Rental background checks are essential screening tools that help landlords evaluate potential tenants while protecting tenants' rights under federal Fair Credit Reporting Act (FCRA) guidelines. A comprehensive rental screening process typically costs $25-75 per applicant and includes credit history, criminal records, employment verification, and rental history checks.

Key Takeaways

- Legal compliance is mandatory: All rental background checks must follow FCRA regulations, requiring written tenant consent and proper adverse action notices.

- Comprehensive screening reduces risk: Property managers who conduct thorough background checks experience 40% fewer evictions compared to those using minimal screening.

- Credit scores indicate reliability: Tenants with credit scores above 650 are statistically 60% more likely to pay rent on time consistently.

- Criminal history requires careful evaluation: Fair housing laws prohibit blanket criminal background policies, requiring individualized assessments based on relevance and recency.

- Employment verification confirms stability: Verifying income and employment status helps ensure tenants earn at least 2.5-3 times the monthly rent.

- Technology streamlines the process: Modern screening platforms can complete comprehensive background checks within 24-48 hours while maintaining legal compliance.

What Is a Rental Background Check?

A rental background check is a comprehensive screening process that evaluates a prospective tenant's financial stability, rental history, and criminal background. This essential tool helps landlords make informed decisions while ensuring compliance with federal and state housing regulations. The rental screening process typically involves multiple components working together to create a complete picture of an applicant.

Modern background checks utilize advanced technology and databases to provide accurate, up-to-date information within 24-48 hours. Property managers and individual landlords rely on these screenings to minimize financial risk and select reliable tenants. Furthermore, the screening process creates standardized evaluation criteria that help ensure fair treatment of all applicants.

For tenants, understanding the background check process helps prepare necessary documentation and sets realistic expectations. The screening process also protects qualified applicants by ensuring fair, consistent evaluation standards across all rental applications. Additionally, proper screening helps create safer rental communities by identifying potentially problematic tenants before lease signing.

Types of Rental Screening Reports

Rental background checks encompass several distinct report types, each serving specific evaluation purposes. Credit reports reveal payment history, outstanding debts, and financial responsibility patterns over time. Criminal background checks examine court records, arrest histories, and conviction data at local, state, and federal levels.

Employment and income verification confirms current job status, salary information, and employment stability. Rental history reports contact previous landlords to verify payment patterns, lease compliance, and property care habits. Additional screenings may include eviction searches, sex offender registry checks, and reference verification calls to provide comprehensive tenant evaluation.

Legal Requirements and FCRA Compliance

The Fair Credit Reporting Act governs all rental background checks, establishing strict guidelines for landlords and screening companies. FCRA compliance requires written consent before conducting any background check, proper disclosure of screening intentions, and specific adverse action procedures when denying applications. Moreover, landlords must maintain careful documentation of their screening processes to demonstrate legal compliance.

Landlords must provide applicants with a pre-adverse action notice if planning to deny based on background check results. This notice includes the screening report and a summary of FCRA rights, giving applicants opportunity to dispute inaccurate information. After final denial, landlords must send an adverse action notice with specific rejection reasons and contact information for the screening company.

State and local fair housing laws add additional compliance requirements beyond federal FCRA regulations. Some jurisdictions limit criminal history inquiries, restrict credit score thresholds, or require specific application procedures. Property managers must understand applicable laws in their operating areas to avoid discrimination lawsuits and regulatory penalties.

Tenant Rights and Protections

Tenants possess several important rights during the rental screening process that landlords must respect. Applicants have the right to know what information will be collected, how it will be used, and which screening companies will access their data. These protections ensure fair treatment while maintaining landlords' legitimate screening needs.

| Tenant Right | Description |

| Consent Requirements | Landlords must obtain written permission before running background checks |

| Report Access | Tenants can request copies of their screening reports and dispute inaccurate information |

| Adverse Action Notice | Applicants must receive specific reasons for rental application denials |

| Privacy Protection | Personal information must be handled securely and disposed of properly |

Tenants should review their credit reports annually and address any errors before apartment hunting. This proactive approach helps prevent application delays and ensures accurate representation during the screening process.

