A tenant screening report consolidates critical information about rental applicants, including credit history, criminal records, eviction history, employment verification, and rental references. Understanding how to accurately interpret these reports—including recognizing which red flags warrant rejection versus those requiring additional context—is essential for maintaining legal compliance while selecting reliable tenants. This guide helps landlords and property managers make informed decisions that protect their investments.

Key Takeaways

- Tenant screening reports typically include five core sections: credit history, criminal background, eviction records, employment verification, and rental history

- Credit scores below 580 generally indicate high risk, while scores above 650 suggest responsible financial management, though context matters more than numbers alone

- Criminal records require careful FCRA-compliant evaluation based on crime type, recency, and relevance to housing rather than automatic disqualification

- Eviction history is one of the strongest predictors of future tenancy problems, with recent evictions (within 3-7 years) raising significant concerns

- Income verification should confirm monthly gross income at least 2.5-3 times the monthly rent to ensure affordability

- Screening criteria must be applied consistently across all applicants to avoid fair housing violations and discrimination claims

- Multiple negative factors combined (poor credit + eviction + unstable employment) present higher risk than single isolated issues

- Federal and state laws, including FCRA and Fair Housing Act, govern how you must use screening information and notify rejected applicants

- Professional screening services provide standardized reports with built-in compliance features, reducing liability compared to DIY background checks

Understanding the Tenant Screening Report Components

A comprehensive tenant screening report serves as your primary decision-making tool when evaluating rental applicants. These reports aggregate data from multiple sources to present a complete picture of an applicant's rental worthiness. The sources include credit bureaus, court records, databases, and verification services. Modern screening reports follow standardized formats mandated by the Fair Credit Reporting Act (FCRA), ensuring consistency and legal compliance across the rental industry.

The typical report structure includes distinct sections for different evaluation categories, each providing specific insights into applicant behavior and reliability. Learning to navigate these sections efficiently helps you identify qualified tenants quickly while maintaining fair and consistent evaluation standards. Professional property managers typically spend 10-15 minutes thoroughly reviewing each complete screening report before making rental decisions.

Credit History and Financial Assessment

The credit report section reveals an applicant's financial responsibility and payment patterns over time. This portion includes the credit score, detailed account histories, payment records, and outstanding debts. It also shows public records like bankruptcies or tax liens. Credit information comes directly from the three major credit bureaus—Equifax, Experian, and TransUnion—providing verified financial data spanning seven to ten years.

Understanding credit context matters more than focusing solely on the score number. A 620 score resulting from medical debt carries different implications than a 620 score from multiple defaulted credit cards and unpaid utilities. Look for patterns of responsibility, recent improvements, and the applicant's debt-to-income ratio when interpreting credit information.

Credit Score Ranges and Risk Levels

Credit scores provide a quick snapshot of overall creditworthiness, but interpreting them requires understanding industry standards and risk thresholds. The scoring models range from 300 to 850, with different tiers indicating varying levels of financial reliability. Most landlords establish minimum credit score requirements between 600-650, though standards vary based on local market conditions and property type.

| Credit Score Range | Risk Level | Typical Characteristics | Landlord Action |

| 750-850 | Excellent/Low Risk | Consistent payment history, low debt utilization, no derogatory marks | Strong approval candidate |

| 650-749 | Good/Moderate Risk | Generally reliable payments, some minor late payments possible | Approve with standard deposit |

| 580-649 | Fair/Elevated Risk | Several late payments, higher debt levels, possible collections | Consider with additional documentation or co-signer |

| 300-579 | Poor/High Risk | Significant payment issues, defaults, collections, possible bankruptcy | Typically requires co-signer, larger deposit, or rejection |

These ranges serve as guidelines rather than absolute rules. Current market conditions should influence your standards accordingly.

Key Credit Report Elements to Examine

Beyond the credit score, specific report elements reveal important behavioral patterns and potential concerns. Payment history shows whether the applicant pays bills on time, with particular attention to rent-related payments like previous landlord-reported accounts or rent reporting services. Collections and charge-offs indicate accounts the applicant abandoned, suggesting possible future nonpayment issues.

