Employment credit checks remain a critical risk management tool for employers hiring into financial, fiduciary, and management positions, but the regulatory landscape has transformed dramatically between 2023 and 2026 with state-level restrictions now covering more than half of U.S. workers. This comprehensive guide provides HR professionals with actionable frameworks to navigate the complex matrix of federal FCRA requirements, state-specific prohibitions, adverse action procedures, and emerging privacy standards while implementing credit screening programs that reduce legal exposure and improve hiring quality.

Key Takeaways

- Employment credit checks are legally permissible under federal law but face significant restrictions in 11+ states and dozens of municipalities as of 2026.

- Employers must demonstrate a legitimate business necessity and ensure positions have direct financial responsibility before requesting credit reports.

- The Fair Credit Reporting Act requires written consent, pre-adverse action notices, and specific disclosure procedures that differ substantially from standard background checks.

- Credit reports used for employment purposes exclude credit scores entirely and contain modified information compared to lending credit reports.

- State laws in California, Colorado, Connecticut, Hawaii, Illinois, Maryland, Nevada, Oregon, Vermont, Washington, and Delaware impose categorical restrictions on employment credit checks.

- Employers face dual liability risks under both FCRA violations (which provide for statutory damages, actual damages, and attorney's fees) and state employment discrimination claims.

- Current legal standards and regulatory expectations indicate that generic "financial responsibility" job descriptions may provide insufficient justification for credit screening.

- Documented policies with position-specific criteria and individualized assessments significantly reduce negligent hiring liability while maintaining compliance.

Understanding Employment Credit Checks in 2026

What Is an Employment Credit Check?

An employment credit check involves requesting a modified version of a consumer credit report specifically formatted for hiring decisions. Unlike credit reports used for lending decisions, employment credit reports do not include credit scores. They present information in a format designed to help employers assess financial responsibility and potential security risks rather than creditworthiness.

Employment credit reports typically include payment history on credit accounts, outstanding debts, public records such as bankruptcies and tax liens, and account status information. They explicitly exclude information prohibited under Equal Employment Opportunity Commission guidance. Data appears in narrative rather than numerical score format, allowing for individualized assessment of each candidate's circumstances.

The Legal Foundation: FCRA Requirements

The Fair Credit Reporting Act establishes the federal baseline for all employment credit checks. Section 604(b) of the FCRA permits employers to obtain consumer reports for employment purposes but imposes strict disclosure and authorization requirements. These requirements distinguish credit checks from other screening tools and create specific procedural obligations.

Employers must provide a clear and conspicuous standalone disclosure that a consumer report may be obtained for employment purposes. This disclosure cannot be buried within employment applications or combined with liability waivers. Written authorization from the applicant must be obtained before requesting any credit report, and this authorization must be separate from the disclosure document.

How Employment Credit Reports Differ from Consumer Credit Reports

The most significant difference involves the complete absence of credit scores. Employment credit reports do not contain numerical scores designed to predict loan default. Instead, they present narrative information about payment patterns, account management, and public records that allow employers to conduct individualized assessments rather than relying on threshold score cutoffs.

Employment credit reports also exclude certain information that appears on consumer credit reports:

- Inquiries from other employers (to prevent discrimination based on job search activity)

- Promotional inquiries from lenders

- Date of birth and age indicators

- Certain medical debt information protected under updated FCRA interpretations

- Spousal information and account data where the applicant is not the primary account holder

These exclusions reflect recognition that certain information either holds no relevance to employment decisions or creates unacceptable discrimination risks. Reports emphasize behavioral indicators rather than predictive algorithms.

