Finding warehouse employment without extensive background verification is possible through major logistics companies that prioritize operational needs during peak seasons, offer temp-to-hire pathways, or have streamlined screening processes for entry-level positions. This comprehensive guide examines the hiring policies of leading warehouse employers, provides salary data and advancement opportunities, and outlines strategic application approaches to help job seekers navigate the logistics industry job market in 2025.

Key Takeaways

- Many major warehouse and logistics employers modify their screening requirements during peak hiring seasons (October-December and June-August), when operational demands often lead to expedited hiring processes for entry-level positions.

- Temp-to-hire pathways through staffing agencies can provide immediate warehouse employment opportunities, as some agencies conduct simplified screening processes before full verification occurs during permanent conversion.

- Amazon, FedEx, UPS, and other major logistics companies evaluate candidates on a case-by-case basis, with screening policies that vary by position level, location, and local regulations rather than applying blanket disqualification policies.

- Entry-level warehouse positions such as package handlers, sorters, and seasonal workers typically face less stringent screening requirements compared to supervisory roles, forklift operators, or positions involving direct financial handling.

- Average hourly wages for warehouse workers in 2025 range from $16-$22 per hour for entry-level positions, with comprehensive benefits packages often available after 90 days of employment at major logistics companies.

- Third-party logistics providers (3PLs) and regional distribution centers frequently have more flexible hiring approaches compared to direct-hire positions at major retailers, creating additional employment pathways for job seekers.

- Understanding company-specific screening timelines—which typically range from 3-10 business days—helps candidates manage expectations and maintain multiple applications simultaneously to increase employment chances.

- Career advancement opportunities within warehouse environments can lead to supervisory positions earning $45,000-$65,000 annually, with many companies promoting from within and offering tuition assistance for continued education.

Understanding Background Verification in the Warehouse Industry

The logistics and warehouse sector operates under unique pressures that influence hiring practices across the industry. Unlike positions in healthcare, education, or financial services where regulatory requirements mandate specific screening protocols, warehouse employers maintain greater flexibility in determining their verification processes. Most employers conduct some level of screening as part of their duty to provide safe working environments—the variation lies in timing, scope, and evaluation criteria rather than complete absence of verification.

How Warehouse Screening Differs from Other Industries

Warehouse and logistics jobs without background verification represent a spectrum rather than an absolute category. Entry-level logistics careers typically involve more streamlined processes focused on recent history and safety-relevant factors. Many companies in this sector conduct verification after hiring or during the onboarding period, allowing candidates to begin earning income while administrative processes complete.

The distinction matters because understanding what employers actually evaluate helps candidates approach applications strategically. Package handling roles rarely require the same depth of verification as positions involving equipment operation, inventory control, or supervisory responsibilities. According to industry staffing data, approximately 68% of warehouse employers in 2025 prioritize physical capability assessments and attendance reliability over extensive investigations for entry-level roles.

EXPERT INSIGHT: Opportunity often begins when someone decides to choose fairness over fear. I've observed recruitment discussions change by putting attention on potential, context, and consistency rather than assumptions. Background screening should protect workplaces, but it should also leave room for people to grow beyond a single moment in their past. As organizations start viewing shared responsibilities for safety, dignity, and second chances, trust starts to work both ways. The best work that I have ever participated in, from an HR perspective, is where safety, dignity, and second chances are viewed as shared responsibilities. - Charm Paz, CHRP

Legal Framework Affecting Warehouse Hiring

Federal and state laws significantly influence how employers approach screening, creating variation across different geographic markets. The Fair Credit Reporting Act establishes specific procedures employers must follow when using third-party screening services, including obtaining written consent and providing adverse action notices if information influences hiring decisions. Additionally, many states and municipalities have implemented "ban the box" legislation that restricts when employers can inquire about certain elements during the hiring process.

