Employment verification is undergoing fundamental transformation as hybrid work models, gig economy expansion, and stricter compliance requirements converge to create unprecedented challenges for HR teams. Organizations verifying employment in 2026 must balance speed, accuracy, and regulatory compliance across increasingly complex workforce structures while managing verification failure rates that significantly extend time-to-hire and create potential FCRA liability exposure.

Key Takeaways

- Employment verification processes face increasing complexity due to remote work documentation gaps and non-traditional employment arrangements that lack standardized verification protocols.

- FCRA compliant employment verification requires written authorization, permissible purpose documentation, and adverse action procedures regardless of automation level or verification method used.

- Automated employment verification systems reduce average verification time from 5-7 business days to 24-48 hours while substantially decreasing manual error rates compared to traditional phone-based methods.

- Gig workers and independent contractors present unique verification challenges requiring alternative documentation approaches since traditional employer-based verification models often fail for these arrangements.

- Remote workers require enhanced identity verification and address confirmation processes, with remote employment verifications frequently flagging discrepancies in stated work locations versus actual employment addresses.

- Employment verification red flags including employment date discrepancies, title inflation, and unverifiable employers represent a significant portion of background screening adverse actions.

- Organizations without standardized employment verification policies face significantly higher compliance violation risk and substantial settlement costs when verification practices violate FCRA or state-level employment laws.

- Digital employment verification infrastructure investment shows measurable ROI through reduced time-to-hire, decreased verification abandonment rates, and stronger compliance audit performance.

The Employment Verification Landscape in 2026

Why Employment Verification Compliance Matters More Than Ever

Employment verification stands as one of the most fundamental yet frequently mishandled components of background screening programs. The convergence of regulatory scrutiny, workforce transformation, and technological capability creates both opportunity and risk for organizations that fail to modernize their verification approaches. Traditional phone-based confirmation methods were designed for a workforce reality that no longer exists in 2026.

The stakes extend beyond simple accuracy concerns. Verification errors directly impact hiring velocity, candidate experience, legal compliance, and organizational reputation. Companies face extended vacancy costs, potential discrimination claims, and FCRA violations that can result in significant financial penalties when verification processes fail. Today's employment landscape features remote-first organizations, gig economy participants, global distributed teams, and frequent job changes that render legacy verification approaches inadequate.

The Compliance Framework Governing Employment Verification

Employment verification falls under strict regulatory oversight, primarily through the Fair Credit Reporting Act when conducted by consumer reporting agencies or when employers use third-party verification services. FCRA compliance requirements mandate specific procedures that cannot be circumvented regardless of verification urgency or organizational convenience. Federal FCRA requirements establish the foundation for compliant verification practices including written authorization, permissible purpose limitations, and adverse action protocols.

Beyond federal requirements, employers must navigate state-level employment laws that may impose additional restrictions:

- Ban-the-box legislation: Restricts timing of background screening in numerous jurisdictions

- Salary history prohibitions: Prevents verification of previous compensation in multiple states

- Arrest record limitations: Prohibits consideration of non-conviction arrests in employment decisions

- Lookback period restrictions: Limits how far back employment history can be considered

- Enhanced disclosure requirements: Mandates additional authorization and notice procedures

The compliance challenge intensifies when verifying non-traditional employment arrangements. Gig workers, independent contractors, and remote employees often lack the documentation infrastructure that traditional verification processes assume.

In every recruitment I have been a part of, I have been reminded of the level to which trust was forged before the first official start date. Background checks and verifications tend to be seen as bureaucratic technicalities, and my experiences with employment have shown a tendency to affect the level to which a candidate feels a sense of fairness and respect. The best human resources strategy comes from the merging of compliance with intelligence and discretion, in which the interests of the organization should not come at the expense of human integrity.

How Workforce Evolution Transforms Verification Requirements

Remote work adoption fundamentally altered employment verification dynamics. Employees work from locations different from official business addresses, requiring verification processes to confirm actual work arrangements rather than relying on physical presence assumptions. This shift demands enhanced documentation protocols and alternative verification methods beyond standard employer confirmation calls.

