Bankruptcy typically appears on background checks for 7-10 years from the filing date, with Chapter 7 bankruptcy remaining visible for 10 years and Chapter 13 for 7 years. However, the impact on employment opportunities varies significantly by industry, position type, and employer screening practices.

Key Takeaways

- Chapter 7 bankruptcy stays on background checks for 10 years from the filing date, while Chapter 13 bankruptcy remains visible for 7 years

- Employment background checks may show bankruptcy records even after they're removed from credit reports, depending on the screening company's data sources

- Financial positions and roles requiring security clearances typically face stricter scrutiny regarding bankruptcy history

- State laws vary on what bankruptcy information employers can access and use in hiring decisions

- Sealed or expunged bankruptcy records may still appear on certain types of background checks conducted by specialized screening companies

- Proactive disclosure and demonstrating financial recovery can help mitigate the negative impact of bankruptcy on job prospects

Understanding Bankruptcy Duration on Background Checks

Bankruptcy records don't disappear overnight from background screening databases. The timeline for when bankruptcy comes off background checks depends on several interconnected factors that job seekers and employers should understand. Most importantly, bankruptcy background check timelines don't always align with credit report removal dates.

The Fair Credit Reporting Act (FCRA) governs how long bankruptcy information can appear on consumer reports used for employment purposes. Under federal law, Chapter 7 bankruptcy can remain on background checks for up to 10 years. Meanwhile, Chapter 13 bankruptcy typically stays for 7 years. However, these timeframes represent maximum allowable periods, not guaranteed removal dates.

Different screening companies maintain varying policies regarding information retention and removal. Some organizations update their databases promptly when records reach expiration dates. Others may retain information longer due to technical delays or database maintenance schedules. Additionally, court records remain permanently accessible in most jurisdictions, even after removal from commercial databases.

Chapter 7 vs. Chapter 13 Bankruptcy Timelines

Chapter 7 bankruptcy, often called "liquidation bankruptcy," appears on background checks for the full 10-year period allowed under federal law. This extended timeline reflects the more severe nature of Chapter 7, where debts are typically discharged without a repayment plan. The 10-year clock starts from the filing date, not the discharge date.

Chapter 13 bankruptcy involves a structured repayment plan and generally remains visible for 7 years from the filing date. Some background check companies may remove Chapter 13 records earlier, especially if the repayment plan was completed successfully ahead of schedule. This shorter reporting period acknowledges the borrower's effort to repay creditors through an organized payment structure.

Database Variations and Reporting Differences

Commercial background screening databases don't always synchronize their information updates simultaneously. Some companies specialize in financial screening and maintain more comprehensive bankruptcy records. Others focus primarily on criminal history and may have limited financial information.

The source of bankruptcy information also affects reporting accuracy and timeliness. Screening companies that pull directly from court records may show more current information. Those relying on third-party data aggregators might experience delays in updates or removals.

Types of Background Checks That Show Bankruptcy

Different background screening methods vary in their ability to detect and report bankruptcy information. Understanding these distinctions helps both job seekers and employers set appropriate expectations during the hiring process. The scope of screening depends largely on the position's requirements and industry standards.

Standard employment background checks typically fall into several categories. Basic criminal screenings focus solely on arrest and conviction records. Credit-based employment screenings include bankruptcy along with other financial history. Comprehensive background investigations combine multiple screening types for sensitive positions.

Industry-specific screenings often have enhanced requirements based on regulatory standards. Financial services companies must comply with banking regulations that mandate thorough financial background reviews. Healthcare organizations may screen differently for clinical versus administrative roles. Government positions requiring security clearances conduct the most extensive investigations.

