Landing a $50K+ entry-level position often comes with one catch: the background check. If you're among the millions of job seekers navigating today's competitive market, you've likely encountered this requirement and wondered how it might affect your prospects for securing high-paying entry-level jobs.

Key Takeaways

- Background checks are standard for most high-paying entry-level positions and should be viewed as part of professional employment rather than a barrier

- Preparation and honesty typically lead to successful outcomes even for candidates with less-than-perfect backgrounds

- Industry choice matters significantly for candidates with background concerns, with technology and manufacturing often offering more flexibility

- Professional development and networking can offset background issues and demonstrate commitment to career growth

- Salary negotiation opportunities often exist for positions requiring background checks due to their premium nature

The reality is that most lucrative entry-level positions, especially those offering salaries above $45,000, require some form of background verification. Rather than viewing this as a barrier, understanding the process can actually give you a competitive advantage in your job search.

This comprehensive guide explores 15+ high-paying entry-level careers, details their specific background check requirements, and provides actionable strategies to navigate the process successfully. Whether you're entering the workforce for the first time or transitioning careers, you'll discover how background checks work in different industries and learn to position yourself for success.

As a Human Resources Professional, I have come across numerous individuals who simply need an equal opportunity. Background checks are conducted, but they may not always deter someone from being hired. I have learned that we are able to observe their development, potential, and actual change if we look at the individual, not the forms. It is not about checking boxes. It is about realizing that human beings are more than their history and bringing them respect and hope as they move forward.

Understanding Background Checks for High-Paying Entry-Level Positions

What Employers Actually Look For

When companies invest in higher starting salaries, they typically implement more thorough vetting processes to protect their investment. Background checks for high-paying entry-level jobs serve multiple purposes beyond simple criminal history verification.

| Check Type | What's Reviewed | Industries Most Common | Key Considerations |

|---|---|---|---|

| Criminal History Screening | Convictions rather than arrests, with focus on job-relevant crimes | All industries, especially healthcare and finance | Nature, timing, and relevance matter more than blanket disqualifications |

| Credit History Verification | Payment patterns, debt levels, financial responsibility indicators | Banking, accounting, finance, roles handling money | Patterns of responsibility valued over perfect scores |

| Education & Certification Verification | Degrees, certificates, professional licenses through third-party services | Technology, healthcare, government, professional services | Discrepancies can disqualify faster than minor credit issues |

| Employment History Validation | Employment dates, job titles, reasons for leaving, performance indicators | All industries requiring reliability assessment | Focuses on professional development and reliability patterns |

Timeline Expectations

Standard Processing Duration: Most background checks for entry-level positions complete within 3-7 business days, though complex screenings can extend to 10-14 days (Indeed, 2025). Government positions and roles requiring security clearances may take several weeks or months.

Process Integration: Leading employers initiate background checks after extending conditional job offers, protecting candidates from unnecessary screening costs and potential discrimination. This timing allows you to complete other onboarding requirements while waiting for results.

Communication During Screening: Professional employers provide clear timelines and regular updates throughout the process. If you haven't heard back within the estimated timeframe, appropriate follow-up demonstrates continued interest without appearing pushy.

15+ High-Paying Entry-Level Jobs That Require Background Checks

Technology Sector ($45K-$75K)

The technology sector offers some of the most attractive entry-level tech jobs background check opportunities, with companies willing to invest in candidates who demonstrate potential and reliability.

- Cybersecurity Analyst ($55K-$70K) Cybersecurity analysts protect organizational digital assets, making background checks essential for these roles. Employers focus heavily on criminal history, particularly any technology-related offenses, and verify educational credentials in computer science or related fields. Given the sensitive nature of security systems access, even minor discrepancies can impact hiring decisions. However, candidates with strong technical skills and clean backgrounds often find rapid career advancement opportunities.

- Data Analyst ($45K-$65K) Data analyst positions require strong analytical skills and attention to detail. Background checks typically emphasize education verification and employment history, as employers want to confirm analytical capabilities and reliability. Credit checks are less common unless the role involves financial data analysis. Many companies offer comprehensive training programs for candidates with strong mathematical backgrounds, even without extensive experience.

