The Role of Bankruptcy Background Checks in Employment

Employment credit reports are a pivotal element in today's employment landscape. In this article, we'll explore the paramount importance of background checks in employment, delving into their significance from the perspectives of both employers and job applicants.

Insolvency: What does it say about a candidate, and why should it factor into background checks? Beyond assessing financial history, recruiters and hiring teams consider the fiscal responsibility that led to the candidate's bankruptcy and their plan for recovery or how they have bounced back. This evaluation varies depending on the company and the role the candidate is applying for. For more insights, read the article.

Why They Matter

Conducting thorough background checks, including assessing bankruptcy history, is an indispensable practice for employers. But why is this aspect so vital? Bankruptcy records are a fundamental component of comprehensive background checks. Employers prioritize this information, particularly for roles requiring financial responsibility.

The Employer's Advantage

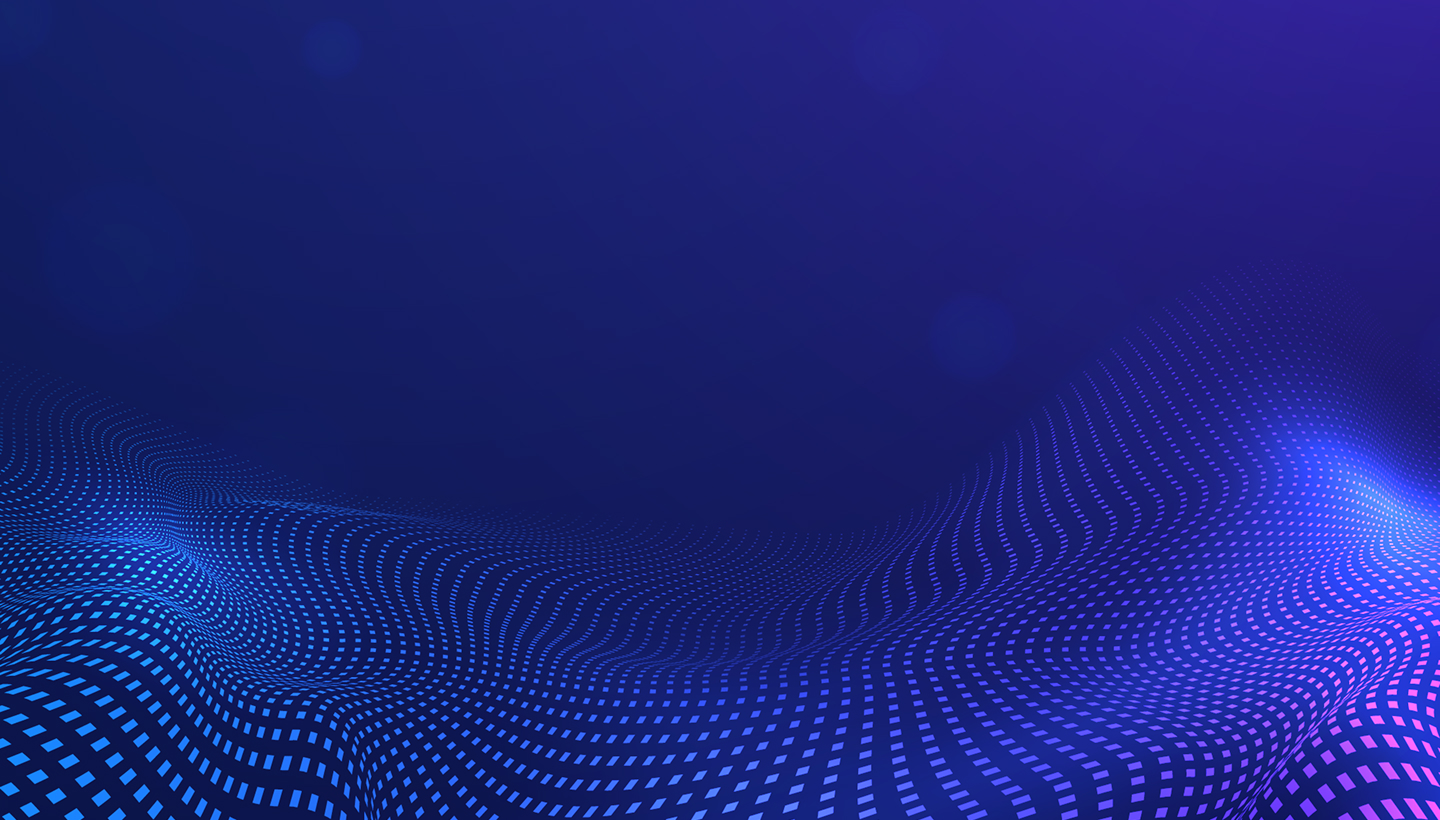

Employers gain a distinct advantage through background checks, which provide essential insights into potential hires. Let's delve into the motivations behind employers' interest in these checks and the legal considerations that accompany them.

Evaluating Financial Stability

Employers conduct bankruptcy checks to assess an applicant's financial stability, a critical factor, especially for positions with fiscal responsibilities.

Navigating Legal Frameworks

Employers must navigate the intricate legal framework surrounding bankruptcy checks, as different states have varying regulations. Compliance with these laws is imperative to avoid legal complications.

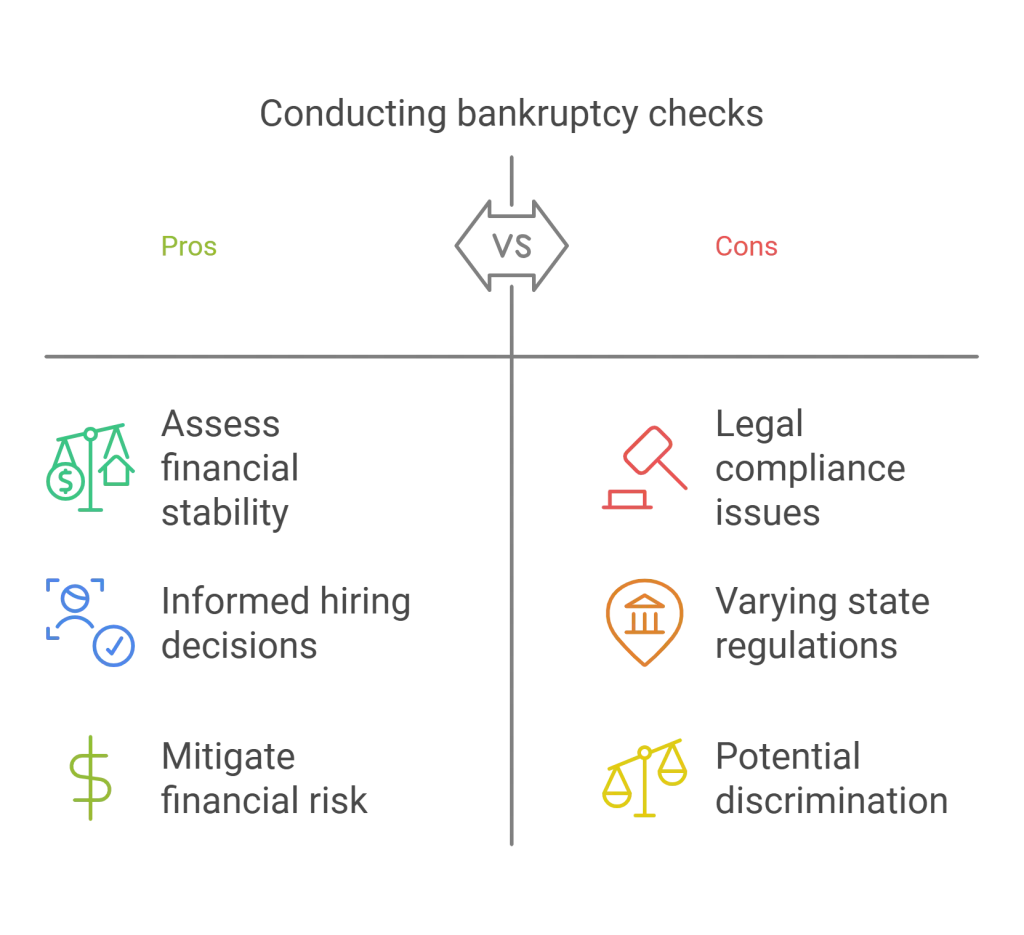

Understanding the Applicant's Perspective

Bankruptcy records can be a source of concern for job seekers. It's essential to comprehend their viewpoint and address their apprehensions effectively.

