Background checks are a crucial aspect of modern society. They are conducted in various situations, including employment, housing, volunteer work, etc. The main aim of a background check is to gather information about an individual's past to assess their suitability for a role or responsibility.

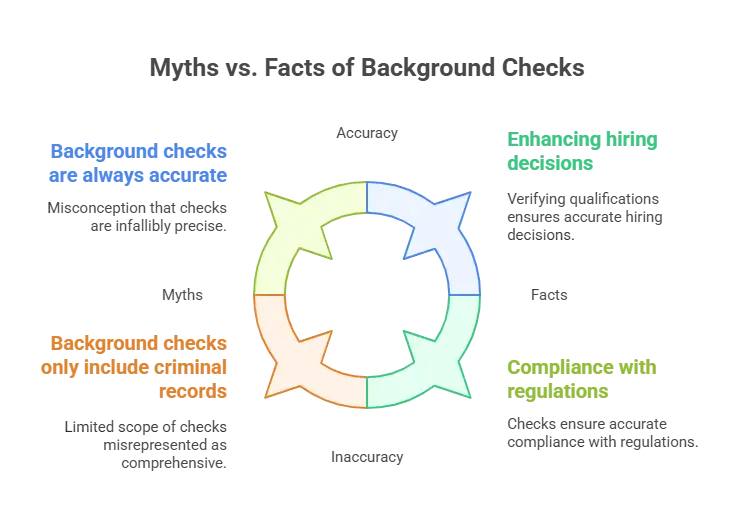

It's essential to acknowledge that there are many misconceptions and myths surrounding background checks. These misconceptions often lead to misunderstandings and misinformation about their purpose, accuracy, and legality.

Myth #1: Background Checks are Always Accurate

Background checks are often perceived as infallible sources of information. Many assume that background check results are accurate and can be blindly trusted. This misconception can lead to misplaced confidence in the information provided by background checks.

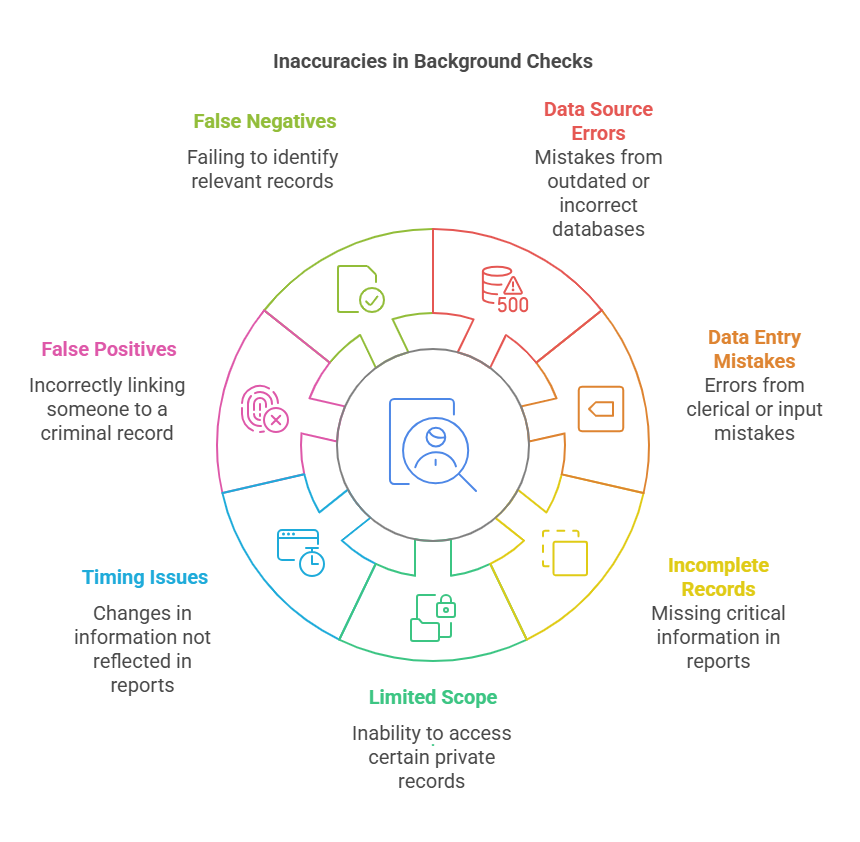

However, it's important to recognize that background checks are not immune to errors or limitations. Several factors contribute to the potential for inaccuracies:

- Data Sources: Background checks rely on various sources of information, such as databases, public records, and third-party providers. These sources may contain errors, omissions, or outdated information that can affect the report's accuracy.

- Data Entry Errors: Mistakes made during data entry can introduce inaccuracies in a background check. For example, a clerical error in recording a criminal conviction or a name misspelling can lead to a false report.

- Incomplete Records: Some records may be incomplete, missing critical information, or not current, resulting in an incomplete picture of an individual's history.

Background checks have inherent limitations, which can impact their accuracy:

- Limited Scope: Background checks can only reveal information available in public records or through authorized databases. They may not uncover specific details, such as unreported crimes or sealed records.

- Timing: Background checks are snapshots of an individual's history at a specific time. The report may not reflect information that has changed or evolved since the last update.

- False Positives and Negatives: Background checks can yield false positives (incorrectly identifying someone with a criminal record) and false negatives (failing to identify a relevant record). These errors can have severe consequences for both employers and individuals.

Background checks rely on various data sources, and errors can occur due to data entry mistakes or outdated information. It's crucial to recognize that background checks may not always present a complete or accurate picture of an individual's history.

To illustrate the potential inaccuracies of background checks, consider the following real-life scenarios:

- Case of Mistaken Identity: John Smith, a job applicant, was wrongly identified as having a criminal record due to a mix-up in names with another individual with a similar name. This error resulted in him being denied a job opportunity.

- Incomplete Record: Sarah Johnson, a prospective tenant, had a clean background check report. She failed to disclose a previous eviction because it was not included in the report, which led to a later housing dispute.

- Expunged Record: Mark Davis had a criminal record expunged from his record, but a background check conducted by a potential employer still showed outdated information, causing him to be unfairly rejected for a job.

These examples underscore the importance of recognizing that while background checks are valuable tools, they are not foolproof and can have real-world consequences when inaccuracies occur. Individuals and organizations must exercise due diligence and be aware of their limitations.

EXPERT INSIGHT: Background checks are more than just a formality; they are a responsibility. Ensuring safety, compliance, and trust within the organization is the role of HR professionals like us. However, with every company's rules and regulations, we ensure that we balance humanity behind every report. True HR leadership focuses on building a healthy workplace where trust, integrity, and opportunity thrive together. - Charm Paz, CHRP

Myth #2: Background Checks Only Include Criminal Records

A common misconception about background checks is that they exclusively focus on an individual's criminal history. Many people assume that when someone mentions a background check, it means solely checking for past criminal offenses. This narrow view of background checks overlooks their comprehensive nature and the wealth of information they can provide.

Background checks are not limited to criminal records but encompass broader information about an individual's past, behaviors, and qualifications. While criminal history is essential, it's just one piece of the puzzle.

