Florida small business background checks must comply with both federal FCRA regulations and state-specific employment laws. This helps avoid costly violations and discrimination claims. Understanding proper screening procedures, consent requirements, and adverse action protocols is essential. Moreover, these practices protect your business while enabling informed hiring decisions.

Key Takeaways

- Florida small businesses must follow FCRA guidelines. Additionally, they need written consent before conducting background checks. Furthermore, proper disclosure forms must be provided to job applicants.

- State law requires specific waiting periods. Specifically, at least three business days must pass between conditional job offers and final hiring decisions. These decisions are based on background check results.

- Ban-the-box legislation exists in select Florida municipalities. Consequently, this prohibits asking about criminal history on initial job applications. Therefore, screening timelines are affected for covered employers.

- Employment verification processes must include I-9 compliance. Additionally, reference checks are required. Furthermore, proper documentation must meet federal and state requirements.

- Adverse action procedures require pre-adverse action notices. Also, waiting periods are mandatory. Finally, final adverse action letters must include specific disclosures about applicant rights.

- Small businesses face penalties up to $5,000 per violation for FCRA non-compliance. Additionally, potential discrimination lawsuits may occur. Furthermore, state regulatory sanctions are possible.

Understanding Florida Small Business Background Check Laws in 2025

Florida's employment screening landscape combines federal Fair Credit Reporting Act (FCRA) requirements with state-specific regulations. Consequently, small businesses must navigate these carefully. The regulatory framework has evolved significantly in 2025. Moreover, enhanced consumer protections exist. Additionally, stricter compliance requirements apply for employers conducting background investigations.

Small businesses in Florida face unique challenges. This is due to varying municipal ordinances. Furthermore, industry-specific regulations layer additional complexity onto federal guidelines.

The foundation of Florida employment screening rests on FCRA compliance. Specifically, this governs how employers obtain consumer reports for employment purposes. Additionally, it covers how they use and act upon these reports. Florida small business background check procedures must include proper disclosure. Furthermore, written authorization is required. Finally, adverse action protocols protect applicant rights while enabling informed hiring decisions.

Recent updates to federal guidance have clarified employer obligations. Particularly, this relates to automated decision-making systems. Moreover, artificial intelligence tools used in screening processes are addressed.

Federal FCRA Requirements for Florida Employers

Federal law requires Florida employers to provide clear disclosure documents. Specifically, these must be standalone documents before ordering background checks. Additionally, they must be separate from job applications or other employment forms. The disclosure must inform applicants that a consumer report may be obtained for employment purposes. Furthermore, specific formatting requirements apply. These include prominent placement and readable fonts.

Employers must obtain written authorization from applicants. This can be included on the disclosure form. However, it must be clearly separated from other document sections.

The FCRA also mandates that employers certify to consumer reporting agencies. Specifically, they must certify their compliance with applicable laws. Additionally, they must certify their intent to use report information only for permissible employment purposes. Small businesses must maintain records of these certifications. Furthermore, they must ensure that any third-party screening vendors they use are fully compliant with federal regulations.

Recent enforcement actions have emphasized vendor due diligence importance. Additionally, proper contractual protections are crucial for employers using background check services.

Florida State-Specific Employment Verification Requirements

Florida law supplements federal requirements with additional protections for job applicants. This includes specific timing requirements for adverse employment actions. These actions are based on background check results. Employers must wait at least three business days after providing pre-adverse action notices. This occurs before taking final negative employment actions. Consequently, applicants have time to dispute inaccurate information. Additionally, they can provide context for disclosed items.

This waiting period extends beyond federal minimums. Furthermore, it reflects Florida's emphasis on due process in employment screening.

State regulations also address criminal history information used in employment decisions. Employers must consider factors such as offensive nature. Additionally, time has elapsed since conviction is important. Furthermore, job relevance must be evaluated when considering applicants. Florida small businesses must document their decision-making processes. This demonstrates compliance with anti-discrimination laws. Moreover, it shows fair hiring practices.

