Financial institutions operate under one of the most stringent regulatory environments for employment screening, where FCRA compliance intersects with multiple federal requirements including FINRA Rule 3110, SEC regulations, and the SAFE Act for mortgage loan originators. Navigating this complex framework requires a comprehensive understanding of permissible purpose limitations, adverse action procedures, and continuous monitoring obligations that extend far beyond standard pre-employment screening practices used in other industries.

Key Takeaways

- Financial institutions must comply with the Fair Credit Reporting Act (FCRA) alongside industry-specific regulations from FINRA, SEC, and state banking authorities, creating a multi-layered compliance framework that requires specialized expertise.

- Credit checks for banking positions serve a permissible business purpose under FCRA but require strict adherence to disclosure, authorization, and adverse action requirements to avoid regulatory penalties.

- Licensed financial professionals including registered representatives and mortgage loan originators require continuous monitoring rather than one-time screening, with reporting obligations triggered by specific criminal or regulatory events.

- The adverse action process for financial services positions involves heightened documentation requirements due to the sensitive nature of disqualifying information and potential discrimination claims.

- FINRA Rule 3110(e) mandates supplemental background checks beyond basic criminal history, including verification of regulatory actions, civil judicial proceedings, and customer complaints.

- State-specific banking requirements often exceed federal FCRA standards, particularly regarding credit report usage and ban-the-box legislation that affects the timing of background screening disclosures.

- Financial institutions face significant liability exposure from both negligent hiring claims and FCRA violations, making proper documentation and process adherence critical risk management priorities.

- Implementing a risk-based screening approach that differentiates between customer-facing positions with financial access versus administrative roles helps optimize compliance resources while meeting regulatory obligations.

Understanding the FCRA Compliance Framework for Financial Services

The Fair Credit Reporting Act establishes the foundational legal requirements for how financial institutions conduct employment background checks. However, compliance extends far beyond basic criminal history screening. Financial services organizations must navigate a complex regulatory landscape where federal banking regulators, self-regulatory organizations like FINRA, and state authorities each impose distinct requirements for employee screening and monitoring.

Core FCRA Requirements for Employment Screening

Under FCRA Section 604(a)(3)(B), employers must have a permissible purpose to obtain consumer reports for employment decisions. Financial institutions conducting background checks must provide clear written disclosure to applicants on a standalone document before obtaining any consumer report. This disclosure cannot be buried within employment applications or combined with liability waivers—a common compliance pitfall that has resulted in class action settlements exceeding $10 million for major employers.

Authorization from the applicant must be obtained separately from the disclosure, though they may appear on the same document if clearly delineated. The authorization should include language allowing the financial institution to obtain reports throughout the employment relationship for positions requiring continuous monitoring. Many banks and credit unions overlook this critical element, necessitating new authorizations when implementing ongoing screening programs for compliance purposes.

Permissible Purpose and Financial Industry Screening

Financial services background checks serve legitimate business purposes that courts consistently recognize under FCRA's permissible purpose doctrine. Banks and investment firms have heightened duties to protect customer assets, prevent fraud, and maintain regulatory compliance. These responsibilities justify more extensive screening than employers in other industries typically conduct.

Credit reports for banking jobs specifically serve permissible purposes when positions involve financial responsibilities, access to customer information, or fiduciary duties. The Consumer Financial Protection Bureau (CFPB) has enforcement authority over FCRA compliance and has issued guidance clarifying that financial institutions must document the business justification for each type of background screening conducted. This documentation becomes critical during regulatory examinations and in defending against applicant challenges to screening practices.

