Small businesses face FCRA penalties ranging from $100 to $1,000 per violation for negligent non-compliance, with willful violations triggering actual damages, punitive damages up to $1,000 per violation, and attorney fees that average $50,000-$150,000 per lawsuit. Non-compliance costs extend beyond statutory fines to include legal defense expenses, settlement payments, operational disruptions, and reputational damage that collectively can exceed $250,000 for businesses with fewer than 50 employees.

Key Takeaways

- FCRA penalties for small businesses include statutory damages of $100-$1,000 per violation for negligent non-compliance, while willful violations result in actual damages plus punitive damages ranging from $1,000 to $500,000 per case.

- Legal defense costs for FCRA violation lawsuits average between $50,000 and $150,000, with settlements typically ranging from $25,000 to $100,000 for small businesses depending on violation severity.

- Common FCRA violations include failure to obtain proper authorization (62% of cases), inadequate adverse action procedures (48%), and improper disclosure practices (41%) according to 2024 CFPB data.

- FCRA compliance costs for small businesses range from $2,500 to $15,000 annually, significantly lower than average non-compliance penalty costs of $75,000 to $250,000 per incident.

- Background check compliance checklists must include written authorization forms, proper disclosure documents, adverse action notification procedures, and vendor agreement verification to minimize legal risk.

- Pre-employment screening best practices require using FCRA-compliant Consumer Reporting Agencies, implementing standardized procedures across all hiring decisions, and training HR staff on legal requirements semi-annually.

- Employment screening legal requirements mandate specific timelines including providing standalone disclosure before screening and waiting 3-5 business days after pre-adverse action notices.

- HR legal risk management strategies should incorporate Employment Practices Liability Insurance with FCRA coverage and regular compliance audits every 6-12 months.

Understanding FCRA Violation Fines and Penalty Structure

The Fair Credit Reporting Act establishes a two-tiered penalty system that distinguishes between negligent and willful violations. This framework creates substantially different financial consequences for small businesses. Understanding these penalty structures is essential for calculating potential exposure and prioritizing compliance investments.

Negligent Non-Compliance Penalties

Negligent FCRA violations occur when businesses fail to comply despite reasonable efforts to maintain compliance. These violations typically result from procedural oversights, inadequate training, or documentation failures rather than intentional disregard.

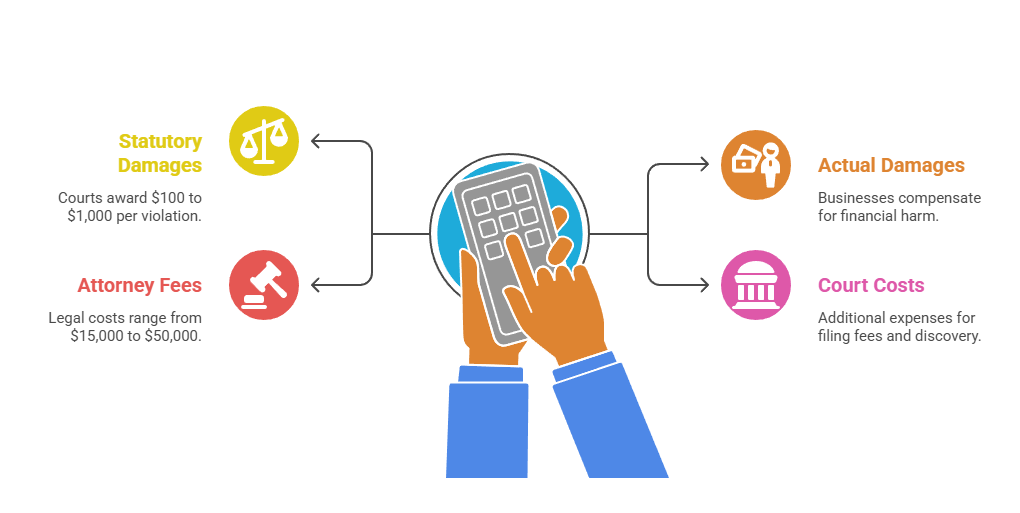

The penalty structure for negligent violations includes several components:

- Statutory damages: Courts award $100 to $1,000 per violation based on severity, number of affected individuals, and business size

- Actual damages: Businesses must compensate for financial harm including lost wages, emotional distress, or credit damage experienced by affected individuals

- Attorney fees: Legal costs typically range from $15,000 to $50,000 even when defending against negligent violation claims

- Court costs: Additional expenses for filing fees, discovery costs, and expert witness fees add to the total financial burden

Multiple violations often occur simultaneously in a single hiring decision. For example, failing to provide proper disclosure while also neglecting adverse action procedures can result in $200-$2,000 in penalties for one candidate.

