Florida landlords must navigate complex tenant screening laws that balance property protection with fair housing rights. Recent 2024 legislative updates have strengthened tenant privacy protections and expanded discrimination safeguards. Understanding these regulations ensures legal compliance while maximizing your ability to select qualified tenants through proper background check procedures.

Key Takeaways

- Florida tenant screening laws require landlords to follow federal Fair Credit Reporting Act (FCRA) guidelines and obtain written consent before conducting background checks.

- Landlords can charge application fees up to $50 per adult applicant, but must provide itemized receipts and return unused portions within 30 days.

- Criminal history screening is permitted, but landlords cannot automatically disqualify applicants based solely on arrest records without convictions.

- Income verification requirements allow landlords to request proof that monthly income equals at least three times the rent amount.

- Fair housing laws prohibit discrimination based on protected classes, with Florida adding additional protections for lawful sources of income in 2024.

- Proper documentation and consistent screening criteria across all applicants are essential for legal compliance and avoiding discrimination claims.

Overview of Florida Tenant Screening Laws

Florida rental application laws operate under a comprehensive framework that combines federal regulations with state-specific requirements. The Fair Credit Reporting Act (FCRA) governs how landlords can obtain and use consumer reports for screening purposes. Meanwhile, Florida Statutes Chapter 83 outlines additional tenant rights and landlord obligations that extend beyond federal minimums.

Recent 2024 amendments have significantly strengthened tenant privacy protections throughout the state. These changes include expanded fair housing requirements and stricter guidelines for handling sensitive applicant information. Additionally, new regulations address discrimination based on lawful source of income, which affects how landlords evaluate government assistance recipients.

Landlords conducting tenant background checks in Florida must establish consistent screening criteria applied equally to all applicants. These standardized procedures protect both parties by ensuring fair treatment while allowing property owners to make informed rental decisions. The screening process typically includes credit checks, criminal background verification, employment history review, and rental history analysis. Understanding the legal boundaries prevents costly discrimination lawsuits and ensures compliance with evolving regulations that continue to expand tenant protections.

Required Legal Disclosures and Consent

FCRA Disclosure Requirements

Florida landlords must provide specific written disclosures before obtaining consumer reports for tenant screening purposes. The disclosure must clearly state that a consumer report may be obtained and used in the rental decision process. Furthermore, this document should be separate from the rental application or clearly distinguished within it using bold text or separate formatting.

| Required Element | Specific Requirement |

| Written format | Must be in writing, verbal consent insufficient |

| Clear language | Plain English explanation of screening process |

| Separate document | Distinguished from other application materials |

| Signature required | Applicant must sign acknowledging understanding |

The consent form requires the applicant's signature and cannot be buried within lengthy application documents. Proper documentation remains essential for legal compliance under both federal and Florida regulations.

Adverse Action Notifications

When denying a rental application based on background check information, landlords must follow precise adverse action procedures established by federal law. The process involves two distinct notifications that protect applicant rights while allowing legitimate screening decisions. First, landlords must provide a pre-adverse action notice before making a final denial decision.

This initial notice must include a copy of the consumer report and a summary of consumer rights under the FCRA. After providing adequate time for the applicant to respond or dispute information, landlords can then send the final adverse action notice. The final notice must explain the specific reasons for denial and provide contact information for the reporting agency.

Permissible Background Check Components

Florida tenant screening laws allow landlords to investigate several aspects of an applicant's background, provided they follow proper legal procedures. Credit history evaluation helps assess financial responsibility and payment patterns over time. Criminal background checks can reveal convictions that might affect property safety or lease compliance, though specific restrictions apply.

Employment verification and income documentation ensure applicants can afford monthly rent payments without financial strain. Most Florida landlords require proof of income totaling at least three times the monthly rent amount as a standard qualification. Rental history from previous landlords provides valuable insight into tenant behavior and lease compliance patterns.