The State-by-State Restriction Landscape

States with Categorical Restrictions

As of 2026, eleven states maintain laws that categorically prohibit or severely restrict employment credit checks except for specifically defined position types. These laws create a complex compliance matrix that requires position-by-position analysis before implementing credit screening.

| State | Year Enacted | Key Exceptions |

| California | 2011 | DOJ positions, managerial roles with $10K+ spending authority, access to confidential information, signatory authority |

| Colorado | 2013 | Executive/management roles, access to financial information, fiduciary responsibilities |

| Connecticut | 2011 | Financial institution positions, management roles, access to confidential financial data |

| Delaware | 2014 | Applies to employers with 4+ employees; exceptions for finance and management roles |

| Hawaii | 2009 | Financial institution positions, management, access to financial/confidential information |

| Illinois | 2011 | Management positions, access to financial information, bonded positions |

| Maryland | 2011 | Positions requiring credit check by law, senior executive positions, public safety |

| Nevada | 2013 | Financial institutions, evaluating credit/lending applications |

| Oregon | 2010 | Financial institution positions, access to confidential financial information |

| Vermont | 2012 | Positions with fiduciary responsibilities, access to financial information |

| Washington | 2007 | Financial institution roles, management with financial authority, law enforcement |

California's law ranks among the strictest nationwide. Employers must be prepared to document how specific positions meet narrow exception criteria. The state requires managerial roles to have spending authority exceeding $10,000, not merely general supervisory responsibilities.

Exception categories across these states generally align around positions involving access to financial information, signatory authority, security or law enforcement roles, and positions requiring specific financial bonding. However, precise definitions vary significantly, requiring employers with multi-state operations to maintain jurisdiction-specific protocols.

Municipal and Local Restrictions

Beyond state-level laws, more than 30 municipalities have enacted local ordinances restricting employment credit checks. New York City, Chicago, Philadelphia, and numerous jurisdictions in California maintain independent requirements. These may exceed their respective state restrictions, creating particular compliance challenges for employers with multiple locations.

Hiring managers may need to apply different screening protocols based on where positions are located rather than where the company maintains its headquarters. Remote work arrangements add additional complexity when determining which jurisdiction's restrictions apply. Employees performing work from restrictive jurisdictions may be covered even when the employer operates in permissive states.

Employers must conduct jurisdiction-specific compliance reviews before implementing any credit screening program. This includes verifying not only state-level restrictions but also examining county and municipal codes for additional limitations.

Emerging Trends in State Legislation

Legislative activity surrounding employment credit checks accelerated significantly between 2023 and 2025. Multiple states have considered or continue to consider new restrictions in recent legislative sessions, indicating continued movement toward limiting employment credit checks to narrow categories of positions with demonstrable financial responsibility.

Recent legislative proposals reflect growing concerns about the impact of pandemic-related financial disruption on hiring opportunities. Several proposed bills explicitly reference COVID-19's economic effects as justification for limiting credit-based employment decisions. These bills typically include sunset provisions or delayed implementation dates designed to allow economic recovery.

State attorneys general have also increased enforcement activity targeting FCRA compliance in employment contexts. Multi-state settlement agreements reached in 2024 and 2025 reflect enhanced documentation expectations and compliance frameworks that many employers have adopted as best practices even in states without specific employment credit check restrictions.

When Credit Checks Are Legally Justified

Positions with Direct Financial Responsibility

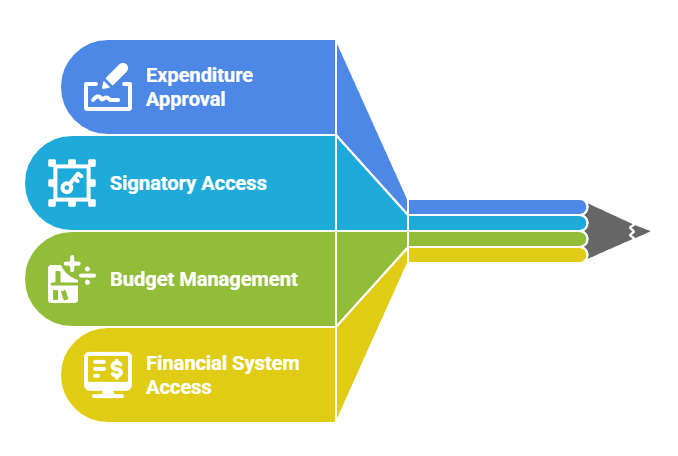

Employment credit checks receive their strongest legal justification for positions involving direct financial authority. These include roles with check signing authority, budget management responsibilities, or access to company financial accounts. Courts generally recognize legitimate business necessity for credit screening when positions involve regular handling of significant monetary amounts and employers can document specific financial authority thresholds.

