Yes, you can work in banking with a bankruptcy. However, employment opportunities depend on the specific role, institution type, and time elapsed since discharge. While federal regulations don't automatically disqualify bankruptcy filers from all banking positions, FDIC-insured institutions must follow strict screening procedures that evaluate financial history as part of their hiring process.

Key Takeaways

- Most banking positions remain accessible after bankruptcy, though some senior roles involving significant financial responsibility may have stricter requirements.

- FDIC Section 19 prohibits individuals with certain criminal convictions from banking employment, but bankruptcy alone doesn't trigger this restriction.

- Credit unions often have more flexible hiring policies compared to traditional banks when evaluating candidates with past financial difficulties.

- Time since bankruptcy discharge matters significantly, with most employers viewing cases older than 3-5 years more favorably.

- Honesty during the application process is crucial, as failing to disclose bankruptcy when directly asked can result in immediate disqualification.

- Alternative financial services companies may offer better employment prospects for those with bankruptcy history compared to traditional banking institutions.

Understanding FDIC Employment Requirements for Bankruptcy History

The Federal Deposit Insurance Corporation sets specific guidelines for banking employment. These guidelines directly impact individuals with bankruptcy records. Additionally, FDIC-insured institutions must conduct thorough background checks on all potential employees. This process includes reviewing credit history and financial stability indicators. However, bankruptcy alone does not automatically disqualify candidates from banking positions.

FDIC Section 19 regulations focus primarily on criminal history rather than financial difficulties. This federal law prohibits individuals convicted of dishonesty, breach of trust, or money laundering from working in banking without special approval. Personal bankruptcy, whether Chapter 7 or Chapter 13, falls outside these criminal prohibitions. Instead, it represents a legal debt relief process rather than fraudulent activity.

Financial institutions must balance regulatory compliance with practical hiring needs when evaluating bankruptcy candidates. Most banks develop internal policies that consider multiple factors beyond the bankruptcy itself:

- Circumstances leading to filing: Job loss, medical expenses, or economic downturns may be viewed more favorably than overspending

- Time elapsed since discharge: Longer periods demonstrate sustained financial stability and recovery

- Evidence of financial recovery: Improved credit scores, stable employment, and responsible money management practices

- Current financial standing: Present ability to manage personal finances and meet obligations

- Professional qualifications: Skills, experience, and certifications that demonstrate job competency

These comprehensive evaluations help employers make informed decisions while maintaining regulatory compliance. Therefore, many qualified candidates with bankruptcy history still find employment opportunities in banking.

Different Types of Banking Positions and Bankruptcy Impact

Entry-level positions face fewer restrictions regarding bankruptcy history. These roles include tellers, customer service representatives, and administrative support positions. Moreover, these jobs involve limited access to sensitive financial information and reduced fiduciary responsibility. Consequently, banks show more willingness to hire qualified candidates despite past financial challenges.

Management positions face stricter scrutiny due to increased responsibility. Loan officers and investment advisors also encounter enhanced screening procedures. Banks carefully evaluate whether candidates with bankruptcy history can effectively counsel clients on financial decisions. They also assess the ability to manage significant monetary transactions without conflicts of interest.

How Banks Screen for Personal Bankruptcy During Hiring

Financial services bankruptcy screening involves multiple verification layers designed to assess candidate suitability and regulatory compliance. Most banks utilize third-party background check companies that specialize in financial industry requirements. This ensures thorough review of credit reports, public records, and bankruptcy filings. These comprehensive screenings typically occur after initial interviews but before final job offers.

Credit reports reveal bankruptcy filings, discharge dates, and current financial standing. This provides employers with detailed insight into candidates' financial management capabilities. Banks also search public court records to verify bankruptcy details. These include filing reasons, asset listings, and creditor information. Some institutions conduct additional reference checks with previous employers. This helps them understand how financial difficulties may have impacted work performance.

| Screening Component | Timeline | Purpose |

| Credit Report Review | 1-3 days | Assess current financial standing and payment patterns |

| Public Records Search | 3-5 days | Verify bankruptcy details and court proceedings |

| Employment Verification | 5-7 days | Confirm work history accuracy and performance |

| Reference Checks | 3-5 days | Gather insights on professional conduct and reliability |

The screening timeline varies by institution size and position level. Additionally, candidates should prepare for potential delays and be ready to provide additional documentation if requested during the review process.