Addressing Applicant Worries

Job seekers often worry about the potential negative impact of bankruptcy records on their job prospects. Discrimination based on financial history is a genuine concern.

Knowing Reporting Durations

Job applicants should be informed about the duration of the bankruptcy records remaining on their background checks, allowing them to anticipate its influence on their job prospects.

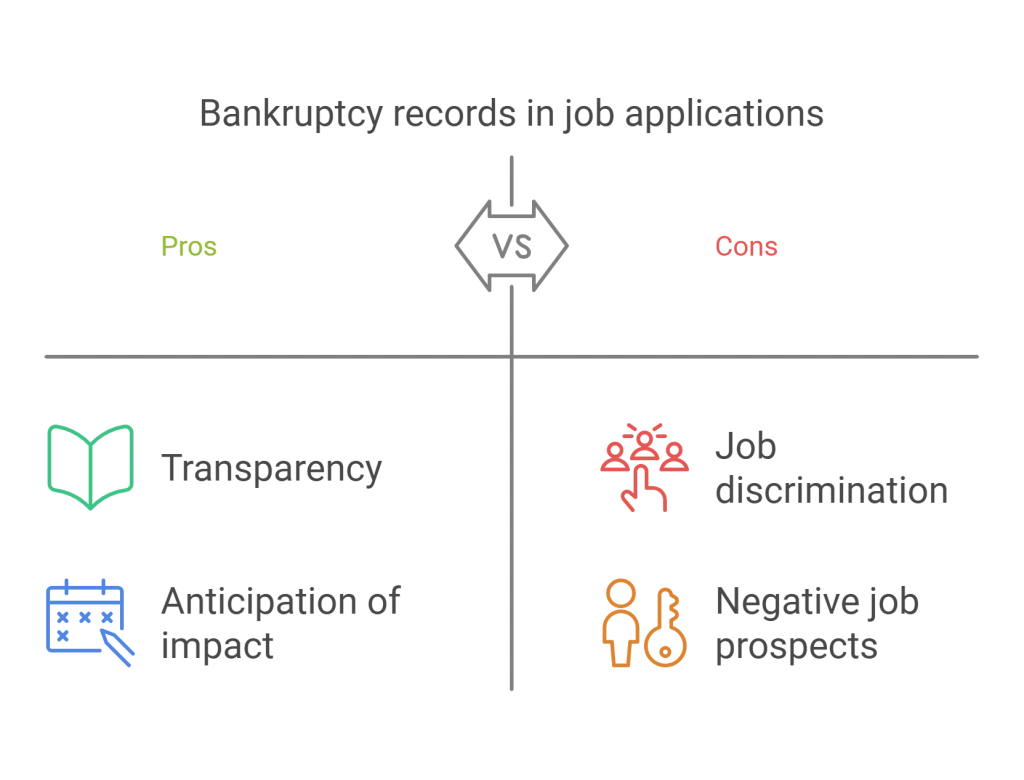

Do Bankruptcies Show Up on Background Checks?

The presence of bankruptcy records on a pre-employment background check depends on various factors:

Type of Background Check

Not all background checks are the same. Some may include bankruptcy records, while others may not. It largely depends on the depth and scope of the check conducted by the employer or the background check company.

Time Frame

Bankruptcy records do not stay on a credit report indefinitely. Generally, they are visible for seven to ten years, depending on the type of bankruptcy filed. After this period, they should not automatically appear on a credit-related background check.

Employer's Policies

Employers can decide which elements they want to include in their background checks. While some may contain bankruptcy history, others focus solely on criminal records and employment verification.