Industry-Specific Regulatory Requirements Beyond FCRA

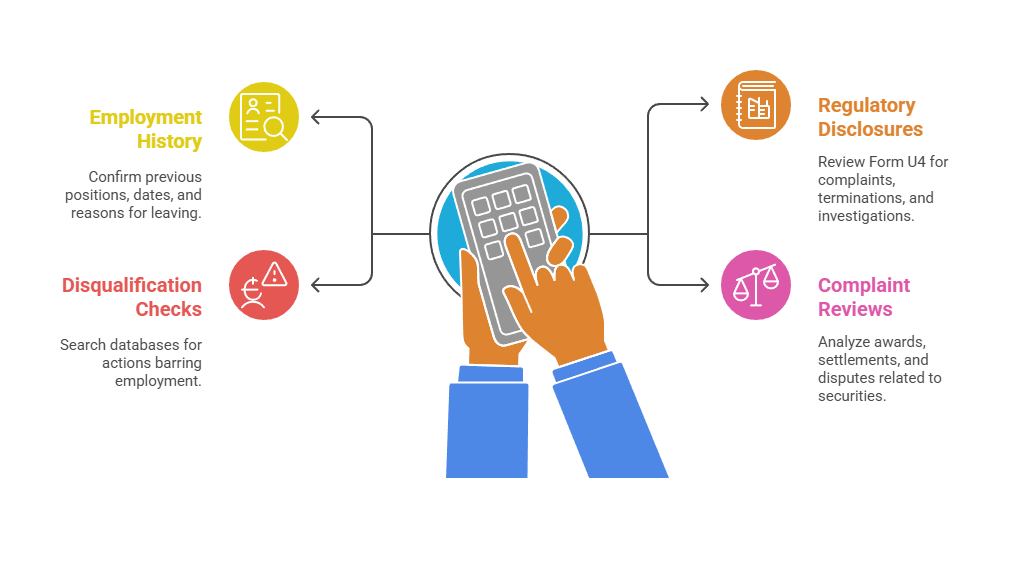

FINRA Rule 3110 requires member firms to establish and maintain a system to supervise associated persons, which includes comprehensive background investigations. These requirements extend beyond FCRA minimums to include several additional components:

- Employment History Verification: Detailed confirmation of previous positions, dates of employment, and reasons for departure from financial services roles.

- Regulatory Disclosure Searches: Review of Form U4 disclosures including customer complaints, terminations for cause, and regulatory investigations.

- Statutory Disqualification Checks: Searches of FINRA databases, SEC enforcement actions, and state regulatory sanctions that may bar employment.

- Customer Complaint Reviews: Analysis of arbitration awards, settlements, and pending customer disputes related to securities activities.

Securities firms must screen for statutory disqualifications under Securities Exchange Act Section 15(b), which encompasses specific criminal offenses and regulatory actions that permanently bar individuals from the industry. The SAFE Act mandates criminal background checks through the Nationwide Mortgage Licensing System (NMLS) for mortgage loan originators, creating federal requirements that supersede some state-level regulations.

Pre-Employment Screening Procedures for Financial Positions

Implementing compliant background screening processes requires financial institutions to establish standardized procedures that satisfy both FCRA requirements and industry-specific regulations. The pre-employment phase presents unique compliance challenges due to timing considerations, disclosure requirements, and the need to coordinate multiple screening components across different regulatory frameworks.

Disclosure and Authorization Best Practices

The standalone disclosure document must clearly identify that a consumer report may be obtained for employment purposes. The language must comply with both federal FCRA requirements and state-specific variations. California's Investigative Consumer Reporting Agencies Act (ICRAA) requires additional disclosures when interviews are conducted about character and reputation, while New York City's Fair Chance Act restricts when criminal history inquiries can occur.

Financial institutions should implement a two-stage authorization process. First, obtain initial authorization for pre-employment screening. Second, secure a separate continuous monitoring authorization for licensed positions. The continuous monitoring authorization should specifically reference ongoing obligations under FINRA rules or state licensing requirements, helping demonstrate the business necessity for periodic rescreening.

Coordinating Multiple Screening Components

Financial services onboarding compliance requires orchestrating several distinct background check elements. Each component has specific legal requirements and permissible use limitations that must be carefully managed:

| Screening Component | Primary Regulatory Requirement | Typical Turnaround Time |

| Criminal Background Check | FCRA, State Ban-the-Box Laws | 3-5 business days |

| Credit Report | FCRA, State Employment Credit Check Restrictions | 1-2 business days |

| Employment Verification | FINRA Rule 3110 | 5-10 business days |

| Education Confirmation | General Due Diligence Standards | 3-7 business days |

| Professional License Verification | State Licensing Boards, NMLS | 2-5 business days |

| Regulatory Database Searches | FINRA, SEC, State Regulators | 1-3 business days |

Criminal background checks are subject to ban-the-box laws in 37 states that restrict when employers can inquire about conviction history. Credit check requirements for banking jobs demand particular attention to FCRA's adverse action procedures and Equal Employment Opportunity Commission (EEOC) guidance on avoiding discriminatory impact.