Credit Union Employment Bankruptcy Screening Practices

Credit unions often demonstrate more flexibility when evaluating candidates with bankruptcy history. They show greater understanding compared to traditional banking institutions. These member-owned financial cooperatives frequently emphasize community connection and second chances. Consequently, they develop hiring policies that consider individual circumstances rather than applying blanket disqualifications. Credit unions may view bankruptcy as a learning experience that provides valuable perspective on financial challenges their members face.

Many credit unions actively seek employees who understand financial hardship firsthand. They believe this experience enhances empathy and customer service quality. However, credit union employment bankruptcy screening still includes comprehensive background checks. This ensures regulatory compliance and member fund security. The cooperative structure creates different risk tolerance levels and decision-making processes. Board members and management teams often have more discretion in hiring decisions.

Regional Variations in Credit Union Hiring

Community-focused credit unions in economically challenged areas show increased understanding of bankruptcy situations. This occurs particularly when local economic conditions contributed to widespread financial difficulties. These institutions often prioritize local hiring and community investment. Additionally, they focus less on strict financial history requirements. As a result, they create more opportunities for candidates with diverse financial backgrounds.

Larger federal credit unions typically maintain more standardized screening procedures similar to traditional banks. Nevertheless, they may still offer more flexibility in final hiring decisions. Geographic location and member demographics significantly influence individual credit union policies. Therefore, researching specific credit union cultures and practices helps candidates target applications more effectively.

Timeline Factors: When Bankruptcy Affects Banking Employment

The time elapsed since bankruptcy discharge plays a crucial role in employment eligibility and employer perception. Most financial institutions view bankruptcy cases as less concerning as years pass. This occurs particularly when candidates demonstrate consistent financial recovery and responsible money management. Recent bankruptcies face greater scrutiny and potential hiring obstacles. Specifically, those discharged within the past two years encounter more challenges.

| Time Since Discharge | Employment Impact | Typical Employer Response |

| 0-2 years | High scrutiny | Recently unstable, requires extensive evaluation |

| 3-5 years | Moderate consideration | Improving stability, case-by-case review |

| 5+ years | Minimal impact | Resolved issue, standard evaluation process |

| 7+ years | Very minimal impact | Ancient history, focus on current qualifications |

Banking employers often establish internal guidelines regarding acceptable timeframes for bankruptcy history. However, these policies vary significantly between institutions. Some banks require minimum waiting periods before considering candidates for sensitive positions. Others evaluate applications on individual merit regardless of timing.

Factors That Improve Employment Prospects Over Time

Financial recovery evidence carries substantial weight in overcoming recent bankruptcy concerns during the hiring process. Candidates who demonstrate improved credit scores receive more favorable consideration. Stable employment history and responsible financial behavior since discharge also help significantly. Those with longer-elapsed but unresolved financial patterns face more challenges.

