North Carolina presents a unique challenge for landlords: the state lacks comprehensive tenant screening legislation, requiring property owners to navigate primarily federal regulations while understanding limited state-specific requirements. This guide provides a definitive roadmap through the Fair Housing Act, Fair Credit Reporting Act, and North Carolina's scattered tenant protection provisions to help landlords build legally compliant screening processes that minimize risk and maximize efficiency.

Key Takeaways

- North Carolina defers most tenant screening regulations to federal law, creating a compliance framework built primarily on the Fair Housing Act and Fair Credit Reporting Act rather than comprehensive state statutes.

- Landlords must obtain written consent before conducting background checks and provide adverse action notices when denying applications based on criminal history, credit reports, or eviction records.

- Fair Housing Act protections prohibit discrimination based on seven protected classes: race, color, national origin, religion, sex, familial status, and disability throughout the screening process.

- Application fees in North Carolina are unregulated by state law, but landlords must ensure fees are reasonable and directly related to actual screening costs to avoid legal challenges.

- Criminal background check policies must comply with HUD guidance regarding individualized assessments rather than blanket bans on applicants with conviction histories.

- Security deposits are capped at 1.5 weeks' rent for week-to-week leases, one and one-half months' rent for month-to-month leases, and two months' rent for terms longer than month-to-month.

- Landlords face potential liability under federal law for using outdated consumer reporting agencies or failing to follow proper adverse action procedures, with penalties reaching $1,000 per violation.

- Documentation retention for all screening materials should extend at least three years to defend against potential Fair Housing complaints or FCRA violations.

Understanding North Carolina's Regulatory Framework for Tenant Screening

North Carolina tenant screening laws operate within a regulatory vacuum that places primary responsibility on federal statutes. Unlike states such as California or New York with extensive tenant protection legislation, North Carolina has chosen not to establish comprehensive screening requirements beyond scattered provisions in Chapter 42 of the General Statutes. This creates a compliance landscape where the Fair Housing Act (FHA), Fair Credit Reporting Act (FCRA), and limited state regulations intersect to form the operational framework. Landlords must recognize that federal law establishes the floor, not the ceiling, for tenant screening compliance requirements.

The Federal-State Jurisdictional Split

The FCRA governs how consumer reports are obtained and used, requiring specific authorization and disclosure procedures. Meanwhile, the FHA prohibits discriminatory practices throughout the application process. Property managers in Charlotte, Raleigh, Durham, and Greensboro face identical federal requirements but must also monitor local ordinances that occasionally supplement state law.

Key State-Specific Provisions Affecting Screening

North Carolina General Statute § 42-46 addresses security deposit limits, directly impacting the financial screening component of tenant evaluation. The statute caps deposits at different levels based on lease terms. These limits indirectly influence screening rigor, as landlords with constrained deposit options may conduct more thorough background investigations to compensate for limited financial protection.

North Carolina's specific provisions include several important components:

- Security deposit caps: 1.5 weeks' rent for weekly tenancies, one and one-half months' rent for month-to-month agreements, and two months' rent for longer-term leases

- Pet fee allowances: Reasonable nonrefundable pet fees permitted under N.C. Gen. Stat. § 42-46(a1), separate from standard deposit limits

- Assistance animal exceptions: No pet deposits allowed for verified assistance animals required as disability accommodations

The state's approach creates an additional screening consideration for properties accepting animals. Landlords must distinguish between pet deposits, assistance animal accommodations under Fair Housing regulations, and standard security deposits when calculating total upfront costs during the screening phase.

Why North Carolina's Approach Creates Compliance Challenges

The absence of comprehensive North Carolina rental application background checks legislation creates uncertainty for landlords seeking clear guidance. Property managers frequently encounter questions about permissible screening criteria, appropriate fee structures, and documentation requirements without finding definitive state-level answers. This regulatory gap forces reliance on federal interpretations, court precedents, and industry best practices rather than explicit statutory direction. Landlords face particular challenges when addressing criminal history screening, as North Carolina provides no state-level guidance beyond federal HUD standards.

