The Work Opportunity Tax Credit (WOTC) represents a federal tax incentive program, subject to periodic Congressional reauthorization, that may provide tax benefits to employers who hire individuals from targeted groups facing significant barriers to employment. Under current law, the program offers tax credits that may range from $1,200 to $9,600 per eligible new hire, though actual benefits depend on individual circumstances and tax positions. Many employers fail to capture available credits due to timing errors and inadequate documentation processes, leaving substantial tax savings unclaimed despite maintaining active hiring programs that regularly bring aboard WOTC-eligible candidates.

Key Takeaways

- The Work Opportunity Tax Credit provides federal tax credits between $1,200 and $9,600 per qualified hire, depending on the target group and hours worked by the employee.

- Employers must submit IRS Form 8850 to their State Workforce Agency within 28 days of the employee's start date, making timing adherence absolutely critical to credit eligibility.

- Ten distinct target groups qualify for WOTC, including veterans, SNAP recipients, ex-felons, vocational rehabilitation referrals, and long-term unemployment recipients.

- WOTC certification requires coordination between employers, state workforce agencies, and the Department of Labor, with most denials resulting from missed deadlines rather than candidate ineligibility.

- Successful WOTC programs integrate screening questions into application processes and establish automated workflows that flag potentially eligible candidates before hiring decisions are finalized.

- The credit amount varies by target group, with special provisions for disabled veterans and long-term TANF recipients that can reach maximum values of $9,600 per hire.

- WOTC participation creates no obligation to hire from target groups but rewards employers who do, making it a zero-risk enhancement to existing recruitment strategies.

- Employers can claim WOTC retroactively for current employees if proper documentation and timing requirements were met, though proactive systems yield significantly higher capture rates.

Understanding the Work Opportunity Tax Credit Framework

The Work Opportunity Tax Credit stands as one of the federal government's primary tools for reducing unemployment among populations facing significant employment barriers. Congress enacted this program to incentivize private sector job creation for individuals who historically encounter obstacles in securing stable employment. WOTC offers substantial tax benefits to employers while creating pathways to economic self-sufficiency for targeted groups.

The credit operates as a general business credit against federal income tax liability. It directly reduces the amount employers owe rather than serving as a deduction that merely lowers taxable income. This structure delivers a more powerful financial impact compared to standard business expense deductions.

Legislative Foundation and Purpose

Congress established WOTC under the Small Business Job Protection Act of 1996. Subsequent reauthorizations have extended and modified the program through the present day. The dual-purpose design addresses both economic and social policy objectives simultaneously.

From an economic perspective, WOTC reduces the cost of expanding payroll. This makes job creation more financially attractive during periods when employers might otherwise postpone hiring decisions. From a social policy standpoint, the program combats long-term unemployment, supports veterans' transition to civilian employment, assists individuals overcoming substance abuse or incarceration, and helps families move from public assistance to earned income.

How WOTC Functions as a Strategic Business Tool

Forward-thinking organizations recognize WOTC not merely as a tax benefit but as a strategic instrument. When systematically implemented, WOTC programs can offset significant portions of hiring and training costs while simultaneously expanding the talent pipeline to include qualified candidates that competitors might overlook.

The credit calculation bases itself on qualified wages paid during the employee's first year of employment. Specific percentages and caps vary by target group. For most categories, employers can claim 40% of qualified first-year wages up to $6,000, resulting in a maximum credit of $2,400 per employee who works at least 400 hours.

The Ten WOTC Target Groups and Eligibility Criteria

Employers must hire individuals from specific target groups to qualify for WOTC benefits. Understanding these categories enables HR teams to identify potentially eligible candidates during recruitment processes. This knowledge helps implement screening mechanisms that flag opportunities before they slip through procedural cracks.

