Georgia landlords and property managers must navigate federal and state regulations when screening prospective tenants. These include the Fair Credit Reporting Act (FCRA), Fair Housing Act (FHA), and Georgia-specific landlord-tenant statutes. While Georgia law provides landlords considerable discretion in tenant selection, compliance with federal anti-discrimination provisions remains essential. Proper consent procedures and adverse action notification requirements help avoid costly litigation and regulatory penalties.

Key Takeaways

- Georgia has no state-specific tenant screening statute, requiring compliance primarily with federal FCRA and Fair Housing Act requirements

- Landlords must obtain written consent before background checks and provide adverse action notices when denying applications

- Security deposits in Georgia are uncapped, but screening fees must be reasonable and disclosed upfront

- Criminal background checks must be applied consistently and comply with HUD guidelines on arrest records and lookback periods

- Credit criteria must align with legitimate business purposes and cannot be used as a discrimination proxy

- Income verification typically follows the 3x rent threshold, though Georgia law doesn't mandate specific ratios

- All screening criteria must be documented in written policies and applied uniformly to avoid fair housing violations

Understanding Georgia's Tenant Screening Legal Framework

Georgia operates under a landlord-friendly legal environment with minimal state-level tenant screening regulations. The absence of comprehensive state statutes means property managers must rely primarily on federal laws. These federal laws govern consumer reports, credit checks, and anti-discrimination protections. Understanding this regulatory landscape is critical for landlords who want to select qualified tenants while avoiding legal exposure.

The legal foundation for Georgia tenant screening requirements comes from three primary sources. The federal Fair Credit Reporting Act (FCRA) governs how consumer information is obtained and used. The Fair Housing Act (FHA) prohibits discrimination based on protected characteristics. Georgia's landlord-tenant laws are codified in Title 44 of the Official Code of Georgia Annotated. Property managers must also consider HUD guidance documents. These documents address criminal history screening policies that may create disparate impact on protected classes.

Federal Laws Governing Tenant Screening in Georgia

The Fair Credit Reporting Act establishes strict requirements for obtaining and using consumer reports during tenant screening. Landlords must provide clear disclosure that a background check will be conducted. They must obtain written authorization from applicants before requesting reports. Additionally, they must notify applicants if adverse action is taken based on report information. These requirements apply whether landlords use professional screening companies or conduct checks independently.

The Fair Housing Act prohibits discrimination based on seven protected classes. These include race, color, national origin, religion, sex, familial status, and disability. Georgia landlords cannot use screening criteria that disproportionately exclude protected classes without legitimate business justification. For example, blanket policies rejecting all applicants with criminal records may violate fair housing laws. This occurs even without discriminatory intent if they create disparate impact on minority applicants.

Georgia State-Specific Regulations

Georgia law provides limited statutory guidance on tenant screening procedures compared to states like California or New York. The Official Code of Georgia Annotated § 44-7-1 through § 44-7-81 addresses general landlord-tenant relationships. However, it contains minimal provisions specifically governing application processing or screening methodologies. This regulatory gap gives Georgia landlords substantial flexibility in establishing screening criteria. It also requires careful attention to federal compliance standards.

Georgia Code § 44-7-30 through § 44-7-37 governs security deposits but doesn't cap deposit amounts. It also doesn't restrict application fees charged during the screening process. Landlords must maintain security deposits in Georgia banking institutions. They can deduct for unpaid rent, damages beyond normal wear and tear, and other lease violations. Screening fees are considered separate from security deposits. They should reflect actual costs incurred for background checks, credit reports, and administrative processing.

Georgia Landlord Tenant Screening Requirements

Establishing comprehensive screening criteria before accepting applications is essential for legal compliance and operational consistency. Georgia landlords should document all screening standards in written policies. These policies specify minimum qualifications for creditworthiness, income verification, rental history, and criminal background. Written policies serve as both operational guidelines and legal protection. They provide defense if screening decisions are later challenged as discriminatory or arbitrary.

