California tenant screening laws provide comprehensive protections for renters while establishing clear guidelines for landlords conducting background checks and rental applications. Understanding these regulations is essential for compliance with state and federal fair housing requirements, consumer protection laws, and avoiding costly legal violations.

Key Takeaways

- California's Consumer Investigative Reporting Agencies Act (CIRA) requires landlords to provide written disclosure before conducting tenant background checks

- Application fees are capped at actual costs, typically around $30-50, and must be refunded if no screening is performed

- Landlords cannot discriminate based on source of income, criminal history older than seven years, or credit scores below specific thresholds without justification

- Tenants have the right to receive copies of screening reports and dispute inaccurate information within 30 days

- Fair Housing Act protections extend beyond federal requirements in California, covering additional protected classes

- Employment background check laws also apply to residential screening when credit and criminal history are evaluated

Understanding California Rental Application Laws

California rental application laws create a complex framework for tenant screening. These laws protect both landlords and tenants throughout the application process. Moreover, they ensure fair and consistent screening practices across all rental properties.

The Consumer Investigative Reporting Agencies Act (CIRA) serves as California's primary screening regulation. This law establishes stricter requirements than federal guidelines. Additionally, it provides enhanced tenant protections and disclosure obligations for landlords.

California rental screening process requirements apply to all residential properties. This includes single-family homes, apartments, and condominiums. Furthermore, these laws cover both individual landlords and large property management companies.

The legal framework combines state and federal regulations effectively. Federal Fair Credit Reporting Act (FCRA) provides baseline protections. Meanwhile, California laws expand these protections significantly for tenant rights.

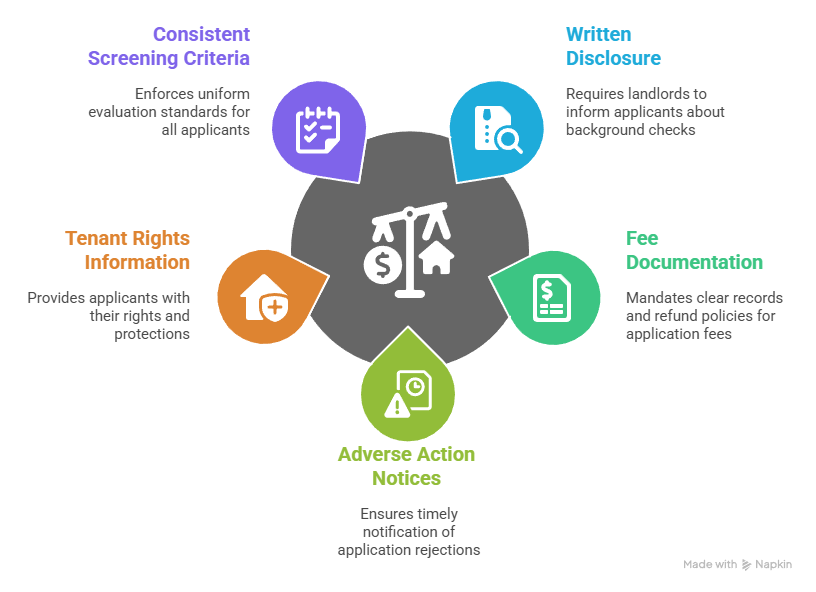

Key California Rental Application Requirements:

- Written disclosure before any background investigation begins

- Itemized application fee documentation and refund policies

- Adverse action notices within seven business days of rejection

- Tenant rights information provided with all screening materials

- Consistent application of screening criteria across all applicants

Compliance violations can result in substantial financial penalties. Statutory damages range from $100 to $1,000 per incident. Additionally, landlords may face attorney fees and actual damages claims.

Recent enforcement trends show increased scrutiny of screening practices. Consequently, landlords must maintain current knowledge of legal requirements. Professional legal consultation can help navigate complex compliance issues effectively.

Consumer Investigative Reporting Agencies Act (CIRA) Requirements

CIRA Disclosure Obligations

The Consumer Investigative Reporting Agencies Act (CIRA) mandates specific disclosure requirements. Landlords must provide written notice before conducting any tenant background investigation. This notice must be separate from the rental application itself.

The disclosure must identify the screening company being used. It must also explain the tenant's rights to dispute information. Furthermore, contact information for obtaining screening reports must be included clearly.