- Software Support Specialist ($40K-$60K) These customer-facing technical roles require both technical competency and communication skills. Background checks focus on criminal history that might affect customer interactions and verify technical certifications or education. Employment history verification helps employers assess customer service experience and professional reliability.

Healthcare Administration ($40K-$65K)

Healthcare entry level jobs background requirements are particularly stringent due to HIPAA compliance and patient safety considerations.

- Medical Records Technician ($35K-$50K) Medical records technicians handle sensitive patient information, requiring comprehensive background screening. Employers conduct criminal history checks with particular attention to fraud, theft, or privacy violations. Drug screening is standard, and many facilities require ongoing monitoring. Education verification confirms medical coding or health information management training.

- Healthcare Data Coordinator ($45K-$60K) These analytical roles combine healthcare knowledge with data management skills. Background checks emphasize both healthcare-related criminal history and education verification in health information management or related fields. Employers also verify any professional certifications in medical coding or data analysis.

- Insurance Claims Processor ($40K-$55K) Claims processors handle significant financial decisions affecting patient care and company profitability. Background screening includes credit history review, criminal background checks focusing on fraud or theft, and employment history verification. Professional licensing may be required depending on state regulations.

Financial Services ($45K-$70K)

Bank entry-level jobs background check credit requirements are among the most comprehensive, reflecting regulatory requirements and fiduciary responsibilities.

- Bank Teller ($35K-$45K) Entry-level banking positions require extensive screening due to cash handling and customer financial information access. Credit history review is mandatory, with employers looking for patterns of financial responsibility rather than perfect scores. Criminal background checks focus particularly on financial crimes, theft, or fraud. Employment history verification helps assess customer service experience and reliability.

- Financial Services Representative ($45K-$65K) These client-facing roles involve investment advice and financial product sales. Background screening includes Series licensing verification, criminal history review with emphasis on financial crimes, and comprehensive credit history analysis. Educational background in finance or business is typically verified through degree confirmation services.

- Loan Processor ($40K-$60K) Loan processors evaluate creditworthiness and financial documentation, requiring thorough background verification. Employers review personal credit history to ensure processors understand credit management, conduct criminal background checks focusing on fraud or financial crimes, and verify relevant education or certification in finance or real estate.

Government and Public Sector ($40K-$65K)

Government positions often offer excellent benefits and job security alongside competitive starting salaries, though background check requirements can be extensive.

- Administrative Assistant (Federal) ($40K-$55K) Federal administrative positions require security clearance investigations that can take several months. Background checks include comprehensive criminal history review, credit history analysis, employment verification going back 7-10 years, and personal reference interviews. The thoroughness reflects access to sensitive government information and facilities.

- Court Clerk ($35K-$50K) Court system employees handle confidential legal documents and interact with various stakeholders in the justice system. Background screening emphasizes criminal history review with particular attention to legal system interactions, education verification for relevant legal or administrative training, and employment history confirmation focusing on reliability and integrity.

- Municipal Planning Assistant ($45K-$60K) Local government planning roles involve community development and policy implementation. Background checks typically include standard criminal history review, education verification for planning, public administration, or related degrees, and employment history verification emphasizing public service or relevant experience.

Corporate Operations ($45K-$65K)

Corporate operational roles often provide clear advancement paths and competitive compensation for entry-level candidates.

- Human Resources Coordinator ($40K-$55K) HR roles require exceptional discretion and trustworthiness due to access to employee personal information. Background screening includes comprehensive criminal history review, credit history analysis (as HR often handles payroll), education verification for human resources or business degrees, and employment history verification focusing on administrative and interpersonal skills.

- Operations Analyst ($50K-$65K) These analytical business roles support strategic decision-making across organizations. Background checks emphasize education verification for business, economics, or analytical degrees, employment history review focusing on analytical or business experience, and criminal history screening with attention to any fraud or financial crimes.