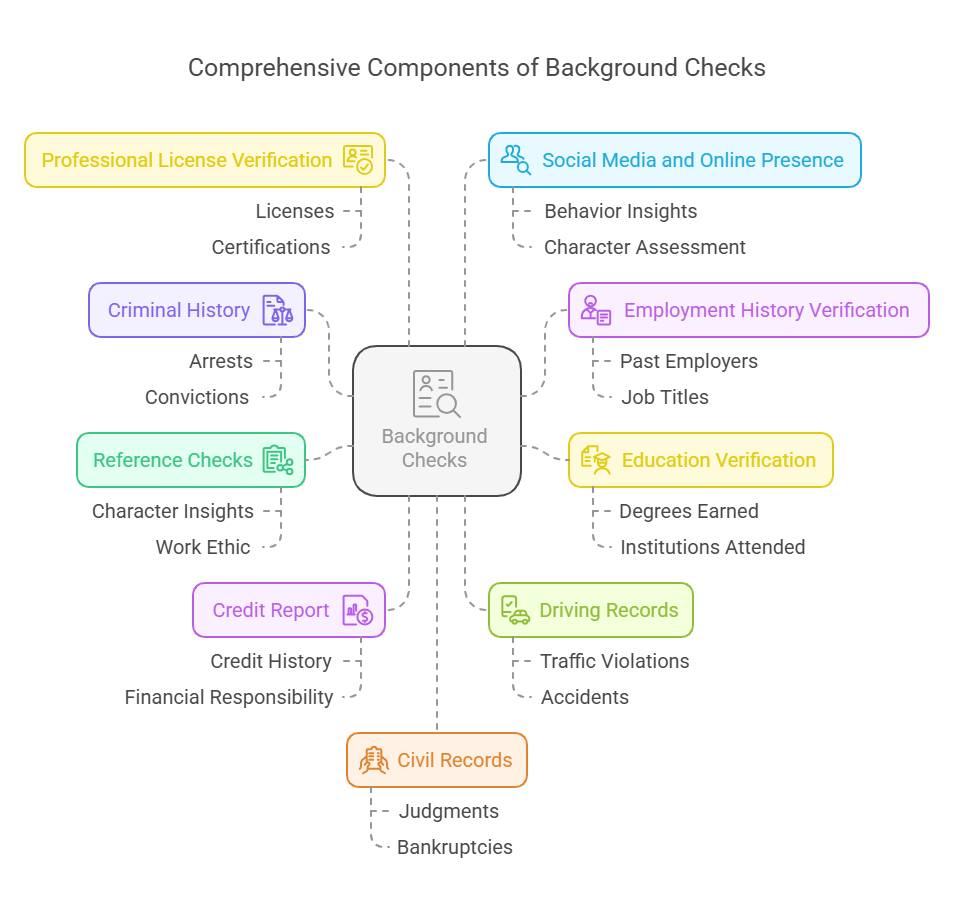

A comprehensive background check typically includes the following components:

- Criminal History: This is the most commonly known aspect of background checks. It involves searching for criminal records, including arrests, convictions, and pending charges at the local, state, and federal levels.

- Employment History Verification: Background checks verify an individual's work history, including past employers, job titles, and dates of employment. This helps confirm the accuracy of information provided on a resume or job application.

- Education Verification: Educational background checks confirm an individual's academic credentials, including degrees earned, institutions attended, and graduation dates. This is vital for employers and academic institutions.

- Reference Checks: Contact references provided by the individual to gather insights into their character, work ethic, and qualifications.

- Credit Report: In some cases, particularly for positions involving financial responsibility, background checks may include a credit report to assess an individual's financial stability and credit history.

- Driving Records: For positions that require driving, background checks may include a check of an individual's driving history, including any traffic violations or accidents.

- Professional License Verification: Ensures that an individual's professional licenses, certifications, or credentials are valid and in good standing.

- Social Media and Online Presence: Employers and organizations may also review an individual's online presence, including social media profiles, to gain insights into their behavior and character.

- Civil Records: This component can reveal information about civil lawsuits, such as judgments, liens, or bankruptcies, which can be relevant for certain positions.

It's essential to understand that the specific components of a background check can vary depending on its purpose and the regulations governing it. Organizations tailor background checks to meet their needs while ensuring compliance with applicable laws.

By recognizing the depth of information in comprehensive background checks, individuals and organizations can better understand their value beyond criminal records.

Myth #3: Background Checks Violate Privacy Rights

One common misconception is that background checks infringe on an individual's privacy rights. This belief arises from concerns that thorough background investigations may delve too deeply into personal information, potentially violating an individual's right to privacy. It is crucial to address these concerns and clarify the boundaries of privacy in the context of background checks.