The tenant screening process typically begins when prospective renters submit completed applications. Applications must include authorization for background checks. Georgia property managers should provide applicants with clear disclosure forms. These forms explain what information will be reviewed, how decisions will be made, and the estimated timeline. Transparency in the screening process reduces misunderstandings. It also demonstrates good faith compliance with consumer protection laws.

Written Screening Policies and Criteria

Documented screening policies should outline specific, objective criteria applied consistently to all applicants. Georgia landlords need comprehensive standards covering multiple qualification areas. These standards must be defensible as job-related and consistent with business necessity. Clear documentation protects against discrimination claims while ensuring operational consistency.

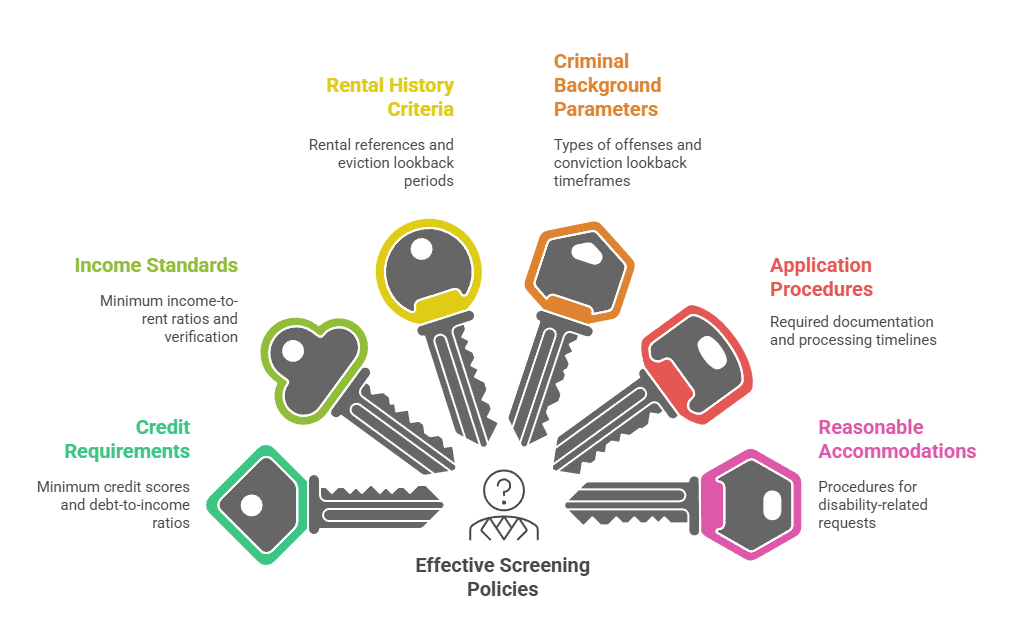

Effective screening policies should address:

- Credit requirements: Minimum credit scores (typically 600-650), acceptable debt-to-income ratios, and timeframes for negative credit events

- Income standards: Minimum income-to-rent ratios (usually 3x monthly rent), acceptable income documentation, and verification procedures

- Rental history criteria: Required rental references, acceptable gaps in rental history, and eviction lookback periods

- Criminal background parameters: Types of offenses considered, conviction lookback timeframes, and individualized assessment procedures

- Application procedures: Required documentation, processing timelines, and applicant notification methods

- Reasonable accommodations: Procedures for disability-related accommodation requests and alternative documentation acceptance

Screening criteria must be job-related and consistent with business necessity to withstand legal scrutiny. For rental housing, requirements should reasonably relate to an applicant's likelihood of fulfilling lease obligations. Standards should also relate to maintaining the property and not creating safety concerns. Georgia property managers should regularly review screening policies to ensure they remain legally compliant. This is especially important as HUD guidance and court interpretations evolve.

Application Process and Disclosure Requirements

The rental application should collect comprehensive information needed for thorough tenant evaluation. It should avoid questions that might elicit information about protected characteristics. Georgia landlords should request employment history, current income, previous addresses, and landlord references. Applications must include authorization for credit and criminal background checks. Questions about arrest records, bankruptcy discharge dates, or sources of lawful income may create fair housing liability.