The key factor involves demonstrating that the specific position requires financial decision-making authority, not merely the department or general job category. Generic statements that a position requires "financial responsibility" may provide insufficient justification under current legal standards. Employers should document the specific financial thresholds, authorization levels, and monetary access associated with each position.

Employers should document the specific financial thresholds, authorization levels, and monetary access associated with each position:

- Authority to approve expenditures: Positions with authorization to approve expenditures exceeding defined thresholds (e.g., $5,000 or $10,000) provide defensible specificity.

- Signatory access to accounts: Roles with signatory access to operating accounts containing customer funds or company assets demonstrate direct financial responsibility.

- Budget management authority: Positions with responsibility for managing departmental or organizational budgets above specific amounts justify credit screening.

- Financial system access: Roles with administrative access to financial systems enabling fund transfers or payment processing create legitimate business necessity.

Generic descriptions like "handles money" or "works in finance department" do not meet current legal standards for business necessity justification.

Fiduciary and Trust-Based Roles

Positions involving fiduciary responsibilities present clear justification for employment credit checks. These roles include managing client funds, overseeing trust accounts, or serving in legally defined fiduciary capacities. The fiduciary standard creates heightened legal duties that support employer claims of legitimate business necessity when screening for financial distress indicators.

Investment advisors, trustees, guardians, and similar roles where individuals hold legal obligations to manage others' assets appropriately fall within this category. The fiduciary relationship itself creates the nexus between financial history and job responsibilities that courts require. Employers should reference specific fiduciary duties in position descriptions and credit check authorization documents, establishing the direct connection between the screening tool and the position's legal responsibilities.

Security and Access Considerations

Positions with access to sensitive financial data, customer credit card information, or confidential business intelligence may justify employment credit checks based on data security rationales. However, employers must demonstrate specific access privileges rather than general exposure to business information.

The security justification strengthens when positions involve remote access to systems, unsupervised work environments, or roles where financial data theft could occur without immediate detection. Database administrators with access to customer payment information, accountants with remote system access, and similar positions present clearer justification than general office roles where multiple controls and oversight mechanisms exist.

Employers should maintain detailed documentation:

- System access privileges and permission levels

- Data classification levels for information accessible from the position

- Security protocols and monitoring mechanisms

- Unsupervised access periods or remote work arrangements

This information security framework supports credit screening justification while also satisfying broader data protection compliance obligations.

Management and Executive Positions

Senior management and executive roles may justify employment credit checks based on their broad authority and access to confidential strategic information. However, the management-level justification has faced increasing scrutiny in recent state legislation and regulatory guidance.

Several states specifically exclude management status alone as sufficient justification, requiring additional factors such as specific financial authority or fiduciary responsibilities. California's exception for "managerial positions" requires spending authority thresholds, and similar specifications appear in other state restrictions. Employers should avoid blanket policies applying credit checks to all management positions, instead conducting position-specific analyses identifying the particular financial responsibilities, data access, or fiduciary duties that justify credit screening for each senior role.

Implementing a Compliant Credit Check Program

Developing Position-Specific Criteria

Effective employment credit check programs begin with documented position-specific criteria identifying which roles require credit screening. This framework protects against claims of discriminatory application and establishes legitimate business purpose. Position criteria should reference specific job functions, authorization levels, and access privileges rather than job titles or organizational hierarchy.

