Employee theft costs U.S. retailers over $50 billion annually. This makes comprehensive background screening essential for retail loss prevention strategies. Implementing systematic pre-employment screening can reduce internal theft by up to 65% while ensuring FCRA compliance and maintaining hiring efficiency.

Key Takeaways

- Retail employee theft accounts for 28.5% of total inventory shrinkage, making background screening a critical first line of defense.

- Criminal history checks, employment verification, and reference screening form the foundation of effective retail theft prevention programs.

- FCRA-compliant background screening processes protect employers from legal liability while identifying high-risk candidates.

- Multi-layered screening approaches combining automated checks with behavioral assessments yield the highest ROI for loss prevention.

- Regular screening policy updates and staff training ensure consistent application across all retail locations and hiring managers.

- Data-driven screening metrics help retailers measure program effectiveness and justify background check investments to stakeholders.

The Financial Impact of Employee Theft in Retail

Employee theft represents one of the most significant financial challenges facing retail businesses today. The National Retail Federation's 2024 Security Survey shows internal theft accounts for $18.2 billion in annual losses across the retail sector. This staggering figure translates to an average loss of $1,551 per dishonest employee incident.

The retail industry experiences unique vulnerabilities that make employee screening particularly crucial. Workers have access to cash registers, inventory stockrooms, and merchandise. This creates numerous opportunities for internal theft. High turnover rates and seasonal hiring pressures often lead to rushed recruitment processes. These factors combine to create an environment where comprehensive retail employee theft prevention measures become business necessities.

Research from the Loss Prevention Research Council demonstrates important findings about screening programs. Retailers implementing systematic background screening programs experience 40-65% reductions in employee theft incidents. The return on investment for these programs typically ranges from 300-500%. The cost of background checks is minimal compared to potential theft losses. Effective screening programs also contribute to improved employee morale and customer confidence. This creates additional indirect benefits beyond direct loss prevention.

Understanding Internal Theft Patterns and Risk Factors

Internal theft manifests in various forms throughout retail operations. Cash theft represents the most direct form of employee dishonesty. Merchandise theft involves taking products for personal use or resale. Time theft occurs when employees falsify hours worked or take unauthorized breaks.

Certain employee characteristics correlate with higher theft risks. Financial stress often drives otherwise honest employees to steal. Substance abuse problems can impair judgment and increase desperation. Previous criminal history, particularly for theft or fraud offenses, indicates elevated risk levels. Understanding these patterns helps retailers develop targeted screening strategies.

| Risk Factor | Theft Likelihood Increase | Screening Method |

| Financial Stress | 45% higher | Credit checks, reference verification |

| Substance Abuse | 67% higher | Criminal background, behavioral interviews |

| Prior Theft History | 89% higher | Comprehensive criminal searches |

| Employment Gaps | 23% higher | Employment verification, reference checks |

Seasonal employment patterns create additional challenges for retail loss prevention hiring. Holiday hiring often involves expedited processes that may skip thorough screening. Summer employees may have limited work history for verification. These situations require adjusted screening protocols that balance speed with effectiveness.

Essential Components of Retail Background Screening

Criminal History Verification Strategies

Criminal background checks serve as the cornerstone of retail loss prevention hiring strategies. These searches reveal conviction records that may indicate propensity for theft, fraud, or other dishonest behaviors. Effective criminal screening requires understanding different search types and their limitations.