Review account age and credit mix to understand financial maturity. Applicants with longer credit histories and diverse account types (credit cards, auto loans, student loans) typically demonstrate more stable financial management. Debt-to-income ratio, calculated by dividing monthly debt payments by monthly gross income, should ideally stay below 40% for rental applicants to ensure sufficient income remains for rent obligations.

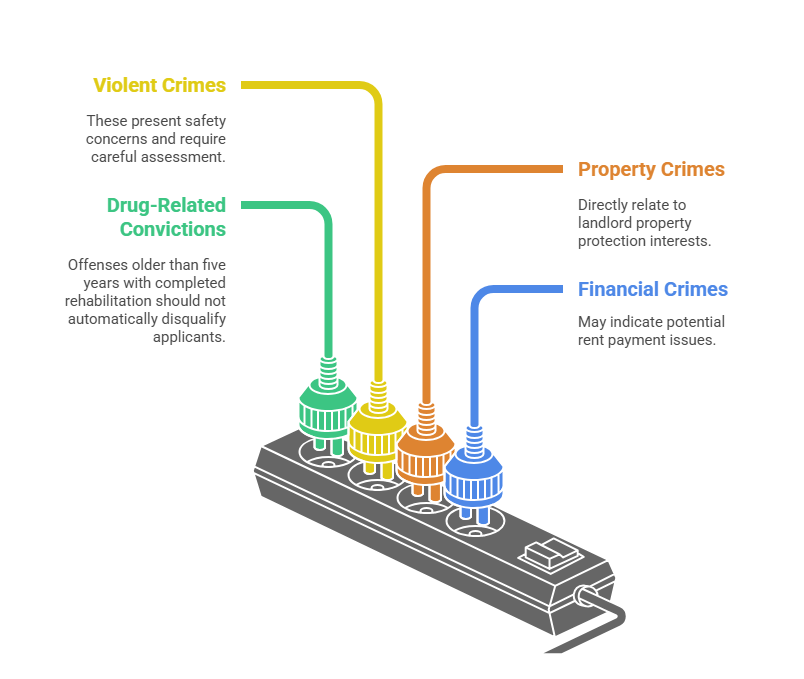

Criminal Background Check Interpretation

Criminal background checks reveal court records, arrests, convictions, and sometimes incarceration history from county, state, and federal databases. This section presents legally sensitive information requiring careful, compliant interpretation under Fair Housing Act guidelines and FCRA regulations. The 2016 HUD guidance specifically addresses how criminal records should be evaluated to avoid disparate impact discrimination against protected classes.

Modern screening reports typically search seven years of criminal history, though some jurisdictions limit how far back landlords can consider certain offenses. The report includes offense descriptions, conviction dates, case dispositions, and sometimes sentencing information. Understanding the difference between arrests (which don't prove guilt) and convictions (which do) is fundamental to proper interpretation. Not all criminal records justify tenant rejection—evaluation must consider offense nature, severity, recency, and relevance to housing safety.

FCRA-Compliant Criminal Record Evaluation

Legally compliant criminal background evaluation follows a structured approach examining multiple factors. The nature and gravity of the offense matters significantly—violent crimes raise different concerns than minor infractions. The time elapsed since the offense or completion of sentence helps determine current risk level. The nature of the rental property or tenancy, including proximity to schools or vulnerable populations, may influence evaluation.

Key evaluation considerations include:

- Drug-related convictions: Offenses older than five years with completed rehabilitation generally shouldn't automatically disqualify applicants.

- Violent crimes or sexual offenses: These present legitimate safety concerns for other residents and require careful assessment.

- Property-related crimes: Arson, property damage, or theft directly relate to landlord property protection interests.

- Financial crimes: Fraud or identity theft may indicate potential rent payment issues.