- Credit reports and scores: FICO scores, payment history, outstanding debts, credit utilization ratios, and bankruptcy records

- Criminal background checks: Felony and misdemeanor convictions, but not arrest records without resulting convictions

- Eviction history: Court records of previous eviction proceedings, judgments, and payment outcomes

- Employment verification: Current job status, salary confirmation, employment duration, and supervisor references

- Rental references: Previous landlord contacts, rental payment history, and lease violation records

- Identity verification: Social Security number validation, address confirmation, and photo identification matching

Property owners should focus screening efforts on factors directly related to tenancy success and property protection. Irrelevant personal information cannot legally be used in rental decisions under fair housing regulations.

Criminal Background Check Restrictions

Prohibited Practices

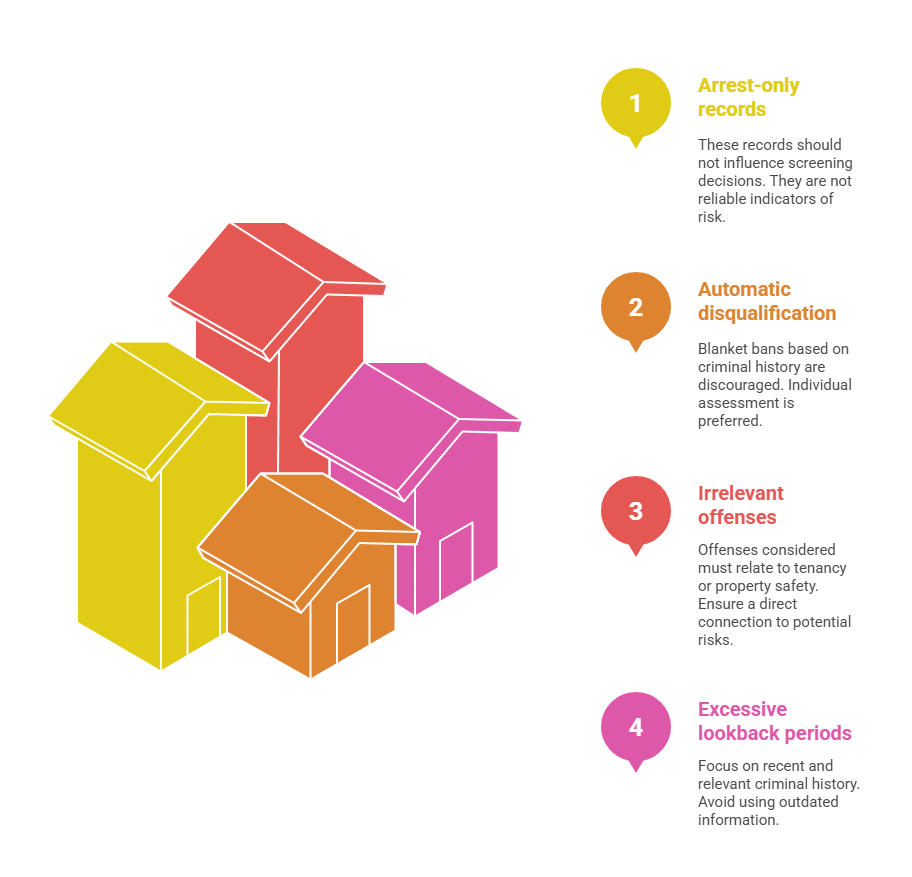

Florida law prohibits certain criminal screening practices that violate fair housing principles and tenant rights. Landlords cannot automatically disqualify applicants based solely on arrest records without resulting convictions or charges. Additionally, blanket bans on all criminal history may constitute discriminatory practices under current federal housing guidance.

- Arrest-only records: Cannot be used for screening decisions

- Automatic disqualification: Blanket criminal history bans discouraged

- Irrelevant offenses: Must relate to tenancy or property safety

- Excessive lookback periods: Should focus on recent, relevant history

The "Ban the Box" movement continues to influence rental screening practices, though Florida hasn't enacted comprehensive statewide legislation yet. However, some municipalities have local ordinances that limit initial criminal history inquiries on rental applications.

Individualized Assessment Requirements

When criminal history exists, landlords should conduct individualized assessments considering multiple relevant factors rather than automatic denials. The nature and severity of the offense must be weighed against the time elapsed since conviction. Evidence of rehabilitation, such as steady employment, education completion, or positive references, should also factor into decisions.

