California employers have paid over $18 million in FCRA violation settlements, with cases like Target ($8.5M) and Syed v. M-I LLC ($1.6M) establishing precedents that make technical background check errors costly liabilities (Ogletree Deakins, 2022; Privacy World, 2021). HR leaders must immediately audit disclosure forms and implement compliant procedures to avoid statutory damages of $100-$1,000 per violation across entire employee classes.

Key Takeaways

- California Employers Face Massive FCRA Liability California settlements exceed $18 million, with individual cases reaching $8.5 million. Technical violations like adding explanatory text to disclosure forms create per-employee statutory damages of $100-$1,000.

- Standalone Disclosure Violations Are the Costliest Mistake Any additional language in FCRA forms violates federal requirements. Even "helpful" disclaimers or legal advice footnotes can trigger class-action lawsuits affecting thousands of employees.

- The Ninth Circuit Sets the Strictest Standards Nationwide California's federal appeals court finds violations "willful" more frequently than other circuits. This classification increases damages and makes settlements more likely than successful defenses.

- Consumer Reporting Agencies Are Essential Compliance Partners Modern CRAs provide legal guidance, automated compliance systems, and contractual protection. Selecting the right vendor partnership is critical for avoiding technical violations.

- Proactive Compliance Programs Create Competitive Advantage Companies with robust FCRA procedures avoid litigation while building efficient hiring processes. Investment in compliance technology and legal guidance pays dividends beyond risk mitigation.

The California FCRA Litigation Landscape: A $18+ Million Wake-Up Call

California has emerged as the epicenter of Fair Credit Reporting Act (FCRA) litigation against employers, with major settlements reshaping how companies approach background screening. The state's employee-friendly legal environment, combined with the Ninth Circuit's increasingly strict interpretations of FCRA requirements, has created a perfect storm for employer liability.

The financial impact speaks volumes: California-based FCRA settlements have exceeded $18 million in recent years, affecting hundreds of thousands of employees and job applicants. These cases aren't isolated incidents—they represent a fundamental shift in how courts interpret technical compliance requirements, transforming minor procedural oversights into multi-million-dollar liabilities.

In Human Resources, our main goals often revolve around the process of finding appropriate qualified candidates for the given vacancies; however, the practices used during this process also take precedence. Background checks are not formalities; instead, they represent pivotal points of trust, equity, and compliance.Done correctly, they protect not just our people and our company, but the dignity of each applicant walking through our building. This process isn’t about fear, though, but about care, about clarity, about doing things right. That’s the kind of culture we need to build.

Key California FCRA Cases and Their Devastating Impact

| Case | Employer | Settlement | Violation Type | Class Size |

|---|---|---|---|---|

| Target Corporation | Target | $8.5 million | Extraneous language in disclosure forms | ~74,000 members |

| Syed v. M-I, LLC | M-I, LLC | $1.6 million | Liability waiver in disclosure | 65,000+ members |

| Whole Foods Settlement | Whole Foods | $800,000 | Waiver/release language | ~20,000 members |

| Barnes & Noble | Barnes & Noble | $600,000 | "Not legal advice" footnote | ~2,700 members |

Case Analysis: How Technical Violations Became Million-Dollar Mistakes

Target Corporation: When "Helpful" Language Costs $8.5 Million

The Violation: Target's background check disclosure form included what seemed like helpful clarifying language alongside the required FCRA disclosure. This additional text violated the FCRA's "standalone disclosure" requirement, which mandates that background check authorizations appear in documents containing nothing else.

The Court's Reasoning: The Northern District of California found that any extraneous language—even seemingly benign explanatory text—transforms a compliant disclosure into a violation. The court emphasized that FCRA's requirements are strict and inflexible, designed to ensure applicants clearly understand they're authorizing background checks.

Financial Impact: With approximately 74,000 class members affected over a six-year period (November 2010 - November 2016), Target faced statutory damages that could have reached $74 million at the maximum penalty. The $8.5 million settlement represented significant savings compared to potential exposure.