The state has increased enforcement efforts in 2025. Particularly, attention focuses on disparate impact issues. Additionally, protected class discrimination receives scrutiny.

Essential Components of Compliant Background Screening Programs

A comprehensive Florida small business background check program begins with clear written policies. These define screening procedures, timelines, and decision criteria. Furthermore, they apply to different positions within the organization. These policies should specify which roles require background checks. Additionally, they should identify what types of information will be reviewed. Moreover, they should explain how findings will be evaluated in relation to job requirements.

Consistent application of screening policies across all candidates helps protect employers. Specifically, this protection is from discrimination claims. Additionally, it ensures thorough evaluation of potential hires.

Documentation requirements extend throughout the entire screening process. This starts from initial disclosure and authorization. Furthermore, it continues through final hiring decisions and record retention. Small businesses must maintain organized files. These demonstrate compliance with each step of the FCRA process. Specifically, this includes copies of disclosure forms. Additionally, signed authorizations are needed. Furthermore, consumer reports, adverse action notices, and applicant responses must be kept.

Proper documentation serves as crucial evidence of compliance. This is important during regulatory investigations. Additionally, it's vital during legal challenges.

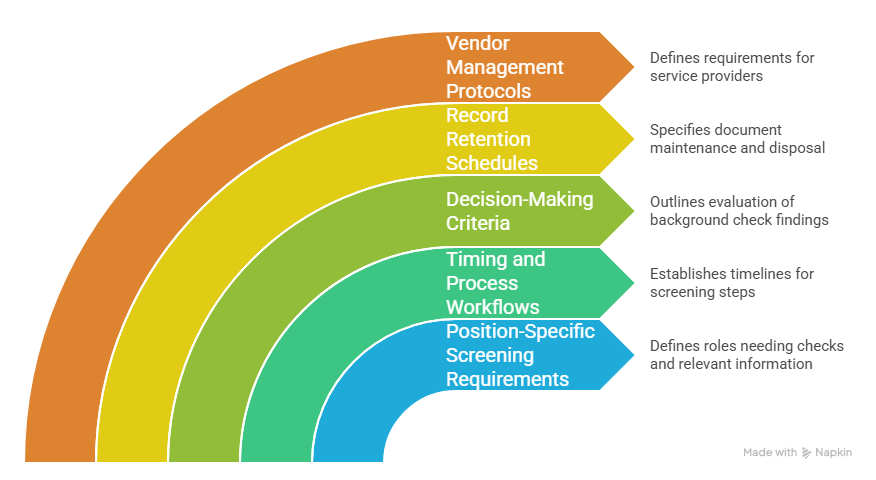

Key Policy Elements:

- Position-specific screening requirements: Define which roles require background checks. Additionally, specify what types of information are relevant to each position category.

- Timing and process workflows: Establish clear timelines for each screening step. This includes disclosure, authorization, report ordering, review, and decision-making phases.

- Decision-making criteria: Document how background check findings will be evaluated. This includes consideration of job relevance. Additionally, time elapsed is important. Furthermore, rehabilitation evidence should be considered.

- Record retention schedules: Specify how long screening documents will be maintained. Additionally, include proper disposal procedures for sensitive consumer information.

- Vendor management protocols: Define requirements for background check service providers. This includes compliance certifications. Additionally, data security measures are important. Furthermore, quality assurance standards must be specified.

Effective screening programs also incorporate regular training. This is for hiring managers and HR personnel. Topics include FCRA compliance requirements. Additionally, state law updates are covered. Furthermore, best practices for fair applicant evaluation are included.

Disclosure and Authorization Best Practices

Proper disclosure documents must be standalone forms. These clearly communicate the employer's intent to obtain background information for employment purposes. They should not be buried in lengthy job applications. Additionally, they shouldn't be hidden in employee handbooks. The disclosure should use plain language that applicants can easily understand. Furthermore, legal jargon should be avoided. Similarly, complex terminology that might obscure the document's purpose should not be used.

Small businesses should ensure their disclosure forms are updated regularly. This reflects current legal requirements. Additionally, industry best practices should be incorporated.