- Executive Assistant ($45K-$60K) Executive support roles require access to confidential business information and direct interaction with senior leadership. Background screening includes criminal history review with emphasis on trustworthiness, employment history verification focusing on administrative experience, and education verification for relevant business or administrative credentials.

How to Prepare for Background Checks in High-Paying Roles

Before You Apply

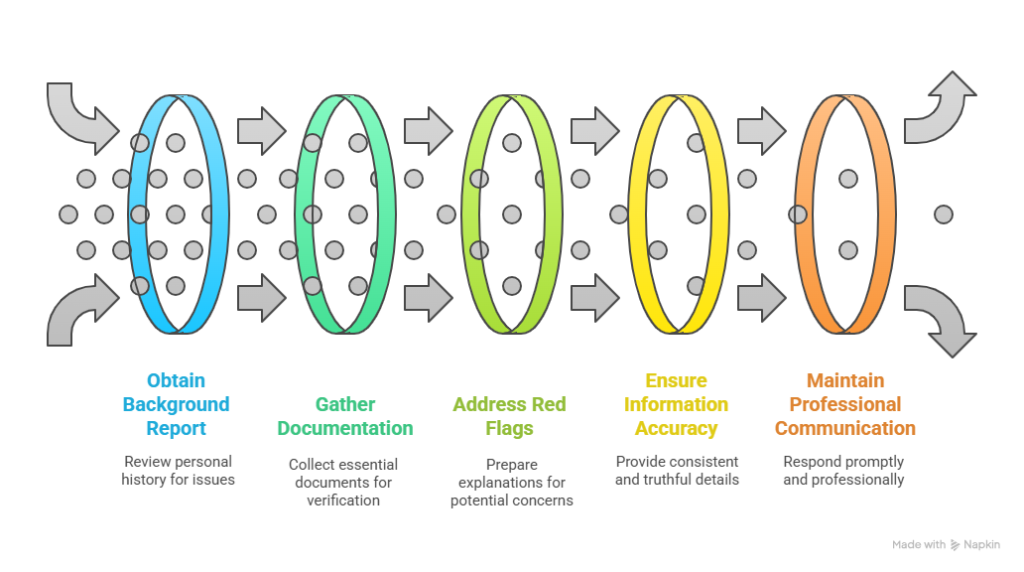

Obtaining Your Own Background Report: Proactively reviewing your background helps identify potential issues before employers discover them. Request reports from major consumer reporting agencies including Experian, TransUnion, and Equifax for comprehensive coverage. Many states provide free criminal background check services for residents, allowing you to verify accuracy of criminal records.

Gathering Required Documentation: Organize essential documents before beginning your job search. This includes official transcripts from educational institutions, professional licenses and certifications, employment verification letters from previous employers, and personal identification documents. Having these readily available accelerates the background check process and demonstrates professionalism.

Addressing Potential Red Flags Proactively: Identify and prepare explanations for any potential concerns. This might include gaps in employment due to education, family responsibilities, or economic conditions, minor criminal history with demonstration of rehabilitation and growth, or credit issues with evidence of improvement and financial responsibility.

During the Process

Information Accuracy: Provide complete and accurate information on all applications and background check forms. Inconsistencies or omissions often raise more concerns than minor issues that are disclosed upfront. Use consistent dates, job titles, and educational information across all documents.

Professional Communication: If employers request additional information or clarification during background screening, respond promptly and professionally. This demonstrates reliability and strong communication skills that employers value in high-paying roles.

Appropriate Follow-Up: Maintain professional contact without appearing anxious or impatient. If background checks exceed estimated timelines, one polite inquiry after the expected completion date is appropriate and shows continued interest in the position.

Common Disqualifiers and How to Address Them

Recent Criminal Convictions: Focus on demonstrating rehabilitation and positive life changes since any criminal history. This includes completion of required programs, community service or volunteer work, stable employment or education history, and character references from employers, educators, or community leaders.

Credit Issues for Financial Roles: For positions requiring good credit, prepare explanations for any credit problems. Document efforts to improve financial standing, such as debt reduction plans, financial counseling completion, or improved payment history. Many employers consider the trend and context of credit history rather than just current scores.