Precedent Set: This case established that employers cannot add any explanatory language, disclaimers, or additional information to FCRA disclosure forms, no matter how well-intentioned.

Syed v. M-I, LLC: The Ninth Circuit's Willfulness Standard

The Violation: M-I, LLC included a liability waiver clause within their FCRA disclosure form, stating that applicants released the company from liability related to background check information.

The Court's Reasoning: The Ninth Circuit Court of Appeals made a landmark ruling that including liability waivers in FCRA disclosures constitutes a "willful" violation. This finding was crucial because willful violations carry higher statutory damages and are more difficult to defend.

The Willfulness Factor: The court determined that when employers ignore clear regulatory guidance about standalone disclosures, their violations become willful rather than negligent. This distinction can multiply damages significantly and makes settlements more likely.

Industry Impact: The decision sent shockwaves through the background screening industry, as it suggested that common practices could be deemed willful violations, exposing employers to maximum statutory damages of $1,000 per violation rather than the $100-$400 range typically seen in negligent cases.

Whole Foods Market: Small Additions, Big Consequences

The Details: Whole Foods included waiver and liability release language in their background check disclosure forms, violating the standalone document requirement that has become the cornerstone of FCRA compliance litigation.

The Settlement: The $800,000 settlement for approximately 20,000 class members ($40 per person) might seem modest compared to other cases, but it established important precedent about what constitutes acceptable disclosure language.

Compliance Lesson: Even companies with sophisticated legal teams can fall into the trap of trying to provide additional protections or clarifications that ultimately violate FCRA requirements.

Understanding California's Unique Legal Environment

Why California Leads FCRA Litigation

California's position as the leading state for FCRA employment litigation isn't accidental. Several factors contribute to this trend:

- Ninth Circuit Precedent: The Ninth Circuit Court of Appeals, which covers California, has issued some of the most employer-unfavorable FCRA decisions in the country. Cases like Syed v. M-I, LLC have established strict interpretation standards that make violations easier to prove.

- State Law Synergy: California's Investigative Consumer Reporting Agencies Act (ICRAA) provides additional employee protections that complement federal FCRA requirements. The interplay between state and federal law creates additional compliance complexity.

- Class Action Environment: California's legal system is particularly favorable to class action lawsuits, with procedural rules and judicial attitudes that facilitate large-scale employment litigation.

- Employment-At-Will Limitations: California's restrictions on at-will employment create additional incentives for employees to challenge background check procedures as part of broader employment disputes.

The "Gilberg Standard" for Dual Compliance

The Ninth Circuit's decision in Gilberg v. California Check Cashing Stores established that employers cannot use combined disclosure forms for both FCRA and California ICRAA requirements. This ruling requires separate standalone forms for each law, effectively doubling the disclosure burden for California employers.

Practical Impact: Employers must now maintain two separate disclosure processes:

- Federal FCRA disclosure (standalone document)

- California ICRAA disclosure (separate standalone document)

Compliance Challenge: The dual-disclosure requirement creates additional opportunities for technical violations and increases the administrative burden of background screening programs.

