Pennsylvania tenant screening laws operate under a unique dual-jurisdiction framework where statewide fair housing requirements intersect with Philadelphia's groundbreaking "ban the box" housing ordinanceâone of the nation's most restrictive criminal history screening policies. Property managers operating across multiple Pennsylvania jurisdictions must navigate federal Fair Housing Act protections, state-specific credit reporting limitations, and municipal ordinances that fundamentally reshape traditional background check procedures.

Key Takeaways

- Pennsylvania landlords must comply with federal Fair Housing Act protections while adhering to stricter local ordinances in Philadelphia and other municipalities that limit criminal background screening.

- Philadelphia's "ban the box" housing law prohibits landlords from asking about criminal history on initial applications and restricts when and how criminal records can be used in tenant selection.

- Rental screening requirements in Pennsylvania mandate written consent before conducting credit checks, background screenings, or contacting previous landlords under Fair Credit Reporting Act provisions.

- Adverse action notices must be provided to applicants when denying housing based on credit reports, criminal records, or background check findings, including specific reasons and dispute rights.

- Security deposit limitations in Pennsylvania cap first month's rent advance plus two months' rent for the first year, with reduced caps after the initial lease term.

- Criminal history screening outside Philadelphia remains permissible but must apply individualized assessments considering offense nature, time elapsed, and rehabilitation evidence to avoid fair housing violations.

- Income verification standards typically require applicants demonstrate monthly income 2.5-3 times the monthly rent, though no statewide statute mandates specific income-to-rent ratios.

- Philadelphia landlords face penalties up to $2,000 per violation for non-compliance with criminal history screening restrictions, plus potential civil liability for discriminatory housing practices.

Understanding Pennsylvania's Tenant Screening Legal Framework

Pennsylvania rental screening requirements exist at three regulatory levels: federal Fair Housing Act mandates, state-specific consumer protection statutes, and municipal ordinances that frequently exceed baseline requirements. The federal framework prohibits discrimination based on race, color, national origin, religion, sex, familial status, and disability. Meanwhile, Pennsylvania law adds protections through the Pennsylvania Human Relations Act. Philadelphia's 2020 Fair Chance Housing ordinance represents the most significant departure from traditional screening practices. It creates a "ban the box" housing framework that fundamentally restricts criminal background inquiries during initial application stages.

Property managers must recognize that Pennsylvania operates as a "home rule" state. This means municipalities possess substantial authority to enact housing regulations stricter than state law. Consequently, screening procedures legal in Pittsburgh or Allentown may violate Philadelphia ordinances. Beyond Philadelphia, cities including Lancaster and Reading have explored similar criminal history restrictions. This signals a broader trend toward progressive tenant screening reform across Pennsylvania's urban centers.

The legal landscape continues evolving in 2025. Ongoing litigation challenges various municipal ordinances while federal guidance emphasizes individualized assessments over blanket criminal history exclusions. Therefore, landlords operating across multiple Pennsylvania jurisdictions need jurisdiction-specific compliance protocols rather than one-size-fits-all screening policies.

Federal vs. State vs. Municipal Authority

Federal Fair Housing Act requirements establish the compliance floor. They prohibit screening criteria that create disparate impact on protected classes even without discriminatory intent. Pennsylvania's Human Relations Act mirrors these protections while providing state-level enforcement mechanisms through the Pennsylvania Human Relations Commission. State law also incorporates Fair Credit Reporting Act provisions requiring specific disclosures and adverse action procedures when using consumer reports for tenant screening.

Municipal ordinances in Pennsylvania frequently exceed both federal and state requirements, particularly regarding criminal history screening. Property managers must identify which jurisdictions impose additional restrictions beyond baseline Pennsylvania tenant screening laws. The Philadelphia Fair Chance Housing Act exemplifies this regulatory layering, creating obligations that don't exist elsewhere in the Commonwealth.

Protected Classes and Housing Discrimination

Pennsylvania fair housing screening must avoid both intentional discrimination and policies creating unjustified disparate impact on protected classes. Protected characteristics include race, color, religious creed, ancestry, age, sex, national origin, familial status, and disability. Additionally, protections extend to use of guide or support animals, handling or training of support or guide animals, and relationships or associations with disabled persons. Screening criteria disproportionately excluding protected classes require demonstrable business necessity and lack of less discriminatory alternatives.

