Digital identity verification hiring has evolved from basic ID checks to sophisticated fraud detection as deepfake technology and AI-manipulated credentials threaten the integrity of remote hiring processes. Organizations now face mounting pressure to implement verification systems capable of distinguishing authentic candidates from fraudulent applicants using synthetic identities, forged documents, and algorithmically generated personas.

Key Takeaways

- Deepfake technology has reduced the cost and complexity of credential fraud, enabling sophisticated impersonation attacks that bypass traditional document verification methods used in remote hiring environments.

- Employment history screening fraud now includes AI-generated reference letters, fabricated employment verification calls, and digitally altered transcripts that appear legitimate under standard review protocols.

- Candidate identity screening technology must now incorporate liveness detection, biometric analysis, and multi-factor authentication to counter synthetic identity fraud in virtual interview settings.

- AI-powered background screening platforms provide real-time cross-referencing against multiple databases, enabling immediate detection of discrepancies that manual processes might miss over days or weeks.

- Remote employee background screening requires layered verification approaches that combine digital credential authentication with behavioral analysis and continuous monitoring throughout the hiring lifecycle.

- Employment screening fraud prevention strategies deliver measurable ROI through reduced turnover costs, minimized compliance violations, and protection against reputational damage from high-profile hiring failures.

- Organizations must balance fraud detection sophistication with anti-discrimination compliance, ensuring verification protocols do not create disparate impact based on protected characteristics.

The Evolution of Identity Fraud in Modern Hiring

The shift to remote work transformed hiring from in-person interactions to digital exchanges. This transition created vulnerability gaps that sophisticated fraudsters exploit with increasing frequency. Traditional verification methods designed for physical document inspection struggle to detect manipulated digital files and synthetic video presentations.

From Paper Forgeries to AI-Generated Personas

Document forgery once required specialized equipment and expertise that limited its accessibility. The barrier to entry has collapsed as generative AI tools democratize sophisticated fraud techniques. A 2024 analysis of employment fraud cases revealed that approximately one-third involved digitally manipulated credentials, compared to roughly one-eighth in 2021.

Fraudulent candidates now generate convincing reference letters using large language models trained on professional correspondence patterns. These documents replicate industry-specific terminology, formatting conventions, and communication styles that appear authentic under cursory review. The sophistication extends beyond static documents to interactive fraud schemes.

Voice synthesis technology enables impersonation during employment verification calls. An applicant providing fraudulent references can coordinate AI-generated voice responses that confirm fabricated employment histories. Detection requires verification protocols that extend beyond simple callback procedures to include multi-channel confirmation through professional verification services.

The Synthetic Identity Problem

Synthetic identities combine real and fabricated information to create profiles that pass basic validation checks—a technique distinct from pure identity theft, which involves assuming another person's complete identity. These constructs incorporate legitimate data points—such as valid identification numbers, real addresses, or authentic educational institutions—paired with false employment or credential information.

Detection requires comprehensive verification that examines relationship consistency across data elements rather than validating components in isolation. Professional verification services employ multi-database cross-referencing to identify these patterns, which individual organizations typically cannot replicate through internal processes alone.

Remote Interview Technology Challenges

Video interview fraud has evolved beyond simple misrepresentation to include sophisticated technical manipulation. Deepfake video tools now operate in real-time, allowing fraudulent candidates to appear as different individuals during live interviews. Screen-sharing exploits enable proxy test-takers to complete technical assessments while another person appears on camera.

Organizations should implement verification platforms with built-in liveness detection and authentication capabilities rather than relying on interviewer observation alone. Professional verification services employ technical analysis—including behavioral biometrics, device fingerprinting, and multi-factor authentication—that exceed individual interviewer detection capabilities. These systematic approaches provide defensible documentation and reduce reliance on subjective human judgment that may introduce bias.

Digital Identity Verification Hiring Technology Architecture

Modern verification infrastructure operates through layered authentication protocols that address multiple fraud vectors simultaneously. The architecture combines document analysis, biometric verification, database cross-referencing, and behavioral monitoring to create comprehensive assurance.

Liveness Detection and Biometric Authentication

Basic identity verification compares photo IDs against applicant-submitted images. This approach fails against deepfakes and photo substitution. Liveness detection adds real-time verification that the person presenting credentials physically appears during the verification session.