Timing Considerations and Conditional Offers

Best practice dictates extending conditional employment offers before conducting background screening for non-licensed positions. This sequence provides legal protection under Title VII's disparate impact framework. The approach allows financial institutions to establish that the applicant was otherwise qualified before any background screening information influenced the decision.

Licensed positions present different timing considerations because regulatory requirements mandate screening before allowing any customer contact or securities activities. The screening process for financial industry roles typically requires 5-10 business days for comprehensive results. Complex cases involving multiple jurisdictions or international background checks may extend to 3-4 weeks. Financial institutions should communicate expected timelines to applicants and implement tracking systems to ensure adverse action procedures are triggered within legally required timeframes.

Credit Reports and Financial Services Employment

Credit report usage in employment decisions remains one of the most legally contentious aspects of background screening. This is particularly true for financial institutions where such reports serve legitimate business purposes. Understanding the permissible use doctrine, adverse action requirements, and discrimination risks associated with credit-based employment decisions is essential for compliance officers managing screening programs.

Permissible Purpose for Employment Credit Checks

FCRA Section 604(a)(3)(B) permits employers to obtain credit reports when the information is relevant to employment decisions. However, several states have enacted legislation restricting this practice. As of 2025, eleven states have laws limiting employment credit checks: California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maryland, Nevada, Oregon, Vermont, and Washington.

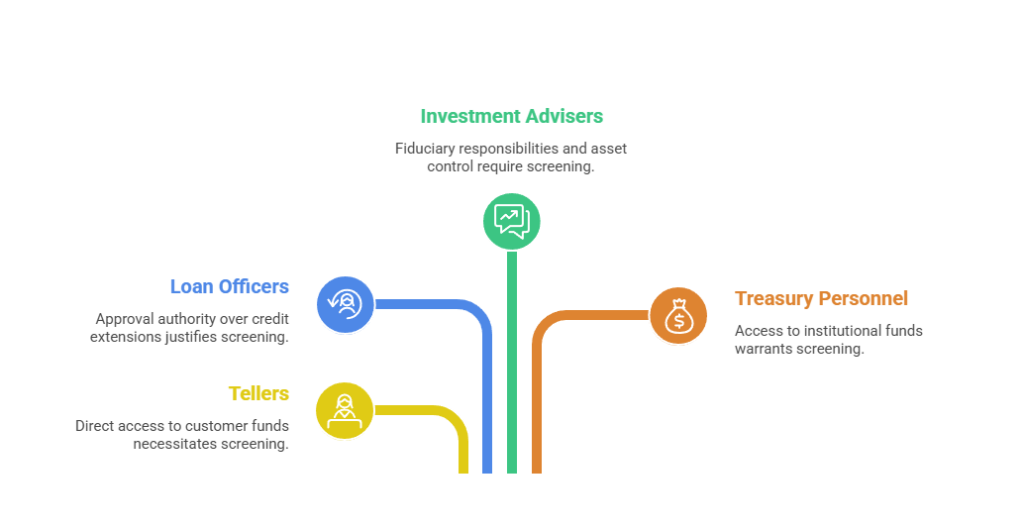

These restrictions typically contain exceptions for positions with financial responsibilities, law enforcement roles, and positions requiring security clearances. Financial institutions must conduct position-specific analyses to determine which roles genuinely require credit checks. The following positions clearly fall within permissible categories:

- Tellers with Cash Handling Responsibilities: Direct access to customer funds and vault operations creates legitimate business necessity for credit screening.

- Loan Officers with Approval Authority: Decision-making power over credit extensions and loan terms justifies assessment of personal financial responsibility.

- Investment Advisers with Discretionary Trading Authority: Fiduciary responsibilities and customer asset control necessitate comprehensive financial background review.

- Treasury and Finance Department Personnel: Access to institutional funds and financial system controls warrants credit history evaluation.

Administrative assistants, IT support personnel, and facilities staff generally lack sufficient financial responsibilities to justify credit screening. The exception occurs when they have system access to customer financial information that could be exploited for fraudulent purposes.

Interpreting Credit Information for Employment Decisions

Employment credit reports differ substantially from lending credit reports. They omit credit scores and account numbers while providing information about payment history, bankruptcies, liens, and judgments. Compliance officers must train hiring managers on appropriate interpretation of credit information.