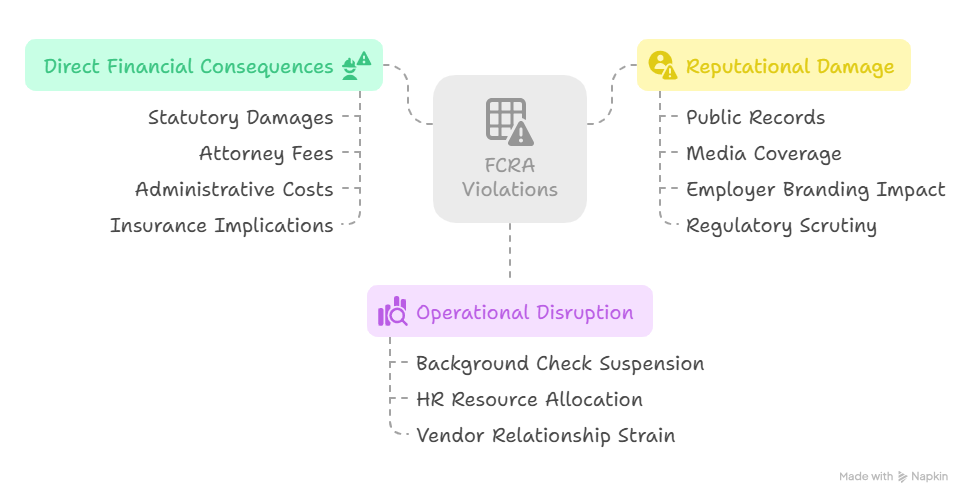

Business Impact Assessment: Beyond Financial Settlements

Direct Financial Consequences

The immediate financial impact of FCRA violations extends beyond settlement amounts:

- Statutory Damages: $100-$1,000 per violation, multiplied by class size

- Attorney Fees: Prevailing plaintiffs can recover attorney fees under FCRA

- Administrative Costs: Internal legal costs, HR time, and settlement administration

- Insurance Implications: Employment practices liability insurance may not cover all FCRA violations

Operational Disruption

FCRA litigation creates significant operational challenges:

- Background Check Program Suspension: Many companies suspend background screening during litigation, creating hiring delays and potential security risks.

- HR Resource Allocation: Legal compliance becomes a major HR priority, diverting resources from strategic initiatives.

- Vendor Relationship Strain: Background check vendors may face scrutiny or require contract modifications to address compliance gaps.

Reputational Damage in the Digital Age

Modern FCRA settlements create lasting reputational consequences:

- Public Records: Court filings and settlement agreements become permanent public records searchable online.

- Media Coverage: Large settlements often generate negative media attention, particularly in employment-focused publications.

- Employer Branding Impact: Prospective employees may view FCRA violations as indicative of broader compliance issues or disregard for employee rights.

- Regulatory Scrutiny: FCRA violations may trigger additional regulatory attention from the CFPB, FTC, or state agencies.

HR Leadership Implications: Strategic Considerations for People Operations

The Compliance-First Mindset Shift

HR leaders must fundamentally shift from viewing background checks as administrative tasks to treating them as high-risk legal compliance areas requiring specialized expertise.

Risk Assessment Integration: Background check compliance should be integrated into broader enterprise risk management programs, with regular audits and updates.

Vendor Management Evolution: Background check vendors must be evaluated not just on price and speed, but on their compliance expertise and ability to provide ongoing regulatory guidance.

Training and Development: HR teams need specialized training on FCRA requirements, with regular updates as legal standards evolve.

Strategic Decision-Making Framework

California's FCRA landscape requires HR leaders to make strategic decisions about background screening programs:

Risk vs. Benefit Analysis: Each background check requirement should be evaluated against potential FCRA liability exposure.

Geographic Risk Assessment: Companies with multi-state operations must consider California's heightened requirements when developing national policies.

Position-Specific Screening: Different roles may justify different levels of background screening, with corresponding compliance requirements.

Building Legal-HR Partnerships

Successful FCRA compliance requires close collaboration between HR and legal teams:

Regular Compliance Reviews: Monthly or quarterly reviews of background check procedures, forms, and vendor practices.

Legal Updates Integration: Systematic process for incorporating new legal developments into HR practices.

Incident Response Planning: Predetermined procedures for addressing potential FCRA violations or litigation threats.

Risk Mitigation Framework: Proactive Measures for FCRA Compliance

The Four Pillars of FCRA Compliance

1. Disclosure Excellence

- Use truly standalone disclosure forms with no additional language

- Avoid any disclaimers, explanations, or liability waivers

- Maintain separate forms for federal FCRA and state law requirements

- Regular legal review of all disclosure documents

2. Authorization Precision

- Obtain clear, written authorization before conducting background checks

- Ensure authorization forms are separate from job applications

- Use plain language that clearly explains what is being authorized

- Maintain proper documentation of all authorizations

3. Adverse Action Procedures

- Provide pre-adverse action notices before making negative employment decisions

- Include required documentation (background report copy, rights summary)

- Allow reasonable time for dispute resolution

- Follow up with final adverse action notices when appropriate

4. Vendor Management Excellence

- Verify vendor FCRA compliance certifications

- Require contractual indemnification for vendor compliance failures

- Regular vendor audits and performance reviews

- Maintain documentation of vendor compliance efforts

Technology Solutions for Compliance Management

Modern HR technology can significantly reduce FCRA compliance risks:

- Automated Workflow Systems: Technology platforms that enforce compliant procedures and prevent common errors.