Willful Violation Consequences

Willful FCRA violations represent intentional disregard or reckless indifference to legal requirements. Courts interpret "willful" broadly, including situations where businesses knew or should have known about FCRA obligations but failed to implement proper procedures. The financial consequences escalate dramatically compared to negligent violations.

| Penalty Type | Range | Notes |

| Actual Damages | Varies | Compensates plaintiff for documented financial harm |

| Punitive Damages | $1,000-$500,000+ | Averages 2-5 times actual damages; can reach 10ratio |

| Statutory Damages | $100-$1,000 per violation | Applied per affected individual |

| Attorney Fees | $50,000-$150,000+ | Mandatory payment of plaintiff's legal costs |

Class action lawsuits present the most severe financial threat to small businesses. Willful violations affecting multiple employees or applicants can generate combined penalties exceeding $500,000, potentially threatening business viability.

Additional Financial Consequences Beyond Direct Penalties

FCRA compliance costs extend well beyond statutory fines and damage awards. Settlement negotiations, even in weak plaintiff cases, typically cost $15,000-$40,000 due to the risk calculation that litigation defense will exceed settlement amounts.

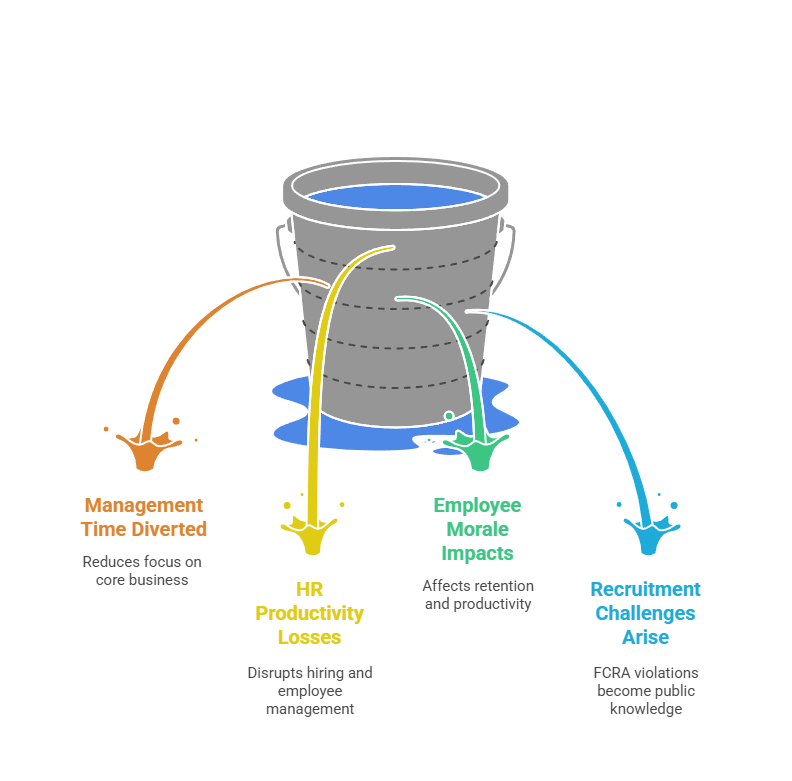

Operational disruptions during litigation strain small business resources significantly:

- Management time diverted to legal proceedings reduces focus on core business operations

- HR productivity losses during discovery and depositions disrupt normal hiring and employee management

- Employee morale impacts from workplace legal actions affect retention and productivity

- Recruitment challenges arise when FCRA violations become public knowledge

These indirect costs average $25,000-$75,000 for small businesses over 12-18 month case lifecycles according to 2024 SHRM data. Reputational damage from publicized violations affects recruiting effectiveness, customer relationships, and vendor partnerships, particularly in regulated industries where compliance signals operational reliability.

Real-World FCRA Penalty Case Studies

Examining documented FCRA violation cases provides concrete context for understanding how penalties materialize in real scenarios. These examples illustrate what specific compliance failures trigger litigation and the resulting financial impact on small businesses.

Manufacturing Company: Disclosure Form Violations

A 35-employee Ohio manufacturing company faced an FCRA class action lawsuit in 2023 after conducting background checks on 42 applicants over three years. The company embedded background check authorization language within its general employment application, violating FCRA's requirement for separate disclosure documents. This single procedural shortcut created exponential financial exposure.