Criminal history screening presents particular disparate impact concerns. Arrest and conviction records disproportionately affect racial minorities. HUD guidance emphasizes that blanket criminal history exclusions likely violate fair housing law absent individualized assessment of offense relevance to tenancy risks. Similarly, credit score requirements, income thresholds, and rental history criteria warrant scrutiny for potential discriminatory effects on protected populations.

Philadelphia Ban the Box Housing: What Landlords Must Know

Philadelphia's Fair Chance Housing ordinance, effective March 2020, prohibits landlords from inquiring about an applicant's criminal history on initial rental applications or during preliminary screening stages. This "ban the box" housing policy represents one of the nation's most comprehensive restrictions on criminal background checks in tenant selection. The ordinance applies to all Philadelphia rental properties except owner-occupied buildings with three or fewer units and buildings where the owner resides in one unit.

The law establishes a three-stage screening process that fundamentally restructures traditional background check procedures. During the initial application stage, landlords cannot ask about criminal history or conduct criminal background checks. Only after completing preliminary screeningâverifying income, employment, rental history, and creditâcan landlords request criminal history information. Even then, the ordinance restricts which convictions may be considered and requires individualized assessment rather than automatic denials.

Philadelphia landlords face significant penalties for non-compliance. Fines reach up to $2,000 per violation, plus civil liability for discriminatory housing practices. The Philadelphia Commission on Human Relations actively enforces the ordinance through complaint investigations and compliance audits. Property managers operating in Philadelphia require specialized screening protocols distinct from procedures used elsewhere in Pennsylvania.

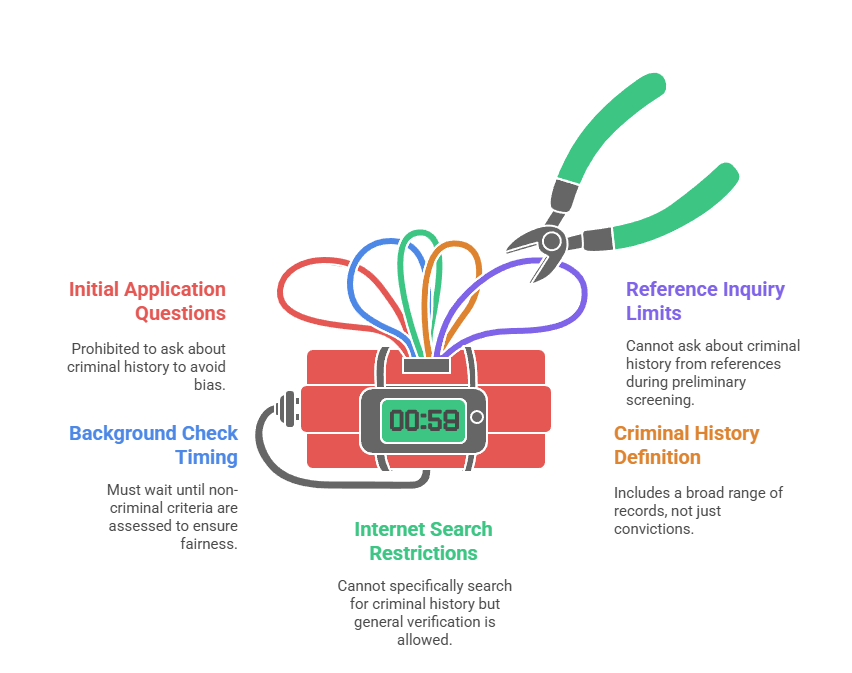

Prohibited Inquiries and Application Restrictions

Philadelphia tenant background check laws create specific boundaries around criminal history screening during the application process. Understanding these restrictions prevents costly violations while ensuring compliant tenant selection procedures across all Philadelphia rental properties subject to the ordinance.

- Initial application questions: Criminal history questions on initial applications are prohibited, including checkboxes asking "Have you ever been convicted of a crime?"