When criminal records raise concerns, conduct individualized assessments rather than applying automatic rejection policies. Request explanation letters from applicants, consider evidence of rehabilitation, and verify information accuracy.

Eviction History and Court Records

The eviction records section searches civil court filings for unlawful detainer actions, eviction judgments, and landlord-tenant disputes. This information proves particularly valuable as past eviction history strongly predicts future tenancy problems—applicants with prior evictions are statistically more likely to face eviction again. Screening services typically search 7-10 years of eviction records across multiple jurisdictions where the applicant previously resided.

Eviction records include filing dates, case outcomes (judgment for landlord, judgment for tenant, dismissed, settled), amounts owed, and sometimes the underlying reason for eviction. Not all eviction filings result in actual evictions—many cases are dismissed, settled, or resolved in the tenant's favor. Distinguishing between filed cases and actual eviction judgments is critical for accurate risk assessment. Recent evictions (within the past three years) present the highest risk and often warrant application rejection unless exceptional circumstances exist.

Understanding Eviction Context

Understanding eviction context helps separate legitimate housing issues from tenant fault. Evictions resulting from job loss during economic downturns differ significantly from evictions caused by property damage or illegal activity. Medical emergencies or domestic violence situations present different circumstances than chronic nonpayment without extenuating reasons.

Request applicant explanations for any eviction records discovered and verify their account against court documentation. This approach ensures fair evaluation while protecting your property interests. Multiple evictions, regardless of timeframe, indicate a pattern of tenancy problems requiring serious consideration before approval.

Employment and Income Verification

Employment verification confirms an applicant's current job status, employer, position, hire date, and income level. This section addresses the fundamental question of rental affordability—whether the applicant earns sufficient income to reliably pay rent without financial strain. Standard landlord practice requires monthly gross income at least 2.5-3 times the monthly rent, though some markets use higher multiples (3.5-4x) for premium properties.

Income verification typically includes pay stubs, tax returns, employer contact verification, and sometimes direct employer portal verification through automated systems. Self-employed applicants require additional documentation including business tax returns, bank statements, and profit-and-loss statements spanning 12-24 months. Gig economy workers and freelancers present unique verification challenges requiring flexible but thorough income assessment approaches.

Employment stability matters as much as income amount. Applicants with consistent employment history (2+ years in current position or industry) demonstrate reliability, while frequent job changes may indicate instability. However, career advancement job changes differ from termination-driven job hopping, so examine employment patterns contextually rather than applying rigid tenure requirements.

Income Documentation by Source

Different income types require specific documentation to verify reliability and consistency. W-2 employees provide recent pay stubs, employer verification, and offer letters for new positions. Self-employed individuals need tax returns, bank statements, and business documentation to confirm income stability.

| Income Type | Verification Documentation | Key Considerations |

| W-2 Employment | Recent pay stubs (2-3 months), employer verification, offer letter | Income consistency, employment stability, recent hire status |

| Self-Employment | Tax returns (2 years), bank statements (3-6 months), CPA letter | Income trends, business stability, ability to document earnings |

| Social Security/Disability | Award letter, bank statements, benefits verification | Benefit amount adequacy, continuation timeline, supplemental income |

| Investment/Passive Income | Investment statements, trust documents, tax returns | Income sustainability, source documentation, distribution regularity |

Alternative income sources including alimony, child support, Social Security, disability benefits, and investment income are legally acceptable under Fair Housing Act provisions. You cannot discriminate against applicants whose income derives from lawful sources, provided total verifiable income meets your established requirements applied consistently across all applicants.

Assessing Income Stability

Income stability extends beyond current earnings to include employment duration and career trajectory. Recent job changes with valid explanations like promotions or relocations differ from frequent terminations. New employment with strong industry experience presents lower risk than constant position changes across unrelated fields.

Seasonal workers, commissioned salespeople, and contract employees require additional scrutiny. Review multiple years of income history to identify patterns and average earnings. Applicants should demonstrate consistent annual income meeting your requirements despite monthly fluctuations.