The case resulted in multiple cost categories:

- Settlement damages: $89,000 distributed among class members

- Plaintiff attorney fees: $38,000 as mandated by FCRA

- Defense legal costs: $47,000 through settlement negotiations

- Total non-compliance cost: $174,000 (approximately $4,143 per affected applicant)

Post-settlement, the company invested $8,500 in comprehensive compliance system implementation. Management estimated this prevention investment would have saved approximately $165,500 compared to actual violation costs.

Retail Chain: Adverse Action Procedure Failures

A 12-location retail chain with 47 employees settled an FCRA lawsuit in 2024 for failing to follow proper adverse action procedures. The business provided pre-adverse action notices but failed to wait the required period before finalizing rejections. This timing violation denied applicants opportunity to dispute report accuracy.

Eight affected applicants demonstrated they could have corrected erroneous information if given proper notice. Three subsequently obtained employment elsewhere that proved the background report inaccuracies. The financial breakdown illustrates how timing violations create substantial liability even without willful intent.

| Cost Component | Amount |

| Compensatory Damages | $58,000 |

| Plaintiff Attorney Fees | $25,000 |

| Defense Costs | $31,000 |

| Total Cost | $114,000 |

The company's failures stemmed from inadequate HR training rather than willful disregard. However, the distinction provided little financial protection once litigation commenced.

Professional Services Firm: Systematic Compliance Failures

A 28-employee professional services firm faced the most severe penalties after a 2023 lawsuit revealed systematic compliance failures spanning five years. The firm obtained background checks without any written authorization, never provided adverse action notices, and used non-compliant screening vendors. Most damaging, evidence showed the owner attended HR training seminars explaining FCRA requirements but chose not to implement compliant procedures.

The court found willful violations based on this demonstrated knowledge and inaction. The penalty structure reflected the severity:

- Punitive damages of $175,000 demonstrated court's intent to deter similar conduct

- Actual damages of $87,000 compensated affected individuals for documented harm

- Statutory damages of $25,000 applied mandatory per-violation penalties

- Attorney fees of $25,000 reimbursed plaintiff's legal costs

- Defense costs of $68,000 accumulated before settlement acceptance

The total $312,000 cost nearly bankrupted the firm. This case illustrates how knowledge of compliance requirements without corresponding action transforms violations from negligent to willful, dramatically increasing financial exposure.

FCRA Compliance Costs vs. Non-Compliance Impact

Comparing investment requirements for proper employment screening legal requirements against potential violation expenses reveals compelling financial justification. Small businesses often assume compliance costs exceed their risk exposure, but data demonstrates the opposite reality.

Implementation and Maintenance Investment

Establishing compliant background check procedures requires upfront investment in policy development, vendor selection, and HR training. Small businesses typically spend $2,500-$6,000 for initial compliance framework implementation. This investment varies based on employee count, hiring volume, and existing system sophistication.

| Investment Category | Initial Cost | Annual Maintenance |

| Policy Development | $800-$2,500 | $400-$800 |

| HR Training | $500-$1,500 | $600-$1,200 |

| Compliant Vendors | $25-$75 per check | Ongoing per use |

| Compliance Audits | Included in setup | $1,200-$3,500 |

| EPLI Insurance | N/A | $500-$3,000 |

| Legal Consultations | $500-$1,000 | $800-$2,400 |

Annual maintenance costs range from $1,500-$8,000 for small businesses. These recurring investments ensure procedures remain current with regulatory updates and case law developments. Quarterly compliance audits verify proper disclosure provision, authorization documentation, and adverse action notice timing.

Return on Investment Analysis

Financial analysis comparing five-year compliance investment costs against single violation penalty expenses demonstrates overwhelming ROI. A small business investing $5,000 in initial implementation and $3,000 annually in maintenance spends $17,000 over five years. This investment protects against average violation costs of $75,000-$250,000 per incident.

Small businesses conducting 20-50 background checks annually face approximately 15-25% probability of experiencing an FCRA-related legal challenge over five years without proper compliance systems. Expected value calculations provide objective justification for compliance programs:

- Expected loss without compliance: 20% probability à $125,000 average cost = $25,000

- Five-year compliance investment: $17,000 total

- Risk reduction benefit: $8,000+ net savings plus additional probability reduction

- ROI ratio: 4 to 12 returns through avoided legal expenses

Beyond direct penalty avoidance, compliance investments improve hiring process quality through better vendor relationships and more thorough screening procedures. These operational benefits reduce bad hire costs, estimated at 30% of first-year salary.