The focus should be on patterns of irresponsibility rather than isolated incidents. A bankruptcy filing from five years ago during a documented hardship period should be evaluated differently than ongoing collections and charge-offs occurring while the applicant was employed. The EEOC has issued guidance warning that blanket exclusions based on credit history may violate Title VII if they create disparate impact on protected classes.

Financial institutions should implement individualized assessment procedures. These procedures must consider the nature of credit issues, the time elapsed, evidence of rehabilitation, and the specific financial responsibilities of the position. Documentation of these considerations becomes critical evidence in defending employment decisions if challenged.

Adverse Action Procedures for Credit-Based Decisions

When credit report information leads to an adverse employment decision, FCRA mandates a specific pre-adverse action and adverse action notice process. The pre-adverse action notice must include three essential components:

- Copy of the Credit Report: The complete consumer report on which the decision is based, not a summary or excerpt.

- Summary of Consumer Rights: The standardized FCRA summary explaining consumer rights to dispute inaccurate information.

- Consumer Reporting Agency Information: Contact details for the agency that provided the report, clarifying that they did not make the employment decision.

Financial institutions must provide reasonable time—typically 5 business days—for applicants to dispute inaccuracies before finalizing the decision. The final adverse action notice must identify the consumer reporting agency, reiterate that the agency did not make the decision, and inform the applicant of their right to dispute the accuracy of the report. Many financial institutions overlook the requirement to provide reasonable time between pre-adverse and final adverse action, creating legal liability for FCRA violations.

Criminal Background Checks and Statutory Disqualifications

Criminal history screening for financial services positions involves heightened scrutiny due to regulatory provisions that permanently or temporarily bar individuals with specific convictions from industry employment. Section 19 of the Federal Deposit Insurance Act prohibits individuals convicted of crimes involving dishonesty, breach of trust, or money laundering from working for FDIC-insured institutions without written consent from the FDIC. Similar statutory disqualifications exist under securities laws and state banking regulations.

FDIC Section 19 Compliance Requirements

Section 19 applies to all FDIC-insured institutions including banks, savings associations, and credit unions. The prohibition covers convictions and pretrial diversion programs for specified offenses. Covered offenses include fraud, embezzlement, theft, forgery, bribery, perjury, money laundering, and conspiracy to commit such offenses.

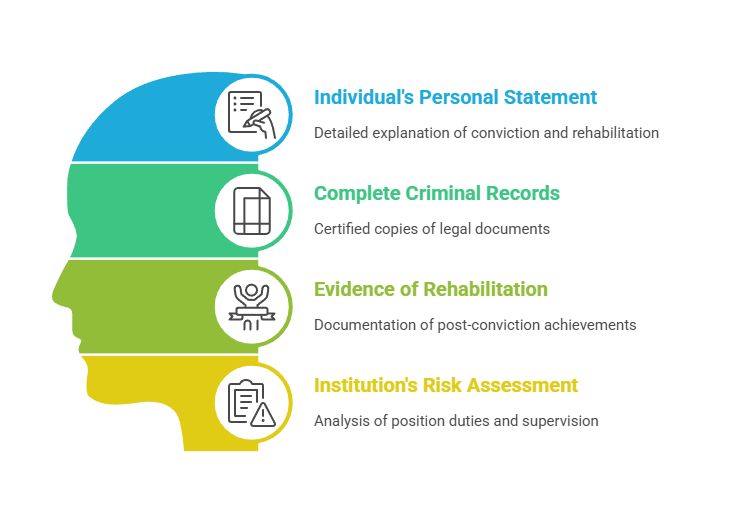

The prohibition remains in effect for convictions occurring at any point in the individual's history, with no time limit for expungement under federal law. Financial institutions discovering a Section 19-covered conviction for a current or prospective employee must either terminate the employment relationship or apply for written consent from the FDIC regional director. The application process requires substantial documentation:

- Individual's Personal Statement: Detailed explanation of the circumstances surrounding the conviction and subsequent rehabilitation efforts.

- Complete Criminal Records: Certified copies of charging documents, plea agreements, sentencing orders, and probation completion records.

- Evidence of Rehabilitation: Documentation of employment history, community service, educational achievements, and character references post-conviction.

- Institution's Risk Assessment: Analysis of the position duties, proposed supervision structure, and justification for employing the individual despite the conviction.