CIRA requires landlords to inform applicants about additional disclosure rights. Tenants can request information about screening criteria and processes. They can also ask about minimum credit score requirements and evaluation policies.

CIRA Investigation Standards

When tenants dispute screening information, specific procedures must be followed. Landlords must halt adverse action decisions until investigations are completed. This requirement prevents rejections based on contested information.

Screening companies must complete investigations within 30 days. They must provide written results to both tenants and landlords. Moreover, inaccurate information must be corrected or removed immediately.

California Tenant Background Check Procedures

California tenant background check laws establish strict parameters for information gathering. Landlords must follow consistent procedures for all applicants. Additionally, they must maintain documentation demonstrating objective screening standards.

The screening process begins with proper disclosure to applicants. Next, landlords must obtain written consent before conducting investigations. Then, they must apply consistent evaluation criteria across all applications.

Background check companies must comply with both state and federal regulations. They must provide accurate, up-to-date information only. Furthermore, they must have procedures for handling disputes and corrections.

Permitted Background Check Components:

| Information Type | Time Limitations | Usage Restrictions |

| Credit history | 7 years for most items | Must be relevant to rental ability |

| Criminal convictions | 7 years generally | Must relate to legitimate safety concerns |

| Eviction records | 7 years maximum | Cannot include sealed or dismissed cases |

| Employment verification | Current and recent only | Limited to income confirmation |

Landlords cannot use certain types of information in screening decisions. Arrests without convictions are prohibited considerations. Similarly, sealed or expunged records cannot be accessed or used.

The California rental screening process must be applied uniformly. Landlords cannot use different standards for different applicants. This consistency requirement prevents discriminatory screening practices effectively.

Third-party screening companies often help ensure compliance. They provide standardized procedures and required disclosures. Moreover, they maintain current knowledge of legal requirements and updates.

Application Fees and Cost Limitations

California Civil Code Section 1950.6 strictly regulates application fees. Landlords can only charge actual screening costs incurred. These fees cannot include profit margins or administrative markups.

Current market rates for legitimate screening typically range from $30 to $50. However, landlords must justify these amounts with actual expenses. They must also provide itemized receipts when requested by applicants.

Application fees must be refunded under specific circumstances. If screening is not performed, the entire fee must be returned. Additionally, any unused portion of fees must be refunded promptly.

Required Fee Refund Situations:

- Application withdrawal before screening begins

- Landlord decision not to screen due to application volume

- Screening company fails to provide services paid for

- Fees collected exceed actual screening costs incurred

The refund process must be completed within 30 days. Landlords must maintain detailed records of all fee transactions. Furthermore, they must be able to demonstrate actual costs for each fee charged.

Many landlords use professional screening services to ensure compliance. These services handle fee collection, screening, and refunds automatically. They also provide required documentation and legal compliance support.

Violations of fee regulations result in significant penalties. Tenants can recover wrongfully collected fees plus damages. Additionally, they may be entitled to attorney fees and court costs.

Fair Housing Act in California Protections

Protected Classes Under California Law

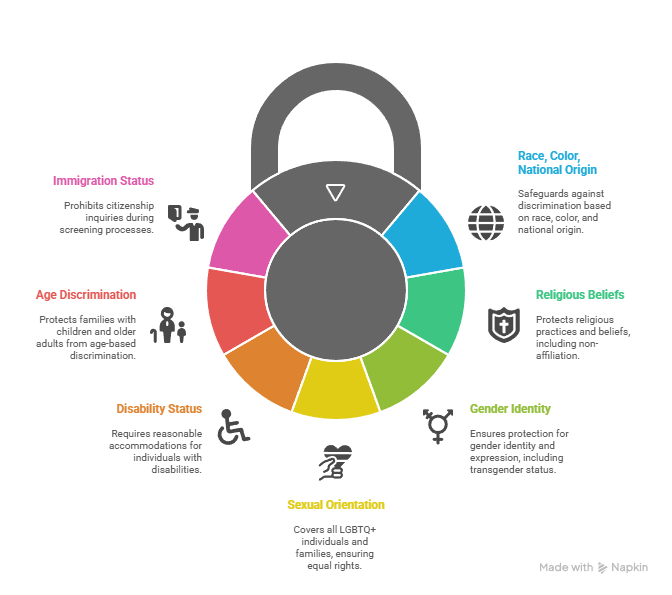

The Fair Housing Act in California provides broader protections than federal law. The Unruh Civil Rights Act and Fair Employment and Housing Act expand coverage significantly. These laws protect additional characteristics beyond federal requirements.