Cost and Timeline for Background Checks

Rental background check costs typically range from $25-75 per applicant, depending on the comprehensiveness of screening services. Basic credit and criminal checks cost $25-40, while comprehensive packages including employment verification, rental history, and multiple database searches range $50-75. The investment in thorough screening often pays for itself by preventing costly evictions and property damage.

Most screening companies offer different pricing tiers to accommodate various property management needs. High-volume landlords often receive discounted rates, while individual property owners may pay standard retail pricing. Some platforms charge monthly subscription fees plus per-report costs, while others use simple pay-per-use models that provide more flexibility for smaller landlords.

Timeline expectations vary based on screening depth and information availability. Basic credit and criminal checks typically complete within 24 hours, while employment verification and rental history contacts may require 48-72 hours. Complex cases involving incomplete information or dispute resolution can extend timelines to one week, particularly when previous landlords are difficult to reach.

Who Pays for Screening Costs

Application fee structures vary significantly across different rental markets and property types. Most landlords charge applicants non-refundable screening fees to cover background check costs and administrative time. These fees typically match actual screening expenses, as charging excessive amounts may violate state regulations.

Some progressive property managers absorb screening costs as business expenses, using this policy as a competitive advantage to attract quality applicants. However, most rental properties require applicants to pay screening fees upfront with their rental applications. Transparency about these costs helps set proper expectations and demonstrates professional property management practices.

What Shows Up in a Rental Background Check

Credit history forms the foundation of most rental background checks, revealing payment patterns, outstanding debts, and financial responsibility indicators. Credit reports show payment histories for credit cards, loans, mortgages, and previous collection accounts. Property managers pay particular attention to recent payment patterns, current debt-to-income ratios, and any bankruptcy or foreclosure records.

- Payment history analysis: Late payments, missed payments, and collection accounts over the past seven years

- Current debt obligations: Outstanding credit card balances, loan payments, and monthly financial commitments

- Credit utilization rates: Percentage of available credit currently being used across all accounts

- Length of credit history: How long credit accounts have been established and maintained

- Recent credit inquiries: New applications for credit that might indicate financial stress

Credit scores provide a quick snapshot of overall financial health, though individual circumstances require careful consideration. Most landlords prefer scores above 650, but other factors can compensate for lower scores in certain situations.

Criminal background information varies based on screening depth and jurisdiction requirements. Standard checks reveal felony convictions, recent misdemeanors, and pending criminal cases from county, state, and federal databases. Some comprehensive screenings include arrest records, though many jurisdictions limit how this information can be used in housing decisions.

Employment verification confirms current job status, income levels, and employment stability patterns. Screening companies contact employers directly to verify salary information, job titles, and length of employment. Income verification helps landlords ensure applicants meet minimum income requirements, typically 2.5-3 times monthly rent.

Previous rental history provides insights into tenant behavior, payment reliability, and property care habits. Background check companies contact former landlords to verify lease dates, payment timeliness, property condition, and lease violation issues. This information helps predict future tenant performance and rental compliance, making it one of the most valuable screening components.

Information Not Included in Background Checks

Several types of personal information are legally restricted from rental background checks to prevent discrimination and protect privacy rights. Medical information, disability status, and health records cannot be accessed or considered during tenant screening processes. These restrictions ensure fair housing compliance while protecting applicants' fundamental privacy rights.

- Protected health information: Medical records, prescription histories, and disability-related data

- Genetic information: DNA test results, family medical histories, and hereditary condition data

- Religious affiliation: Church membership, religious beliefs, and spiritual practice information

- Political associations: Voting records, party affiliations, and political activity participation

- Personal relationships: Marital status details, sexual orientation, and family planning information

Landlords who request or consider prohibited information face significant legal liability and discrimination lawsuits. Understanding these boundaries helps property managers focus on legitimate screening criteria while avoiding legal complications.

How Landlords Conduct Background Checks

Property managers typically utilize professional screening companies rather than attempting independent background investigations. These specialized platforms provide comprehensive databases, legal compliance tools, and standardized reporting formats that streamline the evaluation process. Professional services also offer liability protection and ensure consistent screening standards across all applications.

The screening process begins when landlords collect completed rental applications with signed consent forms. Applications should clearly state that background checks will be conducted and specify what types of information will be reviewed. Professional screening companies then access multiple databases to compile comprehensive reports within 24-48 hours.