Before conducting any background check, Georgia landlords must provide applicants with clear written disclosure. The disclosure must state that a consumer report may be obtained for tenant screening purposes. The FCRA requires this disclosure to be in a standalone document. It cannot be buried within the application language. Applicants must sign authorization forms acknowledging they understand background checks will be conducted. The authorization confirms consent to the landlord's access to their consumer information.

Conducting Background Checks Under Georgia Law

Background check procedures must comply with FCRA standards. This applies whether Georgia landlords use professional tenant screening services or access public records independently. Consumer reporting agencies (CRAs) face strict regulatory requirements for ensuring report accuracy. Landlords who compile information from multiple sources may themselves be considered CRAs. They become subject to FCRA obligations. Understanding these distinctions is critical for proper compliance.

Georgia landlords should use screening reports from reputable consumer reporting agencies. These agencies follow FCRA-compliant procedures for verifying information accuracy and respecting reporting limitations. Credit reports, eviction records, and criminal histories each have specific regulatory requirements. These govern reporting timeframes and verification methods. Property managers who understand these requirements can make better-informed decisions. They also avoid reliance on stale or inaccurate data.

Credit Check Requirements and Limitations

Credit reports provide insight into an applicant's payment history, outstanding debts, and overall financial responsibility. Georgia landlords commonly establish minimum credit score thresholds. These often range between 600-650 for conventional rental markets. However, thresholds should be set based on actual experience with tenant performance rather than arbitrary numbers. Credit criteria should be applied uniformly and balanced against other factors. These factors include income stability and rental references.

The Fair Credit Reporting Act limits credit reporting agencies to including negative information for specific timeframes:

- Most adverse items: Seven years for late payments, collections, judgments, and tax liens

- Bankruptcies: Ten years for Chapter 7 bankruptcies, seven years for Chapter 13

- Credit inquiries: Two years for hard inquiries on credit reports

- Positive information: No time limit for accounts in good standing

Georgia landlords should understand these limitations. They must avoid requesting or relying on information that legally shouldn't be included in consumer reports. Additionally, credit inquiries must be for permissible purposes. Tenant screening is explicitly recognized as a legitimate use under FCRA.

Criminal Background Screening Best Practices

Criminal history screening requires particular care given HUD guidance. HUD warns that blanket policies excluding applicants with any criminal record likely violate the Fair Housing Act. These policies create a disparate impact on minority populations. Georgia landlords should adopt individualized assessment approaches. These consider the nature and severity of criminal conduct, time elapsed since conviction, and evidence of rehabilitation. Arrest records without convictions should generally not be considered in tenant selection decisions.

HUD's 2016 guidance recommends landlords evaluate three key factors when assessing criminal history. First, consider the nature and severity of the criminal conduct. Second, evaluate the time that has passed since conviction or completion of sentence. Third, assess the nature of the rental housing involved. For example, consider proximity to schools for certain offenses. Georgia property managers should document how these factors were weighed in screening decisions. They must maintain consistent application across all applicants to demonstrate non-discriminatory practices.

Georgia Security Deposit and Screening Fees

Financial aspects of tenant screening in Georgia include both screening fees and security deposits. Screening fees are charged during application processing. Security deposits are collected before move-in. Unlike many states, Georgia imposes no statutory limits on security deposit amounts. This gives landlords flexibility to set deposits based on perceived risk and market conditions. However, all fees must be clearly disclosed. Screening charges should reasonably reflect actual costs incurred.

Screening fees compensate landlords for the expense of obtaining various reports. These include credit reports, criminal background checks, and eviction history searches. Georgia property managers typically charge between $30-$75 per applicant. The amount depends on the comprehensiveness of screening services used. These fees should be non-refundable. They are collected only after applicants have been provided with required FCRA disclosures and have authorized the background check process.

Security Deposit Regulations

Georgia Code § 44-7-30 requires landlords to place security deposits in separate escrow accounts. These must be at Georgia banking institutions. Landlords must provide tenants with the account location information within 30 days. Deposits must be returned within one month after lease termination, minus any lawful deductions. Landlords must provide an itemized statement explaining any deductions made from the security deposit. Deductions can cover damages, unpaid rent, or other lease violations.