These legal protections mean that even when companies conduct verification, they must evaluate candidates individually rather than applying automatic disqualifications. Several states including California, New York, and Illinois have laws limiting how far back employers can review certain information, typically ranging from 7-10 years.

Peak Seasons and Hiring Urgency

The warehouse and distribution sector experiences dramatic seasonal fluctuations that directly impact hiring practices and screening timelines. During peak periods—particularly the holiday shipping season from October through December and the summer fulfillment surge from June through August—companies hire thousands of temporary workers to manage volume increases. This operational pressure often results in streamlined onboarding processes where candidates can begin working more quickly than during slower periods.

Understanding these cycles provides strategic advantages for applicants. Companies like Amazon, Target, and UPS collectively hire over 200,000 seasonal workers annually, with many positions converting to permanent employment for high-performing workers. During these peak hiring periods, some employers adjust their processes to prioritize speed-to-productivity, conducting abbreviated screening initially with more comprehensive verification occurring later.

Major Logistics Companies and Their Hiring Approaches

Navigating the warehouse job market requires understanding how individual companies structure their hiring processes, screening timelines, and position-specific requirements. The following analysis examines major employers in the logistics sector, providing current information about their general hiring approaches based on publicly available information and industry reports. Policies can vary by location, position level, and local legal requirements, so information obtained directly from specific hiring locations will be most accurate for your situation.

Amazon Warehouse and Fulfillment Centers

Amazon operates over 175 fulfillment centers, sortation facilities, and delivery stations across the United States, making it one of the largest warehouse employers nationally. The company's hiring approach emphasizes accessibility and speed, with many locations offering same-day job offers for entry-level positions.

Entry-level positions at Amazon fulfillment centers start at $16-$22 per hour depending on location, with additional incentives during peak seasons. Benefits include:

- Health insurance starting on day one of employment

- 401(k) matching contributions

- Tuition assistance through the Career Choice program

- Sign-on bonuses during peak hiring periods

Amazon typically conducts employment verification after candidates receive conditional offers, with the process generally taking 3-7 business days to complete. The company evaluates candidates individually and considers various factors rather than applying automatic disqualifications. According to Amazon's public statements, they've committed to hiring 100,000+ individuals with criminal records over the next five years, reflecting a policy approach focused on opportunity and individual assessment.

FedEx Ground and Express Facilities

FedEx operates through multiple business units with different operational models affecting their hiring approaches. Ground operations primarily use independent contractors who operate routes and hire their own package handlers, while Express divisions directly employ warehouse workers and package handlers. This structural difference creates varied pathways into FedEx employment, with contractor-based hiring often involving more streamlined processes compared to direct corporate employment.

| FedEx Division | Starting Pay | Hiring Model | Typical Timeline |

| FedEx Ground | $15-$19/hour | Independent contractors | 3-7 days |

| FedEx Express | $17-$21/hour | Direct employment | 5-10 days |

Package handler positions typically include shifts available during early morning, day, evening, and overnight periods. FedEx Express positions involve direct employment and typically include comprehensive benefits such as health insurance, pension plans, and tuition assistance.

UPS Warehouse and Distribution Operations

United Parcel Service operates an extensive network of distribution facilities and package sorting hubs, employing over 440,000 workers globally with significant U.S. warehouse operations. UPS positions are known for strong compensation and benefits, particularly for union-represented roles covered by Teamsters agreements. Part-time package handlers start at $15.50-$21 per hour depending on location and shift, with the company offering one of the industry's most comprehensive benefits packages including health coverage for part-time workers.

UPS hiring processes typically involve in-person or virtual information sessions followed by facility tours and interviews. For package handler positions, the company focuses heavily on physical capabilities and availability rather than extensive requirements. Career advancement represents a significant advantage of UPS employment, with the company maintaining a strong promote-from-within culture where many supervisors, managers, and even executives started as part-time package handlers.