The gig economy presents even more complex verification challenges. Platform-based workers, freelance professionals, and independent contractors may have legitimate work histories that cannot be verified through traditional employer references. Hybrid workforce models create additional verification complexity by mixing traditional employees, remote workers, contractors, and temporary staff within single organizations, requiring HR teams to apply appropriate verification standards across different employment types while maintaining consistency and compliance.

Implementing Automated Employment Verification Systems

Understanding Automated Verification Technology and Capabilities

Automated employment verification systems connect directly with authoritative employment data sources to provide instant or near-instant verification without manual employer contact. These systems leverage employment data that employers already maintain, eliminating the communication delays and accuracy issues associated with phone-based verification methods. Established automated verification networks maintain employment and income data for a substantial portion of U.S. workers through connections with major payroll providers.

Alternative automated verification approaches include digital reference platforms where candidates directly provide employment documentation. Verification services systematically contact employers through standardized digital channels, while blockchain-based credential verification systems enable employees to maintain verified employment records independent of specific employers.

Automated systems significantly reduce verification time, decrease manual errors, improve candidate experience through faster hiring decisions, and provide structured verification documentation that supports compliance audit requirements. However, these systems have limitations including incomplete employer participation and reduced context compared to conversational verification that might uncover relevant details automated queries miss. Organizations should evaluate verification options based on their specific candidate populations and compliance requirements.

Evaluating ROI and Implementation Considerations

Employment verification automation investment decisions should consider multiple ROI factors beyond simple cost-per-verification comparisons. Time-to-hire reduction represents significant value through decreased vacancy costs, improved candidate acceptance rates, and faster organizational scaling. Organizations often experience measurable time-to-hire improvements when implementing automated verification for verifications covering participating employers.

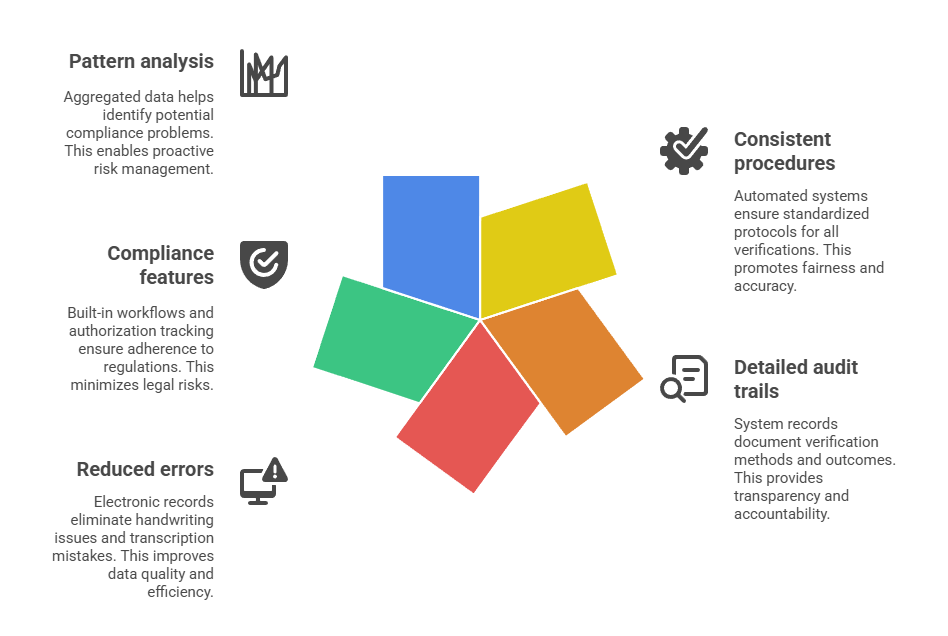

Compliance risk reduction provides substantial but harder-to-quantify value:

- Consistent verification procedures: Automated systems enforce standardized protocols across all verifications

- Detailed audit trails: System-generated records document verification methodology and results

- Reduced documentation errors: Electronic records eliminate handwriting legibility issues and transcription mistakes

- Compliance-by-design features: Built-in adverse action workflows and authorization tracking

- Pattern analysis capability: Aggregated data enables identification of compliance concerns

Candidate experience improvement increasingly drives verification automation decisions as talent competition intensifies. Candidates expect rapid hiring processes reflecting consumer technology experiences in other contexts. Extended verification delays create negative impressions suggesting organizational inefficiency, while rapid automated verification signals professionalism and respect for candidate time.