The following table illustrates the difference between insufficient and defensible position criteria:

| Insufficient Criteria | Defensible Criteria |

| "All accounting staff" | "Positions with authority to process vendor payments exceeding $10,000" |

| "Management positions" | "Roles with budget approval authority for departmental spending over $50,000 annually" |

| "Finance department employees" | "Positions with administrative access to general ledger and accounts payable systems" |

| "People who handle money" | "Roles with signatory authority on company operating accounts" |

| "Senior leadership team" | "Executive positions with fiduciary responsibilities to shareholders or board oversight of financial reporting" |

Employers should review position criteria annually and update them to reflect organizational changes, evolving job responsibilities, and new legal requirements. This regular review process demonstrates good-faith compliance efforts.

Creating Clear Policy Documentation

Written policies governing employment credit checks serve multiple compliance functions. They establish consistent application, document business necessity, and create training resources for hiring managers. These policies should address disclosure timing, authorization procedures, adverse action processes, and recordkeeping requirements.

Policy documents should specify which position categories require credit checks and explain the business justification for each category. This explanation need not appear in candidate-facing documents but should exist in internal compliance documentation. Policies should also address state-specific restrictions, creating clear guidelines for multi-state employers about which screening protocols apply in different jurisdictions. Legal requirements vary by jurisdiction, and employers should consult with legal counsel regarding specific implementation details.

Obtaining Proper Authorization and Disclosure

The FCRA's disclosure and authorization requirements create specific procedural steps that employers must follow precisely. The standalone disclosure requirement means that employers cannot simply include credit check language within general employment application forms or background check authorization documents covering multiple screening types.

Step 1: Provide Standalone Disclosure The disclosure document must appear separately, consisting solely of the disclosure that a consumer report may be obtained for employment purposes. A copy of "A Summary of Your Rights Under the Fair Credit Reporting Act" must accompany this disclosure, using the specific format and language required by federal regulation.

Step 2: Obtain Written Authorization After providing the disclosure, employers must obtain written authorization before requesting any credit report. While this authorization may appear in the same document as the disclosure, it must be clearly distinguished. Electronic signatures are permissible if they satisfy E-SIGN Act requirements.

Step 3: Maintain Documentation Employers should retain copies of signed disclosure and authorization forms, proof of delivery for disclosure documents, and documentation of when consent was obtained. This creates an audit trail demonstrating FCRA compliance.

Conducting Individualized Assessments

When credit reports reveal negative information, employers must conduct individualized assessments rather than applying categorical exclusions. The Equal Employment Opportunity Commission's guidance on background checks recommends individualized consideration to help prevent disparate impact discrimination.

The individualized assessment should consider:

- Nature and severity: The type of credit issues and their seriousness in relation to position responsibilities

- Time elapsed: How long ago negative items occurred and whether recent history shows improvement

- Relationship to position: Direct connection between credit history and specific job duties

- Mitigating factors: Circumstances such as medical hardship, identity theft, or economic disruption beyond the individual's control

A bankruptcy that occurred five years ago may have minimal relevance to current financial responsibility, particularly if recent credit history shows consistent management. Employers should document their individualized assessment process, including the factors considered and the reasoning supporting any adverse decision.

Following Adverse Action Procedures

When employers decide not to hire based wholly or partly on credit report information, they must follow specific adverse action procedures mandated by the FCRA. These procedures involve a two-step pre-adverse and final adverse action process that differs substantially from general rejection notice requirements.

Pre-Adverse Action Requirements: Before taking final adverse action, employers must provide the candidate with a pre-adverse action disclosure that includes a copy of the credit report, a copy of "A Summary of Your Rights Under the Fair Credit Reporting Act," and a reasonable opportunity to dispute the report's accuracy. This pre-adverse action period allows candidates to identify errors and provide context for negative information. Many employers provide five to seven business days, though reasonable time may vary based on individual circumstances.

Final Adverse Action Requirements: After providing pre-adverse action notice and allowing reasonable time for response, employers may proceed with final adverse action if they still decide not to hire. The final adverse action notice must include the contact information for the consumer reporting agency that provided the report, a statement that the agency did not make the hiring decision, and notice of the candidate's right to dispute the report's accuracy with the agency.