Retail Distribution Centers and Their Hiring Practices

Major retailers operate extensive distribution networks supporting their store locations and e-commerce operations. These retail distribution centers represent significant employment opportunities with hiring approaches that often differ from pure-play logistics companies.

Target Distribution Centers

Target operates over 40 distribution centers across the United States, with facilities specializing in general merchandise, food, or e-commerce fulfillment. Starting wages range from $15-$24 per hour for warehouse positions depending on location and shift.

Target's comprehensive benefits package includes:

- Health insurance with low employee premium contributions

- 401(k) matching at 50% up to 6% of salary

- Merchandise discounts of 10-20%

- Paid time off starting after 90 days

The Target hiring process emphasizes cultural fit and reliability, with positions filled through their online application system followed by phone screenings and interviews. Target conducts employment verification following conditional job offers, with the process typically completing within 5-7 business days. The company has publicly committed to fair chance hiring practices and evaluates candidates individually, considering the nature and timing of any elements in relation to specific job responsibilities.

Walmart Distribution and Fulfillment Centers

Walmart operates one of the largest private distribution networks globally, with over 150 distribution centers and fulfillment facilities in the United States. The company's warehouse operations support both store replenishment and the rapidly growing e-commerce business. Walmart distribution center positions offer competitive compensation starting at $16-$25 per hour depending on facility location and shift, with additional incentives for overnight and weekend availability.

Walmart's hiring process for distribution positions involves online applications followed by assessment tests evaluating problem-solving and situational judgment. Candidates who pass initial screenings typically attend group information sessions or individual interviews at the facility. The company maintains differentiated screening approaches based on position responsibilities, with entry-level order fillers and loader positions typically involving more streamlined verification compared to roles operating powered industrial equipment.

Home Depot and Lowe's Distribution Networks

Home improvement retailers operate specialized distribution centers designed to handle building materials, appliances, and hardware products. With over 200 distribution facilities including rapid deployment centers and direct fulfillment centers, Home Depot maintains one of the industry's largest networks, while Lowe's operates approximately 15 regional distribution centers supplemented by flatbed distribution facilities.

| Retailer | Number of Facilities | Starting Pay | Special Requirements |

| Home Depot | 200+ | $15-$21/hour | Physical capability for heavy materials |

| Lowe's | 15+ regional | $15-$20/hour | Safety orientation emphasis |

| Target | 40+ | $15-$24/hour | Cultural fit assessment |

Compensation at home improvement distribution centers typically ranges from $15-$21 per hour for entry-level warehouse associates, with both companies offering benefits packages including health insurance, 401(k) plans, and employee purchase discounts. Hiring processes emphasize safety orientation and physical capability assessment, as the work often involves heavy lifting and operation of material handling equipment.

Third-Party Logistics Providers and Staffing Agency Pathways

Third-party logistics companies (3PLs) and staffing agencies represent alternative pathways into warehouse employment, often with different hiring approaches compared to direct employment with major brands. These organizations operate on business models that prioritize quick placement and operational flexibility, which can create opportunities for candidates seeking immediate employment.

Understanding 3PL Operations

Third-party logistics providers operate warehouse and distribution facilities on behalf of multiple client companies, managing inventory storage, order fulfillment, and shipping operations. Companies like XPO Logistics, DHL Supply Chain, and C.H. Robinson operate hundreds of facilities across the United States, creating substantial employment opportunities.

Wages at 3PL facilities typically range from $14-$20 per hour for entry-level warehouse positions, with variation based on geographic location and client requirements. Some 3PL operations pay slightly less than direct employment with major brands but offer advantages including flexible scheduling, diverse work environments, and opportunities to work at facilities near residential areas. The hiring process at 3PLs often emphasizes rapid placement to meet client commitments, with many facilities conducting abbreviated initial screening.

Temp-to-Hire Staffing Agency Models

Staffing agencies specializing in warehouse and logistics placement provide another entry pathway into the industry. Major agencies including Randstad, Adecco, PeopleReady, and Kelly Services maintain dedicated logistics divisions that place thousands of workers monthly in warehouse environments.