- Background check timing: Landlords cannot conduct criminal background checks until completing preliminary screening of non-criminal criteria like income and rental history

- Internet search restrictions: Searches specifically aimed at discovering criminal history during initial screening violate the ordinance, though general online searches for applicant verification remain permissible

- Criminal history definition: Broadly includes arrests not leading to conviction, expunged or sealed records, juvenile adjudications, summary offenses, and convictions more than seven years old

- Reference inquiry limits: Landlords cannot proactively inquire about criminal history from previous landlord references during preliminary screening stages

These restrictions fundamentally reshape traditional screening workflows. Property managers must restructure application forms and staff training to ensure compliance with Philadelphia's unique requirements.

When and How Criminal History Can Be Considered

After completing preliminary screening, Philadelphia landlords may request criminal history through background check services or applicant self-disclosure. Permissible considerations include convictions within seven years for most offenses. Lifetime reporting applies for murder, aggravated assault, rape, involuntary deviate sexual intercourse, kidnapping, arson, and drug trafficking. The ordinance requires individualized assessment examining offense nature, time since conviction, evidence of rehabilitation, and relationship between conviction and tenancy risks.

Landlords must provide applicants an opportunity to present mitigating evidence. This includes rehabilitation completion, employment stability, housing stability since conviction, and reference letters. Automatic denials based solely on conviction existence violate the ordinance. Written denials must specify which conviction(s) led to adverse action and explain why the conviction creates unacceptable tenancy risk despite mitigating factors.

Credit Check and Background Screening Requirements

Pennsylvania tenant credit check laws require written applicant consent before obtaining consumer reports under Fair Credit Reporting Act provisions. Landlords must provide disclosure statements informing applicants that credit reports, criminal background checks, or other consumer reports may be obtained for screening purposes. These disclosures must be standalone documents, not buried within lengthy applications. Applicants must provide written authorization before screening occurs.

Application fees in Pennsylvania are not statutorily capped but must reasonably reflect actual screening costs. Typical application fees range from $30-75, covering credit report costs ($15-30), criminal background checks ($20-40), and administrative processing. Landlords cannot charge application fees exceeding actual screening expenses without risking deceptive practices claims. Non-refundable application fees are permissible when clearly disclosed. However, landlords must apply consistent screening criteria to all applicants rather than selectively screening based on protected characteristics.

Third-party screening services must comply with Fair Credit Reporting Act standards as consumer reporting agencies. Landlords using these services remain liable for FCRA violations. This includes failure to provide proper disclosures, adverse action notices, or reasonable procedures ensuring report accuracy. Property managers should verify that screening vendors maintain FCRA compliance and provide proper documentation for adverse action procedures.

Obtaining Applicant Consent and Required Disclosures

Written consent requirements mandate clear disclosure of screening scope before conducting background checks. Pennsylvania rental screening requirements include informing applicants about credit reports, criminal background checks, eviction history searches, employment verification, and previous landlord contacts. Consent forms should list specific consumer reporting agencies used. They should also explain how information will be evaluated in tenant selection.

Applicants maintain rights to dispute inaccurate information and receive copies of reports used in adverse decisions. Disclosure statements should inform applicants of these rights and provide contact information for reporting agencies. Screening consent typically remains valid for the application period. However, it does not authorize ongoing monitoring after tenancy begins unless separately disclosed and authorized.