Rental History and Reference Verification

Rental history provides the most directly relevant predictor of future tenant behavior, revealing how applicants treated previous properties and fulfilled lease obligations. This section includes previous addresses, landlord contact information, tenancy dates, rent amounts, payment timeliness, lease violations, property condition, and re-rental recommendations. Quality screening reports verify 2-3 most recent rental references covering at least the past 3-5 years.

Professional property managers and institutional landlords typically provide more detailed, objective rental references than individual landlords who may have personal biases. Direct landlord conversations often reveal information not documented in written reports—ask specific questions about payment consistency, property maintenance, neighbor complaints, lease violations, and whether the landlord would rent to the applicant again. Gaps in rental history require explanation—applicants may have lived with family, owned previous homes, or experienced housing instability.

Critical Landlord Reference Questions

When contacting previous landlords directly, structured questioning ensures consistent information gathering across applicants. Focus on objective, verifiable facts rather than subjective landlord opinions that may reflect personal conflicts rather than tenant quality. Document all conversations with dates, landlord names, and responses for your records.

Essential questions include:

- Payment history: Did the tenant pay rent on time consistently, and how many late payments occurred during the tenancy?

- Lease compliance: Did the tenant fulfill all lease terms without noise complaints, unauthorized occupants, or policy violations?

- Property condition: How did the tenant maintain the property, and was the unit returned in acceptable condition?

- Communication: Was the tenant responsive to communications and cooperative during inspections?

- Re-rental recommendation: Would you rent to this tenant again without hesitation?

Red flags include landlord inability or unwillingness to provide references, significant security deposit deductions beyond normal wear, and chronic late payments. Property damage, frequent complaints from neighbors, and particularly any indication the landlord was relieved when the tenant left warrant serious concern.

Identifying Red Flags in Tenant Screening Reports

Red flags are warning indicators suggesting increased risk of future tenancy problems, though not all red flags automatically justify rejection. Effective screening distinguishes between minor concerns that can be mitigated and serious issues warranting application denial. Understanding red flag severity, recency, patterns, and context enables informed, legally defensible decisions. Single isolated issues occurring years ago with clean history generally shouldn't eliminate otherwise qualified applicants.

However, multiple concurrent red flags or patterns of problematic behavior significantly increase risk. A pattern of late rent payments combined with an eviction and poor landlord references presents much higher risk than an old bankruptcy followed by years of positive credit rebuilding. Context matters—consider the complete applicant profile rather than focusing excessively on individual negative items.

High-Priority Warning Indicators

Certain red flags indicate severe risk requiring strong justification for approval. Recent evictions within the past 3 years demonstrate fundamental inability or unwillingness to fulfill rental obligations. Outstanding balances owed to previous landlords suggest applicants may also leave your property with unpaid rent. Criminal convictions for violent crimes, sexual offenses, or property crimes present serious safety and liability concerns.

Fraudulent application information including falsified income documentation, fake references, or misrepresented employment indicates dishonesty that should disqualify applicants immediately. Income below 2.5x monthly rent creates financial strain making consistent rent payment difficult regardless of good intentions. Chronic late payment patterns across credit accounts, utilities, and previous rent indicates habitual payment issues likely to continue.

Moderate-Risk Considerations

Moderate red flags warrant additional scrutiny and documentation but may not require rejection if explanations and mitigating factors exist. Credit scores in the 580-649 range suggest some financial management issues but may reflect recoverable situations like medical debt or past hardships with subsequent improvement. Unexplained employment gaps or frequent job changes (3+ jobs in 2 years) create income stability concerns but legitimate reasons sometimes explain career transitions.

Short-term rental histories at multiple recent addresses may indicate instability, though relocations, temporary housing, or transitions from homeownership sometimes explain frequent moves. Negative landlord references require investigation—personality conflicts or disagreements over security deposit deductions differ from legitimate performance problems. Collections or charge-offs for non-rent items (medical bills, telecommunications) are concerning but less directly predictive of rent payment behavior than utility collections or rent-specific debts.