Employment Screening Categories

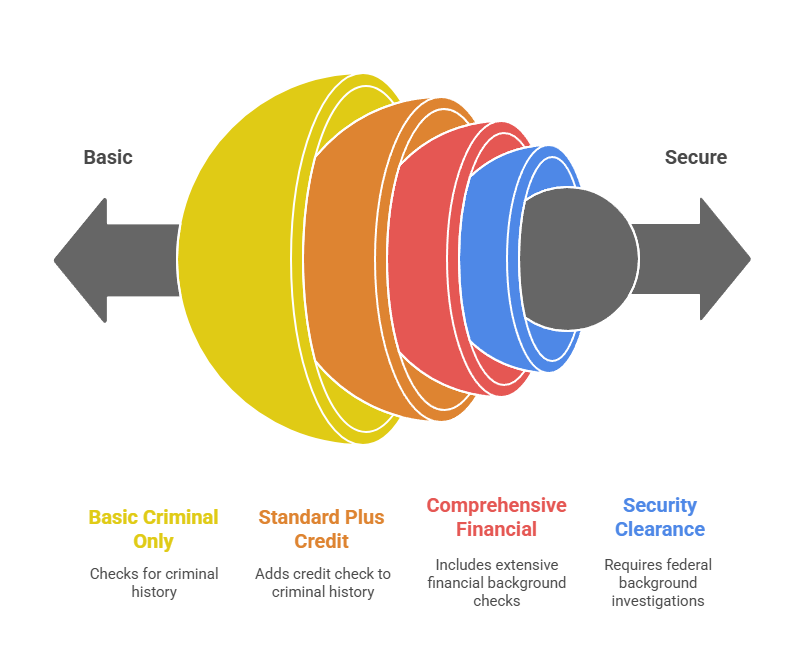

Most employers choose from several standard screening packages offered by background check companies. Basic packages typically include criminal history verification and employment confirmation. Enhanced packages add education verification, reference checks, and sometimes driving records. Comprehensive packages include credit checks, civil court records, and bankruptcy information.

- Basic Criminal Only: Most common for entry-level positions in retail, hospitality, and general services

- Standard Plus Credit: Typical for supervisory roles, administrative positions, and customer-facing jobs

- Comprehensive Financial: Required for banking, insurance, accounting, and money-handling positions

- Security Clearance: Government and contractor positions requiring federal background investigations

The screening level often correlates with the position's access to sensitive information or financial assets. Entry-level positions rarely require comprehensive financial screening. Senior management and financial roles almost always include credit and bankruptcy checks.

Industry-Specific Bankruptcy Screening Practices

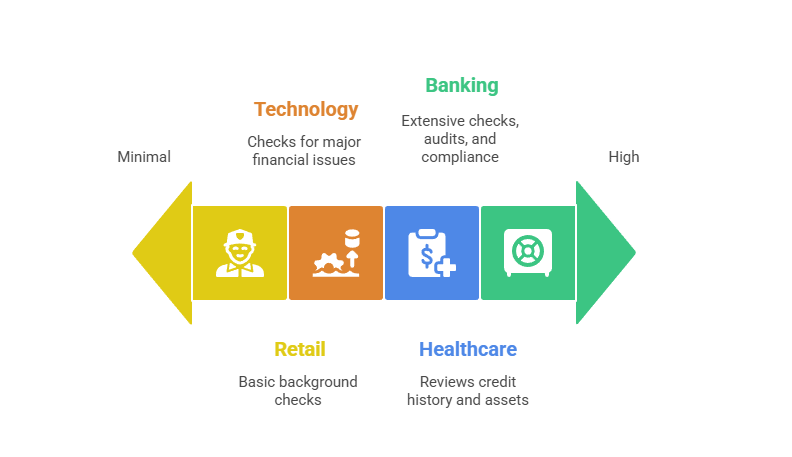

The impact of bankruptcy on background checks varies dramatically across different industries and job types. Some sectors place minimal emphasis on financial history, while others consider it a critical hiring factor. Understanding these differences helps job seekers target appropriate opportunities and prepare for various screening levels.

