Texas employers must navigate complex federal and state regulations when conducting Texas bankruptcy background check procedures in 2025. The Fair Credit Reporting Act and Texas Labor Code provide specific protections for job applicants with bankruptcy history, making compliance essential for avoiding discrimination lawsuits.

Key Takeaways

- Texas employers can legally check bankruptcy records but must follow strict FCRA notification and consent requirements before screening applicants.

- Job applicants cannot be automatically disqualified based solely on bankruptcy history unless it directly relates to essential job functions.

- The Texas Labor Code prohibits employment discrimination based on bankruptcy status for most positions, with limited exceptions for financial and fiduciary roles.

- Employers must provide adverse action notices and allow applicants to dispute inaccurate bankruptcy information before making final hiring decisions.

- Best practices include developing clear policies, training hiring managers, and documenting legitimate business reasons for any bankruptcy-related employment decisions.

- Violation of Texas bankruptcy employment laws can result in federal lawsuits, state penalties, and significant financial damages for employers.

Understanding Texas Bankruptcy Background Check Laws

Texas bankruptcy employment screening operates under a complex legal framework that combines federal and state regulations. The Fair Credit Reporting Act establishes baseline standards for accessing bankruptcy information during hiring processes. Meanwhile, Texas Labor Code Chapter 52 adds additional protections that specifically prohibit discrimination based on bankruptcy status.

This dual regulatory system creates unique compliance challenges for employers in 2025. Companies must satisfy both federal consumer protection standards and state anti-discrimination requirements. Additionally, recent court decisions have strengthened applicant protections and increased penalties for violations.

The legal landscape continues evolving as more workers seek employment protection after financial difficulties. Furthermore, economic conditions following recent years have made bankruptcy discrimination a growing concern for Texas regulators. Consequently, employers face increased scrutiny when conducting any form of financial background screening.

Legal Framework Governing Bankruptcy Employment Screening

Federal FCRA Requirements

The Fair Credit Reporting Act establishes fundamental procedures that Texas employers must follow when conducting bankruptcy background checks. These requirements apply to all consumer reporting activities, including credit reports that contain bankruptcy information. Moreover, the Consumer Financial Protection Bureau has increased enforcement efforts significantly in recent years.

FCRA compliance begins with proper disclosure and authorization procedures before any background screening occurs. Employers must provide separate written notices that clearly explain their intent to review consumer reports. Subsequently, they must obtain explicit written consent from job applicants before proceeding with any screening activities.

| FCRA Requirement | Employer Obligation |

| Pre-screening disclosure | Separate written document explaining consumer report use |

| Authorization | Explicit written consent from job applicant |

| Adverse action notice | Pre-adverse and final adverse action notifications |

| Record retention | Documentation of all screening procedures and decisions |

Violation of FCRA requirements can result in substantial penalties ranging from $100 to $1,000 per violation. Additionally, willful violations may trigger punitive damages that can reach tens of thousands of dollars per affected applicant.

Texas State Anti-Discrimination Laws

Texas bankruptcy employment laws provide broader protections than federal requirements alone. The Texas Labor Code specifically prohibits employment discrimination based on bankruptcy status for most job categories. These protections recognize that bankruptcy often results from circumstances beyond individual control.

State regulations require employers to conduct individualized assessments rather than applying blanket exclusions. Each case must be evaluated based on job relevance, time elapsed since filing, and legitimate business necessity. Therefore, automatic screening systems that flag bankruptcy records must include human review processes.

Recent amendments to Texas employment laws have strengthened these protections further. The Texas Workforce Commission now has expanded authority to investigate discrimination complaints. As a result, employers face more rigorous oversight of their screening practices throughout 2025.

When Texas Employers Can Legally Screen for Bankruptcy

Permissible Job Categories

Certain employment positions in Texas justify legitimate consideration of bankruptcy history during hiring decisions. Financial services roles represent the most defensible category for bankruptcy screening activities. These positions involve direct access to client funds, investment accounts, and sensitive financial information.

Executive positions with fiduciary responsibilities also warrant bankruptcy consideration in many circumstances. Additionally, accounting roles that involve direct asset management may justify financial background screening. However, employers must document specific job duties that create genuine financial risk exposure.

High-Risk Financial Positions:

- Bank tellers and loan officers: Direct access to customer deposits and lending decisions require financial trustworthiness assessments

- Investment advisors and financial planners: Fiduciary responsibilities for client assets create legitimate screening interests

- Corporate treasurers and CFOs: Executive financial management duties justify comprehensive background evaluation

- Accounting managers and controllers: Direct access to company financial records and asset control systems

- Insurance agents and brokers: Client premium handling and claims processing involve significant financial responsibilities

The key legal standard centers on demonstrating direct relationships between bankruptcy history and essential job functions. Employers cannot simply assume that financial difficulties indicate poor character or work performance.