California protects source of income from discrimination. This includes government benefits, housing vouchers, and disability payments. Landlords must accept these income sources in qualification evaluations.

California Fair Housing Protected Classes:

- Race, color, and national origin discrimination protection

- Religious beliefs and practices, including lack of religious affiliation

- Gender identity and expression, including transgender status protection

- Sexual orientation, covering all LGBTQ+ individuals and families

- Disability status, requiring reasonable accommodations in screening procedures

- Age discrimination, particularly for families with children and older adults

- Immigration status, prohibiting citizenship inquiries during screening process

Reasonable Accommodations in Screening

Landlords must provide reasonable accommodations for applicants with disabilities. This may include accepting alternative documentation or modifying standard procedures. These accommodations must be provided unless they create undue hardship.

Common accommodation requests include modified application procedures. Some applicants need additional time for completion. Others require alternative income documentation due to disability-related circumstances.

Service animals cannot be restricted despite "no pets" policies. This accommodation applies during screening and throughout tenancy. Moreover, landlords cannot charge additional fees for service animals.

Credit and Income Screening Standards

Credit screening standards must be consistent and reasonable. Landlords cannot apply arbitrary credit score minimums without justification. Additionally, they must consider the complete financial picture of applicants.

Income verification requirements must comply with privacy laws. Landlords can request basic employment confirmation and income amounts. However, they cannot require detailed salary histories or excessive financial information.

The standard income-to-rent ratio is typically 2.5 to 3 times monthly rent. This ratio must be applied consistently across all applicants. Furthermore, landlords must consider all legal income sources equally.

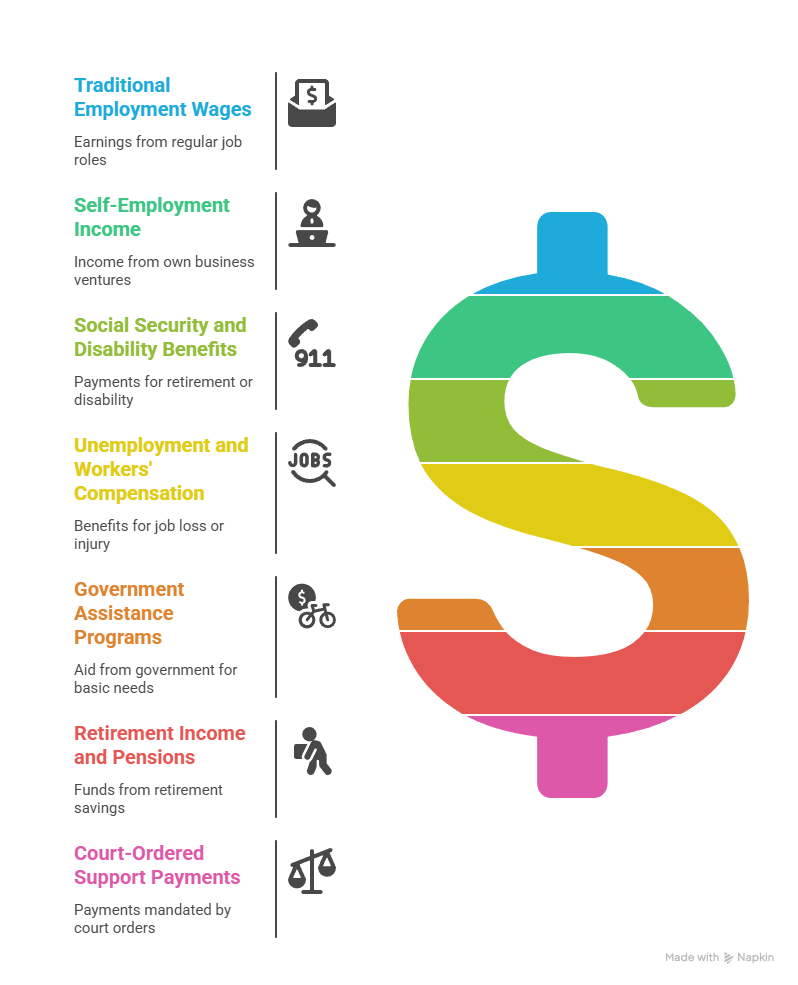

Acceptable Income Sources for Qualification:

- Traditional employment wages and salaries

- Self-employment income with proper documentation

- Social Security and disability benefit payments

- Unemployment compensation and workers' compensation benefits

- Government assistance programs and housing vouchers

- Retirement income and pension payments

- Court-ordered support payments and alimony

Alternative income verification may be required for non-traditional sources. Bank statements can document consistent income deposits. Additionally, benefit letters provide official income confirmation.

