Three high-profile cases from the past two decades illustrate the devastating financial and reputational consequences of inadequate executive background screening. Each represents a different failure point: ongoing investigations missed during due diligence, fabricated academic credentials, and incomplete education verification. Together, they demonstrate how even respected companies can fall victim to preventable hiring disasters.

Jorge Gomez lasted exactly one day as Moderna's CFO before resigning—yet still collected $700,000 in severance pay when his former employer's financial investigation became public (Corporate Compliance Insights, 2022). In 2002, Kenneth Lonchar resigned as Chief Financial Officer of Veritas Software after it was revealed he had falsely claimed to hold an MBA from Stanford University. The disclosure led to a sharp drop in Veritas’s stock—falling nearly 15% intraday—as investors reacted to concerns over leadership integrity (Fox Business, 2012). David Tovar's incomplete college degree derailed his promotion to Senior VP at Walmart after eight successful years (TIME, 2014). These aren't isolated incidents—A 2017 HireRight Employment Screening Benchmark Report revealed that 85% of employers uncovered misrepresentations on candidate resumes or applications, highlighting the importance of comprehensive background screening in hiring processes (HireRight, 2017), yet many organizations still lack comprehensive screening protocols.

In today's complex regulatory landscape, a thorough background verification process isn't just due diligence—it's legal necessity. The Fair Credit Reporting Act (FCRA), Equal Employment Opportunity Commission (EEOC) guidelines, and state-specific legislation create a web of compliance requirements that can expose employers to significant liability when ignored.

Key Takeaways

- Seven core components form the foundation of legally compliant background verification

- Criminal history checks must balance safety needs with fair chance employment principles

- Employment and education verification prevents costly credential fraud and inflated experience claims

- Identity and financial screening protects against security risks and regulatory violations

- Comprehensive policies ensure consistent application and legal compliance across all hiring decisions.

EXPERT INSIGHT: When it comes to Human Resources, the conversation usually centers on discovering people on the basis of potential, of values, and fit within the culture of the organization; however, the important step of due diligence is never omitted. Over the years, I've come to consider background checks not just a legal nicety but a core reaffirmation of our people and our purpose. Done well, the checks work to help preserve the trust we work so hard to develop—trust between teams, between leaders, and the communities we work for. This process is not about distrust but about the duty of accountability. As HR professionals, we're charged with the responsibility of making sure on paper what looks admirable actually translates to reality. - Charm Paz, CHRP

Key Components of a Comprehensive Background Check

Modern employment screening encompasses seven critical verification areas, each serving distinct risk mitigation purposes while operating under specific legal frameworks. Understanding these components helps employers design screening programs that protect their organizations while respecting candidate rights.

The Seven Essential Components:

- Criminal History Verification: Multi-jurisdictional searches revealing relevant criminal records

- Employment History Confirmation: Verification of work experience, positions, and performance

- Education and Credential Validation: Academic degree and professional license verification

- Identity and SSN Authentication: Confirming applicant identity and work authorization

- Credit and Financial Background: Financial responsibility assessment for relevant positions

- Drug Testing and Medical Screening: Safety-sensitive position requirements and health assessments

- Reference and Character Evaluation: Professional and personal character assessments

The Professional Background Screening Association (PBSA) represents over 750 member companies conducting millions of employment-related background checks annually (PBSA, 2024), emphasizing the critical role comprehensive screening plays in risk mitigation and informed hiring decisions.

Legal Framework Overview:

- FCRA governs consumer reporting procedures and candidate rights

- EEOC guidance ensures non-discriminatory application of screening criteria

- State and local laws may impose additional restrictions or requirements

- Industry-specific regulations (DOT, healthcare, financial services) add specialized requirements

Criminal History Verification: Understanding Legal Boundaries and Best Practices

Criminal background screening represents the most complex component of employment verification, requiring careful navigation of federal guidance, state legislation, and local ordinances. The EEOC's 2012 Enforcement Guidance emphasizes individualized assessment over blanket exclusions, while "ban-the-box" legislation in 37 states restricts when criminal history inquiries can occur.

Multi-Level Criminal Search Strategy

Federal Criminal Searches Federal databases cover crimes prosecuted in federal courts, including white-collar offenses, drug trafficking, and interstate crimes. These searches are essential for positions involving federal contracts, regulated industries, or national security clearances.

State Criminal Repository Searches State databases aggregate criminal records from multiple counties within the state, though reporting completeness varies significantly. Some states maintain comprehensive databases updated in real-time, while others rely on sporadic county submissions.

County Criminal Court Searches County-level searches provide the most accurate and up-to-date criminal records, as these are the courts of original jurisdiction for most criminal cases. Best practice requires searching all counties where an applicant has lived, worked, or attended school during the past seven years.