Background Check Compliance Checklist

Implementing comprehensive pre-employment screening best practices requires systematic procedures covering each phase of the background check process. Small businesses need clear action items that translate legal requirements into operational steps. This checklist framework ensures nothing falls through the cracks during hiring processes.

Pre-Screening Requirements

FCRA compliance begins before initiating any background check process. Businesses must provide standalone disclosure documents in clear, conspicuous format explaining that background reports may be obtained for employment purposes. These documents must appear separate from employment applications or other hiring forms.

Essential pre-screening steps include:

- Standalone disclosure: Create a separate document dedicated solely to background check notification without extraneous information, liability waivers, or employment terms

- Plain language: Use 8th-grade reading level language ensuring all candidates understand document contents regardless of education level

- Written authorization: Obtain explicit written permission before requesting background reports, clearly identifying the information being sought and how it will be used

- Electronic compliance: Ensure digital signature systems guarantee candidates understand document contents and voluntarily provide consent without coercion

- Documentation retention: Implement systems retaining signed disclosure and authorization forms for minimum seven years per FCRA requirements

Many small businesses violate these requirements by embedding background check language within general employment applications. This common shortcut invalidates FCRA compliance and creates liability exposure.

Vendor Management Procedures

Background check vendors must qualify as Consumer Reporting Agencies with proper FCRA compliance certifications. Small businesses should verify vendor FCRA compliance through written certifications, contract language requiring legal adherence, and periodic compliance reviews. Vendor selection and management directly impacts business legal exposure.

Your vendor compliance checklist should address:

- FCRA certification: Verify vendors maintain current Consumer Reporting Agency status with proper compliance credentials and data security measures

- Contract provisions: Ensure agreements clearly allocate FCRA compliance responsibilities and include indemnification protections for vendor-caused violations

- Report content limits: Confirm vendors exclude prohibited information including bankruptcy records older than 10 years, civil suits older than seven years, and arrest records without convictions

- Dispute procedures: Establish clear processes for handling consumer disputes about report accuracy, with defined timelines and documentation requirements

- Annual reviews: Conduct yearly compliance assessments examining sample reports, verifying insurance coverage, and evaluating dispute resolution effectiveness

Due diligence on potential vendors includes reviewing client references and examining sample reports for prohibited content. Many small business FCRA violations stem from using non-compliant vendors that provide reports containing illegal information.

Adverse Action Protocols

When background check information influences employment decisions negatively, FCRA requires specific adverse action notice procedures. Pre-adverse action notices must be provided before finalizing negative decisions, including a copy of the background report and written explanation of FCRA rights. The business must allow reasonable time, typically 5 business days, for applicants to dispute report accuracy.

The complete adverse action process requires:

- Pre-adverse action notice: Provide background report copy, Summary of Rights document, and notification that adverse action is being considered before finalizing any negative decision

- Waiting period: Allow 3-5 business days for applicant response, genuinely considering disputes or explanations rather than treating notices as mere formality

- Final adverse action notice: Send after concluding the process, including CRA contact information, statement that the CRA didn't make the decision, and notice of dispute rights

- Documentation: Maintain records of adverse action notice delivery, applicant responses, and decision rationales supporting employment choices

Courts scrutinize whether businesses provide meaningful opportunity for dispute resolution. Several recent cases found violations where companies finalized rejections despite pending applicant responses, demonstrating that timing compliance matters significantly.

Common FCRA Violations in Small Businesses

Understanding frequent compliance failures helps small businesses prioritize prevention efforts. Recognizing high-risk practices enables immediate correction before violations trigger legal challenges. Most small business violations fall into three primary categories that account for over 80% of FCRA litigation.