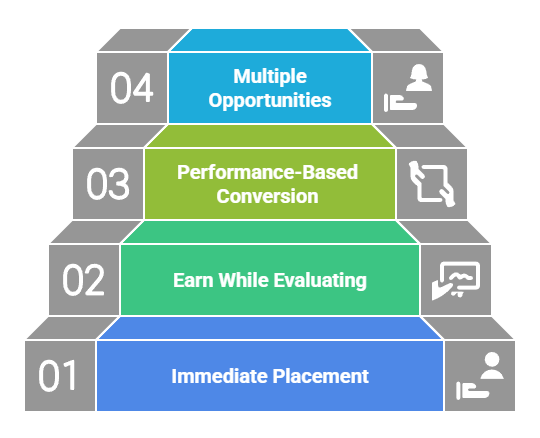

The staffing model creates a different screening dynamic compared to direct hiring:

- Immediate Placement: Agencies often place workers within 24-48 hours with simplified initial screening

- Earn While Evaluating: Workers earn income ($14-$18/hour typically) while demonstrating capability to potential permanent employers

- Performance-Based Conversion: Strong performers often convert to direct employment after 90 days to 6 months

- Multiple Opportunities: Exposure to various companies helps workers identify best-fit employers

This arrangement allows the agency to serve as the legal employer initially, handling payroll, basic benefits, and HR functions while the worker performs duties at a client facility. Temp-to-hire pathways offer strategic advantages for candidates concerned about screening, as workers can demonstrate reliability, work ethic, and capability before undergoing comprehensive verification.

Regional and Local Distribution Operations

Beyond national brands and major 3PLs, thousands of regional distribution companies, food distributors, beverage warehouses, and local fulfillment operations create employment opportunities throughout the United States. These smaller operations—often employing 50-500 workers—face competitive pressure for talent and frequently adopt pragmatic hiring approaches focused on availability and work ethic.

Regional food distributors like US Foods, Sysco, and Performance Food Group operate warehouse facilities in most metropolitan areas, hiring order selectors, loaders, and inventory clerks. These positions typically pay $16-$22 per hour with physical demands higher than general merchandise warehouses due to weight and temperature-controlled environments. Local operations may conduct simplified verification processes compared to national corporations, particularly for positions without equipment operation or supervisory responsibilities.

Strategic Application Approaches for Warehouse Positions

Successfully securing warehouse employment involves more than simply submitting applications—strategic timing, presentation, and follow-through significantly impact outcomes. The following approaches help candidates maximize their opportunities in the competitive warehouse job market while presenting themselves as reliable, capable workers that employers want to hire.

