Florida's financial industry maintains some of the nation's strictest background check requirements. These are overseen by the Office of Financial Regulation (OFR) and federal agencies like the FDIC and CFPB. Understanding these comprehensive screening processes is essential for both employers seeking compliant hiring practices and job seekers navigating career opportunities in banking, mortgage brokering, insurance, and investment services.

Key Takeaways

- Florida financial industry background checks involve multi-layered screening including credit history, criminal records, and regulatory compliance verification through state and federal oversight.

- The SAFE Act mandates mortgage professionals maintain clean records with no felony convictions in seven years and zero tolerance for financial crimes throughout their career.

- Credit score requirements vary by position, with mortgage brokers typically needing 620+ scores, banking roles requiring 680+, and investment advisors often needing 700+ ratings.

- FDIC Section 19 prohibits employment of individuals with certain criminal convictions in insured depository institutions without special regulatory approval.

- Job seekers have specific rights under the Fair Credit Reporting Act (FCRA), including notification of adverse actions and opportunities to dispute inaccurate information.

- Emerging technologies like AI-driven screening and blockchain verification are reshaping background check processes while raising new compliance and privacy considerations.

Introduction

Florida's financial sector employs rigorous background screening to protect consumers and maintain industry integrity. These comprehensive checks analyze credit histories, criminal backgrounds, and regulatory compliance across multiple agencies. Whether you're seeking employment or managing hiring processes, understanding these requirements directly impacts career advancement and business operations. Furthermore, proper preparation and compliance knowledge can mean the difference between securing opportunities and facing unexpected barriers.

Understanding Florida's Financial Background Check Framework

Florida financial industry background checks operate through a complex regulatory ecosystem. This system is designed to ensure only qualified, trustworthy professionals handle sensitive financial matters. Moreover, the state's approach combines federal oversight with local regulatory requirements. Consequently, this creates multiple checkpoints for verification and compliance.

The Office of Financial Regulation (OFR) serves as Florida's primary state regulator. It oversees licensing and compliance for state-chartered financial institutions. Additionally, it works alongside federal agencies like the Federal Deposit Insurance Corporation (FDIC), Office of the Comptroller of the Currency (OCC), Consumer Financial Protection Bureau (CFPB), and Financial Crimes Enforcement Network (FinCEN). Therefore, this framework ensures comprehensive oversight. Furthermore, these agencies coordinate to maintain consistent standards while addressing specific industry risks and consumer protection needs.

Primary Regulatory Bodies and Their Roles

The regulatory landscape involves multiple agencies with distinct responsibilities. First, the OFR focuses on state-licensed institutions. It ensures compliance with Florida-specific requirements and conducts thorough background investigations for licensing applications. Meanwhile, federal agencies provide additional oversight layers. For instance, the FDIC manages deposit insurance matters, while the OCC regulates national banks. Similarly, the CFPB protects consumer interests.

FinCEN plays a crucial role in anti-money laundering compliance. At the same time, the CFPB ensures fair lending practices and consumer protection. This multi-agency approach creates thorough vetting processes that examine candidates from various angles. As a result, it ensures comprehensive risk assessment and regulatory compliance across all financial service sectors.

Key Industries Subject to Enhanced Screening

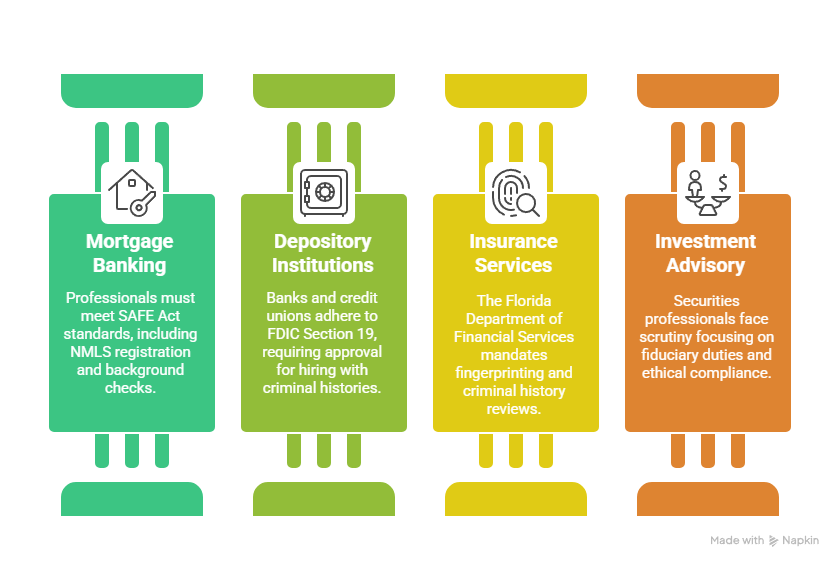

Several financial sectors face particularly stringent background check requirements in Florida:

