Managing E-Verify compliance effectively requires transforming mandatory employment verification from an administrative checkpoint into a strategic operational capability that accelerates onboarding while ensuring audit readiness. Organizations with systematic E-Verify management frameworks can reduce verification cycle times while simultaneously decreasing compliance risk through standardized processes, centralized monitoring, and proactive exception management across all hiring locations.

Key Takeaways

- Strategic E-Verify management may help convert regulatory requirements into operational efficiencies by reducing onboarding friction and building audit confidence through systematic verification processes.

- Centralized compliance monitoring across multiple locations requires standardized workflows, role-based access controls, and real-time case tracking to prevent procedural gaps and timing violations.

- Effective Form I-9 and E-Verify coordination depends on establishing clear process sequences, designated responsibilities, and verification deadline tracking systems that prevent common timing errors.

- Multi-location E-Verify management succeeds through centralized policy administration combined with location-specific training, local compliance champions, and standardized exception handling procedures.

- Proactive audit readiness strategies include continuous self-audits, documentation protocols, correction procedures, and retention systems that demonstrate good-faith compliance efforts.

- Technology-enabled compliance monitoring tools provide case status dashboards, automated deadline alerts, exception reporting, and audit trail documentation that reduce administrative burden while improving oversight.

Understanding E-Verify as a Strategic Compliance Function

E-Verify represents more than a mandatory verification step for many employers. When managed strategically, employment verification becomes an operational capability that demonstrates organizational competence. This approach supports efficient onboarding and builds confidence with employees, auditors, and stakeholders.

The Business Case for Advanced E-Verify Management

Organizations that invest in robust E-Verify management systems realize measurable operational benefits beyond basic compliance. Systematic verification processes can reduce average onboarding timelines. They also decrease administrative rework and minimize the resource drain associated with reactive compliance responses.

Effective E-Verify management may deliver competitive advantages through several key mechanisms:

- Faster time-to-productivity: New employees begin contributing sooner when verification processes move efficiently

- Reduced compliance risk exposure: Standardized procedures help prevent timing violations and documentation errors

- Enhanced organizational reputation: Consistent verification demonstrates professionalism to candidates and regulators

- Lower administrative costs: Streamlined workflows may require fewer person-hours per verification case

- Improved audit outcomes: Complete documentation and proactive compliance can reduce penalty risk

The financial implications extend beyond avoiding penalties. Streamlined verification reduces HR administrative costs and minimizes hiring delays that impact operational capacity. Organizations also decrease legal expenses associated with compliance investigations.

Regulatory Foundation and Requirements

E-Verify is an internet-based system operated by the Department of Homeland Security in partnership with the Social Security Administration. The program compares information from an employee's Form I-9 to government records to confirm employment authorization. This electronic verification supplements the Form I-9 process that all U.S. employers must complete.

| Requirement Type | Key Obligations |

| Timing | Create cases within three business days of hire date in most circumstances |

| Notice | Provide written E-Verify participation notice to employees |

| Documentation | Display required posters in workplace |

| Non-discrimination | Verify all new hires without selective application |

| Tentative Nonconfirmations | Follow prescribed resolution procedures |

Employer participation is mandatory for federal contractors and subcontractors subject to the Federal Acquisition Regulation E-Verify clause. Participation is also required for employers in states with mandatory E-Verify requirements. Voluntary participants must verify all new hires and may not selectively verify employees, a practice that could constitute unlawful discrimination.

In most circumstances, employers must create E-Verify cases within three business days of an employee's hire date, which is generally the first day of work for pay. Employers should consult current E-Verify program guidance or legal counsel regarding any exceptions or special circumstances that may apply to their specific situations. Critical compliance requirements also include providing specific notices to employees, displaying required posters, and following prescribed procedures for handling tentative nonconfirmations.