FCRA Compliance Requirements

The Fair Credit Reporting Act establishes specific procedures for criminal background screening:

- Pre-screening disclosure and authorization must be provided on a standalone document

- Adverse action procedures require pre-adverse action notices and five-day waiting periods

- Dispute resolution processes must be available to candidates challenging report accuracy

- Reporting limitations restrict certain criminal records based on age and case disposition

Ban-the-Box Legislation Impact

As of 2025, 27 states and over 150 cities have enacted ban-the-box legislation restricting criminal history inquiries (Clockify, 2025):

| Legislation Type | Timing Restriction | Coverage | States/Cities |

|---|---|---|---|

| Public Sector Only | After conditional offer | Government jobs | 15 states |

| Private Sector Included | After initial interview | All employers | 22 states |

| Limited Scope | Various restrictions | Specific industries | 150+ cities |

Time Limitations and Reporting Restrictions

Seven-Year Rule: Most states limit criminal record reporting to seven years, though exceptions exist for positions with salaries exceeding $75,000 annually.

Arrest vs. Conviction Records: The EEOC generally prohibits consideration of arrests not leading to convictions, though pending charges may be considered with individualized assessment.

Sealed and Expunged Records: Employers typically cannot access sealed records, though some exceptions exist for law enforcement and childcare positions.

International Criminal Screening

For global organizations, international criminal screening presents unique challenges:

- Availability varies by country, with some nations prohibiting criminal record disclosure

- Verification timing can extend 4-8 weeks for comprehensive international searches

- Legal restrictions in EU countries require GDPR compliance and legitimate business interest documentation

Best Practices for Legal Compliance

- Develop written policies outlining criminal record evaluation criteria

- Conduct individualized assessments considering crime nature, time elapsed, and job relevance

- Document decision rationales to demonstrate non-discriminatory application

- Provide appeal processes for candidates to dispute adverse decisions

- Train hiring managers on appropriate criminal record considerations

Common Disqualifying Offenses by Industry:

- Financial Services: Fraud, embezzlement, money laundering

- Healthcare: Patient abuse, drug diversion, violent crimes

- Transportation: DUI/DWI, reckless driving, substance abuse

- Education: Child abuse, sexual offenses, violent crimes

- Retail: Theft, shoplifting, fraud

Employment History and Reference Verification

Employment verification serves dual purposes: confirming claimed work experience and identifying potential performance issues or policy violations. The Reference Checking Center reports that 78% of candidates embellish job responsibilities, while 34% falsify employment dates or positions held (ERE, 2012).

Verification Methods and Best Practices

Direct Employer Contact Primary verification method involving direct contact with previous employers' HR departments or designated verification contacts. Success rates vary by company size and industry, with larger corporations typically maintaining formal verification procedures.

Third-Party Verification Services Professional verification services like The Work Number or HireRight maintain databases of employment records for participating employers, offering faster turnaround times and standardized reporting formats.

Digital Verification Platforms Emerging blockchain-based platforms allow candidates to maintain verified employment records, though adoption remains limited and primarily concentrated in technology sectors.

Information Typically Verified

| Verification Element | Standard Practice | Legal Considerations |

|---|---|---|

| Employment Dates | Start/end dates, gaps | No legal restrictions |

| Position/Title | Exact title held | Title inflation common |

| Salary History | Limited or prohibited | 21+ states restrict inquiry |

| Reason for Leaving | Often not disclosed | Potential discrimination risks |

| Rehire Eligibility | Standard inquiry | May indicate policy violations |

| Performance Ratings | Rarely disclosed | Subjective and legally risky |

Handling Employment Gaps and Job-Hopping

Employment Gap Analysis Gaps exceeding three months warrant additional investigation, though candidates aren't legally obligated to explain personal decisions like family care, health issues, or education pursuits.

Job-Hopping Patterns While frequent job changes may indicate instability, economic factors, industry norms, and generational differences require contextual evaluation. Technology and consulting sectors typically exhibit higher mobility rates.

International Employment Verification

Documentation Requirements International employment verification often requires translated documents, notarization, and apostille certification for legal recognition.

Cultural Considerations Employment practices vary significantly by country, affecting reference checking approaches and information availability.

Privacy Law Compliance GDPR, Canada's PIPEDA, and other international privacy laws may restrict information disclosure and require specific consent procedures.

Reference Check Legal Framework

Permissible Inquiries

- Job performance and skills demonstration

- Attendance and reliability

- Ability to work with others

- Specific work-related incidents (with documentation)

Prohibited Inquiries

- Protected class information (age, race, religion, etc.)

- Medical conditions or disabilities

- Personal relationships or lifestyle choices

- Salary history (in restricted jurisdictions)

Technology Tools and Automation

Automated Verification Systems Integration with applicant tracking systems (ATS) enables automated verification requests and response tracking, reducing administrative burden while maintaining audit trails.

AI-Powered Analysis Emerging AI tools analyze reference responses for consistency indicators and potential red flags, though human oversight remains essential for final decisions.

Education and Professional Credential Verification

Education fraud costs U.S. employers an estimated $600 million annually, according to the Association of Certified Fraud Examiners (ACFE). Professional license verification prevents regulatory violations and reduces liability exposure in licensed industries.

Academic Verification Methods

National Student Clearinghouse The primary database for degree verification, covering 98% of U.S. higher education institutions (National Student Clearinghouse, 2024). Provides real-time verification for degrees, certificates, and enrollment status.

Direct Institution Contact Required for international degrees or institutions not participating in clearinghouse systems. Verification timing varies significantly, from 24 hours to several weeks.