Modern screening platforms offer user-friendly interfaces that allow landlords to order reports, review results, and generate compliance documentation efficiently. Many services provide risk assessment scores and automated red flag notifications to help property managers make consistent decisions. Integration with property management software further streamlines application processing and record keeping.

Choosing a Background Check Service

Selecting the right screening partner requires evaluating several key factors including database coverage, compliance support, and pricing structures. Established companies like TransUnion, Experian, and specialized rental screening firms offer different advantages depending on property management needs. Database comprehensiveness affects report accuracy and completeness, with national providers typically offering superior coverage compared to regional services.

FCRA compliance support is essential, as screening companies should provide proper disclosure forms, adverse action templates, and legal guidance. Customer service quality becomes important when dealing with disputed information or technical issues requiring rapid resolution. Additionally, integration capabilities with existing property management systems can significantly improve operational efficiency.

Red Flags in Tenant Background Checks

Credit-related warning signs include recent bankruptcies, high debt-to-income ratios, and patterns of late payments across multiple accounts. Applicants with credit scores below 600 present elevated risk, though individual circumstances should be considered rather than applying blanket rejection policies. Multiple recent credit inquiries may indicate financial distress or desperate housing searches that warrant closer examination.

Criminal history requires careful evaluation based on offense type, recency, and relevance to rental housing. Violent crimes, property destruction, and drug-related convictions warrant serious consideration, while minor infractions may have minimal impact on rental suitability. Fair housing laws require individualized assessments rather than automatic disqualification policies.

Employment instability patterns such as frequent job changes, income verification discrepancies, or unemployment gaps can indicate financial unreliability. However, legitimate reasons like career advancement, industry changes, or economic factors should be considered during evaluation. Rental history problems including evictions, lease violations, and negative landlord references present direct indicators of future rental performance.

| Red Flag Category | High Risk Indicators | Moderate Risk Indicators |

| Credit Issues | Bankruptcy, Collections, Score <550 | Late payments, High utilization, Score 550-650 |

| Criminal History | Violent crimes, Property damage, Recent felonies | Minor misdemeanors, Old convictions, Non-housing related |

| Employment | Frequent job changes, Income misrepresentation | Recent employment gap, Industry transition |

These indicators should guide decision-making while maintaining fair housing compliance. Documentation of evaluation rationale helps demonstrate consistent, legal screening practices across all applications.

Balancing Risk Assessment with Fair Housing

Property managers must carefully balance legitimate risk concerns with fair housing compliance requirements. Blanket policies that automatically reject applicants based on specific criteria often violate federal and state discrimination laws. Individual assessment approaches consider the totality of circumstances rather than focusing on isolated negative factors.

For example, an applicant with past credit problems but stable current employment and positive rental references may present acceptable risk. Documentation of decision-making rationale helps demonstrate fair, consistent evaluation standards across all applications. Regular training on fair housing laws helps property management teams avoid discriminatory practices while maintaining effective screening standards.

How Tenants Can Prepare for Background Checks

Prospective tenants should obtain copies of their credit reports from all three major bureaus before beginning apartment searches. Free annual reports from annualcreditreport.com allow applicants to identify and dispute any inaccurate information that could negatively impact rental applications. Addressing credit report errors can take 30-60 days, making advance preparation essential for smooth application processes.

Gathering documentation in advance streamlines the application process and demonstrates preparedness to potential landlords. Essential documents include recent pay stubs, tax returns, bank statements, and reference contact information. Having these materials readily available allows quick response to rental opportunities in competitive markets where speed often determines success.

Applicants with complicated backgrounds should prepare explanatory letters addressing potential concerns proactively. These letters should briefly explain circumstances surrounding credit problems, employment gaps, or other issues while emphasizing positive changes and current stability. Honest, upfront communication often proves more effective than hoping negative information goes unnoticed during the screening process.

Building a Strong Rental Application

Competitive rental markets require applicants to present compelling packages that stand out among multiple qualified candidates. Strong applications combine excellent credit scores, stable employment history, and positive references from previous landlords. Professional presentation matters significantly in landlord decision-making processes, particularly when multiple qualified applicants compete for the same property.

Applications should be complete, legible, and submitted promptly with all required documentation. Including a brief cover letter highlighting positive attributes and rental goals can help personalize applications in competitive situations. Providing additional references beyond previous landlords, such as employers or personal references, demonstrates stability and reliability to potential landlords.