Business Necessity Requirements

Texas employers must establish clear business necessity when using bankruptcy information in hiring decisions. This standard requires demonstrating that financial stability constitutes a bona fide occupational qualification. General preferences or assumptions about character do not satisfy legal requirements for screening justification.

Documentation becomes critical when defending business necessity claims in discrimination complaints or lawsuits. Employers should maintain detailed job descriptions that specify financial responsibilities and risk factors. Furthermore, they must show how bankruptcy history directly relates to these documented job requirements.

The business necessity standard has become more stringent following recent court decisions in Texas. Judges increasingly scrutinize employer justifications for financial background screening practices. Consequently, companies need stronger documentation and clearer connections between screening criteria and job duties.

Prohibited Discrimination Practices

Automatic Disqualification Restrictions

Texas law explicitly prohibits automatic rejection of job applicants based solely on bankruptcy records. Employers cannot establish blanket policies that exclude all candidates with bankruptcy history regardless of circumstances. This protection acknowledges that bankruptcy often stems from medical emergencies, job loss, or economic factors beyond individual control.

Anti-discrimination requirements mandate individualized assessments for each applicant with bankruptcy history. These evaluations must consider multiple factors including the nature of bankruptcy, time elapsed since filing, and evidence of financial recovery. Additionally, employers must weigh these factors against specific job requirements and responsibilities.

Recent enforcement actions have targeted employers who use automated screening systems without proper human review. The Texas Workforce Commission has issued significant penalties for companies that automatically disqualify bankruptcy applicants. Therefore, screening procedures must include meaningful individual evaluation processes throughout 2025.

Protected Employment Categories

Most Texas employment positions fall under comprehensive bankruptcy discrimination protections with limited exceptions for legitimate financial roles. General labor positions cannot legally consider bankruptcy history during hiring decisions. Similarly, administrative roles without financial access receive full protection under state anti-discrimination laws.

Healthcare positions also enjoy strong bankruptcy discrimination protections unless they involve billing or financial management duties. Educational roles receive similar protections, with exceptions only for positions involving significant financial responsibilities. Additionally, retail and customer service positions cannot legally screen for bankruptcy history in most circumstances.

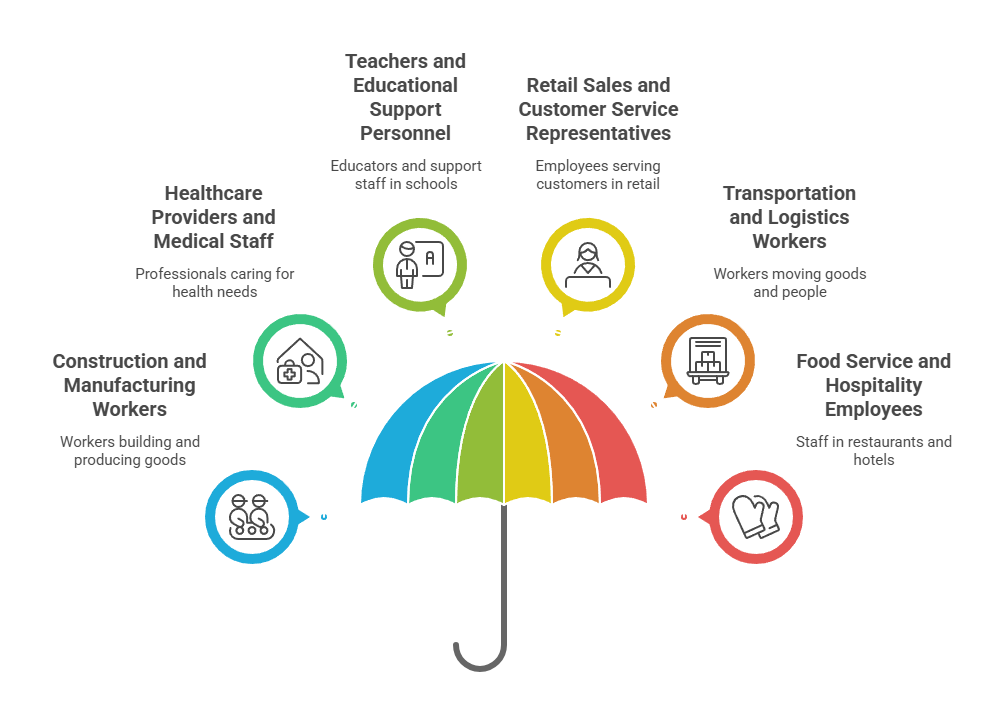

Fully Protected Job Categories:

- Construction and manufacturing workers

- Healthcare providers and medical staff

- Teachers and educational support personnel

- Retail sales and customer service representatives

- Transportation and logistics workers

- Food service and hospitality employees

Employers who screen bankruptcy records for protected job categories face significant legal exposure. State and federal enforcement agencies actively investigate these discrimination complaints. Moreover, affected applicants can pursue private lawsuits seeking substantial damages and attorney fees.

