Background screening is undergoing a fundamental transformation driven by artificial intelligence, regulatory evolution, and the distributed nature of modern workforces. Organizations that understand emerging trends in continuous monitoring, blockchain-based verification, and AI-assisted compliance will gain significant competitive advantages in talent acquisition while reducing legal risk and operational friction in an increasingly complex regulatory environment.

Key Takeaways

- Artificial intelligence is automating identity verification and report generation processes, reducing turnaround times from days to hours while improving accuracy through machine learning algorithms that detect anomalies human reviewers might miss.

- Continuous background monitoring is replacing traditional point-in-time screenings, allowing employers to receive real-time alerts about criminal convictions, license suspensions, and other disqualifying events throughout the employment lifecycle.

- Blockchain technology is enabling tamper-proof credential verification systems that allow candidates to maintain portable, verifiable records of education, certifications, and employment history across multiple employers.

- Remote and distributed workforces are driving demand for multi-jurisdiction screening capabilities that navigate complex state and international compliance requirements without manual coordination.

- Regulatory frameworks governing background checks are expanding rapidly, with new state-level restrictions on criminal history inquiries, credit checks, and social media screening requiring sophisticated compliance management systems.

- Candidate experience expectations are shifting screening from a compliance burden to a competitive differentiator, with transparency, speed, and mobile-friendly processes influencing employer brand perception.

- Biometric identity verification technologies are reducing identity fraud while raising new privacy concerns that employers must balance against security needs under evolving data protection statutes.

- Integration between applicant tracking systems, human resources information systems, and background screening platforms is becoming essential infrastructure rather than optional enhancement as hiring velocity increases.

The Evolution of Background Screening Technology

Artificial Intelligence and Machine Learning Applications

Artificial intelligence is fundamentally reshaping how background screening operates at the technical level. Machine learning algorithms now assist with optical character recognition when digitizing court records, reducing transcription errors that previously led to false positives or incomplete reporting. Natural language processing helps categorize offense types and determine FCRA compliance requirements based on jurisdiction-specific regulations without manual legal review for routine cases.

AI-powered identity verification compares applicant-provided information against multiple authoritative databases simultaneously. These systems flag discrepancies that warrant human investigation. Predictive analytics models help employers understand statistical risk patterns while maintaining FCRA compliance and individualized assessment requirements.

Organizations must ensure AI-assisted processes do not create disparate impact on protected classes. Federal law requires human judgment for adverse actions—AI cannot make hiring decisions autonomously. These tools surface relevant context that informs decision-making within legal boundaries while maintaining accuracy and dispute resolution requirements.

Blockchain Technology in Credential Verification

Blockchain-based verification systems create immutable records of educational credentials, professional licenses, and employment history. Candidates can share these records across multiple applications without repeated verification delays. Educational institutions and licensing boards are beginning to issue digital credentials stored on distributed ledgers, allowing instant verification without contacting registrar offices or waiting for transcript processing.

This technology addresses the persistent problem of credential fraud, which costs U.S. employers billions annually through falsified degrees and fabricated certifications. Blockchain verification reduces the administrative burden on educational institutions that process thousands of verification requests. Candidates gain control over their verified credentials as portable digital assets.

Implementation challenges remain significant. Widespread institutional adoption is needed for the system to function effectively. Standardized protocols across verification platforms must be established. Privacy considerations require careful design to ensure candidates control who accesses their credential data and that verification systems comply with data protection regulations including state-level privacy statutes.

EXPERT INSIGHT: As an HR professional, I've witnessed that screening has evolved from a straightforward candidate validation to an ongoing responsibility related to trust, safety, and integrity. While AI, monitoring, and changing regulations ensure a faster process, it has also become a more human task compared to before, as accuracy and discernment are as important as ever. Each screen is a living individual, not a data set, and our challenge is to ensure that we protect as much as we preserve dignity. When done correctly, screening helps not only protect, but also strengthens our company culture by demonstrating that integrity is a value that exists before day one. - Charm Paz, CHRP

Continuous Monitoring and Real-Time Alerts

Traditional background screening operates as a point-in-time snapshot—employers verify information at hire but rarely revisit unless an incident occurs. Continuous monitoring represents a fundamental shift toward ongoing verification throughout the employment relationship. Automated alerts notify employers when new criminal records, license suspensions, or sanctions appear.