Debt-to-income analysis should consider total financial obligations. This includes existing rent, loan payments, and other debts. However, medical debt related to disabilities may require special consideration.

Credit report errors must be addressed during the screening process. Tenants have the right to dispute inaccurate information. Landlords must allow reasonable time for corrections before making final decisions.

Criminal History Evaluation Guidelines

Seven-Year Reporting Limitations

California law limits criminal history reporting to seven years for most offenses. This aligns with federal Fair Credit Reporting Act guidelines. However, certain exceptions apply for serious felonies and high-rent properties.

Arrests that did not result in convictions cannot be considered. This protection prevents discrimination based on dismissed charges or acquittals. Only actual convictions, guilty pleas, or deferred adjudication may be evaluated.

Sealed and expunged records are not available for screening purposes. These records have been legally cleared from public access. Therefore, landlords cannot access or use this information in decisions.

Legitimate Criminal History Considerations

Landlords may consider criminal history that relates to legitimate rental concerns. Violence against persons poses direct safety risks to other tenants. Similarly, property crimes may indicate risks to rental property.

Permitted Criminal History Evaluations:

- Violent felonies: Assault, battery, domestic violence within seven years

- Property crimes: Burglary, vandalism, arson directly related to rental risks

- Drug manufacturing: Large-scale distribution or production, not simple possession

- Financial crimes: Fraud, embezzlement relevant to rent payment ability

Prohibited Criminal History Discrimination:

- Arrests without conviction: Cannot be considered under any circumstances

- Expunged or sealed records: Not accessible for legitimate screening purposes

- Juvenile offenses: Generally sealed and unavailable for adult screening

- Minor infractions: Traffic violations, public intoxication, or similar charges

Blanket policies excluding all applicants with criminal histories are problematic. These policies likely violate fair housing laws. Instead, landlords must evaluate each case individually and demonstrate legitimate business reasons.

Recent legislative trends favor rehabilitation and second chances. Courts increasingly scrutinize criminal history policies for discriminatory impact. Consequently, landlords should focus on relevant, recent offenses only.

Tenant Rights During Screening Process

Tenants have extensive rights throughout the California rental screening process. These rights include access to information used in decisions. Additionally, tenants can dispute inaccurate screening information effectively.

The right to receive screening report copies is fundamental. Tenants can request these reports within 60 days of application. Moreover, they can obtain reports used in adverse action decisions.

Dispute procedures provide meaningful recourse for inaccurate information. Tenants can challenge errors directly with screening companies. They can also work with landlords to correct misunderstandings.

Essential Tenant Screening Rights:

| Right | Timeline | Process |

| Pre-screening disclosure | Before investigation begins | Written notice required |

| Report access | Within 60 days of request | Free copy for adverse action |

| Dispute resolution | 30 days for investigation | Written response required |

| Adverse action notice | 7 business days after decision | Detailed reasons provided |

| Accommodation requests | Reasonable timeline allowed | Interactive process required |

Privacy rights protect tenants from excessive information requests. Landlords cannot require irrelevant personal information. Furthermore, they must safeguard sensitive data collected during screening.

Financial privacy protections limit income verification requirements. Landlords can confirm employment and basic income amounts. However, they cannot access detailed financial records without legitimate business need.

Tenants who experience screening violations have legal remedies available. They can recover statutory damages and attorney fees. Additionally, they may seek injunctive relief to stop discriminatory practices.

Adverse Action Procedures and Requirements

Notification Timing and Content

Adverse action notices must be provided within seven business days of rejection decisions. This timeline is shorter than federal requirements. Additionally, the notice content must be more detailed than federal standards.

The notice must include specific reasons for denial clearly stated. Generic rejections citing "failed to meet criteria" are insufficient. Instead, landlords must identify particular factors that led to rejection.