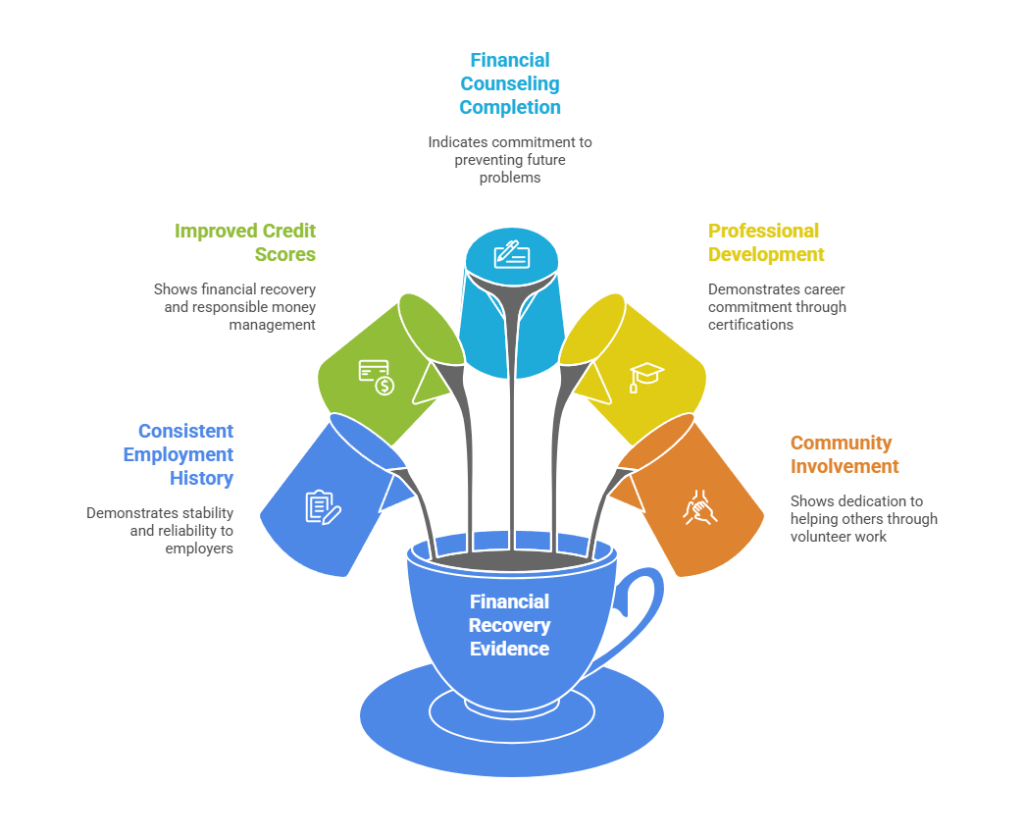

Several key factors help banking candidates overcome bankruptcy history concerns:

- Consistent employment history: Demonstrates stability and reliability to potential employers

- Improved credit scores: Shows financial recovery and responsible money management practices

- Completion of financial counseling: Indicates commitment to preventing future problems

- Professional development: Industry certifications and continuing education demonstrate career commitment

- Community involvement: Volunteer work, especially in financial literacy, shows dedication to helping others

Documentation of these improvements strengthens applications considerably. Therefore, maintaining records of progress helps support employment applications.

Strategies for Job Seekers With Bankruptcy History

Successful job hunting in banking after bankruptcy requires strategic preparation and honest communication throughout the application process. Candidates should prepare comprehensive explanations of their bankruptcy circumstances. Focus on external factors, lessons learned, and recovery efforts rather than dwelling on past mistakes. Professional presentation of this information demonstrates maturity and accountability that employers value highly. Additionally, research targets employers thoroughly before applying since institutional culture and hiring practices vary significantly.

Building a strong professional portfolio helps shift focus from past financial difficulties to current qualifications. Industry-specific certifications demonstrate commitment to professional development. Continuing education credentials show dedication to staying current with industry standards. Volunteer experience in financial literacy programs demonstrates community service and industry engagement. These elements combined create a compelling case for employment consideration.