Credit Check Information and What Employers Actually See

Report Components and Data Elements

Employment credit reports contain several distinct information categories, each presenting different insights into financial management and potential risk factors. Understanding what information appears and how it should be interpreted helps employers conduct meaningful assessments while avoiding inappropriate weight on irrelevant factors.

The following table outlines the primary components of employment credit reports:

| Report Component | Information Included | Information Excluded |

| Account Payment History | Payment patterns, on-time vs. late payments, delinquency severity over time | Credit scores, credit utilization ratios, debt-to-income calculations |

| Outstanding Debt | Account balances, types of credit accounts, account status | Predictive algorithms, numerical risk ratings |

| Public Records | Bankruptcies, tax liens, civil judgments with dates and amounts | Date of birth, age indicators |

| Collections | Collection accounts, amounts owed, collection agency information | Medical debt in certain circumstances |

| Account Details | Account opening dates, account types, creditor names | Spousal account information where applicant is not primary holder |

Account payment history shows patterns of on-time payments, late payments, and the severity of any delinquencies across credit accounts. This information appears in narrative or tabular format showing payment status over time rather than as numerical scores or ratings. Outstanding debt and account balances appear on employment credit reports but without the context of credit utilization ratios or debt-to-income calculations used in lending decisions.

Public records including bankruptcies, tax liens, and civil judgments appear on employment credit reports. These items carry greater significance than account payment patterns because they indicate more serious financial distress or disputes. Employers should still consider the timing, circumstances, and resolution status of public record items rather than treating them as automatic disqualifiers.

Information Excluded from Employment Reports

Employment credit reports explicitly exclude several data elements that appear on consumer credit reports used for lending purposes. These exclusions reflect recognition that certain information either holds no relevance to employment decisions or creates unacceptable discrimination risks.

Credit scores do not appear on employment credit reports under any circumstances. The numerical scores generated for lending decisions use algorithms designed to predict loan default probability, which does not correlate meaningfully with job performance or workplace trustworthiness. Employers requesting credit scores or using them in hiring decisions may face significant legal liability under the FCRA framework.

Additional exclusions include:

- Date of birth and age indicators: Removed to prevent age discrimination

- Employment inquiries from other employers: Prevented from appearing to avoid discrimination based on job search activity

- Promotional inquiries: Soft pulls from lenders offering pre-approved credit do not appear

- Spousal information: Account data for accounts where the applicant is not the primary account holder appears in limited form

These exclusions ensure employment credit reports focus solely on information relevant to assessing the individual applicant's financial management rather than introducing protected characteristic information or irrelevant data.

Common Interpretation Mistakes

Employers frequently misinterpret credit report information, leading to inappropriate hiring decisions and potential legal liability. Understanding common interpretation errors helps HR professionals avoid these pitfalls when implementing credit screening programs.

One frequent mistake involves treating all negative information as equally disqualifying regardless of timing or context. A single late payment five years ago carries substantially different weight than an ongoing pattern of delinquencies. Some employers apply mechanical screening that fails to distinguish between these scenarios, creating unnecessary adverse impact and potential liability.

Another common error involves overweighting debt levels without considering the position's actual financial responsibilities. High debt may be completely irrelevant for positions involving data access or fiduciary duties that do not involve personal financial stress as a risk factor. Employers should focus on information directly related to the specific business necessity justifying the credit check.

Employers also sometimes fail to recognize that credit report information may be incomplete or inaccurate. Research has identified accuracy concerns with credit reports, making the pre-adverse action process critically important for identifying incorrect information before making final hiring decisions.

Impact on Candidates and Discrimination Considerations

When Credit Checks Affect Credit Scores

Employment credit checks are classified as "soft inquiries" that do not affect credit scores. Unlike "hard inquiries" generated when consumers apply for credit, employment inquiries do not appear on credit reports shown to lenders and do not factor into credit score calculations. This distinction applies universally across all credit scoring models, providing candidates assurance that job searching will not damage their creditworthiness.