Active liveness testing requires subjects to perform specific actions—head turns, facial expressions, or response to random prompts—that deepfake systems struggle to execute convincingly in real-time. Passive liveness analysis examines video characteristics including micro-expressions, natural eye movement, reflection patterns, and subtle color variations from blood flow under skin.

Advanced systems combine multiple verification factors:

| Verification Layer | Detection Capability | Fraud Prevention |

| Facial geometry mapping | Compares bone structure proportions against government ID photos | Prevents photo substitution and basic deepfakes |

| Behavioral biometrics | Analyzes typing patterns, mouse movements, and interaction rhythms | Identifies proxy test-takers and automated responses |

| Device fingerprinting | Tracks hardware signatures and network characteristics | Detects credential sharing and location inconsistencies |

| Document authentication | Examines security features, print quality, and material properties | Identifies forged documents and template-based fakes |

Integration with interview platforms enables continuous verification throughout hiring interactions rather than single-point authentication. The approach creates fraud complexity requiring real-time deepfake generation capability beyond current accessible technology.

Multi-Database Cross-Referencing Systems

Comprehensive verification queries multiple authoritative databases simultaneously to identify inconsistencies that single-source checks miss. The systems compare applicant-provided information against educational institution records, employment verification databases, professional licensing authorities, and public records repositories.

Real-time processing returns verification results within minutes rather than the days required for manual outreach. Automated cross-referencing identifies discrepancies immediately, flagging applications for enhanced review before proceeding through hiring stages.

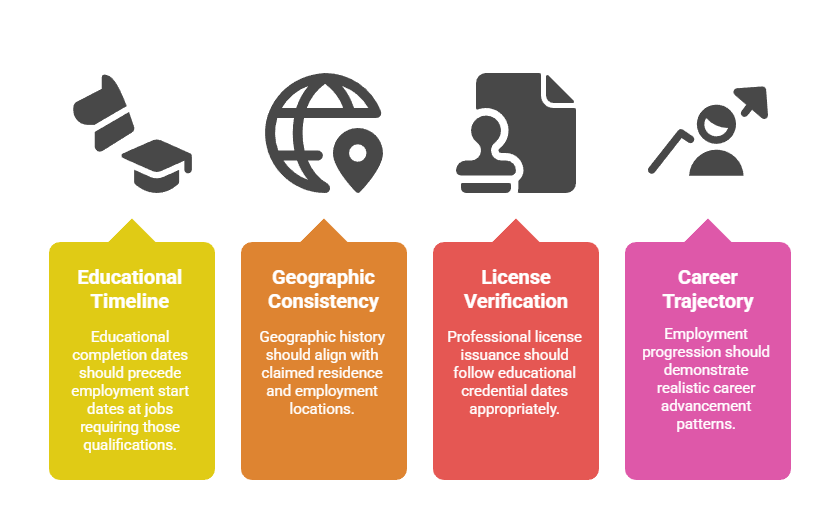

The architecture addresses synthetic identity fraud through relationship analysis. Rather than validating individual data points, the systems examine whether the complete profile demonstrates logical coherence:

- Educational completion dates should precede employment start dates at jobs requiring those qualifications

- Geographic history should align with claimed residence and employment locations

- Professional license issuance should follow educational credential dates appropriately

- Employment progression should demonstrate realistic career advancement patterns

Algorithmic analysis detects anomalies human reviewers might overlook, particularly when evaluating hundreds of applications simultaneously during high-volume recruiting cycles.

AI-Powered Employment Verification

Traditional employment verification relies on HR department callbacks to confirm dates and positions. The process creates delays, depends on responsive record-keeping, and struggles with defunct companies or organizations lacking verification infrastructure. AI-powered approaches augment direct verification with alternative data analysis.

The systems analyze digital footprints including professional social media activity, industry publication mentions, conference participation records, and patent filings to corroborate claimed employment. Machine learning algorithms assess whether online presence patterns align with stated career progression and expertise development.

