Employment credit checks remain a complex legal minefield where federal protections intersect with expanding state and local restrictions, creating compliance challenges for employers who must navigate varying jurisdictions while job seekers face potential discrimination based on financial history. This comprehensive guide examines the Fair Credit Reporting Act's requirements, state-by-state restrictions, permissible use cases, and strategic compliance frameworks to help HR professionals mitigate legal risk while enabling informed career decisions for applicants.

Key Takeaways

- The Fair Credit Reporting Act requires employers to obtain written consent before conducting credit checks and provide adverse action notices if credit information influences hiring decisions.

- Eleven states and numerous cities have enacted laws restricting employment credit checks, with most prohibiting their use unless the position involves financial responsibilities, security clearances, or access to sensitive information.

- Employers face penalties ranging from $100 to $16,000 per violation under FCRA, plus potential state-specific fines, class action lawsuits, and reputational damage for non-compliance.

- Credit checks disproportionately affect minority candidates and those recovering from medical debt or economic hardship, creating potential discrimination liability under Title VII and state fair employment laws.

- Permissible use cases typically include executive positions, roles with fiduciary responsibilities, law enforcement, financial services positions, and jobs requiring security clearances.

- Job seekers have rights to dispute inaccurate credit information, receive copies of reports used in employment decisions, and understand the specific reasons for adverse actions.

- Companies including Amazon, Walmart, and several major banks have faced class action lawsuits totaling millions in settlements for improper credit check procedures.

- Best practices include implementing position-specific assessment matrices, documenting business necessity, training HR staff on multi-jurisdictional compliance, and establishing consistent adverse action procedures.

Understanding the Fair Credit Reporting Act and Employment Rights

The Fair Credit Reporting Act, enacted in 1970 and substantially amended in 2003, establishes the federal framework governing how employers can use consumer reportsâÂÂincluding credit reportsâÂÂin employment decisions. This landmark legislation balances employer interests in screening candidates against individual privacy rights and protection from inaccurate information. As of 2025, FCRA violations have resulted in over $800 million in settlements across employment-related cases.

Core FCRA Requirements for Employers

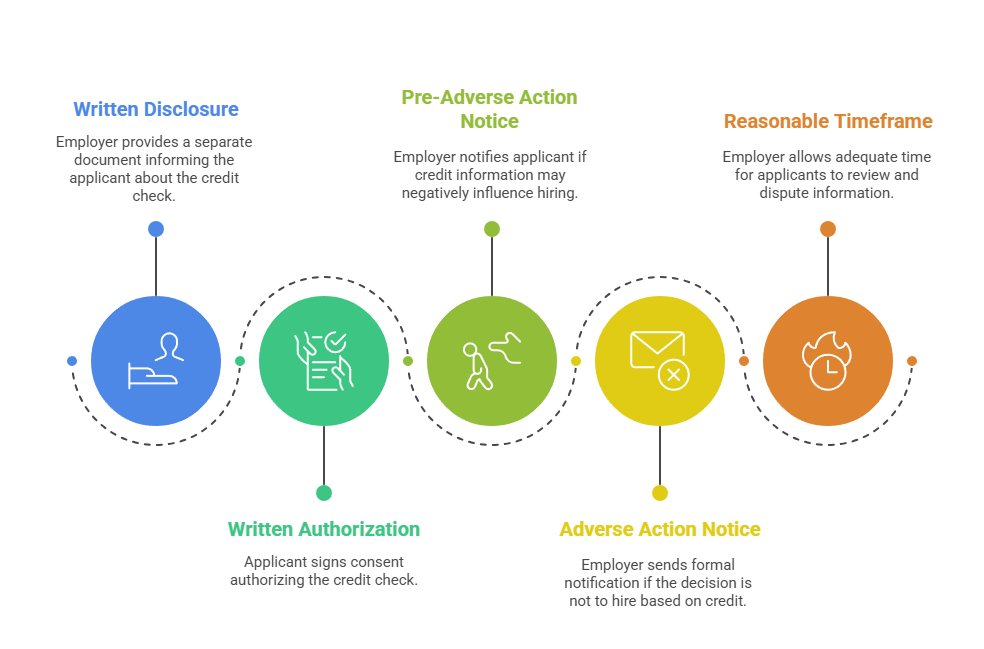

Before obtaining a credit report for employment purposes, employers must satisfy specific procedural requirements that create a documented consent trail. The process involves disclosure, authorization, and adverse action protocols that protect applicant rights. Federal law mandates employers follow a specific sequence.