Financial services, banking, and insurance industries maintain the strictest bankruptcy screening protocols. These employers often require comprehensive financial background checks that examine bankruptcy history, current debt levels, and overall financial stability. Federal regulations mandate these screenings for positions involving customer funds, loan decisions, or financial advisory services.

| Industry Sector | Screening Intensity | Typical Requirements |

| Financial Services | High | Complete financial history review |

| Government/Military | High | Security clearance investigations |

| Healthcare Administration | Moderate | Position-dependent screening |

| Technology | Low | Skills-focused, minimal financial review |

| Retail/Hospitality | Low | Basic criminal checks only |

| Education | Variable | Administrative roles face more scrutiny |

Technology companies generally focus more on skills and experience than financial history, unless the role involves financial responsibilities. Many tech employers conduct basic background checks that don't include detailed financial screening. This approach makes technology sector positions more accessible for individuals with bankruptcy history.

Regulated Industry Requirements

Certain industries face federal or state regulations that mandate specific screening requirements. Banks must comply with Federal Deposit Insurance Corporation (FDIC) guidelines for employee background checks. Insurance companies follow state insurance commission regulations. Securities firms adhere to Financial Industry Regulatory Authority (FINRA) standards.

These regulatory requirements often specify that employers must review bankruptcy history for positions involving customer funds or financial decision-making authority. However, regulations also typically require individualized assessments rather than blanket disqualifications. Employers must demonstrate that financial screening requirements relate directly to job responsibilities.

Healthcare and Professional Services

Healthcare organizations vary in their bankruptcy screening practices depending on the specific role and level of financial access. Clinical positions like nurses, doctors, and therapists typically face minimal financial screening. Administrative roles handling billing, insurance claims, or patient financial information may require more comprehensive checks.

Professional services firms, including law offices, accounting practices, and consulting companies, often conduct moderate financial screening. Partners and senior associates typically face more scrutiny than entry-level staff. Client-facing roles may require enhanced screening to maintain professional credibility and trust.

How Bankruptcy Affects Different Employment Sectors

Employment sectors respond differently to bankruptcy information discovered during background screening processes. Understanding these sector-specific approaches helps job seekers target appropriate opportunities and prepare for potential challenges. The key lies in matching your situation with industries that prioritize your skills over financial history.

Manufacturing and industrial companies typically focus on safety records, technical skills, and reliability rather than financial history. These employers often conduct basic criminal background checks but rarely include comprehensive financial screening. The emphasis remains on workplace safety, technical competence, and attendance records.

Retail and hospitality industries generally maintain minimal financial screening requirements for most positions. Store associates, servers, and customer service representatives typically undergo basic criminal checks only. Management positions may face additional scrutiny, particularly roles involving cash handling or financial responsibilities.

Education sector screening varies significantly by position type and geographic location. Teachers and direct student-contact roles typically undergo extensive criminal screening but limited financial review. Administrative positions, especially those involving district finances or procurement, may require comprehensive background checks including bankruptcy history.

- High Financial Scrutiny: Banking, insurance, accounting, securities, government contracting

- Moderate Financial Review: Healthcare administration, real estate, legal support, senior management roles

- Limited Financial Screening: Technology, manufacturing, education, nonprofit organizations

- Minimal Requirements: Retail, hospitality, food service, general labor positions

The reasoning behind sector-specific screening relates to job responsibilities and regulatory requirements. Positions involving money handling, financial decision-making, or access to sensitive financial information naturally require more thorough screening. Jobs focusing on technical skills, customer service, or manual labor typically emphasize other qualifications.

Government and Security Clearance Positions

Government employment and positions requiring security clearances involve the most comprehensive background investigations available. These screenings examine bankruptcy history as part of assessing overall financial responsibility and potential security risks. The logic suggests that financial distress could make individuals more susceptible to bribery or other security compromises.

However, bankruptcy alone doesn't automatically disqualify candidates for government positions or security clearances. Investigators consider the circumstances leading to bankruptcy, current financial stability, and overall character assessment. Many individuals with bankruptcy history successfully obtain security clearances by demonstrating financial recovery and responsibility.

Legal Protections and Employer Limitations

Federal and state laws provide important protections regarding how employers can use bankruptcy information in hiring decisions. These legal frameworks balance legitimate business interests with fair employment practices and consumer protection principles. Understanding these protections helps both job seekers and employers navigate screening processes appropriately.