Veterans and Military Service Members

The veterans category encompasses several subcategories with varying credit amounts. These distinctions recognize different levels of employment barriers and service sacrifice. Understanding the nuances maximizes credit capture for veteran hires.

| Veteran Category | Credit Amount | Qualifying Criteria |

| Disabled veterans (unemployed 6+ months) | Up to $9,600 | Service-connected disability with extended unemployment |

| Veterans unemployed 4-6 months | Up to $5,600 | Unemployment duration between four and six months |

| SNAP-recipient veterans | Up to $2,400 | Receiving food assistance for at least three months |

Disabled veterans unemployed for six months or more in the year before hiring represent the highest-value category. Veterans unemployed for at least four weeks but less than six months generate credits up to $5,600. Those receiving SNAP assistance for at least three months qualify employers for $2,400 credits.

SNAP and TANF Recipients

Individuals receiving Supplemental Nutrition Assistance Program (SNAP) benefits qualify under specific conditions. They must have received benefits for at least three months before hiring, or been members of families receiving SNAP for at least three consecutive months in the previous 15 months. This category recognizes that food assistance recipients often face employment challenges related to skill gaps, transportation limitations, or caregiving responsibilities.

TANF recipients form a separate category with enhanced provisions. Standard first-year credits are available for short-term recipients. Long-term recipients who remain employed for consecutive periods exceeding two years enable employers to claim $10,000 in combined credits across both years.

Ex-Felons and Designated Community Residents

Individuals convicted of felonies who are hired within one year of conviction or release from prison may qualify under the ex-felon category. This provision supports reentry efforts and reduces recidivism by creating economic incentives for employers willing to consider qualified candidates with criminal histories. Note: Employers must comply with all applicable state and local "ban-the-box" laws and fair chance hiring ordinances, which may restrict when and how criminal history information can be obtained or considered during the hiring process.

Designated community residents include individuals aged 18 to 39 who reside in Empowerment Zones or Rural Renewal Counties. These geographic designations target areas with concentrated poverty and limited economic opportunity, channeling job creation incentives toward communities most in need of employment growth.

Vocational Rehabilitation and Other Referrals

Additional target groups complete the WOTC roster by addressing specific employment barriers. Vocational rehabilitation referrals encompass individuals with physical or mental disabilities who complete or are completing rehabilitative services from approved state agencies. Qualified summer youth employees, qualified long-term unemployment recipients, and Supplemental Security Income recipients round out the categories.

| Target Group | Maximum Credit | Key Requirements |

| Vocational rehabilitation referrals | $2,400 (first year) or $9,000 (two years if long-term) | State agency certification of rehabilitation completion |

| Long-term unemployment recipients | $2,400 | Unemployed for at least 27 consecutive weeks with UI receipt |

| Summer youth employees | $1,200 | Ages 16-17, work May 1-September 15, reside in Empowerment Zone |

| SSI recipients | $2,400 | Receiving Supplemental Security Income benefits |

Critical Timing Requirements and Documentation Protocols

WOTC eligibility hinges on strict adherence to timing requirements that catch many employers off guard. Unlike tax credits claimed during annual filing processes, WOTC requires proactive certification efforts that must begin almost immediately after a candidate accepts employment. Missing deadlines eliminates credit eligibility regardless of clear target group membership.

The 28-Day Rule and Why It Matters

Employers must submit IRS Form 8850 to the designated State Workforce Agency (SWA) no later than 28 days after the eligible worker begins employment. Under current IRS guidance, this requirement allows very limited exceptions. The 28-day clock begins on the employee's start date, defined as the first day the individual performs services for wages.

Calendar days count toward the deadline, not business days. This means weekends and holidays contribute to the deadline's approach. Employers must account for mail delivery times if submitting paper forms, making electronic submission systems significantly safer for deadline compliance.

State Workforce Agencies process certification requests by verifying target group membership. They use data matches with relevant agencies and programs. Processing times vary significantly by state and may range from several weeks to several months depending on state workforce agency capacity and verification complexity.

Essential Forms and Certification Process

The certification process involves multiple forms and coordinated submission. Understanding each component prevents incomplete applications that result in denials. Proper sequencing ensures smooth processing through state systems.