Required Compliance Procedures for Texas Employers

Pre-Screening Notification Requirements

Texas employers must follow specific notification procedures before conducting any bankruptcy background check through consumer reporting agencies. The process begins with providing clear written disclosure about potential consumer report reviews. This disclosure must be presented as a separate document that stands alone from job applications or other employment materials.

The disclosure document must use plain language that job applicants can easily understand without legal expertise. Technical terms should be avoided, and the purpose of background screening must be clearly explained. Furthermore, employers cannot bundle these disclosures with liability waivers or other unrelated legal documents that might confuse applicants.

Following proper disclosure, employers must obtain explicit written authorization before proceeding with any background screening activities. The authorization process cannot be presented as a mandatory condition for application consideration. Instead, it must be voluntary and separate from other employment decisions or requirements.

Documentation and Record-Keeping Standards

Comprehensive documentation becomes essential for defending Texas bankruptcy employment screening decisions against discrimination claims. Employers must maintain detailed records of all screening procedures, applicant notifications, and decision-making factors. These records serve as crucial evidence in administrative investigations and potential litigation proceedings.

Record-keeping requirements extend beyond simple documentation of screening results to include evidence of business necessity and individualized assessments. Companies should document specific job requirements that justify bankruptcy consideration. Additionally, they must record the reasoning behind each employment decision involving bankruptcy information.

| Required Documentation | Retention Period | Legal Purpose |

| Pre-screening disclosures | 3 years minimum | FCRA compliance proof |

| Authorization forms | 3 years minimum | Consent documentation |

| Individual assessments | 5 years recommended | Discrimination defense |

| Business necessity justification | 5 years recommended | Legal screening validation |

The Texas Workforce Commission regularly audits employer record-keeping practices during discrimination investigations. Inadequate documentation can result in administrative penalties and strengthen applicant discrimination claims. Therefore, comprehensive record-keeping systems are essential for legal compliance throughout 2025.

Adverse Action Procedures and Applicant Rights

Pre-Adverse Action Requirements

When bankruptcy information influences potential employment decisions, Texas employers must follow strict adverse action procedures that protect applicant rights. The process begins with pre-adverse action notices that inform candidates about possible negative decisions based on background check results. These notices must be provided before any final employment determination occurs.

Pre-adverse action notices must include copies of the consumer report containing bankruptcy information along with summaries of applicant rights under federal law. The notice must clearly explain that the employment decision is not yet final and that applicants have opportunities to respond. Additionally, employers must provide reasonable time periods for applicant responses before proceeding with final decisions.

Pre-Adverse Action Components:

- Complete copy of consumer report used in decision-making

- Summary of rights under Fair Credit Reporting Act

- Clear statement that decision is preliminary, not final

- Contact information for consumer reporting agency

- Reasonable response period for applicant input

The reasonable response period typically ranges from three to five business days, depending on circumstances and job urgency. However, employers should err on the side of providing more time rather than less to avoid procedural violations.

Final Adverse Action Notifications

After completing the pre-adverse action process and considering any applicant responses, employers must provide final adverse action notices if they proceed with negative employment decisions. These notices must clearly state that the employment decision is final and based on information in consumer reports. Furthermore, they must provide specific information about applicant appeal rights and dispute procedures.

Final adverse action notices must include contact information for the consumer reporting agency that provided bankruptcy information. Applicants have rights to obtain free copies of their consumer reports and dispute inaccurate information directly with reporting agencies. Additionally, the notice must explain these rights in plain language that applicants can understand without legal assistance.

The adverse action process represents a critical compliance point where many employers make costly procedural errors. Incomplete notices, inadequate response periods, or missing required information can result in significant FCRA violations. Therefore, employers should develop standardized procedures and training programs to ensure consistent compliance with adverse action requirements.

Best Practices for Compliant Screening Programs

Policy Development and Implementation

Effective Texas bankruptcy employment screening requires comprehensive written policies that address legal requirements, business needs, and consistent application procedures. These policies should clearly define which positions justify bankruptcy screening based on legitimate business necessity. Additionally, they must establish criteria for evaluating bankruptcy information when it becomes relevant to hiring decisions.