Building a Systematic E-Verify Management Framework

Establishing robust E-Verify management requires deliberate system design that addresses policy standardization, role clarity, and process documentation. Organizations must create frameworks that work across the entire employment verification lifecycle. These systems help ensure consistency regardless of hiring volume fluctuations or personnel changes.

Policy Development and Standardization

Comprehensive E-Verify policies establish organization-wide standards that help ensure consistent application regardless of location, department, or hiring volume. Written policies should define which positions require E-Verify verification and specify timing requirements. They should also establish roles and responsibilities while documenting procedures for all verification scenarios.

Policy frameworks should address coordination between Form I-9 completion and E-Verify case creation. This includes specifying the sequence of activities and maximum elapsed time between steps. Clear guidance on acceptable documentation, reverification requirements, and record retention helps prevent common compliance errors.

Organizations with mature policy frameworks document decision trees for handling exceptions. They also create escalation pathways for complex situations and establish approval requirements for any deviations from standard procedures. Standardized policies reduce procedural variation that creates audit vulnerabilities.

Role Definition and Technology Integration

Effective E-Verify management requires clear delineation of responsibilities across multiple organizational roles. Designated E-Verify administrators hold system access and bear primary responsibility for case creation, monitoring, and resolution. These administrators require specific training, appropriate authority, and sufficient capacity to manage verification volume.

| Role | Primary Responsibilities | Required Capabilities |

| E-Verify Administrator | Case creation, status monitoring, tentative nonconfirmation handling | System training, regulatory knowledge, attention to detail |

| Compliance Officer | Policy maintenance, training delivery, audit coordination | Regulatory expertise, communication skills, analytical ability |

| HR Business Partner | Form I-9 coordination, deadline communication, employee liaison | Process knowledge, relationship management, time management |

Modern E-Verify management depends on technology systems that support efficient case processing, deadline tracking, and compliance monitoring. While the government-provided E-Verify system offers core verification functionality at no cost, some organizations choose to implement supplemental technology solutions to support internal workflow management, deadline tracking, and documentation organization. Integration between E-Verify and HR information systems can eliminate duplicate data entry and reduce transcription errors. Case management systems should provide centralized visibility into verification status across all locations.

Coordinating Form I-9 and E-Verify Processes

Effective employment verification requires seamless coordination between Form I-9 completion and E-Verify case creation. Organizations must establish clear process sequences that help prevent timing violations and documentation errors. This coordination represents a critical control point where many compliance issues originate.

Sequencing Requirements and Timing Management

Federal regulations require employers to complete Form I-9 before creating E-Verify cases. This establishes a mandatory sequence that verification processes must follow. Employees must complete Section 1 of Form I-9 by their first day of work for pay.

Employers must complete Section 2 within three business days of the employee's start date. In most circumstances, E-Verify cases must be created within three business days of the employee's hire date. This timing creates a narrow window for verification activities and requires careful coordination to avoid delays.