The following forms constitute the complete certification package:

- IRS Form 8850: Pre-screening notice capturing basic employee information and target group category, requiring signatures from both employer and applicant on or before the job offer date.

- DOL Form 9061: Individual Characteristics Form providing detailed information about the individual's target group qualifications for state verification.

- DOL Form 9062: Conditional certification allowing preliminary determinations with final verification occurring after state data matching processes complete.

Both employers and job applicants must sign Form 8850. The applicant signature must occur on or before the job offer date. Forms 9061 or 9062 accompany Form 8850, providing specific data points that enable State Workforce Agencies to verify eligibility.

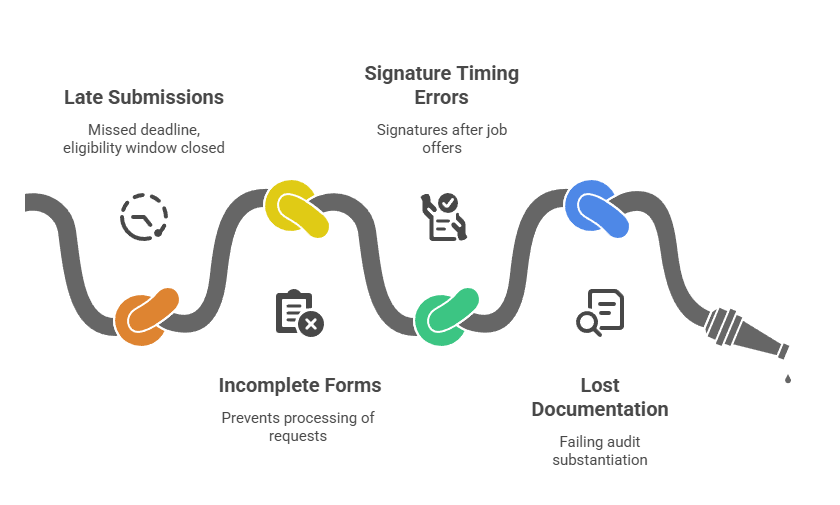

Common Documentation Failures and Prevention Strategies

Most WOTC denials stem from procedural errors rather than actual ineligibility. Documentation failures typically fall into these categories:

- Late submissions: Missing the 28-day deadline, often because employers learn about potential eligibility weeks after the window closes.

- Incomplete forms: Missing signatures or vague target group designations that prevent State Workforce Agencies from processing requests.

- Signature timing errors: Obtaining applicant signatures after job offers are extended rather than on or before offer dates.

- Lost documentation: Failing to maintain copies of submitted forms and certification letters for audit substantiation.

Successful WOTC programs implement systematic safeguards at multiple hiring process stages. Application systems incorporate screening questions that identify potential target group membership before interviews occur. Offer letter templates include language informing new hires about WOTC and requesting their cooperation with certification processes.

Calculating Credit Values and Understanding Wage Qualifications

WOTC credit calculations involve specific formulas that vary by target group and employee tenure. Understanding these mechanics enables accurate projection of potential tax savings. Organizations can prioritize certification efforts when resource constraints limit capacity to pursue every possible claim.

Standard Credit Calculations

For most target groups, the credit equals 40% of qualified first-year wages up to $6,000. This results in a maximum credit of $2,400 per eligible employee who works at least 400 hours during the one-year period beginning with the start date. Employees who work between 120 and 400 hours qualify employers for a reduced credit of 25% of qualified wages up to $6,000, capping at $1,500.

Qualified wages include amounts paid or incurred by the employer for services performed by the qualified employee. Wages paid or incurred during the 60-day period following the start date do not count toward the hours threshold but do count as qualified wages once the employee surpasses the minimum hours requirement.