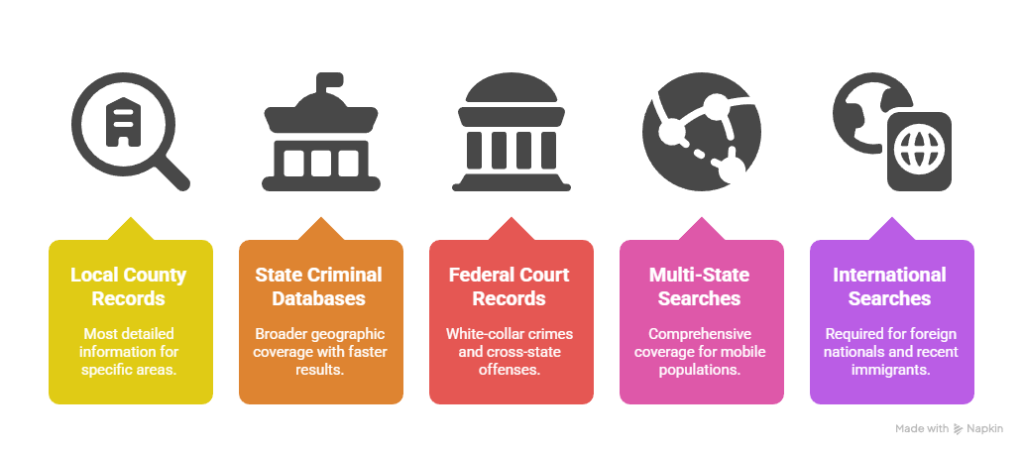

County-level searches provide detailed local records but miss activity in other jurisdictions. State-wide searches offer broader coverage but may lack recent updates. Federal searches capture white-collar crimes but miss local misdemeanors. Multi-jurisdictional approaches combine these sources for comprehensive coverage.

- Local County Records: Most detailed information for specific areas

- State Criminal Databases: Broader geographic coverage with faster results

- Federal Court Records: White-collar crimes and cross-state offenses

- Multi-State Searches: Comprehensive coverage for mobile populations

- International Searches: Required for foreign nationals and recent immigrants

Retail employers must balance thoroughness with compliance requirements when conducting criminal history checks. The timing of criminal inquiries matters for legal compliance. Many jurisdictions now prohibit asking about criminal history on initial applications.

Employment and Education Verification Processes

Previous employment verification provides critical insights into candidate reliability and honesty. This process involves contacting former employers to confirm job titles, employment dates, and reasons for separation. For retail positions involving cash handling or inventory management, verification becomes particularly important.

Employment verification can reveal patterns that indicate potential theft risks. Frequent job changes may suggest performance problems or integrity issues. Unexplained employment gaps could indicate incarceration or other concerning circumstances. Discrepancies between stated and actual job responsibilities may reveal dishonesty.

Reference checks complement employment verification by providing qualitative assessments of candidate character. Former supervisors can offer perspectives on trustworthiness and attention to detail. They can also comment on adherence to company policies and cash handling accuracy. These insights prove invaluable when evaluating candidates for positions with significant retail security background checks responsibilities.

Education verification serves multiple purposes in retail hiring decisions. It confirms basic honesty about qualifications and achievements. It can reveal attention to detail and follow-through capabilities. However, education verification may be less critical for entry-level retail positions compared to management roles.