Screening company contact information must be included in adverse action notices. Tenants need this information to obtain report copies and dispute errors. Furthermore, instructions for accessing reports must be clear and complete.

Post-Rejection Tenant Rights

After receiving adverse action notices, tenants have several important rights. They can obtain free copies of screening reports used in decisions. They can also dispute any inaccurate information found in reports.

The dispute process allows tenants to challenge errors effectively. Screening companies must investigate disputes within 30 days. Moreover, they must provide written results to all parties involved.

Landlords must reconsider applications if disputed information is corrected. This requirement ensures accurate decision-making based on correct information. However, landlords are not required to approve applications automatically.

Employment and Business Owner Considerations

Employment Screening Law Overlap

California employment background check laws often intersect with rental screening. This affects landlords who evaluate credit history and criminal records. It also impacts job seekers and business owners applying for rentals.

"Ban the box" legislation affects initial criminal history assessment procedures. Landlords cannot ask about criminal history on initial applications. However, they can inquire later in the screening process.

Salary history bans impact income verification for self-employed applicants. Landlords cannot request detailed salary information from previous positions. Instead, they must rely on current income documentation.

Professional Reference Standards

Employment verification in rental screening must comply with privacy laws. Landlords can confirm basic employment information and income. However, they cannot request detailed job performance evaluations.

Professional references should focus on rental-relevant characteristics. Reliability, responsibility, and character traits are appropriate topics. Conversely, detailed work performance discussions may violate employment privacy rights.

Business owners may need alternative income documentation methods. Traditional employment verification doesn't apply to self-employed applicants. Therefore, tax returns, bank statements, or accountant letters may be necessary.

Compliance Best Practices and Documentation

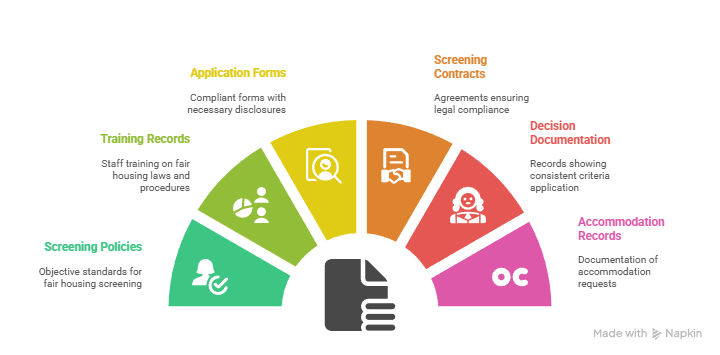

Successful compliance requires comprehensive written policies and consistent procedures. Landlords should develop clear screening criteria that outline qualification standards. These policies must be applied uniformly across all applicants.

Documentation is essential for defending screening decisions legally. Maintain detailed records of screening criteria and application reviews. Additionally, document all decision-making processes and reasoning clearly.

Essential Compliance Documentation:

- Written screening policies with objective qualification standards clearly stated

- Training records for staff on fair housing laws and procedures

- Compliant application forms with all required disclosures and notices included

- Screening company contracts that ensure California law compliance

- Decision documentation showing consistent application of stated criteria

- Accommodation request records and interactive process documentation

Regular policy updates ensure continued compliance with changing laws. California housing laws evolve frequently through legislation and court decisions. Therefore, landlords must stay informed about legal developments.

Professional property management companies provide valuable compliance support. They offer screening services, legal updates, and training programs. Moreover, they maintain current knowledge of complex regulatory requirements.

Staff training on fair housing laws prevents inadvertent violations. All employees involved in screening must understand legal requirements. Additionally, they must know proper procedures for handling accommodation requests.

Technology solutions can streamline compliance and reduce errors. Automated screening systems ensure consistent application of criteria. Furthermore, they maintain required documentation and provide audit trails.

Recommended Compliance Tools:

| Tool Type | Purpose | Benefits |

| Written policies | Establish clear standards | Consistent application, legal defense |

| Training programs | Educate staff on requirements | Prevent violations, improve procedures |

| Screening software | Automate compliance processes | Reduce errors, maintain documentation |

| Legal updates | Stay current with law changes | Avoid outdated practices, ensure compliance |

| Professional services | Expert guidance and support | Reduce liability, improve efficiency |

Regular compliance audits help identify potential problems early. Review screening procedures, documentation, and outcomes periodically. This proactive approach prevents violations and improves overall compliance.