Permissible Screening Criteria and Evaluation Standards

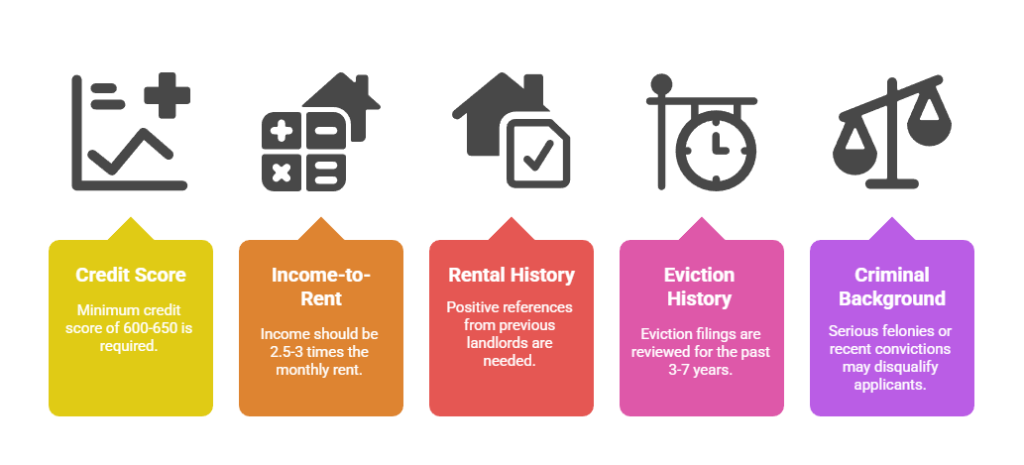

Pennsylvania landlords may establish objective screening criteria. These include minimum credit scores, income requirements, rental history standards, and criminal background thresholds (outside Philadelphia's restrictions). Screening standards must comply with both legal requirements and business necessity principles. This ensures consistent, non-discriminatory tenant selection that protects property investments while respecting applicant rights.

- Credit score minimums: Typically set at 600-650, reflecting statistical correlations between credit behavior and rental payment reliability, with documented business justification for threshold selection.

- Income-to-rent ratios: Standard requirements of 2.5-3 times monthly rent ensure sufficient income for rent obligations plus other living expenses without creating excessive barriers.

- Rental history verification: Positive references from previous landlords covering the most recent 2-3 years, with documented procedures for evaluating negative references and rental gaps.

- Eviction lookback periods: Typically 3-7 years for eviction filings or judgments, with individualized assessment of pandemic-era evictions and consideration of resolved versus outstanding cases.

- Criminal background standards: Outside Philadelphia, criteria may exclude serious felonies, recent convictions (within 3-7 years), or offenses indicating property damage or tenant safety risks.

Documented screening criteria provide legal protection. They demonstrate non-discriminatory, business-related tenant selection standards applied consistently across all applicants within the same property class. These standards should reflect genuine business necessity rather than arbitrary barriers potentially creating disparate impact on protected populations.

Adverse Action Requirements Under Pennsylvania Law

When denying rental applications based on information in consumer reports, Pennsylvania landlords must provide adverse action notices under Fair Credit Reporting Act requirements. These notices must include specific reasons for denial and identification of consumer reporting agencies providing information. They must also contain statements that reporting agencies didn't make the adverse decision and cannot explain specific reasons. Finally, they must include notice of applicants' rights to dispute report accuracy. Failure to provide proper adverse action notices exposes landlords to FCRA liability including actual damages, statutory damages up to $1,000, and attorney fees.

Adverse action notices must be provided before or promptly after taking adverse actionâtypically within three business days of the denial decision. Notices must be sufficiently specific that applicants understand denial reasons. Generic statements like "failed to meet screening criteria" are inadequate. If criminal history, credit score, rental history, or specific report items triggered denial, the notice must identify these factors.

Pre-adverse action procedures provide applicants the opportunity to dispute inaccurate information before final denial. Best practices include sending pre-adverse action notices with report copies. Landlords should allow 5-7 days for disputes and consider corrections before making final decisions. While FCRA requires adverse action notices after denials, this pre-adverse action step reduces disputes and demonstrates fair screening procedures.

Notice Content and Delivery Requirements

Adverse action notices must contain four core elements: the specific reasons for denial, the consumer reporting agency's name and contact information, a statement that the reporting agency didn't make the decision, and notice of the right to dispute report accuracy within 60 days. Pennsylvania tenant screening laws require these notices in writing. Delivery occurs via mail, email, or personal delivery with confirmation of receipt. Verbal notifications are insufficient for FCRA compliance.

Generic denial notices fail FCRA standards. Instead of "application denied based on background check," proper notices specify details. For example: "application denied based on credit score of 550 (below 600 minimum), eviction filing in 2023, and outstanding judgment from previous landlord." This specificity enables applicants to understand and potentially dispute the basis for denial.

Applicant Rights and Dispute Procedures

Applicants receiving adverse action notices have specific rights under federal consumer protection law. Understanding these rights helps landlords manage the post-denial process while maintaining compliance with Fair Credit Reporting Act requirements and Pennsylvania fair housing screening principles.

- Free credit report access: Applicants can obtain free credit report copies from reporting agencies within 60 days of receiving adverse action notices

- Dispute investigation rights: Reporting agencies must investigate disputes within 30 days and correct or delete unverified information from consumer reports

- Reconsideration opportunities: If investigations result in report corrections, landlords may need to reconsider applications based on updated, accurate information

Pennsylvania fair housing screening principles suggest providing applicants an opportunity to explain negative information before final denials. This is particularly important for criminal history, credit issues resulting from medical debt or identity theft, and rental history disputes. Documentation of applicant explanations and landlord consideration demonstrates good-faith screening procedures if discrimination claims later arise.