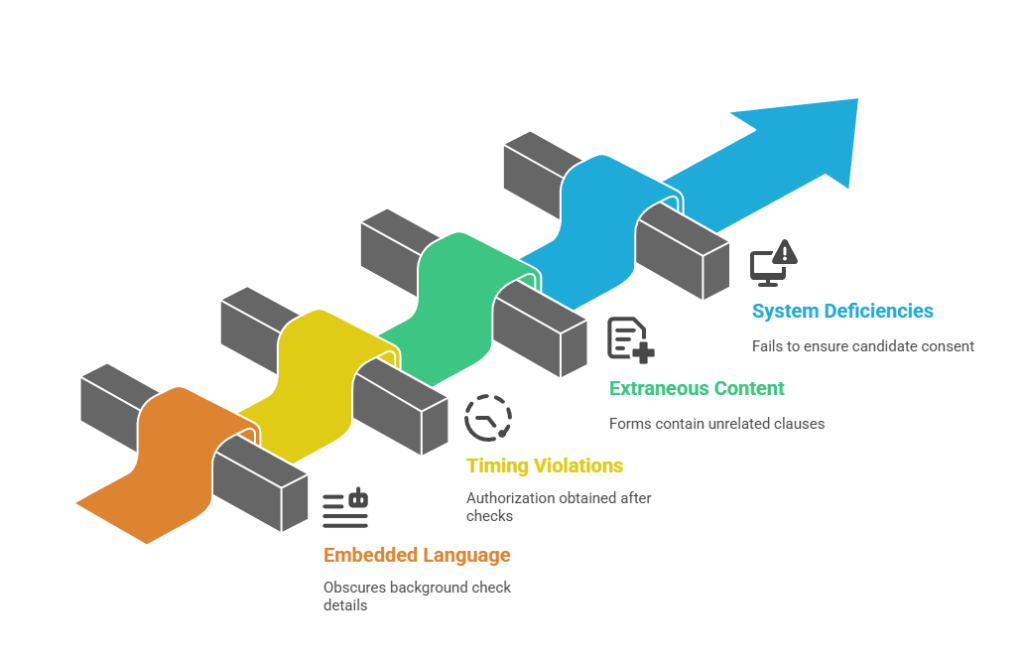

Authorization and Disclosure Problems

The most common FCRA penalty trigger involves improper disclosure and authorization procedures, representing 62% of small business violations. Businesses frequently embed background check language within general employment applications or include liability waivers with disclosure forms. These practices violate FCRA's requirement for standalone documents dedicated solely to background check notification.

Common authorization failures include:

- Embedded language: Using general employment application statements like "I authorize investigation of my background" instead of standalone disclosure documents

- Timing violations: Obtaining authorization after initiating background checks, particularly when hiring urgency drives procedural shortcuts

- Extraneous content: Adding employment terms, liability releases, or at-will disclaimers to disclosure forms that must contain only background check information

- Electronic system deficiencies: Using applicant tracking systems that fail to ensure candidates understand disclosure content or voluntarily provide consent

Many small businesses assume general application language satisfies FCRA requirements. This assumption is incorrect and creates immediate liability exposure the moment background checks commence.

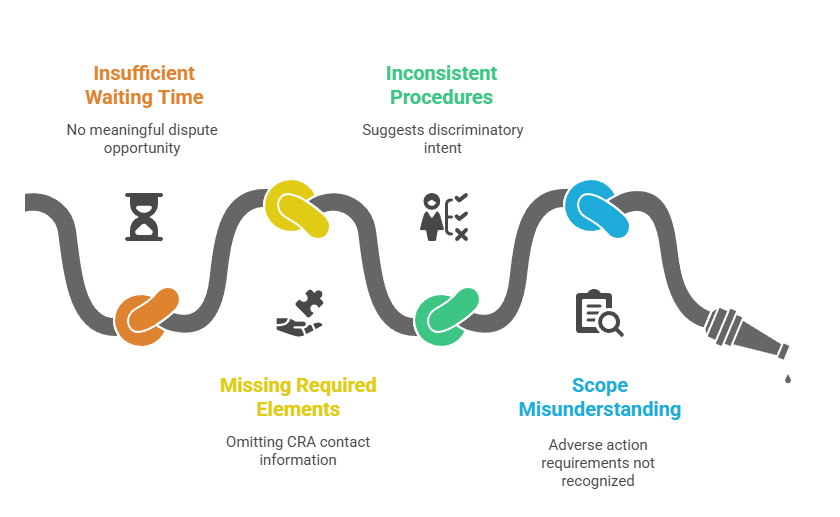

Adverse Action Procedure Gaps

Adverse action procedure failures account for 48% of FCRA violations affecting small businesses. These violations frequently involve inadequate waiting periods, missing pre-adverse action notices, or failure to provide required documentation. The most costly mistake involves finalizing negative employment decisions before providing proper notices.