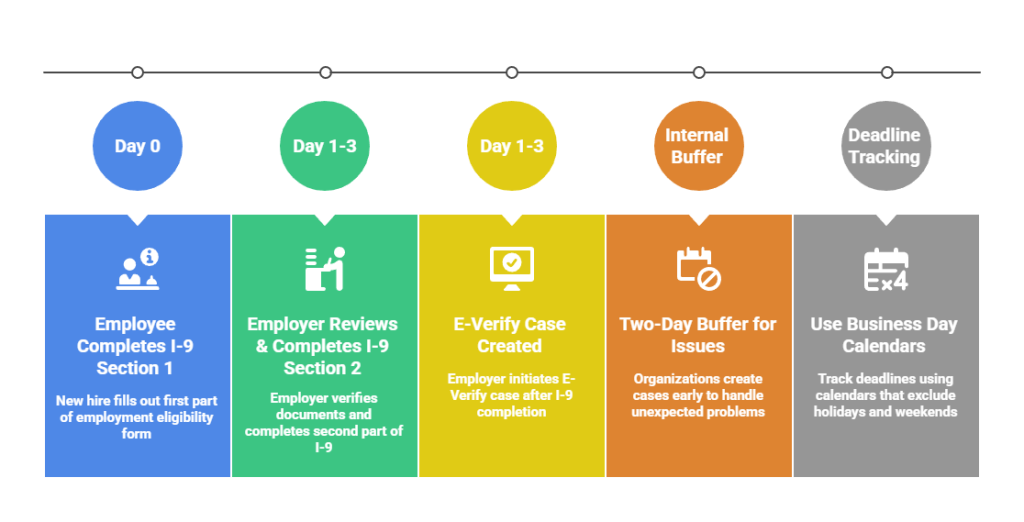

Key timing benchmarks for effective coordination:

- Day 0 (Hire Date): Employee completes Form I-9 Section 1

- Day 1-3: Employer reviews documents and completes Form I-9 Section 2

- Day 1-3: E-Verify case created after Form I-9 completion

- Internal Buffer: Organizations often create cases within two business days to allow margin for unexpected issues

- Deadline Tracking: Use business day calendars that account for holidays and weekends

Organizations should establish internal deadlines that build buffer time into compliance requirements. Calendar management systems that account for business days, organizational holidays, and system availability help prevent timing violations. Automated deadline tracking with escalating alerts helps ensure cases receive attention before compliance windows close.

Data Consistency and Documentation Scenarios

Maintaining consistency between Form I-9 information and E-Verify case data is essential for successful verification. Discrepancies between documents trigger tentative nonconfirmations and create resolution burdens. Organizations should implement verification checkpoints where personnel confirm that data entered into E-Verify exactly matches information on Form I-9 before submitting cases.

Certain employment situations require reverification that presents coordination challenges. When employment authorization documents expire, employers must reverify work authorization using Section 3 of Form I-9. E-Verify should not be used for reverification purposes, which is a common source of confusion among employers.

| Scenario | Form I-9 Required? | E-Verify Required? | Notes |

| New Hire | Yes (Sections 1 & 2) | Yes (if enrolled) | Complete I-9 before creating case |

| Expired Work Authorization | Yes (Section 3) | No | Reverification uses only Form I-9 |

| Name Change | Yes (Section 3) | No | Update I-9, no new E-Verify case |

| Rehire Within 3 Years | Depends on timing | Yes (if enrolled) | May use previous I-9 or complete new one |

Process documentation should address how to handle common scenarios including expired Employment Authorization Documents and renewed Permanent Resident Cards. Training programs must emphasize these distinctions and provide practical examples that help personnel recognize when reverification applies. State and local laws may impose additional requirements beyond federal E-Verify obligations, so employers operating in multiple jurisdictions should consult legal counsel familiar with employment law in each location.

Managing E-Verify Across Multiple Locations

Multi-location organizations face unique challenges in maintaining consistent E-Verify compliance across geographically dispersed operations. These environments deal with varying hiring volumes, local management structures, and workforce characteristics. Systematic approaches balance standardization benefits with operational flexibility needs.

Management Models and Training Programs

Organizations must decide whether to manage E-Verify through centralized teams that handle all verification activities or decentralized models where local HR personnel perform verifications. Centralized models concentrate expertise and enable standardized procedures, providing consistency and quality control. Decentralized models position verification closer to hiring activities, enabling faster processing and better integration with local HR responsibilities.

Hybrid approaches combine central policy administration, training, and oversight with local execution of verification activities. This model balances standardization benefits with operational flexibility but requires robust communication systems. Clear authority boundaries help prevent confusion about who makes decisions in various scenarios.