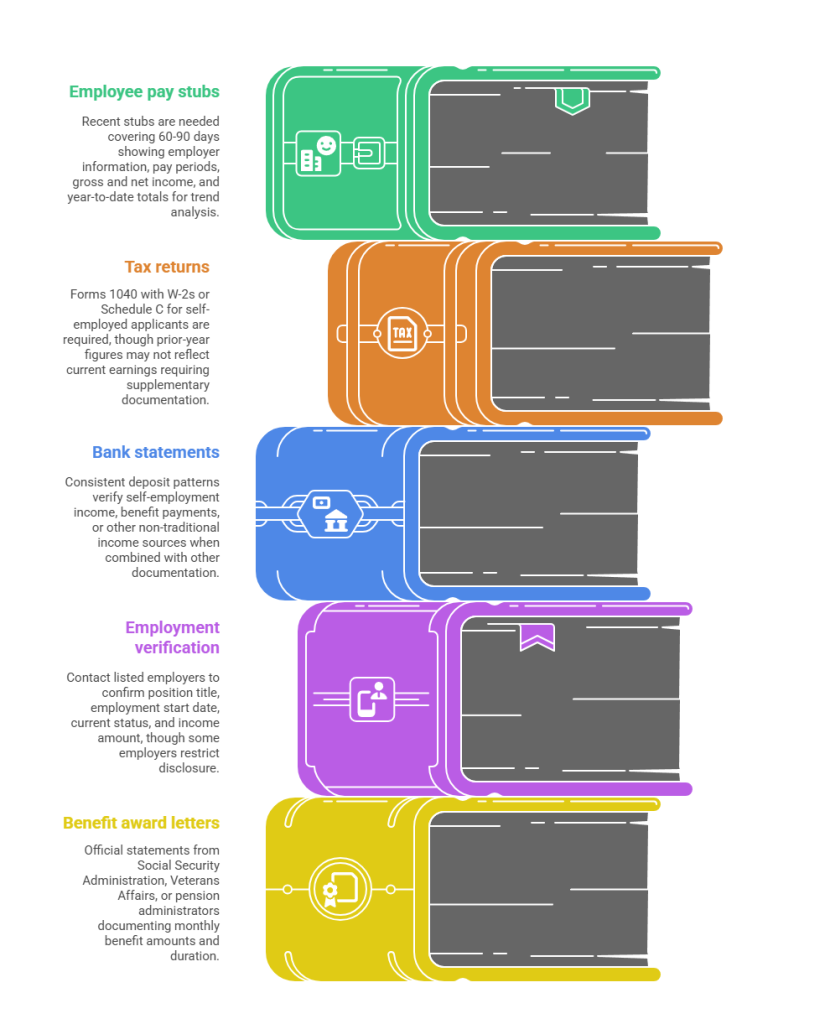

Income Verification and Financial Screening Standards

Income verification represents a critical component of Pennsylvania rental screening requirements. No statewide statute mandates specific income-to-rent ratios. However, industry standards typically require applicants demonstrate gross monthly income of 2.5-3 times monthly rent. This ensures sufficient income for rent obligations plus other living expenses. These ratios help establish objective financial qualifications while reducing default risks.

Acceptable income documentation includes recent pay stubs covering the last 60-90 days. Tax returns verify income for self-employed applicants. Benefit award letters document Social Security or disability income. Pension statements and verified employment letters also serve as acceptable proof. Landlords should verify documentation authenticity, particularly for pay stubs which are easily fabricated using online templates. Employment verification calls to listed employers confirm employment status, income amounts, and employment duration.

Alternative income sources must be considered equally to employment income under fair housing principles. Social Security benefits, disability payments, veteran's benefits, pension income, alimony, child support, and public assistance constitute legitimate income sources. These cannot be discounted because of their nature. Rejecting applicants solely because income derives from public benefits may violate fair housing law if such policies disproportionately affect protected classes.