This approach reduces discrimination risk while maintaining legitimate safety concerns for other tenants and property protection. Documentation of the decision-making process provides crucial legal protection for landlords facing potential discrimination claims.

Application Fees and Security Deposits

Florida rental application laws strictly regulate fees landlords can charge during the screening process to prevent exploitation. Application fees cannot exceed $50 per adult applicant and must be used exclusively for actual screening costs. These costs include credit reports, background checks, and reasonable administrative processing expenses directly related to application review.

Landlords must provide itemized receipts showing exactly how fees were used within the screening process. Any unused portions must be returned to applicants within 30 days of the screening decision. Security deposit regulations differ from application fees and vary based on lease terms and local ordinances.

| Fee Type | Maximum Amount | Refund Timeline |

| Application fee | $50 per adult applicant | 30 days if unused |

| Security deposit | Varies by lease terms | End of tenancy |

| Pet deposit | Separate from application | End of tenancy |

Excessive application fees or failure to return unused amounts can result in tenant complaints and potential legal challenges. Transparent fee structures build trust with prospective tenants while ensuring full legal compliance.

Fair Housing Compliance in Screening

Fair housing laws significantly impact tenant background check procedures throughout Florida, with 2024 updates expanding protected class definitions. Federal law prohibits discrimination based on race, color, religion, sex, national origin, disability, and familial status. Florida adds marital status and, as of 2024, lawful source of income as additional protected categories that landlords must consider.

Landlords must apply identical screening criteria to all applicants regardless of protected class membership or personal characteristics. Different standards for different applicants create substantial liability exposure even when discrimination wasn't intentionally practiced. Consistent documentation demonstrates fair treatment and helps establish legal compliance during investigations or litigation.

Reasonable accommodations for disabled applicants may require modifying standard screening procedures in specific circumstances. Service animal policies, application assistance for visual or hearing impairments, and modified communication methods represent common accommodation requests. Landlords must engage in interactive processes to determine appropriate accommodations that don't create undue financial hardship.

Income and Employment Verification Standards

Acceptable Income Sources

Florida's 2024 legislative updates expanded protections for applicants using lawful sources of income, including government assistance programs. Landlords can still verify income adequacy but cannot discriminate based on the income source itself. Social Security benefits, disability payments, and housing vouchers must be considered equally with employment income.

- Employment wages: Pay stubs, employer verification, tax returns

- Government benefits: Social Security, disability, unemployment compensation

- Investment income: Dividends, interest, rental property earnings

- Retirement income: Pensions, 401k distributions, annuity payments

Documentation requirements should be consistent across all income types to avoid discriminatory practices. Alternative verification methods may be necessary for non-traditional income sources.

Income Calculation Methods

Most Florida landlords require monthly income equal to at least three times the rent amount, though some properties set higher thresholds. Gross income calculations typically include all sources before taxes and deductions. However, landlords should clearly communicate their specific calculation methods to all applicants.

Combined household income from multiple adult applicants can be considered when determining qualification thresholds. Co-signers or guarantors may help applicants meet income requirements when individual income falls short of established criteria.

Record Retention and Privacy Requirements

Florida tenant screening laws require landlords to maintain screening records for specific periods while protecting sensitive personal information from unauthorized access. Application materials, background check reports, and decision documentation should be stored securely for at least two years after screening concludes. Digital storage systems must include appropriate cybersecurity measures protecting applicant data from breaches or unauthorized access.

Physical documents require locked storage with limited access to authorized personnel only. Cloud storage solutions should include encryption and multi-factor authentication to meet privacy standards. Regular security audits help identify vulnerabilities before data breaches occur.

- Document types requiring retention: Applications, credit reports, criminal background checks, employment verification, rental references, and decision records

- Storage requirements: Secure physical or digital systems with restricted access controls

- Disposal procedures: Secure destruction methods including shredding for physical documents and data wiping for electronic files

Proper disposal of screening documents protects both landlords and applicants from identity theft risks when information is no longer needed. The Fair and Accurate Credit Transactions Act (FACTA) mandates secure destruction of consumer report information according to federal guidelines.