- Document Management: Centralized systems for storing and retrieving FCRA-compliant forms and authorizations.

- Audit Trail Maintenance: Comprehensive logging of all background check activities for legal documentation purposes.

- Regular Compliance Reporting: Automated reports highlighting potential compliance issues or procedural deviations.

California-Specific Compliance Enhancements

Given California's unique legal environment, additional measures are essential:

- Dual-Disclosure Systems: Separate processes for FCRA and ICRAA compliance

- Ninth Circuit Monitoring: Regular review of new court decisions affecting California employers

- State Law Integration: Comprehensive understanding of how California employment laws interact with FCRA requirements

- Local Legal Counsel: Access to California-specific employment law expertise

Implementation Roadmap: Step-by-Step Guidance for Immediate Action

Phase 1: Immediate Risk Assessment (Week 1-2)

Document Review:

- Audit all current background check forms and procedures

- Identify potential standalone disclosure violations

- Review vendor contracts and compliance certifications

- Assess current adverse action procedures

Risk Quantification:

- Calculate potential exposure based on employee/applicant volume

- Identify highest-risk positions or procedures

- Evaluate insurance coverage for FCRA violations

- Prioritize immediate compliance gaps

Phase 2: Compliance Infrastructure Development (Week 3-6)

Form Development:

- Create new standalone FCRA disclosure forms

- Develop separate California ICRAA disclosure forms (if applicable)

- Design compliant authorization documents

- Prepare adverse action notice templates

Process Design:

- Map compliant background check workflows

- Create decision trees for adverse action procedures

- Develop vendor management protocols

- Establish audit and monitoring procedures

Technology Implementation:

- Select or configure compliance management systems

- Set up automated workflow enforcement

- Implement document management solutions

- Create compliance reporting dashboards

Phase 3: Training and Rollout (Week 7-10)

HR Team Training:

- Comprehensive FCRA compliance education

- Hands-on practice with new procedures

- Scenario-based training for adverse action situations

- Regular update and refresher planning

Manager Education:

- Basic FCRA compliance awareness

- Proper procedures for handling background check results

- When to involve HR or legal teams

- Documentation requirements and best practices

Vendor Coordination:

- Communicate new compliance requirements

- Update contracts and service agreements

- Test new procedures with vendor systems

- Establish ongoing monitoring protocols

Phase 4: Ongoing Compliance Management (Week 11+)

Regular Auditing:

- Monthly compliance reviews and assessments

- Quarterly vendor performance evaluations

- Annual comprehensive program audits

- Continuous improvement initiatives

Legal Update Integration:

- Subscription to relevant legal update services

- Regular consultation with employment law counsel

- Participation in HR compliance professional organizations

- Proactive monitoring of regulatory developments

Expert Commentary: Industry Insights and Professional Perspectives

Legal Expert Perspective: The Evolution of FCRA Enforcement

Employment law attorneys note that FCRA litigation has evolved from targeting obvious violations to focusing on increasingly technical compliance issues. The trend toward finding "willful" violations for what were previously considered minor oversights represents a fundamental shift in how courts view employer obligations.

"The California cases demonstrate that good intentions don't matter in FCRA compliance," explains employment law specialist Jennifer Martinez. "Employers who think they're being helpful by adding explanatory language to disclosure forms are actually creating massive liability exposure."

HR Technology Perspective: Automation as Risk Mitigation

Human resources technology vendors increasingly emphasize compliance automation as a core value proposition. The complexity of maintaining FCRA compliance across multiple jurisdictions makes manual processes unsustainable for most employers.

"The days of managing background checks with paper forms and manual tracking are over," notes HR technology consultant Robert Chen. "The risk of human error in FCRA compliance is simply too high given the potential financial consequences."