Acceptable Documentation and Verification Methods

Pay stubs should include several key elements. These include employer name, employee name, pay period dates, gross and net income, and year-to-date totals. Recent pay stubs covering 60-90 days provide income trend visibility beyond single-pay-period anomalies. Understanding acceptable documentation types and proper verification procedures ensures accurate financial assessment. It also maintains fair housing compliance throughout the income verification process.

- Employee pay stubs: Recent stubs covering 60-90 days showing employer information, pay periods, gross and net income, and year-to-date totals for trend analysis.

- Tax returns: Forms 1040 with W-2s or Schedule C for self-employed applicants, though prior-year figures may not reflect current earnings requiring supplementary documentation.

- Bank statements: Consistent deposit patterns verify self-employment income, benefit payments, or other non-traditional income sources when combined with other documentation.

- Employment verification calls: Contact listed employers to confirm position title, employment start date, current status, and income amount, though some employers restrict disclosure.

- Benefit award letters: Official statements from Social Security Administration, Veterans Affairs, or pension administrators documenting monthly benefit amounts and duration.

Third-party employment verification services like The Work Number provide automated verification for participating employers. This streamlines the verification process while ensuring accuracy. It also reduces privacy concerns associated with direct employer contact.

Income Source Protection and Fair Housing Compliance

Pennsylvania landlords cannot discriminate based on lawful income sources under fair housing principles. However, Pennsylvania law doesn't explicitly prohibit income source discrimination at the state level. Federal guidance indicates that policies disproportionately excluding public assistance recipients may create disparate impact on protected classes, particularly familial status and race. Philadelphia's fair housing ordinance explicitly prohibits discrimination based on domestic or sexual violence victim status. This may intersect with income source issues.

Screening policies should evaluate total income sufficiency rather than income source preferences. If an applicant meets income ratio requirements through Social Security disability benefits, those benefits must be considered equivalent to employment income of the same amount. Requesting additional documentation or imposing higher income thresholds for benefit recipients compared to wage earners suggests discriminatory treatment. This requires strong business justification.

Rental History and Eviction Record Screening

Previous landlord references provide valuable insights into applicant behavior, payment reliability, property maintenance, and lease compliance. Pennsylvania tenant background check laws don't restrict rental history inquiries. However, landlords should apply consistent reference-checking procedures across all applicants. Typical reference checks verify tenancy dates, rent amount and payment timeliness, lease violations, property condition at move-out, and whether the landlord would rent to the applicant again.

Eviction records in Pennsylvania are public court records accessible through county court systems and commercial tenant screening services. Landlords may consider eviction filings and judgments in screening decisions. However, recent eviction moratoria and pandemic-related housing disruptions warrant careful evaluation. Evictions filed but not resulting in judgments suggest resolved disputes rather than tenant fault. These casesâincluding dismissed and settled casesârequire nuanced assessment rather than automatic disqualification.

Negative rental history requires individualized evaluation, particularly given pandemic-related housing disruptions between 2020-2023. Applicants may have legitimate explanations for past issues. These include pandemic job loss, medical emergencies, domestic violence situations, or disputes with problematic landlords. Allowing applicants to explain negative rental history and provide mitigating evidence demonstrates fair screening procedures. This approach identifies genuine risk factors versus temporary hardships.

Contacting Previous Landlords and Documentation

Reference checks should contact at least two previous landlords covering the most recent 2-3 years of rental history. Current landlords may provide biased references hoping to facilitate problem tenants' departure. Therefore, previous landlords often provide more candid assessments. Standardized reference check forms ensure consistent information gathering across applicants. They also create documentation of screening procedures.

Key reference questions probe core tenancy concerns. Landlords should ask about tenancy dates and monthly rent amounts. They should inquire whether the tenant paid rent on time and in full. Questions about noise complaints, lease violations, or property damage provide important insights. Landlords should also ask about property conditions at move-out, whether the tenant provided proper notice, and whether they would rent to this applicant again.

Evaluating Gaps, Evictions, and Negative References

Rental history gaps require explanation but aren't automatic disqualifiers. Applicants may have lived with family, owned rather than rented, or resided in institutional settings. Documentation explaining gaps provides context for evaluation. This includes home ownership records, family letters, or educational enrollment verification. Unexplained gaps spanning years raise concerns about undisclosed problematic rental history worth investigating further.