Technology and Digital Screening Platforms

Third-Party Screening Services

Many Florida landlords use professional tenant screening companies to streamline the background check process while ensuring compliance. These services typically provide comprehensive reports combining credit, criminal, and eviction history in standardized formats. However, landlords remain legally responsible for compliance even when using third-party providers.

Screening companies must also follow FCRA requirements and provide proper disclosures to applicants. Landlords should verify that their chosen providers maintain current compliance certifications and industry standards. Service agreements should clearly define liability and responsibility for regulatory violations.

Online Application Systems

Digital application platforms have become increasingly popular for their efficiency and record-keeping capabilities. These systems can automatically track consent, store required disclosures, and maintain audit trails for compliance purposes. However, technology solutions must still meet all legal requirements for accessibility and fair housing compliance.

Mobile-friendly applications help reach broader applicant pools while maintaining professional screening standards. Integration with screening services can reduce processing time while ensuring consistent application of criteria across all applicants.

Municipal and Local Ordinances

City-Specific Requirements

Several Florida cities have enacted additional tenant screening regulations beyond state requirements that landlords must understand. Miami-Dade County has specific fair housing ordinances that expand protected classes and screening limitations. Orlando has implemented source-of-income protection that affects how landlords evaluate housing voucher recipients.

Tampa has considered "Ban the Box" legislation that would limit initial criminal history inquiries on applications. Jacksonville has specific requirements for application fee handling and refund procedures that exceed state minimums.

Staying Updated on Local Changes

Local ordinances change frequently, requiring landlords to monitor multiple jurisdictions where they own properties. Municipal websites, local apartment associations, and legal counsel provide updates on regulatory changes. Regular training helps ensure compliance across different markets and jurisdictions.

Property management companies often provide compliance monitoring services for multiple markets. However, individual landlords must take responsibility for understanding local requirements in their specific areas.

Common Legal Pitfalls and Prevention Strategies

Many Florida landlords inadvertently violate tenant screening laws through common mistakes that create significant legal liability. Inconsistent application of screening criteria ranks among the most frequent violations, often resulting in costly discrimination claims. Using outdated or incorrect background check information can lead to FCRA violations and wrongful denial lawsuits that damage landlord reputations.

Failure to provide proper adverse action notices represents another significant compliance gap that continues to affect landlords. The FCRA requires specific timing and content for these notifications, and missing deadlines or providing incomplete information creates substantial liability exposure. Additionally, charging excessive application fees or failing to return unused portions violates state regulations and creates tenant complaint opportunities.

Establishing written policies and comprehensive training procedures helps prevent these common violations effectively. Regular legal updates ensure screening practices remain compliant with evolving regulations that continue expanding tenant protections. Documentation of all screening decisions and procedures provides crucial evidence during investigations or litigation proceedings.

Emergency Screening Situations

Expedited Processing Requirements

Urgent rental situations may require faster screening processes, but legal requirements remain unchanged regardless of timing pressures. Landlords cannot skip required disclosures or consent procedures even when facing tight deadlines. Emergency situations might include last-minute move-outs, seasonal rental demands, or urgent occupancy needs.

Expedited screening services are available from many providers, though costs may be higher for faster turnaround times. Digital platforms can significantly reduce processing time while maintaining compliance with all legal requirements.

Temporary Housing Considerations

Short-term or temporary housing arrangements may have modified screening procedures, but fair housing laws still apply fully. Month-to-month leases, corporate housing, and extended-stay arrangements require the same legal compliance as traditional annual leases. Furnished rental properties cannot use different screening standards based solely on furnishing status.

Vacation rental properties transitioning to long-term housing must implement proper screening procedures for extended stays. Local zoning and licensing requirements may affect screening procedures for certain property types.

Industry Best Practices and Compliance Programs

Professional property management organizations recommend comprehensive compliance programs that exceed minimum legal requirements for tenant screening. These programs typically include regular staff training, policy updates, documentation systems, and legal review processes. Industry certifications help demonstrate commitment to fair housing practices and legal compliance.