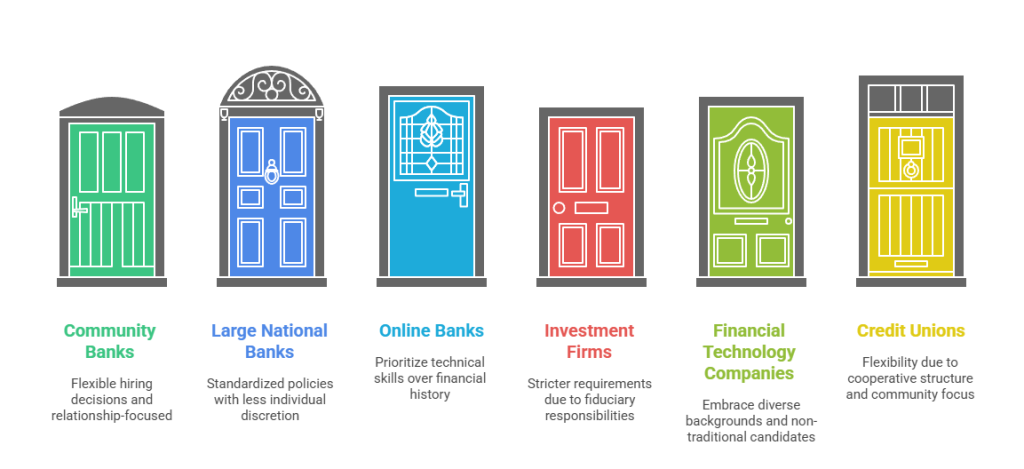

Different types of financial institutions maintain varying approaches to hiring candidates with bankruptcy history:

- Community banks: Often more flexible and relationship-focused in hiring decisions

- Large national banks: Typically have standardized policies with less individual discretion

- Online banks: May prioritize technical skills over financial history for certain roles

- Investment firms: Generally maintain stricter requirements due to fiduciary responsibilities

- Financial technology companies: Often embrace diverse backgrounds and non-traditional candidates

- Credit unions: Usually show more flexibility due to cooperative structure and community focus

Understanding these differences helps focus job search efforts more effectively. Additionally, networking within the financial services industry provides valuable insights into company cultures.

Disclosure Best Practices During Applications

Honesty remains the most critical factor when addressing bankruptcy history during job applications and interviews. Most banking positions require candidates to answer direct questions about financial history. Failure to disclose known bankruptcy filings results in immediate disqualification regardless of other qualifications. Therefore, transparency becomes essential for maintaining credibility throughout the hiring process.

Prepare concise, professional explanations that acknowledge the bankruptcy without excessive detail or defensiveness. Frame bankruptcy discussions around lessons learned and positive changes implemented since filing. Emphasize personal growth and improved financial management skills. Avoid making excuses or blaming external circumstances entirely. Instead, demonstrate accountability while highlighting recovery efforts and current stability.

Alternative Banking Career Paths After Bankruptcy

Financial services extends far beyond traditional banking institutions and offers numerous career opportunities for individuals with bankruptcy history. Fintech companies maintain more flexible hiring policies while still providing meaningful careers in finance-related fields. Payment processors and financial education organizations also show greater openness to diverse backgrounds. These alternative paths allow professionals to build experience and demonstrate competence before potentially transitioning to traditional banking roles.

Insurance companies frequently hire individuals with banking experience and may show more lenience regarding past financial difficulties. This occurs particularly for sales and customer service positions. Investment advisory firms offer finance-related opportunities that don't require the same regulatory scrutiny as direct banking employment. Tax preparation services and accounting practices also provide relevant career options. Government financial agencies sometimes prioritize diverse experience and may value candidates who understand financial challenges from personal experience.

| Alternative Career Path | Bankruptcy Flexibility | Skill Transfer Potential |

| Fintech Companies | High flexibility | Strong technical and customer service skills |

| Insurance Firms | Moderate flexibility | Sales and client relationship management |

| Accounting Services | Moderate flexibility | Financial analysis and compliance knowledge |

| Government Agencies | High flexibility | Regulatory understanding and consumer advocacy |

| Non-profit Organizations | Very high flexibility | Community service and financial education |

Consulting and financial education represent growing fields where bankruptcy experience can become a professional asset. These opportunities create pathways for career development and professional growth.

Government and Non-Profit Opportunities

Government financial agencies offer unique opportunities for individuals with bankruptcy history. State banking departments and federal regulatory bodies sometimes prioritize diverse experience over perfect financial records. These positions often focus on consumer protection and financial education. Bankruptcy experience provides authentic perspective on regulatory importance and consumer needs.