Employment Gaps or Terminations: Prepare honest, brief explanations for any employment issues. Focus on lessons learned and positive changes made since problematic employment situations. Demonstrate stability through education, volunteer work, or other productive activities during unemployment periods.

Education Discrepancies: Ensure all educational claims are accurate and verifiable. If you haven't completed claimed degrees, clarify the coursework completed and timeline for completion. Many employers value honesty about educational status more than exaggerated credentials.

Frequently Asked Questions

Do entry level jobs really pay well with background checks?

Yes, many entry-level positions requiring background checks offer competitive salaries precisely because employers invest more in candidate screening. Companies implementing thorough background check processes often provide:

**Starting salaries 15-25% above market average for similar roles without screening requirements

- Comprehensive benefits packages including health insurance, retirement contributions, and professional development

- Clear advancement opportunities with merit-based promotion systems

- Job security and stable work environments due to careful candidate selection

The return on investment for completing background check processes is typically substantial, with candidates often seeing faster salary growth and better long-term career prospects.

How long does a background check take for entry level positions?

Background check duration varies by industry and position requirements:

Standard Screening (3-7 business days): Most corporate entry-level positions complete basic criminal history, employment, and education verification within one week.

Financial Services (5-10 business days): Banking and financial roles requiring credit history review typically take longer due to comprehensive financial background analysis.

Government Positions (2-8 weeks): Federal, state, and local government roles often require security clearance investigations that involve extensive background research and personal interviews.

Healthcare Roles (1-2 weeks): Medical positions may require drug screening, license verification, and specialized background checks that extend standard timelines.

Factors that can delay background checks include incomplete application information, difficulty contacting previous employers or educational institutions, discrepancies requiring additional verification, and high volume periods in background check processing.

Can you get hired with a criminal record for high paying entry level jobs?

Many high-paying entry-level employers use fair chance hiring practices that consider individual circumstances rather than implementing blanket criminal history disqualifications. Success factors include:

Industry Tolerance Levels: Technology companies and startups often focus more on skills and potential than criminal history. Manufacturing and logistics roles frequently emphasize reliability and work ethic over background issues. Healthcare and financial services maintain stricter requirements due to regulatory compliance.

Offense Relevance: Employers typically consider whether criminal history relates directly to job responsibilities. A decade-old minor offense rarely affects technology or manufacturing opportunities, while recent financial crimes significantly impact banking or accounting roles.

Demonstration of Rehabilitation: Successful candidates with criminal history often emphasize education completion, steady employment history, community involvement, and character references that demonstrate positive life changes.

What shows up on background checks for entry level positions?

Background check scope varies by industry and position level:

Criminal History: Felony and misdemeanor convictions (arrests without convictions typically don't appear), with lookback periods usually limited to 7-10 years depending on state laws.

Employment Verification: Job titles, employment dates, eligibility for rehire, and sometimes performance information from recent employers.

Education Confirmation: Degree verification, graduation dates, and sometimes GPA for recent graduates or positions requiring specific academic achievement.

Credit History (Selected Roles): Credit scores, payment history, debt levels, and financial judgments for positions involving financial responsibility.

Professional Licensing: Current license status, any disciplinary actions, and renewal dates for roles requiring professional credentials.

Reference Checks: Personal and professional references providing insight into character, work ethic, and interpersonal skills.

Maximizing Your Chances: Strategic Application Tips

Industries Most Welcoming to Background Check Challenges

- Technology Companies with Progressive Hiring Policies: Many tech companies prioritize skills and potential over perfect backgrounds. Companies like Ban the Box initiative participants actively recruit candidates with criminal history, focusing on rehabilitation and current capabilities. Startups often have more flexible hiring criteria and may be willing to take chances on candidates with strong technical skills.

- Second-Chance Employer Programs: Major corporations including Starbucks, Target, and IBM have formal programs designed to provide opportunities for candidates with criminal history. These programs often include mentorship, additional training, and support systems to ensure success.