The Fair Credit Reporting Act requires employers to obtain written consent before conducting background checks that include financial information. Additionally, if an employer decides not to hire someone based on background check information, they must provide an adverse action notice. This notice explains the decision and gives the applicant an opportunity to dispute inaccurate information.

Employers must also ensure that background screening companies comply with FCRA certification requirements. Screening companies must verify information accuracy and provide dispute resolution procedures. They cannot report bankruptcy information beyond the legal time limits without specific authorization for certain high-level positions.

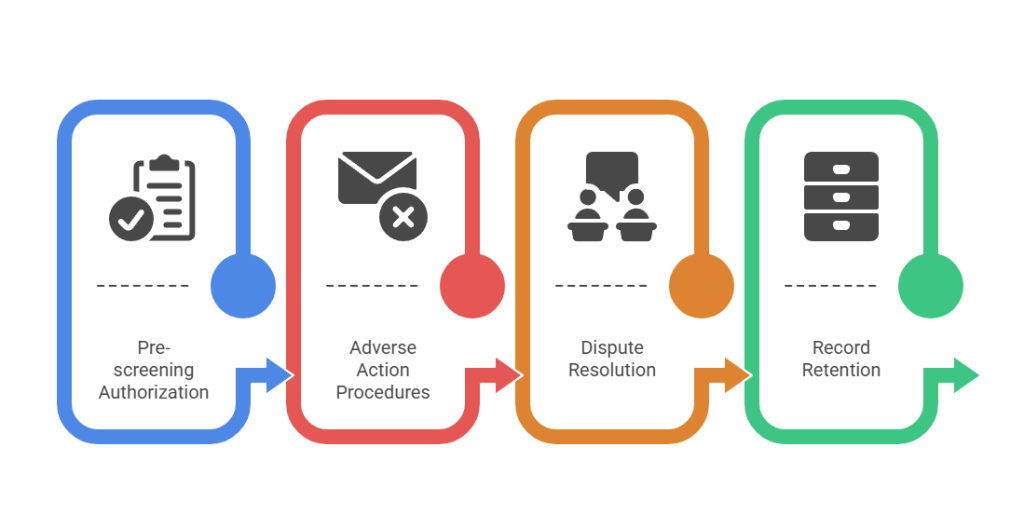

FCRA Compliance Requirements

The FCRA establishes specific procedures that employers must follow when using background checks for hiring decisions. First, employers must obtain separate written authorization from job candidates before conducting any background screening. This authorization cannot be buried within employment applications or other documents.

- Pre-screening Authorization: Written consent required before conducting any background check

- Adverse Action Procedures: Specific notice requirements when rejecting candidates based on background information

- Dispute Resolution: Candidates have rights to challenge inaccurate information and receive corrections

- Record Retention: Employers must maintain background check documentation according to specific timeframes

Second, employers must provide pre-adverse action notices if they intend to reject a candidate based on background check findings. This notice must include a copy of the background report and information about dispute rights. Candidates then have opportunity to explain circumstances or correct inaccuracies before final hiring decisions.

State Law Variations

State laws add additional protections that vary significantly across jurisdictions. Some states prohibit employers from asking about bankruptcy during initial application stages, while others limit how bankruptcy information can be used in hiring decisions. California restricts the use of credit information unless directly related to job responsibilities.

New York has implemented "ban the box" legislation that limits when employers can inquire about criminal history. Similar protections exist in some states regarding financial history inquiries. Illinois requires employers to provide specific justifications for using credit information in hiring decisions.

Equal Employment Opportunity Commission Guidelines

The Equal Employment Opportunity Commission provides guidance on using financial information, including bankruptcy history, in employment decisions. Employers must demonstrate that financial screening requirements are job-related and consistent with business necessity to avoid discriminatory practices. This standard helps prevent blanket policies that may disproportionately affect certain demographic groups.

EEOC guidelines emphasize that policies rejecting all applicants with bankruptcy history may constitute disparate impact discrimination. Different demographic groups file for bankruptcy at varying rates due to economic and social factors. Therefore, blanket exclusions could indirectly discriminate against protected classes.