Enhanced Credits for Specific Categories

Certain target groups generate substantially higher credit values that reflect greater employment barriers. These enhanced provisions recognize both the challenges these individuals face and the additional support employers provide.

| Enhanced Credit Category | First-Year Credit | Second-Year Credit | Total Potential |

| Disabled veterans (unemployed 6+ months) | Up to $9,600 (40% of $24,000) | N/A | $9,600 |

| Long-term TANF recipients | Up to $4,000 (40% of $10,000) | Up to $5,000 (50% of $10,000) | $9,000 |

| Qualified long-term unemployment recipients | Up to $2,400 (40% of $6,000) | N/A | $2,400 |

Veterans with service-connected disabilities unemployed for six months or more qualify employers for 40% of first-year wages up to $24,000. Long-term TANF recipients enable employers to claim 40% of first-year wages up to $10,000 and 50% of second-year wages up to $10,000. To qualify for the second-year credit, the employee must work at least 400 hours in each year and remain in the same target group category.

Tax-Exempt Employer Considerations

Tax-exempt organizations under Internal Revenue Code Section 501(c) can participate in WOTC with modified mechanics. Rather than receiving credits against income tax liability, tax-exempt employers claim WOTC against payroll tax obligations. Specifically, credits offset the employer's share of Social Security tax on wages paid to all employees. The same timing requirements, target groups, and documentation protocols apply.

Consultation with Tax Professionals

The credit calculations, tax position impacts, and benefit realization discussed in this article represent general program mechanics. Actual tax benefits depend on individual organizational circumstances including tax liability, carryforward provisions, alternative minimum tax considerations, and interaction with other credits. Employers should consult with qualified tax professionals to assess WOTC's specific applicability and value within their tax planning strategies.

Building a High-Performance WOTC Program

Organizations that consistently capture WOTC credits approach the program as a strategic initiative rather than an ad hoc opportunity. High-performance WOTC programs integrate eligibility screening into recruitment workflows. They establish clear accountability for certification processes and train hiring managers to recognize target group indicators during candidate interactions.

Integrating WOTC Screening into Recruitment Systems

Application systems should incorporate screening questions that identify potential WOTC eligibility without creating discriminatory barriers. Carefully worded voluntary self-identification questions can flag candidates who may qualify under various target groups. These systems ensure that information plays no role in hiring decisions while enabling proactive credit capture.

Questions might address recent SNAP receipt, veteran status, unemployment duration, participation in vocational rehabilitation programs, or residence in designated community areas. These inquiries must clearly communicate their voluntary nature. They must explain that responses will not affect hiring decisions but may benefit both the applicant and employer through tax credit programs designed to expand employment opportunities.

Applicant tracking systems can automatically flag potentially eligible candidates. These systems generate alerts that prompt HR teams to provide WOTC information during offer processes.

Establishing Clear Roles and Accountability

Successful WOTC programs implement defined responsibilities across multiple functions:

- Recruiters: Handle initial screening and candidate flagging based on voluntary self-identification during application processes.

- HR coordinators: Manage form completion, obtain required signatures, and track 28-day submission deadlines.

- Onboarding specialists: Educate new hires about WOTC participation and facilitate completion of required documentation.

- Payroll teams: Track hours worked by certified employees and maintain wage records for credit calculation substantiation.

- Finance departments: Calculate credits during tax preparation and maintain documentation for potential IRS audits.

Documented standard operating procedures codify each step from candidate identification through credit claiming. Regular training ensures that staff turnover does not erode institutional knowledge about WOTC requirements.

Leveraging Technology and Third-Party Administrators

Many organizations partner with third-party WOTC administrators who specialize in managing the certification process. These vendors typically screen candidates, prepare required forms, track deadlines, submit documentation to State Workforce Agencies, and monitor certification outcomes. Services commonly operate on contingency-fee arrangements based on a percentage of captured credits rather than upfront fees.

While third-party administrators reduce internal administrative burden, employers retain ultimate responsibility for compliance and deadline adherence. Service level agreements should specify performance metrics including capture rates and submission timeliness. Organizations maintaining internal WOTC programs can leverage specialized software platforms that automate form generation and track certification statuses.