Critical adverse action errors include:

- Insufficient waiting time: Sending pre-adverse action notices simultaneously with rejection letters, negating the purpose of the notice requirement and eliminating meaningful dispute opportunity

- Missing required elements: Omitting CRA contact information, statements that the CRA didn't make the employment decision, or specific information about applicant dispute rights

- Inconsistent procedures: Applying different standards across hiring decisions, suggesting discriminatory intent beyond FCRA violations and compounding legal exposure

- Scope misunderstanding: Failing to recognize that adverse action requirements apply to rescinded offers, demotions, and terminations based on background checks, not just initial rejections

FCRA requires providing background report copies and dispute opportunities before finalizing decisions. Courts consistently find violations even when businesses provide some form of adverse action notification that lacks required elements or proper timing.

FCRA Compliance Implementation Timeline

Establishing comprehensive employment screening legal requirements compliance requires systematic implementation following structured timelines. Small businesses must balance urgency with thoroughness to create sustainable compliance systems. This phased approach enables businesses to stop critical violations immediately while building long-term compliance infrastructure.

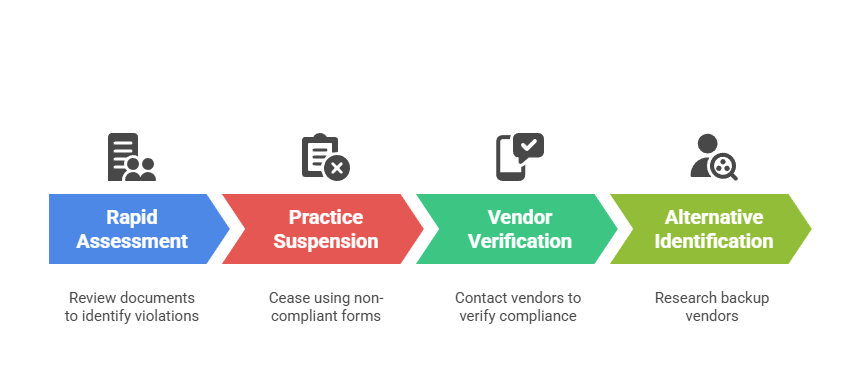

Immediate Actions (Week 1-2)

First-priority actions focus on stopping obvious compliance violations and establishing basic legal protections. Small businesses should immediately audit current background check procedures and suspend non-compliant practices, even if delays affect hiring timelines.

Week 1-2 priorities include:

- Rapid assessment: Review disclosure forms, authorization documents, adverse action notices, and vendor contracts to identify clear FCRA violations (typically requires 4-8 hours for small businesses)

- Practice suspension: Immediately cease using non-compliant disclosure forms that embed background check language in employment applications or include extraneous content

- Vendor verification: Contact current background check vendors to verify FCRA compliance certifications, request sample report reviews, and assess contract compliance provisions

- Alternative identification: Research qualified vendors if current providers cannot immediately verify FCRA compliance, preparing backup options to prevent extended hiring disruptions

The cost of continued violations exceeds hiring timeline disruptions. Temporary suspension protects businesses from accumulating additional legal exposure while developing proper procedures.

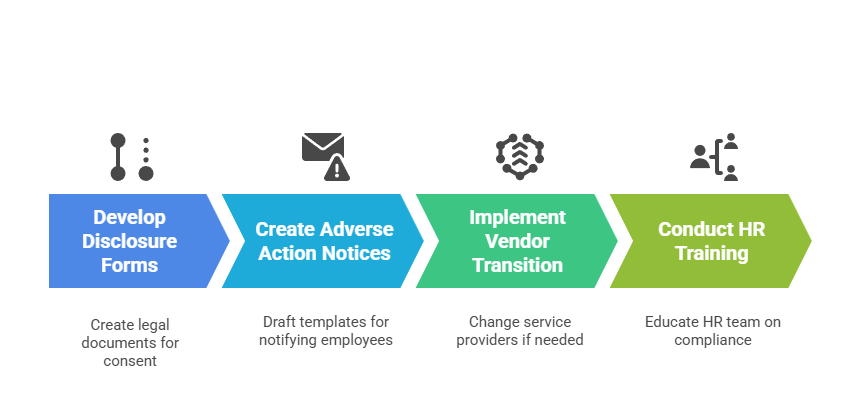

Short-Term Implementation (Week 3-8)

Short-term implementation focuses on establishing core compliant procedures including proper documentation, vendor relationships, and basic HR training. This phase creates functional compliance systems allowing businesses to resume background screening with substantially reduced legal risk. Most small businesses complete this phase within 6-8 weeks.