Automated compliance monitoring systems can track application processing times, fee calculations, and required notifications to prevent violations. Regular audits of screening procedures help identify potential problems before they result in legal challenges. Professional liability insurance provides additional protection against compliance-related claims.

- Training components: Fair housing law, FCRA requirements, local ordinances, documentation procedures, and emergency protocols

- Documentation systems: Application tracking, decision records, fee accounting, disclosure delivery confirmation, and correspondence files

- Quality control measures: Random file reviews, compliance checklists, supervisor approvals, and legal consultations

Membership in professional associations provides access to updated legal information, training resources, and industry best practices. Regular networking with other landlords helps identify emerging compliance challenges and solutions.

Conclusion

Florida tenant screening laws require landlords to balance thorough applicant evaluation with strict compliance obligations that protect tenant rights throughout the process. Success depends on understanding federal FCRA requirements alongside state-specific regulations, including recent 2024 legislative updates that expand fair housing protections and income source discrimination safeguards. Consistent application of written screening criteria, proper documentation procedures, and transparent fee structures create the foundation for legally compliant tenant selection processes. Regular training updates and policy reviews ensure landlords can effectively screen applicants while avoiding costly discrimination claims and regulatory violations that continue to increase across the state.

Frequently Asked Questions

What is the maximum application fee landlords can charge in Florida?

Florida landlords can charge up to $50 per adult applicant for rental application fees in 2025. This fee must be used for actual screening costs like credit reports and background checks. Unused portions must be returned within 30 days along with itemized receipts showing how funds were spent.

Can Florida landlords deny applications based on criminal history?

Yes, but landlords cannot automatically disqualify applicants based solely on arrest records without convictions. Criminal background screening should involve individualized assessment considering the nature of the offense, time elapsed since conviction, and evidence of rehabilitation. Blanket criminal history bans may violate fair housing guidelines.

What disclosures are required before conducting tenant background checks?

Landlords must provide written FCRA disclosure stating that a consumer report may be obtained for screening purposes. This disclosure must be separate or clearly distinguished from other application materials and requires the applicant's written consent. Verbal consent alone is insufficient under federal law.

How long must landlords keep tenant screening records?

Florida landlords should maintain screening records for at least two years after the screening process concludes. This includes applications, background check reports, and decision documentation. All records must be stored securely to protect personal information from unauthorized access or data breaches.

What constitutes proper adverse action notification in Florida?

When denying applications based on background check information, landlords must provide pre-adverse action notice with a copy of the consumer report. After allowing time for applicant response, they must send a final adverse action notice explaining the denial reason and providing credit agency contact information.

Are there restrictions on what criminal history landlords can consider?

While landlords can review criminal convictions, they cannot use arrest records without convictions in rental decisions. Fair housing guidelines also discourage blanket criminal history bans that may disproportionately affect protected classes. Individualized assessments focusing on relevant, recent history are recommended.

Can landlords discriminate based on source of income in Florida?

No, Florida's 2024 legislative updates added a lawful source of income as a protected class. Landlords cannot discriminate against applicants using government assistance, Social Security benefits, or other legal income sources. However, they can still verify that total income meets qualification requirements.

What happens if landlords violate tenant screening laws?

Violations can result in discrimination lawsuits, FCRA penalty fees, and regulatory enforcement actions. Common consequences include monetary damages, attorney fees, and required policy changes. Repeat violations may lead to increased scrutiny and higher penalty amounts.

Additional Resources

- Florida Residential Landlord and Tenant Act - Chapter 83, Florida Statutes

https://www.flsenate.gov/Laws/Statutes/2024/Chapter83 - Fair Credit Reporting Act (FCRA) Compliance Guide for Landlords

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-landlords-need-know - HUD Fair Housing Guidelines for Tenant Screening

https://www.hud.gov/program_offices/fair_housing_equal_opp/fair_housing_act_overview - Florida Department of Agriculture - Consumer Services Division

https://www.fdacs.gov/Consumer-Resources/Landlord-Tenant-Law - National Association of Residential Property Managers - Legal Resources

https://www.narpm.org/education/legal-library - Florida Bar Real Property, Probate and Trust Law Section Resources

https://www.floridabar.org/public/consumer/tip014/

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.