Natural language processing examines communication samples—cover letters, email correspondence, writing samples—for consistency with claimed background. Red flag identification occurs automatically when employment history shows no corresponding digital footprint from the claimed timeframe, credential claims appear unsupported by professional community recognition, or timeline gaps suggest fabricated chronology.

Continuous Monitoring Protocols

Verification at a single hiring moment provides insufficient protection against evolving fraud. Continuous monitoring systems track credential validity and identity indicators throughout employment, detecting issues that emerge post-hire.

The approach addresses scenarios where legitimate credentials become invalid after verification, fraudulent documents initially pass inspection before database updates reveal problems, or identity theft victims report compromised information. Real-time alerts enable immediate response when verification status changes.

Monitoring extends to performance patterns that may indicate credential fraud. Organizations should implement monitoring transparently with clear policy communication about verification practices and data usage, after consulting legal counsel to ensure compliance with state-specific employee monitoring laws that may require explicit consent, advance notice periods, or scope limitations. Legal counsel reviews protocols for compliance with employment law, privacy regulations, and jurisdictional restrictions on employee monitoring.

Employment Screening Fraud Prevention Strategy Framework

Effective fraud prevention requires systematic approaches integrating technology, process design, and human judgment. Organizations build resilience through layered defenses that address both current threats and emerging techniques.

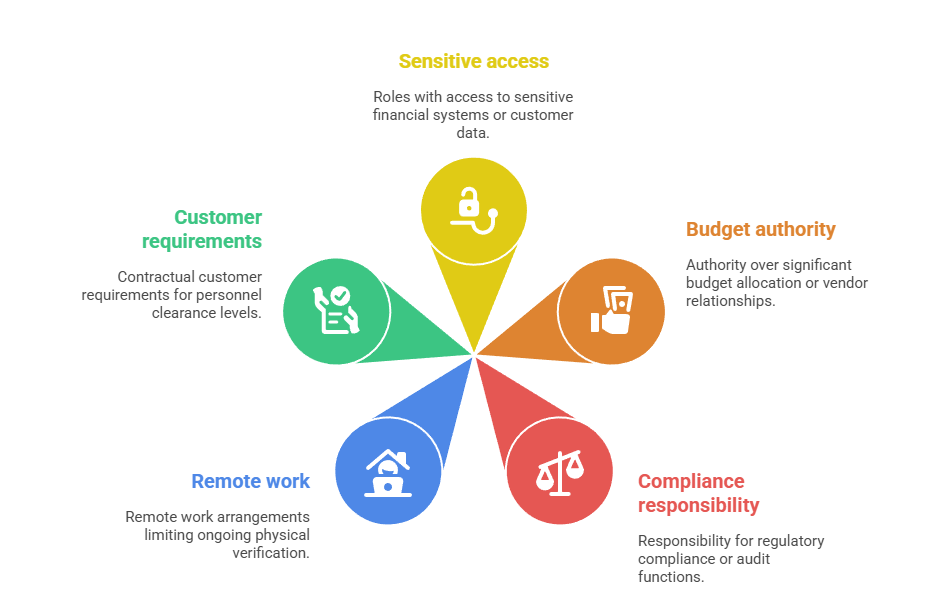

Risk-Based Verification Intensity

Not all positions warrant identical verification depth. Strategic frameworks calibrate verification thoroughness to role-specific fraud risk and organizational impact. The approach optimizes resource allocation while maintaining appropriate protection levels.

High-risk positions include:

- Roles with access to sensitive financial systems or customer data

- Authority over significant budget allocation or vendor relationships

- Responsibility for regulatory compliance or audit functions

- Remote work arrangements limiting ongoing physical verification

- Contractual customer requirements for personnel clearance levels

These roles justify comprehensive verification including direct institutional credential confirmation, detailed employment history validation through multiple sources, professional reference interviews with structured questioning protocols, and enhanced document authentication examining security features.

Moderate-risk positions employ streamlined verification addressing core credential elements without exhaustive investigation. Lower-risk roles with limited access and close supervision may utilize automated verification supplemented by selective manual review of flagged discrepancies.

Vendor Selection Criteria for Verification Services

Organizations increasingly partner with specialized verification providers offering sophisticated technology and database access beyond internal capability. Vendor evaluation should assess technical capability, compliance alignment, and operational reliability.