Maintaining Compliance in Automated Verification Environments

Automated employment verification systems must comply with identical FCRA requirements governing manual verification processes. The use of automated systems does not eliminate obligations to obtain proper authorization, limit information use to permissible purposes, or follow adverse action procedures when verification results contribute to negative hiring decisions. Technology acceleration creates compliance convenience but does not modify underlying legal requirements.

Written authorization remains mandatory before conducting employment verification through any method. Authorization forms must clearly disclose that employment verification will occur, identify who will conduct verification, and explain how verified information will be used in employment decisions. Bundling employment verification authorization with other background screening authorizations is permissible provided disclosures remain clear and conspicuous.

Critical Compliance Requirements in Automated Environments:

- Permissible purpose enforcement: Implement access controls ensuring verification data serves only appropriate employment decision purposes

- Adverse action protocols: Configure systems to trigger required pre-adverse action and final adverse action notice workflows automatically

- Data security measures: Deploy encryption, access logging, and breach prevention safeguards for aggregated employment information

- Retention limitations: Program automatic data deletion after legitimate business need expires

- Authorization tracking: Maintain electronic records proving proper consent before each verification instance

Data security and privacy protection requirements intensify with automated verification systems that aggregate employment data across multiple sources. Organizations must implement appropriate safeguards protecting verified employment information from unauthorized access and prevent data breaches that could expose sensitive employment information.

Best Practices for 2026 Employment Verification Programs

Designing Verification Protocols for Diverse Workforce Types

Modern employment verification programs must accommodate multiple workforce segments with different verification requirements and documentation availability. Rather than applying one-size-fits-all verification approaches, effective programs implement tiered verification protocols matching verification depth and methodology to position requirements, risk profiles, and candidate population characteristics. Standardized templates fail when workforce diversity demands flexible adaptation.

Verification Protocol Matrix by Employment Type:

| Employment Type | Verification Focus | Acceptable Documentation | Completion Timeline |

| Traditional employees | Employment dates, titles, supervisors, departure circumstances | Automated database query, phone verification, HR letter | 24-72 hours |

| Gig/platform workers | Platform participation, performance ratings, work volume | Platform account verification, payment records, rating history | 48-96 hours |

| Independent contractors | Client relationships, project completion, work quality | Client references, contract documentation, deliverable samples | 5-7 business days |

| Remote workers | Work location, identity verification, employment authorization | Enhanced ID verification, address confirmation, jurisdiction authorization | 3-5 business days |

Traditional employees with standard employer relationships should proceed through conventional verification protocols confirming employment dates, job titles, supervisors, and departure circumstances. Automated verification systems provide optimal efficiency for this population segment when candidates work for participating employers.