Processing typically requires 90-120 days, during which the individual cannot work for the institution. Violations of Section 19 carry civil penalties up to $1 million per day and potential criminal sanctions for knowing violations.

FINRA and SEC Statutory Disqualifications

Securities industry employers must navigate statutory disqualification provisions under Securities Exchange Act Section 3(a)(39). This encompasses criminal convictions, regulatory sanctions, and false statements on registration applications. Convictions for securities fraud, investment-related offenses, or any felony within the past ten years create statutory disqualifications requiring eligibility proceedings before FINRA.

Lesser misdemeanor convictions involving false statements, theft, or fraud trigger the same disqualification. FINRA member firms discovering disqualifying information must file a Membership Continuance Application (MC-400). The application must demonstrate that continuing to employ the individual is consistent with the public interest, requiring detailed disclosure and justification.

State-Level Banking Prohibitions and Ban-the-Box Laws

State banking regulators often impose additional criminal history restrictions beyond federal requirements. These restrictions particularly affect positions with fiduciary responsibilities or customer contact. State laws may extend disqualifying offenses to include domestic violence convictions, drug offenses, or computer crimes not specifically covered by federal statutes.

Ban-the-box legislation in 37 states and over 150 municipalities restricts when employers can inquire about criminal history. These laws typically prohibit such inquiries until after an initial interview or conditional offer. However, they contain varied exceptions for financial institutions, law enforcement, and positions with vulnerable populations. California's Fair Chance Act applies to all employers with five or more employees and requires individualized assessments before taking adverse action based on conviction history.

Continuous Monitoring for Licensed Financial Professionals

Unlike most industries where background screening occurs once at hiring, financial services regulations mandate ongoing monitoring for registered representatives, investment advisers, and mortgage loan originators. This continuous monitoring obligation creates unique compliance challenges regarding FCRA authorization scope, triggering events for rescreening, and coordination between automated monitoring systems and manual review processes.

FINRA Rule 3110(e) Ongoing Reporting Requirements

FINRA Rule 3110(e) requires member firms to obtain and review criminal background checks on associated persons at least every three years. The rule provides for more frequent screening when risk factors warrant additional scrutiny. Beyond periodic rescreening, firms must establish procedures to receive notification of arrests and criminal charges through database monitoring or self-reporting requirements.

The three-year rescreening must include searches of national criminal databases, county court records where the person resides and works, and federal court systems. FINRA examination findings consistently cite deficiencies in background screening scope. Common deficiencies include failures to search all relevant jurisdictions or reliance solely on database searches without supplemental county-level verification. Member firms bear responsibility for ensuring the accuracy and completeness of background checks, which cannot be delegated to screening vendors.

Form U4 Update Obligations and DRP Reporting

Registered representatives must amend Form U4 within 30 days of any customer complaint, criminal charge, regulatory investigation, or civil judgment meeting disclosure thresholds. These Disclosure Reporting Page (DRP) events trigger supervisory review obligations by the employing firm. The firm must determine whether the event affects the individual's continued registration or requires enhanced supervision.

Criminal charges must be reported regardless of disposition. This creates situations where firms must manage regulatory reporting for charges ultimately dismissed or reduced. Investment advisers face parallel reporting obligations through Form U4 or Form ADV depending on their registration status. State-registered advisers are subject to varying disclosure thresholds across jurisdictions, adding complexity to determining reportable events.

FCRA Authorization Scope for Ongoing Monitoring

Continuous monitoring programs must be supported by proper FCRA authorization obtained at hire that explicitly permits ongoing screening throughout employment. The authorization should specify several key elements:

- Types of Reports: Criminal background checks, credit reports, regulatory database searches, and other consumer reports that may be obtained during employment.

- Frequency of Screening: Three-year periodic rescreening, event-triggered checks, or continuous automated monitoring depending on position requirements.

- Monitoring Purposes: Regulatory compliance obligations under FINRA rules, state licensing requirements, or institutional risk management policies.

- Duration of Authorization: Continuous authorization throughout employment with the financial institution for positions requiring ongoing monitoring.

Generic employment authorizations often lack sufficient specificity to support automated monitoring programs. This creates potential FCRA violations when reports are obtained beyond the scope of the original authorization. When employees move from positions not requiring continuous monitoring to licensed roles necessitating ongoing screening, financial institutions must obtain supplemental authorization.