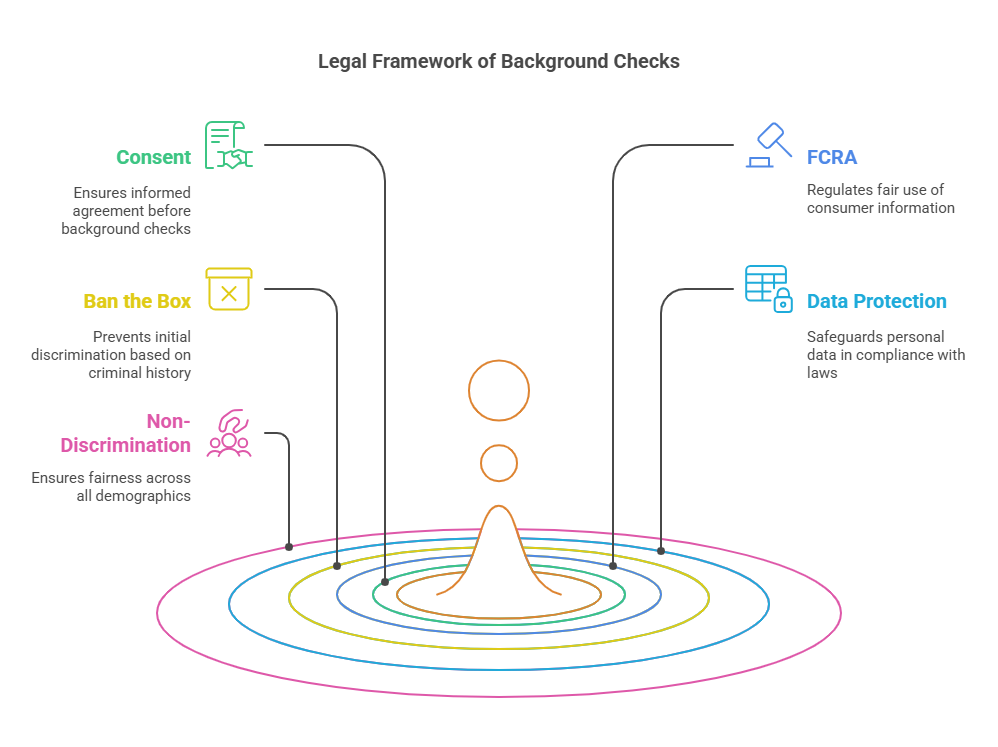

To provide a more precise understanding, it's essential to explain the legal framework that governs background checks and privacy:

- Consent: The foundation of a lawful background check is obtaining the individual's informed and voluntary consent. Before conducting a background check, organizations or individuals must obtain written consent from the person being screened.

- Fair Credit Reporting Act (FCRA): The FCRA is a federal law in the United States that regulates the collection, dissemination, and use of consumer information, including background checks. It sets strict standards for background check procedures and protects individuals' privacy rights by requiring transparency, accuracy, and the right to dispute inaccurate information.

- Ban the Box Laws: Many jurisdictions have implemented "Ban the Box" laws, which restrict employers from asking about an individual's criminal history during the initial job application process. These laws aim to reduce discrimination against individuals with criminal records.

- Data Protection Regulations: In other countries, such as the European Union, data protection regulations like the General Data Protection Regulation (GDPR) govern the handling personal information in background checks. These regulations emphasize transparency, data security, and individual consent.

- Non-Discrimination: Background checks must not be used as a tool for discrimination. The Equal Employment Opportunity Commission (EEOC) in the U.S. enforces regulations that prevent discrimination based on race, color, national origin, sex, religion, disability, and genetic information, and these regulations also apply to background check practices.

It's crucial to underscore the significance of obtaining explicit and informed consent from individuals before conducting background checks. Without consent, any attempt to access an individual's personal information may violate their privacy rights and legal protections.