Diploma Mill Detection Sophisticated diploma mills create convincing documentation, requiring verification through accreditation databases and institutional legitimacy checks.

Professional License and Certification Verification

State Licensing Boards Most professional licenses can be verified through state board websites or direct contact. Verification should include license status, expiration dates, and disciplinary actions.

Professional Associations Industry certifications often require verification through issuing organizations, with some maintaining public databases while others require formal requests.

Continuing Education Requirements Licensed professionals must maintain continuing education credits; verification ensures compliance with professional standards.

International Education Verification

Credential Evaluation Services Organizations like World Education Services (WES) or Educational Credential Evaluators (ECE) provide standardized evaluations of international degrees.

Country-Specific Challenges

- Document Authentication: Some countries require government attestation or embassy verification

- Educational System Differences: Varying degree structures and grading systems require expert evaluation

- Language Translation: Certified translations may be required for non-English documents

Red Flags in Education Verification

Common Fraud Indicators:

- Degrees from unaccredited institutions

- Compressed timeframes for advanced degrees

- Institutions with names similar to legitimate schools

- Lack of verifiable contact information for claimed schools

- Degrees from "life experience" programs

Technology and License Monitoring

Ongoing License Monitoring For positions requiring active licenses, ongoing monitoring systems alert employers to license suspensions, revocations, or disciplinary actions.

Blockchain Verification Emerging blockchain-based credential verification systems provide tamper-proof academic records, though adoption remains limited.

AI-Powered Fraud Detection Machine learning algorithms analyze application patterns to identify potential education fraud indicators.

Identity and Social Security Number Verification

Identity verification forms the foundation of all other background screening components, ensuring the person being hired matches the person being screened. The Federal Trade Commission reports over 1.1 million identity theft cases annually (FTC, 2024), making robust identity verification essential for organizational security.

Social Security Number Validation

SSN Verification Services Third-party services cross-reference provided SSNs against Social Security Administration databases, confirming validity and identifying potential fraud indicators.

Address History Verification SSN verification typically includes address history, helping identify all locations where additional background screening may be required.

Death Master File Screening Ensures the SSN isn't associated with deceased individuals, preventing identity theft using dead persons' credentials.

Identity Theft Red Flags

Documentation Inconsistencies:

- Mismatched names across documents

- Inconsistent address histories

- Recently issued identification for older applicants

- Suspicious document modifications or alterations

Behavioral Indicators:

- Reluctance to provide additional verification

- Inconsistent personal information across applications

- Knowledge gaps about claimed personal history

- Nervousness or evasiveness during identity discussions

Right to Work Verification (I-9 Compliance)

Form I-9 Requirements Federal law requires employers to verify employment eligibility for all employees within three days of hire start. Acceptable documents must establish both identity and work authorization.

E-Verify System Federal contractors and some states require E-Verify participation to confirm employee work authorization through government databases.

Document Examination Standards Employers must examine original documents in person, though remote verification procedures were expanded during COVID-19 and some changes remain permanent.

International Applicant Verification

Visa Status Verification For non-citizen applicants, verification includes visa type, expiration dates, and work authorization restrictions.

Document Translation and Authentication International documents may require certified translation and government authentication for legal acceptance.

Cultural Name Variations Understanding naming conventions across cultures prevents verification errors and ensures respectful treatment of international candidates.

Biometric Verification Technologies

Fingerprint Screening Some industries require fingerprint-based background checks through FBI databases, particularly for positions involving children, elderly care, or security clearances.

Facial Recognition Systems Emerging identity verification systems use facial recognition to match applicant photos with government databases, though privacy concerns limit adoption.

Document Authentication Technology Advanced scanning systems detect document alterations, forgeries, and security features to prevent fraudulent credential submission.