Consumer Reporting Agency Perspective: Partnership in Compliance

Modern consumer reporting agencies (CRAs) position themselves as compliance partners rather than mere service providers. The most sophisticated CRAs offer comprehensive compliance consulting, regular legal updates, and technology solutions designed to minimize employer risk.

"Our clients don't just want background reports—they want confidence that their entire screening program is legally compliant," explains CRA executive Sarah Johnson. "We've evolved from being report providers to being compliance partners."

Industry Association Insights: Collaborative Compliance Approaches

Professional organizations like the Society for Human Resource Management (SHRM) and the Professional Background Screening Association (PBSA) emphasize the importance of industry-wide compliance standards and best practice sharing.

"The California cases have been a wake-up call for the entire industry," notes PBSA president Michael Thompson. "We're seeing unprecedented collaboration between employers, CRAs, and legal experts to develop practical compliance solutions."

The Consumer Reporting Agency Solution: Strategic Partnership for Risk Mitigation

Beyond Traditional Background Screening

Modern consumer reporting agencies have evolved far beyond simple background check providers. Today's leading CRAs offer comprehensive compliance solutions that address the full spectrum of FCRA requirements:

Compliance Consulting Services:

- Regular audits of employer procedures and forms

- Legal update services and regulatory monitoring

- Customized training programs for HR teams

- Incident response and litigation support

Technology-Driven Compliance:

- Automated workflow systems that enforce compliant procedures

- Real-time compliance monitoring and alerting

- Comprehensive audit trails and documentation

- Integration with existing HR information systems

Legal Protection and Support:

- Contractual indemnification for vendor-related violations

- Access to specialized employment law counsel

- Litigation support and expert witness services

- Regulatory response assistance

Selecting the Right CRA Partner

The California FCRA landscape makes CRA selection a critical strategic decision:

- Compliance Expertise: Look for CRAs with dedicated compliance teams and proven track records in complex regulatory environments.

- Technology Capabilities: Ensure the CRA's systems can support sophisticated compliance requirements and provide comprehensive documentation.

- Legal Resources: Evaluate the CRA's access to specialized legal expertise and ability to provide ongoing regulatory guidance.

- Industry Experience: Consider CRAs with specific experience in your industry and understanding of sector-specific compliance challenges.

- Geographic Coverage: For multi-state employers, ensure the CRA understands compliance requirements across all relevant jurisdictions.

Resources and Next Steps: Your FCRA Compliance Action Plan

Immediate Action Items

Week 1:

- Conduct emergency audit of current background check forms

- Identify and document potential standalone disclosure violations

- Review vendor contracts for compliance obligations

- Assess current insurance coverage for FCRA violations

Week 2-4:

- Develop new compliant disclosure and authorization forms

- Create adverse action procedure templates

- Research and evaluate compliance management technology solutions

- Establish relationships with employment law counsel specializing in FCRA

Month 2-3:

- Implement new compliant procedures across all locations

- Train HR team on updated compliance requirements

- Establish vendor management and monitoring protocols

- Create ongoing audit and review schedules

Essential Compliance Resources

Legal Resources:

- Federal Trade Commission FCRA guidance documents

- Consumer Financial Protection Bureau enforcement actions

- Ninth Circuit Court of Appeals employment law decisions

- California Department of Fair Employment and Housing guidance

Professional Organizations:

- Society for Human Resource Management (SHRM)

- Professional Background Screening Association (PBSA)

- National Association of Professional Background Screeners (NAPBS)

- Employment Law Alliance

Technology Solutions:

- Background check compliance management platforms

- HR information systems with built-in FCRA compliance features

- Document management systems for regulatory documentation

- Audit and monitoring tools for ongoing compliance assessment

Long-Term Strategic Considerations

Regulatory Monitoring:

- Establish processes for tracking new FCRA developments

- Monitor California-specific employment law changes

- Stay informed about Ninth Circuit court decisions

- Participate in industry compliance forums and discussions

Continuous Improvement:

- Regular compliance program assessments and updates

- Employee feedback integration for procedure improvements

- Technology upgrades and system enhancements

- Best practice sharing with industry peers

Risk Management Integration:

- Include FCRA compliance in enterprise risk assessments

- Regular board-level reporting on compliance status

- Integration with broader employment law compliance programs

- Coordination with legal, HR, and risk management teams

Conclusion: Transforming Risk into Competitive Advantage

The California FCRA litigation landscape represents both a significant challenge and a strategic opportunity for forward-thinking employers. While the financial consequences of non-compliance are severe, companies that invest in robust compliance programs can transform regulatory requirements into competitive advantages.