State Regulations

State regulations can also influence the inclusion of bankruptcy records in pre-employment background checks. Some states have restrictions on using bankruptcy information for employment decisions.

Both employers and job applicants must be aware of these factors and communicate openly during the hiring process regarding the scope of the background check to ensure transparency and informed decisions.

Guidance for Job Seekers

For individuals with bankruptcy records, employing effective strategies during the hiring process can make a significant difference.

Navigating the Hiring Process

Job applicants should prepare to discuss their bankruptcy history confidently during interviews, emphasizing their resilience in overcoming financial challenges.

The Power of Transparency

Transparency is the key to success. Applicants should openly discuss their bankruptcy history, providing context for their financial situation and showcasing their commitment to a fresh start.

The Role of Background Check Companies

Background check companies play a pivotal role in facilitating these checks, offering various services tailored to employers' requirements while ensuring compliance with legal mandates.

Comprehensive Service Offerings

These companies offer services encompassing identity verification, work history validation, educational background checks, criminal record assessments, and credit report evaluations. This wealth of information empowers employers to make well-informed decisions.

Customized Solutions

Background check companies customize their services to align with an employer's specific needs, ensuring strict adherence to state and federal regulations.

Frequently Asked Questions

Can I Pass a Background Check with a Bankruptcy?

Passing a background check with a bankruptcy is possible. However, it depends on the type of background check conducted and the employer's specific requirements. Bankruptcy may be visible in credit-related background checks but is typically not included in standard criminal background checks. Be prepared to discuss your bankruptcy transparently during the hiring process to address any concerns.

Does Bankruptcy Show Up on a Background Check?

Insolvency can appear on certain background checks, particularly credit-related ones. However, it will not occur in a standard criminal background check. Including bankruptcy information in a background check largely depends on the employer's policies and the type of check they perform.

Will Bankruptcy Show Up in a Criminal Background Check?

No, bankruptcy does not show up in a standard criminal background check. Criminal background checks focus on an individual's criminal history, including arrests, convictions, and related legal matters. Bankruptcy is a financial issue typically not considered in criminal background checks.

Can a Bankruptcy Affect My Job Prospects?

Yes, bankruptcy can affect job prospects, especially for positions requiring financial responsibility, such as accounting or finance roles. Employers may view it as a potential concern in roles involving money management, but it is not usually a disqualifying factor for other positions.

How Long Does Bankruptcy Stay on a Background Check?

Bankruptcy can remain on a credit report for up to 10 years, depending on the type (Chapter 7 or Chapter 13). If a credit-related background check is performed, the bankruptcy will be visible during this period. After that, it will no longer appear.

Are Employers Allowed to Deny Employment Based on Bankruptcy?

Federal law prohibits private employers from denying employment solely because of bankruptcy under the Bankruptcy Act. However, public sector employers and some financial positions may consider bankruptcy as part of the overall assessment.

Can I Explain My Bankruptcy During the Hiring Process?

Yes, explaining the circumstances of your bankruptcy during the hiring process can help alleviate employer concerns. Transparency and providing context about the situation can demonstrate accountability and financial responsibility moving forward.

Do All Employers Check for Bankruptcy?

No, not all employers check for bankruptcy. Most employers perform criminal and employment history checks. Bankruptcy information is typically only included in credit background checks, which are more common for financial positions.

How Can I Improve My Credit After Bankruptcy for Background Checks?

You can improve your credit after bankruptcy by paying bills on time, reducing debt, and using credit responsibly. Over time, these efforts will help rebuild your financial profile, making a better impression on potential employers who perform credit checks.

Is a Credit Background Check the Same as a Criminal Background Check?

No, a credit background check focuses on financial history, including credit scores, debt, and bankruptcy, while a criminal background check examines criminal history, including arrests and convictions. Employers may request one or both depending on the job requirements.

In Conclusion: Empowering Informed Decisions

Background checks for bankruptcy are an essential part of the employment process. They provide employers with important information about a candidate's financial history. Both employers and job applicants need to approach these checks with transparency and care. By understanding the significance and legal complexities of these background checks, informed decisions can be made to benefit all parties involved in the hiring process.

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.