- Manufacturing and Logistics: These industries typically focus on reliability, work ethic, and safety rather than background perfection. Many manufacturing companies report success with second-chance hiring and actively recruit candidates seeking fresh starts.

How to Stand Out Despite Background Concerns

- Professional Certifications: Industry-relevant certifications demonstrate commitment to professional development and can offset background concerns. Technology certifications like CompTIA, Cisco, or Microsoft credentials show technical competency. Project management certifications (PMP, Scrum Master) demonstrate organizational and leadership skills. Industry-specific credentials in healthcare, finance, or other fields show specialized knowledge.

- Portfolio Development: Create tangible demonstrations of your capabilities through personal projects, volunteer work, or freelance assignments. Technology candidates can develop GitHub portfolios showcasing coding skills. Business candidates can create case studies or analytical projects demonstrating problem-solving abilities. Creative professionals can build comprehensive portfolios showing range and growth.

- Strategic Networking: Build professional relationships that can provide referrals and character references. Join industry associations and attend networking events to meet potential employers and mentors. Volunteer for professional organizations to demonstrate commitment and build relationships. Seek informational interviews to learn about opportunities and make personal connections.

Salary Negotiation with Background Check Requirements

- Timing Your Negotiation: The optimal time for salary negotiation is after receiving a conditional job offer but before completing background checks. This timing allows you to negotiate from a position of mutual interest while demonstrating transparency about any background issues.

- Leveraging Clean Background Results: If your background check comes back clear, you can use this as a point of negotiation, emphasizing your reliability and trustworthiness. Clean backgrounds may justify requests for faster promotion timelines or additional responsibilities that could lead to salary increases.

- Market Rate Research: Research compensation for similar roles requiring background checks, as these positions often pay premium rates. Use resources like Glassdoor, PayScale, and industry salary surveys to understand market rates for background-check-required positions in your area.

Alternative Paths to High-Paying Entry Level Work

Remote-First Companies

Relaxed Background Check Policies: Some remote companies have more flexible background check requirements, particularly for roles that don't involve financial responsibility or sensitive data access. International companies may have different background check standards than traditional U.S. employers.

Global Opportunities: Remote work opens opportunities with companies based in different countries with varying background check requirements and cultural attitudes toward criminal history rehabilitation.

Contract-to-Hire Opportunities

Proving Yourself First: Contract positions often allow you to demonstrate capabilities before formal background checks, giving you opportunity to build relationships and prove value. Many companies prefer to convert successful contractors to permanent employees rather than conducting extensive external searches.

Higher Hourly Rates: Contract positions frequently offer higher hourly compensation that can exceed entry-level salary rates, providing excellent income while building experience and professional relationships.

Conclusion and Next Steps

High-paying entry-level jobs with background check requirements offer excellent opportunities for career advancement and financial stability. While the screening process may seem daunting, preparation and honesty typically lead to successful outcomes for qualified candidates.

The positions outlined in this guide represent just a fraction of available opportunities across technology, healthcare, finance, government, and corporate sectors. Many of those employers that include background screening as part of a multifaceted approach invest in broad-based training programs, beneficial plans, and specific career development, thus successfully reducing costs related to screening. Most employers implementing background checks are also investing in comprehensive training, competitive benefits, and clear advancement paths that make the screening process worthwhile.

BONUS: This Week's Action Steps:

- Research your own background through free annual credit reports and available criminal background check services

- Identify 3-5 target companies in industries aligned with your interests and background situation

- Begin building relevant certifications or portfolio materials for your target roles

- Organize documentation needed for background checks, including educational transcripts and employment verification information

- Start networking within your target industry through professional associations, LinkedIn, or local meetups

The job market continues to evolve toward skills-based hiring and second-chance employment opportunities. With proper preparation and strategic approach, background check requirements need not prevent you from securing the high-paying entry-level position that launches your career.

References

Indeed. (2025). How long do pre-employment background checks take? https://www.indeed.com/career-advice/career-development/how-long-do-a-background-check-take-for-a-job

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.