Building Verification Processes for Non-Traditional Employment

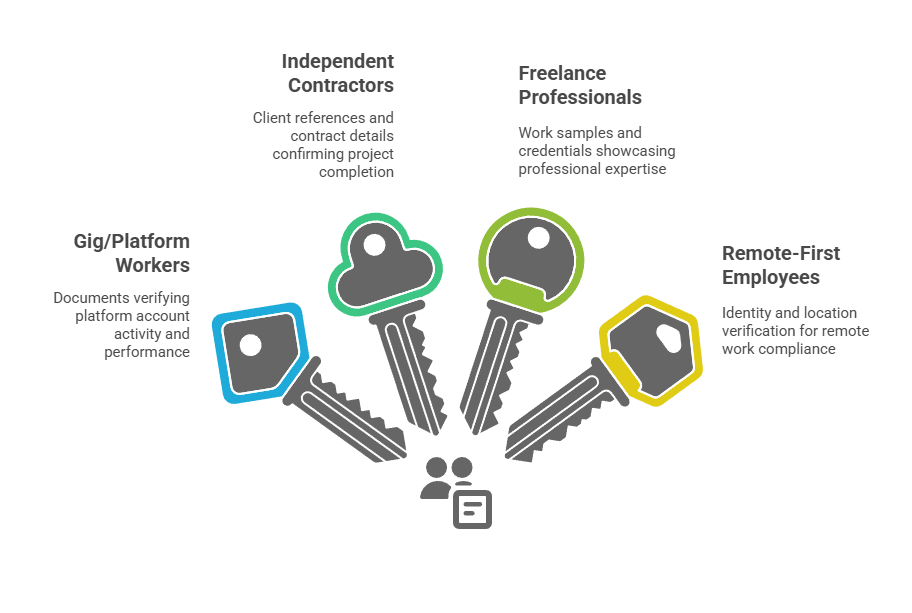

Gig workers present unique verification challenges that require adapted approaches beyond standard employment confirmation. Platform-based workers including rideshare drivers, delivery professionals, and freelance marketplace participants typically work through intermediary platforms rather than traditional employer relationships. Verification for these workers may require platform account confirmation, payment records, or performance ratings rather than conventional employer references.

Organizations must determine what verification standard appropriately balances risk management with realistic documentation availability for contractor populations. Independent contractors and freelance professionals often maintain client relationships rather than employment relationships, requiring verification approaches that confirm project completion and work product rather than traditional employment details.

Alternative Verification Documentation by Worker Type:

- Gig/Platform Workers: Platform account verification, payment history records, performance ratings, completed transaction logs

- Independent Contractors: Client reference letters, contract documentation, project deliverables, professional portfolio evidence, 1099 tax records

- Freelance Professionals: Work samples, testimonial letters, industry credential verification, professional association membership confirmation

- Remote-First Employees: Enhanced identity verification, work location confirmation, employment authorization for actual jurisdiction, equipment assignment records

Employment verification for non-traditional arrangements should focus on confirming the substance of work rather than strictly conforming to traditional employment verification templates. This requires establishing alternative documentation standards, training verification specialists on non-traditional employment types, and implementing flexible verification protocols.

Identifying and Responding to Employment Verification Red Flags

Employment verification red flags fall into several categories that require different response approaches. Date discrepancies represent the most common verification issue, occurring when candidates report employment periods that differ from employer-confirmed dates. Title inflation occurs when candidates report job titles that differ from employer records, while unverifiable employers present challenging scenarios where reported employers cannot be located or contacted for verification.

When verification red flags emerge, FCRA adverse action procedures require specific steps before taking negative employment action. Employers must provide pre-adverse action notice including a copy of the consumer report containing discrepant information and a summary of rights under FCRA. Candidates must receive reasonable opportunity to dispute inaccurate information before final adverse action occurs, protecting candidates from employment decisions based on inaccurate verification information.

Training Staff on Verification Compliance and Red Flag Assessment

Employment verification quality depends heavily on staff competency in conducting verification, identifying discrepancies, evaluating red flags, and following compliant decision-making protocols. Organizations conducting internal verification rather than outsourcing to consumer reporting agencies bear direct FCRA compliance responsibility requiring substantial staff training investment. Inadequately trained staff create compliance exposure regardless of policy quality or leadership commitment.

Verification specialists must understand FCRA requirements including authorization mandates, permissible purpose limitations, adverse action procedures, and record retention obligations:

- Authorization requirements: What constitutes valid written consent, when authorization must be obtained, how long authorization remains effective, consent scope limitations

- Permissible purpose standards: What employment decisions justify verification access, prohibited uses of verification information, third-party sharing restrictions

- Adverse action procedures: Pre-adverse action notice requirements, minimum waiting periods, final notice content requirements, documentation obligations

- Record retention rules: Minimum retention periods, secure storage requirements, destruction procedures, audit access protocols

Red flag assessment training helps staff distinguish between material misrepresentations warranting serious concern and minor discrepancies reflecting documentation inconsistencies or innocent errors. Customer service skills matter significantly in employment verification contexts, as verification interactions shape candidate perceptions and employer brand reputation.

Establishing Documentation and Audit Trail Requirements

Comprehensive documentation serves dual purposes: supporting hiring decisions with factual employment history evidence and demonstrating compliance with applicable regulations during audits or litigation. Employment verification programs should establish documentation standards ensuring sufficient detail for both purposes while avoiding excessive retention of unnecessary information. Under-documentation leaves organizations unable to defend decision-making, while over-documentation creates unnecessary privacy exposure.