Critical selection factors include database coverage breadth with direct connections to educational institutions, employment verifiers, licensing authorities, and government databases rather than secondary aggregators. Verification speed should deliver real-time or near-real-time results enabling hiring timeline adherence without sacrificing thoroughness.

Fraud detection sophistication must encompass AI-powered anomaly identification, deepfake detection capability, and synthetic identity analysis. Compliance expertise should cover FCRA adherence, data privacy regulation compliance, adverse action protocols, and audit trail maintenance. Integration capability through API connectivity with applicant tracking systems, automated workflow triggers, and consolidated reporting remains essential.

Service level agreements should define verification timeframes, accuracy guarantees, support responsiveness, and dispute resolution procedures. Regular performance auditing ensures maintained standards as provider operations scale.

Training HR Teams on Appropriate Verification Practices

Technology provides critical infrastructure but human judgment remains essential. HR professionals require training in verification protocol adherence, appropriate escalation procedures when discrepancies arise, and discrimination risk awareness throughout verification processes.

Training curricula should emphasize:

- Consistent application of verification requirements across all candidates

- Proper documentation of verification steps and results

- Immediate legal counsel consultation when fraud suspicion emerges

- Distinction between verification discrepancies requiring investigation and subjective impressions that may reflect unconscious bias

Escalation protocols establish clear procedures when fraud indicators emerge. Premature accusations create legal risk while delayed response enables fraud completion. Structured approaches balance caution with appropriate investigation, involving legal counsel and specialized verification resources when warranted.

Organizations must train staff that verification focuses exclusively on factual credential confirmation—dates, titles, degrees, licenses—rather than subjective assessments of candidate demeanor, communication style, or behavioral characteristics that may correlate with protected characteristics.

AI-Powered Background Screening Competitive Advantages

Organizations implementing sophisticated verification capabilities gain strategic benefits beyond fraud prevention. Enhanced screening infrastructure enables faster hiring, improved quality, better compliance, and competitive positioning for talent acquisition.

Hiring Velocity Without Verification Compromise

Traditional thorough verification created timeline conflicts with competitive hiring markets. Comprehensive manual checks required weeks while competitors extended offers within days. Organizations chose between verification thoroughness and candidate acceptance rates.

AI-powered employment verification platforms resolve the tension through automation that maintains rigor while compressing timeframes. Real-time database queries, parallel verification processing, and automated discrepancy flagging deliver comprehensive results within 24-48 hours rather than multi-week manual processes.

Speed advantages compound in competitive talent markets where top candidates evaluate multiple offers simultaneously. Organizations completing verification rapidly while maintaining standards gain acceptance rate improvements. The capability becomes particularly critical for remote positions attracting geographically dispersed candidates expecting efficient digital processes.

Quality of Hire Improvements

Verification sophistication directly impacts hiring quality by filtering candidates relying on credential exaggeration or fabrication. Organizations report measurable performance improvements when enhanced screening eliminates fraudulent applicants who would underperform relative to represented qualifications.

Research examining companies implementing AI-powered verification found significant reductions in first-year turnover among verified hires compared to historical averages. Performance management issues declined substantially as hired candidates possessed claimed capabilities rather than fabricated credentials.

Quality improvements extend beyond fraud prevention to enhanced matching. Comprehensive verification provides reliable data for skills assessment, experience level evaluation, and culture fit analysis. Hiring decisions rest on accurate information rather than unverified candidate representations.

Compliance Risk Mitigation

Industries with regulatory credential requirements face significant exposure from hiring individuals lacking proper qualifications. Healthcare, financial services, and professional services sectors encounter licensing violations, audit failures, and regulatory sanctions when credential verification proves inadequate.

Digital credential authentication platforms providing direct institutional verification create defensible compliance documentation. Audit trails demonstrate verification attempt timing, sources queried, results obtained, and follow-up actions taken. This documentation proves critical during regulatory examinations or legal challenges.

Automated verification reduces human error in compliance-critical checks. Systems flag missing credentials, expired certifications, or incomplete verifications that manual processes might overlook under time pressure. Standardized workflows ensure consistent application of verification requirements across all candidates.

