The rise of remote work has revolutionized the employment landscape, creating new opportunities and challenges for employers and employees alike. In Virginia, this shift is accompanied by the complex issue of background checks for remote workers, especially those working across state lines. With the integration of remote work into mainstream business practices, it's crucial for employers to understand the intricacies of background checks and the multi-state tax nexus implications involved. This article provides a comprehensive look at Virginia remote work background checks, addressing legal, social, and technological dimensions, and offers actionable insights for both employers and employees.

Key Takeaways

- Remote work has become an integral part of business operations in Virginia, influenced by the COVID-19 pandemic.

- Employers in Virginia need to navigate complex federal and state regulations for remote work background checks, ensuring compliance with laws like the Fair Credit Reporting Act.

- Privacy and fairness are essential in background screenings, with companies needing to manage data carefully and prevent bias in automated processes.

- Technological tools, such as GoodHire and Checkr, streamline background checks but necessitate robust data security measures.

- Employers face challenges with multi-state tax compliance, requiring systems to track employee work locations and consulting tax professionals to avoid surprises.

Introduction

Remote work has seen rapid growth, especially since the COVID-19 pandemic changed how we view traditional office settings. With more and more people working from home, businesses in Virginia have been adopting flexible work arrangements to keep up with this shifting landscape. Remote work isn't just a trend; it's a significant part of how businesses operate today.

Background checks play a critical role in this new environment. They help ensure remote workers meet the necessary standards, whether they're in Virginia or working across state lines. For employers, understanding how to navigate these checks is vital, not only for legal compliance but also for making informed hiring decisions in a largely digital world.

Legal Considerations in Virginia Remote Work Background Checks

Background

Virginia presents a complex legal landscape for remote work background checks, demanding a clear understanding of both federal and state regulations. The Fair Credit Reporting Act (FCRA) plays a central role by setting the baseline for how personal information is collected, used, and shared. As an employer, you must get explicit consent from an applicant before conducting a background check. Yes, it sounds straightforward, but skipping this step can land you in legal hot water.

State-specific laws in Virginia add another layer. Virginia fully embraces Ban-the-Box legislation, meaning you cannot ask about convictions on initial job applications. For jobs involving remote work, this means thinking about when and how you ask candidates about their criminal histories.

Implications

Now, let's tackle the out-of-state factor. If you're running checks on a Virginia resident working outside the state, you're pulled into a jigsaw of varying rules. Non-residents working for Virginia companies face reverse challenges. This situation requires not just compliance with Virginia laws but also those of other states where the employees reside. Legal counsel becomes not a luxury but a crucial step here.

Telecommuting compliance? It's more than just a buzzword. If your remote workforce includes Virginia residents, you need to follow Virginia laws, even if your company is based elsewhere. Federal labor laws certainly guide the way, but make sure you leverage (remember not to use that word!) tools available from the U.S. Department of Labor to stay on the right side of the line.

Every background check comes with a chance of misstep. Are you familiar with Virginiaâs stand on adverse action notices? If a background check leads you to reconsider a job offer, Virginia mandates additional disclosure steps. Skip them, and it's not just about a slap on the wristâit could lead to litigation, which no one needs.

Take time to reflect on how your current practices align with these regulations. It's not just about avoiding penalties; it's about building trust. Are you doing enough to stay compliant and fair? Legal consideration is not merely checking boxes; it's about fostering a strong, legally-sound hiring process ingrained in efficiency. Make the checklist your friend, not an afterthought.

Social and Ethical Dimensions

Privacy is a key concern in remote work background checks. In Virginia, the law seeks to manage these issues by enforcing strict guidelines on data handling and storage. Employers must obtain consent before conducting checks and provide clear information about the process. Are you aware of how your personal data is being used?