Organizations and individuals conducting background checks must follow privacy and personal information laws. Failure to do so can lead to legal consequences and harm the organization's reputation.

The article highlights the significance of obtaining consent and complying with privacy regulations, ensuring that background checks can be conducted while respecting privacy rights. This clarification ensures a balance between the need for background information and the protection of personal privacy.

Myth #4: Background Checks Are Only for Hiring

Many people mistakenly believe that background checks are exclusively meant for employment purposes. This misconception often arises from the widespread association between background checks and the hiring process. However, it's crucial to clarify that background checks serve a more extensive range of purposes beyond just evaluating job applicants.

Background checks are versatile tools that provide valuable insights into an individual's history, behavior, and qualifications. While employment screening is a primary application, its utility extends to various scenarios and industries.

Background checks play a vital role in multiple scenarios and can be valuable in the following contexts:

- Tenant Screening: Landlords and property management companies routinely use background checks to assess the suitability of potential tenants. These checks help identify individuals with a history that may pose risks to the property or other tenants.

- Volunteer Organizations: Organizations that rely on volunteers, such as schools, youth programs, and nonprofit entities, can benefit significantly from background checks. Ensuring that volunteers have clean records and do not pose any potential risks to vulnerable populations is essential for maintaining safety and trust within these organizations.

- Financial Transactions: Financial institutions often conduct background checks on individuals applying for loans, mortgages, or credit cards. These checks help assess an applicant's creditworthiness and financial responsibility, reducing the risk of default.

- Professional Licensing: Regulatory bodies and licensing authorities require background checks to ensure that individuals seeking professional licenses, such as doctors, lawyers, or real estate agents, meet the necessary ethical and legal standards.

- Firearms Purchases: In many jurisdictions, individuals looking to purchase firearms are subject to background checks to prevent firearms from falling into the hands of individuals with violent criminal histories or mental health issues.

- Adoption and Foster Care: Agencies involved in adoption and foster care processes conduct rigorous background checks on prospective parents to ensure children's safety and well-being.

- Online Dating and Relationships: In the age of online dating, some individuals conduct background checks on potential partners to verify their identities and ensure they have no criminal history.

- Personal Safety: Individuals may choose to conduct background checks on personal acquaintances or new acquaintances for personal safety reasons, especially when concerns about trust or safety arise.

The article dispels the myth that they are solely confined to employment by exploring these scenarios where background checks are valuable. Highlighting the versatility of background checks reinforces their importance as tools for making informed decisions and ensuring safety and trust in numerous aspects of life and business.

Myth #5: Background Checks Are Too Expensive for Small Businesses

One prevalent myth is that conducting background checks is cost-prohibitive for small businesses. Many small business owners and entrepreneurs assume that comprehensive background screening services are only accessible to larger corporations with substantial budgets. This misconception can deter smaller It's essential to clarify that cost-effective options and strategies are available for small businesses that wish to implement background checks:

- Online Background Check Services: Numerous online background check providers offer affordable, pay-as-you-go options. These services allow small businesses to select specific screening components, such as criminal history checks or employment verification, rather than comprehensive packages.

- Volume Discounts: Some background check providers offer discounts for small businesses conducting multiple checks. This can significantly reduce the overall cost per background check.

- Package Customization: Small businesses can tailor their background check packages to match their needs and budget constraints. For instance, they can opt for basic checks when hiring for low-risk roles and more comprehensive checks for sensitive positions.

- Local Resources: In some cases, small businesses can utilize local resources, such as county courthouse records, for certain aspects of background checks, like criminal history checks, at a lower cost than national databases.

- Ban the Box Considerations: Small businesses should be aware of "Ban the Box" laws in their jurisdictions, which may restrict when and how to inquire about an applicant's criminal history during the hiring process. Complying with these laws can save on costs associated with unnecessary background checks.