While Georgia doesn't cap security deposit amounts, market practices typically involve deposits equal to one month's rent. This applies for qualified tenants. Landlords may charge higher deposits for applicants with elevated risk factors. These factors include marginal credit, limited rental history, or past lease violations. Any deposit requirement exceeding standard market practices should be clearly justified. It must be consistently applied to avoid appearing arbitrary or discriminatory.

Application and Screening Fee Guidelines

Screening fees in Georgia should reflect the reasonable cost of obtaining consumer reports and processing applications. Property managers structure fees to cover specific screening and administrative expenses. Transparency in fee structure protects against challenges of excessive or unfair charges.

Property managers typically structure fees to cover specific expenses:

| Fee Component | Typical Cost Range | Purpose |

| Credit Report | $15-$30 | Obtaining consumer credit history from major bureaus |

| Criminal Background Check | $10-$25 | Accessing county, state, and national criminal records |

| Eviction History Search | $10-$20 | Reviewing court records for prior landlord-tenant disputes |

| Administrative Processing | $5-$15 | Staff time for application review and verification calls |

Landlords who charge $75 for screening must be prepared to demonstrate that their actual costs approach that amount. Excessive screening fees may be challenged as unfair business practices or as barriers to housing access.

Georgia landlords should provide clear written disclosure of all application fees before collecting payment. This disclosure should specify whether fees are refundable under any circumstances. It should explain what screening services will be performed and the approximate timeline for application decisions. Some property managers include screening fee information directly on rental advertisements. This helps filter applicants who cannot afford the upfront costs.

Adverse Action Notice Requirements in Georgia

When Georgia landlords deny rental applications or impose less favorable terms based on consumer reports, FCRA requires specific notifications. The reports may include credit checks, criminal background checks, or eviction history. These notices inform applicants about the basis for unfavorable decisions. They also explain applicants' rights to obtain report copies and dispute inaccurate information. Failure to provide proper adverse action notices is among the most common FCRA violations. It can result in statutory damages, attorney fees, and litigation costs.

The adverse action process involves two required notices. First comes the pre-adverse action notice provided before final denial. Then follows the final adverse action notice sent after the decision becomes official. Georgia landlords should implement procedures ensuring both notices are properly delivered with required information. Sufficient time must pass between notices for applicants to address potential errors in their consumer reports.

Pre-Adverse Action Notice Procedures

Before denying an application based on information in a consumer report, Georgia landlords must provide a pre-adverse action notice. This notice must include a copy of the report and a document titled "A Summary of Your Rights Under the Fair Credit Reporting Act." The notice gives applicants an opportunity to review report contents. They can dispute any inaccuracies before final decisions are made. The waiting period between pre-adverse and final adverse action notices is not specifically defined by FCRA. However, it should allow reasonable time for dispute resolutionâtypically 5-7 business days.

The pre-adverse action notice should clearly state that unfavorable information may result in application denial. However, it must clarify that no final decision has been made. Georgia property managers should document when pre-adverse action notices were sent. They should maintain copies in applicant files as proof of FCRA compliance. During this waiting period, landlords should refrain from re-renting the unit to other applicants. This preserves the initial applicant's opportunity to address report inaccuracies.

Final Adverse Action Notice Requirements

After the appropriate waiting period, Georgia landlords who proceed with application denial must provide a final adverse action notice. This notice must contain specific information required by FCRA. It must identify the consumer reporting agency that provided the report. It must state that the CRA didn't make the adverse decision and cannot explain the specific reasons for it. The notice must inform applicants of their right to obtain a free copy of the report within 60 days. It must also explain their right to dispute inaccurate information.