Legal Compliance in Screening Report Interpretation

Federal, state, and local laws strictly regulate how landlords must obtain, use, and store tenant screening information. The Fair Credit Reporting Act (FCRA) governs consumer report usage, requiring specific applicant notifications, authorization procedures, and adverse action protocols. Fair Housing Act prohibitions prevent discrimination based on protected classes including race, color, national origin, religion, sex, familial status, and disability.

FCRA compliance begins with proper applicant authorization—you must obtain written consent before pulling credit or background reports and provide specific disclosures about your screening process. When screening information causes application rejection, FCRA requires adverse action notices explaining the decision, identifying the screening company, and informing applicants of their right to dispute report accuracy. State and local laws often impose additional requirements beyond federal standards, including restrictions on criminal record consideration, credit check requirements, or eviction record usage.

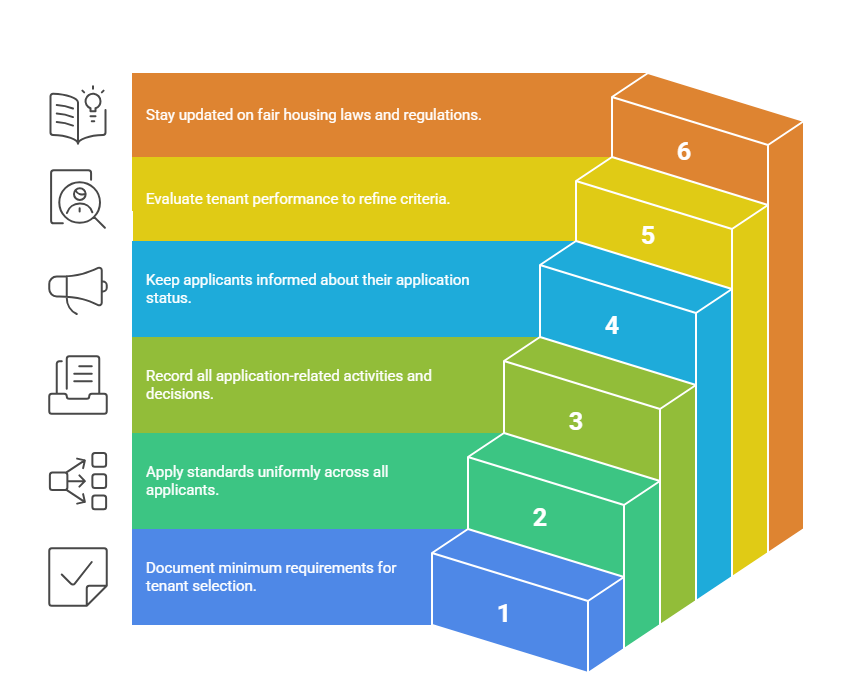

Consistent Screening Criteria Application

Legal compliance requires applying identical screening criteria consistently across all applicants to avoid discriminatory disparate treatment or disparate impact. Establish written, objective screening standards before beginning applicant evaluation, and apply those standards uniformly regardless of applicant demographics, personal impressions, or subjective preferences. Document your screening criteria explicitly, including minimum credit score thresholds, income requirements, acceptable background check results, and disqualifying factors.

Publish these criteria in your rental listings and application materials so applicants understand requirements before applying. When making exceptions to standard criteria, document legitimate business justifications thoroughly. Accepting an applicant with credit below your minimum because they have excellent rental references and high income addresses actual risk through compensating factors. However, making exceptions for some applicants while strictly enforcing standards for others invites discrimination allegations.

Training and Documentation Requirements

Train anyone involved in tenant screening on fair housing laws, FCRA requirements, and your specific screening policies. Property management staff, leasing agents, and co-owners must understand both legal obligations and your established procedures to ensure compliant, consistent applicant evaluation across your entire operation.