Federal Fair Housing Act Requirements in North Carolina

The Fair Housing Act establishes seven protected classes that North Carolina landlords must respect throughout tenant screening compliance requirements. These protections apply to race, color, national origin, religion, sex (including sexual orientation and gender identity as of recent HUD interpretations), familial status, and disability. Screening policies that disproportionately impact these protected groupsâeven without intentional discriminationâmay constitute illegal disparate impact discrimination.

Protected Classes and Screening Implications

Familial status protections deserve particular attention during tenant background check requirements implementation. Landlords cannot refuse to rent to families with children, apply different screening standards based on family composition, or establish occupancy policies that effectively exclude families. The reasonable occupancy standard typically allows two persons per bedroom, though this varies based on property characteristics and local health codes.

Disability Accommodations During Screening

Disability protections extend beyond the rental period into the application process itself. Landlords must provide reasonable accommodations for applicants with disabilities during screening, such as accepting alternative documentation when disability prevents standard paperwork completion or allowing additional time for application submission. Refusing to waive a "no pets" policy for verified assistance animals constitutes illegal discrimination under Fair Housing regulations.

| Protected Class | Key Screening Considerations |

| Race/Color/National Origin | Apply identical standards regardless of ethnicity; avoid policies with disparate impact |

| Religion | Cannot inquire about religious affiliation or practices; accommodate religious observances during application process |

| Sex/Gender Identity | Equal treatment regardless of gender, sexual orientation, or gender identity; cannot apply different standards |

| Familial Status | Cannot discriminate against families with children; two-per-bedroom occupancy standard typical |

| Disability | Provide reasonable accommodations; allow assistance animals; cannot inquire about specific diagnoses |

Screening criteria cannot include blanket policies against applicants receiving disability benefits or those with documented mental health conditions. Questions about disability status, specific diagnoses, or the severity of conditions violate Fair Housing requirements.

Avoiding Disparate Impact in Screening Policies

Disparate impact discrimination occurs when facially neutral policies disproportionately affect protected classes, even without discriminatory intent. Criminal background check policies that automatically reject applicants with any conviction history may create disparate impact against racial minorities, who experience disproportionate conviction rates. North Carolina tenant screening rights require landlords to demonstrate that challenged policies are necessary to achieve legitimate business interests and that no less discriminatory alternatives exist.

Income requirements illustrate another potential disparate impact concern. While landlords may establish minimum income thresholds (typically 2.5-3 times monthly rent), policies that reject certain income sources may violate Fair Housing protections. These problematic rejections include housing vouchers, disability benefits, or child support. North Carolina law does not require landlords to accept Section 8 vouchers, but local jurisdictions including Durham and Chapel Hill have enacted source-of-income discrimination protections.

Fair Credit Reporting Act Compliance for North Carolina Landlords

The FCRA mandates written authorization before landlords obtain consumer reports for tenant screening purposes. This authorization must be contained in a standalone documentânot buried within a general application form. The document must clearly disclose that a background check will be conducted. North Carolina landlords using consumer reporting agencies must provide applicants with a clear, conspicuous disclosure and obtain signature consent before requesting credit reports, criminal records, or eviction histories.

Obtaining Proper Consent for Background Checks

Oral consent never satisfies FCRA requirements, regardless of documentation quality or witness availability. Digital applications may use electronic signatures if they meet E-SIGN Act requirements, including clear affirmative action demonstrating consent. The authorization should specify what types of checks will be conducted to ensure transparency and informed consent.