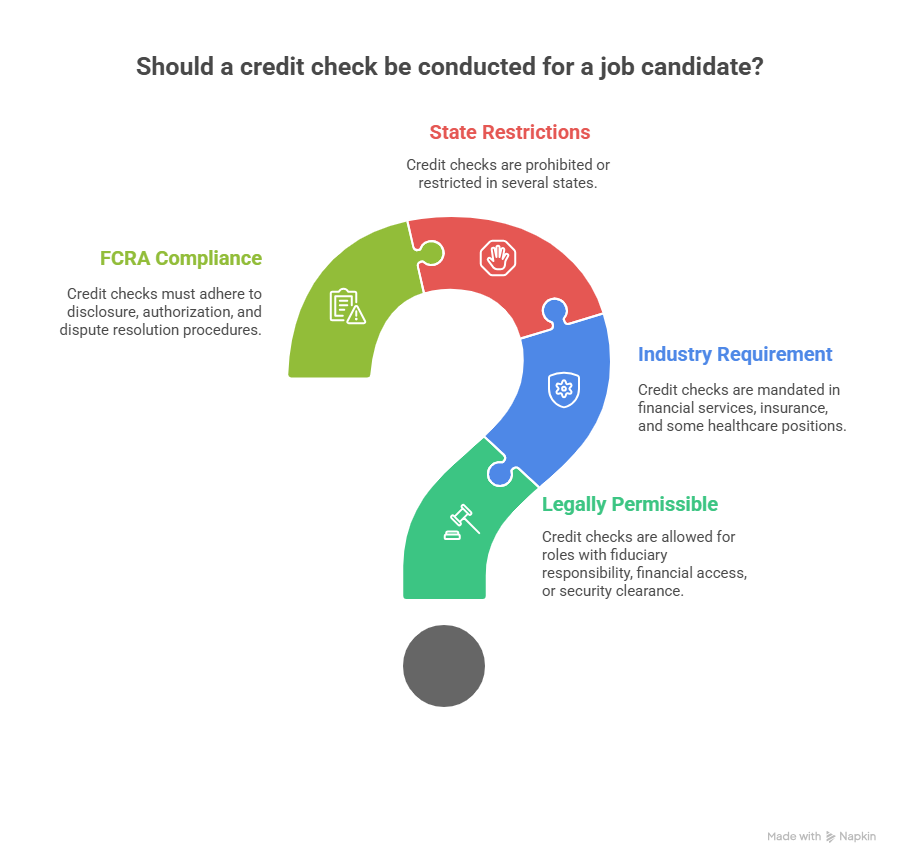

Credit History and Financial Background Checks

Financial background screening helps employers assess candidate reliability and reduce theft risks, particularly for positions involving money handling, financial decision-making, or access to sensitive information. However, credit checks face increasing legal restrictions as states recognize their potential for discriminatory impact.

When Credit Checks Are Appropriate

Legally Permissible Positions:

- Executive or management roles with fiduciary responsibility

- Positions with access to financial information or assets

- Jobs requiring security clearances or bonding

- Roles involving regular cash handling or financial transactions

- Credit or insurance industry positions

Industry-Specific Requirements: Financial services, insurance, and some healthcare positions may require credit checks under regulatory mandates or industry standards.

State Restrictions on Employment Credit Checks

As of 2025, 11 states and numerous cities restrict employment credit checks (Credit.com, 2022; Workplace Fairness, 2023):

| State | Restriction Type | Permitted Exceptions |

|---|---|---|

| California | Prohibited except specific roles | Managerial, financial access, security clearance |

| New York | Limited use | Credit/insurance industry, cash handling |

| Illinois | Restricted application | Executive roles, fiduciary responsibility |

| Washington | Prohibited with exceptions | Banking, credit reporting, collection agencies |

FCRA Requirements for Credit Screening

Disclosure and Authorization Credit checks require separate disclosure and written authorization, typically obtained during the application process before conditional offers.

Adverse Action Procedures Employers must provide pre-adverse action notices, copies of credit reports, and summary of rights before taking negative actions based on credit information.

Dispute Resolution Candidates have rights to dispute credit report accuracy and request investigation of errors through credit reporting agencies.

Evaluating Credit Information

Relevant Credit Factors:

- History of financial responsibility

- Recent negative changes indicating stress

- Patterns of extended delinquency

- Bankruptcy filings and circumstances

- Outstanding judgments or liens

Prohibited Considerations:

- Medical debt resulting from health emergencies

- Credit impacts from identity theft (when documented)

- Economic hardship beyond individual control

- Short-term financial difficulties with demonstrated recovery

Financial Crimes and Bankruptcy Considerations

Criminal Financial History Convictions for fraud, embezzlement, or financial crimes may disqualify candidates from financial positions, depending on job relevance and time elapsed.

Bankruptcy Analysis Bankruptcy alone shouldn't automatically disqualify candidates; evaluation should consider circumstances, time elapsed, and current financial stability.

International Financial Screening

Credit Bureau Availability Credit reporting systems vary significantly by country, with some nations having limited or no consumer credit databases.

Privacy Law Compliance International credit checks must comply with local privacy laws, which may restrict information sharing or require specific consent procedures.

Best Practices for Credit Screening

- Establish clear policies defining when credit checks are appropriate

- Train hiring managers on legal considerations and prohibited factors

- Document business necessity for credit screening requirements

- Consider alternative indicators of financial responsibility when appropriate

- Provide appeal processes for candidates to explain adverse credit information

Drug Testing and Medical Screening Protocols

Drug testing represents a significant component of employment screening, particularly for safety-sensitive positions where impairment could result in serious injury or death. The Department of Transportation (DOT) mandates drug testing for transportation workers, while many employers implement voluntary programs to reduce workplace incidents and insurance costs.

Pre-Employment vs. Ongoing Drug Testing

Pre-Employment Testing Most common form of workplace drug screening, typically conducted after conditional job offers to comply with ADA requirements. Testing usually occurs at certified medical facilities using standardized collection procedures.

Random Testing Programs Ongoing random testing programs help deter drug use among current employees, particularly in safety-sensitive industries. Programs must follow strict procedural requirements to ensure fairness and legal compliance.

Post-Incident Testing Required in many safety-sensitive roles following workplace accidents or incidents. Testing helps determine if substance use contributed to the incident and supports workers' compensation claims.