Adverse Action Process and Documentation Requirements

The adverse action process represents a critical compliance juncture where procedural errors can result in significant FCRA liability and discrimination claims. Financial institutions must implement detailed procedures ensuring proper timing, content, and documentation of all adverse action communications. Coordination between HR, compliance, and legal departments is essential when assessing complex disqualifying information.

Pre-Adverse Action Notice Requirements

Before taking adverse action based on consumer report information, employers must provide the applicant with a pre-adverse action notice. This notice must include a copy of the report, the Summary of Consumer Rights, and contact information for the consumer reporting agency. This requirement applies regardless of whether the adverse action basis is criminal history, credit information, employment verification discrepancies, or education confirmation issues.

The pre-adverse action notice triggers the applicant's right to dispute inaccuracies. The consumer reporting agency must investigate these disputes, typically within 30 days. Financial institutions must provide reasonable time between pre-adverse and final adverse action notices for applicants to identify and dispute inaccuracies.

While FCRA does not specify a minimum time period, regulatory guidance and court decisions suggest 5-10 business days as reasonable for most situations. During this period, employers should not communicate final employment decisions to applicants, maintaining the conditional nature of the adverse action determination. Providing pre-adverse action notice simultaneously with final rejection letters constitutes an FCRA violation that has resulted in class action settlements.

Individualized Assessment and EEOC Compliance

The EEOC's Enforcement Guidance on the Consideration of Arrest and Conviction Records requires employers to conduct individualized assessments before taking adverse action based on criminal history. This assessment must consider three specific factors:

| Assessment Factor | Evaluation Criteria | Documentation Requirements |

| Nature and Gravity of Offense | Type of crime, violence involved, fraud elements | Copy of charging documents, sentencing orders, detailed offense description |

| Time Elapsed Since Conviction | Years since conviction, probation completion, subsequent conduct | Timeline of post-conviction employment, certificates of rehabilitation, character references |

| Nature of Job Sought | Financial responsibilities, customer contact, fiduciary duties | Position description, access levels, supervision structure, business necessity justification |

For positions where statutory disqualifications apply under Section 19 or securities laws, the individualized assessment focuses on whether to pursue regulatory consent or eligibility proceedings. The assessment does not determine whether to permit employment without such approval. Documentation should clearly distinguish between situations where employment is legally prohibited versus discretionary decisions based on risk assessment.

Final Adverse Action Notice and Record Retention

Final adverse action notices must identify the consumer reporting agency that provided the report and explain that the agency did not make the employment decision. The notice must inform the applicant of their right to dispute the report's accuracy within 60 days and include contact information for the consumer reporting agency. Many financial institutions erroneously assume that providing this information in the pre-adverse action notice satisfies the final notice requirement, but both notices are legally mandated.

Financial institutions should retain documentation of the adverse action process for at least five years. This includes copies of both notices, evidence of when they were sent, the consumer report on which the decision was based, and any dispute correspondence. FCRA's statute of limitations is two years from the date of discovery of the violation or five years from the date of the violation, whichever occurs first.

Implementing Compliant Background Screening Programs

Establishing comprehensive background screening programs requires cross-functional collaboration, vendor due diligence, and ongoing program assessment. Financial institutions must develop risk-based screening matrices, implement appropriate technology systems, and establish governance structures ensuring consistent application of screening policies across the organization.

Risk-Based Screening Matrices and Position Classification

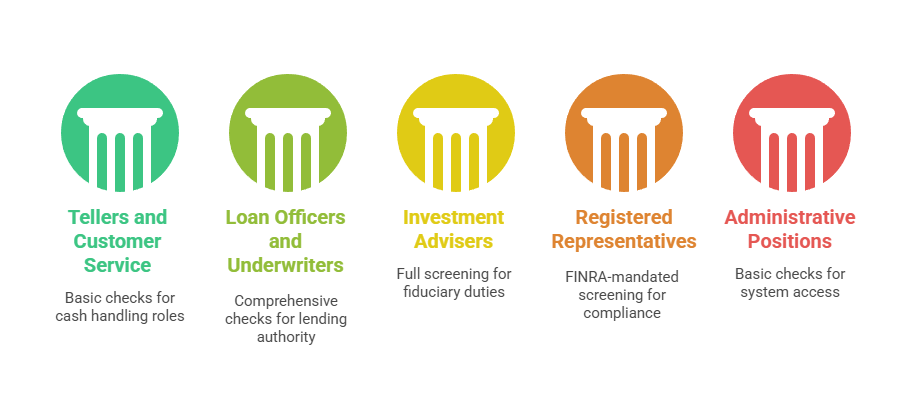

Financial institutions should develop position-specific screening matrices that identify required background check components based on job responsibilities and regulatory requirements. This risk-based approach optimizes compliance resources while ensuring regulatory requirements are met for positions where enhanced screening is legally mandated:

- Tellers and Customer Service Representatives: Criminal background checks and identity verification, with credit reports added only when cash handling or account opening authority exists.

- Loan Officers and Underwriters: Comprehensive screening including credit reports, criminal background checks, employment verification, and education confirmation due to lending decision authority.

- Investment Advisers and Wealth Management Professionals: Full screening battery including regulatory database searches and continuous monitoring due to fiduciary responsibilities and customer asset access.

- Registered Representatives and Broker-Dealers: FINRA-mandated screening including Form U4 verification, regulatory action searches, customer complaint reviews, and three-year rescreening.

- Administrative Positions: Basic criminal history screening for due diligence, with enhanced screening only when financial system access or customer information access exists.

The screening matrix should be documented in written policies approved by senior management and legal counsel. Annual reviews ensure continued alignment with regulatory expectations and emerging compliance requirements.

Vendor Selection and Due Diligence

Most financial institutions engage consumer reporting agencies to conduct background screening. However, the financial institution retains liability for FCRA compliance even when outsourcing screening functions. This makes vendor due diligence essential for risk management.

Due diligence should assess the vendor's FCRA compliance program, data sources and accuracy standards, security controls protecting applicant information, and professional liability insurance coverage. Consumer reporting agencies must maintain reasonable procedures ensuring maximum possible accuracy under FCRA Section 607(b). Courts interpret this as requiring established protocols for database source verification, regular data accuracy audits, and processes for investigating disputes.

Financial institutions should review vendor contracts to ensure appropriate representations and warranties regarding FCRA compliance. Contracts should include indemnification provisions for vendor errors and service level agreements for report turnaround times. Annual vendor assessments should evaluate performance metrics including report accuracy rates, dispute investigation timelines, and regulatory examination findings.

Training and Quality Assurance Programs

Hiring managers, HR personnel, and compliance officers require specialized training on FCRA requirements and adverse action procedures. Training should address common compliance pitfalls:

- Premature Adverse Action Communications: Sending final rejection letters before providing reasonable time for applicants to dispute background check inaccuracies.

- Inappropriate Credit Information Interpretation: Using credit history as an absolute disqualifier without individualized assessment of financial responsibilities and rehabilitation evidence.

- Failure to Conduct Individualized Assessments: Applying blanket criminal history exclusions that may create disparate impact on protected classes without job-related justification.

- Inadequate Documentation: Failing to record the business necessity for screening decisions, risk assessment factors, and regulatory compliance obligations driving employment decisions.

Quality assurance programs should include regular file reviews assessing whether proper disclosures and authorizations were obtained and adverse action procedures were followed correctly. Financial institutions should track key metrics including time-to-hire, adverse action rates by position type, and dispute rates to identify potential compliance risks or process inefficiencies requiring remediation.

Conclusion

Financial institutions face uniquely complex compliance obligations for employment background screening due to the intersection of FCRA requirements with industry-specific regulations from FINRA, SEC, FDIC, and state banking authorities. Implementing compliant screening programs requires risk-based approaches that differentiate between positions based on regulatory requirements and job responsibilities while maintaining consistent adverse action procedures. The continuous monitoring obligations for licensed financial professionals extend compliance responsibilities throughout employment relationships, not merely at the hiring stage. As regulatory enforcement intensifies and employment privacy laws evolve, financial institutions must treat background screening compliance as a dynamic risk management priority requiring ongoing assessment and program refinement.

Frequently Asked Questions

What is FCRA compliance and why is it important for financial institutions?

FCRA compliance refers to adherence to the Fair Credit Reporting Act, the federal law governing how employers obtain and use consumer reports for employment decisions. Financial institutions must comply with FCRA when conducting background checks, credit reports, or other consumer report screenings on job applicants and employees. Violations can result in statutory damages of $100-$1,000 per violation, punitive damages for willful violations, class action liability, and regulatory sanctions from banking regulators during safety and soundness reviews.