FCRA Compliance in Retail Employee Screening

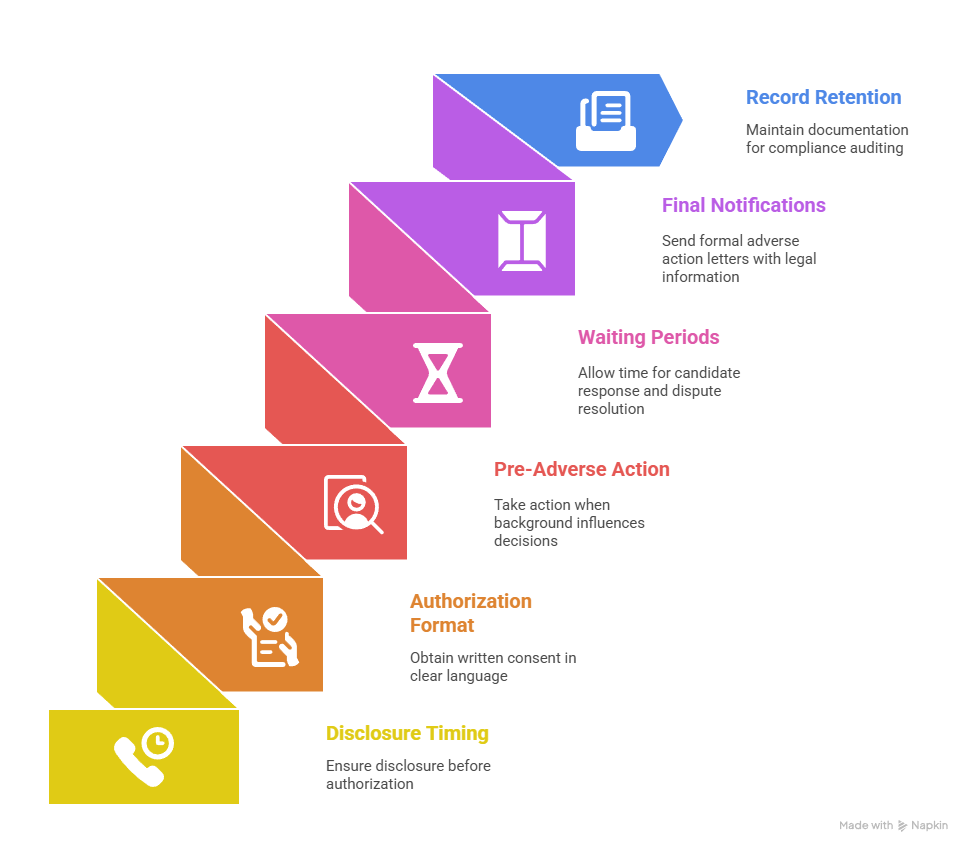

The Fair Credit Reporting Act establishes strict guidelines for conducting background checks in retail environments. FCRA compliance begins with proper disclosure and authorization procedures. Employers must provide clear notification to candidates before initiating screening processes. This notification must occur in standalone disclosure documents separate from job applications.

Authorization requirements mandate written consent from candidates before conducting any background checks. The authorization language must be clear and easily understood. Employers cannot condition the authorization on employment offers. Candidates must have genuine opportunities to decline authorization without automatic disqualification.

Adverse action procedures represent critical FCRA compliance requirements for retail employers. When background check results lead to negative hiring decisions, specific steps must follow. Employers must provide pre-adverse action notices including copies of background reports. They must also include summaries of consumer rights during this process.

The pre-adverse action process allows candidates opportunities to dispute inaccurate information. This waiting period typically lasts 3-5 business days minimum. Candidates can contact background screening companies to challenge findings. They can also provide additional context or explanations to employers. Following the waiting period, employers must provide final adverse action notices if proceeding with negative hiring decisions.

- Disclosure Timing: Must occur before obtaining authorization from candidates

- Authorization Format: Written consent using clear, understandable language

- Pre-Adverse Action: Required when background information influences hiring decisions

- Waiting Periods: Minimum time frames for candidate response and dispute resolution

- Final Notifications: Formal adverse action letters with required legal information

- Record Retention: Documentation requirements for compliance auditing purposes

State-Specific Compliance Requirements

California's employment law requirements add complexity for retail employers operating in the state. The California Consumer Privacy Act (CCPA) imposes data handling obligations beyond federal requirements. The Fair Employment and Housing Act (FEHA) provides additional protections for candidates and employees. These laws require specialized knowledge and careful implementation.

Ban-the-box legislation varies significantly across different states and municipalities. Some jurisdictions prohibit criminal history inquiries until after conditional job offers. Others allow earlier inquiries but restrict how employers can use the information. New York City has particularly strict requirements for retail employers regarding criminal history.

Credit check restrictions apply in numerous states for most retail positions. Illinois, California, and several other states limit credit checks to specific job categories. These restrictions typically allow credit checks only for management positions or roles involving financial responsibilities. Violation of these restrictions can result in significant penalties and legal liability.

Implementing Risk-Based Screening Strategies

Different retail positions require varying levels of background screening intensity based on theft risk exposure. Cash handling positions warrant comprehensive criminal history searches and credit checks. Management roles require extensive employment verification and professional references. General sales floor positions may need only basic criminal background checks and employment verification.

Position-specific screening matrices help standardize decisions across hiring managers and locations. These tools specify required checks for each role type. They ensure consistent application while maintaining compliance with equal employment opportunity requirements. Regular matrix updates reflect changing business needs and regulatory requirements.

| Position Level | Criminal Check Scope | Employment History | Reference Checks | Credit Check Required |

| Entry Sales | County + Adjacent | 2 years | 1 professional | No |

| Cash Handler | Multi-State | 5 years | 2 professional | Yes |

| Shift Supervisor | Comprehensive | 7 years | 2 professional + 1 personal | Yes |

| Management | Federal + State + County | 10 years | 3 professional | Yes |

Risk assessment frameworks incorporate multiple data points beyond background check results. Application inconsistencies can indicate dishonesty or carelessness. Employment gaps may suggest undisclosed problems or instability. Reference feedback provides qualitative insights into character and work ethic. This holistic approach reduces false positives while maintaining effective theft prevention capabilities.