Reputational Protection

High-profile hiring fraud incidents generate significant reputational damage, particularly when fraudulent employees access sensitive information, interact with customers, or make consequential decisions. Media coverage of credential fraud cases emphasizes organizational verification failures alongside perpetrator actions.

Robust verification infrastructure prevents reputation-damaging incidents while demonstrating organizational sophistication and security consciousness. The capability becomes a positive talking point with customers, partners, and candidates valuing thorough security practices.

Remote Employee Background Screening Specialized Considerations

Remote workforce growth created verification challenges absent from traditional in-person hiring. Geographic dispersion, digital-only interactions, and ongoing authentication needs require adapted approaches and specialized capabilities.

International Credential Verification Approaches

Remote hiring often involves candidates across multiple states or internationally, each jurisdiction presenting distinct verification requirements and record access procedures. Educational credential verification in one country follows different protocols than another. Employment history confirmation requires familiarity with regional record-keeping practices.

Comprehensive platforms maintain verification relationships across jurisdictions, understanding regional nuances and access procedures. The infrastructure handles:

- International degree verification through credential evaluation services

- Employment confirmation through country-specific databases

- Identity document authentication accounting for format variations

- Compliance with jurisdiction-specific data privacy requirements

International credential verification typically requires specialized credential evaluation services translating foreign degrees into U.S. equivalency standards and confirming institutional legitimacy, though evaluation depth may vary based on institutional recognition, credential type, and position requirements. Organizations establish verification minimum standards applicable regardless of location alongside jurisdiction-specific requirements addressing local compliance mandates. Legal counsel should review international verification protocols to ensure compliance with data privacy requirements including GDPR for European candidates and similar regulations in other jurisdictions.

Ongoing Authentication Requirements

Single-point verification at hire provides insufficient assurance for remote employees working outside direct supervision. Continuous authentication protocols verify the person performing work matches the hired individual.

Approaches include periodic identity confirmation through multi-factor authentication, device fingerprinting confirming consistent hardware use, and network analysis detecting anomalous access locations. The methods balance security needs against privacy considerations and employee experience.

Organizations should implement monitoring transparently with clear policy communication about verification practices and data usage, after consulting legal counsel to ensure compliance with state-specific employee monitoring laws that may require explicit consent, advance notice periods, or scope limitations.

Digital Workspace Access Controls

Remote employees require system access to perform responsibilities, creating security considerations when identity assurance depends entirely on digital verification. Access control frameworks incorporate identity verification into permission structures.

Multi-factor authentication requirements, privileged access management for sensitive systems, session monitoring for unusual activity patterns, and automated access revocation upon employment termination create layered protection. Integration between identity verification platforms and access management systems enables real-time credential status updates affecting system permissions.

Zero-trust architecture principles treat all access requests as potentially requiring verification regardless of apparent origin. Continuous verification of identity, device integrity, and session legitimacy occurs throughout work activities rather than assuming initial authentication provides ongoing assurance.

Implementation Considerations

Organizations transitioning to enhanced verification should begin with comprehensive assessment of current practices, identifying gaps in fraud detection capability and compliance adherence. Legal counsel should participate in initial planning to ensure proposed verification enhancements comply with FCRA requirements, privacy regulations, and anti-discrimination law.

Technology platform selection requires evaluation of vendor FCRA compliance, data security practices, and technical capabilities. Vendor contracts must clearly allocate data protection responsibilities, establish security requirements, and define breach notification procedures. Organizations should request vendor compliance certifications, security audit reports, and customer references from similar industries.