- Consider the Risk vs. Benefit: Small businesses should evaluate the level of risk associated with a particular position. Conducting extensive background checks may not be cost-effective for roles with minimal risk, while critical positions may warrant more thorough screening.

By highlighting these cost-effective options and strategies, the article can empower small businesses to make informed decisions about implementing background checks without breaking their budgets. It's essential to emphasize that background checks can be tailored to each organization's needs and financial constraints, ensuring a balance between due diligence and affordability.

Fact #1: Background Checks Can Help Ensure Safety

Accurate background checks serve as a critical tool in safeguarding safety across various domains, offering several essential benefits:

- Enhanced Workplace Safety: Accurate background checks in the employment context help organizations identify individuals with relevant qualifications and assess potential risks. This leads to a safer working environment, as employers can screen out candidates with histories of violence, theft, or other behaviors that may jeopardize workplace safety.

- Improved Tenant Safety: Accurate background checks help ensure the safety and security of tenants in housing and property management. Landlords can identify applicants with records of property damage, eviction, or criminal activity, reducing the risk of disruptive or unsafe living conditions for residents.

- Protection for Vulnerable Populations: Organizations working with children, the elderly, or other vulnerable populations rely on background checks to safeguard those they serve. Accurate screening helps prevent individuals with harmful intentions or histories of abuse from gaining access to these vulnerable groups.

- Consumer Safety: Financial institutions and credit agencies utilize background checks to protect consumers by assessing loan and credit applicants' financial stability and creditworthiness. This reduces the risk of lending to individuals who may default, preserving financial stability.

- Community Well-being: Background checks for firearms purchases and professional licensing contribute to public safety. They identify individuals with violent criminal records or ethical violations, reducing the risk of harm to society.

Real-life success stories underscore the tangible benefits of accurate background checks in preventing harm and ensuring safety:

- Workplace Violence Prevention: A background check revealed a job applicant's history of violent behavior. The employer's decision not to hire the individual prevented a potential workplace violence incident, ensuring the safety of employees.

- Child Protection: In a volunteer organization, a background check uncovered an applicant's previous child abuse conviction. Rejecting this applicant protected the children under the organization's care from potential harm.

- Tenant Security: A background check performed by a landlord identified an applicant with a history of property damage and eviction. Choosing not to rent to this individual protected the safety and property of other tenants in the building.

- Preventing Employee Theft: A retail store's background check revealed that a candidate had been terminated from a previous job due to theft. This information prevented the hiring of the individual, protecting against potential theft within the organization.

These real-world examples emphasize the proactive role of background checks in identifying individuals with histories of harmful behavior, preventing fraudulent hires, and safeguarding organizations, communities, and individuals from financial losses and harm. Background checks promote safety, trust, and well-being across various aspects of life and business.

Fact #2: Background Checks Are Essential for Regulatory Compliance

Background checks play a vital role in helping organizations comply with industry-specific regulations by providing a systematic and standardized means of evaluating the qualifications and suitability of individuals in various roles. Here's how background checks contribute to regulatory compliance:

- Ensuring Qualifications: Background checks verify that individuals possess the qualifications and credentials required by industry-specific regulations. This helps organizations confirm that their employees meet the minimum standards set by regulatory bodies.

- Maintaining Safety Standards: In industries where safety is paramount, such as healthcare or aviation, background checks help identify candidates with behavior histories that may pose risks to others. Ensuring a safe working environment is a fundamental aspect of regulatory compliance.

- Protecting Vulnerable Populations: Background checks are crucial in industries that serve vulnerable populations, like childcare or eldercare. They help prevent individuals with histories of abuse or neglect from being employed in positions where they could potentially harm those they are supposed to care for.

- Ethical and Financial Integrity: Industries such as finance and law require individuals to uphold high ethical and financial standards. Background checks verify applicants' history and professional conduct, ensuring they meet their industries' moral and financial integrity standards.