- Mortgage Banking: Professionals must comply with SAFE Act requirements, including NMLS registration and comprehensive background screening for loan originators and brokers.

- Depository Institutions: Banks and credit unions follow FDIC Section 19 guidelines, requiring special approval for hiring individuals with certain criminal histories.

- Insurance Services: Florida Department of Financial Services mandates thorough screening including fingerprinting and criminal history reviews for all licensed professionals.

- Investment Advisory: Securities professionals undergo enhanced scrutiny focusing on fiduciary responsibilities and ethical standards compliance.

These industries demonstrate varying levels of screening intensity based on consumer exposure and regulatory risk. Therefore, understanding specific requirements for your target sector helps prepare for appropriate compliance expectations. In addition, each sector maintains unique risk profiles that influence screening depth and evaluation criteria.

SAFE Act and Mortgage Broker Compliance Requirements

The Secure and Fair Enforcement for Mortgage Licensing Act (SAFE Act) establishes comprehensive standards for mortgage professionals operating in Florida. This federal legislation requires stringent background checks, educational requirements, and ongoing compliance obligations. Specifically, it applies to anyone involved in residential mortgage origination activities.

SAFE Act compliance begins with character and fitness evaluations. These examine seven years of criminal history and lifetime financial crime records. Moreover, the Act maintains zero tolerance for financial misconduct convictions. This includes fraud, money laundering, or any crime involving dishonesty or breach of trust. These permanent disqualifiers reflect the industry's commitment to protecting consumers. Furthermore, they help prevent potential financial harm through mortgage transactions.

Required Documentation and Application Process

Mortgage licensing applications require extensive documentation submitted through the Nationwide Multistate Licensing System (NMLS). First, applicants must complete Form MU4. This provides detailed personal history, employment records, and criminal background disclosures. Additionally, credit report authorization enables regulatory review of financial responsibility. Other required documentation may include tax returns, personal financial statements, and character references.

The application process typically takes several weeks to months. The timeline depends on documentation completeness and background complexity. During this period, regulators conduct thorough reviews of all submitted materials. Often, they request additional information or clarification during the evaluation process.

Ongoing Compliance and Renewal Requirements

Licensed mortgage professionals face continuous compliance obligations beyond initial licensing. Annual license renewals require updated background information, continuing education completion, and disclosure of any material changes. These changes include personal or financial circumstances. These ongoing requirements ensure professionals maintain qualification standards throughout their careers.

Significant life changes must be reported promptly to maintain licensing compliance. These include new criminal charges, financial difficulties, or regulatory actions. Failure to disclose material changes can result in license suspension or revocation. Therefore, this emphasizes the importance of transparent, ongoing communication with regulatory authorities.

Credit and Financial History Evaluation Standards

Credit history evaluation represents a critical component of Florida financial industry background checks. This is because financial responsibility directly correlates with professional trustworthiness in money-handling roles. Employers analyze multiple credit factors to assess candidates' ability to manage personal finances responsibly. Consequently, this indicates their likely performance handling client assets and sensitive financial information.

Payment history carries the most significant weight in credit evaluations. Consistent on-time payments demonstrate reliability and responsibility. Conversely, late payments, defaults, or collections raise red flags about financial management capabilities. They also indicate potential risk factors. Similarly, credit utilization ratios receive scrutiny. High debt-to-credit-limit percentages suggest overextension or poor financial planning skills that could impact job performance.

Credit mix diversity and account longevity provide additional insights into financial management patterns. A balanced combination of credit cards, installment loans, and mortgages demonstrates experience managing various financial obligations. Furthermore, longer credit histories offer more comprehensive data for evaluation. Therefore, it's beneficial to maintain older accounts in good standing rather than closing them unnecessarily.