- Written Disclosure: Employers must provide a standalone document informing the applicant that a credit report may be obtained, separate from the job application.

- Written Authorization: Applicants must sign consent specifically authorizing the credit check before any inquiry occurs.

- Pre-Adverse Action Notice: If credit information may negatively influence hiring decisions, employers must provide the applicant with a copy of the report and a summary of FCRA rights before taking action.

- Adverse Action Notice: After making a final decision not to hire based on credit information, employers must send formal notification identifying the consumer reporting agency and informing the applicant of their right to dispute report accuracy.

- Reasonable Timeframe: Employers must allow adequate time between pre-adverse action notice and final decision for applicants to review and dispute information.

Violations expose employers to statutory damages of $100 to $1,000 per violation, actual damages, attorney's fees, and in willful cases, punitive damages. The Consumer Financial Protection Bureau reported investigating over 340 employment-related FCRA complaints in 2024 alone.

Behind every credit report is a story (and sometimes, a struggle). As HR professionals, we walk a fine line between compliance and compassion, legality and humanity. The Fair Credit Reporting Act protects both sides, but the best protection is empathy: taking the time to ask, âÂÂDoes this data really reflect someoneâÂÂs ability to do the job?â When we approach screening with curiosity, not judgment, we build trust before we ever make a hire.

What Employment Credit Checks Actually Reveal

Employment credit checks differ substantially from credit checks conducted for lending purposes. They contain information relevant to financial responsibility but exclude credit scores in most cases. Understanding what information appears helps both employers assess relevance and job seekers prepare for potential concerns.

An employment credit report typically includes payment history showing whether accounts are current or delinquent, outstanding debt amounts and credit utilization, accounts in collections or charged-off status, bankruptcies filed within the past ten years, tax liens and civil judgments, and credit inquiry history. Employment reports do not include credit scores, account numbers (truncated for security), birth dates (only year of birth), or spousal information. Employers cannot legally claim they rejected candidates based on low credit scores since the score doesn't appear.

Employee Rights and Dispute Procedures

The FCRA grants job seekers substantial rights to ensure credit information accuracy and fair use in employment contexts. Applicants have the right to know when credit checks will occur, receive copies of any credit report obtained by employers, and obtain a free copy if adverse action is taken. They can dispute inaccurate information with both the consumer reporting agency and information furnishers, sue employers for FCRA violations, and place fraud alerts or security freezes on credit files.

When disputing credit report information, job seekers should immediately contact the consumer reporting agency in writing with specific disputed items and supporting documentation. Agencies must investigate within 30 days and correct or delete inaccurate information. If employers take adverse action based on disputed information still under investigation, applicants have stronger grounds for legal challenges.

State-by-State Credit Check Restrictions and Compliance Matrix

While the FCRA establishes federal baseline protections, state and local jurisdictions have increasingly restricted employment credit checks beyond federal requirements. As of 2025, eleven states plus Washington D.C. and numerous cities have enacted laws limiting when employers can access credit information. This creates a complex compliance landscape for multi-state employers.

States with Comprehensive Credit Check Bans

Several states have implemented broad prohibitions on employment credit checks with limited exceptions for specific position types. These states represent the most restrictive environments where employers must carefully justify business necessity. Most statutes contain nuanced exception language requiring careful legal review.

| State | Year Enacted | Key Exceptions | Penalties |

| California | 2011 | Managerial positions, sworn peace officers, positions with regular access to sensitive financial information | $100-$1,000 per violation plus actual damages |

| Colorado | 2013 | Executive/management, access to confidential financial information, signatory power for contracts over $10,000 | Civil action for actual damages and attorney fees |

| Connecticut | 2011 | Financial institutions, managerial positions requiring expense approval, security clearance positions | Civil penalties plus private right of action |

| Hawaii | 2009 | Managerial or supervisory employees, access to confidential financial information, financial institutions | Unfair labor practice complaint |

| Illinois | 2010 | Financial institutions, signatory authority positions, access to confidential financial information | Civil penalties up to $2,500 plus actual damages |

| Maryland | 2011 | Security clearance positions, financial information access, executive positions with fiduciary responsibilities | Civil action for damages and injunctive relief |

The remaining states with restrictions include Nevada (2013), Oregon (2010), Vermont (2012), Washington (2007), and Delaware (2014). These restrictions reflect growing recognition that credit history often reflects economic circumstances beyond individual control.

Municipal and Local Ordinances

Beyond state laws, major cities have enacted local ordinances restricting employment credit checks, creating additional compliance layers. These local laws often apply to employers with facilities or positions located within city limits, regardless of company headquarters location. Local ordinances frequently impose stricter penalties than state laws.