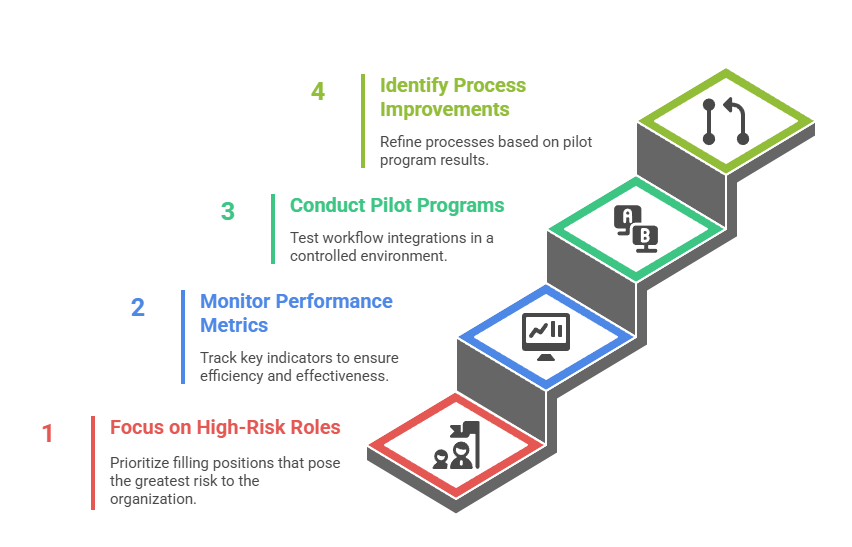

Phased implementation allows operational refinement while managing change:

- Begin with highest-risk positions before enterprise expansion

- Monitor performance metrics including completion timeframes, false positive rates, and candidate experience

- Pilot programs enable testing of workflow integrations

- Identify process improvements before full deployment

All verification procedures require thorough documentation establishing legitimate business justification, consistent application protocols, and adverse action compliance procedures. Regular legal compliance auditing ensures maintained standards as programs mature. Documentation should demonstrate that verification requirements apply uniformly across candidates and relate directly to position requirements.

Legal and Compliance Considerations in Digital Verification

Enhanced verification practices must align with employment law, privacy regulations, and consumer protection statutes. Non-compliant verification approaches create legal exposure potentially exceeding fraud prevention benefits.

FCRA Compliance in Third-Party Verification

Organizations using consumer reporting agencies for background screening generally must comply with Fair Credit Reporting Act requirements governing disclosure, authorization, and adverse action procedures, though specific obligations vary based on organizational structure, screening methods employed, and applicable court interpretations. Digital verification platforms often constitute consumer reporting agencies under FCRA definitions, triggering compliance obligations.

Proper implementation requires clear written disclosure that consumer reports will be obtained for employment purposes, separate standalone authorization from candidates before obtaining reports, and structured adverse action procedures when verification results lead to hiring denials.

Adverse action protocols include pre-adverse action notice providing verification report copies and dispute rights information, reasonable waiting periods (commonly 5-7 business days, though legal minimums vary) allowing candidate response, and final adverse action notices specifying verification basis for decisions. Documentation proves compliance during regulatory examinations or legal challenges. Organizations should consult legal counsel regarding specific FCRA requirements, as technical violations can result in significant statutory damages even absent actual harm to candidates.

Data Privacy and Retention Requirements

Verification processes collect extensive personal information subject to privacy law restrictions on collection, use, retention, and protection. State privacy statutes including California Consumer Privacy Act and emerging comprehensive privacy laws in Virginia, Colorado, and other jurisdictions impose handling requirements that vary by location.

Compliant practices generally limit data collection to employment-related verification needs, restrict data sharing to authorized purposes, implement appropriate security protections against unauthorized access, and establish retention schedules deleting verification data after legitimate business needs expire, though organizations should consult legal counsel to balance competing retention obligations under employment law, privacy statutes, and potential litigation holds.

Vendor contracts must address data processing responsibilities, security requirements, breach notification procedures, and deletion obligations. Organizations maintain liability for vendor data handling practices, requiring due diligence on provider security capabilities and compliance infrastructure.

Discrimination Risk Mitigation and Disparate Impact Analysis

Organizations must exercise caution to ensure fraud detection protocols do not create discriminatory impact. Verification requirements, fraud indicators, and enhanced scrutiny triggers should be validated through disparate impact analysis before implementation. Factors that appear facially neutral—such as document format variations, international credential structures, or non-standard career progression patterns—may correlate with protected characteristics including national origin, disability status, or age.

Legal counsel should review all verification protocols before deployment, and organizations should maintain statistical monitoring of verification outcomes across demographic categories. Any indicators of disproportionate impact require immediate investigation and remediation, even absent intentional discrimination. The legal standard focuses on outcome disparities, not intent.