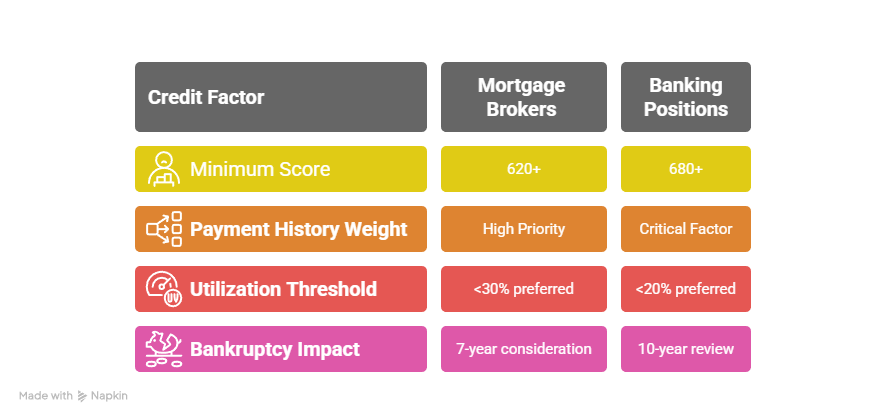

Industry-Specific Credit Thresholds

Different financial sector positions maintain varying credit score requirements. These are based on role responsibilities and consumer exposure levels. Investment advisory positions typically demand the highest standards. They often require scores above 700 to demonstrate exceptional financial management capabilities. These elevated requirements reflect the fiduciary responsibilities inherent in managing client investments and providing financial advice.

Banking and credit union positions generally require scores of 680 or higher. This is particularly true for roles involving cash handling, loan processing, or suspicious activity reporting. Meanwhile, insurance professionals face moderate requirements. In contrast, money service businesses maintain strict standards due to high fraud risk and regulatory scrutiny from anti-money laundering compliance perspectives.

Criminal Background Screening Standards and Procedures

Criminal background screening in Florida's financial industry follows strict federal and state guidelines. These are designed to identify individuals who might pose risks to consumer funds or institutional integrity. The screening process examines criminal history comprehensively. It considers both the nature of offenses and their relevance to financial responsibilities.

Certain criminal offenses result in automatic permanent disqualification from financial industry employment. These include money laundering, embezzlement, fraud, identity theft, and any crimes involving dishonesty or breach of trust. Such offenses demonstrate fundamental character flaws incompatible with financial responsibilities. This applies regardless of time elapsed since conviction or evidence of rehabilitation efforts.

Temporary Disqualifications and Rehabilitation Considerations

Non-financial felonies may result in temporary disqualifications. These typically last seven years from conviction or release dates. During evaluation processes, regulators consider multiple factors. These include offense severity, time elapsed, rehabilitation evidence, and subsequent conduct patterns. Successful completion of probation, community service involvement, and steady employment history can positively influence these assessments.

Character references from employers, community leaders, or rehabilitation program coordinators provide valuable evidence. They demonstrate personal growth and reformed behavior. Educational achievements, professional certifications, and volunteer activities further demonstrate commitment to positive lifestyle changes. Additionally, they show community contribution. Consequently, these factors can potentially mitigate past criminal history concerns.

Appeal and Waiver Procedures

Individuals facing disqualification due to criminal history can pursue appeal processes. These go through regulatory authorities or employer compliance departments. These procedures require comprehensive documentation. This includes court records, police reports, character references, and personal statements. The statements should explain circumstances and rehabilitation efforts. The burden of proof rests with applicants to demonstrate they no longer pose risks to consumers or financial institutions.

Waiver processes vary by regulatory agency and employer policies. Sometimes they involve formal hearings where applicants present their cases directly to decision-makers. Success rates depend heavily on offense types, demonstration of rehabilitation, and current character evidence quality.

Industry-Specific Background Check Requirements

Florida's diverse financial sectors maintain specialized background check requirements. These reflect unique risks and regulatory environments. Understanding these sector-specific standards helps job seekers target appropriate opportunities. At the same time, it enables employers to implement compliant screening processes.

Banking and credit union positions face particularly stringent requirements under FDIC Section 19. This regulation prohibits employment of individuals convicted of crimes involving dishonesty, breach of trust, or money laundering. However, exceptions are possible with special regulatory approval. This regulation applies to all FDIC-insured institutions. Therefore, it creates uniform standards across the banking industry for employee background screening and hiring decisions.