Organizations that partner with sophisticated consumer reporting agencies, implement technology-driven compliance solutions, and maintain proactive legal guidance will not only avoid costly litigation but will also build more efficient, effective, and legally sound employment practices.

The message from California's $18+ million in FCRA settlements is clear: technical compliance is not optional, and good intentions cannot substitute for rigorous legal adherence. However, employers who treat FCRA compliance as a strategic priority rather than an administrative burden will find themselves well-positioned for success in an increasingly complex regulatory environment.

The investment in comprehensive FCRA compliance—whether through internal resources, external partnerships, or advanced technology solutions—is not just about avoiding litigation. It's about building sustainable, scalable employment practices that protect both employers and employees while supporting business growth and success.

In the evolving landscape of employment law, FCRA compliance represents a fundamental test of organizational maturity and strategic thinking. Companies that pass this test will not only avoid the costly mistakes of their predecessors but will also establish themselves as employers of choice in competitive talent markets.

The time for reactive compliance is over. The California cases demand proactive, strategic, and comprehensive approaches to FCRA compliance that treat California background screening as a critical business function worthy of significant investment and attention. Those who answer this call will find themselves not just legally protected, but strategically advantaged in the modern employment landscape.

Related Internal Links

For comprehensive guidance on FCRA compliance and background check best practices, explore these related resources:

California-Specific Compliance

- Navigating Background Checks in California: A Comprehensive Guide for Employers - Essential guide covering California's unique background check laws and FCRA/ICRAA dual compliance requirements.

FCRA Compliance Fundamentals

- FCRA Compliance: What Employers Need to Know - Complete overview of Fair Credit Reporting Act requirements, disclosure procedures, and adverse action processes.

- Background Check Laws: A Comprehensive Overview - Federal and state law requirements governing background checks, including FCRA mandates and consent procedures.

Multi-State Compliance Strategies

- Multi-State Screening Rules for Staffing Agencies - Navigate complex multi-jurisdictional compliance requirements and state-specific regulations.

Privacy and Data Protection

- Data Privacy Concerns in Background Checks - Understanding GDPR, CCPA, and FCRA data protection requirements for background screening.

Practical Implementation Tools

- A Step-by-Step Background Check Checklist - Comprehensive checklist ensuring legal compliance and risk mitigation.

- Top 30 Most Common Background Check Questions (and How to Prepare) - Essential preparation guide for navigating background check processes.

Industry-Specific Guidance

- Federal Background Check for Employment: What You Need to Know - Understanding federal employment screening requirements and security clearance processes.

- Best Practices in Civil Background Checks - Comprehensive guide to civil litigation searches and legal compliance.

Personal Background Check Resources

- How to Run a Background Check on Yourself: Costs and Process Explained - Self-screening guidance for employment preparation.

- How to Get a Background Check for Yourself: A Step-by-Step Guide - Complete guide to conducting personal background reviews.

Background Check Fundamentals

- How Far Back Does a Background Check Go? - Understanding timeframes and scope limitations for different types of background checks.

- The Truth About Free Background Checks: What You Need to Know in 2025 - Comparing free vs. paid background check services and FCRA compliance considerations.

Frequently Asked Questions (FAQ)

What makes California FCRA violations so expensive for employers?

California's unique legal environment creates a perfect storm for high-dollar settlements. The Ninth Circuit Court of Appeals frequently finds violations "willful" rather than negligent, which increases statutory damages from $100-$400 per violation to up to $1,000 per violation. When multiplied across large employee classes (Target's case affected 74,000 people), even minor technical errors can result in multi-million-dollar exposure.