Seasonal hiring adjustments account for compressed timelines and limited candidate pools. Holiday season hiring may require expedited screening processes. Summer employment programs might involve student workers with limited employment history. These situations demand flexible approaches that maintain screening effectiveness while meeting operational needs.

Technology Solutions for Retail Screening Programs

Modern background screening platforms integrate seamlessly with retail hiring workflows. Applicant tracking system connections automate data transfer and status updates. Real-time reporting provides immediate access to screening results. Cloud-based solutions enable mobile access for busy retail managers across multiple locations.

Artificial intelligence enhances screening effectiveness by identifying patterns across large datasets. Machine learning algorithms can predict theft likelihood more accurately than traditional methods. However, AI-powered tools must maintain FCRA compliance and avoid discriminatory outcomes. Regular auditing ensures these systems operate fairly and legally.

Integration with Hiring Workflows

Seamless technology integration ensures background screening enhances rather than delays retail hiring processes. API connections between screening providers and HR systems eliminate manual data entry. Automated status updates keep hiring managers informed throughout the screening process. This integration proves particularly valuable during peak hiring seasons.

Mobile-optimized platforms accommodate the fast-paced nature of retail hiring decisions. Managers can review results and approve hiring decisions from any location. They can access compliance documentation and candidate information instantly. This flexibility supports multi-location retail operations while maintaining consistent screening standards.

Workflow automation reduces administrative burden on retail hiring staff. Automated reminders ensure timely follow-up on pending screenings. System notifications alert managers when results become available. Electronic document storage eliminates paper filing and retrieval challenges.

Data Security and Privacy Considerations

Background screening data requires robust security measures to protect candidate privacy. Encryption protocols safeguard information during transmission and storage. Access controls limit who can view sensitive candidate information. Regular security audits identify potential vulnerabilities in data handling processes.

Privacy regulations like GDPR affect international retail operations and foreign candidates. Data retention policies must comply with various jurisdictional requirements. Candidate consent management becomes more complex with multiple regulatory frameworks. These considerations require specialized expertise and careful planning.

Cost-Benefit Analysis of Screening Programs

Comprehensive cost-benefit analysis helps justify background screening investments to retail stakeholders. Direct costs include screening fees, technology platforms, and administrative overhead. Indirect costs involve time spent by HR staff and hiring managers on screening activities. Training costs for compliance and proper implementation also factor into total program expenses.

Benefits calculations encompass prevented theft losses, reduced turnover, and improved hiring efficiency. Industry data suggests each prevented theft incident saves retailers an average of $1,551. Reduced employee turnover saves recruitment and training costs for replacement workers. Improved hiring quality leads to better customer service and operational efficiency.

- Screening Costs per Hire: Typically $25-75 depending on comprehensiveness and position level

- Average Theft Loss Prevention: $1,551 per incident based on industry research data

- Turnover Reduction: 15-30% decrease in employee turnover rates with better screening

- Training Cost Savings: Reduced need for replacement worker onboarding and development

- Insurance Benefits: Potential reductions in fidelity bond and liability insurance premiums

- Operational Efficiency: Improved productivity from more reliable and trustworthy workforce

Return on investment calculations typically show positive results within the first year of implementation. The 300-500% ROI range reflects the high cost of employee theft relative to screening expenses. Even conservative estimates usually demonstrate significant financial benefits from comprehensive screening programs.

Long-term financial benefits extend beyond immediate theft prevention. Better hiring decisions lead to more stable workforces and reduced management overhead. Improved employee morale results from working in more secure environments with trustworthy colleagues. Enhanced company reputation can attract better candidates and reduce recruitment costs.

Training and Implementation Best Practices

Successful retail employee theft prevention programs require comprehensive training for all personnel involved in hiring decisions. Hiring managers must understand FCRA requirements, company screening policies, and proper documentation procedures. Training should cover both technical procedures and interpersonal skills for candidate interaction. Regular updates ensure knowledge stays current with changing regulations and best practices.

Implementation timelines should account for policy development, technology setup, and staff training requirements. Phased rollouts allow for testing and refinement before full program deployment. Pilot programs in select locations can identify potential issues and solutions. Change management strategies help overcome resistance and ensure adoption across diverse retail environments.

Documentation requirements extend beyond FCRA compliance to include internal audit trails. Standardized forms ensure consistency across all hiring decisions and locations. Regular documentation reviews identify process improvements and compliance gaps. Proper record-keeping supports legal defensibility and regulatory auditing requirements.