Insurance Industry Standards

Florida's insurance sector requires comprehensive background screening through the Department of Financial Services. This includes mandatory fingerprinting and thorough criminal history reviews. The screening process examines both state and federal criminal databases. Its purpose is to identify any disqualifying offenses related to financial crimes, fraud, or professional misconduct.

Insurance professionals face ongoing monitoring requirements. Any subsequent criminal charges or regulatory actions require immediate disclosure to licensing authorities. This continuous oversight ensures industry integrity. Additionally, it protects consumers from potential fraud or misconduct by licensed professionals.

Investment Advisory and Securities Compliance

Investment advisory professionals undergo enhanced background screening. This focuses on fiduciary responsibilities and ethical standards. The screening process examines criminal history, regulatory actions, civil litigation, and financial responsibility. It does this through comprehensive review of Form ADV and related documentation.

Securities professionals must maintain clean records regarding financial crimes, regulatory violations, and customer complaints. Any history of investment-related misconduct typically results in permanent industry disqualification. This includes churning, unauthorized trading, or breach of fiduciary duty. This applies regardless of rehabilitation efforts or time elapsed.

Employment Screening Process and Employer Obligations

Employers in Florida's financial industry must navigate complex screening requirements. Simultaneously, they must maintain compliance with federal and state employment laws. The screening process begins with clear job descriptions outlining security-sensitive responsibilities and required background check components. This ensures candidates understand expectations before applying.

Pre-employment verification involves multiple steps. It starts with application review and employment history verification. Employers must obtain written consent before conducting background checks. They must clearly explain the scope and purpose of screening activities. This transparency protects both employers and candidates. Furthermore, it ensures compliance with Fair Credit Reporting Act (FCRA) requirements.

The comprehensive screening process includes:

- Educational Verification: Confirming degrees, certifications, and professional credentials through direct contact with issuing institutions

- Employment History: Verifying previous positions, tenure, performance, and reasons for departure through former employer contacts

- Professional References: Contacting supervisors, colleagues, or clients to assess character, work ethic, and professional competency

- Credit History Analysis: Reviewing credit reports for financial responsibility indicators and potential risk factors

- Criminal Background Checks: Examining local, state, and federal criminal databases for disqualifying offenses or concerning patterns

Documentation requirements mandate employers maintain detailed records of all screening activities, decisions, and communications with candidates. These records prove essential during regulatory audits or legal challenges. They demonstrate consistent application of screening criteria and compliance with applicable laws.

FCRA Compliance and Candidate Rights

Employers must strictly adhere to FCRA requirements throughout the screening process. This begins with proper disclosure and consent procedures. If adverse employment decisions result from background check findings, employers must provide pre-adverse action notices. These include copies of background reports and summaries of candidate rights under federal law.

The FCRA requires employers to allow reasonable time for candidates to dispute inaccurate information. This must happen before making final employment decisions. This process protects candidates from erroneous or outdated information. At the same time, it ensures employers base decisions on accurate, current data.

Common Disqualifying Factors and Mitigation Strategies

Financial-related disqualifications represent the most common barriers to employment in Florida's financial industry. Bankruptcy filings, excessive debt levels, and poor credit management patterns signal potential financial instability. This could compromise professional responsibilities or create conflicts of interest in client relationships.

Recent bankruptcy filings typically disqualify candidates from mortgage brokering and banking positions. These suggest inability to manage personal finances responsibly. However, bankruptcies resulting from medical emergencies, divorce, or business failures may receive more favorable consideration. This is particularly true when accompanied by evidence of financial recovery and improved money management skills.

Criminal History Rehabilitation Approaches

Candidates with criminal histories can improve employment prospects through proactive rehabilitation efforts. They should also prepare comprehensively for background screening processes. Obtaining certified copies of court records, completion certificates for rehabilitation programs, and character references from credible sources demonstrates commitment to positive change. Additionally, it shows community contribution.

Professional counseling, educational achievements, and consistent employment history following criminal convictions provide evidence of rehabilitation. They also indicate reduced recidivism risk. Some candidates benefit from legal counsel to explore record expungement or sealing options. These can remove barriers to employment in security-sensitive positions.