Common Background Check Mistakes and Solutions

Landlords frequently make screening errors that can lead to legal problems or poor tenant selection decisions. One common mistake involves inconsistent application of screening criteria across different applicants. This inconsistency can create fair housing violations and discrimination claims, particularly when protected classes receive different treatment during the screening process.

Another frequent error involves relying solely on credit scores without considering other relevant factors. While credit scores provide valuable information, they don't tell the complete story of an applicant's rental suitability. Employment stability, rental history, and personal circumstances often provide better predictors of future rental performance than credit scores alone.

Inadequate documentation of screening decisions creates legal vulnerabilities for property managers. Proper record-keeping should include copies of all screening reports, notes about decision-making rationale, and documentation of compliance with FCRA requirements. These records become essential if applicants dispute decisions or file discrimination complaints.

Best Practices for Screening Success

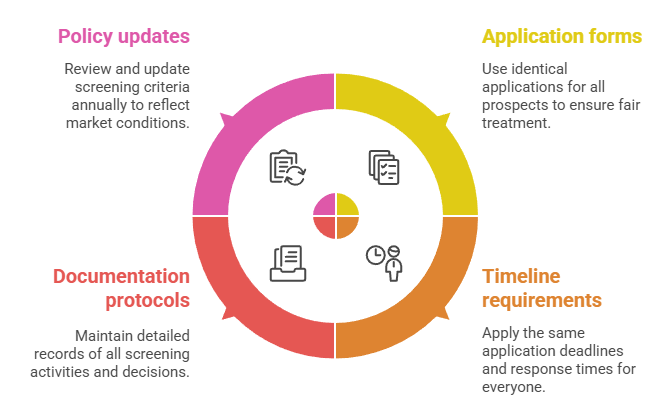

Successful rental screening requires consistent policies applied fairly across all applicants. Written screening criteria should specify minimum credit scores, income requirements, and acceptable criminal history parameters. These standards help ensure consistent decision-making while providing clear expectations for potential tenants.

- Standardized application forms: Use identical applications for all prospects to ensure fair treatment

- Consistent timeline requirements: Apply the same application deadlines and response times for everyone

- Documentation protocols: Maintain detailed records of all screening activities and decisions

- Regular policy updates: Review and update screening criteria annually to reflect market conditions

Training property management staff on proper screening procedures helps maintain consistency and legal compliance. Regular updates on fair housing requirements and FCRA changes ensure continued adherence to evolving regulations.

Industry Standards and Market Variations

Rental screening standards vary significantly across different geographic markets and property types. Urban areas with high demand often maintain stricter screening criteria, while rural markets may accept lower credit scores or alternative income verification methods. Luxury properties typically require higher credit scores and income levels compared to affordable housing options.

Regional preferences also influence which screening components receive the most emphasis. Some markets prioritize credit history, while others focus more heavily on employment verification or rental history. Understanding local market standards helps both landlords and tenants set appropriate expectations during the screening process.

Property management companies often develop proprietary scoring systems that weight different screening factors according to their experience and risk tolerance. These systems may give greater importance to recent payment history compared to older credit issues, or prioritize local rental history over distant previous residences.

Specialized Property Considerations

Different property types require tailored screening approaches based on their unique characteristics and tenant populations. Student housing near universities may emphasize parent guarantors rather than individual student credit histories. Senior living communities often focus on income stability from retirement sources rather than traditional employment verification.

Short-term rental properties require different screening criteria compared to long-term leases. These properties may prioritize identity verification and previous guest reviews rather than traditional credit and employment checks. Corporate housing serves business travelers and relocating employees, requiring verification of employer arrangements and temporary housing allowances.

Dispute Resolution and Appeals Process

When tenants discover errors in their background check reports, prompt dispute resolution becomes essential for maintaining fair screening processes. The FCRA provides specific procedures for challenging inaccurate information, requiring screening companies to investigate disputes within 30 days. Landlords should pause application decisions pending dispute resolution to avoid legal complications.

Tenants initiating disputes should provide supporting documentation such as court records, payment receipts, or employment letters to substantiate their claims. Screening companies must remove or correct verified inaccuracies and provide updated reports to affected landlords. This process protects both tenants from unfair treatment and landlords from making decisions based on incorrect information.