Risk mitigation includes:

- Analyzing verification false positive rates across demographic categories

- Ensuring database coverage includes institutions serving diverse populations

- Providing clear dispute mechanisms for verification errors

- Documenting legitimate business justification for verification requirements

International credential verification requires particular attention to ensure foreign educational institutions and employment history receive equivalent treatment to domestic verification. Blanket rejection of international credentials without individualized verification assessment creates discrimination risk and may violate national origin discrimination prohibitions.

Measuring Verification Program Effectiveness

Organizations assess verification infrastructure performance through metrics addressing fraud detection, operational efficiency, compliance adherence, and business impact.

Fraud Detection and Prevention Metrics

Primary effectiveness measures focus on verification capability to identify fraudulent credentials and suspicious applications. Key performance indicators include:

- Fraud detection rate: Percentage of applications flagged for credential discrepancies or identity anomalies during verification

- False positive rate: Proportion of flagged applications ultimately verified as legitimate

- Fraud confirmation rate: Percentage of flagged applications confirmed as fraudulent upon investigation

Trending analysis monitors whether detection rates change over time, potentially indicating evolving fraud techniques requiring verification protocol updates. Benchmark comparison against industry averages provides performance context where available.

Operational Efficiency Indicators

Verification infrastructure should maintain or improve hiring efficiency while enhancing fraud detection. Operational metrics include:

- Average verification completion time: Measured in days from verification initiation to results delivery

- Time-to-hire impact: Change in overall hiring duration attributable to verification processes

- Candidate experience scores: Feedback ratings on verification process clarity and communication

Efficiency improvements demonstrate verification program maturity as automation increases, workflow integration improves, and false positive rates decline through threshold optimization.

Compliance and Risk Metrics

Verification programs carry compliance obligations requiring monitoring and audit trail maintenance. Tracking indicators include:

- Adverse action protocol compliance rate: Percentage of adverse hiring decisions following proper FCRA procedures

- Verification documentation completeness: Proportion of hires with complete verification records meeting retention requirements

- Vendor SLA compliance: Third-party verification provider adherence to contracted performance standards

Proactive compliance monitoring prevents violations that create legal exposure and regulatory penalties. Documentation quality ensures defensibility during audits or legal challenges.

Future Trends in Identity Verification Technology

The verification landscape continues evolving as fraud techniques advance and new technologies emerge. Organizations maintaining fraud resilience must anticipate coming developments and prepare adaptive strategies.

Decentralized Credential Verification

Blockchain-based credential systems enabling direct verification from issuing institutions without intermediary database queries represent emerging infrastructure. Educational institutions and professional licensing bodies increasingly issue digital credentials with cryptographic verification enabling instant authenticity confirmation.

The approach reduces verification cost and timeline while improving accuracy through direct institutional validation. Organizations adopting decentralized verification infrastructure gain efficiency advantages while positioning for broader credential ecosystem evolution. Implementation requires technical capability to verify cryptographic signatures, relationships with institutions issuing blockchain credentials, and fallback procedures for credentials not yet available in decentralized formats.

Behavioral Biometrics Expansion

Identity verification increasingly incorporates behavioral analysis examining typing patterns, mouse movements, and device interaction characteristics unique to individuals. The techniques provide continuous authentication beyond single-point verification at application or interview stages.

Behavioral biometric monitoring during pre-hire assessments and skills testing identifies proxy test-takers or credential sharing. Privacy considerations require transparent disclosure, legitimate business justification, and appropriate data protection for behavioral biometric information. Legal review ensures compliance with biometric privacy laws in jurisdictions including Illinois (BIPA), Texas, Washington, and other states with biometric data regulations, as this legal landscape continues evolving through 2025.

AI Detection and Generation Technology Evolution

Deepfake generation technology and detection capabilities exist in ongoing competition. As detection methods improve, fraud techniques adapt to circumvent new controls. Organizations must anticipate continuing sophistication in synthetic media and maintain verification infrastructure capable of addressing emerging manipulation methods.

Strategies include partnerships with verification providers investing heavily in detection research, participation in industry information sharing about emerging fraud techniques, regular assessment of verification effectiveness against latest fraud methods, and layered defenses incorporating multiple detection approaches.