| Monitoring Feature | Traditional Screening | Continuous Monitoring |

| Timing | One-time at hire | Ongoing throughout employment |

| Updates | None unless re-screening ordered | Real-time alerts when records change |

| Authorization | Single consent at application | Separate ongoing consent required |

| Cost Structure | Per-check pricing | Subscription or per-employee pricing |

| Compliance Requirements | Standard FCRA procedures | Enhanced disclosure and adverse action protocols |

Legal and ethical considerations require careful implementation. Employers must establish clear policies about what triggers monitoring includes and how alerts are investigated before adverse action. The Fair Credit Reporting Act requires specific disclosures and authorization before implementing continuous monitoring, separate from initial background check consent.

Regulatory Landscape and Compliance Challenges

Expanding State and Local Restrictions

The regulatory environment governing background screening is fragmenting rapidly as states and municipalities adopt jurisdiction-specific restrictions. Ban-the-box legislation now exists in over 35 states and 150+ cities. These laws prohibit criminal history inquiries until specific hiring stages with significant variation in timing, covered employers, and exempted positions.

Salary history bans prevent employers from requesting previous compensation information in over 20 states. Several jurisdictions restrict credit history checks to positions with specific financial responsibilities, narrowing permissible use beyond Fair Credit Reporting Act requirements. Some states impose lookback period limitations that prevent consideration of criminal convictions after specified timeframes ranging from seven to ten years depending on offense severity.

Organizations with distributed workforces face the challenge of applying the most restrictive applicable standard. Technology solutions that embed jurisdiction-specific rules into screening workflows become essential. Manual compliance processes become untenable as regulatory requirements proliferate and penalties for violations increase through private rights of action and regulatory enforcement.

FCRA Requirements and Individualized Assessments

The Fair Credit Reporting Act establishes federal baseline requirements that apply regardless of state law. Employers must provide standalone disclosure documents before obtaining background reports—not buried in application materials. Written consent must be clear and separate from employment applications.

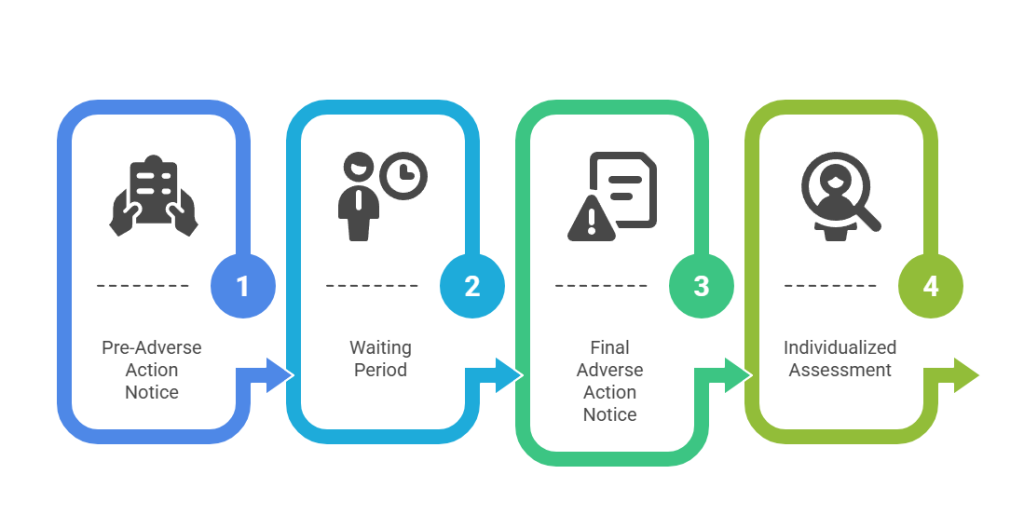

When background information could lead to adverse employment action, specific procedures apply:

- Pre-Adverse Action Notice: Employer must provide a copy of the consumer report and a summary of FCRA rights

- Waiting Period: Reasonable time must pass (typically five business days minimum) before finalizing the decision

- Final Adverse Action Notice: Written notice must specify the consumer reporting agency used, the agency's contact information, and the candidate's right to dispute report accuracy

- Individualized Assessment: Employers should consider the nature and gravity of offenses, time elapsed since conviction, and the nature of the position sought

Federal guidance and case law increasingly emphasize individualized assessment requirements rather than blanket disqualification policies. Categorical exclusions based on conviction history without individualized review create heightened legal risk. Documented racial disparities in criminal justice system contact make these policies vulnerable to disparate impact discrimination claims.