New York City prohibits credit checks with narrow exceptions for police officers, positions requiring security clearance or financial fiduciary responsibilities, and positions with regular access to trade secrets. Philadelphia maintains similar restrictions, while Chicago's ordinance applies to all positions except those involving financial responsibilities, confidential information access, or unsupervised access to children or vulnerable adults. New York City assesses fines up to $500 for initial violations and $1,000 for subsequent violations within two years.

Permissible Use Exceptions Across Jurisdictions

Despite varying restriction frameworks, common permissible use exceptions emerge across state and local laws reflecting consensus about positions where credit information presents legitimate business concerns. Understanding these exceptions helps employers develop defensible screening policies.

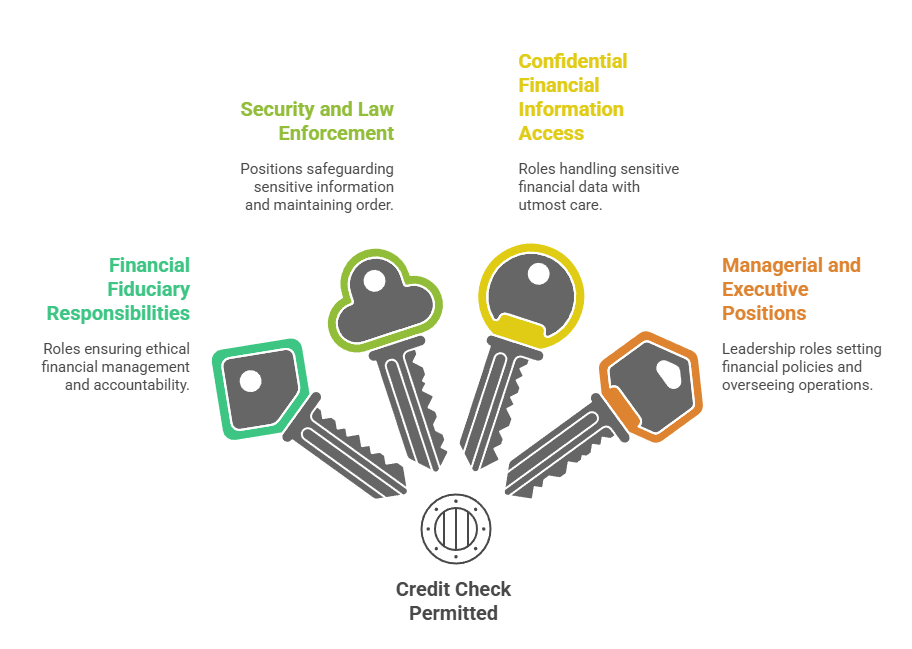

Most jurisdictions permit credit checks for positions involving these characteristics:

- Financial Fiduciary Responsibilities: Executive officers, signatory authority over company accounts, expense approval above specified thresholds, treasury and accounting positions with banking access.

- Security and Law Enforcement: Positions requiring federal or state security clearances, sworn law enforcement officers, security personnel with access to sensitive facilities, Department of Justice employees.

- Confidential Financial Information Access: Roles with regular access to customer financial data, proprietary financial information, trade secrets with economic value, IT personnel with administrative access to financial systems.

- Managerial and Executive Positions: Upper-level management with significant operational authority, hiring and firing authority, executives setting financial policy, board members of financial institutions.

The specific scope varies by jurisdiction, with some states defining "managerial" broadly while others require specific fiduciary duties. Employers should document how each position meets exception criteria before conducting credit checks in restricted jurisdictions.

When Employers Can Legally Check Credit Reports

Even in jurisdictions without statutory restrictions, employers cannot conduct credit checks arbitrarily. Both federal law and discrimination liability require demonstrating legitimate business necessity. Understanding when credit information presents job-relevant concerns helps employers develop defensible screening criteria.

Establishing Business Necessity and Job Relatedness

Legal employment credit checks require demonstrating clear connections between credit information and essential job functions drawn from both FCRA requirements and EEOC guidance. Courts consistently hold that employers must show specific business reasons justifying credit screening rather than applying blanket policies.

Employers should evaluate whether positions involve direct financial responsibilities such as handling cash, processing payments, or managing budgets. They should also consider access to financial accounts or banking information requiring trust and integrity. Additionally, fiduciary duties where employees make financial decisions affecting company or client assets matter. Access to valuable property or confidential information with theft or fraud risk is also relevant.

