws.

Some organizations conduct psychological assessments or personality testing for specific roles, particularly positions involving high-stress environments or significant authority. These assessments must comply with testing validation requirements and avoid medical inquiries prohibited before conditional offers.

Building Effective Screening Programs

Banking industry screening best practices extend beyond individual check components to comprehensive program design that integrates compliance, risk management, operational efficiency, and candidate experience.

Risk-Based Screening Matrices

Role-specific screening requirements should reflect actual risk exposure rather than uniform maximum scrutiny for all positions:

- Customer interaction levels

- Financial transaction authority

- System access and data privileges

- Supervisory responsibilities

- Regulatory registration requirements

Entry-level roles with limited access and authority warrant less extensive screening than senior positions with broad privileges. Screening matrices should receive periodic review and updates as roles evolve, technologies change, and risks emerge.

Clear Policy Documentation and Stakeholder Training

Comprehensive written policies establish expectations, document compliance intentions, and provide consistency across hiring managers and locations. Policies should address screening scope by role type, timing within the hiring process, candidate notice and consent procedures, adverse action protocols, and continuous monitoring practices.

| Stakeholder Group | Training Focus Areas | Frequency |

| Hiring managers | Legal requirements, prohibited inquiries, escalation protocols | Annual + new hire |

| Recruiters | Timing, candidate communication, consent procedures | Annual + new hire |

| HR personnel | Adverse action procedures, documentation standards | Annual + updates |

| Compliance staff | Regulatory changes, audit processes, vendor oversight | Quarterly + updates |

Policy documentation alone proves insufficient without stakeholder training. Regular training updates ensure awareness of legal developments and process changes.

Vendor Selection and Oversight

Many organizations engage third-party consumer reporting agencies to conduct background screening rather than performing checks internally. Vendor relationships require careful management to ensure compliance, accuracy, and service quality.

Important evaluation criteria include:

- Data source quality and breadth

- Turnaround time performance

- Accuracy and dispute resolution processes

- Technology platform capabilities

- Compliance expertise and support

- Customer service responsiveness

Ongoing vendor oversight includes monitoring turnaround time and accuracy metrics, reviewing consumer dispute patterns, assessing customer service quality, and ensuring continued compliance with legal requirements.

Adverse Action Procedures and Documentation

When background screening results lead to negative employment decisions, organizations must follow specific procedures to comply with legal requirements and minimize litigation risk. When using consumer reports from consumer reporting agencies, federal law requires providing pre-adverse action notices, copies of background reports, and summaries of consumer rights before finalizing decisions. Final adverse action notices must follow. Requirements may differ when organizations conduct direct background research not subject to Fair Credit Reporting Act coverage.

Some states impose additional requirements, including specific disclosure language, extended waiting periods between pre-adverse and final notices, or individualized assessment documentation. Documentation throughout screening and adverse action processes provides critical protection in disputes.

Audit Processes and Continuous Improvement

Periodic screening program audits identify compliance gaps, process inefficiencies, and improvement opportunities. Internal or external auditors should review policy documentation, sampling of background screening files, adverse action procedures, vendor oversight activities, and training records.

Audit findings should lead to corrective action plans with assigned ownership and completion deadlines. Continuous improvement extends beyond compliance to operational efficiency and candidate experience. Organizations should gather hiring manager feedback on process effectiveness, analyze screening timeline data to identify delays, and monitor candidate satisfaction indicators.

Conclusion

Financial sector background checks require balancing thoroughness, compliance, efficiency, and fairness in an evolving regulatory and workforce landscape. Organizations succeed by implementing risk-based screening matrices, maintaining clear policies and training, managing vendor relationships effectively, and adapting to emerging developments while protecting candidate rights and organizational interests.

Frequently Asked Questions

The hiring of temporary employees also brings very practical concerns about timing, compliance, and, indeed, the level of scrutiny that is really necessary for each position. As rules differ state by state, and operational need varies position by position, it is perfectly normal for HR departments to look for clarity on these matters before establishing their process. The FAQs below address the most common concerns that organizations face when establishing their process for conducting background screenings on seasonal employees.

What types of background checks do financial institutions typically conduct?

Financial services organizations commonly verify identity, employment history, education credentials, professional licenses, and criminal records. Many also review credit history for roles with financial responsibilities and conduct fingerprint-based checks for positions requiring regulatory registration.

How long do financial sector background checks usually take?

Timeline varies significantly based on screening components, information sources, and candidate history complexity. Basic verifications may complete within days, while comprehensive checks involving international records, professional license verification, or fingerprint processing can require several weeks.

Can past financial problems disqualify candidates from banking jobs?

Financial history considerations depend on role responsibilities, offense nature, time elapsed, and state law restrictions. Federal law creates barriers for certain criminal convictions. Many state and local laws require individualized assessments rather than automatic disqualifications, and federal guidance recommends case-by-case evaluation that considers the nature of the offense, time elapsed, and job relevance.

What is the difference between FINRA background checks and standard employment screening?

FINRA requirements apply specifically to securities industry registered representatives and associated persons. These obligations include Form U4 disclosure reporting, fingerprint-based FBI criminal checks, and ongoing update requirements throughout employment rather than point-in-time verification.

Do financial services background checks differ by state?

State laws create significant variation in permissible screening practices. Some jurisdictions restrict criminal record lookback periods, limit credit report use, prohibit consideration of certain offenses, or impose specific disclosure and assessment requirements. Organizations with multi-state operations must develop jurisdiction-specific workflows.

How do continuous monitoring systems work in financial services?

Continuous monitoring involves ongoing automated searches of criminal records, sanctions lists, professional licenses, and other relevant databases throughout employment rather than one-time verification at hiring. Systems generate alerts when new information appears, which organizations review to determine materiality and appropriate response.

Can employers check social media during financial services background screening?

Social media screening legality varies by jurisdiction, with some states restricting consideration of lawful off-duty conduct or political activity. Organizations that conduct social media reviews should focus on professional platforms, avoid accessing protected characteristic information before hiring decisions, and document legitimate business justifications.

What rights do candidates have if background checks contain errors?

Federal law requires consumer reporting agencies to investigate disputes and correct inaccurate information. Candidates must receive copies of background reports before adverse employment decisions and have opportunities to explain or dispute findings. Organizations should pause adverse action processes while investigating candidate challenges.

Additional Resources

- Fair Credit Reporting Act Full Text and Summary

https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act - FINRA Registration and Background Check Requirements

https://www.finra.org/registration-exams-ce/classic-crd/registration-requirements - FDIC Section 19 Guidance on Employment of Convicted Individuals

https://www.fdic.gov/resources/bankers/convictions/index.html - Equal Employment Opportunity Commission Background Check Guidance

https://www.eeoc.gov/laws/guidance/enforcement-guidance-consideration-arrest-and-conviction-records-employment-decisions - Consumer Financial Protection Bureau Employment Screening Resources

https://www.consumerfinance.gov/consumer-tools/background-checks/ - National Conference of State Legislatures: State Laws on Employment Background Checks

https://www.ncsl.org/labor-and-employment/state-laws-on-employment-related-background-checks

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.