International Screening and Data Privacy Regulations

Global workforce expansion requires navigating international background screening laws that differ substantially from U.S. frameworks. The European Union's General Data Protection Regulation imposes strict limitations on processing criminal history information. Legitimate interest assessments, data minimization principles, and explicit candidate consent with robust withdrawal rights are required.

| Region | Key Restrictions | Primary Compliance Framework |

| European Union | Limited criminal history access; strict data transfer rules | GDPR; national data protection laws |

| United Kingdom | Disclosure and Barring Service checks for specific roles only | UK GDPR; Rehabilitation of Offenders Act |

| Canada | Provincial variations; consent requirements | PIPEDA; provincial privacy legislation |

| Asia-Pacific | Highly variable by country; limited centralized databases | Country-specific data protection statutes |

| Latin America | Generally permissive; growing privacy framework adoption | Emerging national privacy laws |

Data transfer restrictions under GDPR and similar frameworks create technical compliance challenges. Standard contractual clauses, adequacy determinations, and data processing agreements must address cross-border data flows. Verification source availability varies dramatically by country—some jurisdictions maintain centralized criminal databases accessible for employment screening while others prohibit background check access to court records entirely.

Technological Infrastructure and Integration

Applicant Tracking System Integration

Seamless integration between background screening platforms and applicant tracking systems eliminates manual data entry and reduces processing delays. Modern integrations pass candidate information directly from ATS to screening providers when candidates reach designated workflow stages. Completed reports return without requiring recruiters to toggle between systems.

This integration enables compliance with ban-the-box timing requirements by preventing criminal history checks until candidates reach interview or conditional offer stages. Automated triggers based on position type ensure appropriate screening packages match role requirements. Real-time status updates within applicant tracking systems give hiring teams visibility into screening progress without requiring separate logins.

API-based integrations allow customization beyond out-of-box connectors. Organizations with specific workflow requirements can build tailored processes that reflect their unique compliance obligations. Webhook configurations provide event-driven notifications when screening status changes, supporting high-volume hiring operations that need immediate awareness of cleared candidates.

Mobile-Optimized Candidate Experience

Candidate expectations around background screening have shifted dramatically as consumer technology raises baseline usability standards. Mobile-optimized authorization and information collection processes are becoming requirements rather than enhancements. Hourly and frontline positions particularly benefit since candidates primarily interact with employers via smartphones.

Key mobile optimization features include:

- Document Photography: Candidates photograph identity documents rather than accessing scanners

- Touch Signatures: Authorization forms support touch-signature capabilities

- Text Notifications: Status updates deliver via text message

- Self-Service Portals: Candidates review screening status and submit corrections

- Multilingual Support: Non-English speakers navigate authorization without language barriers

Speed and convenience directly impact candidate perception of employer brand. Friction in screening processes influences acceptance rates for competitive talent. Self-service candidate portals provide transparency into screening status and empower individuals to correct inaccuracies before reports reach employers.

Data Security and Privacy Infrastructure

Background screening involves processing highly sensitive personal information including Social Security numbers, dates of birth, criminal records, and financial history. Organizations must implement robust data security controls to protect this information from unauthorized access. Encryption protocols must protect data both in transit and at rest.

Access controls limit information visibility to personnel with legitimate business need to know. Audit logging tracks who accessed candidate information, when, and for what purpose. These logs support regulatory compliance audits and investigations of potential unauthorized access.

Data retention policies must balance operational needs against privacy principles favoring minimal collection and storage:

- During Employment: Maintain records as needed for operational and legal compliance purposes

- Post-Employment: Retain for statute of limitations periods (typically 2-5 years depending on claim type)

- Automated Deletion: Implement scheduled purging of screening records after retention periods expire

- Vendor Security: Evaluate third-party vendors' SOC 2 compliance, penetration testing, and incident response capabilities

Third-party vendor security assessments are essential when outsourcing background screening functions. Data processing agreements must specify vendor responsibilities for protecting information and notification requirements for security incidents.