Non-profit credit counseling organizations actively seek staff members who understand financial challenges firsthand. They believe this experience enhances credibility and effectiveness when working with clients facing similar situations. Community development financial institutions also value diverse backgrounds and real-world experience with financial recovery. Therefore, these sectors provide excellent alternative career paths for banking professionals with bankruptcy history.

Legal Protections and Discrimination Considerations

Federal bankruptcy law provides certain employment protections that prevent discrimination based solely on bankruptcy status. However, these protections have limitations in the banking industry. The Bankruptcy Code prohibits government employers from discriminating against individuals based on bankruptcy filings. Private employers, including banks, maintain more discretion in hiring decisions related to financial history. Therefore, understanding these legal boundaries helps job seekers navigate the application process more effectively.

Equal Employment Opportunity Commission guidelines suggest that blanket policies excluding all bankruptcy filers may constitute discriminatory practices. This occurs particularly when bankruptcy disproportionately affects protected classes. However, banking employers can legally consider financial history when it relates to job requirements and fiduciary responsibilities. Consequently, successful discrimination claims remain challenging in financial services contexts.

State laws vary regarding bankruptcy employment discrimination and some jurisdictions provide stronger protections than federal legislation:

- California: Limits credit check usage for most employment decisions with banking exceptions

- New York: Requires specific justification for adverse employment actions based on credit history

- Connecticut: Prohibits credit checks except for positions with substantial financial responsibilities

- Illinois: Restricts credit history consideration to roles with specific financial duties

- Washington: Limits employer use of credit reports except for certain banking positions

Understanding specific state laws helps candidates know their rights and potential recourse options. Additionally, some states require specific disclosures before conducting credit checks.

Documentation and Legal Recourse Options

Understanding legal protections helps job seekers advocate for fair treatment while maintaining realistic expectations about banking industry requirements. Documentation of superior qualifications provides support for potential legal claims. Relevant experience and evidence of discriminatory practices strengthen cases. However, most candidates find success through persistence and strategic job searching rather than legal remedies.

Keep detailed records of all job applications and employer responses. Document any instances where bankruptcy appears to be the sole reason for rejection. This information becomes valuable if legal action becomes necessary. Additionally, maintain records of professional qualifications and achievements that demonstrate job competency regardless of financial history.

Industry Trends Affecting Bankruptcy Employment Screening

The banking industry continues evolving its approach to employment screening and candidate evaluation. Technology advances enable more sophisticated background checking while also providing tools for better candidate assessment. Many institutions now focus on predictive analytics that consider multiple factors beyond traditional credit scores. This shift creates opportunities for candidates who demonstrate strong performance indicators despite past financial challenges.

The growing emphasis on diversity and inclusion influences hiring practices across the financial services sector. Banks recognize the value of employees who bring diverse perspectives and life experiences to their organizations. Some institutions actively seek candidates who understand financial hardship firsthand. They believe this experience enhances their ability to serve customers facing similar challenges. Additionally, regulatory changes continue shaping employment practices within the banking industry.

New guidelines emphasize fair lending and consumer protection priorities:

- Enhanced focus on financial wellness: Banks increasingly offer financial counseling and education services

- Diverse hiring initiatives: Many institutions actively recruit candidates with varied backgrounds and experiences

- Skills-based hiring: Greater emphasis on competencies and abilities rather than perfect financial records

- Technology integration: Advanced screening tools provide more nuanced candidate evaluations

- Regulatory compliance: Evolving requirements for fair and non-discriminatory hiring practices

Labor market conditions also influence how banks approach candidate evaluation and selection. Competitive markets for qualified employees may lead to more flexible screening criteria. Skills shortages in certain banking specialties create opportunities for candidates who might face challenges in other circumstances.

Future Outlook for Banking Employment After Bankruptcy

Industry experts predict continued evolution in banking employment practices regarding financial history screening. The focus shifts toward holistic candidate evaluation that considers current capabilities alongside past challenges. This trend benefits individuals with bankruptcy history who can demonstrate professional competence and financial recovery.