Timing Applications for Maximum Success

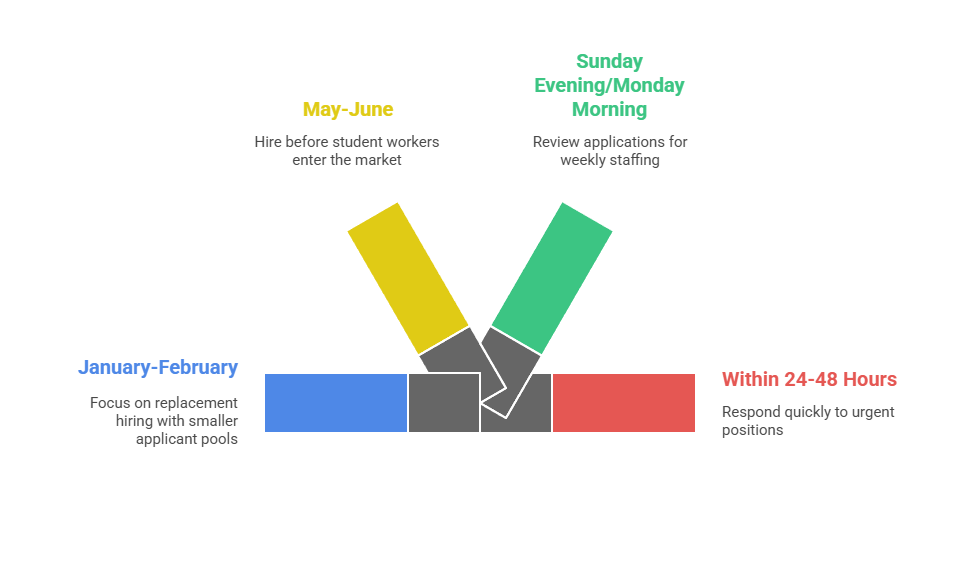

The warehouse employment market operates with predictable seasonal patterns that create optimal application windows. Peak hiring occurs during late summer (June-August) when facilities prepare for back-to-school and fall product launches, and late fall (October-December) for holiday shipping seasons. Applying during these windows increases the likelihood of expedited hiring processes and positions candidates among large cohorts of new hires.

Less obvious timing opportunities exist throughout the year:

- January-February: Replacement hiring after seasonal departures with smaller applicant pools

- May-June: Pre-summer hiring before student workers enter the market

- Sunday evening/Monday morning: Hiring managers review applications when planning weekly staffing

- Within 24-48 hours of posting: Quick responses to "urgent hiring" positions demonstrate initiative

Day-of-week timing also matters for application success. Friday applications often get delayed until the following week or lost among weekend submissions. For positions advertised as "urgent hiring" or "immediate start," responding quickly increases the likelihood of rapid screening and job offers.

Highlighting Relevant Experience and Capabilities

Warehouse positions emphasize physical capability, reliability, and safety awareness—qualities that can be demonstrated through various experience types beyond previous warehouse work. Former retail associates can highlight experience receiving shipments, stocking shelves, and working on their feet for extended periods. Construction workers can emphasize familiarity with safety protocols, physical stamina, and experience with heavy equipment.

Certifications and licenses significantly strengthen warehouse applications:

- Forklift Certification: Opens positions paying $2-5 more per hour, obtainable for $150-$400 through community colleges

- OSHA 10-Hour General Industry: Demonstrates safety knowledge and professional commitment

- Basic Computer Literacy: Helps for positions involving RF scanners or inventory systems

Emphasizing availability and scheduling flexibility provides substantial competitive advantage in warehouse hiring. Many facilities struggle to fill overnight shifts (typically 10 PM-6 AM), weekend shifts, or variable schedules that change based on operational needs. Candidates who explicitly state availability for these less desirable shifts often receive priority consideration and faster hiring decisions.

Following Up Effectively Without Being Intrusive

The balance between persistence and patience challenges many applicants, particularly in warehouse hiring where high application volumes may delay individual responses. After submitting an online application, waiting 3-5 business days before following up demonstrates patience while showing continued interest. Follow-up should occur during business hours, avoiding shift change times around 6-7 AM, 2-3 PM, or 10-11 PM when supervisors are busiest.

Warehouse interviews typically focus on availability, physical capability, safety awareness, and reliability rather than complex behavioral questions. Many warehouse interviews last 15-30 minutes and may occur in group settings, particularly during high-volume hiring periods. After interviews, brief thank-you communication—either via email if provided or through a phone call to the facility—reinforces professional interest without being excessive.

Compensation, Benefits, and Advancement Opportunities

Understanding the complete value proposition of warehouse employment extends beyond hourly wages to encompass benefits, scheduling flexibility, and career progression potential. This comprehensive view helps candidates evaluate opportunities and make informed decisions about which positions align with their financial needs and long-term career goals.

Current Wage Trends and Earning Potential

Warehouse wages have increased significantly in recent years due to tight labor markets and competition among logistics companies. As of 2025, entry-level warehouse positions typically pay $15-$22 per hour depending on geographic location, company, and shift.