What is a "standalone disclosure" and why is it so important?

A standalone disclosure means the FCRA background check authorization must appear in a document that contains nothing else—no job application language, no liability waivers, no explanatory text, and no "helpful" disclaimers. Courts have ruled that even adding a footnote saying the disclosure is "not legal advice" violates this requirement and can trigger class-action lawsuits.

How does California's dual disclosure requirement work?

California employers must provide two separate standalone documents: one for federal FCRA compliance and another for California's Investigative Consumer Reporting Agencies Act (ICRAA). The Ninth Circuit's Gilberg decision established that these cannot be combined into a single form, effectively doubling the disclosure burden for California employers.

What constitutes "willful" versus "negligent" FCRA violations?

Courts increasingly find violations "willful" when employers ignore clear regulatory guidance about FCRA requirements. For example, including liability waivers in disclosure forms after regulatory agencies have explicitly warned against this practice can be deemed willful. Willful violations carry higher damages and are much harder to defend against in court.

Can small employers be targeted for FCRA class actions?

Yes, any employer conducting background checks can face FCRA litigation regardless of size. Class actions are often filed based on the number of affected employees rather than company size. Even a small company that conducts hundreds of background checks annually could face significant exposure if their forms contain technical violations.

What should employers do immediately to assess their FCRA risk?

Conduct an emergency audit of all background check forms and procedures. Look specifically for: (1) any additional language in disclosure forms beyond the basic FCRA requirements, (2) combined application and disclosure documents, (3) liability waivers or disclaimers, and (4) inadequate adverse action procedures. Document any potential violations and consult with employment law counsel specializing in FCRA.

How can technology help reduce FCRA compliance risks?

Modern compliance platforms can automate workflows to prevent common errors, maintain comprehensive audit trails, enforce standalone disclosure requirements, and provide real-time monitoring for potential violations. However, technology is only as good as the compliance procedures it's designed to enforce—employers still need expert legal guidance to design compliant processes.

Are there safe harbor provisions for employers who work with compliant vendors?

While working with FCRA-compliant consumer reporting agencies provides some protection, employers remain primarily liable for their own compliance failures. The best CRA partnerships include contractual indemnification, ongoing compliance consulting, and technology solutions that prevent employer-side violations. However, employers cannot simply delegate their FCRA obligations to third parties.

How do California FCRA requirements affect multi-state employers?

Multi-state employers face complex compliance challenges because they must meet the strictest requirements across all jurisdictions. California's heightened standards often become the de facto national standard for companies operating there. This can actually simplify compliance by establishing uniform, California-compliant procedures across all locations.

What's the typical timeline for FCRA class action lawsuits?

FCRA class actions can take 2-5 years to resolve, during which employers face ongoing legal costs, operational disruption, and potential suspension of background check programs. Early settlement is often the most cost-effective resolution, which is why prevention through robust compliance programs is much more economical than litigation defense.

How often should employers review their FCRA compliance procedures?

Given the evolving legal landscape, employers should conduct quarterly compliance reviews and annual comprehensive audits. Additionally, any changes to background check vendors, forms, or procedures should trigger immediate compliance assessments. Legal developments in the Ninth Circuit should be monitored continuously for California employers.

What role do insurance policies play in FCRA violations?

Employment Practices Liability Insurance (EPLI) may provide some coverage for FCRA violations, but policies often contain exclusions for regulatory fines and may not cover all aspects of class-action settlements. Employers should review their coverage with insurance professionals and consider whether additional protection is needed based on their FCRA risk exposure.

References

Ogletree Deakins. (2022, January 7). Ninth Circuit issues a positive decision for employers in the world of background checks. https://ogletree.com/insights/ninth-circuit-issues-a-positive-decision-for-employers-in-the-world-of-background-checks/

Privacy World. (2021, May 13). California federal court approves FCRA class action settlement. https://www.privacyworld.blog/2021/05/california-federal-court-approves-fcra-class-action-settlement/

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.