Financial Impact Analysis and ROI Calculation

Organizations evaluating whether to implement formal WOTC programs benefit from structured analysis of potential returns relative to required investments. While specific results vary based on hiring volumes and applicant pool characteristics, most mid-to-large employers discover significant unclaimed credits once systematic screening begins.

The following projections are illustrative examples only and should not be interpreted as guaranteed or typical results. Actual credit capture rates, eligibility percentages, and net benefits vary significantly based on industry, hiring volumes, applicant pool characteristics, and organizational implementation effectiveness. Organizations should consult with tax professionals to assess potential benefits specific to their circumstances.

Estimating Eligible Hires Within Your Applicant Pool

Historical hiring data provides the foundation for impact projections. Organizations should review recent hires to estimate the percentage likely qualifying under various target groups. Veteran status is often readily apparent from resumes, while SNAP receipt and unemployment duration may be less visible but can be estimated using demographic data about recruiting communities.

Industries with higher turnover or those recruiting for entry-level positions typically see elevated WOTC eligibility rates. Professional roles in tight labor markets may yield lower rates, particularly if recruiting focuses on currently employed candidates. Conservative estimates assume 15-20% eligibility rates for general hiring across diverse industries.

| Annual Hiring Volume | Estimated Eligible Candidates (18%) | Average Credit per Hire | Potential Annual Credits |

| 100 employees | 18 candidates | $2,400 | $43,200 |

| 250 employees | 45 candidates | $2,400 | $108,000 |

| 500 employees | 90 candidates | $2,400 | $216,000 |

These examples illustrate potential scenarios only. Companies hiring 100 employees annually at an 18% eligibility rate might identify approximately 18 WOTC-eligible candidates. At an average credit value of $2,400 per certified employee, this could represent $43,200 in annual tax credit potential, though actual results depend on numerous variables.

Calculating Implementation Costs

Internal program costs include staff time for screening, form preparation, submission tracking, and coordination with finance teams. A dedicated part-time coordinator might allocate 10-15 hours weekly to WOTC administration in an organization hiring 200-300 employees annually. At loaded labor costs of $35-$50 per hour, internal administration might cost $20,000-$35,000 annually.

Third-party administrator fees vary by provider but commonly operate on contingency-fee arrangements based on a percentage of captured credits. This structure eliminates upfront investment risk, with costs only incurred when credits are successfully claimed. Technology platforms for internal WOTC management range from $3,000 to $15,000 annually depending on hiring volumes and feature sets.

Compliance Considerations and Legal Safeguards

While WOTC offers substantial benefits, employers must navigate program requirements carefully to avoid compliance pitfalls. Mishandling WOTC processes can create legal exposure under anti-discrimination laws, privacy regulations, or tax code provisions. Understanding these intersections protects organizations while maximizing credit capture.

Anti-Discrimination Law Intersection

WOTC target groups correlate with characteristics protected under federal and state anti-discrimination laws. Veterans status receives explicit protection under the Uniformed Services Employment and Reemployment Rights Act. Disability status is protected under the Americans with Disabilities Act. Race and national origin protections under Title VII of the Civil Rights Act intersect with geographic residence categories.