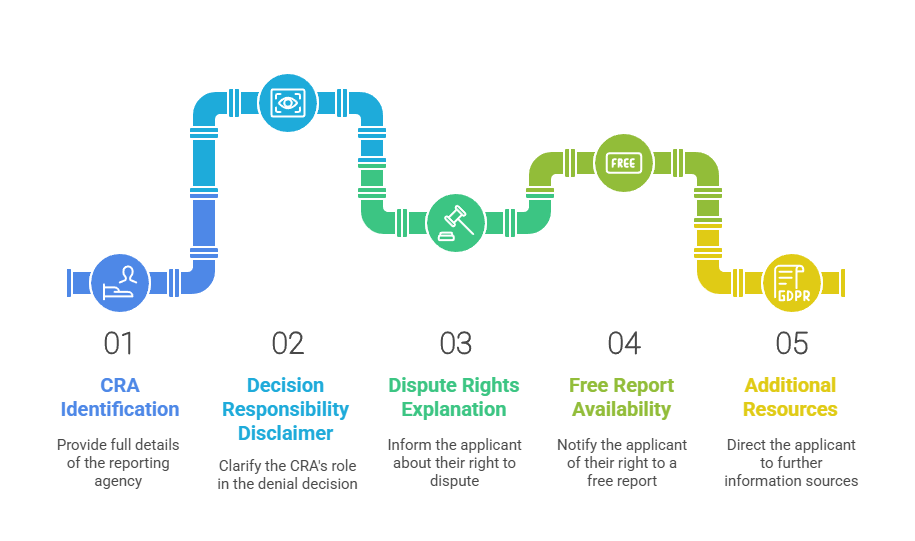

Final adverse action notices require five essential elements for FCRA compliance:

- CRA identification: Full name, address, phone number, and website of the reporting agency

- Decision responsibility disclaimer: Statement clarifying the CRA didn't make the denial decision

- Dispute rights explanation: Information about the applicant's right to dispute report accuracy directly with the CRA

- Free report availability: Notice of the right to request a free consumer report copy within 60 days

- Additional resources: Statement that more information about consumer rights is available from the FTC or CFPB

Final adverse action notices should be sent via methods that create delivery confirmation. Examples include certified mail or email with read receipts. Georgia landlords should retain copies of all adverse action notices in compliance files. These should be kept for at least three years to demonstrate FCRA adherence if challenged.

Fair Housing Laws in Georgia Tenant Screening

The Fair Housing Act's prohibition on discrimination fundamentally shapes tenant screening practices in Georgia. It protects seven classes based on specific characteristics. Landlords must ensure their screening criteria don't create disparate impact on protected classes. This applies even when policies appear neutral on their face. Disparate impact occurs when screening standards disproportionately exclude members of protected groups. It violates fair housing law when standards don't serve legitimate business purposes or when less discriminatory alternatives exist.

Georgia property managers should regularly analyze their screening outcomes. This helps identify potential disparate impact patterns. For example, minimum credit score requirements may result in significantly higher denial rates for minority applicants. Landlords should evaluate whether the specific threshold serves a genuine business need. They should consider whether a lower score combined with additional documentation might serve equally well. Alternative approaches may reduce discriminatory effects. This ongoing evaluation demonstrates good faith compliance efforts.

Protected Classes and Screening Policies

Federal fair housing law protects seven classes. These include race, color, national origin, religion, sex, familial status, and disability. Sex protection includes sexual orientation and gender identity under current HUD interpretation. Georgia has not enacted broader state-level protections. However, some Georgia municipalities have added protected categories like source of income. Screening policies that explicitly consider protected characteristics are per se illegal. Facially neutral policies with discriminatory effects may violate fair housing laws through disparate impact.

Common screening practices that risk fair housing violations include several problematic approaches. Requiring excessive income levels disproportionately excludes families with children. Refusing to consider government housing assistance as income discriminates based on source of funds. Blanket criminal history bans disparately impact racial minorities. Failing to provide reasonable accommodations for disabled applicants during screening violates disability rights. Georgia landlords should review each screening criterion against potential discriminatory effects. They must be prepared to justify standards with legitimate business necessity if challenged.

Reasonable Accommodations in Screening

The Fair Housing Act requires Georgia landlords to provide reasonable accommodations in screening procedures for disabled applicants. Accommodations must be provided when necessary to afford equal housing opportunity. This might include accepting alternative documentation for applicants who cannot provide standard verification due to disability. Landlords may need to extend application deadlines for applicants who need additional time due to disability-related issues. They must waive pet policies for service and emotional support animals. However, landlords can verify disability-related needs for assistance animals.