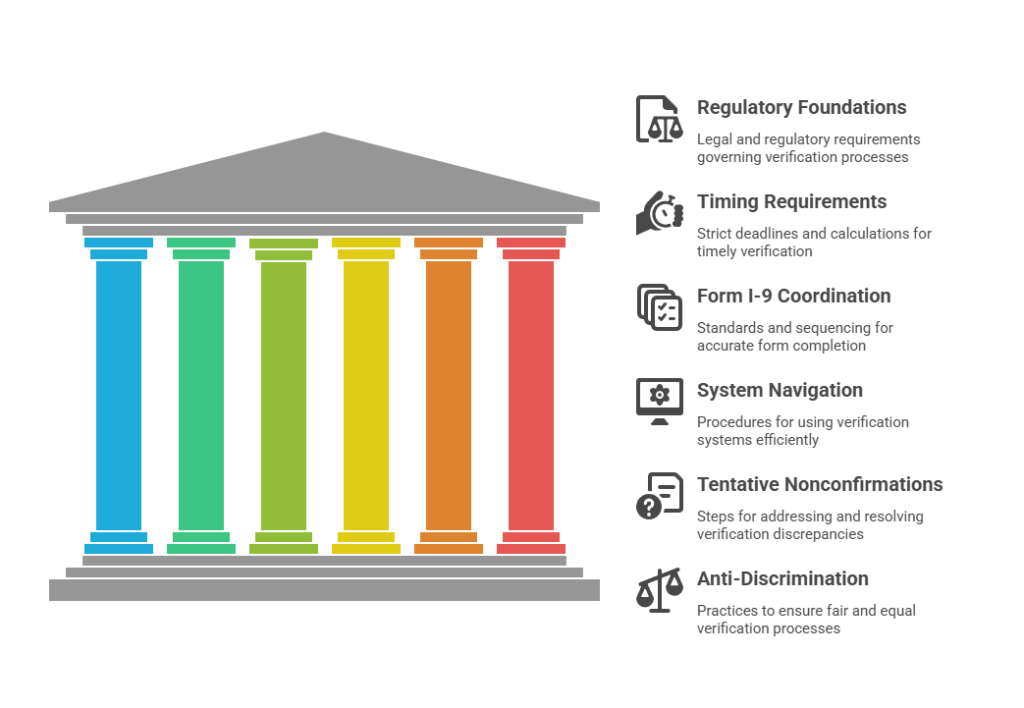

Regardless of management model, multi-location organizations require standardized training that helps ensure all personnel performing verification activities possess current knowledge:

- Regulatory foundations: IRCA requirements, E-Verify legal framework, employer obligations

- Timing requirements: Three-day rules, business day calculations, deadline tracking

- Form I-9 coordination: Sequencing requirements, documentation standards, data consistency

- System navigation: Login procedures, case creation steps, status checking, case closure

- Tentative nonconfirmations: Employee notification, contest procedures, resolution tracking

- Anti-discrimination: Prohibited practices, selective verification risks, employee rights

Initial certification processes verify that personnel demonstrate competency before receiving independent verification responsibilities. Organizations should maintain training records for all current and former E-Verify users. Ongoing training maintains knowledge currency as regulations change and organizational procedures are updated.

Performance Monitoring and Reporting

Effective oversight of multi-location E-Verify compliance requires monitoring systems that provide visibility into verification performance. Key performance indicators should track both operational efficiency and compliance quality. Metrics for operational efficiency include average time from hire to case creation, percentage of cases created within required timelines, and average case resolution time.

| Metric Category | Sample Performance Indicators for Internal Monitoring |

| Timing Compliance | Percentage of cases created within regulatory timeframes |

| Processing Speed | Average time elapsed from hire to case creation |

| Error Rate | Percentage of cases requiring correction due to data entry issues |

| TNC Resolution | Average time to resolve tentative nonconfirmations |

| Training Currency | Percentage of staff with current certification |

Note: These are example metrics that organizations might use for internal quality management. They do not represent regulatory requirements or industry standards. Organizations should develop benchmarks appropriate to their specific operational contexts.