- Data Protection: Background checks also play a role in industries dealing with sensitive data, such as IT or cybersecurity. They help ensure that individuals handling sensitive information have clean backgrounds and do not pose a risk of data breaches or security compromises.

Numerous industries require background checks to meet regulatory compliance standards. Here are some examples:

- Healthcare: The healthcare sector mandates thorough background checks for healthcare professionals, ensuring patient safety and maintaining the integrity of the healthcare system.

- Finance: Financial institutions, including banks and investment firms, require background checks for employees dealing with financial transactions to prevent fraud and protect consumers.

- Childcare and Education: Schools, daycare centers, and educational institutions conduct background checks on teachers and staff to protect students and ensure a safe learning environment.

- Aviation: The aviation industry mandates background checks for airport security, air traffic control, and aircraft maintenance employees to maintain safety and security.

- Legal: Law firms and legal organizations perform background checks on attorneys and staff to uphold ethical standards within the legal profession.

- Security and Law Enforcement: Background checks are fundamental for individuals pursuing careers in security, law enforcement, and public safety roles.

- Government Contracts: Organizations bidding for government contracts often need to conduct background checks on their employees to meet government regulatory requirements.

These examples highlight the diverse range of industries that rely on background checks to comply with industry-specific regulations. Background checks are not just a best practice but a necessity in maintaining these sectors' integrity, safety, and ethical standards.

Fact #3: Background Checks Improve Hiring Quality

Accurate background checks are critical in maintaining safety across various contexts, including employment, housing, and volunteer organizations. Emphasizing these benefits underscores the importance of background checks in safeguarding individuals and communities.

- Workplace Safety: Accurate background checks help employers identify candidates with relevant qualifications and assess any potential risks. By screening out individuals with criminal histories or behavioral concerns, employers create a safer work environment for their employees. This contributes to a positive workplace culture and minimizes the chances of workplace incidents or misconduct.

- Tenant Safety: Background checks help ensure tenants' safety and security in housing and property management. Landlords can identify applicants with a history of property damage, non-payment of rent, or criminal activity. This reduces the likelihood of disruptive or unsafe living conditions for other tenants.

- Child and Vulnerable Population Safety: Organizations that work with children, vulnerable populations, or volunteers, such as schools, youth programs, and nonprofit organizations, rely on background checks to protect those under their care. Accurate screening helps prevent individuals with predatory or harmful intentions from gaining access to these groups, ensuring their safety.

- Consumer Safety: Background checks conducted by financial institutions and credit agencies help protect consumers by assessing the creditworthiness and economic stability of individuals applying for loans or credit. This reduces the risk of lending to individuals who may default on their financial obligations.

- Community Safety: Background checks for firearms purchases or professional licensing contribute to public safety. They identify individuals with violent criminal records or ethical violations, reducing the risk of harm to society.

Real-life success stories demonstrate the tangible benefits of accurate background checks in preventing harm and ensuring safety. Here are a few examples:

- Preventing Workplace Violence: A background check revealed a history of violent behavior in a job applicant. The employer decided not to hire the individual, preventing a potential workplace violence incident that could have endangered employees.

- Protecting Vulnerable Populations: A youth program conducting background checks on volunteers discovered a volunteer applicant with a previous child abuse conviction. By rejecting this applicant, the organization prevented potential harm to the children it served.

- Tenant Safety: A landlord's background check identified an applicant with a history of property damage and eviction. Choosing not to rent to this applicant protected the safety and property of other tenants in the building.

- Online Dating Safety: In the context of online dating, a person conducting a background check discovered that their potential date had a history of domestic violence. This information allowed them to make an informed decision to prioritize their safety.

These success stories highlight the real-world impact of background checks in preventing harm, protecting individuals and communities, and underscoring their essential role in maintaining safety across various domains of life and business.