Document every step of your screening process including when you received applications, what reports you ordered, what information you reviewed, and how you reached your decision. Detailed documentation protects against discrimination claims and demonstrates professional property management practices. Keep adverse action documentation for legally required retention periods (typically 2-5 years depending on jurisdiction).

Making the Final Decision

The final approval decision synthesizes all screening report components into an overall risk assessment weighing positive factors against negative indicators. No applicant is perfectly risk-free—your goal is identifying applicants whose risk level falls within acceptable parameters for your property and tolerance. Consider the complete picture rather than focusing excessively on single factors, unless those factors present severe, disqualifying concerns.

Strong applications demonstrate financial stability (good credit, income 3x+ rent), rental reliability (positive references, no evictions), employment stability (consistent work history), and clean background checks (no serious criminal or legal issues). These applicants present low risk and warrant straightforward approval with standard lease terms and security deposits. Marginal applications with mixed indicators require careful judgment—evaluate which factors matter most for your specific situation, as steady rent payment history often predicts future performance better than credit scores alone.

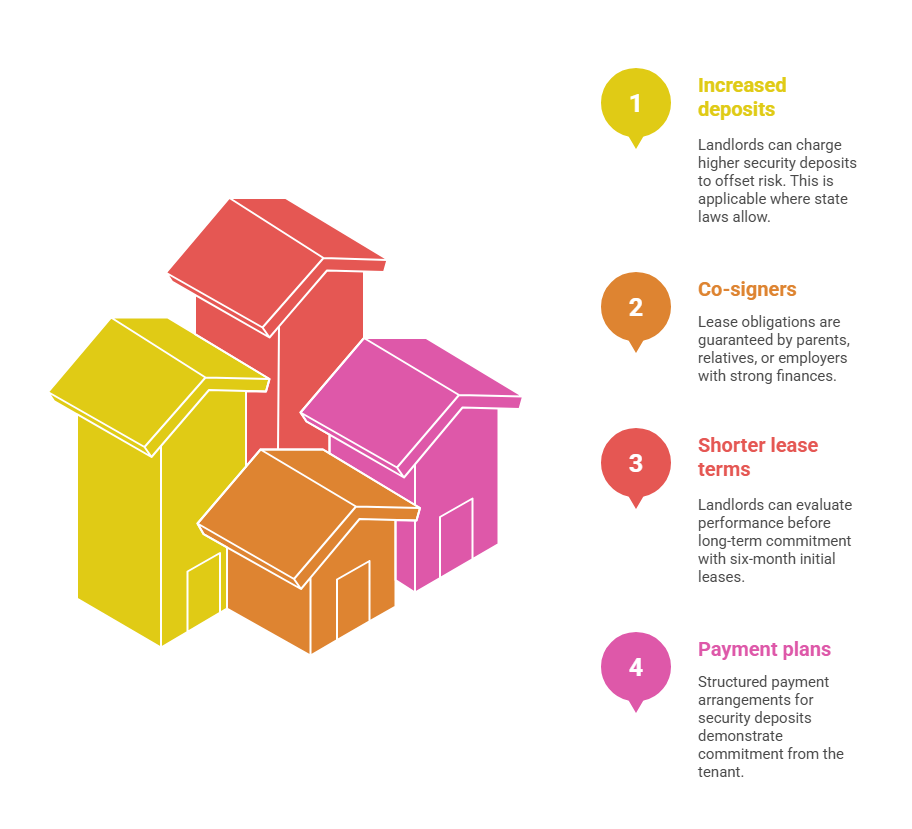

Risk Mitigation Strategies

Risk mitigation strategies help approve borderline applicants while protecting your interests. Additional security deposits (where legally permitted) provide extra protection against property damage or nonpayment. Co-signers with strong credit and income reduce risk from applicants who don't meet standard criteria but have extenuating circumstances.

Effective mitigation approaches include:

- Increased deposits: Higher security deposits (1.5-2 months rent) offset elevated risk where state laws allow.