Instead, the EEOC recommends individualized assessments that consider specific factors relevant to job performance. These factors include the nature and circumstances of the bankruptcy, time elapsed since filing, and direct relevance to the specific position. Employers should also consider evidence of financial rehabilitation and current stability.

Employers can establish legitimate business justifications for financial screening in certain circumstances. Positions involving access to customer funds, financial decision-making authority, or sensitive financial information may warrant comprehensive screening. However, the screening requirements must relate directly to essential job functions rather than general preferences.

Strategies for Job Seekers with Bankruptcy History

Job seekers with bankruptcy in their background can take proactive steps to minimize its impact on employment opportunities. Preparation, transparency, and demonstrating financial recovery significantly improve hiring prospects across various industries. The key is developing a strategic approach that emphasizes strengths while addressing concerns honestly.

Researching potential employers' screening practices helps candidates target appropriate opportunities and prepare for different types of background checks. Companies in less regulated industries may conduct minimal financial screening. Those in financial services typically require comprehensive reviews. Understanding these differences allows for better job search targeting.

Building a strong professional network becomes particularly important when bankruptcy appears on background checks. Referrals and internal recommendations often carry more weight than background check concerns. Former colleagues, industry contacts, and professional associations can provide valuable introductions and endorsements.

Proactive Disclosure Strategies

Timing disclosure appropriately can significantly impact employer responses to bankruptcy history. Bringing up bankruptcy too early may eliminate opportunities unnecessarily. Waiting too long can appear deceptive and damage trust. The optimal timing typically occurs after initial interest but before formal background checks begin.

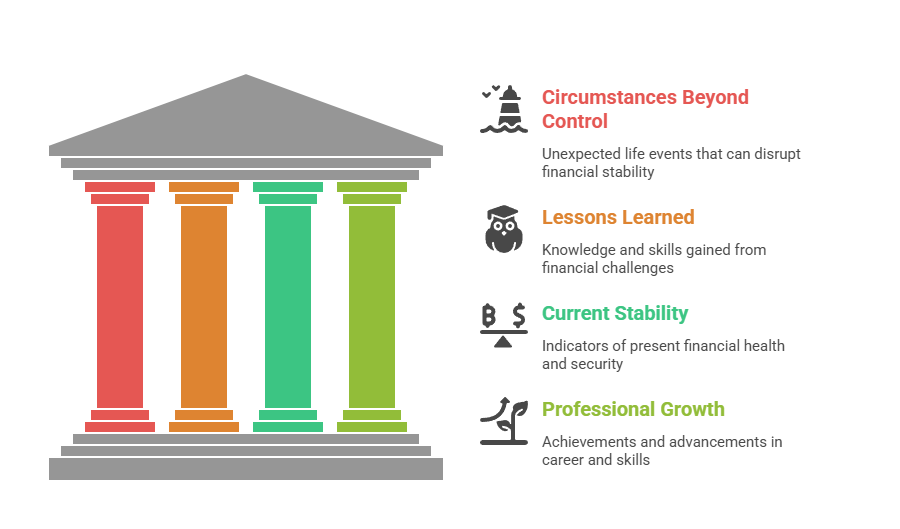

When discussing bankruptcy history, focus on circumstances, lessons learned, and current financial stability. Avoid excessive detail about financial problems while providing enough context to demonstrate the situation was beyond your control. Medical emergencies, job loss, divorce, or other life events provide understandable explanations that employers can relate to.

- Circumstances Beyond Control: Medical bills, job loss, divorce, family emergencies

- Lessons Learned: Financial management education, budgeting skills, spending discipline

- Current Stability: Steady employment, debt reduction, emergency savings, financial counseling completion

- Professional Growth: Skills development, certifications, performance achievements since bankruptcy

Documentation supporting your financial recovery strengthens your position significantly. Completion certificates from credit counseling programs demonstrate commitment to financial education. Employment records showing stable work history indicate reliability. References from recent employers can speak to your current performance and trustworthiness.

Building a Positive Financial Narrative

Developing a compelling explanation for bankruptcy history requires balancing honesty with strategic positioning. Focus on external factors that contributed to financial difficulties while taking appropriate responsibility for recovery efforts. Avoid blaming others excessively or making excuses, but don't accept blame for circumstances genuinely beyond your control.