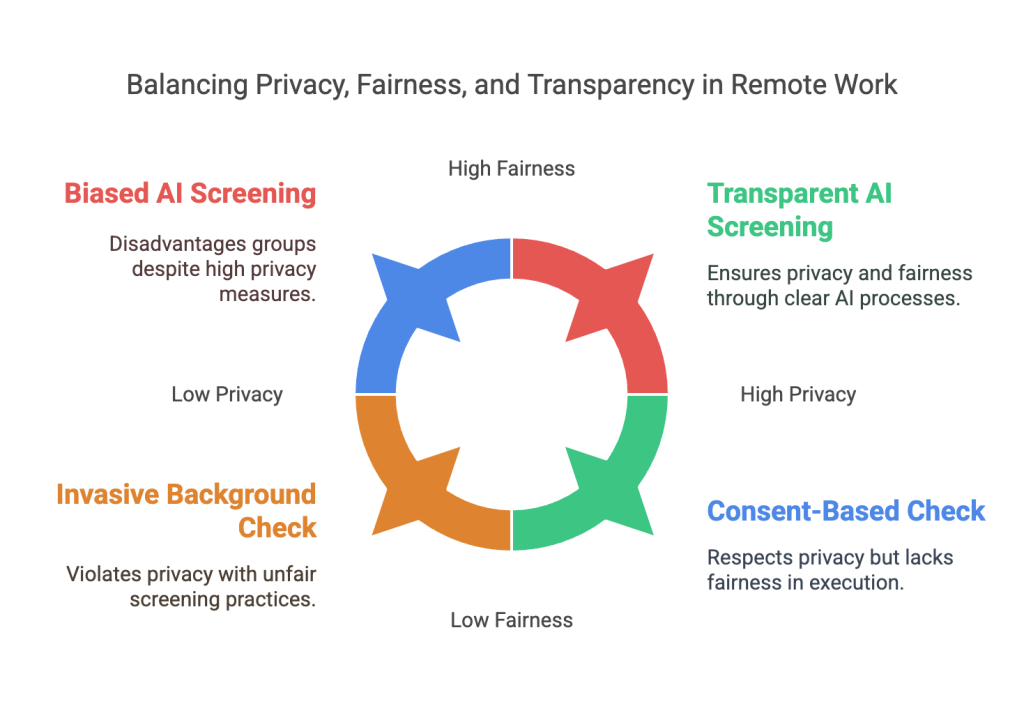

Fairness in background screenings is another critical aspect. With AI playing a larger role in these processes, the risk of biases increases. Employers need to scrutinize these technologies to ensure they don't unfairly disadvantage certain groups. How can you ensure that algorithms are not perpetuating discrimination?

Employee awareness of their rights during these checks is essential. Transparency in the process can build trust between employers and employees. You should understand what information is being collected, how it will be used, and your rights to dispute inaccuracies. Are you informed about your rights in these checks?

Navigating these social and ethical dimensions requires a careful balance of privacy, fairness, and transparency. As an employee or employer, itâs crucial to stay informed and engaged with these issues to foster a fair digital work environment. What steps will you take to address these concerns in your organization?

Technological Aspects of Background Checks

Digital tools have reshaped how background checks are done. Platforms like GoodHire or Checkr offer automated services, making it faster and simpler to verify credentials. These tools can quickly scan public records, employment histories, and educational backgrounds. They help save time, reducing the manual workload significantly. For you as an employer, this means a quicker, more efficient hiring process. Are you using the right tools to enhance your hiring?

Data security is paramount. With sensitive information being transferred and stored, there's a greater risk of breaches. Implementing robust cybersecurity measures is non-negotiable. Encrypting data, using secure data transfer protocols, and regular audits can protect against unauthorized access. An incident of a data breach won't just impact your business legally but also damage trust with potential hires. Are your current security measures up to par?

Integrating background checks with HR systems is the next step in ensuring streamlined operations. When these systems talk to each other, data flows seamlessly, reducing redundancy and errors. This integration can automate tasks like follow-ups or reminders, allowing HR teams to focus on decision-making rather than administrative tasks. Ensuring your systems are well-integrated can lead to improved efficiency and better compliance. How integrated are your HR processes?

Multi-State Tax Nexus Implications

Defining tax nexus begins with understanding that it refers to the connection a business has with a state that allows the state to subject the business to its tax laws. For Virginia employers, this can become complex when navigating remote work scenarios.

Virginia businesses with employees working from other states must consider nexus rules carefully. If you're employing someone remotely from a different state, that state might have different tax requirements. This could obligate your business to file additional tax returns or remit taxes there, even if the only connection to that state is the employee's presence.