Authorization forms must provide applicants with meaningful choice. Specifically, this relates to whether they consent to background screening. The forms should make clear that refusal to authorize may result in withdrawal of job offers. Additionally, it may result in elimination from consideration. The authorization should be separate from the disclosure. This applies even if included on the same document. Furthermore, it should specify the scope of information that may be obtained.

Recent regulatory guidance emphasizes that authorizations cannot be overly broad. Additionally, they must reasonably relate to the specific position being sought.

Criminal History Screening and Ban-the-Box Compliance

Florida's approach to criminal history in employment decisions balances employer safety concerns. Additionally, it provides second-chance employment opportunities for individuals with criminal records. While Florida does not have a statewide ban-the-box law, several municipalities have enacted relevant ordinances. These include Tampa, Miami-Dade County, and Jacksonville. Consequently, they restrict when and how employers can inquire about criminal history.

These local laws create a patchwork of compliance requirements. Therefore, small businesses must navigate based on their specific locations. Additionally, their operations determine requirements.

Criminal background screening must focus on job-related offenses. Furthermore, it should consider factors such as offense, nature and gravity. Additionally, time has elapsed since conviction is important. Moreover, completion of sentence timing matters. Finally, the nature of the job sought is relevant. Florida small business background check policies should include individualized assessment procedures. These give applicants opportunities to provide context. Additionally, they can provide evidence of rehabilitation. Furthermore, clarification about criminal record information is possible.

Documentation of these individualized assessments helps demonstrate compliance. Specifically, this relates to fair hiring practices. Additionally, it reduces discrimination risks.

| Municipal Ordinance | Coverage | Key Requirements |

| Tampa Fair Chance Act | Employers with 10+ employees | No criminal history questions on initial applications; conditional offer required before inquiry |

| Miami-Dade County | All employers within county boundaries | Delay criminal history inquiry until after first interview or conditional offer |

The individualized assessment process should include written procedures. These are for evaluating criminal history information. Additionally, standardized forms for applicant responses are needed. Furthermore, clear documentation of final decisions is required.

Conducting Job-Relevant Criminal Assessments

Job relevance analysis requires employers to demonstrate a clear connection. Specifically, this is between specific criminal offenses and essential job functions. Additionally, safety requirements of particular positions are important. Financial crimes may be relevant for accounting positions. Similarly, violent offenses might disqualify candidates for childcare roles. However, employers must avoid blanket exclusions. These must be directly related to job duties.

Small businesses should develop position-specific guidelines. These identify relevant offense categories. Additionally, they justify these determinations based on job analysis. Furthermore, risk assessment supports these decisions.

The assessment process should also consider mitigating factors. These include evidence of rehabilitation. Additionally, employment history since conviction is important. Furthermore, education or training completed matters. Finally, references that speak to character and reliability are valuable. Applicants should have opportunities to provide this information. This occurs through structured processes that ensure consistent evaluation across all candidates.

Recent legal developments have emphasized the importance of giving applicants meaningful chances. Specifically, this is to present their cases before making final decisions.

Employment Verification and Reference Check Requirements

Employment verification forms a critical component of comprehensive screening programs. It helps employers confirm candidate qualifications. Additionally, it verifies work history and professional references. Florida small businesses conducting employment verification must comply with federal I-9 requirements. These are for work authorization documentation. Additionally, they must implement thorough reference checking procedures. These provide insights into candidate performance and character.

The verification process should be systematic. Furthermore, it should be consistent across all positions. This ensures fair treatment. Additionally, it provides comprehensive evaluation.

Reference checking best practices include contacting previous supervisors directly. Additionally, structured interview questions should be used. These relate to job requirements. Furthermore, all reference conversations should be documented with detailed notes. These include responses and observations. Employers should verify employment dates. Additionally, job titles should be confirmed. Furthermore, salary ranges, reason for leaving, and eligibility for rehire should be verified. Behavioral questions about work quality should also be asked. Additionally, reliability and interpersonal skills are important topics.

Professional references provide valuable insights. These complement background check information. Furthermore, they help predict job performance.