Emphasize the positive changes you've made since filing for bankruptcy. This might include completing financial counseling, developing better budgeting skills, building emergency savings, or securing stable employment. Concrete examples of financial improvement carry more weight than general statements about lessons learned.

When Bankruptcy Records Actually Disappear

The actual removal of bankruptcy information from background check databases doesn't always align with legal reporting timeframes. Various factors influence when records truly become inaccessible to employers and screening companies. Understanding these factors helps set realistic expectations for when bankruptcy will stop affecting employment opportunities.

Court records remain permanently accessible in most jurisdictions, even after bankruptcy information is removed from credit reports and consumer background check databases. Some specialized screening companies access court records directly, potentially revealing bankruptcy information beyond standard reporting periods. However, most routine employment background checks rely on commercial databases that follow FCRA guidelines for information removal.

Background screening companies typically update their databases regularly to remove aged information, but the process isn't instantaneous. Records might remain visible for several months after reaching the legal removal date while databases undergo updates and purging processes. Different companies maintain different update schedules, creating variations in when information actually disappears.

| Record Source | Removal Timeline | Post-Removal Access |

| Consumer Credit Reports | 7-10 years exact | Not accessible to employers |

| Commercial Background Databases | 7-10 years plus delays | Not accessible after removal |

| Federal Court Records | Permanent retention | Accessible with direct searches |

| State Court Records | Varies by jurisdiction | May remain permanently accessible |

The distinction between automated database searches and manual court record research becomes important for understanding long-term accessibility. Most employment background checks use automated systems that search commercial databases. These systems typically respect FCRA time limits and remove expired information automatically.

Database Update Cycles and Timing

Commercial background screening companies operate on different database update schedules that affect when expired information gets removed. Some companies update monthly, others quarterly, and some maintain continuous update systems. The timing of when your bankruptcy reaches its expiration date relative to these update cycles determines actual removal timing.

Large screening companies typically maintain more current databases with frequent updates. Smaller companies may update less frequently, potentially showing expired information longer. Additionally, different databases within the same company may update on different schedules, creating inconsistencies in what information appears.

Specialized Screening for High-Security Positions

Certain positions, particularly those requiring security clearances or involving significant financial responsibility, may involve specialized screening that goes beyond standard commercial databases. These screenings might include direct court record searches that could reveal bankruptcy information even after standard removal timeframes.

Security clearance investigations conducted by federal agencies involve comprehensive financial reviews that include direct court record searches. These investigations can access bankruptcy information regardless of commercial database removal timelines. However, such extensive screening is reserved for positions requiring the highest levels of trust and security access.

Improving Your Chances Despite Bankruptcy History

Career advancement remains possible even with bankruptcy history on background checks. Strategic approaches to job searching, professional development, and financial recovery can overcome initial screening barriers. The key is focusing on industries and employers that prioritize skills and experience over financial history.

Building strong professional relationships and obtaining referrals creates opportunities where your reputation precedes background check concerns. Networking within your industry and maintaining positive relationships with former colleagues opens doors that might otherwise remain closed. Many hiring managers place significant weight on personal recommendations from trusted sources.

Professional development and skill advancement demonstrate forward momentum that can offset bankruptcy concerns. Industry certifications, continuing education, and specialized training show commitment to career growth. These credentials often carry significant weight with employers and may overshadow background check issues.

Consider targeting smaller companies or startups that may have less formal background screening processes. These organizations often prioritize cultural fit and immediate skills over comprehensive background investigations. They may also be more willing to consider individual circumstances and potential rather than focusing solely on past financial difficulties.