The FTC and CFPB emphasize that employers must articulate why credit history predicts performance or integrity specifically for the position in question. Generic concerns about "trustworthiness" without connection to financial temptation fail this standard. Checking credit for warehouse workers with no cash handling responsibilities would likely be deemed unnecessary and potentially discriminatory.

Industry-Specific Credit Check Standards

Certain industries face heightened scrutiny regarding financial responsibility, making employment credit checks standard practice and legally defensible. Regulatory frameworks and bonding requirements in these sectors create clear business necessity justifications. Financial services institutions including banks, credit unions, investment firms, and insurance companies routinely conduct credit checks for virtually all positions.

The Financial Industry Regulatory Authority (FINRA) requires member firms to conduct background checks including credit reports for registered representatives. Federal banking regulators expect financial institutions to assess employee financial stability as part of operational risk management. Security and law enforcement positions including police officers, federal agents, and Department of Defense employees typically require credit checks as part of comprehensive background investigations for security clearances.

Discrimination Risks and Disparate Impact Concerns

Employment credit checks create significant discrimination liability because credit problems disproportionately affect protected classes including racial minorities, women, older workers, and individuals with disabilities. The EEOC has pursued numerous cases alleging that credit check policies produce unjustified disparate impact.

Protected Class Disparities in Credit Histories

Research consistently demonstrates that credit problems correlate with membership in protected classes. This raises concerns that credit-based employment decisions function as proxies for illegal discrimination even when employers lack discriminatory intent. These disparities create legal vulnerability under Title VII and state fair employment laws.

The Urban Institute found that 54% of Black consumers and 46% of Hispanic consumers have collections debt compared to 31% of white consumers. Women are more likely than men to experience credit damage following divorce, while older workers recovering from recession-era job losses often carry credit scars from unemployment periods. Medical debt represents a particularly problematic factor, as serious illness can devastate credit regardless of employment qualifications.

These disparities mean that credit-based employment criteria will statistically screen out protected class members at higher rates. Under disparate impact theory, employers must prove such criteria are job-related and consistent with business necessityâÂÂa challenging standard when credit problems often reflect economic circumstances rather than character.

EEOC Guidance and Enforcement Actions

The Equal Employment Opportunity Commission has issued guidance warning employers about discrimination risks in background check policies, including credit checks. In its 2012 guidance on criminal background checks (applicable by analogy to credit checks), the EEOC emphasized that employers must show individualized assessment.

The Commission specifically warned against policies that automatically disqualify applicants based on credit problems without considering the nature, severity, and recency of issues. Employers should conduct regular adverse impact analyses of their credit check policies, examining whether applicants from protected classes are rejected at significantly higher rates than other applicants.