Candidates sometimes confuse pre-employment credit checks with other financial verification methods such as income verification services or rental history reports, which may involve different inquiry types. Employers can clarify this distinction by explaining that the employment credit check process uses consumer reports specifically formatted for employment purposes that do not impact creditworthiness evaluations. Employers should consider proactively addressing this concern in disclosure materials or during hiring process discussions.

Disparate Impact Concerns

Research and regulatory guidance indicate that employment credit checks may have disparate impact on certain protected classes, particularly on the basis of race and national origin, which is why individualized assessments and business necessity documentation are critical. Federal and state regulators have issued guidance addressing these concerns and establishing frameworks for minimizing discriminatory effects while allowing legitimate credit screening.

The Equal Employment Opportunity Commission's guidance emphasizes that policies causing disparate impact may violate Title VII even when applied neutrally unless employers can demonstrate they are job-related and consistent with business necessity. Research documenting credit history disparities across demographic groups establishes that even neutral credit screening policies may disproportionately exclude candidates from protected classes.

Employers can reduce disparate impact risk through several strategies:

- Limit screening scope: Restrict credit checks to positions with clear financial responsibility rather than broad categories

- Conduct individualized assessments: Consider context and mitigating factors rather than applying mechanical exclusions

- Analyze hiring data: Regularly review hiring outcomes across demographic groups to identify adverse impact patterns

- Document business necessity: Maintain detailed justification for why specific positions require credit screening

These measures demonstrate good-faith efforts to minimize discrimination while maintaining legitimate risk management practices.

Economic Disruption and Pandemic Considerations

The 2020-2023 economic disruptions caused by the COVID-19 pandemic significantly affected consumer credit profiles. Many state bills restricting credit checks explicitly reference pandemic-related financial hardship as justification for limitations. Employers should recognize that credit reports may reflect pandemic-related hardships including forbearance periods, payment deferrals, and economic disruptions unrelated to an individual's fundamental financial responsibility.

Individualized assessments should specifically consider whether negative credit information corresponds to pandemic timeframes and whether recent history shows financial recovery. Some states enacted temporary restrictions or safe harbor provisions recognizing pandemic-related credit disruptions. While many temporary provisions expired by 2026, the underlying principle that employers should consider extraordinary economic circumstances when evaluating credit history remains embedded in compliance best practices.

Strategic Alternatives and Supplemental Screening

Reference Checks with Financial Focus

For positions where direct financial responsibility justifies credit screening but employers want to minimize potential disparate impact, structured reference checks can provide supplemental information. Reference questions can address an applicant's handling of financial responsibilities in previous roles without accessing credit reports.

Questions should focus on workplace financial responsibilities rather than personal credit management:

- "How would you describe [candidate's] management of budget responsibilities in their role?"

- "Did [candidate] handle any financial reporting or expense management duties? How did they perform in these areas?"

- "Was [candidate] ever responsible for approving expenditures or managing departmental funds?"

These reference checks should comply with discrimination laws and should avoid requesting information about personal financial circumstances unrelated to job performance. Structured reference checks work best as supplements rather than replacements for credit checks in high-risk financial positions.

Criminal Background Checks for Financial Crimes

Criminal background checks screening specifically for financial crimes, fraud, theft, and embezzlement provide an alternative risk management tool. Unlike credit checks, which reveal financial stress that might create temptation for misconduct, criminal background checks reveal records of financial crime convictions, though employers must still consider the nature, timing, and relevance of such convictions under EEOC guidance.

However, criminal background checks face their own complex regulatory landscape, including ban-the-box laws, EEOC guidance on arrest and conviction records, and state-specific restrictions on considering criminal history. Employers cannot simply substitute criminal checks for credit checks without ensuring compliance with the separate legal framework governing criminal history screening. For positions with significant financial responsibility, employers often implement both credit checks and criminal background checks as complementary tools providing different risk-related information.