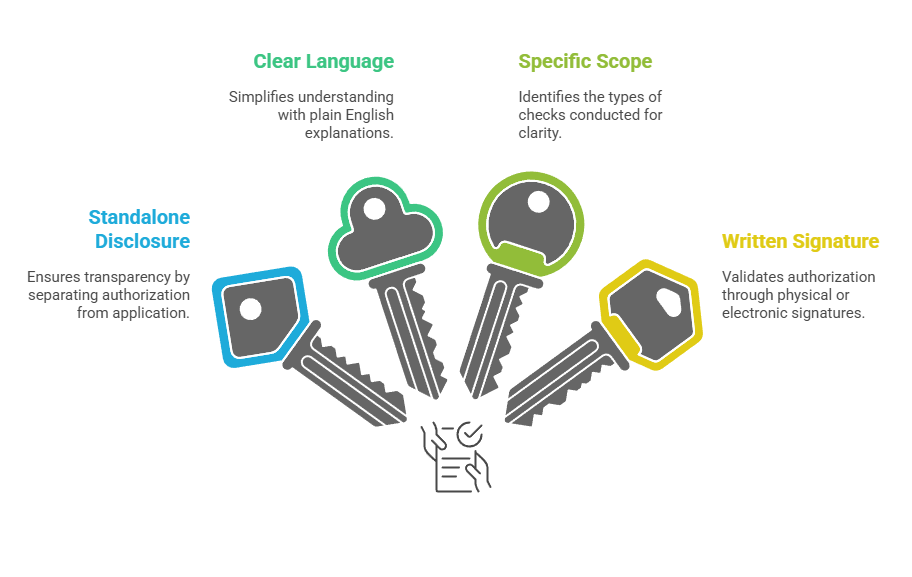

Key consent requirements include:

- Standalone disclosure: Background check authorization separated from general application documents

- Clear language: Plain English explanation of what reports will be obtained and how they'll be used

- Specific scope: Identification of check types (credit, criminal, eviction, employment verification)

- Written signature: Physical or valid electronic signature meeting E-SIGN Act standards

Pre-Adverse Action Notice Requirements

When landlords intend to deny an application based wholly or partly on information in a consumer report, FCRA requires a pre-adverse action process. This involves providing the applicant with a pre-adverse action notice, a copy of the consumer report, and a "Summary of Your Rights Under the Fair Credit Reporting Act" before finalizing the denial. The applicant must receive reasonable timeâtypically 5-7 business daysâto review the information and dispute inaccuracies.

The pre-adverse action waiting period serves a critical purpose: allowing applicants to identify and correct reporting errors before final decisions. North Carolina landlords who skip this step or provide insufficient time face potential FCRA liability. Penalties include statutory damages of $100-$1,000 per violation, actual damages, and attorney fees. Consumer reporting agencies typically provide standard pre-adverse action forms, but landlords bear ultimate responsibility for proper procedure.

Final Adverse Action Notice Procedures

After the waiting period expires, landlords who proceed with application denial must send a final adverse action notice. This document must identify the consumer reporting agency that provided the report and state that the agency did not make the adverse decision. The notice must explain the applicant's right to dispute report accuracy. The notice should include the reporting agency's contact information and clarify that applicants may request free copies of their reports within 60 days.

| Adverse Action Step | Timeline | Required Components |

| Pre-Adverse Action Notice | Before denial | Consumer report copy, rights summary, reporting agency contact information |

| Waiting Period | 5-7 business days | Allow time for applicant to dispute inaccuracies |

| Final Adverse Action Notice | After waiting period | Agency identification, dispute rights, free report information |

North Carolina tenant screening laws through federal FCRA mandate these procedures regardless of property size or landlord sophistication. Individual landlords renting a single property face identical requirements as large property management companies.

Criminal Background Checks: HUD Guidance and Best Practices

HUD's 2016 Office of General Counsel Guidance established that blanket criminal history policies excluding all applicants with conviction records may violate Fair Housing Act disparate impact provisions. The guidance recognizes legitimate landlord interests in resident safety and property protection but requires individualized assessments. These assessments must consider conviction nature, time elapsed, and evidence of rehabilitation. North Carolina landlords must balance risk management with anti-discrimination requirements when evaluating criminal backgrounds.