Financial Recovery Strategies

Individuals with problematic credit histories can take specific steps to improve their standing. First, they should obtain current credit reports from all three major bureaus. Next, they should dispute any inaccuracies immediately. Additionally, implementing debt consolidation plans can demonstrate financial responsibility. Credit counseling services provide professional guidance for creating sustainable repayment strategies.

Establishing consistent payment patterns over 12-24 months shows commitment to financial recovery. Similarly, reducing credit utilization ratios below 30% significantly improves credit scores. Moreover, maintaining stable employment during this recovery period strengthens the overall financial profile presented to potential employers.

Rights and Protections for Job Seekers

Job seekers in Florida's financial industry enjoy specific protections under federal and state laws. These are designed to ensure fair treatment during background screening processes. The Fair Credit Reporting Act (FCRA) provides comprehensive rights. These include notification of background checks, access to screening results, and opportunities to dispute inaccurate information.

Candidates must receive clear disclosure of background check intentions. They must also provide written consent before screening begins. If adverse employment decisions result from background check findings, employers must provide detailed explanations and copies of reports used in decision-making processes. This allows candidates to identify and address any inaccuracies.

Florida's anti-discrimination laws provide additional protections. They prevent employers from automatically disqualifying candidates based solely on criminal history. Instead, employers must consider rehabilitation evidence, offense relevance, and time elapsed since convictions. These protections recognize that past mistakes shouldn't permanently bar individuals from employment opportunities when they demonstrate genuine rehabilitation.

| Protection Type | Federal (FCRA) | Florida State |

| Consent Requirements | Written authorization required | Enhanced disclosure mandates |

| Dispute Rights | 30-day investigation period | Additional state-specific appeals |

| Discrimination Protections | Basic federal standards | Expanded rehabilitation considerations |

Record Expungement and Sealing Options

Florida provides pathways for eligible individuals to expunge or seal criminal records. This can potentially remove barriers to financial industry employment. Expungement completely removes records from public view. In contrast, sealing restricts access to authorized personnel only. These options require meeting specific eligibility criteria and completing formal legal processes.

Successful record expungement or sealing can significantly improve employment prospects in security-sensitive financial positions. However, certain regulatory agencies may still access sealed records for licensing purposes. Therefore, it's important to understand the scope and limitations of these remedies.

Compliance Best Practices and Future Trends

Employers should develop comprehensive background check policies. These should clearly outline screening procedures, evaluation criteria, and decision-making processes. Regular policy updates ensure compliance with evolving regulations. Additionally, they maintain consistency in hiring practices across all organizational levels and departments.

Technology integration is transforming background screening through artificial intelligence and blockchain verification systems. These innovations promise faster, more accurate screening. However, they raise new questions about privacy, bias, and regulatory compliance that organizations must carefully navigate.

Emerging Technology Considerations:

- AI-Driven Screening: Automated analysis of criminal records and credit histories for pattern recognition and risk assessment

- Blockchain Verification: Immutable credential verification reducing fraud while protecting candidate privacy

- Continuous Monitoring: Real-time updates on employee criminal charges or credit issues for ongoing compliance

- Biometric Integration: Enhanced identity verification preventing fraudulent applications and improving screening accuracy

Organizations investing in advanced screening technologies must ensure these tools comply with existing regulations. At the same time, they should prepare for future regulatory developments. This proactive approach maintains competitive advantages. Moreover, it minimizes compliance risks and legal exposure.

Regulatory Evolution and Industry Impact

Florida's financial regulatory environment continues evolving in response to technological advances, consumer protection needs, and industry innovations. Recent trends toward increased transparency and candidate rights suggest future regulations may require more detailed disclosure. Specifically, they may mandate clearer explanation of screening criteria and decision factors.

The integration of artificial intelligence in screening processes will likely prompt new regulations addressing algorithmic bias, decision transparency, and candidate appeal rights. Organizations should monitor regulatory developments closely. Furthermore, they should engage with industry associations and legal counsel to ensure ongoing compliance.

Preparation Strategies for Stakeholders

Both employers and job seekers should adopt proactive approaches to navigate evolving background check requirements. Employers should invest in staff training programs covering current regulations and emerging compliance requirements. They should also establish relationships with qualified background screening vendors who understand industry-specific requirements.