Compliance quality metrics monitor timing violations, error rates in case creation, tentative nonconfirmation resolution compliance, and audit findings. Location-specific reporting enables comparison across the enterprise to identify locations that may need additional support. Exception reporting that flags potential compliance issues for immediate attention helps prevent small problems from becoming significant violations.

Implementing Proactive Compliance Monitoring

Continuous compliance monitoring transforms E-Verify management from reactive problem response to proactive risk prevention. Organizations that implement systematic oversight and self-assessment can maintain higher compliance levels. They also respond more effectively when issues emerge.

Internal Audit Programs and Exception Tracking

Regular internal audits identify compliance gaps before external authorities discover them. Comprehensive audit programs examine both procedural compliance and documentation quality across representative case samples. Audit protocols should verify that cases were created within required timelines and that information accurately matches Form I-9 documentation.

Sample sizes should be sufficient to detect patterns while remaining practical to complete regularly. Organizations might consider reviewing a representative percentage of cases based on their annual verification volume, with adjustments for higher-risk scenarios. Legal or compliance professionals can help determine appropriate sample sizes for specific organizational contexts.

Quarterly or semi-annual audit cycles provide sufficient frequency to detect problems early. Systematic tracking of verification exceptions, errors, and compliance incidents creates data for root cause analysis. Each exception should trigger investigation to determine whether the incident represents an isolated mistake or indicates systemic process problems.

Corrective action processes must address both immediate incident remediation and long-term prevention:

- Immediate actions: Correct specific compliance violations through case updates or employee notifications

- Root cause analysis: Identify contributing factors like training gaps, unclear procedures, or system limitations

- Prevention measures: Modify processes, enhance training, or implement system controls

- Documentation: Maintain records of exceptions, investigations, and corrective actions for audit purposes

Documentation of exceptions, investigations, and corrective actions demonstrates organizational commitment to compliance during government audits. Well-documented responses to identified problems may help mitigate penalties even when violations occurred.

Continuous Improvement and Technology Tools

Leading organizations treat E-Verify management as a continuous improvement opportunity. Process improvement initiatives draw on exception data, audit findings, user feedback, and performance metrics. Improvement methodologies might include lean process analysis that reduces unnecessary steps and error-proofing techniques that help prevent mistakes.

Technology systems can transform E-Verify administration by automating routine tasks and providing real-time visibility. The following discussion addresses optional technology approaches that some employers find helpful, not required system components. Dedicated case management platforms centralize verification administration, tracking each verification from initiation through final closure. Real-time case tracking enables supervisors to monitor verification progress across all locations and identify cases approaching deadlines.

Automated alert systems address deadline management challenges. Platforms should calculate verification deadlines based on hire dates and business day calendars, then generate escalating notifications as deadlines approach. Initial alerts notify assigned administrators that cases require action, while escalating notifications to supervisors help prevent timing violations when cases remain incomplete.

Advanced reporting tools transform verification data into actionable insights. Standard reports should address operational metrics, compliance indicators, and audit documentation needs. Custom analytics enable organizations to investigate specific questions like how verification performance varies by location or which scenarios create the most processing challenges.

Managing Tentative Nonconfirmations Effectively

Note: The following information provides general guidance on tentative nonconfirmation procedures as outlined in E-Verify program requirements. Employers facing actual tentative nonconfirmations, particularly those resulting in final nonconfirmations, should consult with qualified employment counsel before taking any adverse action to ensure compliance with all applicable federal, state, and local laws.

Tentative nonconfirmations represent one of the most operationally challenging aspects of E-Verify compliance. These situations require careful handling that balances regulatory obligations, employee rights, and operational efficiency. Organizations that develop systematic tentative nonconfirmation management processes may resolve cases faster and maintain better employee relations.

Understanding Causes and Procedural Requirements

Tentative nonconfirmations occur when information entered into E-Verify does not match government database records. Understanding common causes helps organizations prevent mismatches and respond appropriately when they occur. Data entry errors represent a frequent cause where information entered incorrectly differs from Form I-9 documentation.