The 2016 HUD Guidance on Criminal Records

The guidance distinguishes between arrests and convictions with significant implications for screening policies:

- Arrests without convictions: Cannot form the basis for adverse decisions; provide no reliable evidence of criminal conduct

- Conviction records: May be considered through individualized assessment examining specific factors

- Time considerations: Length of time since conviction and sentence completion matters significantly

- Rehabilitation evidence: Current circumstances, completed programs, and positive references must be evaluated

This distinction proves particularly important in North Carolina, where arrest rates may not reflect actual criminal behavior. The state's expungement processes allow records sealing, further complicating screening decisions.

Implementing Individualized Assessment Protocols

Compliant criminal background screening requires examining specific conviction details rather than applying automatic exclusions. Landlords should consider the nature and severity of criminal conduct, the time elapsed since conviction and completion of sentence, and evidence of rehabilitation or mitigating circumstances. A drug possession conviction from 15 years ago with no subsequent criminal activity presents a vastly different risk than recent violent offenses. North Carolina tenant background check requirements under federal guidance should incorporate written policies establishing relevant factors for criminal history evaluation.

Documentation demonstrates good faith compliance efforts if screening decisions face challenges. Property managers should train staff on individualized assessment protocols, ensuring consistent application across all applicants while maintaining flexibility for case-specific circumstances.

Sex Offender Registry Considerations

Landlords may check state and national sex offender registries during screening without violating Fair Housing protections. The North Carolina Sex Offender and Public Protection Registration Program provides public access to registered offender information, including residential addresses and offense details. However, landlords should apply consistent policies regarding sex offender status rather than making arbitrary decisions based on offense type or community pressure.

Blanket prohibitions on registered sex offenders may face legal scrutiny depending on implementation. Policies should consider offense type, victim characteristics, property location proximity to schools or daycare facilities, and residency restrictions. North Carolina General Statute § 14-208.18 imposes specific restrictions. Landlords operating family properties or properties near protected locations have stronger justifications for sex offender exclusions than those managing adult-only commercial properties.

Credit and Financial Screening Standards

North Carolina landlords commonly require applicant income at 2.5 to 3 times monthly rent, though no state statute mandates specific ratios. These requirements must apply consistently across all applicants to avoid Fair Housing violations. Income verification typically includes recent pay stubs, tax returns, bank statements, or employer verification letters confirming gross monthly earnings sufficient to satisfy established thresholds.

Establishing Reasonable Income Requirements

Alternative income sources must receive equal consideration to employment wages. These sources include Social Security, disability benefits, retirement income, child support, and alimony. Policies that discount or reject these sources may constitute illegal source-of-income discrimination or disability discrimination. Landlords should calculate total household income from all legal sources when evaluating financial capacity.

Credit Score Thresholds and Alternatives

Minimum credit score requirements (typically 600-650 for conventional landlords) provide standardized financial risk assessment but must accommodate applicants with limited credit history. Young renters, recent immigrants, and individuals rebuilding after financial hardships may lack sufficient credit data for score generation. North Carolina tenant screening compliance requirements suggest offering alternative verification methods rather than automatic denial for insufficient credit history.

Alternative verification options include:

- Utility payment history: Demonstrates consistent payment behavior over time

- Rental references: Previous landlord confirmation of timely rent payment and responsible tenancy

- Bank statements: Shows income stability and financial management capability

- Increased security deposits: Provides additional protection when credit history is limited

Credit reports reveal critical information including outstanding debts, payment patterns, bankruptcies, foreclosures, and collections accounts. Landlords should establish clear policies regarding acceptable debt-to-income ratios, acceptable bankruptcy timelines (typically 2-3 years post-discharge), and medical debt treatment. Recent changes to credit reporting have removed many medical collections from consumer reports, recognizing that medical debt poorly predicts rental payment behavior.

Application Fee Regulations in North Carolina

Unlike states with strict application fee caps, North Carolina imposes no statutory limits on tenant screening application fees. However, landlords should charge fees reasonably related to actual screening costs. Typical fees range from $30-$75 covering credit reports, criminal background checks, and eviction history searches. Excessive fees unrelated to verification expenses may trigger consumer protection concerns or Fair Housing challenges if they disproportionately burden protected classes.