The approach acknowledges no single verification method provides permanent sufficiency. Adaptive frameworks incorporating new detection capabilities as they emerge maintain protection as fraud techniques evolve.

Conclusion

Digital identity verification hiring has transformed from administrative credential checking to sophisticated fraud detection addressing AI-manipulated credentials and synthetic identities. Organizations implementing layered verification infrastructure combining document authentication, biometric analysis, and comprehensive database cross-referencing gain protection against emerging threats while achieving competitive advantages in hiring velocity, quality, and compliance. Strategic verification programs balance fraud prevention sophistication with legal compliance requirements, ensuring protocols detect fraudulent credentials without creating discriminatory impact on legitimate candidates.

Frequently Asked Questions

What is the average cost impact of implementing AI-powered identity verification systems for hiring?

As of 2025, mid-sized organizations typically invest between $15,000 and $50,000 annually for comprehensive verification platforms covering applicant volume of 500-2,000 hires yearly. Enterprise implementations serving higher volumes generally range from $75,000 to $200,000 depending on verification depth, integration complexity, and included features. Cost-benefit analysis should compare platform expenses against prevented fraud losses, with single prevented fraudulent hire often exceeding annual platform costs when accounting for salary, training investment, and operational disruption.

How do verification requirements differ between remote and on-site positions?

Remote positions generally warrant enhanced identity verification including liveness detection during video interviews, continuous authentication monitoring work patterns, and stricter document validation given reduced in-person interaction opportunities. On-site roles benefit from physical presence verification and ongoing supervision providing natural authentication, potentially allowing somewhat streamlined initial verification. Both position types require comprehensive credential validation, but remote arrangements may justify additional ongoing verification given physical access limitations.

What legal obligations apply when verification identifies potentially fraudulent credentials?

Organizations generally must follow FCRA adverse action procedures when using consumer reports for hiring decisions. Specific requirements vary based on verification methods employed and jurisdictional requirements. Legal counsel should review adverse action procedures to ensure compliance with applicable federal, state, and local requirements, as technical FCRA violations can result in significant statutory damages even absent actual harm. Documentation should focus on factual verification discrepancies rather than making fraud accusations that may create defamation risk.

How frequently should organizations update verification protocols to address emerging fraud techniques?

Verification procedures warrant formal review every 12-18 months to incorporate new fraud detection capabilities and address emerging threat patterns, though specific timing varies by industry and organizational risk profile. Organizations should monitor industry fraud trend reporting quarterly and implement interim protocol updates when significant new threats emerge. Vendor partnerships providing automatic detection algorithm updates may reduce manual protocol revision burden while maintaining current protection levels.

What verification approaches work for candidates with international credentials or employment history?

International verification typically requires specialized credential evaluation services translating foreign degrees into U.S. equivalency standards and confirming institutional legitimacy, though evaluation depth may vary based on institutional recognition and position requirements. Employment verification depends on country-specific databases and verification procedures, with some jurisdictions offering limited electronic verification infrastructure requiring direct employer contact. Organizations should partner with verification providers maintaining international institutional relationships and understanding regional verification protocols rather than attempting direct foreign verification internally.

How do organizations ensure verification practices comply with anti-discrimination requirements?

Verification protocols require disparate impact analysis before implementation to identify requirements that may disproportionately affect protected categories. Organizations should maintain statistical monitoring of verification outcomes across demographic groups, provide clear dispute mechanisms for verification errors, and ensure database coverage includes institutions serving diverse populations. Legal counsel should review all verification procedures, and international credentials must receive equivalent treatment to domestic verification to avoid national origin discrimination.

Additional References

- FCRA Compliance Guide for Employment Screening

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-employers-need-know - EEOC Guidance on Background Checks and Employment Decisions

https://www.eeoc.gov/laws/guidance/enforcement-guidance-consideration-arrest-and-conviction-records-employment-decisions - Professional Background Screening Association Best Practices

https://www.pbsa.org - SHRM Foundation Report on Background Screening Practices

https://www.shrm.org/topics-tools/news/hr-magazine/background-screening-practices-2025 - National Consumer Law Center - Fair Credit Reporting Act Resources

https://www.nclc.org/issues/fair-credit-reporting-act.html

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.