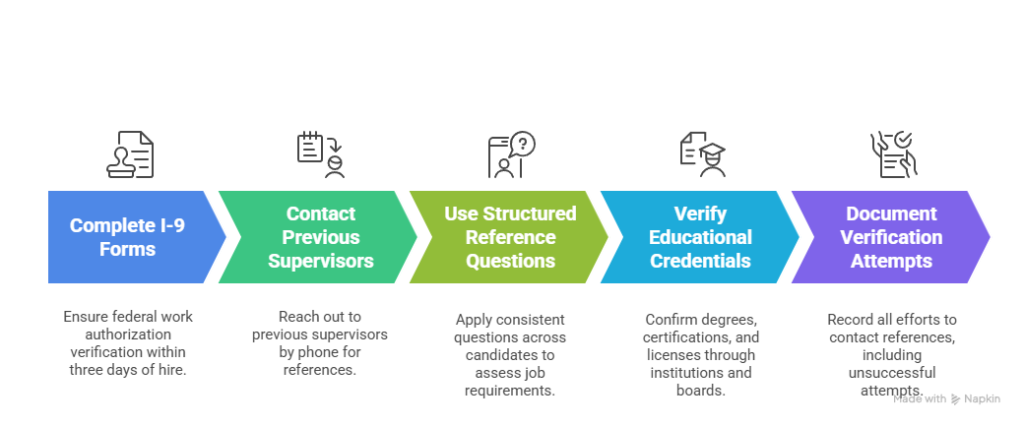

Verification Documentation Checklist:

- I-9 forms completed within required timeframes: Ensure proper completion of federal work authorization verification. This must occur within three days of hire start date.

- Direct supervisor contact: Reach previous supervisors by phone when possible. This is rather than relying solely on HR departments. Additionally, written references alone are insufficient.

- Structured reference questions: Use consistent questions across candidates. These should relate specifically to job requirements. Additionally, they should address essential functions.

- Educational credential verification: Confirm degrees, certifications, and professional licenses. This occurs through appropriate institutions. Additionally, licensing boards should be contacted.

- Documentation of verification attempts: Record all efforts to contact references. This includes unsuccessful attempts. Additionally, reasons for incomplete verification should be noted.

Small businesses should establish relationships with reputable verification services. This is for positions requiring extensive credential checking. Additionally, internal capabilities should be maintained for routine employment verification activities. Furthermore, reference verification activities should be handled internally when appropriate.

I-9 Compliance and Work Authorization Verification

Form I-9 compliance requires employers to verify work authorization for all employees. This must occur within three days of hire. Additionally, acceptable documents must be examined. These establish both identity and employment eligibility. Small businesses must review original documents presented by employees. They cannot specify which acceptable documents employees must provide. Furthermore, they cannot reject documents that reasonably appear genuine. Additionally, documents must relate to the presenting individual.

The verification process must be applied consistently to all employees. This applies regardless of citizenship status. Additionally, national origin doesn't matter. Furthermore, accent is irrelevant.

E-Verify requirements apply to federal contractors. Additionally, they apply to employers in certain industries. This requires electronic verification of work authorization through the Department of Homeland Security system. Even employers not required to use E-Verify may voluntarily participate in the program. However, they must apply it consistently to all new hires once enrolled.

Proper I-9 and E-Verify compliance helps protect small businesses. Specifically, this is from employment eligibility violations. Additionally, it ensures lawful hiring practices.

Adverse Action Procedures and Applicant Rights

FCRA adverse action requirements protect applicants. This occurs when employers make negative employment decisions based wholly or partially on background check information. The process begins with pre-adverse action notices. These include copies of consumer reports. Additionally, summaries of applicant rights under the FCRA are included. Furthermore, reasonable time is provided for applicants to review information. They can also dispute information before final decisions.

Florida's three-business-day minimum waiting period extends federal requirements. Additionally, it provides additional protection for job seekers. This helps them address inaccurate information. Furthermore, they can address incomplete information.