Reasonable accommodation requests should be evaluated individually. Evaluation considers whether the modification is reasonable and whether it's necessary due to disability. A modification is considered reasonable if it doesn't pose undue financial or administrative burden to the landlord. Georgia property managers should establish clear procedures for receiving and processing accommodation requests. This includes designated contacts for disability-related issues. It also includes documentation requirements that comply with fair housing standards. While landlords may request verification of disability and disability-related need for accommodations, they cannot require specific disclosures. Applicants should not be required to disclose specific diagnoses or detailed medical records.

Georgia Rental Application Screening Process

An effective rental application screening process balances thorough tenant evaluation with efficient processing. It doesn't unnecessarily delay qualified applicants. Georgia landlords should establish standardized procedures that guide staff through consistent evaluation steps. These apply for every application. Documented processes protect against discrimination claims by demonstrating uniform treatment. They also help ensure no required compliance steps are inadvertently omitted during busy leasing periods.

The screening timeline typically spans 3-7 business days. This covers the period from completed application submission to final decision communication. Georgia property managers should set realistic timeframe expectations with applicants. They should provide status updates if processing delays occur. Quick turnaround on qualified applicants is competitive advantage in tight rental markets. It also reduces fair housing risk by limiting opportunities for inconsistent treatment. This matters when similarly qualified candidates are processed at different times.

Income Verification Standards

Income verification confirms applicants have sufficient financial resources to meet rental obligations throughout the lease term. Georgia landlords assess various income documentation based on employment type and income source. Different documentation and verification methods apply depending on income source. Income may come from traditional employment, self-employment, government benefits, or investment sources. Landlords typically require gross monthly income of at least three times the monthly rent. Some adjust this ratio based on credit strength or other compensating factors.

Acceptable income documentation varies by source type:

| Income Source | Acceptable Documentation | Verification Method |

| W-2 Employment | Pay stubs (2-3 months), Employment verification letter | Direct employer contact, Third-party verification service |

| Self-Employment | Tax returns (1-2 years), Bank statements, CPA letter | Business documentation review, Schedule C income calculation |

| Social Security/Disability | Benefits award letter, Bank statements | SSA verification (with consent), Statement review |

| Government Assistance | Housing voucher documentation, Benefits verification | Direct PHA contact, Official program documentation |

| Retirement/Investment | Bank statements, 1099 forms, Retirement account statements | Document review, Financial institution verification |

Georgia landlords must be careful not to treat different income sources discriminatorily. HUD guidance emphasizes that lawful sources of income should be evaluated based on reliability and sufficiency. They should not be rejected because they come from government assistance programs. Some Georgia municipalities have enacted source of income anti-discrimination ordinances. These explicitly require landlords to consider housing vouchers and other assistance on equal footing with employment income.

Rental History Verification

Previous rental performance is often the strongest predictor of future tenancy quality. Georgia landlords should contact prior landlords from the most recent 2-3 years. Contacts should verify payment history and lease compliance. Reference conversations should also cover property condition at move-out. They should ask whether the landlord would rent to the applicant again. Conversations should follow consistent question formats. This ensures comparable information is gathered for all applicants.

Eviction history searches reveal court records of past landlord-tenant disputes. These disputes resulted in formal eviction proceedings. Georgia landlords should access these records through county court databases or commercial tenant screening services. When evaluating eviction records, property managers should verify case outcomes. Some cases are filed but dismissed. They should consider how long ago the eviction occurred and review circumstances surrounding the filing. For instance, an eviction for lease violations carries different weight than non-payment during documented hardship periods. Complete reliance on eviction records without contextual evaluation may create fair housing liability. This occurs if it produces discriminatory disparate impact.

Comparing Multiple Applications

When multiple qualified applicants compete for the same unit, Georgia landlords must document objective selection criteria. This avoids discrimination claims from rejected applicants. First-come, first-served approaches based on complete application submission time are generally safest. Alternatively, landlords may establish point-based ranking systems that weight qualification factors. These must be applied uniformly. Selection decisions should never be based on subjective preferences for particular applicant characteristics. This is especially important for characteristics correlating with protected class membership.