Shift differentials substantially impact earning potential:

- Overnight Premium: $1-$3 per hour additional, translating to $2,000-$6,000 annually for full-time employment

- Weekend Premium: Additional pay for Saturday/Sunday availability

- Attendance Bonuses: $50-$150 monthly for perfect or near-perfect attendance

- Peak Season Increases: Temporary wage increases or completion bonuses during busy periods

Overtime represents significant income potential in warehouse environments. Many facilities regularly require or offer overtime during peak periods or due to understaffing, with time-and-a-half pay for hours over 40 weekly. A warehouse associate earning $18 per hour base pay who works 50 hours weekly earns $1,035 weekly ($18 × 40 hours + $27 × 10 hours), translating to approximately $53,820 annually.

Benefits Packages and Total Compensation

Major warehouse employers increasingly offer comprehensive benefits to compete for talent, with packages that significantly increase total compensation value. Health insurance represents the most substantial benefit, with companies like Amazon, UPS, and Target offering medical coverage with relatively low employee premium contributions.

| Benefit Type | Typical Value | Availability Timeline | Notes |

| Health Insurance | $5,000-$8,000/year | Day 1 to 90 days | UPS offers to part-timers |

| 401(k) Matching | 3% of salary | Immediate to 1 year | Vesting periods vary |

| Paid Time Off | 40-80 hours/year | After 90 days typically | Increases with tenure |

| Tuition Assistance | $3,000-$5,250/year | After 90 days to 1 year | Amazon, Walmart, UPS programs |

Additional benefits that enhance total compensation value include emergency savings programs, financial wellness counseling, and employee purchase discounts ranging from 10-30% for retail distribution centers. When evaluating job offers, calculating the monetary value of benefits packages—often worth $5,000-$12,000 annually—provides a complete compensation picture beyond hourly wages.

Career Pathways and Advancement Timelines

Warehouse employment offers clear advancement pathways for workers who demonstrate reliability and capability. Entry-level associates typically have opportunities to progress into specialized roles within 6-12 months:

- Forklift Operators: $18-$24/hour with certification

- Quality Control Inspectors: $17-$22/hour with attention to detail

- Inventory Control Specialists: $19-$25/hour with system knowledge

- Training Coordinators: $20-$26/hour with communication skills

Supervisory positions represent the next advancement tier, typically requiring 2-4 years of warehouse experience. Shift supervisors, area managers, and operations coordinators earn $40,000-$60,000 annually, oversee teams of 15-30 workers, and gain valuable leadership experience. Senior management and specialized logistics roles offer further advancement for committed professionals, with operations managers ($65,000-$90,000), facility managers ($75,000-$110,000), and supply chain specialists ($60,000-$95,000) representing career destinations achievable over 5-10 years in the industry.

Alternative Verification Options and Second-Chance Employers

The warehouse and logistics sector includes numerous employers who have embraced fair chance hiring practices or implemented alternative screening approaches that create opportunities for candidates with various concerns. Understanding which companies have made public commitments to inclusive hiring helps candidates focus their application efforts where they're most likely to succeed.

Companies with Second-Chance Hiring Commitments

Several major corporations have publicly committed to fair chance hiring initiatives, explicitly stating their willingness to employ individuals with criminal records. Amazon has pledged to hire over 100,000 people with criminal records over a five-year period. JP Morgan Chase committed to second-chance hiring across their operations including warehouse and logistics facilities. Walmart has implemented fair chance hiring policies in many locations, particularly for distribution center positions.

Dave's Killer Bread—owned by Flowers Foods—maintains one of the most comprehensive second-chance employment programs, with approximately 30% of their workforce composed of individuals with criminal backgrounds. Koch Industries companies, including Georgia-Pacific and Molex, have embraced second-chance hiring as company policy. These explicit commitments mean candidates don't need to wonder about their opportunities—these employers have stated their openness clearly.