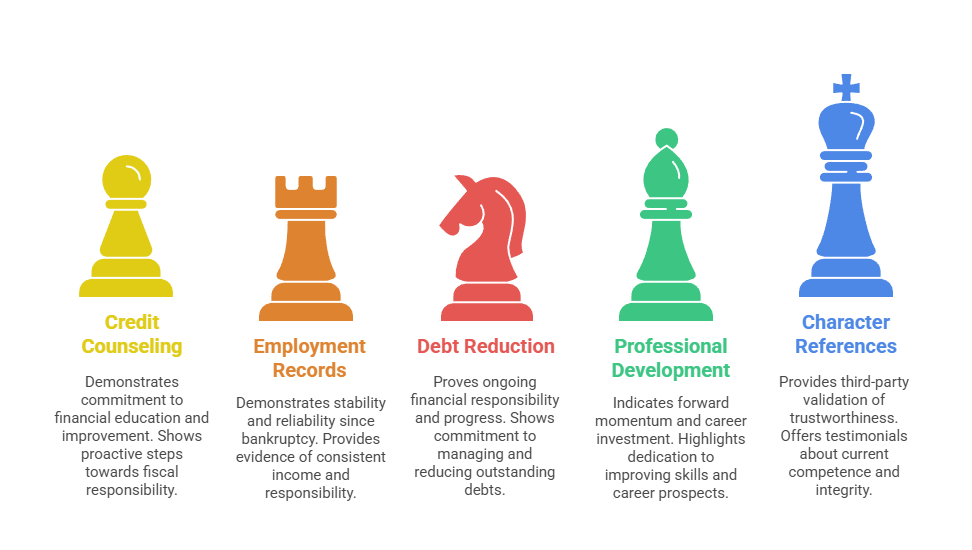

Financial Recovery Documentation

Maintaining documentation of your financial recovery efforts provides concrete evidence of improvement to potential employers. This documentation might include completion certificates from credit counseling programs, evidence of debt reduction, or records of consistent employment since bankruptcy. Having this information readily available demonstrates preparation and professionalism.

- Credit Counseling Certificates: Show commitment to financial education and improvement

- Employment Records: Demonstrate stability and reliability since bankruptcy

- Debt Reduction Evidence: Prove ongoing financial responsibility and progress

- Professional Development: Indicate forward momentum and career investment

- Character References: Provide third-party validation of current trustworthiness and competence

Financial recovery documentation becomes particularly important when applying for positions that require financial screening. Being able to present a clear picture of improvement and stability can help overcome initial concerns about bankruptcy history. This proactive approach demonstrates transparency and responsibility.

Industry Targeting and Career Planning

Strategic career planning involves understanding which industries and positions are most accessible given your bankruptcy history. Technology companies, manufacturing firms, and many service industries prioritize skills over financial history. Focusing your job search on these sectors increases success probability significantly.

Avoiding industries with strict financial screening requirements during the first few years after bankruptcy filing makes sense strategically. As time passes and you build a stronger financial recovery record, you can gradually expand into more regulated industries if desired. This phased approach maximizes opportunities while building toward long-term career goals.

Rebuilding Professional Credibility

Professional credibility rebuilding requires consistent demonstration of competence, reliability, and ethical behavior in your current role. Excellent performance reviews, successful project completions, and positive colleague relationships all contribute to a professional reputation that can overcome background check concerns. Focus on building a track record that speaks louder than past financial difficulties.

Volunteer work and community involvement can also help rebuild credibility and demonstrate character. Many employers value community engagement and volunteer leadership as indicators of personal values and commitment. These activities provide additional references and demonstrate your ability to manage responsibilities effectively.

Professional associations and industry networking groups offer opportunities to build relationships and establish expertise in your field. Active participation in these organizations can lead to speaking opportunities, committee positions, or other visibility that enhances your professional profile. Industry recognition can significantly offset bankruptcy concerns.

Consider pursuing leadership roles in professional organizations or volunteer groups. These positions demonstrate that others trust you with responsibility and oversight. Leadership experience also provides excellent talking points during interviews and shows that you've moved beyond past financial difficulties to contribute meaningfully to your community and profession.

Long-term Career Strategy

Developing a long-term career strategy that acknowledges bankruptcy history while focusing on future opportunities requires realistic planning and patient execution. Set career goals that account for current limitations while building toward positions that may require more extensive screening in the future. This approach ensures steady progress without unrealistic expectations.