Eviction records warrant careful assessment. Landlords should distinguish pandemic-related hardships from patterns of non-payment. Single evictions filed during 2020-2023 surrounded by otherwise positive rental history deserve different consideration than multiple evictions across several years. Outstanding judgments from previous landlords indicate unresolved financial obligations that may affect current rent payment. Conversely, satisfied judgments suggest financial recovery. Philadelphia ban the box housing principles of individualized assessment apply equally to eviction and rental history evaluation.

Security Deposits and Move-In Cost Limitations

Pennsylvania security deposit laws establish clear financial boundaries for move-in costs. Deposits are capped at two months' rent for the first year of tenancy. After the first year, the cap reduces to one month's rent. Landlords may collect first month's rent plus two months' security deposit, totaling three months' rent at move-in. Pet deposits count toward the two-month security deposit cap rather than as separate charges. These statutory limits prevent excessive move-in costs that create housing access barriers.

Security deposits must be held in federally or state-regulated financial institutions. Landlords must provide deposit account information to tenants. After two years of tenancy, security deposits must be placed in interest-bearing accounts. Interest (minus 1% annual fee) gets paid to tenants annually or at lease end. Deposit accounting requirements mandate written notice of deposit location, account information, and interest accrual terms.

Move-out procedures require landlords to return deposits within 30 days of lease termination. Returns must be accompanied by itemized statements of deductions for damages beyond normal wear and tear. Failure to provide itemized statements within 30 days forfeits landlords' rights to retain deposits for damages. Disputes over deposit deductions frequently escalate to magisterial district court claims. This makes thorough documentation of property conditions at move-in and move-out essential.

| Deposit Type | First Year Limit | After First Year | Interest Requirements |

| Security Deposit | 2 months' rent | 1 month's rent | Required after 2 years |

| First Month's Rent | 1 month's rent | N/A | Not applicable |

| Pet Deposit | Counts toward security deposit cap | Counts toward security deposit cap | Same as security deposit |

Pennsylvania's deposit limitations are more restrictive than many states. They create tenant-friendly protections that reduce move-in cost barriers. Property managers accustomed to higher deposits in other jurisdictions must adjust screening criteria. This accounts for lower deposit protection against damages.

Compliance Best Practices for Multi-Jurisdiction Property Managers

Property managers operating across multiple Pennsylvania jurisdictions need location-specific screening protocols. These must reflect varying municipal requirements. Philadelphia properties require specialized ban the box housing procedures fundamentally different from Pittsburgh or suburban properties. Effective compliance management systems integrate technology solutions, staff training, documentation standards, and regular audits. This ensures consistent adherence to complex regulatory requirements across diverse property portfolios.

| Compliance Component | Implementation Strategy | Expected Outcome |

| Jurisdiction-Specific Workflows | Compliance systems flag property locations and apply corresponding screening protocols | Prevents inadvertent violations across multiple jurisdictions |

| Documentation Practices | Maintain written screening criteria, document all decisions, retain materials per statutory requirements | Provides strongest defense against discrimination claims |

| Staff Training Programs | Annual training covering Fair Housing Act, FCRA, Philadelphia ordinances, documentation procedures | Ensures consistent compliance across organizations |

| Quarterly Compliance Audits | Review application files, screening documentation, adverse action notices, denial patterns | Detects potential concerns before violations occur |

| Technology Automation | Applicant tracking systems with disclosure forms, consent documents, adverse action templates, geographic coding | Streamlines compliance through automated workflows |

Documentation provides the strongest defense against discrimination claims and fair housing complaints. It demonstrates objective, non-discriminatory screening procedures if complaints arise. Engaging fair housing counsel for periodic audits provides expert evaluation of screening procedures. This ensures alignment with evolving legal standards in 2025.

Conclusion

Pennsylvania tenant screening laws demand sophisticated compliance strategies. These balance federal Fair Housing Act requirements, state consumer protection statutes, and progressive municipal ordinances like Philadelphia's ban the box housing policy. Property managers must recognize that screening procedures legal in most Pennsylvania jurisdictions may violate Philadelphia's Fair Chance Housing ordinance. This requires location-specific protocols for multi-jurisdiction portfolios. Successful screening balances thorough due diligence with individualized assessments. These consider applicant circumstances, mitigating factors, and rehabilitation evidence rather than applying blanket exclusions that risk fair housing violations. As Pennsylvania municipalities continue adopting tenant-protective ordinances in 2025, proactive compliance systems provide the foundation for legally defensible screening practices that minimize risk while identifying qualified tenants.