Understanding Individual Assessment Practices

Even employers who conduct verification increasingly use "individual assessment" approaches rather than blanket exclusion policies. This means they consider multiple factors including the nature of any past issues, how much time has passed, evidence of rehabilitation, and the relationship between someone's history and the specific job responsibilities.

The Equal Employment Opportunity Commission (EEOC) has issued guidance encouraging employers to conduct individualized assessments and avoid policies that create discriminatory impact:

- Nature Consideration: What happened and whether it relates to job duties

- Time Passage: How long ago events occurred and what's changed since

- Rehabilitation Evidence: Steps taken toward personal improvement and stability

- Position Relevance: Whether history affects ability to perform specific warehouse duties safely

Candidates can support successful individual assessments by preparing explanations that demonstrate rehabilitation, accountability, and forward progress. Brief written statements addressing concerns—focusing on what was learned, steps taken since, and commitment to reliability—help employers make favorable decisions.

Geographic Variations in Hiring Practices

State and local laws significantly impact warehouse hiring practices, creating geographic variation in opportunities. "Ban the box" laws in states including California, Illinois, Massachusetts, and New Jersey restrict when employers can inquire about criminal history, typically prohibiting questions on initial applications and sometimes requiring conditional offers before discussions.

Some jurisdictions go further with "fair chance" ordinances that limit how employers can use information in hiring decisions:

- San Francisco and Los Angeles: Require employers to demonstrate direct relationships between history and job duties

- Philadelphia: Restricts employers from considering arrests without convictions

- Chicago: Requires employers to provide specific reasons for denials and opportunities to respond

- New York City: Limits consideration timeframe and mandates individual assessment

Understanding your local legal landscape helps identify which protections apply to your situation. State workforce development websites typically maintain information about employment laws including restrictions.

Conclusion

The warehouse and logistics industry offers numerous accessible employment pathways, with major employers increasingly adopting flexible hiring approaches that prioritize operational needs, individual assessment, and second-chance opportunities. By understanding company-specific hiring practices, strategically timing applications during peak seasons, exploring temp-to-hire pathways, and focusing on employers with inclusive policies, job seekers can successfully navigate the market to secure positions offering competitive wages, comprehensive benefits, and genuine advancement potential. Remember that employment screening practices vary by location and position, so researching specific opportunities and understanding your local legal protections will help you approach the application process with confidence and realistic expectations.

Frequently Asked Questions

The Frequently Asked Questions that follow are designed to provide clarification on some of the key points discussed within this article. These FAQs are meant to provide insight that will help organizations strike the right balances that are covered throughout this article.

Do Amazon warehouses hire without doing background checks?

Amazon conducts employment verification for warehouse positions but evaluates candidates individually rather than applying automatic disqualifications. The company has publicly committed to hiring 100,000+ individuals with criminal records and focuses on factors relevant to specific job responsibilities. Verification typically occurs after conditional job offers and takes 3-7 business days to complete.

What warehouse jobs can I start immediately without waiting for background verification?

Temporary positions through staffing agencies often provide the fastest path to immediate warehouse employment, with many agencies placing workers at client facilities within 24-48 hours. Agencies conduct simplified initial screening with more comprehensive verification occurring later if positions convert to permanent employment. Seasonal positions during peak hiring periods (October-December) also frequently involve expedited processes to meet urgent operational needs.

Which major logistics companies have the most lenient hiring policies?

Companies including Amazon, Walmart, Target, and various third-party logistics providers have implemented fair chance hiring policies emphasizing individual assessment rather than automatic disqualifications. Hiring practices vary significantly by location due to state and local laws, specific facility needs, and labor market conditions. Research opportunities in your specific geographic area for the most accurate information.

How much do entry-level warehouse jobs pay in 2025?

Entry-level warehouse positions typically pay $15-$22 per hour depending on location, company, and shift timing, with major metropolitan areas commanding higher wages. Overnight and weekend shifts often include premiums of $1-3 per hour. Total compensation including benefits, overtime potential, and shift differentials can result in annual earnings of $35,000-$50,000 for full-time warehouse associates.