Common tentative nonconfirmation triggers include transposed numbers in Social Security numbers, name discrepancies between legal names and database records, typographical errors in names or dates of birth, recent status changes not yet updated in government systems, and database delays in reflecting administrative changes. Employee documentation errors occur when individuals provide incorrect information on Form I-9. Database record issues arise when government databases contain outdated or incorrect information.

Federal regulations establish specific procedures employers must follow when tentative nonconfirmations occur. Employers must promptly inform employees of tentative nonconfirmations and provide written notice explaining findings and employee rights. They must also allow employees to contest findings if they choose.

Employees who contest tentative nonconfirmations have eight federal government work days to contact the appropriate agency. Employers may not take adverse employment actions based on tentative nonconfirmations while employees are resolving issues. Documentation requirements include maintaining copies of all notices provided to employees, recording dates when employees were informed, tracking contest actions and resolution steps, and preserving all case-related communications.

Resolution Tracking and Case Closure

Systematic tracking of tentative nonconfirmation cases helps ensure proper resolution. Case management systems should track key dates including when tentative nonconfirmations were issued, employee notification dates, contest deadlines, expected resolution dates, and actual closure dates. Organizations should establish clear responsibilities for monitoring case progression and checking case status in E-Verify.

Regular review of open tentative nonconfirmation cases identifies situations requiring action. When final nonconfirmations result after exhausting resolution attempts, employers must terminate employment while carefully documenting that termination stems from final E-Verify findings. Legal consultation for final nonconfirmation terminations helps ensure appropriate handling and compliance with all applicable laws.

Preparing for E-Verify Audits and Investigations

Government agencies conduct E-Verify audits and investigations to assess employer compliance with program requirements. Preparation and appropriate response to audit activities help protect organizations from penalties. These practices also demonstrate good-faith compliance efforts that may influence enforcement outcomes.

Audit Selection and Documentation Requirements

While government agencies do not publicly disclose comprehensive audit selection criteria, some factors have been associated with increased regulatory attention. These may include federal contractor status, operation in certain industries, previous compliance concerns, or unusual verification patterns. However, any employer enrolled in E-Verify may be selected for audit at any time.

Organizations cannot predict audit selection with certainty. They should maintain continuous audit readiness rather than attempting to prepare only after receiving audit notices. Consistent compliance practices and thorough documentation provide protection regardless of when audits occur.

| Document Category | Required Contents | Retention Period |

| Forms I-9 | Completed forms with supporting documentation | 3 years after hire or 1 year after termination |

| E-Verify Cases | Case confirmation numbers, dates, status history | Same as Form I-9 |

| Employee Notices | E-Verify participation notices, TNC notifications | Same as Form I-9 |

| Training Records | Completion certificates, course materials, assessments | Duration of employment plus 3 years |

| Policy Documents | Written procedures, approval records, updates | Current version plus previous versions |

Comprehensive documentation represents the foundation of successful audit response. Organizations must maintain Forms I-9, E-Verify case documentation, employee notices, training records, policy documents, and all communications related to employment verification. Forms I-9 must be retained for three years after hire or one year after employment termination, whichever is later.

Response Protocols and Communication

Receiving an audit notice requires prompt, organized response following established protocols. Organizations should immediately notify relevant personnel including legal counsel, compliance officers, HR leadership, and E-Verify administrators. Initial response steps include confirming receipt of audit notices, identifying requested information, assessing document retrieval requirements, and establishing response teams with clear responsibilities.

Communication with auditors should be professional, factual, and coordinated through designated organizational representatives. Organizations should provide requested information completely and accurately while not volunteering additional information beyond what auditors request. When audits identify compliance deficiencies, organizations should acknowledge findings, explain circumstances, present any mitigating factors, and describe corrective actions implemented to prevent recurrence.