Implementing Individualized Assessment Procedures

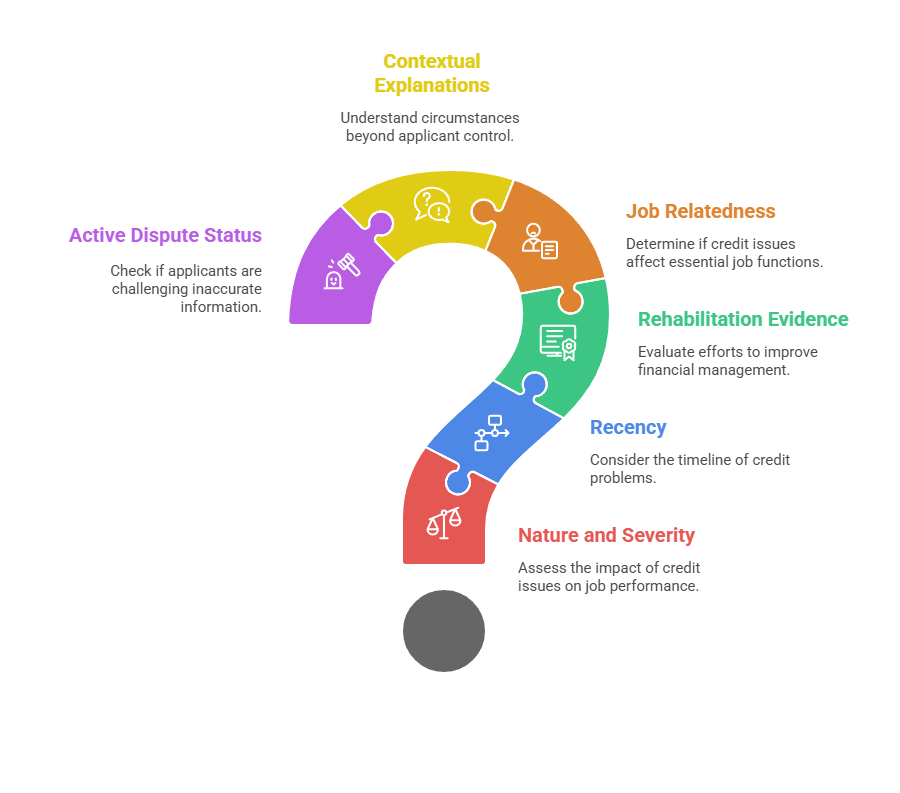

Rather than categorical exclusions based on credit problems, best practices involve individualized assessment that considers the nature and relevance of credit issues. This approach reduces discrimination risk while enabling employers to address legitimate concerns.

Effective individualized assessment includes evaluating these key factors:

- Nature and Severity: Minor delinquencies versus major bankruptcies or fraud patterns.

- Recency: Problems from five years ago versus ongoing delinquencies.

- Rehabilitation Evidence: Improved financial management, credit counseling participation, or debt management plans.

- Job Relatedness: Connection between specific credit issues and essential job functions.

- Contextual Explanations: Medical debt, identity theft, divorce, unemployment, or other circumstances beyond applicant control.

- Active Dispute Status: Whether applicants are currently challenging inaccurate information.

Documentation becomes critical in individualized assessment, with employers maintaining written explanations of how specific credit factors relate to job requirements.

Real-World Case Studies and Legal Consequences

Understanding theoretical compliance requirements becomes concrete when examining actual cases where employers faced legal consequences. These examples illustrate common mistakes and their financial, legal, and reputational costs.

Major Settlement Cases and Enforcement Actions

Amazon Employment Screening Lawsuit (2020-2021): Amazon faced a class action lawsuit alleging the company violated California's credit check restrictions by conducting credit checks on warehouse workers and delivery drivers. The case argued these positions didn't fall under statutory exceptions, making the credit checks illegal. Amazon settled for an undisclosed amount and agreed to revise its screening policies.

Walmart Pre-Employment Screening Litigation (2019): Walmart encountered legal challenges alleging the company failed to provide proper adverse action notices. The lawsuit claimed thousands of applicants received inadequate notice about credit-based rejections, violating FCRA's procedural requirements. The case settled with Walmart agreeing to policy modifications and applicant notification improvements.

Financial Services Firm FCRA Violations (2018): A major financial services company paid $3.5 million to settle FTC allegations that it failed to provide legally required disclosure and authorization forms. The company used a combined application and authorization document rather than the standalone disclosure required by FCRA.

Lessons from Compliance Failures

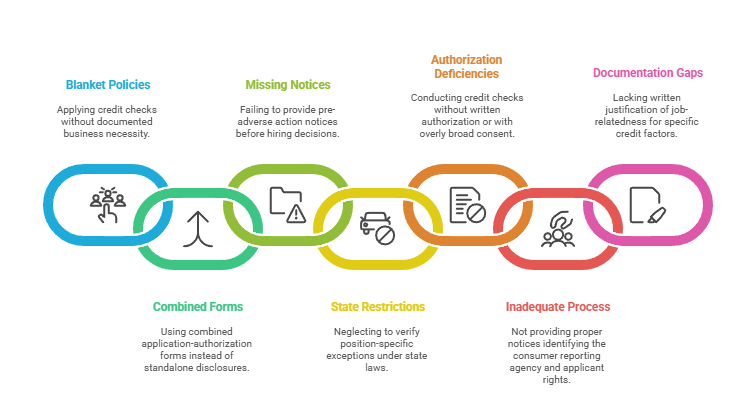

Analyzing enforcement actions reveals predictable patterns in employer mistakes that create legal vulnerability. Learning from these failures helps companies avoid similar pitfalls.

The most common compliance failures include:

- Blanket Policies: Applying credit checks broadly without documenting business necessity for each role.

- Combined Forms: Using combined application-authorization forms instead of standalone credit check disclosures.

- Missing Pre-Adverse Action Notices: Failing to provide required notices before making final hiring decisions.

- Ignoring State Restrictions: Neglecting to verify position-specific exceptions under state laws.

- Authorization Deficiencies: Conducting credit checks without written authorization or with overly broad consent language.

- Inadequate Adverse Action Process: Not providing proper notices identifying the consumer reporting agency and applicant rights.

- Documentation Gaps: Lacking written justification of job-relatedness for specific credit factors.