DOT and Safety-Sensitive Position Requirements

DOT-Regulated Positions:

- Commercial drivers (CDL holders)

- Aviation personnel (pilots, mechanics, controllers)

- Railroad workers

- Pipeline workers

- Maritime personnel

Testing Requirements:

- Five-panel drug testing (marijuana, cocaine, amphetamines, opiates, PCP)

- Alcohol testing with 0.04% blood alcohol limit for safety-sensitive functions

- Medical Review Officer (MRO) verification of results

- Return-to-duty and follow-up testing for violations

Medical Examination Legality Under ADA

ADA Compliance Requirements The Americans with Disabilities Act restricts medical examinations and inquiries:

- Pre-offer: No medical examinations or disability-related inquiries permitted

- Post-offer: Medical examinations allowed if job-related and consistent for all candidates

- Current employees: Medical examinations only when job-related and business necessity

Fitness-for-Duty Evaluations Specific job functions may require medical clearance, particularly for positions involving:

- Heavy lifting or physical demands

- Operation of dangerous equipment

- Public safety responsibilities

- Exposure to hazardous materials

State Marijuana Law Considerations

Recreational Marijuana States As of 2025, 24 states have legalized recreational marijuana, creating complex compliance challenges for employers (NCSL, 2024). State laws vary significantly regarding workplace protections and testing rights.

Medical Marijuana Protections 38 states provide medical marijuana patient protections, though most don't require workplace accommodation (NCSL, 2024). Employers must navigate varying state requirements while maintaining safety standards.

Testing Policy Updates Many employers are revising drug testing policies to address marijuana legalization while maintaining safety requirements for safety-sensitive positions.

International Medical Screening Standards

Country-Specific Requirements International assignments may require specific medical screenings, vaccinations, or health certifications depending on destination country requirements.

Privacy Law Compliance Medical information sharing across borders must comply with privacy laws in both origin and destination countries, requiring careful data handling procedures.

Testing Methods and Accuracy

Urine Testing Most common method, detecting recent drug use (typically 1-3 days for most substances, longer for marijuana).

Hair Testing Longer detection window (up to 90 days) but more expensive and may have different legal implications under state laws.

Saliva Testing Shorter detection window but useful for detecting very recent use or in post-incident situations.

Blood Testing Most accurate but invasive; typically reserved for post-incident testing or specific legal requirements.

Implementation Best Practices

- Develop comprehensive policies addressing all testing scenarios

- Train supervisors on reasonable suspicion indicators and procedures

- Use certified facilities and follow chain-of-custody procedures

- Maintain confidentiality of all medical information

- Provide employee assistance programs for substance abuse treatment

- Stay current with changing state and federal laws

Reference and Character Assessment Methods

Professional references provide valuable insights into candidate performance, work style, and character that resumes and interviews cannot capture. However, legal concerns have reduced employer willingness to provide detailed references, requiring sophisticated approaches to gather meaningful information.

Structured Reference Interview Techniques

Performance-Based Questions Focus on specific job-related behaviors and outcomes rather than general impressions:

- "Can you describe a specific project where [candidate] demonstrated leadership?"

- "How did [candidate] handle tight deadlines or pressure situations?"

- "What was [candidate's] most significant accomplishment in their role?"

Behavioral Indicator Assessment Use behavioral interviewing techniques to gather concrete examples:

- Communication skills demonstration

- Problem-solving approaches

- Team collaboration examples

- Adaptability in changing situations

360-Degree Reference Approach Gather perspectives from multiple organizational levels:

- Direct supervisors for performance evaluation

- Peers for collaboration and communication assessment

- Subordinates for leadership and management style (when applicable)

- Internal customers for service quality and reliability

Professional vs. Personal Reference Value

Professional References Generally more valuable for employment decisions, providing work-related insights and performance data. Professional references should ideally include:

- Direct supervisors who can speak to performance

- Colleagues familiar with work quality and collaboration

- Clients or customers who received services

- Internal stakeholders who worked with the candidate

Personal References Limited value for employment decisions but may provide character insights for sensitive positions. Personal references are most useful for:

- Entry-level positions with limited work history

- Positions requiring high trust or security clearances

- Roles involving community interaction or representation

- Character verification for regulated industries

Legal Questions and Prohibited Inquiries

Permissible Reference Questions:

- Job performance and quality of work

- Attendance and punctuality

- Ability to work with supervisors and colleagues

- Specific skills and competencies

- Adherence to company policies and procedures

- Circumstances of departure (if voluntary)

Prohibited Inquiries:

- Age, race, gender, religion, or other protected characteristics

- Marital status, pregnancy, or family planning

- Medical conditions, disabilities, or workers' compensation claims

- Personal lifestyle choices or political affiliations

- Sexual orientation or gender identity

Digital Reference Checking Platforms

Automated Reference Systems Technology platforms streamline reference collection through:

- Automated request distribution

- Standardized questionnaire formats

- Digital response collection and analysis

- Integration with applicant tracking systems

Video Reference Interviews Some platforms enable video-based reference interviews, allowing for more nuanced communication while maintaining efficiency.

AI-Powered Analysis Advanced platforms use natural language processing to analyze reference responses for sentiment, consistency, and potential red flags.