Documentation is critical when explaining why one applicant was selected over others with similar qualifications. Georgia property managers should maintain application files. These should show qualification scores and submission timestamps. Files should include written justification for selection decisions. This documentation demonstrates selection was based on legitimate criteria consistently applied. It shows decisions were not based on discriminatory preferences. Files should be retained for at least three years. This covers the statute of limitations for most fair housing claims.

Conclusion

Navigating Georgia tenant screening laws requires understanding the interplay between federal FCRA requirements and Fair Housing Act protections. It also involves Georgia's landlord-friendly state framework. Property managers who implement documented screening policies position themselves for both legal compliance and effective tenant selection. They must obtain proper authorizations, provide required notices, and regularly evaluate criteria for discriminatory effects. As fair housing enforcement intensifies and HUD guidance continues evolving, Georgia landlords must maintain current knowledge. This is particularly important regarding criminal history screening and disparate impact standards. Successful tenant screening balances thorough evaluation of applicant qualifications with consistent procedures that withstand legal scrutiny.

Frequently Asked Questions

Does Georgia limit how much landlords can charge for tenant screening fees?

Georgia has no statutory limit on screening fees. However, fees should reasonably reflect actual costs for credit checks, criminal reports, and eviction searches. Most Georgia landlords charge $30-$75 per applicant with fees disclosed upfront.

Can Georgia landlords reject applicants based on criminal history?

Georgia landlords can consider criminal history but must avoid discriminatory disparate impact. Blanket policies rejecting all applicants with any criminal record likely violate fair housing laws. HUD recommends individualized assessment considering offense severity, time elapsed, and rehabilitation evidence.

Are Georgia landlords required to provide adverse action notices when denying rental applications?

Yes, FCRA requires adverse action notifications when denying applications based on consumer reports. Landlords must provide pre-adverse action notice with report copy and FCRA rights summary, then final adverse action notice. Violations can result in $1,000 statutory damages plus attorney fees.

What income-to-rent ratio is required in Georgia?

Georgia law doesn't mandate specific income ratios. Most landlords require gross monthly income of at least three times monthly rent. This 3x threshold is industry standard and defensible as reasonable business practice when applied consistently.

Can Georgia landlords require applicants to have minimum credit scores?

Yes, landlords can establish minimum credit score requirements applied uniformly to all applicants. Common thresholds range from 600-650 for conventional markets. Credit minimums should be documented in written policies, and denied applicants must receive FCRA adverse action notices.

How long must Georgia landlords keep rental application records?

Georgia law doesn't specify retention requirements, but federal fair housing statute of limitations suggests maintaining documentation for at least three years. Records should include applications, authorization forms, consumer reports, adverse action notices, and selection justifications.

Must Georgia landlords accept Housing Choice Vouchers during tenant screening?

Georgia has no statewide voucher acceptance requirement. However, some cities and counties mandate participation through source of income ordinances. Refusing vouchers may create fair housing liability if it produces discriminatory disparate impact on protected classes.

Can Georgia landlords use social media in tenant screening?

Landlords can review public social media profiles, but this carries significant fair housing risk. Social media reveals protected characteristics that cannot legally influence decisions. If applicants are denied after profile reviews, they may claim discrimination based on protected characteristics.

Additional Resources

- Fair Credit Reporting Act Compliance Guide

https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act - HUD Guidance on Application of Fair Housing Act Standards to the Use of Criminal Records

https://www.hud.gov/sites/documents/HUD_OGCGUIDAPPFHASTANDCR.PDF - Official Code of Georgia Annotated Title 44 (Property)

https://law.justia.com/codes/georgia/2010/title-44 - Georgia Department of Community Affairs - Landlord-Tenant Handbook

https://www.dca.ga.gov/safe-affordable-housing/housing-development/programs/georgia-landlord-tenant-handbook - Consumer Financial Protection Bureau - Background Screening Reports

https://www.consumerfinance.gov/consumer-tools/background-screening-reports/ - National Apartment Association - Fair Housing Resources

https://www.naahq.org/fair-housing

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.