Technological advances in hiring and background screening provide more sophisticated tools for candidate assessment. These systems can better distinguish between past financial difficulties and current professional capabilities. Additionally, the growing recognition of systemic economic factors in personal bankruptcy cases influences employer attitudes and policies.

Building Long-Term Career Success After Bankruptcy

Career development after bankruptcy requires strategic planning and consistent effort to demonstrate professional growth and financial recovery. Focus on building a strong track record of performance and reliability in whatever position you secure initially. Even entry-level banking positions provide opportunities to showcase skills and work ethic. Successful performance creates internal advancement opportunities and positive references for future career moves.

Continuing education plays a crucial role in career advancement within the banking industry. Pursue industry certifications that demonstrate expertise and commitment to professional development. Many banking institutions offer tuition reimbursement programs that support employee education. Take advantage of these opportunities to build credentials and expand knowledge. Professional associations also provide networking opportunities and continuing education resources.

Maintain excellent financial management practices to demonstrate ongoing recovery and responsibility:

- Monitor credit reports regularly: Address any issues promptly to maintain improving scores

- Build emergency savings: Demonstrate financial stability and preparedness for unexpected expenses

- Maintain stable housing: Consistent residence shows stability and responsible financial management

- Document recovery progress: Keep records of financial improvements to support future applications

- Pursue financial education: Continue learning about money management and industry best practices

Consider mentorship opportunities within the banking industry to accelerate career development. Experienced professionals can provide guidance on navigating career challenges and identifying advancement opportunities.

Professional Development and Networking Strategies

Building professional relationships creates support networks that benefit long-term career success. Many banks have formal mentorship programs that support employee development. Additionally, industry associations often offer mentoring resources for career advancement. Attend industry conferences and networking events to build connections and stay current with trends.

| Professional Development Activity | Career Benefit | Investment Required |

| Industry Certifications | Enhanced credibility and expertise | Time and exam fees |

| Professional Association Membership | Networking and continuing education | Annual membership dues |

| Conference Attendance | Industry knowledge and connections | Registration and travel costs |

| Mentorship Programs | Career guidance and support | Time commitment |

| Volunteer Activities | Community involvement and skill development | Time and effort |

Focus on building expertise in growing areas of banking and financial services. Fintech, digital banking, and financial wellness represent expanding fields with strong career prospects. These areas often value innovation and diverse perspectives over traditional banking backgrounds.

Conclusion

Working in banking after bankruptcy remains achievable through strategic job searching, honest communication, and patience with the screening process. While financial institutions maintain strict hiring standards due to regulatory requirements and fiduciary responsibilities, bankruptcy alone doesn't automatically disqualify candidates from all banking positions. Success depends largely on time elapsed since discharge, evidence of financial recovery, and matching qualifications to appropriate positions within the industry. Alternative financial services careers provide additional pathways for building experience and demonstrating professional competence before pursuing traditional banking roles.

Frequently Asked Questions

How long after bankruptcy discharge can I apply for banking jobs?

You can apply for banking jobs immediately after bankruptcy discharge. However, most employers prefer candidates with 2-3 years of post-discharge financial stability. Some institutions may consider recent bankruptcy cases on individual merit. This occurs particularly for entry-level positions that involve less financial responsibility.

Do all banks check credit reports during the hiring process?

Yes, virtually all FDIC-insured banks and credit unions conduct credit checks as part of standard background screening procedures. This requirement stems from regulatory compliance needs and risk management policies within the financial services industry. The screening helps banks assess candidate suitability for positions involving financial responsibility.

Can I work as a bank teller with Chapter 7 bankruptcy on my record?

Many banks hire tellers with Chapter 7 bankruptcy history. This occurs especially when sufficient time has passed since discharge and candidates demonstrate financial recovery. Teller positions typically face less stringent requirements than management or lending roles. Therefore, these positions often provide good entry points into banking careers.