Cultural Considerations for International References

Communication Style Differences Cultural variations in communication may affect reference interpretation:

- Direct vs. indirect feedback cultures

- Hierarchy and authority respect differences

- Positive bias variations across cultures

- Language nuances and translation challenges

Reference Availability International references may be challenging due to:

- Time zone differences affecting contact timing

- Different business practices regarding reference provision

- Privacy law restrictions on information sharing

- Language barriers requiring translation services

Overcoming Reference Reluctance

Building Rapport with References

- Clearly explain the position and its requirements

- Assure confidentiality and professional handling

- Provide specific questions in advance when possible

- Respect time constraints and offer flexible scheduling

Alternative Information Sources When traditional references aren't available:

- LinkedIn recommendations and endorsements

- Professional association involvement

- Conference presentations or published work

- Online professional presence and reputation

Legal Protections for Reference Providers Many states provide qualified immunity for good-faith reference provision, helping overcome employer reluctance to provide detailed feedback.

Reference Red Flags and Warning Signs

Response Pattern Indicators:

- Reluctance to provide references or contact information

- References who seem coached or overly rehearsed

- Inconsistent information across multiple references

- Evasive responses to specific performance questions

- References who lack direct knowledge of candidate's work

Verification Steps:

- Confirm reference identity and relationship to candidate

- Verify reference contact information independently

- Cross-reference information across multiple sources

- Follow up on vague or concerning responses

Technology and Social Media Screening

Digital footprint screening represents an evolving area of employment verification, offering insights into candidate character and judgment while raising significant privacy and discrimination concerns. Legal boundaries continue developing as courts and legislatures address social media's role in employment decisions.

Legal Boundaries for Social Media Screening

First Amendment Protections Public sector employees enjoy broader social media protections under the First Amendment, limiting employers' ability to take adverse actions based on political expression or social commentary.

State Privacy Laws 26 states prohibit employers from requesting social media passwords or forcing candidates to provide access to private accounts. However, publicly available information generally remains accessible for employment screening.

Protected Activity Considerations The National Labor Relations Act protects certain social media activity as "concerted activity," even for non-union employees discussing working conditions or wages.

Professional vs. Personal Online Presence Evaluation

Professional Platform Assessment LinkedIn and industry-specific platforms provide legitimate insights into:

- Professional accomplishments and endorsements

- Industry involvement and thought leadership

- Network quality and professional relationships

- Communication skills and professional presentation

Personal Social Media Evaluation Facebook, Twitter, Instagram, and other personal platforms may reveal concerning behaviors, but evaluation must avoid protected characteristics and focus on job-relevant factors:

- Illegal activity or substance abuse evidence

- Discriminatory or harassing behavior

- Violence or threatening language

- Confidentiality breaches from previous employers

Third-Party Social Media Screening Services

Professional Screening Companies Specialized firms conduct social media screening with trained analysts who:

- Focus on job-relevant content only

- Filter out protected class information

- Provide standardized reporting formats

- Maintain audit trails for compliance purposes

Technology-Based Solutions AI-powered screening tools can scan social media profiles for:

- Problematic content identification

- Risk scoring based on predefined criteria

- Large-scale screening for high-volume hiring

- Compliance monitoring and documentation

International Privacy Law Considerations

GDPR Compliance European General Data Protection Regulation affects social media screening for EU candidates or employees:

- Legitimate interest documentation required

- Right to erasure and data portability obligations

- Consent requirements for certain types of screening

- Data protection impact assessments for systematic screening

Country-Specific Restrictions Various nations restrict social media screening:

- Canada's privacy laws limit personal information collection

- Australia requires reasonable necessity for information gathering

- Japan restricts personal data processing without specific consent

Ongoing Monitoring vs. Pre-Hire Screening

Pre-Employment Screening One-time social media review during hiring process, typically conducted after conditional offers to minimize discrimination risks.

Ongoing Monitoring Continuous monitoring of employee social media activity raises additional legal and ethical concerns:

- Employee privacy expectations

- Off-duty conduct protection laws

- Union activity monitoring restrictions

- Retaliation prevention requirements

Implementation Best Practices

Policy Development

- Define legitimate business reasons for social media screening

- Establish clear criteria for evaluation

- Train screeners on legal compliance requirements

- Document decision-making processes

Compliance Procedures

- Conduct screening after conditional offers when possible

- Focus on public information only

- Avoid requesting private account access

- Provide candidates opportunity to explain concerning content

Technology Solutions

- Use third-party services for objective screening

- Implement filtering systems to remove protected information

- Maintain audit trails for all screening activities

- Regular compliance training for screening personnel

Emerging Trends and Future Considerations

Artificial Intelligence Development Advanced AI tools increasingly sophisticated at analyzing social media content for employment relevance while filtering protected information.

Regulatory Evolution Expect continued legislative development addressing social media screening rights and restrictions as technology capabilities expand.

Industry Standards Professional associations developing best practice guidelines for ethical and legal social media screening implementation.

Creating a Compliant Background Check Policy

A comprehensive background check policy serves as the foundation for consistent, legally compliant hiring practices while protecting both employer interests and candidate rights. The policy must address FCRA requirements, EEOC guidance, state-specific laws, and industry regulations while providing clear implementation procedures.