Transparency regarding fee purpose and refund policies enhances compliance and applicant relations. Some landlords apply fees toward first month's rent for approved applicants or refund fees if reports are not actually obtained. Clear written policies regarding fee disposition prevent disputes and demonstrate good faith business practices, particularly when multiple applicants compete for a single unit.

Eviction History and Rental Reference Verification

Eviction records provide valuable information about prior tenancies, but landlords must interpret this data carefully. Not all eviction filings result in judgmentsâmany represent resolved payment disputes or lease violations subsequently cured. North Carolina tenant screening rights require distinguishing between eviction judgments (indicating court-determined lease violations) and dismissed cases (which may reflect landlord overreach or tenant vindication).

The time elapsed since eviction matters significantly for risk assessment. A single eviction from five years ago during financial hardship differs substantially from multiple recent evictions. These patterns may suggest nonpayment habits or property damage tendencies. Individualized assessment principles apply: landlords should consider circumstances, time passed, and subsequent rental history when evaluating eviction records rather than applying automatic exclusions.

| Eviction Record Type | Screening Consideration | Risk Assessment |

| Dismissed filings | May indicate resolved disputes or landlord error | Low risk; investigate circumstances |

| Judgments (5+ years old) | Consider circumstances and subsequent history | Moderate risk; allow explanation |

| Recent judgments (< 2 years) | Significant concern requiring careful evaluation | Higher risk; assess pattern and cause |

| Multiple evictions | Pattern suggesting chronic issues | Highest risk; strong justification needed for approval |

Rental reference verification provides context for eviction records and general tenancy history. Contact previous landlords to confirm rental periods, payment timeliness, property condition maintenance, and lease compliance. Ask about notice provision, reason for move-out, and eligibility for re-rental. Multiple positive references can offset older negative records, demonstrating rehabilitation and improved circumstances.

Building a Compliant Screening Process: Step-by-Step Implementation

Documented screening criteria form the foundation of compliant tenant evaluation processes. Written policies should specify minimum income requirements, acceptable income sources, credit score thresholds, criminal history evaluation factors, eviction record considerations, and rental history verification procedures. Specificity demonstrates objective, consistent application while providing flexibility for individualized assessments where required.

Creating Written Screening Policies

Screening policies must balance clarity with adaptability. Rigid policies may inadvertently create discriminatory effects, while overly vague standards invite inconsistent application. The optimal approach establishes clear benchmarks while incorporating individualized assessment provisions for criminal history and mitigating circumstances.

Essential policy components include:

- Income requirements: Specific ratio (2.5-3x rent) with acceptable income source list

- Credit thresholds: Minimum scores with alternative verification options for limited credit history

- Criminal history framework: Individualized assessment factors rather than blanket exclusions

- Eviction evaluation criteria: Timeframes and circumstance considerations for past evictions

- Documentation standards: Required application materials and verification procedures

Regular policy reviewâideally annuallyâensures alignment with evolving legal requirements and industry best practices. Property managers should consult legal counsel when updating screening criteria to ensure continued Fair Housing and FCRA compliance.

Application Process and Consent Forms

The application process begins with comprehensive information collection. Required information includes personal identification, employment history, income verification, current and previous addresses, rental references, and authorization for background checks. Applications must include standalone FCRA disclosure and consent forms clearly explaining that consumer reports will be obtained and used for rental decisions.

Digital applications should capture electronic signatures meeting E-SIGN Act requirements. Applicants should receive clear information about screening timelines, typically 3-5 business days for most checks. Transparency regarding evaluation criteria and decision factors enhances applicant experience while reducing discrimination risks. Some landlords provide screening criteria summaries before application submission, allowing self-screening by applicants unlikely to qualify and reducing unnecessary application fees.