Frequently Asked Questions

Can landlords in Pennsylvania charge application fees?

Yes, Pennsylvania landlords may charge application fees, though no state statute caps the amount. Application fees must reasonably reflect actual screening costs, typically ranging from $30-75 for credit reports, background checks, and administrative processing. Landlords must disclose that application fees are non-refundable before collecting payment and should apply consistent screening procedures to all applicants rather than selectively screening based on protected characteristics.

What criminal history can Philadelphia landlords consider?

Philadelphia's Fair Chance Housing ordinance permits consideration of convictions within seven years for most offenses, and lifetime reporting for murder, aggravated assault, rape, involuntary deviate sexual intercourse, kidnapping, arson, and drug trafficking. Landlords cannot consider arrests without convictions, expunged or sealed records, juvenile adjudications, summary offenses, or convictions older than seven years except listed serious felonies. Even permissible convictions require individualized assessment examining offense nature, time elapsed, rehabilitation evidence, and relationship to tenancy risks.

Do Pennsylvania landlords need written consent for background checks?

Yes, Fair Credit Reporting Act requirements mandate written consent before obtaining consumer reports for tenant screening. Landlords must provide standalone disclosure statements informing applicants that credit reports, criminal background checks, or other consumer reports may be obtained. These disclosures cannot be buried in lengthy applications but must be clear, conspicuous documents that applicants separately acknowledge.

Can landlords reject applicants receiving Section 8 or housing assistance?

While Pennsylvania state law doesn't explicitly prohibit income source discrimination, rejecting applicants solely because income derived from Section 8 vouchers may violate fair housing law if such policies create disparate impact on protected classes. Many Pennsylvania municipalities, including Philadelphia, prohibit income source discrimination explicitly. Best practices involve evaluating total income sufficiency through consistent income-to-rent ratios regardless of income source.

What's required in adverse action notices to rejected applicants?

Pennsylvania adverse action notices must include four elements: specific reasons for application denial, the consumer reporting agency's name and contact information, a statement that the reporting agency didn't make the decision, and notice of the right to dispute report accuracy within 60 days. Notices must be sufficiently specific that applicants understand the denial basis and must be provided in writing within three business days of denial decisions.

How long must landlords keep tenant screening records?

Pennsylvania law doesn't specify screening record retention periods, but federal Fair Housing Act compliance suggests maintaining records for at least three years. This retention period covers the statute of limitations for most fair housing claims and provides documentation if discrimination complaints arise. Longer retention periods (5-7 years) provide additional protection for properties with complex screening histories.

Can landlords use different screening criteria for different properties?

Yes, landlords may establish different screening criteria for different property types or rent levels, provided criteria are applied consistently within each property class. However, criteria variations must reflect legitimate business reasons rather than proxies for discrimination. Documentation explaining business rationale for criteria differences protects against discrimination claims.

What penalties exist for violating Philadelphia's criminal history screening restrictions?

Philadelphia's Fair Chance Housing ordinance authorizes penalties up to $2,000 per violation, enforced by the Philadelphia Commission on Human Relations. Violations include asking criminal history questions on initial applications, conducting criminal background checks before completing preliminary screening, and failing to provide individualized assessment opportunities. Beyond administrative penalties, landlords face potential civil liability for discriminatory housing practices under fair housing law.

Additional Resources

- Pennsylvania Landlord-Tenant Law: Official Resources

https://www.palawhelp.org/resource/pennsylvania-landlord-tenant-law - Philadelphia Fair Chance Housing Ordinance Full Text

https://www.phila.gov/media/20200228144946/Fair-Chance-Housing-Fact-Sheet.pdf - Fair Credit Reporting Act: Summary of Rights

https://www.ftc.gov/enforcement/statutes/fair-credit-reporting-act - HUD Guidance on Criminal History Screening

https://www.hud.gov/sites/documents/HUD_OGCGUIDAPPFHASTANDCR.PDF - Pennsylvania Human Relations Commission Fair Housing Resources

https://www.phrc.pa.gov/About-Us/Pages/default.aspx

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.