Training curricula should address both technical screening procedures and soft skills. Managers need guidance on discussing background check requirements with candidates. They must learn to maintain positive candidate experiences while gathering necessary information. This balanced approach supports both loss prevention objectives and employer branding goals.

Change Management for Screening Implementation

Resistance to new screening procedures often comes from hiring managers concerned about delays or complexity. Clear communication about program benefits and support resources addresses these concerns. Success stories from other locations or companies provide compelling evidence. Regular feedback sessions allow managers to voice concerns and suggest improvements.

Incentive alignment ensures managers prioritize screening compliance alongside hiring speed goals. Performance metrics should balance time-to-hire with screening completion rates. Recognition programs can highlight managers who excel at both efficiency and compliance. This approach prevents screening shortcuts that undermine program effectiveness.

Measuring Program Effectiveness and ROI

Effective measurement systems track both quantitative metrics and qualitative improvements from screening programs. Inventory shrinkage rates provide direct measures of theft prevention success. Employee retention statistics indicate hiring quality improvements. Customer satisfaction scores may reflect better service from more reliable employees.

Key performance indicators should encompass multiple aspects of program success. Financial metrics demonstrate clear return on investment calculations. Operational metrics show improvements in efficiency and consistency. Compliance metrics track adherence to legal requirements and company policies.

| Metric Category | Key Indicators | Measurement Frequency | Target Improvement |

| Financial Impact | Shrinkage rates, theft incidents | Monthly | 25-40% reduction |

| Hiring Quality | Employee retention, performance | Quarterly | 15-30% improvement |

| Compliance | FCRA adherence, audit results | Ongoing | 100% compliance |

Benchmarking against industry standards provides context for program performance. National Retail Federation data offers comparison points for shrinkage and theft statistics. Industry associations provide best practice guidelines and performance benchmarks. This external perspective helps identify areas for improvement and validate success.

Regular program reviews ensure screening strategies remain aligned with business objectives. Quarterly assessments evaluate screening criteria effectiveness and technology performance. Annual comprehensive reviews provide opportunities for strategic adjustments. These reviews should incorporate feedback from hiring managers, loss prevention staff, and senior leadership.

Continuous improvement processes incorporate lessons learned and emerging best practices. Regular updates to screening criteria reflect changing risk patterns and legal requirements. Technology upgrades maintain competitive advantages and operational efficiency. Staff feedback helps identify practical improvements for daily operations.

Legal Considerations and Risk Management

Employment law compliance requires ongoing attention to changing regulations and court decisions. State and local laws frequently change regarding background check procedures and timing. Industry-specific regulations may impose additional requirements for retail employers. Regular legal reviews ensure policies remain compliant and defensible.

Discrimination risks arise when screening policies disproportionately affect protected classes. Criminal history restrictions may have disparate impact on certain demographic groups. Credit check requirements could discriminate against economically disadvantaged candidates. Careful policy design and consistent application help mitigate these risks.

Documentation quality directly affects legal defensibility of hiring decisions. Detailed records of screening procedures and decision rationales support employer positions. Consistent application across all candidates and positions demonstrates fair treatment. Regular training ensures all staff understand documentation requirements and best practices.

Legal risk mitigation strategies include regular policy reviews and staff training updates. Employment law counsel should review screening policies annually or when regulations change. Insurance coverage for employment practices liability provides additional protection. Proactive compliance efforts typically cost less than reactive legal defense.

Future Trends in Retail Background Screening

Technology advancement continues to transform background screening capabilities and efficiency. Artificial intelligence improves accuracy and speed of criminal record searches. Blockchain technology may enhance verification of employment and education credentials. Biometric identification could strengthen identity verification processes.

Regulatory trends indicate increasing restrictions on criminal history inquiries and credit checks. More jurisdictions are adopting ban-the-box legislation for private employers. Fair chance hiring initiatives promote individualized assessments over blanket exclusions. These trends require adaptive screening policies and procedures.

Social media screening gains popularity but raises privacy and compliance concerns. Automated tools can scan public social media profiles for relevant information. However, these tools may capture protected class information illegally. Careful policy development ensures compliant use of social media information.