Conclusion

Managing E-Verify compliance effectively requires transforming mandatory verification from administrative burden into strategic operational capability through systematic processes, technology enablement, continuous monitoring, and organizational commitment. Organizations that invest in robust E-Verify management frameworks may realize advantages through reduced onboarding friction, enhanced audit confidence, and demonstrated regulatory competence while fulfilling employment verification obligations. E-Verify requirements and procedures are subject to change, so this article reflects requirements as understood as of its publication date. Employers should verify current requirements through official E-Verify resources or consult with qualified legal counsel.

Frequently Asked Questions

What is the difference between Form I-9 completion and E-Verify verification?

Form I-9 is a mandatory employment eligibility verification form that all U.S. employers must complete for every new hire. E-Verify is an additional electronic verification program that compares Form I-9 information against government databases. Form I-9 completion must occur before creating E-Verify cases, and the two processes coordinate but serve distinct verification functions with separate compliance requirements.

How quickly must employers create E-Verify cases after hiring employees?

In most circumstances, employers must create E-Verify cases within three business days of an employee's hire date, which is generally the first day of work for pay. Business days exclude weekends and federal holidays. Organizations should establish internal deadlines that build buffer time to help ensure compliance even when unexpected delays occur.

Can employers use E-Verify for current employees or only new hires?

Employers enrolled in E-Verify must verify all newly hired employees but generally may not create E-Verify cases for existing employees already working at the time of enrollment. Creating cases for current employees could constitute unlawful discrimination unless done as part of specific federal contractor requirements. E-Verify should not be used for routine reverification when employment authorization expires.

What should employers do when employees receive tentative nonconfirmations?

Employers must promptly inform employees of tentative nonconfirmations in private and provide written notice explaining the finding and employee rights. Employees who choose to contest have eight federal government work days to contact the appropriate agency. During this period and while employees work to resolve mismatches, employers must allow continued employment and may not take adverse actions. Employers should consult with qualified legal counsel before taking any adverse action based on E-Verify findings.

Do employers in all states have the same E-Verify requirements?

E-Verify requirements vary significantly by state. Some states mandate E-Verify participation for all employers or employers above certain size thresholds. Other states have no mandatory requirements beyond federal contractor obligations. Multi-state employers must understand requirements in each jurisdiction where they operate. State and local laws may impose additional requirements beyond federal E-Verify obligations.

How long must employers retain E-Verify records and documentation?

Organizations should retain E-Verify case documentation consistent with Form I-9 retention requirements, which mandate keeping forms for three years after hire or one year after employment termination, whichever is later. Records should include case confirmation numbers, case creation and closure dates, copies of employee notices, and tentative nonconfirmation documentation. Organized retention systems that enable rapid retrieval support efficient audit responses.

What employee rights and protections exist in the E-Verify process?

Federal law prohibits employers from discriminating in employment verification based on citizenship status or national origin. While employees choose which acceptable documents to present from the Lists of Acceptable Documents, employers may not reject facially valid documents that reasonably appear genuine or request different or additional documents based on an employee's citizenship status, immigration status, or national origin. Employees have the right to contest tentative nonconfirmations and to continue working during contest periods. Employers should consult the USCIS M-274 Handbook for Employers for detailed guidance on acceptable document practices.

Additional Resources

- E-Verify Program Overview and Employer Requirements

https://www.e-verify.gov/ - U.S. Citizenship and Immigration Services Form I-9 Central Page

https://www.uscis.gov/i-9-central - Department of Homeland Security E-Verify User Manual

https://www.e-verify.gov/employers/employer-resources - Department of Justice Immigrant and Employee Rights Section

https://www.justice.gov/crt/immigrant-and-employee-rights-section - Federal Acquisition Regulation E-Verify Requirements for Federal Contractors

https://www.acquisition.gov/far/subpart-22.18

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.