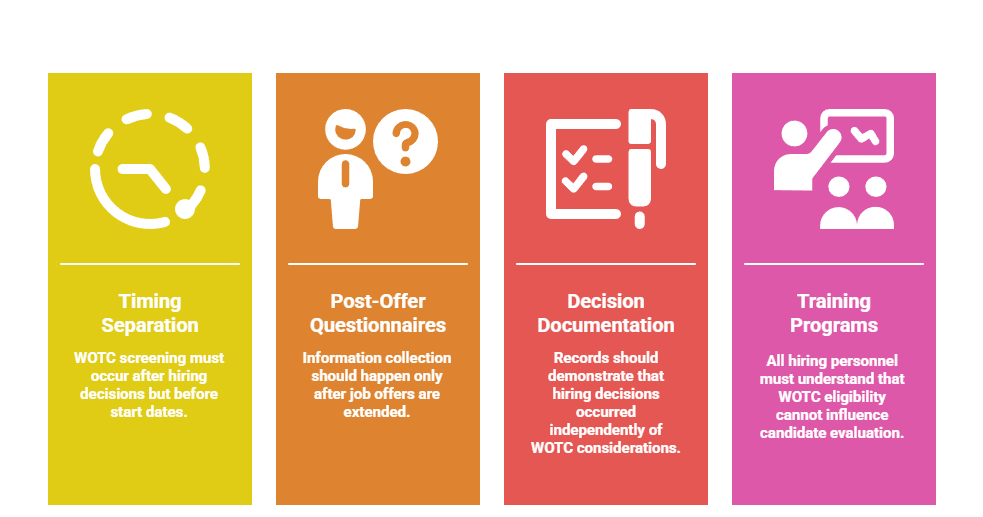

Employers must never make hiring decisions based on WOTC eligibility or potential credit values, as such practices would constitute prohibited discrimination. Critical safeguards include the following protocols:

- Timing separation: WOTC screening must occur through voluntary self-identification after hiring decisions are made but before start dates.

- Post-offer questionnaires: Information collection should happen only after job offers are extended, clearly communicating the voluntary nature of responses.

- Decision documentation: Records should demonstrate that hiring decisions occurred independently of WOTC considerations.

- Training programs: All hiring personnel must understand that WOTC eligibility cannot influence candidate evaluation or selection.

Candidates should never be asked about target group membership during interviews or before receiving job offers.

Privacy and Data Security Obligations

WOTC certification forms collect sensitive personal information that triggers privacy obligations. This includes Social Security numbers, disability status, public assistance receipt, criminal history, and veteran service records. Organizations must implement appropriate safeguards to protect this information under various federal and state laws.

Data minimization principles suggest collecting only information necessary for WOTC certification. Retention should not exceed periods required for tax credit substantiation. Access should be limited to HR personnel with legitimate need to process certifications. Electronic systems should employ encryption and access logging to prevent unauthorized disclosure.

State privacy laws in California, Virginia, Colorado, and other jurisdictions grant employees specific rights regarding personal information that may include access, correction, or deletion rights, with requirements varying by jurisdiction. Employers operating in multiple states should consult with legal counsel regarding applicable privacy obligations in their operating locations.

Tax Credit Substantiation and Audit Preparation

Employers claiming WOTC face potential IRS audits requiring substantiation of credits. Documentation must prove target group eligibility and wage calculations. Organized records enable rapid response to information requests and demonstrate good-faith compliance efforts.

| Required Documentation | Retention Period | Storage Best Practices |

| State Workforce Agency certification letters | At least 4 years after filing return, or longer as required | Digital storage with backup systems |

| Completed Forms 8850 and 9061/9062 | At least 4 years after filing return, or longer as required | Organized by tax year and employee |

| Payroll records for certified employees | At least 4 years after filing return, or longer as required | Integrated with regular payroll archives |

| Credit calculation worksheets | At least 4 years after filing return, or longer as required | Linked to tax return preparation files |

Documentation should be organized by tax year and retained for at least four years after filing returns claiming credits, or longer as required by applicable federal or state law. Employers should consult with legal counsel regarding jurisdiction-specific recordkeeping requirements.

Advanced Strategies for Maximizing WOTC Value

Organizations that master WOTC fundamentals can pursue advanced strategies that compound benefits. These approaches integrate tax credits into broader talent acquisition and corporate social responsibility frameworks. Strategic implementation transforms WOTC from a passive benefit into an active driver of recruitment outcomes.

Geographic Recruitment Targeting

Empowerment Zones and Rural Renewal Counties represent geographic areas where residents may qualify for WOTC based on address. Organizations may consider inclusive recruitment strategies that make opportunities accessible in these areas while maintaining consistent, non-discriminatory candidate evaluation standards. This approach can expand talent pipelines while potentially increasing WOTC capture rates for candidates who voluntarily self-identify as eligible after receiving employment offers.