Job seekers should conduct regular self-assessments of their background check profiles. This includes obtaining annual credit reports and monitoring criminal record databases for accuracy. Additionally, they should maintain documentation of rehabilitation efforts, professional development activities, and character references to support employment applications.

Conclusion

Navigating Florida's financial industry background check requirements demands thorough understanding of complex regulatory frameworks, industry-specific standards, and candidate rights protections. Success depends on proactive preparation, comprehensive compliance programs, and ongoing attention to regulatory evolution. Whether seeking employment or managing hiring processes, staying informed about these requirements ensures better outcomes while maintaining the industry's integrity and consumer trust. The investment in proper background check procedures ultimately protects all stakeholders while supporting Florida's robust financial services sector.

Frequently Asked Questions

What specific criminal offenses permanently disqualify someone from Florida financial industry employment?

Permanent disqualifying offenses include money laundering, embezzlement, fraud, identity theft, and any crimes involving dishonesty or breach of trust. These financial crimes demonstrate fundamental character issues incompatible with handling consumer funds or sensitive financial information, regardless of rehabilitation efforts or time elapsed since conviction.

How long do employers typically take to complete background checks for financial positions?

Most financial industry background checks take 2-4 weeks to complete, depending on the complexity of the candidate's history and the thoroughness required for the specific position. Mortgage broker licensing through NMLS can take 6-12 weeks due to comprehensive regulatory review requirements and multi-agency coordination.

Can I work in Florida's financial industry if I've declared bankruptcy?

Bankruptcy doesn't automatically disqualify candidates, but it significantly impacts eligibility for many positions. Recent bankruptcies (within 7-10 years) typically disqualify candidates from mortgage brokering and senior banking roles, while older bankruptcies with evidence of financial recovery may be acceptable for some positions.

What credit score do I need for different financial industry positions in Florida?

Credit score requirements vary by position: mortgage brokers typically need 620+, banking positions require 680+, and investment advisory roles often demand 700+. These thresholds reflect the level of financial responsibility and consumer trust associated with each role type.

Do I have to disclose expunged or sealed criminal records during background checks?

Florida law generally prohibits employers from considering expunged records in hiring decisions, and candidates aren't required to disclose them. However, certain regulatory agencies may still access sealed records for licensing purposes, so consulting with legal counsel about disclosure obligations is recommended.

What rights do I have if my background check contains errors?

Under the FCRA, you have the right to dispute inaccurate information, receive free copies of reports used in adverse decisions, and have reporting agencies investigate disputed items within 30 days. Employers must provide pre-adverse action notices and allow time for corrections before making final hiring decisions.

How often do financial industry employees undergo background check updates?

Most financial positions require annual license renewals with updated background information, while some employers conduct periodic re-screening every 3-5 years. Employees must promptly report any new criminal charges, financial difficulties, or other material changes that could affect their eligibility.

What can I do to improve my chances if I have a problematic background?

Focus on demonstrating rehabilitation through steady employment, education, community service, and character references. Consider legal options for record expungement or sealing if eligible. Be prepared to provide detailed explanations of circumstances and evidence of positive changes since any problematic incidents occurred.

Additional Resources

- Florida Office of Financial Regulation (OFR) Official Website

https://www.flofr.gov/ - SAFE Act Compliance Guide - Consumer Financial Protection Bureau

https://www.consumerfinance.gov/compliance/compliance-resources/mortgage-resources/safe-act/ - Fair Credit Reporting Act (FCRA) Summary - Federal Trade Commission

https://www.ftc.gov/enforcement/rules/rulemaking-regulatory-reform-proceedings/fair-credit-reporting-act - FDIC Section 19 Guidelines for Financial Institution Employment

https://www.fdic.gov/resources/supervision-and-examinations/consumer-compliance-examination-manual/documents/10/x-3-1.pdf - Florida Department of Financial Services - Insurance Licensing Requirements

https://www.myfloridacfo.com/division/agents-and-agencies - Nationwide Multistate Licensing System (NMLS) Registration Portal

https://www.nmlsconsumeraccess.org/ - Consumer Financial Protection Bureau - Background Check Rights

https://www.consumerfinance.gov/ask-cfpb/what-should-i-know-about-background-checks-en-1157/ - Florida Expungement and Record Sealing Information

https://www.flclerks.com/page/ExpungementSealing

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.