Predictive analytics promise more sophisticated risk assessment capabilities. Machine learning algorithms can identify subtle patterns in candidate data. These tools may predict theft likelihood more accurately than traditional methods. However, algorithmic bias concerns require careful monitoring and adjustment.

Conclusion

Retail employee theft prevention through comprehensive background screening represents a proven strategy for protecting profitability and operational integrity. The financial impact of employee theft demands systematic approaches that balance thoroughness with compliance requirements and hiring efficiency. Successful programs integrate risk-based screening strategies with modern technology solutions while maintaining strict FCRA adherence. Regular measurement and continuous improvement ensure these programs deliver sustained value while adapting to evolving retail challenges and regulatory requirements.

Frequently Asked Questions

What types of background checks are most effective for preventing retail employee theft?

Criminal history checks, employment verification, and professional references form the most effective combination for retail theft prevention. Multi-jurisdictional criminal searches provide broader coverage than single-county checks. Employment verification reveals patterns of job stability and performance issues that may indicate higher theft risks.

How much can retailers expect to spend on employee background screening programs?

Background screening costs typically range from $25-75 per candidate depending on the depth of checks required. However, the ROI averages 300-500% due to prevented theft losses. This makes screening programs highly cost-effective investments for retail loss prevention strategies.

Are there legal risks associated with using background checks for retail hiring decisions?

Yes, FCRA compliance requirements include proper disclosure, authorization, and adverse action procedures. Additionally, state and local laws may impose additional restrictions on criminal history inquiries. This requires careful legal review of screening policies and procedures.

How long does the retail employee background screening process typically take?

Standard background checks usually complete within 2-5 business days, though complex cases may require additional time. Technology integration and automated reporting can streamline results delivery to minimize hiring delays. Rush processing options are available for urgent hiring needs.

Can small retail businesses afford comprehensive background screening programs?

Yes, scalable screening solutions accommodate businesses of all sizes. Risk-based approaches allow small retailers to focus resources on high-risk positions while maintaining basic screening for all employees. The cost savings from preventing theft typically justify screening investments regardless of business size.

What should retailers do if a background check reveals concerning information about a candidate?

Employers must follow FCRA adverse action procedures, providing pre-adverse action notices and allowing candidates time to dispute information. Individual assessments should consider the nature of findings, job relevance, and time elapsed since incidents occurred. Legal counsel can help evaluate complex situations.

Additional Resources

- National Retail Federation Loss Prevention Survey

https://nrf.com/research/national-retail-security-survey - FCRA Compliance Guide for Employers

https://www.ftc.gov/tips-advice/business-center/guidance/using-consumer-reports-what-employers-need-know - Loss Prevention Research Council Studies

https://losspreventionresearch.org - Society for Human Resource Management Background Check Guidelines

https://www.shrm.org/resourcesandtools/hr-topics/risk-management/pages/background-checks.aspx - Equal Employment Opportunity Commission Guidance

https://www.eeoc.gov/laws/guidance/enforcement-guidance-consideration-arrest-and-conviction-records-employment

Still have questions?

Get in touch with our team today for a personalized demo and discover how our tailored volume pricing and packages can drive results for your business!

How useful was this page?*

Note: your comments are anonymous. We use them to improve the website. Do not include any personal details.

Visit our FCRA Compliance Tool or leave a message here if you need a response.

From the blog Explore the GCheck Content Hub

How Long Does a Background Check Take? A Complete 2025 Guide

13 Dec, 2023 • 14 min read

The Ultimate Background Check Guide

13 Dec, 2023 • 4 min read

The Ultimate Guide to Employment Background Checks

13 Dec, 2023 • 10 min readThe information provided in this article is for general informational and educational purposes only and should not be construed as legal advice or a substitute for consultation with qualified legal counsel. While we strive to ensure accuracy, employment screening laws and regulations—including but not limited to the Fair Credit Reporting Act (FCRA), Equal Employment Opportunity Commission (EEOC) guidelines, state and local ban-the-box laws, industry-specific requirements, and other applicable federal, state, and local statutes—are subject to frequent changes, varying interpretations, and jurisdiction-specific applications that may affect their implementation in your organization. Employers and screening decision-makers are solely responsible for ensuring their background check policies, procedures, and practices comply with all applicable laws and regulations relevant to their specific industry, location, and circumstances. We strongly recommend consulting with qualified employment law attorneys and compliance professionals before making hiring, tenant screening, or other decisions based on background check information.