Can I advance my career starting from an entry-level warehouse position?

Warehouse employment offers clear advancement pathways, with workers progressing to specialized roles like forklift operators or inventory specialists within 6-12 months. Supervisory positions ($40,000-$60,000 annually) become accessible within 2-4 years, and operations or facility management roles ($65,000-$110,000 annually) over 5-10 years. Many companies strongly prefer promoting from within and offer tuition assistance.

What should I do if I'm denied a warehouse job due to my background?

Employers must provide written notice (pre-adverse action notice) if they used a report in their decision, giving you opportunity to review for accuracy and provide explanatory information. Check for errors, as reports sometimes contain mistakes about identity, case details, or disposition. Contact the employer's HR department to understand their specific concerns and whether individual assessment or appeals processes are available.

Are there specific warehouse positions that have less stringent screening requirements?

Entry-level positions including package handlers, sorters, loaders, and general warehouse associates typically face more streamlined screening compared to roles involving equipment operation (forklifts, reach trucks), supervisory responsibilities, or financial handling. Seasonal and temporary positions often have expedited processes compared to permanent employment. Specific screening approaches vary by employer and location.

What's the best time of year to apply for warehouse jobs if I want a quick hiring process?

Peak hiring seasons (October-December for holiday shipping and June-August for back-to-school fulfillment) typically involve expedited processes due to urgent staffing needs. January-February and May-June also offer opportunities with less competition as facilities replace departing seasonal workers. Applying for positions advertised as "urgent hiring" or "immediate start" regardless of season increases likelihood of quick processing.

Additional Resources

- U.S. Equal Employment Opportunity Commission: Background Checks and Employment

https://www.eeoc.gov/laws/guidance/background-checks-what-employers-need-know - Federal Trade Commission: Background Checks - Fair Credit Reporting Act

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-employers-need-know - National Employment Law Project: Ban the Box Resource Guide

https://www.nelp.org/campaign/ensuring-fair-chance-to-work/ - U.S. Bureau of Labor Statistics: Material Moving Occupations

https://www.bls.gov/ooh/transportation-and-material-moving/material-moving-occupations.htm - Society for Human Resource Management: Background Checks Best Practices

https://www.shrm.org/topics-tools/tools/toolkits/background-checking

Still have questions?

Get in touch with our team today for a personalized demo and discover how our tailored volume pricing and packages can drive results for your business!

How useful was this page?*

Note: your comments are anonymous. We use them to improve the website. Do not include any personal details.

Visit our FCRA Compliance Tool or leave a message here if you need a response.

From the blog Explore the GCheck Content Hub

Healthcare Background Screening Costs: 2026 Budget Planning Guide for Medical Facilities

30 Dec, 2025 • 23 min read

FACIS Background Check: 2026 Healthcare Compliance Guide

18 Dec, 2025 • 20 min read

Food Delivery Driver Background Check: Complete Compliance Guide for Restaurant Operators

17 Dec, 2025 • 17 min readThe information provided in this article is for general informational and educational purposes only and should not be construed as legal advice or a substitute for consultation with qualified legal counsel. While we strive to ensure accuracy, employment screening laws and regulations—including but not limited to the Fair Credit Reporting Act (FCRA), Equal Employment Opportunity Commission (EEOC) guidelines, state and local ban-the-box laws, industry-specific requirements, and other applicable federal, state, and local statutes—are subject to frequent changes, varying interpretations, and jurisdiction-specific applications that may affect their implementation in your organization. Employers and screening decision-makers are solely responsible for ensuring their background check policies, procedures, and practices comply with all applicable laws and regulations relevant to their specific industry, location, and circumstances. We strongly recommend consulting with qualified employment law attorneys and compliance professionals before making hiring, tenant screening, or other decisions based on background check information.