Emerging Verification Methods and Technologies

Biometric Identity Verification

Biometric authentication technologies including facial recognition, fingerprint scanning, and liveness detection are reducing identity fraud in background screening processes. These systems verify that the person submitting information matches identity documents and previous biometric captures on file with authoritative sources. Facial recognition compares applicant selfies against driver's license photos or passport images.

Liveness detection prevents fraud attempts using photographs or recorded videos. Real-time interaction such as head movements or random gestures is required. Financial services, healthcare, and government contracting sectors with high-value fraud incentives particularly benefit from enhanced identity verification.

Privacy and accuracy concerns require careful implementation oversight. Facial recognition algorithms have documented accuracy disparities across demographic groups. Higher false rejection rates occur for individuals with darker skin tones and women. Biometric data collection triggers heightened regulatory scrutiny under privacy laws including Illinois' Biometric Information Privacy Act.

Social Media and Digital Footprint Analysis

Social media screening presents significant legal and practical challenges despite apparent efficiency gains from reviewing public information. When screening occurs systematically as part of hiring decisions, these activities may constitute consumer reports under the Fair Credit Reporting Act. Disclosure, authorization, and adverse action procedures would then be required.

Protected class information visible on social media profiles creates discrimination liability concerns:

- Visual Information: Photographs reveal race, age, and potentially disability status

- Personal Details: Posts may indicate religious affiliation, pregnancy status, or political beliefs

- Connection Data: Friend lists and group memberships may suggest protected characteristics

- Content History: Old posts may not reflect current views or circumstances

Many jurisdictions restrict or prohibit requesting social media passwords or requiring candidates to add hiring managers as connections to view private content. The legal risks and marginal predictive value of social media screening lead many organizations to avoid it entirely. When organizations choose to conduct social media screening, using third-party vendors who apply consistent protocols creates more defensible processes than ad hoc reviews by hiring managers.

Reference Check Automation and Verification

Automated reference checking platforms standardize the process of gathering and evaluating professional references through structured questionnaires. These systems are sent directly to references via email or text message. Scheduling friction is reduced while comparable information is collected across candidates.

Automation increases reference completion rates by eliminating phone tag. Standardized questions improve defensibility by ensuring all candidates receive equivalent evaluation. Sentiment analysis tools highlight potentially concerning language patterns that warrant follow-up, though human judgment remains essential.

Reference verification faces inherent limitations regardless of methodology. Many employers maintain policies of confirming only dates of employment and job title without substantive performance evaluation due to defamation liability concerns. References provided by candidates naturally skew positive as candidates select individuals likely to offer favorable assessments. Organizations should treat references as one data point among multiple assessment methods.

Strategic Implications for Employers

Competitive Advantage Through Screening Efficiency

Organizations that implement efficient screening processes gain measurable competitive advantages in tight labor markets. Reducing time-to-hire by even a few days increases acceptance rates. Top candidates maintain engagement rather than accepting competing opportunities during prolonged screening delays.

Technology investments in automated workflows create scalability that manual processes cannot match:

- Volume Capacity: Process more candidates in compressed timeframes without proportional staff increases

- Quality Consistency: Maintain standards during high-volume hiring periods

- Cost Optimization: Apply risk-based screening appropriate to position requirements rather than uniform maximum-depth checks

- Brand Enhancement: Transparent processes with clear communication demonstrate respect for candidates' time

Candidate experience during background screening influences employer brand perception and affects recruitment marketing effectiveness. Organizations known for efficient, respectful screening build reputational advantages that improve application volume and candidate quality.

Building Compliant Screening Programs

Comprehensive written policies documenting screening criteria, procedures, and decision-making frameworks provide essential protection against discrimination claims. These policies should specify what screening components apply to which position types. Timing of screening in the hiring process and how flagged information is evaluated before adverse actions must be clear.

Training programs ensure hiring managers understand legal requirements and organizational policies before reviewing background screening results:

- Common Violations: Disqualification based on arrest records rather than convictions

- Assessment Factors: Failure to consider time elapsed and offense relevance

- Procedural Requirements: Neglecting pre-adverse action procedures

- Documentation Standards: Inadequate record-keeping of individualized assessment rationale

Legal counsel review of screening policies and adverse action procedures helps identify compliance gaps before violations occur. Periodic audits of actual screening decisions verify that practice aligns with policy. Vendor management processes should include due diligence before engagement and ongoing performance monitoring.