Fact #4: Background Checks Protect Against Fraud

Background checks serve as a crucial line of defense against fraud within organizations by providing valuable insights into an individual's past behavior, financial history, and qualifications. Here's how they contribute to fraud prevention:

- Identity Verification: Background checks confirm individuals' identities by cross-referencing information such as names, addresses, and social security numbers. This verification helps prevent identity theft and impersonation, often used as tactics in fraudulent activities.

- Criminal History: Checking an individual's criminal history helps organizations identify individuals with a history of fraudulent activities, financial crimes, or other unethical behaviors. Hiring someone with a clean criminal record reduces the risk of internal fraud.

- Employment History: Verifying an applicant's employment history ensures they have the experience and qualifications they claim. Inaccurate or falsified employment information can be a red flag for potential fraudulent intent.

- Credit Reports: Credit reports are essential for roles involving financial responsibility. A poor credit history can indicate financial stress, increasing the risk of fraud or embezzlement. Background checks help organizations assess an applicant's economic stability and reliability.

- Reference Checks: Using references can reveal valuable insights into an applicant's character, work ethic, and ethical standards. References can provide information about an applicant's trustworthiness and honesty.

- Professional License Verification: In professions where professional licenses are required, verifying the authenticity of these licenses ensures that individuals are qualified and authorized to perform specific roles. This prevents fraudulent representation of qualifications.

Real-life examples demonstrate how background checks have uncovered fraudulent activities within organizations:

- Embezzlement Prevention: A financial institution conducting background checks on employees discovered that a recently hired bank teller had a history of embezzlement from a previous employer. This early detection prevented a potential financial loss.

- Qualification Fraud: An organization conducting background checks found that a job applicant had falsely claimed to have a professional license required for the role. This revelation prevented hiring an unqualified individual who could have engaged in fraud.

- Contractor Fraud: A construction company conducting background checks on subcontractors discovered that one had a history of substandard work and unfinished projects. This information helped the company avoid hiring a contractor who might have engaged in fraudulent practices.

- Preventing Employee Theft: A retail store conducting background checks on prospective employees revealed that a candidate had been terminated from a previous job due to theft. This information prompted the store not to hire the individual, protecting against potential theft within the organization.

These examples underscore the proactive role of background checks in identifying individuals with a history of fraudulent activities, preventing fraudulent hires, and safeguarding organizations against financial losses and reputational damage. Background checks are a valuable tool in fraud prevention and risk mitigation.

Conclusion

In conclusion, it's essential to separate the myths from the facts regarding background checks. By dispelling misconceptions and understanding the truth, individuals and organizations can make more informed decisions and ensure safety, trust, and compliance in various aspects of life and business.

To recap, here are the key myths and facts about background checks:

Myths

- Background checks are always accurate.

- Background checks only include criminal records.

- Background checks violate privacy rights.

- Background checks are exclusively for employment purposes.

- Background checks are too expensive for small businesses.

Facts

- Background checks contribute to safety by helping organizations identify qualified individuals and assess potential risks.

- Background checks are crucial for organizations to comply with industry-specific regulations and standards.

- Background checks enhance the quality of hiring decisions by verifying qualifications and evaluating an applicant's suitability.

- Background checks are pivotal in preventing fraud by identifying individuals with a history of fraudulent activities or unethical behavior.

Understanding the truth about background checks is paramount. Relying on inaccurate information can lead to missed opportunities, risks to safety, and potential legal issues. It's essential to recognize that while background checks are valuable tools, they are not infallible. Acknowledging their limitations and conducting them responsibly is crucial for making informed decisions.

We encourage all readers to approach background checks with diligence and responsibility. Whether you're an employer seeking to hire the right candidate, a landlord assessing potential tenants, or an individual concerned about personal safety, background checks can be powerful tools when used correctly.

Remember to obtain explicit and informed consent, comply with relevant regulations, and consider your situation's needs. By making informed decisions and relying on accurate information, you can protect yourself, your organization, and your community while promoting safety and trust.

In a world where information is readily accessible, responsibly harnessing the power of background checks is a step toward creating safer and more secure environments for everyone.