Organizations should implement compliance audits examining authorization forms, adverse action procedures, position classifications, state-specific policy variations, and training materials.

Best Practices for Employers and Compliance Frameworks

Developing comprehensive compliance frameworks requires understanding both legal requirements and practical implementation challenges. Strategic approaches balance legitimate screening interests with legal risk mitigation.

Developing Position-Specific Screening Policies

Employers should categorize positions into screening tiers based on financial responsibilities, confidential information access, and regulatory requirements. This tiered methodology ensures credit checks occur only where genuine business necessity exists.

Position categories include:

- Tier 1 - Comprehensive Credit Checks: Executives with budget control, accounting personnel with banking access, positions requiring signatory authority, treasury and financial planning roles.

- Tier 2 - Focused Credit Screening: Supervisors with expense approval authority, employees handling cash or payment processing, customer service roles with limited financial system access.

- Tier 3 - No Credit Checks: Positions without financial responsibilities, roles lacking access to confidential financial information, general warehouse or production positions, entry-level customer service without payment processing.

For each tier, employers should document specific job duties requiring credit checks, identify which credit factors relate to those duties, list applicable state and local restrictions, and establish decision criteria. This documentation serves as evidence of business necessity.

Training HR Personnel on Multi-Jurisdictional Compliance

Credit check compliance requires specialized knowledge that many HR generalists lack. Effective training should cover FCRA procedural requirements including disclosure, authorization, and adverse action protocols. It should also address state-by-state restriction variations and how to identify applicable laws.

Training should include exception criteria, discrimination risk factors and disparate impact concerns, individualized assessment procedures, and documentation requirements. Organizations should designate compliance specialists with primary responsibility for credit check policy development and legal research on jurisdictional requirements.

Alternative Screening Methods and Risk Mitigation

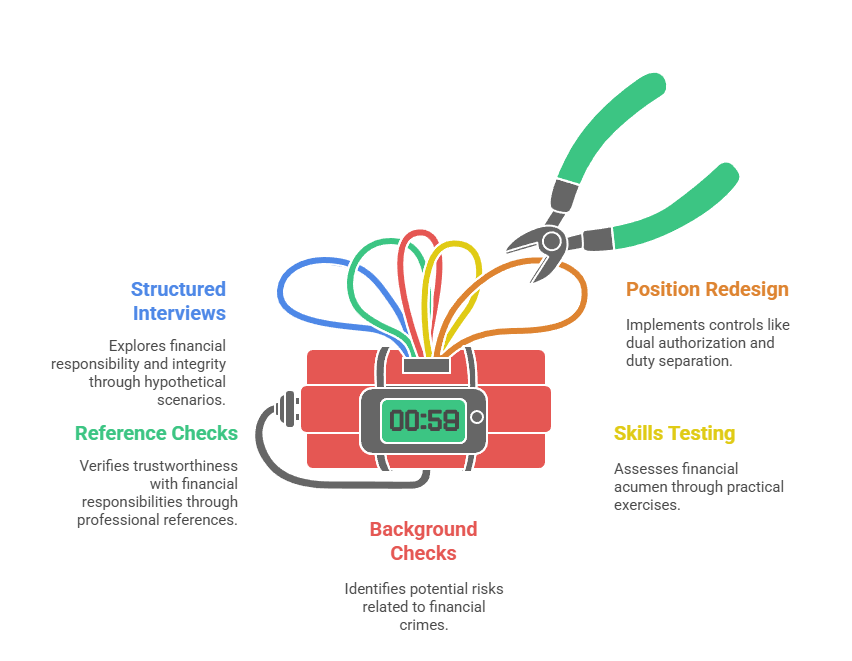

Forward-thinking employers are reconsidering whether credit checks provide sufficient value to justify discrimination risks and compliance complexity. Alternative approaches include:

- Structured Behavioral Interviews: Questions exploring financial responsibility and integrity in hypothetical scenarios relevant to position duties.

- Targeted Reference Checks: Professional references specifically addressing trustworthiness with financial responsibilities.

- Financial Crime Background Checks: Criminal background checks focused on fraud, embezzlement, or theft.

- Skills Testing: For positions requiring financial acumen, practical case studies and financial analysis exercises.

- Position Redesign: Implementing dual authorization requirements, separating cash handling and reconciliation duties, or enhancing oversight controls.

These alternatives can reduce theft and fraud risk without excluding qualified candidates whose credit problems stem from circumstances unrelated to workplace integrity.

Guidance for Job Seekers Facing Credit Check Barriers

Job seekers navigating credit check barriers need practical strategies. Proactive approaches can minimize credit-related employment obstacles.