FCRA Disclosure and Authorization Requirements

Standalone Disclosure Document The Fair Credit Reporting Act requires clear disclosure that background checks may be conducted, provided on a document separate from employment applications. The disclosure must:

- Clearly state that consumer reports may be obtained

- Identify the consumer reporting agency conducting checks

- Include candidate rights under FCRA

- Avoid mixing with other employment documents

Written Authorization Candidates must provide written authorization before background check initiation. Authorization documents should:

- Clearly identify what types of checks will be conducted

- Specify the scope and timeframe of screening

- Include candidate signature and date

- Retain original signed documents for compliance records

Ongoing Authorization For positions requiring periodic rescreening, initial authorization should specify the frequency and scope of future background checks.

Adverse Action Procedures and Timelines

Pre-Adverse Action Notice Before taking adverse action based on background check results, employers must provide:

- Copy of the background check report

- Summary of consumer rights under FCRA

- Reasonable time (typically 5 business days) for candidate response

- Contact information for disputing report accuracy

Final Adverse Action Notice After adverse action decisions, employers must provide:

- Notice that adverse action was taken based on background check

- Consumer reporting agency contact information

- Statement that the agency didn't make the hiring decision

- Right to dispute report accuracy and obtain free copy

Documentation Requirements Maintain detailed records of all adverse action communications, including:

- Dates of notice provision

- Methods of delivery (mail, email, in-person)

- Candidate responses and dispute attempts

- Final decision rationale and documentation

Individualized Assessment Protocols

EEOC Green Factors The Equal Employment Opportunity Commission requires individualized assessment considering:

- Nature and gravity of the offense

- Time elapsed since conviction or completion of sentence

- Nature of the job and its duties

Structured Decision Matrix Develop standardized evaluation criteria addressing:

- Job relevance of criminal history

- Risk assessment based on position requirements

- Consideration of rehabilitation evidence

- Appeal and review procedures

Documentation Standards Record individualized assessment decisions including:

- Specific factors considered in evaluation

- Business justification for final decision

- Evidence reviewed and weight given to each factor

- Consultation with legal counsel when appropriate

Policy Documentation and Training Requirements

Written Policy Components Comprehensive background check policies should address:

- Scope of positions requiring background checks

- Types of checks conducted for different roles

- Legal compliance procedures and requirements

- Decision-making criteria and appeal processes

- Record retention and confidentiality procedures

Training Program Elements Regular training for hiring managers should cover:

- Legal requirements and compliance obligations

- Proper application of individualized assessment

- Documentation requirements and best practices

- Prohibited considerations and discrimination prevention

- Emergency procedures for legal questions

Compliance Monitoring Establish systems for ongoing compliance verification:

- Regular policy review and updates

- Audit trails for all background check decisions

- Legal counsel consultation for complex cases

- Training completion tracking and documentation

Regular Policy Review and Updates

Quarterly Legal Reviews Schedule regular reviews to address:

- Changes in federal, state, and local legislation

- New EEOC guidance or enforcement actions

- Industry-specific regulatory updates

- Technology changes affecting screening procedures

Annual Policy Updates Comprehensive annual policy reviews should evaluate:

- Effectiveness of current procedures

- Employee and candidate feedback

- Compliance audit results

- Best practice developments in the industry

Technology Integration Ensure policies address evolving technology considerations:

- Artificial intelligence in screening decisions

- Digital identity verification methods

- Social media screening guidelines

- International background check procedures

Multi-State Compliance Considerations

State Law Variations Address variations in state requirements for:

- Criminal history inquiry timing restrictions

- Credit check limitations and exceptions

- Drug testing procedures and limitations

- Reference check restrictions and protections

Documentation Requirements Maintain state-specific documentation for:

- Required disclosures and authorizations

- Adverse action procedure modifications

- Appeal processes and timeline requirements

- Record retention obligations

Implementation Checklist

Policy Development Phase:

- Research applicable federal, state, and local laws

- Consult with employment law attorney

- Develop written policy document

- Create implementation procedures and forms

- Design training program for hiring managers

Rollout Phase:

- Train all hiring managers and HR personnel

- Update job descriptions and posting language

- Modify application and interview processes

- Implement technology systems and integrations

- Create compliance monitoring procedures

Ongoing Compliance:

- Conduct regular legal compliance reviews

- Monitor EEOC and court decisions affecting policies

- Update procedures for new state and local laws

- Provide refresher training for hiring personnel

- Maintain accurate documentation and audit trails

Common Policy Pitfalls to Avoid

Inconsistent Application Ensure policies are applied consistently across all candidates and positions to avoid discrimination claims.

Overly Broad Restrictions Avoid blanket criminal history exclusions that may violate EEOC guidance on individualized assessment.

Inadequate Documentation Maintain comprehensive records of all screening decisions and rationale to support defense of challenged decisions.

Technology Overreliance Balance technology efficiency with human judgment and legal compliance requirements.

Training Gaps Ensure all personnel involved in hiring receive regular training on policy requirements and legal updates.

Frequently Asked Questions About Background Check Components

When it comes to background checks, even veteran human resources experts might have questions. Understanding all the components, from time frames to legal compliance, helps to create a safer and more compliant hire process. This FAQ list covers the basics to help move through the background screening process with confidence and accuracy.

What are the seven essential components of a comprehensive background check?