Policy development must involve legal review to ensure compliance with both federal FCRA requirements and Texas anti-discrimination laws. Regular policy updates help employers stay current with evolving legal standards and court interpretations. Moreover, policies should include specific procedures for handling various screening scenarios that hiring managers might encounter.

The policy should address how bankruptcy age affects employment decisions and establish guidelines for weighing different types of bankruptcy filings. Chapter 7 liquidations may warrant different consideration than Chapter 13 reorganizations that demonstrate repayment efforts. Additionally, policies should specify documentation requirements for all screening decisions and business justifications.

Training and Management Education

Successful implementation of compliant bankruptcy screening requires comprehensive training for all personnel involved in hiring decisions. Training programs should address legal requirements, company policies, and practical scenarios that hiring managers encounter during recruitment processes. Regular training updates ensure consistent application of screening criteria and reduce discrimination risks.

Training should emphasize the importance of individualized assessments over automatic disqualification procedures. Hiring managers must understand how to evaluate bankruptcy information in context of specific job requirements. Furthermore, they need clear guidance on documenting legitimate business reasons for employment decisions involving financial background information.

Essential Training Topics:

- Federal FCRA compliance requirements and procedures

- Texas state anti-discrimination law protections and exceptions

- Company policy application and decision-making criteria

- Documentation standards and record-keeping requirements

- Individualized assessment techniques and evaluation factors

- Adverse action procedures and applicant rights protection

Training programs should include regular updates as legal standards evolve and new enforcement guidance emerges. The Texas Workforce Commission and federal agencies periodically issue new interpretations that affect compliance requirements. Therefore, ongoing education helps prevent costly violations and maintains effective screening programs.

Legal Consequences and Enforcement Actions

Federal Penalties and Litigation Risks

Texas employers who violate bankruptcy employment screening laws face substantial legal and financial consequences under federal enforcement mechanisms. FCRA violations can result in federal lawsuits with statutory damages ranging from $100 to $1,000 per violation plus attorney fees and actual damages. Willful violations may trigger punitive damages that substantially increase financial exposure beyond basic statutory amounts.

Recent federal court decisions have resulted in multi-million-dollar settlements for employers who systematically violated FCRA requirements during background screening processes. Class action lawsuits represent particularly significant risks when screening violations affect multiple job applicants. Additionally, the Consumer Financial Protection Bureau has increased enforcement activities and penalty assessments throughout 2024 and into 2025.

Private litigation represents the most common enforcement mechanism for FCRA violations in Texas. Affected applicants can pursue individual lawsuits or join class action proceedings against employers who fail to follow proper procedures. Attorney fees provisions in FCRA make these cases attractive to plaintiff attorneys, increasing litigation risks for non-compliant employers.

State Administrative Penalties

State-level violations of Texas bankruptcy employment laws can result in administrative penalties, cease and desist orders, and regulatory sanctions that impact business operations. The Texas Workforce Commission has authority to investigate discrimination complaints and impose administrative penalties for violations. These investigations can result in public findings that damage employer reputations and business relationships.

Administrative penalties have increased significantly in recent years as Texas regulators focus more attention on employment discrimination issues. The Texas Workforce Commission can order reinstatement, back pay, and other remedial measures for affected applicants. Additionally, repeat violations can result in enhanced penalties and ongoing regulatory oversight of hiring practices.

Potential State Penalties:

- Administrative fines up to $10,000 per violation

- Cease and desist orders prohibiting discriminatory practices

- Mandatory compliance monitoring and reporting requirements

- Public disclosure of violations and enforcement actions

- Required policy changes and employee training programs

State enforcement actions often trigger additional scrutiny from federal agencies and increase private litigation risks. Therefore, administrative violations can have cascading effects that extend beyond immediate penalty assessments.

Industry-Specific Considerations and Exceptions

Financial Services Sector Requirements

The financial services industry operates under unique regulatory requirements that may justify more extensive bankruptcy screening than other employment sectors. Federal banking regulations and state insurance laws create fiduciary responsibilities that support business necessity arguments for financial background screening. However, even these industries must follow proper FCRA procedures and conduct individualized assessments.

Banking positions subject to FDIC bonding requirements face specific regulatory standards that consider bankruptcy history in employment decisions. Similarly, insurance agents and investment advisors operate under state licensing requirements that may involve financial background considerations. Nevertheless, these regulatory frameworks do not override basic anti-discrimination protections under Texas law.