Are credit unions more likely to hire someone with bankruptcy than traditional banks?

Credit unions often show more flexibility in hiring individuals with bankruptcy history. This stems from their community-focused mission and cooperative structure. However, they still conduct thorough background checks and maintain professional standards for all positions. The decision-making process may allow for more individual consideration of circumstances.

What happens if I don't disclose bankruptcy and the bank finds out later?

Failure to disclose bankruptcy when directly asked results in immediate termination for dishonesty. This occurs regardless of job performance or other qualifications. Banks view honesty and integrity as fundamental requirements that cannot be compromised under any circumstances. Therefore, transparency during the application process remains essential.

Can banks hire employees with bankruptcy for management positions?

Banks can hire individuals with bankruptcy history for management roles. However, these positions face enhanced scrutiny due to increased fiduciary responsibility. Factors include time elapsed, circumstances of filing, and evidence of financial rehabilitation. Each case receives individual evaluation based on multiple criteria beyond bankruptcy history alone.

Does the type of bankruptcy (Chapter 7 vs Chapter 13) matter to banking employers?

Some employers view Chapter 13 bankruptcy more favorably since it demonstrates commitment to repaying debts through structured payment plans. However, both types undergo similar evaluation processes focusing on current financial stability and job-related risks. The specific circumstances and recovery efforts typically matter more than the bankruptcy type itself.

Are there specific banking jobs that automatically exclude bankruptcy filers?

No banking positions automatically exclude all bankruptcy filers by federal law. However, individual institutions may maintain internal policies limiting certain high-responsibility roles. Each application receives individual consideration based on multiple factors beyond bankruptcy history. Therefore, candidates should research specific employer policies and requirements before applying.

Additional Resources

- FDIC Employment Background Check Guidelines

https://www.fdic.gov/regulations/examinations/supervisory/insights/siwin00/siwn00.pdf - Fair Credit Reporting Act Employment Screening Requirements

https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act - National Association of Federal Credit Unions Employment Resources

https://www.nafcu.org/compliance-blog/employment-background-checks - Consumer Financial Protection Bureau Credit Report Information

https://www.consumerfinance.gov/ask-cfpb/what-is-a-credit-report/ - U.S. Trustee Program Bankruptcy Basics

https://www.justice.gov/ust/bankruptcy-basics - Equal Employment Opportunity Commission Credit Check Guidance

https://www.eeoc.gov/laws/guidance/background-checks-what-employers-need-know - American Bankers Association Career Development Resources

https://www.aba.com/training-events/schools

Still have questions?

Get in touch with our team today for a personalized demo and discover how our tailored volume pricing and packages can drive results for your business!

How useful was this page?*

Note: your comments are anonymous. We use them to improve the website. Do not include any personal details.

Visit our FCRA Compliance Tool or leave a message here if you need a response.

From the blog Explore the GCheck Content Hub

How Long Does a Background Check Take? A Complete 2025 Guide

13 Dec, 2023 • 14 min read

The Ultimate Background Check Guide

13 Dec, 2023 • 4 min read

The Ultimate Guide to Employment Background Checks

13 Dec, 2023 • 10 min readThe information provided in this article is for general informational and educational purposes only and should not be construed as legal advice or a substitute for consultation with qualified legal counsel. While we strive to ensure accuracy, employment screening laws and regulations—including but not limited to the Fair Credit Reporting Act (FCRA), Equal Employment Opportunity Commission (EEOC) guidelines, state and local ban-the-box laws, industry-specific requirements, and other applicable federal, state, and local statutes—are subject to frequent changes, varying interpretations, and jurisdiction-specific applications that may affect their implementation in your organization. Employers and screening decision-makers are solely responsible for ensuring their background check policies, procedures, and practices comply with all applicable laws and regulations relevant to their specific industry, location, and circumstances. We strongly recommend consulting with qualified employment law attorneys and compliance professionals before making hiring, tenant screening, or other decisions based on background check information.