The seven core components include: criminal history verification, employment history confirmation, education and credential validation, identity and SSN authentication, credit and financial background screening, drug testing and medical screening, and reference and character evaluation. Each component addresses specific risk factors and legal requirements depending on the position and industry.

How long does a comprehensive background check typically take?

Standard background checks usually take 3-5 business days, while comprehensive executive-level screening can take 2-3 weeks. International background checks may extend to 4-8 weeks due to varying country procedures and documentation requirements. Rush processing is available for most components but may increase costs significantly.

What are the key legal requirements I must follow when conducting background checks?

You must comply with the Fair Credit Reporting Act (FCRA) for disclosure and authorization, Equal Employment Opportunity Commission (EEOC) guidelines for non-discriminatory practices, and state-specific laws including ban-the-box legislation in 37 states. Always obtain written consent, provide pre-adverse action notices, and conduct individualized assessments for criminal history.

When should background checks be conducted during the hiring process?

Best practice is to conduct background checks after extending a conditional job offer but before the candidate's start date. This approach complies with ADA requirements and reduces discrimination risks. Some components like drug testing must occur post-offer, while others like reference checks can happen earlier in the process.

Which positions require credit checks, and what are the legal restrictions?

Credit checks are appropriate for positions involving financial responsibility, access to sensitive information, or regulatory requirements. However, 11 states restrict employment credit checks, typically allowing them only for managerial roles, financial positions, or security clearances. Always document business necessity and consider alternative assessment methods.

How do I handle adverse background check results legally and fairly?

Follow FCRA adverse action procedures: provide pre-adverse action notice with a copy of the report, allow 5 business days for candidate response, conduct individualized assessment considering EEOC Green Factors (nature/gravity of offense, time elapsed, job relevance), and provide final adverse action notice if proceeding with rejection.

What's the difference between standard and executive-level background checks?

Executive background checks include additional components like media searches, civil litigation history, regulatory violations, international criminal searches, and ongoing monitoring capabilities. They typically reveal 20% of serious issues compared to less than 1% for standard checks, according to due diligence experts (Infortal Worldwide, 2024).

Are there special considerations for international candidates or global hiring?

Yes, international background checks require understanding varying country laws, privacy regulations (like GDPR), document authentication procedures, and cultural considerations. Some countries prohibit criminal record disclosure, while others require specific consent processes. Translation and apostille certification may be necessary.

How often should I update background check policies and procedures?

Conduct quarterly legal compliance reviews to address changing federal, state, and local legislation. Perform comprehensive annual policy updates incorporating new EEOC guidance, technology developments, and industry best practices. Monitor ongoing court decisions and regulatory changes that may affect your procedures.

Can I use artificial intelligence and automation in background screening?

Yes, but with caution. AI can enhance efficiency in data processing, fraud detection, and risk scoring, but human oversight remains essential for final decisions. Ensure AI tools comply with anti-discrimination laws, maintain audit trails for decision-making processes, and regularly validate algorithms for bias or accuracy issues.

Conclusion: Building a Comprehensive Background Verification Program

Modern background verification requires sophisticated balance between risk mitigation, legal compliance, and candidate rights protection. The seven essential components—criminal history, employment verification, education validation, identity confirmation, financial screening, drug testing, and reference assessment—work together to provide comprehensive candidate evaluation while respecting legal boundaries and privacy rights.

Key Implementation Priorities:

- Develop legally compliant policies addressing FCRA, EEOC, and state-specific requirements

- Train hiring personnel on proper application of individualized assessment criteria

- Implement technology solutions that enhance efficiency while maintaining human oversight

- Establish ongoing compliance monitoring to address evolving legal requirements

- Create candidate-friendly processes that respect privacy while gathering necessary information

The investment in comprehensive background verification pays dividends through reduced turnover, decreased security risks, improved regulatory compliance, and enhanced organizational reputation. As legal requirements continue evolving and technology capabilities expand, successful organizations will adapt their screening programs to maintain effectiveness while respecting candidate rights and legal obligations.

Next Steps for Implementation:

- Assess current background check procedures against this comprehensive framework

- Identify gaps in legal compliance or screening effectiveness

- Consult with employment law counsel to address specific industry or jurisdictional requirements

- Develop implementation timeline with training and technology considerations

- Establish ongoing monitoring and update procedures to maintain compliance

Additional Resources

Federal Agencies:

- EEOC.gov - Equal Employment Opportunity Commission guidance

- FTC.gov - Fair Credit Reporting Act information

- DOT.gov - Department of Transportation drug testing requirements

Professional Organizations:

Legal Resources:

- Employment Law Alliance

- National Employment Law Institute

- State labor department websites for jurisdiction-specific requirements

Reference

HireRight. (2017). 2017 Employment Screening Benchmark Report. Retrieved from https://www.hireright.com/resources/view/2017-employment-screening-benchmark-report

Fox Business. (2012, May 15). Is CEO vetting tough enough? Yahoo scandal fuels doubt. Retrieved from https://www.foxbusiness.com/features/is-ceo-vetting-tough-enough-yahoo-scandal-fuels-doubt

Legal Disclaimer: This guide provides general information about background check components and legal considerations. Specific legal requirements vary by jurisdiction and industry. Consult with qualified employment law counsel to ensure compliance with applicable laws and regulations.

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.