Preparing for Employment Credit Checks

Individuals should obtain free annual credit reports from all three major credit bureaus through AnnualCreditReport.com. They should review for accuracy and identify potential red flags employers might question. Many people discover errorsâÂÂdisputed debts, accounts belonging to someone else, incorrect payment historiesâÂÂthat can be corrected before employment screening.

When credit reports contain legitimate negative information, preparing concise explanations demonstrates accountability. Effective explanations briefly describe the circumstances that led to credit problems, outline steps taken to address the issues, and provide evidence of current financial stability. Job seekers should understand that employment credit reports don't include credit scores, focusing instead on payment patterns, outstanding debts, and public records.

Challenging Improper Credit Checks and Asserting Rights

When employers conduct credit checks without proper authorization or fail to provide required notices, job seekers can assert legal rights through specific procedures. Understanding these rights empowers applicants to identify and challenge violations.

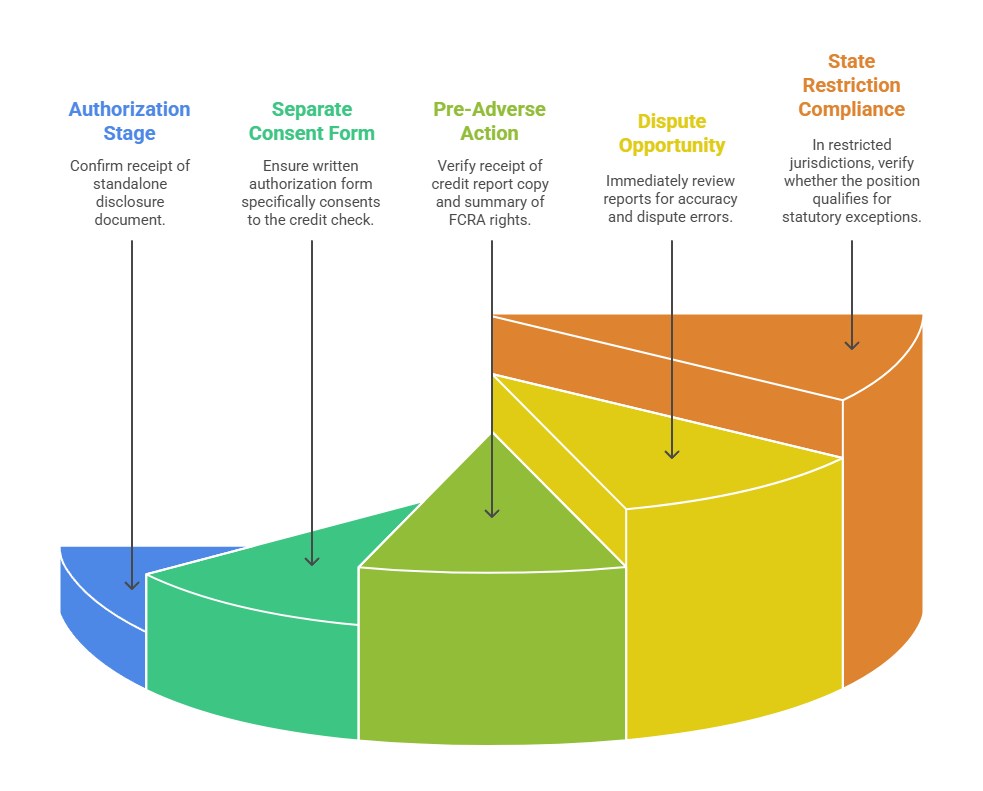

Job seekers should verify proper procedures at each stage:

- Authorization Stage: Confirm receipt of standalone disclosure document clearly stating a credit report may be obtained, separate from job application materials.

- Separate Consent Form: Ensure written authorization form specifically consents to the credit check without being combined with other documents.

- Pre-Adverse Action: If credit influenced the decision, verify receipt of credit report copy and summary of FCRA rights before final decision.

- Dispute Opportunity: Immediately review reports for accuracy and dispute errors with both consumer reporting agencies and employers.

- State Restriction Compliance: In restricted jurisdictions, verify whether the position qualifies for statutory exceptions.

Applicants facing violations can file complaints with state labor departments, attorneys general offices, or the Consumer Financial Protection Bureau.

Resources for Credit Repair and Financial Counseling

Job seekers facing legitimate credit problems should explore resources for credit repair. Nonprofit credit counseling agencies accredited by the National Foundation for Credit Counseling provide free or low-cost services including budget counseling, debt management plans, and credit report review.