- Co-signers or guarantors: Parents, relatives, or employers with strong finances guarantee lease obligations.

- Shorter lease terms: Six-month initial leases with renewal options allow performance evaluation before long-term commitment.

- Payment plans: Structured payment arrangements for security deposits or first month's rent demonstrate commitment.

These strategies work best for applicants with extenuating circumstances rather than those with multiple serious red flags. Document your reasoning clearly when using mitigation strategies instead of standard approval or rejection.

Adverse Action Procedures

When denying applications, follow FCRA adverse action requirements precisely. Provide written notice within required timeframes (typically within 7-10 days) identifying the screening company that provided the report and including their contact information. Explain the applicant's right to dispute report accuracy within 60 days and note that the screening company didn't make the rejection decision.

Keep copies of all adverse action notices and supporting documentation. Proper adverse action compliance protects you from FCRA violation penalties and demonstrates fair screening practices if decisions are later challenged.

Professional Screening Services vs. DIY Background Checks

Professional tenant screening services offer comprehensive reports compiled from multiple authoritative data sources with built-in legal compliance features. These services access credit bureau data, nationwide criminal databases, eviction records, and verification systems that individual landlords cannot access independently. Reports follow standardized formats designed for FCRA compliance, reducing legal liability compared to informal DIY screening approaches. Costs typically range from $25-75 per applicant depending on report comprehensiveness and verification depth.

Most services offer tiered packages—basic credit checks, mid-level credit plus criminal and eviction searches, and comprehensive reports including employment and rental verifications. While these costs represent upfront expenses, they're far less than costs associated with problematic tenants or fair housing lawsuits resulting from improper screening. DIY screening using free or low-cost internet searches, social media reviews, and informal reference checks creates significant legal risks due to potentially inaccurate or incomplete information obtained outside FCRA-regulated channels.

Professional services also provide customer support, compliance guidance, and documentation proving you followed proper procedures—valuable protection if screening decisions are legally challenged. Many services include audit trails, applicant authorization records, and adverse action letter generation ensuring complete regulatory compliance throughout the screening process. This combination of comprehensive data, legal safeguards, and professional support justifies the investment for serious landlords.

Best Practices for Tenant Screening Success

Successful tenant screening combines thorough report analysis with consistent application of objective criteria. Start by establishing clear, written screening standards before reviewing any applications to prevent subjective decision-making and ensure fair evaluation. Screen all qualified applicants who submit complete applications and fees using first-come, first-served evaluation of qualified applicants for the legally safest approach.

Key best practices include:

- Written criteria: Document minimum credit scores, income multiples, acceptable background results, and disqualifying factors.

- Consistent application: Apply standards uniformly regardless of demographics, personal impressions, or subjective preferences.

- Thorough documentation: Record when you received applications, what reports you ordered, and how you reached decisions.

- Clear communication: Establish timelines and keep applicants informed about application status throughout the process.

- Regular review: Track tenant performance to verify your criteria effectively predict success and adjust as needed.

- Ongoing education: Stay informed about changing fair housing laws, FCRA requirements, and local screening regulations.

Approve the first applicant who meets your published criteria rather than comparing multiple applicants subjectively. This approach avoids discrimination claims while efficiently filling vacancies with qualified tenants. Document every step thoroughly to protect against legal challenges and demonstrate professional property management practices.

Conclusion

Mastering tenant screening report interpretation protects your rental investment while ensuring fair, compliant applicant evaluation. Focus on patterns and context rather than isolated factors, apply consistent criteria across all applicants, and understand legal requirements governing screening information use. Quality tenants share common characteristics visible in properly interpreted screening reports—strong rental references, stable income, and responsible financial patterns. By combining thorough report analysis with legal compliance and sound judgment, you'll consistently select reliable tenants who protect your property value and provide steady rental income for years to come.

Frequently Asked Questions

What credit score should I require for rental applicants?