Job postings through community workforce development centers create connections with diverse populations. Faith-based employment programs and local hiring events in designated areas deliver similar results. This approach generates multiple benefits that extend beyond immediate tax savings, including expanded talent access and strengthened employer brand among stakeholders who prioritize social responsibility.

Integrating WOTC with Diversity and Inclusion Initiatives

WOTC target groups overlap substantially with populations that many organizations actively recruit through diversity and inclusion programs. Veterans, individuals with disabilities, and economically disadvantaged populations face systemic barriers that D&I initiatives seek to address. WOTC provides financial reinforcement for inclusive hiring practices, converting social responsibility commitments into measurable ROI.

Organizations can frame WOTC as a mechanism that makes inclusive hiring more financially sustainable. Integration strategies include the following approaches:

- Veteran recruitment programs: Coordinate with military transition assistance programs and veteran service organizations to build pipelines of qualified candidates who also may generate substantial WOTC credits.

- Disability inclusion initiatives: Partner with vocational rehabilitation agencies to access talent pools of individuals with disabilities completing work readiness programs.

- Fair chance employment practices: Consider building awareness of opportunities among reentry programs serving formerly incarcerated individuals seeking employment, while maintaining compliance with all applicable fair chance hiring laws and consistent selection standards.

- Economic opportunity programs: Focus recruiting efforts in designated communities facing concentrated poverty and limited employment access.

Each integration point advances both diversity objectives and financial performance. This dual impact strengthens business cases for expanded inclusion efforts.

Coordinating with Workforce Development Partnerships

State workforce agencies, community colleges, vocational rehabilitation providers, and nonprofit employment programs all serve populations that may qualify for WOTC. Establishing formal partnerships with these organizations creates referral pipelines. These deliver pre-screened, job-ready candidates who meet both role requirements and potential WOTC eligibility criteria.

These partnerships benefit all stakeholders through aligned incentives. Employers access talent pools competitors may overlook while potentially capturing tax credits that reduce net hiring costs. Workforce development organizations achieve placement outcomes that demonstrate program effectiveness and justify continued funding. Candidates gain employment opportunities with organizations committed to their success.

Conclusion

The Work Opportunity Tax Credit transforms hiring from a pure cost center into a strategic advantage that may deliver measurable tax savings while advancing social responsibility objectives. Organizations that implement systematic WOTC programs can capture substantial annual credits by integrating eligibility screening into recruitment workflows, ensuring deadline compliance through clear accountability structures, and maintaining meticulous documentation that substantiates credit claims during tax filing processes.

Frequently Asked Questions

Can employers ask about WOTC eligibility during job interviews?

No, employers should never inquire about WOTC target group membership during interviews or before making hiring decisions. WOTC screening must occur through voluntary self-identification after employment offers are extended but before start dates. This timing ensures that hiring decisions occur independently of credit eligibility, protecting employers from discrimination claims.

What happens if we miss the 28-day certification deadline?

Under current guidance, missing the 28-day deadline for submitting Form 8850 to the State Workforce Agency disqualifies that hire from generating any tax credit, regardless of clear target group eligibility. The IRS grants extensions or waivers only in very limited circumstances. Employers should treat the 28-day requirement as critical and implement systematic deadline tracking.

Do we have to hire someone because they qualify for WOTC?

Absolutely not. WOTC creates no obligation to hire any candidate, nor does it require employers to provide preference to target group members. The program simply rewards employers who hire qualified individuals from specified groups through their normal, merit-based selection processes.

Can we claim WOTC for employees we hired last year?

You can claim credits for prior-year hires only if you obtained State Workforce Agency certification during the tax year and met all requirements including the 28-day submission deadline. You cannot retroactively certify employees for whom you missed deadlines, but if you properly certified employees and have not yet claimed credits on tax returns, you may be able to amend prior returns within applicable statutes of limitations.