Conducting and Evaluating Background Checks

Partner with reputable consumer reporting agencies compliant with FCRA requirements and specializing in tenant screening. These agencies aggregate credit reports, criminal records, eviction histories, and sometimes rental payment data into comprehensive screening reports. Verify that chosen agencies maintain current databases, provide proper disclosures and forms, and offer support for adverse action procedures.

Evaluation should follow documented criteria, applying income requirements, credit thresholds, and individualized criminal history assessments consistently across all applicants. Document decision rationale, particularly for adverse decisions, noting specific factors that contributed to denial or approval. This documentation proves invaluable if screening decisions face subsequent Fair Housing or FCRA challenges.

Legal Risks and Liability Management

Fair Housing violations carry significant penalties that can devastate landlord operations and personal finances. Penalties include compensatory damages covering applicant actual losses, punitive damages particularly for willful violations, and injunctive relief requiring policy changes. Civil penalties reach $21,039 for first violations and $105,194 for subsequent violations within seven years. FCRA violations expose landlords to statutory damages of $100-$1,000 per violation plus actual damages and attorney fees, quickly escalating with multiple applicants or systemic compliance failures.

Common Compliance Violations and Penalties

North Carolina landlords face particular risks from several common violations:

- Inconsistent screening criteria application: Creates evidence of discriminatory treatment or disparate impact

- Missing adverse action notices: Violates FCRA procedural requirements with per-violation penalties

- Blanket criminal history exclusions: Fails individualized assessment standard required by HUD guidance

- Outdated consumer reports: Using reports older than permissible timeframes under FCRA

- Disability accommodation refusals: Denying reasonable modifications or assistance animals

Even unintentional violations stemming from ignorance rather than malice trigger penalties under strict liability provisions. Landlords cannot defend violations by claiming they didn't know the law or didn't intend discrimination.

Insurance and Professional Risk Mitigation

Fair housing liability insurance and errors and omissions policies provide critical protection for landlords navigating complex tenant screening compliance requirements. These policies typically cover defense costs and damages for discrimination claims, FCRA violations, and wrongful denial allegations. Property managers should review policy terms carefully, as coverage often excludes intentional discrimination or violations of known legal requirements.

Professional property management association membership provides access to valuable resources. Organizations such as the North Carolina Association of Realtors Property Management Division offer continuing education on evolving fair housing requirements. These associations provide screening policy templates, compliance training, and legal resources. Investment in professional development and policy review substantially reduces liability exposure.

Responding to Discrimination Complaints

Landlords receiving fair housing complaints from HUD, the North Carolina Human Relations Commission, or private litigation should immediately consult experienced fair housing attorneys. Initial responses prove critical, as admissions or poorly worded explanations can establish liability. Gather all documentation related to the challenged screening decision, including written policies, the applicant's screening report, other applicants' materials, and decision rationale documentation.

Proactive compliance efforts provide robust defenses against discrimination allegations. Documented written policies, consistent application evidence, and staff training records demonstrate good faith. Landlords demonstrating good faith compliance efforts and reasonable, non-discriminatory rationale for challenged decisions frequently achieve favorable complaint resolutions or successful litigation defenses. Conversely, landlords lacking documentation or demonstrating policy inconsistencies face substantial liability exposure and settlement pressure.

Conclusion

North Carolina's regulatory approach to tenant screening creates unique compliance challenges by deferring primarily to federal requirements while providing limited state-specific guidance. Landlords must master Fair Housing Act anti-discrimination principles, Fair Credit Reporting Act procedural requirements, and HUD guidance on criminal history screening. They must also navigate North Carolina's security deposit limitations and emerging local ordinances. Success requires written policies, consistent application, proper documentation, and ongoing education about evolving legal requirements. By implementing the frameworks outlined in this guide, North Carolina property managers can build compliant, efficient screening processes that protect their properties while respecting applicant rights and minimizing legal exposure.

Frequently Asked Questions

What tenant screening laws does North Carolina have?