Financial services employers should coordinate their screening procedures with regulatory compliance requirements while maintaining adherence to employment discrimination laws. Legal counsel specializing in both employment law and financial services regulation can help navigate these complex compliance requirements effectively.

Healthcare and Professional Services

Healthcare employers generally cannot justify bankruptcy screening for most clinical positions, despite the high-trust nature of patient care responsibilities. Medical professionals, nurses, and support staff typically receive full protection under Texas anti-discrimination laws. However, positions involving billing, financial management, or significant administrative responsibilities may warrant different consideration.

Professional services firms face similar restrictions when screening for bankruptcy history during hiring processes. Legal, accounting, and consulting firms cannot automatically screen for financial background information unless specific job duties create legitimate business necessity. Partnership tracks or senior management positions may justify different treatment based on fiduciary responsibilities and client asset access.

The key distinction centers on direct financial responsibilities rather than general professional trust or client interaction requirements. Employers must document specific job duties that involve financial risk exposure to justify bankruptcy screening in professional service contexts.

Conclusion

Texas bankruptcy employment screening in 2025 requires careful navigation of federal and state legal requirements that balance legitimate business interests with applicant protection rights. Successful compliance depends on understanding when bankruptcy screening is legally justified, following proper FCRA procedures, and implementing policies that prevent discriminatory practices. Employers who invest in proper training, clear policies, and legal guidance can effectively manage hiring risks while avoiding costly violations. The evolving legal landscape makes ongoing education and policy updates essential for maintaining compliant screening practices throughout Texas.

Frequently Asked Questions

Can Texas employers automatically reject applicants with bankruptcy records?

No, Texas employers cannot automatically disqualify job applicants based solely on bankruptcy history. State anti-discrimination laws require individualized assessments that consider job relevance, time elapsed since filing, and legitimate business necessity. Employers must evaluate each situation based on specific circumstances rather than applying blanket exclusion policies.

What jobs in Texas can legally consider bankruptcy history?

Texas employers can consider bankruptcy history for positions with direct financial responsibilities, such as banking, accounting, and executive roles involving fiduciary duties. General labor, administrative, retail, and most other positions cannot legally use bankruptcy history as screening criteria. Employers must demonstrate clear business necessity and direct job relevance for any bankruptcy-related screening decisions.

How long must Texas employers wait after bankruptcy to hire someone?

Texas law does not specify mandatory waiting periods after bankruptcy before employers can hire applicants. However, employers must consider time elapsed since bankruptcy filing as part of individualized assessments, and older bankruptcies generally carry less weight in employment decisions. The key factor is whether bankruptcy history remains relevant to specific job requirements rather than arbitrary time limits.

What notices must Texas employers provide during bankruptcy screening?

Texas employers must provide separate written disclosure before conducting bankruptcy background checks and obtain explicit consent from applicants. If bankruptcy information influences employment decisions, employers must follow FCRA adverse action procedures including pre-adverse action notices, reasonable response periods, and final adverse action notifications with appeal rights and consumer reporting agency contact information.

Can job applicants dispute bankruptcy information in Texas?

Yes, job applicants have comprehensive rights to dispute inaccurate bankruptcy information found during employment screening processes. Texas employers must provide reasonable time for applicants to submit corrections or additional context before making final hiring decisions. Applicants can dispute information directly with consumer reporting agencies and provide explanatory information to employers during adverse action procedures.

What penalties do Texas employers face for illegal bankruptcy discrimination?

Texas employers who violate bankruptcy employment screening laws face federal FCRA penalties of $100-$1,000 per violation plus attorney fees, potential punitive damages for willful violations, state administrative sanctions through the Texas Workforce Commission, and civil lawsuits seeking compensatory and punitive damages. Recent enforcement actions have resulted in substantial financial penalties and regulatory oversight for non-compliant employers.

Additional Resources

- Texas Workforce Commission Employment Discrimination Guidelines

https://www.twc.texas.gov/jobseekers/employee-rights-laws - Federal Trade Commission FCRA Compliance Guide for Employers

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-employers-need-know - Texas Labor Code Chapter 52 - Employment Discrimination

https://statutes.capitol.texas.gov/Docs/LA/htm/LA.52.htm - EEOC Guidelines on Arrest and Conviction Records

https://www.eeoc.gov/laws/guidance/arrest-and-conviction-records - National Association of Professional Background Screeners Best Practices

https://www.napbs.com/ - Consumer Financial Protection Bureau FCRA Resources

https://www.consumerfinance.gov/compliance/compliance-resources/other-applicable-requirements/fair-credit-reporting-act/

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.