Can banks and financial institutions check credit reports for all positions?

Financial institutions may check credit reports when the information is relevant to the position's duties, but eleven states restrict employment credit checks with exceptions for positions involving financial responsibilities. Banks should limit credit screening to roles with cash handling, account opening authority, lending decisions, or access to customer financial information to demonstrate business necessity. EEOC guidance warns that blanket credit check policies may create discriminatory disparate impact, requiring employers to conduct individualized assessments and document the specific financial responsibilities justifying credit screening.

What is FDIC Section 19 and how does it affect hiring in banking?

FDIC Section 19 prohibits individuals convicted of crimes involving dishonesty, breach of trust, or money laundering from working for FDIC-insured institutions without written consent from the FDIC. The prohibition applies to convictions at any point in the individual's history with no time limit, covering offenses including fraud, embezzlement, theft, and money laundering. Banks discovering Section 19-covered convictions must either terminate the employment relationship or apply to the FDIC for written consent through a process requiring 90-120 days, with violations carrying penalties up to $1 million per day.

How often must financial institutions conduct background checks on licensed employees?

FINRA Rule 3110(e) requires member firms to obtain criminal background checks on associated persons at least every three years, with more frequent screening when risk factors warrant. Securities firms must also establish procedures for receiving timely notification of arrests and criminal charges between scheduled screenings through automated monitoring services or employee self-reporting requirements. Mortgage loan originators licensed through NMLS are subject to continuous monitoring with criminal history checks processed through the licensing system.

What is the adverse action process under FCRA?

The adverse action process requires employers to provide specific notices before and after taking negative employment actions based on consumer report information. The pre-adverse action notice must include a copy of the report, the Summary of Consumer Rights, and consumer reporting agency contact information, followed by reasonable time (typically 5-10 business days) for the applicant to dispute inaccuracies. The final adverse action notice must identify the consumer reporting agency, explain that the agency did not make the employment decision, and inform the applicant of their right to dispute the report within 60 days.

Do continuous monitoring programs require separate FCRA authorization?

Yes, continuous monitoring programs require FCRA authorization that explicitly permits ongoing screening throughout employment, not just pre-employment checks. The authorization should specify the types of reports that may be obtained, the frequency of screening, and the purposes for ongoing monitoring including regulatory compliance requirements. Generic employment authorizations often lack sufficient specificity to support automated monitoring programs, and when employees move from non-licensed to licensed positions requiring continuous monitoring, supplemental authorization covering the enhanced screening should be obtained.

How should financial institutions handle criminal records that are expunged or sealed?

State laws vary regarding whether expunged or sealed records can be considered in employment decisions, with some jurisdictions treating expungement as legal erasure while others permit consideration for positions with specific responsibilities. Financial institutions should implement policies that comply with the most restrictive applicable state law and generally should not consider expunged convictions unless legally permitted and job-related. However, federal statutory disqualifications under FDIC Section 19 and securities laws may apply regardless of state expungement, requiring legal analysis when expunged convictions involve dishonesty or breach of trust.

What are the penalties for FCRA violations in employment screening?

FCRA violations carry statutory damages of $100-$1,000 per violation, with potential for actual damages when applicants can demonstrate harm such as lost employment opportunities. Willful violations may result in punitive damages without cap, and prevailing plaintiffs can recover attorney's fees, creating significant exposure in class action litigation. The CFPB and FTC have regulatory enforcement authority with civil penalty authority up to $5,000 per violation, while state attorneys general can bring enforcement actions under state FCRA equivalents with additional penalties.

Additional Resources

- FINRA Rule 3110: Supervision and Background Checks

https://www.finra.org/rules-guidance/rulebooks/finra-rules/3110 - EEOC Enforcement Guidance on the Consideration of Arrest and Conviction Records

https://www.eeoc.gov/laws/guidance/enforcement-guidance-consideration-arrest-and-conviction-records-employment - NMLS Resource Center: SAFE Act Background Checks

https://mortgage.nationwidelicensingsystem.org/SAFE/Pages/default.aspx - Federal Trade Commission: Fair Credit Reporting Act Compliance Guide

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-employers-need-know

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.