Final adverse action notices must be provided after employers make definitive negative employment decisions. This includes specific information about the consumer reporting agency used. Additionally, contact information for the agency is required. Furthermore, statements that the agency did not make the employment decision must be included. Finally, additional notices of applicant rights are needed. These include rights to obtain free copies of reports. Additionally, rights to dispute inaccurate information are important.

These notices must be provided even when background check information was only one factor. This emphasizes the FCRA's broad protection for consumer rights.

The adverse action process requires careful timing and documentation. This ensures compliance with both federal and Florida requirements. Employers must maintain records of when notices were provided. Additionally, how they were delivered is important. Furthermore, any applicant responses or disputes that were received must be recorded.

Small businesses should establish standard procedures for handling adverse actions. These include templates for required notices. Additionally, tracking systems for timing requirements are needed. Furthermore, protocols for responding to applicant inquiries are important. Finally, procedures for handling disputes should be established.

Pre-Adverse Action Notice Requirements

Pre-adverse action notices must include complete copies of consumer reports. These will be used in employment decisions. Summaries or excerpts of relevant findings are not sufficient. The notice must also include the current version of "A Summary of Your Rights Under the Fair Credit Reporting Act." This is available from the Federal Trade Commission. Furthermore, it must be included exactly as published.

Employers cannot modify or abbreviate the rights summary. Additionally, they must ensure they are using the most current version available.

Delivery of pre-adverse action notices should be documented through methods that confirm receipt. These include certified mail. Additionally, email with read receipts is acceptable. Furthermore, hand delivery with signed acknowledgments works. The notice should clearly explain that the employer is considering an adverse employment action. This is based on information in the background report. Additionally, the applicant has rights to review information. Furthermore, they can dispute the information before a final decision is made.

Clear communication helps ensure applicants understand their rights. Additionally, it clarifies the timeline for responding to concerns about report accuracy.

Costs, Vendors, and Implementation Strategies

Florida small business background check costs vary significantly. This depends on the scope of screening. Additionally, vendor selection affects costs. Furthermore, volume of checks conducted annually matters. Basic criminal history searches typically range from $25-50 per applicant. However, comprehensive packages are more expensive. These include employment verification, education confirmation, and professional reference checks. They can cost $75-150 per candidate.

Small businesses should evaluate screening costs in relation to position requirements. Additionally, turnover rates should be considered. Furthermore, potential hiring risks matter. This helps develop cost-effective screening strategies.

Vendor selection requires careful evaluation of consumer reporting agency credentials. Additionally, compliance track records are important. Furthermore, data security measures matter. Finally, service quality indicators should be reviewed. Reputable background check companies should maintain FCRA compliance certifications. Additionally, they should carry appropriate insurance coverage. Furthermore, they should provide transparent reporting about their data sources. Finally, accuracy rates should be disclosed.

Small businesses should review vendor contracts carefully. This ensures proper liability allocation. Additionally, data protection requirements should be included. Furthermore, compliance support services must be specified.

Implementation strategies for small businesses should focus on scalable systems. These can accommodate growth while maintaining compliance standards. Starting with essential screening components for key positions is wise. Additionally, gradually expanding programs as resources permit helps manage costs. Furthermore, this builds effective screening capabilities.

Technology solutions including applicant tracking systems with integrated background check capabilities can streamline processes. Additionally, they improve compliance documentation for growing businesses.

| Screening Package | Typical Cost Range | Included Components |

| Basic Criminal | $25-40 | County criminal, sex offender registry |

| Standard Employment | $50-75 | Criminal, employment verification, references |

| Comprehensive | $100-150 | Criminal, employment, education, credit, professional licenses |

Cost management strategies include negotiating volume discounts. Additionally, implementing position-based screening tiers helps. Furthermore, regularly reviewing vendor performance is important. Finally, pricing should be reviewed to ensure competitive rates.

Evaluating Background Check Service Providers

Service provider evaluation should begin with verification of proper licensing. Additionally, certification as consumer reporting agencies under the FCRA is important. This includes review of any regulatory actions. Furthermore, compliance issues in the vendor's history should be examined. Prospective vendors should provide detailed information about their data sources. Additionally, search methodologies should be explained. Furthermore, quality assurance procedures must be described. These ensure accurate and complete reporting.