Verification documentation should include authorization records proving proper consent before conducting verification. Methodology description, information sources contacted, verification dates, confirmed employment details, and any discrepancies identified must appear in documentation. Final verification conclusions supported by factual findings complete the required documentation trail.

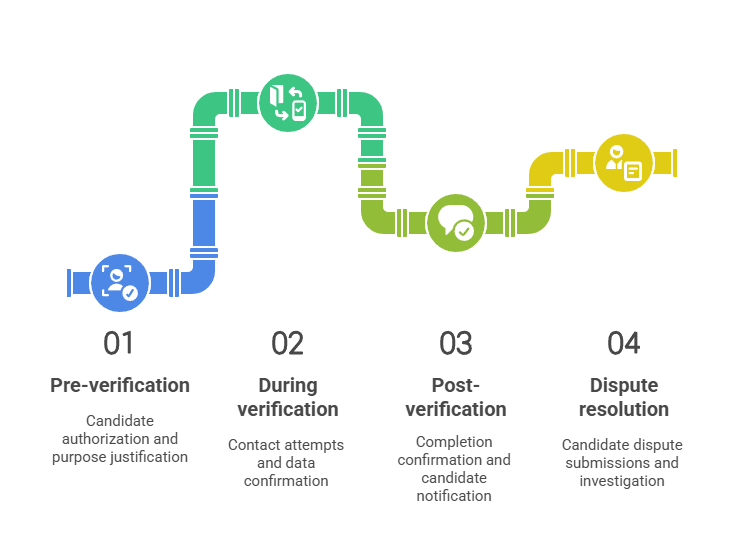

Essential documentation elements by verification stage:

- Pre-verification: Candidate authorization with clear disclosure, permissible purpose justification, verification order records

- During verification: Contact attempts and outcomes, information sources and response dates, confirmed employment data, discrepancies identified

- Post-verification: Verification completion confirmation, candidate notification, hiring decision rationale, adverse action notices if applicable

- Dispute resolution: Candidate dispute submissions, reinvestigation procedures, investigation outcomes, final determination communications

When automated verification systems are used, documentation should include system query records, data source identification, verification timestamps, and verified information retrieved from authoritative databases. Automated verification provides inherently strong documentation through system-generated records capturing verification details without transcription errors common in manual processes.

Preparing Your Employment Verification Program for 2026

Technology Integration and Workflow Optimization

Employment verification technology decisions should prioritize integration capability with existing HR systems, applicant tracking systems, and background screening platforms. Standalone verification solutions requiring duplicate data entry or manual workflow coordination create administrative burden that undermines automation benefits. Integrated verification workflows reduce administrative requirements, improve data accuracy, and accelerate verification completion through automated information flow.

API-based integration enables real-time verification status updates. Automatic verification triggering when candidates reach appropriate hiring stages eliminates manual intervention, while verification result delivery directly into hiring workflow systems provides immediate visibility. Workflow optimization opportunities include automated authorization delivery and collection, verification order batching for efficiency, intelligent verification routing by employment type, and exception management protocols for unusual situations.

Mobile-optimized verification experiences accommodate candidate expectations for smartphone-based interaction while improving authorization completion rates and information accuracy. Candidates increasingly expect mobile-accessible background screening processes matching consumer technology experiences in other contexts. Analytics capabilities should enable verification program performance monitoring through metrics including average verification completion time, verification failure rates, and candidate dispute frequency.

Building Vendor Relationships and Evaluation Criteria

Organizations outsourcing employment verification should establish comprehensive vendor evaluation criteria ensuring selected providers deliver necessary verification quality, compliance capability, and service levels supporting organizational needs. Vendor selection significantly impacts verification program success, making thorough evaluation essential before committing to provider relationships. Price alone provides insufficient vendor differentiation given compliance stakes and candidate experience implications.

Vendor evaluation should assess technology capabilities including automated verification network coverage and integration options. Compliance expertise demonstrated through FCRA training programs, quality assurance procedures, and dispute resolution processes indicates provider reliability. Customer service quality affects candidate experience, while pricing transparency prevents unexpected cost escalation.