Implementation steps should address:

- Develop compliant disclosure and authorization forms using attorney-reviewed templates addressing jurisdiction-specific requirements

- Create adverse action notice templates covering both pre-adverse action and final notice requirements with all mandated elements

- Implement vendor transition if current providers demonstrate compliance deficiencies, selecting FCRA-certified CRAs with appropriate insurance coverage

- Conduct initial HR team training covering FCRA compliance basics, new procedural requirements, and documentation responsibilities with practical exercises

Template development and vendor selection typically require 2-4 weeks including contract negotiations and system integration. HR training should include scenario-based decision frameworks helping staff apply compliance principles to real hiring situations.

Long-Term Sustainment (Month 3+)

Long-term compliance requires ongoing monitoring, periodic audits, and continuous training. These maintenance procedures prevent compliance drift while demonstrating good-faith efforts that reduce willful violation risk. Sustainable systems become embedded in normal business operations rather than requiring special compliance initiatives.

| Activity | Frequency | Purpose |

| Internal Audits | Quarterly | Review 10-20% of screening files for proper documentation |

| Third-Party Reviews | Annually | Objective assessment of procedure effectiveness |

| HR Training Refreshers | Semi-annually | Reinforce requirements and address emerging questions |

| Policy Updates | As needed | Reflect regulatory changes and case law developments |

Subscribe to employment law update services providing timely notification of FCRA regulatory changes and significant court decisions. Proactive awareness of legal developments enables prompt policy adjustments preventing compliance gaps from regulatory evolution.

Insurance and Legal Defense Cost Management

Strategic risk management combines insurance coverage, legal resources, and prevention investments to minimize total FCRA compliance costs. Small businesses need comprehensive protection strategies that address both compliance prevention and violation defense scenarios. Proper insurance and legal planning can mean the difference between manageable disruption and business-threatening financial exposure.

Employment Practices Liability Insurance

EPLI policies with FCRA coverage provide crucial financial protection against employment screening legal requirement violations. These policies cover legal defense costs and settlements up to policy limits, treating insurance premiums as baseline compliance investments rather than optional expenses.

Coverage considerations for small businesses include:

- Coverage limits: Typical policies provide $500,000-$2,000,000 limits with premiums ranging from $800-$4,000 annually based on employee count and hiring volume

- FCRA endorsements: Verify FCRA coverage is included in standard policies or obtain specific endorsements, as some carriers exclude employment screening violations

- Exclusion review: Carefully examine exclusions for willful violations, prior acts, or known issues that could eliminate coverage in likely risk scenarios

- Claims-made structure: Understand reporting requirements and extended reporting periods ensuring continuous protection for incidents occurring during coverage but reported later

Policy exclusions significantly affect coverage value. Small businesses switching insurance carriers must maintain tail coverage for prior policy periods ensuring no protection gaps.

Legal Resource Planning and Cost Control

Establishing relationships with employment law attorneys before compliance issues arise significantly reduces crisis response costs. Attorneys familiar with business operations provide more efficient guidance than those requiring extensive orientation during active litigation. Proactive legal relationships enable quick consultation on unusual hiring situations before they become compliance violations.

Legal cost management strategies include:

- Preventive consultations: Budget $1,500-$5,000 annually for policy reviews, compliance training, vendor contract evaluation, and guidance on complex hiring scenarios

- Early case evaluation: Determine settlement viability versus litigation quickly, avoiding unnecessary discovery costs that accumulate rapidly once lawsuits commence

- Alternative dispute resolution: Pursue mediation for cost-effective case resolution, typically costing $5,000-$15,000 for complete settlement including mediator fees and preparation

- Focused discovery: Limit unnecessary expense through strategic document requests and depositions that address core liability issues without exhaustive investigation

Hourly rates for employment law attorneys range from $200-$500 depending on geographic market and experience level. Effective defense in FCRA cases typically costs $50,000-$150,000, while strategic settlement negotiations reduce expenses to $15,000-$40,000 when pursued early and thoughtfully.

Conclusion

FCRA penalties for small businesses create significant financial exposure ranging from $75,000 to $250,000 per incident when accounting for statutory damages, legal defense costs, and settlements. Comprehensive compliance programs costing $2,500-$15,000 annually provide 4 to 12 ROI through violation prevention while simultaneously improving hiring process quality. Implementing proper employment screening legal requirements through standalone disclosure documents, compliant vendor relationships, and correct adverse action procedures reduces legal exposure substantially. Small businesses should prioritize immediate compliance assessment, systematic procedure implementation, and ongoing monitoring to protect against substantial financial penalties while enhancing HR legal risk management effectiveness.