Most landlords require minimum credit scores between 600-650 for standard approvals, though market conditions influence appropriate thresholds. Scores below 580 indicate high risk, while scores above 650 demonstrate good creditworthiness. Context matters more than the score itself—examine underlying credit behaviors, debt levels, and payment patterns rather than relying solely on the score number.

How far back should I check an applicant's criminal history?

Most screening services search 7 years of criminal records, though some jurisdictions legally limit lookback periods for certain offenses. Federal guidance recommends individualized assessment considering offense nature, severity, and relevance to housing. Recent offenses (within 3-5 years) warrant closer scrutiny than older convictions, and serious crimes may justify consideration beyond 7 years.

Can I reject an applicant based solely on a past eviction?

Yes, eviction history is a legitimate, non-discriminatory rental selection criterion directly related to tenancy performance. Recent evictions (within 3 years) present high risk and commonly justify rejection, while older evictions may be overlooked depending on subsequent rental history. Always apply eviction-related screening criteria consistently across all applicants to avoid discrimination claims.

What income-to-rent ratio should I use for tenant screening?

The standard minimum is monthly gross income at least 2.5-3 times monthly rent, ensuring applicants retain sufficient income for other expenses. Some markets or premium properties require 3.5-4 times rent for added security. This ratio applies to total verifiable income from all lawful sources, and combined income from co-tenants or co-signers can meet the requirement.

How do I handle screening reports with multiple red flags?

Multiple concurrent red flags dramatically increase risk and typically warrant application denial unless exceptional mitigating circumstances exist. Document your decision-making process, apply your criteria consistently, and provide proper adverse action notices. Risk mitigation strategies may address single red flags but rarely sufficiently offset multiple serious concerns.

Are there items I legally cannot consider in tenant screening?

You cannot discriminate based on protected classes including race, color, national origin, religion, sex, familial status, or disability under federal Fair Housing Act. Many states add protected classes like sexual orientation, gender identity, or source of income. Some jurisdictions restrict considering certain criminal records, and arrest records without convictions generally shouldn't influence decisions.

What should I do if an applicant disputes information in their screening report?

FCRA requires you to provide screening company contact information so applicants can dispute inaccuracies directly with the consumer reporting agency. Put the application on hold during the dispute investigation period rather than making decisions based on potentially incorrect information. If disputes resolve in the applicant's favor and they meet your criteria, reconsider the application based on accurate information.

How long should I keep tenant screening reports and application records?

Retain all application materials, screening reports, and decision documentation for at least 2-3 years as protection against potential discrimination claims. Some states require longer retention periods (up to 5-7 years). Store records securely with restricted access to protect applicant privacy and comply with data protection regulations.

Should I screen all applicants or just the one I'm most interested in?

Screen all applicants who meet preliminary qualifications (completed application, application fee) to ensure fair, consistent evaluation. First-come, first-served screening of qualified applicants is the legally safest approach. Screening only preferred applicants creates discrimination risk, particularly if screening patterns correlate with protected class characteristics.

Can I use social media searches as part of tenant screening?

While not illegal, social media screening creates legal risks and may reveal protected class information that shouldn't influence housing decisions. Information from social media lacks the accuracy verification and FCRA protections of professional screening reports. Professional screening services providing legally compliant reports present far less liability than informal social media investigations.

Additional Resources

- Fair Housing Act Overview and Protected Classes - U.S. Department of Housing and Urban Development

https://www.hud.gov/program_offices/fair_housing_equal_opp/fair_housing_act_overview - FCRA Compliance Guide for Landlords - Federal Trade Commission

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-landlords-need-know - HUD Guidance on Criminal Records in Tenant Screening

https://www.hud.gov/sites/documents/HUD_OGCGUIDAPPFHASTANDCR.PDF - State-by-State Landlord Tenant Law Guide - Nolo Legal Encyclopedia

https://www.nolo.com/legal-encyclopedia/landlord-tenant-law - Understanding Credit Scores for Rental Applications - Experian

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/what-is-a-good-credit-score/

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.