Critical vendor evaluation criteria:

- Verification methodology: Automated database access, systematic employer contact protocols, alternative documentation acceptance procedures

- Employer network participation: Workforce coverage breadth, specific employer database partnerships, industry coverage depth

- Compliance program maturity: FCRA training for staff, internal quality audits, regulatory violation history, complaint resolution procedures

- Service level agreements: Verification completion timeframes, escalation procedures, performance reporting frequency

- Data security practices: Encryption standards, access controls, employee screening, security audits, breach notification procedures

Service level agreements should specify verification completion timeframes, escalation procedures for delayed verifications, and quality standards for verification documentation. Clear SLAs prevent misaligned expectations and provide accountability mechanisms when verification performance fails to meet organizational needs.

Staying Current with Evolving Compliance Requirements

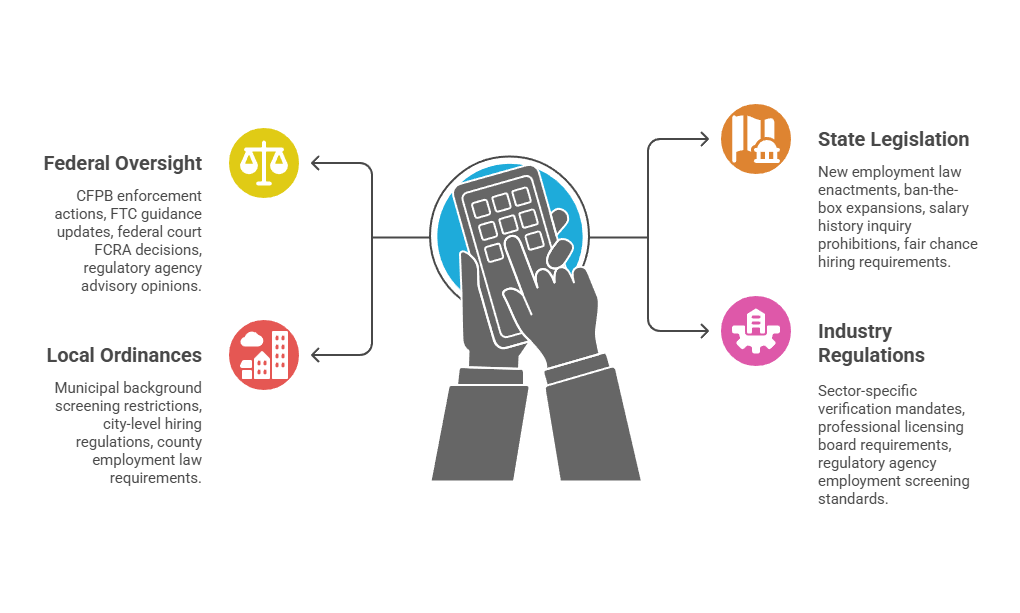

Employment verification compliance requirements evolve continuously through new legislation, regulatory guidance, and court decisions interpreting existing laws. Organizations must implement compliance monitoring processes ensuring verification programs remain current with applicable requirements. Static policies become outdated as legal landscape shifts, creating compliance gaps that expose organizations to violation risk.

Federal compliance monitoring should track FCRA enforcement priorities through Consumer Financial Protection Bureau actions. Federal Trade Commission guidance and court decisions establish compliance standards revealing enforcement trends and compliance vulnerabilities. These sources indicate where regulatory attention focuses and what violations generate enforcement action.

Compliance Monitoring Framework:

- Federal oversight: CFPB enforcement actions, FTC guidance updates, federal court FCRA decisions, regulatory agency advisory opinions

- State legislation: New employment law enactments, ban-the-box expansions, salary history inquiry prohibitions, fair chance hiring requirements

- Local ordinances: Municipal background screening restrictions, city-level hiring regulations, county employment law requirements

- Industry regulations: Sector-specific verification mandates, professional licensing board requirements, regulatory agency employment screening standards

State and local compliance monitoring becomes increasingly important as jurisdictions implement employment law requirements affecting verification practices. Ban-the-box legislation, salary history inquiry prohibitions, arrest record restrictions, and fair chance hiring laws may impact what information can be verified and when verification can occur.