For medical debt, individuals should verify that bills were correctly processed through insurance and request itemized billing. They can negotiate payment plans or discounts directly with providers and explore hospital financial assistance programs. Identity theft victims should place fraud alerts on credit files, file police reports, and dispute fraudulent accounts with credit bureaus.

Conclusion

Navigating employment credit check barriers requires understanding the intersection of federal FCRA requirements, expanding state restrictions, discrimination risks, and legitimate business interests. Employers who implement position-specific screening policies, maintain multi-jurisdictional compliance, and conduct individualized assessments can effectively manage risk. Job seekers who proactively review their credit histories, prepare contextual explanations, and assert their legal rights can minimize credit-related employment obstacles. As legislative trends continue restricting employment credit checks absent clear business necessity, both employers and job seekers benefit from informed approaches. But in the end, compliance should not mean compromise on compassion. There is a human behind every application, facing real-world budgetary problems, and we, in the leadership of human resources, can take regulation and make it humane and fair. When we find the right balance between accountability and understanding, we simultaneously safeguard our companies while restoring faith in our hiring process.

Frequently Asked Questions

Can employers check my credit without permission?

No, federal law requires employers to obtain your written authorization before accessing your credit report for employment purposes. This authorization must be on a standalone document separate from your job application, clearly explaining that a credit report may be obtained. If an employer checks your credit without proper consent, they violate the Fair Credit Reporting Act and you may have legal recourse.

Which states prohibit employment credit checks?

Eleven states currently restrict employment credit checks: California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maryland, Nevada, Oregon, Vermont, and Washington. These states generally prohibit credit checks unless positions involve specific exceptions like executive roles, access to confidential financial information, or law enforcement. Major cities including New York City, Philadelphia, and Chicago have similar local ordinances.

What can employers see on employment credit reports?

Employment credit reports contain payment history showing whether accounts are current or delinquent, outstanding debts and credit utilization, accounts in collections, bankruptcies within ten years, tax liens and judgments, and recent credit inquiries. Employment reports do not include credit scores, complete account numbers, exact birth dates, or spousal information.

Can employers deny employment based on bad credit?

In most states, employers can deny employment based on credit history if they follow proper FCRA procedures and demonstrate the credit check is job-related and consistent with business necessity. However, eleven states restrict this practice, generally prohibiting credit-based decisions unless positions involve financial responsibilities. Even where permitted, employers risk discrimination claims if credit-based decisions disproportionately affect protected classes.

How long do bankruptcies and other negative items affect employment credit checks?

Bankruptcies remain on credit reports for ten years from the filing date and will appear on employment credit checks during that period. Most other negative information including late payments, collections, and foreclosures remains for seven years. However, employers should consider the age and context of negative items rather than automatically disqualifying candidates.

What should I do if my credit report contains errors that might affect employment?

Immediately dispute inaccurate information with the credit reporting agency in writing, clearly identifying each disputed item and providing supporting documentation. Agencies must investigate within 30 days and correct or delete inaccurate information. If you're in an active job search, inform potential employers that you've disputed specific items.

Do employment credit checks hurt my credit score?

No, employment credit checks are "soft inquiries" that appear on your credit report but don't affect your credit score. Unlike "hard inquiries" from applying for loans, employment-related inquiries are only visible to you and won't impact your creditworthiness. This protection exists because employment credit checks serve fundamentally different purposes than lending decisions.

Can I refuse an employment credit check and still get the job?

Legally, you can refuse to authorize a credit check, but employers can then decide not to hire you based on that refusal in most cases. In states that restrict employment credit checks, employers generally cannot require credit checks for positions that don't meet statutory exceptions. Before refusing, consider whether the position involves financial responsibilities where credit checks are reasonable.

Additional Resources

- Fair Credit Reporting Act - Federal Trade Commission

https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act - Background Checks: What Employers Need to Know - EEOC

https://www.eeoc.gov/laws/guidance/background-checks-what-employers-need-know - Using Consumer Reports for Employment Purposes - Consumer Financial Protection Bureau

https://www.consumerfinance.gov/consumer-tools/credit-reports-and-scores/employment-background-checks/ - State Laws on Employment Credit Checks - National Conference of State Legislatures

https://www.ncsl.org/labor-and-employment/use-of-credit-information-in-employment - Annual Credit Report Request Service

https://www.annualcreditreport.com - Disputing Errors on Credit Reports - Federal Trade Commission

https://consumer.ftc.gov/articles/disputing-errors-credit-reports

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.