Some situations involve legitimate negative information that tenants want to explain rather than dispute. In these cases, tenants can provide context through personal statements or additional documentation that demonstrates current stability despite past difficulties. Landlords should consider these explanations as part of their holistic evaluation process.

Handling Special Circumstances

Certain tenant situations require modified screening approaches to ensure fair evaluation while maintaining risk management standards. Recent immigrants may lack extensive U.S. credit history but possess strong international financial records or substantial assets. Military personnel frequently have deployment-related gaps in rental history that don't reflect their actual housing reliability.

- Recent graduates: Limited credit history but strong employment prospects and family support

- Self-employed applicants: Variable income requiring tax returns and business financial statements

- Divorce situations: Temporary credit disruption during legal proceedings with improving current status

- Medical bankruptcies: Financial problems caused by health issues rather than irresponsible spending

These circumstances require individualized evaluation that looks beyond standard screening criteria while maintaining objective decision-making standards. Documenting the rationale for special considerations helps demonstrate fair housing compliance and consistent treatment of similar situations.

Conclusion

Rental background checks serve as essential tools for creating successful landlord-tenant relationships while protecting everyone's interests. Property managers who implement comprehensive, legally compliant screening processes significantly reduce their risk of payment problems, property damage, and eviction costs. For tenants, understanding the background check process enables better preparation and helps secure desired rental properties more efficiently.

The key to effective rental screening lies in balancing thorough evaluation with fair housing compliance and respect for applicant rights. Consistent application of written screening criteria helps ensure fair treatment while providing landlords with necessary risk management tools. Success in today's rental market requires both landlords and tenants to understand their rights, responsibilities, and the screening process itself.

As the rental industry continues to evolve, background checks will likely become even more sophisticated and streamlined through technological advances. Property managers who stay current with best practices, legal requirements, and industry trends will maintain competitive advantages while building stronger rental communities. Ultimately, effective screening benefits everyone by creating safer, more stable rental environments where both landlords and tenants can thrive.

Frequently Asked Questions

How long does a rental background check take?

Most rental background checks complete within 24-48 hours for basic credit and criminal screenings. Comprehensive checks including employment verification and rental history may take 2-3 business days, depending on how quickly previous employers and landlords respond to verification requests.

Can landlords run background checks without permission?

No, landlords cannot run background checks without written consent from rental applicants. The Fair Credit Reporting Act requires explicit authorization before accessing credit reports, criminal records, or other screening information. Verbal consent is not sufficient for legal compliance.

What credit score do most landlords require?

Most landlords prefer credit scores of 650 or higher, though requirements vary by market and property type. Some landlords accept scores as low as 600 with additional deposits or co-signers, while luxury properties may require scores above 700. Individual circumstances are often considered alongside credit scores.

How far back do rental background checks go?

Credit history typically shows seven years of payment information, though bankruptcies may appear for up to ten years. Criminal background checks vary by jurisdiction but commonly cover 7-10 years for most offenses. Employment verification usually focuses on current and previous 2-3 employers.

Can I dispute incorrect information on my rental screening report?

Yes, tenants have the right to dispute inaccurate information on rental screening reports under FCRA regulations. Contact the screening company directly to initiate disputes, and they must investigate within 30 days. Landlords must provide screening company contact information if they deny your application based on report contents.

Are there alternatives if I have bad credit or rental history?

Several options exist for applicants with challenging backgrounds, including offering larger security deposits, finding qualified co-signers, or providing additional references. Some landlords accept alternative credit data like utility payments or bank statements to demonstrate financial responsibility despite poor traditional credit history.

Additional Resources

- Federal Trade Commission FCRA Guide

https://www.ftc.gov/enforcement/rules/rulemaking-regulatory-reform-proceedings/fair-credit-reporting-act - HUD Fair Housing Guidelines

https://www.hud.gov/program_offices/fair_housing_equal_opp/fair_housing_act_overview - Free Annual Credit Report Service

https://www.annualcreditreport.com - National Multifamily Housing Council Screening Standards

https://www.nmhc.org/research-insight/research-report/resident-screening-standards/ - Consumer Financial Protection Bureau Tenant Rights

https://www.consumerfinance.gov/consumer-tools/credit-reports-and-scores/

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.