Conclusion

Employment verification stands at a critical evolution point where workforce transformation, technology capability, and compliance requirements converge. Organizations that strategically implement automated verification systems and adapt protocols for non-traditional employment will achieve competitive advantages in 2026 and beyond. The key to success will be in maintaining accuracy, transparency, and the trust of the candidate pool through automated verification methods. Employers who invest in dynamic structures at this time will be better prepared for regulatory requirements and still be able to provide a just and efficient hiring process.

Frequently Asked Questions

What is FCRA compliant employment verification and why does it matter?

FCRA compliant employment verification requires written authorization before conducting verification, using information only for permissible employment purposes, and providing adverse action notices when verification influences negative hiring decisions. Violations can result in statutory damages, punitive damages, and attorney fees. Organizations face significant financial exposure and reputation damage from non-compliant practices.

How long should employment verification take in 2026?

Verification timelines vary significantly based on methodology and employer responsiveness. Traditional phone-based verification typically requires 5-7 business days, while automated verification provides results within 24-48 hours for participating employers. Organizations should target efficient verification completion for optimal candidate experience while maintaining thoroughness.

What are the biggest employment verification red flags employers should watch for?

Employment date discrepancies where reported dates differ substantially from employer-confirmed dates represent the most common red flag. Unverifiable employers may suggest fabricated experience, though legitimate explanations include business closures. Title inflation indicating significantly higher responsibility than actually held suggests problematic misrepresentation.

How do you verify employment for gig workers and independent contractors?

Gig worker verification requires alternative approaches including platform account verification confirming participation and performance ratings. Payment records or 1099 documentation verify income and work duration. Client references or project deliverables confirm work quality, while portfolio evidence demonstrates skills.

What documentation should be retained from employment verification processes?

Verification documentation should include written authorization, verification methodology description, confirmed employment details, identified discrepancies, and candidate explanations. When verification contributes to adverse action, documentation must prove pre-adverse action notice delivery and appropriate waiting periods. Organizations should retain verification records for at least one year.

Can employers verify employment with a candidate's current employer without permission?

Contacting current employers without candidate permission creates significant candidate relations concerns. Best practice requires obtaining specific authorization before contacting current employers. Authorization forms should distinguish between current and former employer verification. When candidates refuse current employer verification, organizations may accept alternative documentation.

What are the main benefits of automated employment verification systems?

Automated employment verification dramatically reduces verification time for participating employers. Manual error reduction occurs through direct database queries eliminating transcription mistakes. Compliance documentation improves through system-generated audit trails. Candidate experience improves through faster hiring decisions.

How do state and local laws affect employment verification practices?

State and local laws increasingly impact verification through ban-the-box legislation restricting background screening timing. Salary history inquiry bans prohibit verifying previous compensation. Arrest record restrictions prevent considering non-conviction arrests. Fair chance hiring laws require individualized assessment rather than blanket disqualification.

What should candidates do if employment verification contains errors?

Candidates should immediately notify the employer or background screening company when discovering verification errors, providing documentation proving accurate information. FCRA provides dispute rights requiring reasonable reinvestigation. Candidates should submit written disputes with supporting documentation.

What employment verification mistakes create the most legal risk?

Conducting verification without proper authorization creates direct FCRA violations. Failing to provide complete adverse action notices generates frequent liability. Using information beyond permissible purposes violates FCRA limitations. Inconsistent protocols create discrimination claim exposure when correlated with protected characteristics.

Additional Resources

- Fair Credit Reporting Act â Full Text and Official Summary

https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act - Consumer Financial Protection Bureau â Background Screening Guidance

https://www.consumerfinance.gov/compliance/supervision-examinations/consumer-reporting/ - U.S. Equal Employment Opportunity Commission â Background Checks and Employment

https://www.eeoc.gov/laws/guidance/enforcement-guidance-consideration-arrest-and-conviction-records-employment - Federal Trade Commission â Using Consumer Reports for Employment Purposes

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-employers-need-know - Society for Human Resource Management â Background Check Resources

https://www.shrm.org/topics-tools/tools/toolkits/background-checking

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.