North Carolina has limited state-specific tenant screening legislation, relying primarily on federal laws including the Fair Housing Act and Fair Credit Reporting Act. The state regulates security deposit amounts based on lease terms but does not establish comprehensive screening requirements, application fee limits, or criminal background check standards. Landlords must comply with federal anti-discrimination protections and proper consent procedures under FCRA. HUD guidance requires individualized assessment of criminal histories rather than blanket exclusions.

Can North Carolina landlords charge application fees?

Yes, North Carolina landlords may charge application fees with no statutory cap. However, fees should be reasonable and directly related to actual screening costs, typically ranging from $30-$75. Excessive fees may trigger consumer protection concerns or Fair Housing challenges if they disproportionately burden protected classes. Landlords should clearly disclose fee purposes and refund policies to ensure transparency.

Are landlords required to accept Section 8 vouchers in North Carolina?

No, North Carolina state law does not require landlords to accept Section 8 housing vouchers or other housing assistance programs. However, Durham and Chapel Hill have enacted source-of-income discrimination ordinances requiring acceptance of lawful income sources including housing vouchers. Landlords should research applicable local regulations in their operating areas. Blanket policies rejecting all voucher holders may face Fair Housing scrutiny if they create discriminatory effects.

What criminal history can North Carolina landlords consider?

North Carolina landlords may consider criminal conviction records but not arrest records without convictions. HUD guidance requires individualized assessments examining conviction nature and severity, time elapsed since conviction, and evidence of rehabilitation. Landlords should document evaluation factors and apply policies consistently across all applicants. Sex offender registry checks are permissible, particularly for properties near schools.

How long should landlords keep tenant screening records?

Landlords should retain tenant screening records for at least three years to defend against potential Fair Housing complaints or FCRA violations. Documentation should include applications, screening reports, adverse action notices, decision rationale, and written policies. Longer retention periods (5-7 years) provide additional protection, particularly for landlords managing multiple properties. Secure storage protecting applicant privacy is essential.

What are North Carolina's security deposit limits?

North Carolina General Statute § 42-46 caps security deposits at 1.5 weeks' rent for week-to-week leases, one and one-half months' rent for month-to-month tenancies, and two months' rent for longer lease terms. These limits are separate from reasonable nonrefundable pet fees permitted under state law. Landlords cannot charge pet deposits for assistance animals required as disability accommodations.

What must be included in an adverse action notice?

An adverse action notice must identify the consumer reporting agency that provided the screening report and state that the agency did not make the adverse decision. The notice must explain the applicant's right to dispute report accuracy and include the reporting agency's contact information. Landlords must first provide a pre-adverse action notice with a copy of the consumer report and "Summary of Your Rights Under the Fair Credit Reporting Act," allowing 5-7 business days for review.

Can landlords reject applicants with no credit history?

While landlords may establish minimum credit score requirements, blanket rejections of applicants with insufficient credit history may violate Fair Housing principles. North Carolina tenant screening compliance suggests offering alternative verification methods such as utility payment history, rental references, bank statements, or increased security deposits. Young renters, recent immigrants, and individuals rebuilding after hardships commonly lack traditional credit history but may demonstrate financial responsibility through alternative documentation.

Additional Resources

- Fair Housing Act Overview and Protected Classes

https://www.hud.gov/program_offices/fair_housing_equal_opp/fair_housing_act_overview - Fair Credit Reporting Act Summary of Rights

https://www.consumer.ftc.gov/articles/pdf-0096-fair-credit-reporting-act.pdf - North Carolina General Statutes Chapter 42: Landlord and Tenant

https://www.ncleg.gov/Laws/GeneralStatuteSections/Chapter42 - North Carolina Sex Offender and Public Protection Registration Program

https://www.ncsbi.gov/Services/Sex-Offender-Registry - North Carolina Human Relations Commission Fair Housing Information

https://ncadmin.nc.gov/advocacy/human-relations/fair-housing - Federal Trade Commission: Using Consumer Reports for Tenant Screening

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-landlords-need-know

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.