How do WOTC credits affect the employee?

WOTC generates no consequences for employees. Employees receive full wages without any reduction related to tax credits, which flow entirely to employers. The program affects only employer tax liability and creates no reporting on employee W-2 forms or personal tax returns.

Do tax-exempt organizations qualify for WOTC benefits?

Yes, tax-exempt organizations including nonprofits, charities, and certain government entities can participate in WOTC. Rather than reducing income tax liability, tax-exempt employers claim WOTC against payroll tax obligations, specifically reducing the employer portion of Social Security tax. The same eligibility criteria, target groups, timing requirements, and certification processes apply.

What documentation must we retain to support WOTC claims?

Employers should maintain certification letters from State Workforce Agencies, completed Forms 8850 and 9061/9062, payroll records showing qualified wages, and worksheets documenting credit calculations. Documentation should be organized by tax year and retained for at least four years after filing returns claiming credits, or longer as required by applicable law.

Can we work with multiple WOTC service providers simultaneously?

While technically possible, working with multiple WOTC administrators creates coordination challenges and potential duplicate submissions that State Workforce Agencies may reject. Most organizations achieve better results by selecting a single provider or maintaining all processes internally. Clear communication about responsibilities prevents gaps during provider transitions.

How do we calculate the hours worked threshold?

The 400-hour threshold for full credit or 120-hour minimum for reduced credit includes all hours the employee performs services during the one-year period beginning with the start date. For salaried employees, use reasonable estimation methods such as assuming 40-hour weeks for full-time employees. Part-time employees require actual hours tracking.

What if an employee leaves before working the required hours?

If an employee separates before completing 120 hours, no credit is available for that hire. Employers must recapture claimed credits if they filed tax returns before the employee worked sufficient hours. If the employee worked between 120 and 400 hours, the employer may claim the reduced 25% credit capped at $1,500.

Additional Resources

- Work Opportunity Tax Credit Official Program Page

https://www.dol.gov/agencies/eta/wotc - IRS Form 8850 and Instructions

https://www.irs.gov/forms-pubs/about-form-8850 - Department of Labor WOTC Resources and Forms

https://www.dol.gov/agencies/eta/wotc/resources - State Workforce Agency Contact Information

https://www.dol.gov/agencies/eta/wotc/contact - IRS General Business Credit Information

https://www.irs.gov/credits-deductions/businesses/general-business-credit

Still have questions?

Get in touch with our team today for a personalized demo and discover how our tailored volume pricing and packages can drive results for your business!

How useful was this page?*

Note: your comments are anonymous. We use them to improve the website. Do not include any personal details.

Visit our FCRA Compliance Tool or leave a message here if you need a response.

From the blog Explore the GCheck Content Hub

Work Opportunity Tax Credit Requirements: Maximizing Hiring Incentives and Social Impact

31 Dec, 2025 • 22 min read

How to Manage E-Verify Compliance: Strategic Systems for Operational Excellence

31 Dec, 2025 • 19 min read

How to Verify a High School Diploma for Employment in 2026: A Complete Guide for HR Teams

30 Dec, 2025 • 21 min readThe information provided in this article is for general informational and educational purposes only and should not be construed as legal advice or a substitute for consultation with qualified legal counsel. While we strive to ensure accuracy, employment screening laws and regulations—including but not limited to the Fair Credit Reporting Act (FCRA), Equal Employment Opportunity Commission (EEOC) guidelines, state and local ban-the-box laws, industry-specific requirements, and other applicable federal, state, and local statutes—are subject to frequent changes, varying interpretations, and jurisdiction-specific applications that may affect their implementation in your organization. Employers and screening decision-makers are solely responsible for ensuring their background check policies, procedures, and practices comply with all applicable laws and regulations relevant to their specific industry, location, and circumstances. We strongly recommend consulting with qualified employment law attorneys and compliance professionals before making hiring, tenant screening, or other decisions based on background check information.