Future-Proofing Background Screening Operations

Organizations should build flexibility into screening infrastructure recognizing that regulatory requirements will continue evolving. Technology platforms with configurable workflows can adapt to new requirements without complete system replacement. Vendor relationships with partners who actively monitor regulatory changes reduce compliance burden on internal teams.

Scenario planning helps organizations anticipate how potential regulatory changes might affect current screening practices. If additional states adopt seven-year lookback limitations, how would that affect current disqualification patterns? Proactive assessment allows gradual adjustment rather than crisis response when laws change.

Data governance frameworks that treat background screening information with appropriate sensitivity create foundations for compliance with emerging privacy regulations. As more states consider comprehensive privacy legislation similar to California's Consumer Privacy Act, organizations with mature data handling practices will adapt more easily. Industry association participation and continuing education keep HR and compliance professionals informed about emerging trends and proposed legislation.

The Candidate Perspective on Background Screening

Transparency and Communication Expectations

Modern candidates expect clear communication about what background screening involves, how long it takes, and what could affect their candidacy. Opacity creates anxiety and negative employer brand impressions even when screening reveals no concerns. Organizations should provide plain-language explanations of screening components rather than generic statements about "background checks required."

Proactive status updates during screening prevent candidates from feeling abandoned after interviews conclude. Simple notifications when screening begins, if delays occur, and when results are under review demonstrate respect for candidates' legitimate interest. These communications reduce candidate inquiries to recruiters while maintaining engagement.

When issues arise that may affect candidacy, early communication allows candidates to provide context or documentation before final decisions occur. Many flagged items have reasonable explanations—dismissed charges still appearing in records, common name matches to criminal records belonging to different individuals, or old financial issues from specific life circumstances. Professional, respectful final communication preserves goodwill for future opportunities if circumstances change.

Dispute Rights and Error Correction

The Fair Credit Reporting Act provides candidates important rights to dispute inaccurate information in consumer reports. Consumer reporting agencies must investigate disputes within 30 days. Disputed information that cannot be verified must be corrected or deleted.

| Error Type | Common Causes | Resolution Method |

| Identity Mix-ups | Similar names; shared addresses | Submit identity documents distinguishing candidate from record subject |

| Incomplete Records | Court system delays; data entry errors | Provide court documents showing case dismissals or dispositions |

| Outdated Information | Records exceeding legal reporting limits | Reference applicable state lookback period restrictions |

| Incorrect Dates | Administrative errors; system migrations | Submit official documents with correct dates and sequences |

| Wrong Jurisdictions | Geocoding errors; address history mistakes | Provide proof of residence during relevant periods |

Organizations benefit from encouraging candidates to review preliminary findings and submit corrections before adverse actions become final. This informal resolution prevents formal disputes that trigger reinvestigation obligations. When candidates can quickly provide court documents showing case dismissals, screening can proceed efficiently.

Conclusion

Background screening is entering a period of significant transformation as artificial intelligence, continuous monitoring capabilities, and blockchain verification technologies converge with increasingly complex regulatory requirements. Organizations that proactively adapt their screening infrastructure while maintaining strict Fair Credit Reporting Act compliance will gain competitive advantages through faster hiring and improved candidate experience. Success requires balancing technological efficiency with human judgment in an increasingly regulated landscape. Alongside such needs, there are other factors that should be acknowledged by the employer that the results of the screening process affect the individual, not just the step in the process or the risk that they pose. By following rules that include empathy, transparency, and consistency, technology enables the screening process to transcend simply meeting the needs in the workforce and furthers the development of trust.

Frequently Asked Questions

How is artificial intelligence changing background screening processes while maintaining FCRA compliance?

AI assists with data processing tasks such as optical character recognition of court records and identity verification across multiple databases. Federal law requires human judgment for adverse employment actions, so AI serves as a decision-support tool rather than an autonomous decision-maker. Organizations must ensure AI-assisted processes maintain FCRA requirements for accuracy and individualized assessment. Proper adverse action procedures remain mandatory regardless of technology used.

What is continuous background monitoring and should all organizations implement it?