Employment History Verification

Thorough employment history verification can reveal gaps, inconsistencies, or patterns that may indicate financial stress or instability without directly accessing credit reports. Extended unemployment periods, frequent job changes, or discrepancies between reported and verified employment can prompt additional inquiry into candidate stability.

Employment verification should focus on dates, positions, and responsibilities rather than reasons for departure or personal circumstances. Inquiries into financial circumstances may create discrimination risks. The goal involves confirming the accuracy of candidate-provided information rather than investigating personal financial situations. This screening method provides value across all positions regardless of financial responsibility, making it a universal component of background screening programs.

Documentation and Compliance Record Keeping

Required Retention Periods

The FCRA does not specify particular retention periods for employment credit check documentation, but other federal and state employment laws create retention obligations. The Equal Employment Opportunity Commission requires retaining personnel records for at least one year from the date of record creation or the personnel action, whichever comes later, though longer retention may be required under state law or when charges are filed.

When discrimination charges are filed, employers must retain all relevant records until final disposition of the charge or action. This potentially extends retention periods for many years. State laws sometimes impose longer retention requirements, with some jurisdictions requiring employment record retention for three to seven years.

Multi-state employers should adopt retention policies that satisfy the longest applicable retention period:

- Disclosure and authorization forms: Retain for minimum three years after hiring decision

- Credit reports and related documents: Maintain for duration of employment plus three years

- Adverse action documentation: Preserve for minimum three years or until litigation resolved

- Policy and procedure documents: Keep current versions plus historical versions for seven years

Practical considerations also support extended retention periods, as employment litigation may arise years after hiring decisions.

Audit Trail Best Practices

Creating comprehensive audit trails for employment credit check programs serves multiple compliance and risk management purposes. Audit documentation demonstrates consistent policy application, provides evidence of business necessity, and enables identification of potential compliance gaps before regulatory review or litigation.

The audit trail should document which positions are subject to credit checks and the business justification for each position category. This documentation should be reviewed and updated whenever position responsibilities change or new roles are created. Individual candidate files should include disclosure forms with proof of delivery, signed authorization documents, copies of credit reports reviewed, documentation of individualized assessments when negative information appears, and all pre-adverse action and final adverse action notices.

Periodic compliance audits should review a sample of credit check files to verify that required procedures were followed. These internal audits identify training gaps, procedural inconsistencies, and potential compliance vulnerabilities before they result in regulatory action or litigation.

Responding to Regulatory Inquiries

State attorneys general and the Consumer Financial Protection Bureau actively enforce FCRA compliance in employment contexts. When regulatory inquiries occur, comprehensive documentation of policies, procedures, and individual screening instances becomes essential to demonstrating good-faith compliance efforts.

Employers should designate specific personnel responsible for responding to regulatory inquiries. These individuals must understand both the credit check program and relevant legal requirements. Delayed or incomplete responses to regulatory requests may raise concerns and potentially result in expanded investigations.

The initial response to regulatory inquiries should include written policies governing employment credit checks, documentation of business necessity analyses, training materials provided to hiring managers, and sampling of recent credit check files demonstrating procedural compliance. Proactive provision of comprehensive information often satisfies regulatory concerns and prevents expanded investigation. Legal counsel should be involved in responding to any regulatory inquiry regarding employment credit checks.

Conclusion

Employment credit checks remain valuable risk management tools for positions with genuine financial responsibility, but the regulatory environment as of 2026 requires sophisticated compliance frameworks. Employers who limit credit screening to positions with documented business necessity, implement individualized assessment procedures, and maintain comprehensive compliance documentation can effectively balance risk management needs with legal obligations. While this article provides compliance frameworks, employment law evolves regularly, and employers should consult with legal counsel regarding jurisdiction-specific requirements and implementation details.