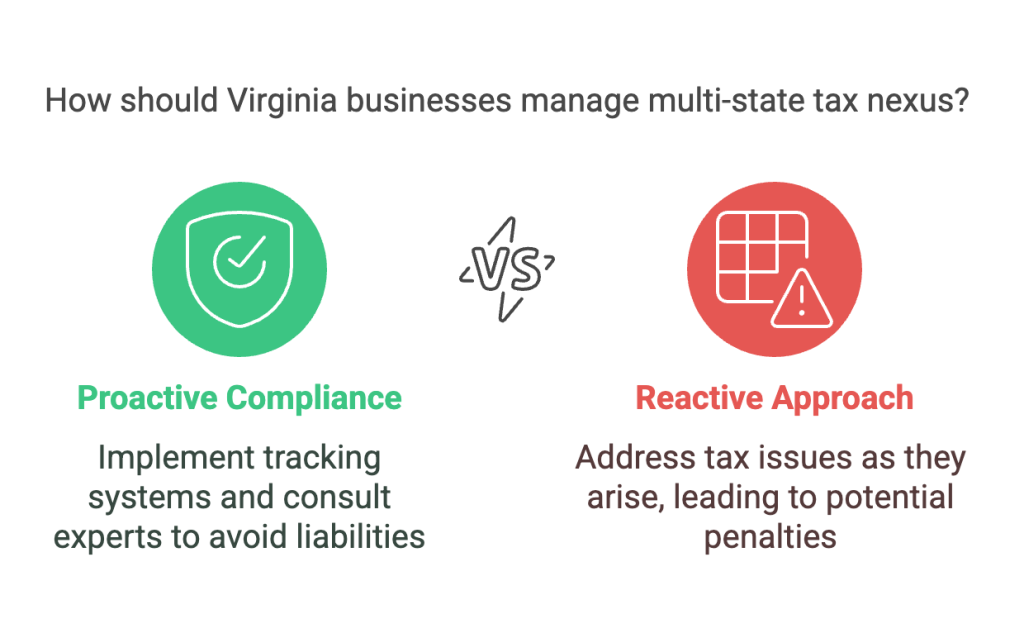

Tax compliance in multi-state situations involves strategizing carefully. Consider implementing systems that track employee work locations. You might also need to consult with tax professionals who understand the nuances of multi-state taxation. Ensuring you're not caught off guard by unexpected tax liabilities will require a proactive approach.

Look at businesses like TechCorp, a Virginia-based software company that adapted by setting up a multi-state tax compliance framework. They leveraged software to monitor where employees worked and engaged with regional tax advisors to handle state-specific obligations. This helped them maintain compliance and avoid financial penalties.

If you're managing remote teams, think about these challenges early. Comprehending tax nexus implications and preparing for varied state tax requirements is essential for smooth operations. Are you ready for this multi-jurisdictional complexity? Consider your current capabilities and resources to manage these obligations efficiently.

Data-Driven Insights

Data tells a story. Businesses in Virginia face unique challenges with remote work background checks and tax compliance. Consider this: A recent survey by Remote Work Knowledge Center shows that 45% of Virginia companies report difficulties in managing tax implications for remote employees across multiple states. Similarly, a study by EmploymentCheck found that 37% of employers in the region struggle with ensuring compliance with state-specific background check regulations.

Diving deeper, the Virginia Chamber of Commerce released a report highlighting shifts in hiring practices. The report reveals that since the rise of remote work, 56% of businesses have modified their background check processes. These changes were primarily prompted by the need to streamline checks for out-of-state workers while adhering to Virginia's legal requirements.

Questions arise about technologyâs role in these changes. Are digital tools improving accuracy or adding complexity? Research by TechHire Solutions suggests that 62% of HR professionals believe technology enhances efficiency in background checks. However, it also reveals concerns over data security, with 28% of respondents indicating breaches as a significant risk.

Consider the result: Businesses are adapting, but are they also safeguarding employee data? Data must be managed securely without compromising employee privacy. This balance is tricky yet crucial in today's landscape.

Data-driven insights provide a snapshot of where Virginia stands in remote work and compliance. They provoke thought and guide action, helping you steer through complex decisions. Are you using data effectively to shape your strategies?

Actionable Takeaways

Effective remote work background checks require a planned approach. Hereâs how you can ensure that:

Best Practices for Employers

Ensure you adhere to both federal and Virginia state laws. This includes compliance with the Fair Credit Reporting Act (FCRA) and specific state regulations. Use digital tools to streamline the process without sacrificing thoroughness. Regularly review and update your screening policies so they remain effective and fair. Encourage transparency by clearly communicating your background check policies to potential employees.

Guidance for Remote Workers

Understand your rights under the FCRA and state laws. Know that you have the right to consent to background checks and to receive a copy of your report. Stay aware of how your tax obligations may change if you move across state lines while working remotely. This can have significant implications for your W-2s and tax filing.

Policy Development

Develop clear, comprehensive policies for remote work background checks, integrating both screening procedures and tax compliance strategies. Ensure these policies are consistently enforced and reviewed as laws and technologies evolve. Training HR teams on these policies can prevent misunderstandings and ensure smooth implementation.

Conclusion

Navigating remote work in Virginia demands a thorough understanding of background checks and associated tax implications. As employers, ensuring compliance and fairness in screening processes is non-negotiable. For employees, knowing your rights protects against potential misuse of personal data. Facing the future, the landscape will continue to change with emerging technologies and evolving laws. Staying informed helps both businesses and individuals tackle the complexities head-on, maximizing the potential of remote working arrangements. Take steps now to adapt, refine policies, and remain vigilant, securing a balanced approach to remote work.