Frequently Asked Questions

What are the minimum FCRA penalties for small businesses?

Minimum FCRA penalties for negligent violations start at $100 per violation plus actual damages, though attorney fees typically add $15,000-$50,000 even in minor cases. Plaintiffs' attorneys recover fees regardless of damage amounts, making technical violations expensive to defend. Willful violations carry $100-$1,000 statutory penalties per violation but typically result in much higher total costs due to punitive damages averaging 2-5 times actual damages.

How long must small businesses keep FCRA compliance documentation?

Small businesses must retain FCRA compliance documentation including disclosure forms, authorization documents, background reports, and adverse action notices for a minimum seven years after the employment decision. Extended retention helps businesses defend against claims filed years after hiring decisions and demonstrates consistent compliance practices. Digital documentation systems with secure backup procedures provide cost-effective long-term retention while ensuring accessibility during litigation discovery processes.

Can small businesses use generic background check forms found online?

Generic online forms rarely satisfy FCRA compliance requirements because effective documents must address jurisdiction-specific regulations and individual business screening practices. Small businesses should have employment law attorneys review template forms to ensure federal FCRA compliance plus state-specific requirements in California, New York, and other states with additional regulations. Template customization typically costs $500-$1,500 but prevents costly violations from inadequate generic forms.

What constitutes willful FCRA violations versus negligent violations?

Willful FCRA violations involve reckless disregard or knowing failure to comply with legal requirements, including situations where businesses learn about obligations but choose not to implement compliant procedures. Courts find willfulness when businesses attend compliance training but fail to act, receive legal advice identifying deficiencies but neglect corrections, or continue practices after learning about similar violations. Negligent violations involve good-faith compliance efforts with inadvertent procedural errors, making documentation of compliance investments crucial for limiting classification to negligent rather than willful.

Do FCRA requirements apply to small businesses with fewer than 15 employees?

FCRA requirements apply to all businesses regardless of size when they use consumer reports for employment purposes, unlike many employment laws with small business exemptions. Small businesses with even one employee must comply with FCRA disclosure, authorization, and adverse action requirements if they obtain background reports from Consumer Reporting Agencies. The lack of small business exemption makes FCRA compliance particularly important for growing companies that may incorrectly assume they fall below regulatory thresholds.

What insurance coverage protects small businesses from FCRA violation costs?

Employment Practices Liability Insurance with specific FCRA coverage endorsements protects against legal defense costs and settlements, typically with coverage limits of $500,000-$2,000,000 and premiums of $800-$4,000 annually. Standard EPLI policies may exclude FCRA claims, making specific endorsement verification essential during procurement. Policy exclusions for willful violations, known issues, or prior acts significantly affect practical coverage, requiring careful review to ensure protection applies to likely risk scenarios.

How quickly can small businesses implement FCRA-compliant procedures?

Small businesses can implement basic FCRA-compliant procedures within 2-4 weeks including proper disclosure forms, vendor compliance verification, adverse action templates, and initial HR training. Immediate protective actions within 1-2 weeks include auditing current practices and suspending non-compliant procedures. Comprehensive compliance including systematic documentation, ongoing training, and audit procedures requires 2-3 months for complete implementation, though core protections against major violations can be established much faster.

What's the difference between FCRA compliance and ban-the-box requirements?

FCRA regulates how businesses obtain, use, and communicate information from consumer reports, while ban-the-box laws restrict when businesses can inquire about criminal history on initial applications. Both legal frameworks apply simultaneously requiring FCRA procedures when conducting background checks while following ban-the-box timing restrictions. Approximately 37 states and 150+ local governments have ban-the-box laws creating additional employment screening legal requirements beyond FCRA compliance that vary by jurisdiction.

Additional Resources

- Federal Trade Commission: Using Consumer Reports for Employment Purposes

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-employers-need-know - Consumer Financial Protection Bureau: Background Screening Guidance

https://www.consumerfinance.gov/compliance/compliance-resources/other-applicable-requirements/fair-credit-reporting-act/ - U.S. Small Business Administration: Hiring Employees Legal Requirements

https://www.sba.gov/business-guide/manage-your-business/hire-manage-employees - Professional Background Screening Association: FCRA Compliance Resources

https://www.pbsa.org/industry-resources/fcra-compliance/

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.