Continuous monitoring provides ongoing alerts about new criminal records, license suspensions, or sanctions throughout employment rather than only screening at hire. This approach benefits industries with regulatory requirements for ongoing suitability verification including healthcare, financial services, and transportation. Implementation requires separate authorization beyond initial screening consent and clear policies about alert investigation procedures. Full adverse action processes apply when monitoring reveals disqualifying information.

How do ban-the-box laws affect when employers can conduct criminal background checks?

Ban-the-box legislation restricts when employers may inquire about criminal history, typically prohibiting questions on initial applications. Requirements vary significantly by jurisdiction—over 35 states and 150+ municipalities have some form of ban-the-box law with different timing requirements and exemptions. Multi-state employers must apply the rules of the jurisdiction where the position is located or where the candidate resides, whichever is more protective. Automated compliance tools help navigate this complexity.

Can employers review candidates' social media profiles as part of screening?

Employers may review genuinely public social media content, but systematic screening as part of hiring decisions may constitute consumer reports under the Fair Credit Reporting Act. Many jurisdictions prohibit requesting passwords or requiring access to private content. Social media screening presents discrimination risks when profiles reveal protected characteristics. The legal risks and marginal predictive value lead many organizations to avoid this practice entirely.

What are the main compliance differences between U.S. background screening and international screening?

International screening faces diverse regulatory frameworks ranging from highly restrictive European Union data protection rules to more permissive regimes in other regions. The EU's General Data Protection Regulation requires legitimate interest assessments, data minimization, and explicit consent. Cross-border data transfer restrictions require legal mechanisms such as standard contractual clauses. Verification source availability varies dramatically by country based on local laws.

How long do employers need to retain background check records?

No universal rule governs retention periods—organizations must balance operational needs against privacy principles favoring minimal data retention. Many employers retain screening records for the employment duration plus applicable statute of limitations periods for potential claims (typically 2-5 years depending on claim type). Clear retention policies with automated deletion schedules reduce unnecessary risk exposure. Legal counsel should review retention policies considering applicable employment laws.

What is the difference between arrest records and conviction records in employment screening?

Arrests indicate that someone was detained by law enforcement but do not establish guilt—many arrests result in dismissed charges or acquittals. Convictions represent final criminal adjudications of guilt. Many states restrict or prohibit considering arrest records without conviction in employment decisions. Employers should generally limit consideration to convictions while maintaining individualized assessment of relevance to specific positions.

What rights do candidates have if background check information is inaccurate?

The Fair Credit Reporting Act provides candidates the right to dispute inaccurate information directly with consumer reporting agencies. Agencies must investigate within 30 days and correct or delete unverified information. Candidates receive a copy of background reports before adverse action and a summary of dispute rights. Employers must provide reasonable time (typically five business days minimum) between pre-adverse action notice and final decisions.

Are there positions where more extensive background screening is legally required?

Federal and state regulations mandate specific screening for certain positions including roles with vulnerable population access (children, elderly, disabled individuals). Healthcare positions requiring professional licensure face statutory screening requirements. Financial services roles are subject to regulatory suitability standards. Industry-specific requirements may include fingerprint-based FBI background checks and sanctions screening against federal exclusion lists.

How can employers balance thorough screening with creating positive candidate experiences?

Efficient processes with clear communication create positive experiences while maintaining thoroughness. Mobile-optimized authorization, transparent status updates, and realistic timeframe expectations reduce friction. Organizations should implement risk-based screening appropriate to position requirements rather than uniform maximum-depth checks that create unnecessary delay. Treating candidates respectfully throughout screening demonstrates professionalism that enhances employer brand regardless of hiring outcomes.

Additional Resources

- Federal Trade Commission: Background Checks and Your Rights

https://consumer.ftc.gov/articles/background-checks - U.S. Equal Employment Opportunity Commission: Background Checks and Employment

https://www.eeoc.gov/laws/guidance/arrest-and-conviction-records - Fair Credit Reporting Act Full Text - Federal Trade Commission

https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act - National Conference of State Legislatures: Criminal Record in Employment and Housing

https://www.ncsl.org/labor-and-employment/criminal-records-in-employment-and-housing - Society for Human Resource Management: Background Checks and Screening

https://www.shrm.org/topics-tools/tools/toolkits/background-checking

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.