Resources and Further Reading

You never know when you'll need more in-depth information. Here are some resources to keep handy. They cover compliance, background checks, and tax implications for remote work.

- GCheck Blog: A source of practical insights into background check processes, trends, and best practices. You'll find articles that dive into specific issues faced by Virginia employers and employees.

- HR Compliance Guide: Look into this for clear guidelines on maintaining compliance with local and federal regulations.

- Remote Work Handbook: Offers structured advice on managing remote teams, including how to handle background checks efficiently.

- U.S. Department of Labor: This provides essential information on hiring practices and compliance standards. It's a good first stop for legal guidelines.

- Virginia Employment Commission: Here, you'll find detailed information specific to Virginia's employment laws and regulations.

- IRS Tax Guide: Understand how tax implications might affect your business, especially when hiring remote workers across state lines.

These resources are your companions in navigating the complexities of remote work background checks and tax nexus issues. Use them to ensure both compliance and efficiency in your operations.

Frequently Asked Questions (FAQs)

Do VA checks apply to remote workers in other states?

Yes, Virginia checks can apply to remote workers in other states, but it's important to comply with both Virginia and the remote workerâs local regulations.

How to verify education for remote hires in VA?

You can verify education through accredited verification services. Contact the educational institution directly for records specific to your needs.

Can VA employers require drug tests for remote workers?

Yes, employers in Virginia can require drug tests for remote workers, as long as the testing policy is clearly communicated and complies with applicable laws.

Are VA companies liable for other statesâ laws?

Yes, companies in Virginia may be subject to the laws of the states where their remote employees reside, so it's crucial to understand these obligations.

How to handle county-specific checks for VA remote hires?

County-specific checks can be requested through background check services that offer searches by county, ensuring compliance with local requirements.

Can remote workers sue VA employers for FCRA violations?

Yes, remote workers can sue Virginia employers for Fair Credit Reporting Act (FCRA) violations if their rights under the act are infringed.

Do international remote workers fall under VA laws?

International remote workers are not subject to Virginia laws but must comply with the regulations of their respective countries.

Are gig workers considered remote employees in VA?

Gig workers are typically considered independent contractors, not employees, in Virginia, which affects how they are treated under employment laws.

Whatâs the cost of multi-state checks in Virginia?

Costs vary depending on the service provider and the complexity of the checks. On average, they can range from $50 to $150 per check.

Does VA require I-9 verification for remote hires?

Yes, Virginia requires all employers to complete Form I-9 verification for remote hires to confirm their employment eligibility.

Are VA employers required to follow remote workers' local tax laws?

Yes, employers must consider and sometimes withhold state and local taxes based on where the remote worker is physically located.

Can VA companies implement a "work-from-anywhere" policy?

Yes, Virginia companies can implement this policy but should be mindful of compliance with state and international labor laws.

Do remote workers qualify for Virginiaâs worker compensation?

Remote workers qualify if their employment is centered in Virginia and the injury arises out of and during their work duties.

Can VA employers monitor remote workers' activities?

Virginia employers can monitor remote worker activities, but they must notify employees about the extent and nature of the monitoring.

Definitions

Remote Work

Remote work allows employees to perform their job duties from a location outside the traditional office, often from home. Employers may provide flexible schedules, digital collaboration tools, and cybersecurity measures to ensure productivity and data protection. Legal and tax compliance can vary based on where an employee is working.

Background Checks

A background check is a process employers use to verify a candidateâs history before hiring them. This may include reviewing criminal records, employment history, education, and credit reports. Federal and state laws, such as the Fair Credit Reporting Act (FCRA), regulate how these checks must be conducted.

Fair Credit Reporting Act (FCRA)

The FCRA is a federal law that regulates how employers and third-party agencies collect and use personal information during background checks. It requires employers to obtain an applicantâs consent, provide a copy of the report if requested, and follow legal steps if taking adverse action based on the findings.

Ban-the-Box

Ban-the-Box laws prevent employers from asking about an applicantâs criminal history on initial job applications. Virginia enforces these regulations to give candidates a fair chance before discussing past convictions later in the hiring process. Employers must follow specific guidelines on when and how they can inquire about criminal records.

Adverse Action Notice

An adverse action notice is a legal requirement if an employer decides not to hire a candidate based on background check findings. The notice must explain the reason, provide a copy of the report, and inform the applicant of their right to dispute inaccuracies. Failure to follow this process can result in legal consequences.

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.