Frequently Asked Questions

Can employers check your credit without permission?

No, employers cannot access your credit report without your written permission. The Fair Credit Reporting Act requires employers to provide a standalone disclosure informing you that a credit report may be obtained and to obtain your written authorization before requesting any credit report. Employers who access credit reports without proper authorization violate federal law and may face statutory damages, actual damages, and attorney's fees.

Do employment credit checks affect your credit score?

No, employment credit checks do not affect your credit score. These inquiries are classified as soft inquiries that appear on versions of your credit report that you can see but do not appear on reports shown to lenders. You can authorize as many employment credit checks as needed during job searches without any effect on your creditworthiness or credit scores.

What exactly do employers see on an employment credit check?

Employers see a modified credit report that includes payment history on credit accounts, outstanding debts and account balances, public records such as bankruptcies and tax liens, and collection accounts, but they do not see your credit score. The report presents information in narrative or tabular format designed to help assess financial responsibility rather than creditworthiness. Employers also do not see date of birth, soft inquiries from other employers, or certain medical debt information.

In which states are employment credit checks restricted or banned?

As of 2026, eleven states maintain laws that prohibit or severely restrict employment credit checks: California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maryland, Nevada, Oregon, Vermont, and Washington. Additionally, more than 30 municipalities including New York City, Chicago, and Philadelphia have enacted local ordinances with their own restrictions. Employers must verify both state and local requirements in the jurisdictions where they operate and where candidates are located.

Can an employer reject you based on bad credit?

Employers can consider credit history in hiring decisions only if the position involves legitimate business necessity, typically meaning direct financial responsibility, fiduciary duties, or access to sensitive financial information. Even when credit checks are legally justified, employers should conduct individualized assessments considering the nature and severity of negative information, how much time has passed, and the relationship between credit issues and the specific job responsibilities. Employers should avoid mechanically rejecting candidates based on credit history elements without this individualized consideration.

How long does negative information from employment credit checks stay on my record?

The negative information itself remains on your actual credit report according to standard credit reporting timeframes: most negative information remains for seven years, while bankruptcies remain for seven to ten years depending on the bankruptcy chapter. The fact that an employer conducted a credit check typically remains visible on your personal credit report for two years but does not affect your credit score. Employers do not report their hiring decisions back to credit bureaus, so being rejected based on credit history does not create any additional negative items.

What should I do if I'm asked to authorize an employment credit check?

First, verify that the position genuinely involves financial responsibilities, as credit checks should only be used for roles with legitimate business necessity. Read all disclosure and authorization documents carefully to understand what information will be accessed. Consider reviewing your own credit report before authorizing an employment check so you can identify any errors and be prepared to provide context for negative information. If the employer decides not to hire you based partly on credit information, you are entitled to pre-adverse action notice with a copy of the report and opportunity to dispute inaccuracies.

Are there positions where credit checks are always allowed regardless of state restrictions?

Most states with employment credit check restrictions create exceptions for specific position categories, though the exact definitions vary by state. Positions consistently permitted across restrictive states include roles with signatory authority over financial accounts, jobs requiring state-issued financial services licenses, law enforcement and public safety positions, positions with access to confidential financial information, and roles requiring specific fidelity bonds. Employers should verify the specific language in applicable state law rather than making assumptions about which positions qualify for exceptions.

Additional Resources

- Fair Credit Reporting Act (15 U.S.C. § 1681)

https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act - A Summary of Your Rights Under the Fair Credit Reporting Act

https://www.consumer.ftc.gov/articles/pdf-0096-fair-credit-reporting-act.pdf - EEOC Background Checks Guidance

https://www.eeoc.gov/laws/guidance/enforcement-guidance-consideration-arrest-and-conviction-records-employment-decisions - Consumer Financial Protection Bureau: Background Screening

https://www.consumerfinance.gov/consumer-tools/background-screening/ - Federal Trade Commission: Using Consumer Reports for Employment Purposes

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-employers-need-know

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.