Small businesses should request references from similar-sized clients. Additionally, due diligence on vendor financial stability should be conducted. Furthermore, operational capabilities should be reviewed.

Data security and privacy protections are critical considerations. This is given the sensitive nature of background check information. Additionally, increasing cybersecurity threats target personal data. Vendors should maintain appropriate security certifications. Furthermore, encryption standards are important. Additionally, incident response procedures should protect both employer and applicant information.

Contract terms should specify data retention periods. Additionally, disposal procedures must be included. Furthermore, notification requirements for any security incidents should be specified. Finally, data breaches that might affect client information must be addressed.

Conclusion

Implementing compliant Florida small business background check procedures requires careful attention to federal FCRA requirements. Additionally, state-specific timing rules must be followed. Furthermore, local municipal ordinances vary across different jurisdictions. Success depends on developing clear policies. Additionally, maintaining thorough documentation is crucial. Furthermore, establishing relationships with qualified service providers is important. These providers understand the complex regulatory environment.

Small businesses that invest in proper screening programs protect themselves from costly compliance violations. Additionally, they make more informed hiring decisions. The evolving landscape of employment screening law in 2025 emphasizes staying current with regulatory changes. Furthermore, maintaining flexible systems that can adapt to new requirements is important.

Frequently Asked Questions

What are the basic FCRA requirements for Florida small businesses conducting background checks?

Florida small businesses must provide standalone disclosure forms. Additionally, they must obtain written authorization from applicants. Furthermore, they must wait at least three business days before taking adverse action. Finally, they must provide pre-adverse and final adverse action notices when making negative employment decisions based on background check information.

Do Florida ban-the-box laws apply to all employers in the state?

No, Florida does not have a statewide ban-the-box law. However, several municipalities have local ordinances. These include Tampa, Miami-Dade County, and Jacksonville. Consequently, they restrict criminal history inquiries for covered employers within their jurisdictions.

How long must Florida employers wait before taking adverse action based on background checks?

Florida law requires employers to wait at least three business days after providing pre-adverse action notices. This occurs before making final negative employment decisions. This exceeds federal FCRA minimum requirements.

What types of criminal history can Florida employers consider in hiring decisions?

Florida employers may consider criminal history that is job-related. Additionally, it must be consistent with business necessity. However, they must conduct individualized assessments that consider factors like offense nature. Furthermore, time elapsed is important. Finally, evidence of rehabilitation should be considered.

What penalties do small businesses face for FCRA violations in Florida?

Small businesses can face federal penalties up to $5,000 per violation for willful FCRA non-compliance. Additionally, potential state sanctions may occur. Furthermore, discrimination lawsuits are possible. Finally, damages for affected applicants or employees may be awarded.

Are Florida small businesses required to use specific background check vendors?

No, but employers must ensure their chosen vendors are legitimate consumer reporting agencies. Additionally, they must comply with FCRA requirements. Furthermore, they must provide appropriate data security protections for sensitive personal information.

Additional Resources

- Federal Trade Commission FCRA Guidance for Employers

https://www.ftc.gov/tips-advice/business-center/guidance/using-consumer-reports-what-employers-need-know - Florida Department of Economic Opportunity Employment Law Resources

https://floridajobs.org/office-directory/division-of-workforce-services/workforce-programs/reemployment-assistance-appeals - Equal Employment Opportunity Commission Background Check Guidelines

https://www.eeoc.gov/laws/guidance/enforcement-guidance-consideration-arrest-and-conviction-records-employment - Society for Human Resource Management Background Screening Resources

https://www.shrm.org/resourcesandtools/tools-and-samples/toolkits/pages/backgroundchecks.aspx - National Association of Professional Background Screeners Compliance Resources

https://www.napbs.com/resources/compliance - Florida Bar Association Employment Law Section Resources

https://www.floridabar.org/about/section/employment-law-section/

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.