As bankruptcy information ages and your financial recovery strengthens, gradually expand your job search to include industries and positions that were initially inaccessible. The combination of time passage, demonstrated financial stability, and professional growth creates opportunities that may not exist immediately after bankruptcy filing.

Conclusion

Bankruptcy remains visible on employment background checks for 7-10 years depending on the chapter filed, but its impact varies significantly across industries and positions. Understanding legal protections, employer screening practices, and strategic approaches helps both job seekers and employers navigate these considerations effectively. While bankruptcy history presents initial challenges, proactive disclosure, financial recovery demonstration, and targeted job searching can lead to successful employment outcomes. The employment landscape offers numerous opportunities for individuals with bankruptcy history, particularly in technology, manufacturing, and service industries that prioritize skills over financial background. Success depends on understanding the timeline, preparing appropriate responses, and focusing efforts on employers that value your professional capabilities above past financial difficulties.

Frequently Asked Questions

Can employers see bankruptcy that happened more than 10 years ago?

Generally, employers cannot see bankruptcy information older than 10 years (Chapter 7) or 7 years (Chapter 13) through standard background checks. However, court records remain permanently accessible, and some specialized screening companies might access this information for high-security positions or financial roles requiring extensive investigation.

Do all background checks show bankruptcy information?

No, only background checks that include financial or credit information will show bankruptcy records. Basic criminal background screenings typically don't include bankruptcy information. The type of check depends on the employer, position requirements, and industry screening standards.

Can I get a job in banking with a bankruptcy on my record?

While challenging, employment in banking with bankruptcy history isn't impossible. Banks typically conduct comprehensive financial screenings, but individual circumstances, time elapsed since filing, and demonstration of financial recovery can influence hiring decisions. Some positions may be more accessible than others.

Will bankruptcy show up on a background check for retail jobs?

Bankruptcy typically won't appear on background checks for most retail positions. Retail employers usually conduct basic criminal screenings that don't include financial information. However, management positions or roles involving significant cash handling might require more comprehensive screening.

How can I find out what shows up on my background check?

You can obtain copies of your background check through consumer reporting agencies or companies that provide background check services to individuals. This allows you to see what information appears and verify its accuracy before potential employers conduct their screenings.

Does bankruptcy automatically disqualify me from government jobs?

No, bankruptcy doesn't automatically disqualify applicants from government positions. While government agencies conduct thorough background investigations, they consider individual circumstances, current financial stability, and overall character assessment when making hiring decisions.

Can I dispute bankruptcy information on background checks?

Yes, you have the right to dispute inaccurate bankruptcy information on background checks. If information is incorrect, outdated, or improperly reported, you can request corrections through the background screening company. They must investigate and correct any verified inaccuracies.

Should I mention bankruptcy in job interviews?

Consider mentioning bankruptcy proactively if the position likely requires financial screening. Address it briefly after establishing initial interest but before background checks begin. Focus on circumstances, lessons learned, and current financial stability rather than dwelling on past difficulties.

Additional Resources

- Fair Credit Reporting Act (FCRA) Consumer Guidelines

https://www.consumer.ftc.gov/articles/pdf-0096-fair-credit-reporting-act.pdf - EEOC Guidance on Arrest and Conviction Records

https://www.eeoc.gov/laws/guidance/arrest_conviction.cfm - Consumer Financial Protection Bureau - Credit Reports and Background Checks

https://www.consumerfinance.gov/ask-cfpb/can-a-potential-employer-use-my-credit-report-when-considering-me-for-employment-en-5/ - National Association of Professional Background Screeners (NAPBS)

https://www.napbs.com/ - Free Annual Credit Report (Authorized by Federal Law)

https://www.annualcreditreport.com/ - State-by-State Employment Background Check Laws

https://www.nolo.com/legal-encyclopedia/state-laws-use-credit-reports-employment-screening.html - Bankruptcy Court Records Database (PACER)

https://www.pacer.gov/ - U.S. Department of Labor Employment Laws Guide

https://www.dol.gov/agencies/whd/laws-and-regulations

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.