Emergency procedures should address compliance violations when they occur. Quick corrective action can minimize legal liability. Additionally, proper response demonstrates good faith compliance efforts.

Legal Remedies and Enforcement

Tenant Legal Remedies

Tenants who experience screening law violations have multiple legal remedies available. Statutory damages provide compensation even without proving actual financial harm. These damages range from $100 to $1,000 per violation.

Actual damages compensate tenants for real financial losses from violations. This may include additional housing costs or moving expenses. Furthermore, emotional distress damages may be available in discrimination cases.

Attorney fees are often recoverable in fair housing and consumer protection cases. This provision makes legal representation accessible to violation victims. Additionally, it creates strong incentives for landlord compliance.

Enforcement Agency Oversight

The California Department of Fair Employment and Housing (DFEH) enforces fair housing laws. This agency investigates discrimination complaints and pursues enforcement actions. Moreover, it provides education and guidance to landlords and tenants.

Local fair housing organizations also provide enforcement support. They investigate complaints and assist with legal proceedings. Additionally, they offer education and mediation services.

Federal agencies may also investigate violations of federal laws. The Consumer Financial Protection Bureau oversees FCRA compliance. Meanwhile, HUD enforces federal fair housing requirements.

Recent enforcement trends show increased scrutiny of screening practices. Agencies focus particularly on criminal history and source of income discrimination. Consequently, landlords must ensure their practices comply fully with current requirements.

Conclusion

California tenant screening laws create a comprehensive framework that balances landlord business needs with essential tenant protections. These regulations require careful attention to disclosure requirements, fee limitations, and fair housing compliance. Success depends on understanding both the Consumer Investigative Reporting Agencies Act (CIRA) and Fair Housing Act in California requirements. Whether you are a tenant protecting your rights or a landlord ensuring compliance, these laws provide crucial protections that benefit California's rental housing market. Professional legal guidance can help navigate complex situations and ensure full compliance with evolving requirements.

Frequently Asked Questions

How much can California landlords charge for application fees?

California landlords can only charge actual screening costs, typically $30-50, and must provide itemized receipts when requested. Fees exceeding actual expenses must be refunded, and no screening fees can be charged if background checks aren't performed.

Can landlords in California reject applicants based on criminal history?

Landlords can consider criminal convictions within seven years if directly related to rental risks, such as violent crimes or property damage. However, arrests without convictions, expunged records, and minor offenses cannot be used for rejection decisions.

What disclosure requirements must California landlords follow for tenant screening?

Landlords must provide written disclosure before screening that identifies the screening company, explains dispute rights, and provides contact information. After adverse action, detailed written notice must be provided within seven business days explaining specific rejection reasons.

Are California tenants entitled to copies of their screening reports?

Yes, tenants have the right to obtain copies of all screening reports used in rental decisions. When applications are rejected, tenants can request free copies within 60 days and dispute any inaccurate information with screening companies.

Can California landlords discriminate based on source of income?

No, California prohibits sources of income discrimination, including rejection based on government benefits, housing vouchers, disability payments, or other legal income sources. Landlords must accept these income types in qualification evaluations.

What happens if landlords violate California tenant screening laws?

Violations can result in statutory damages of $100-1,000 per incident, plus actual damages and attorney fees. Tenants can also seek injunctive relief and may recover additional damages for fair housing violations or discriminatory practices.

Do California screening laws apply to all rental properties?

Yes, California tenant screening laws apply to all residential rental properties, including single-family homes, apartments, and mixed-use buildings. Local ordinances may impose additional requirements in certain cities.

How long do California landlords have to provide adverse action notices?

Adverse action notices must be provided within seven business days of the rejection decision. The notice must include specific reasons for denial, screening company contact information, and instructions for obtaining screening reports and disputing information.

Additional Resources

- California Department of Fair Employment and Housing - Fair Housing Guide

https://www.dfeh.ca.gov/housing/ - Consumer Financial Protection Bureau - Tenant Screening Reports Guide

https://www.consumerfinance.gov/consumer-tools/tenant-screening-reports/ - California Civil Code Section 1950.6 - Application Screening Fees

https://leginfo.legislature.ca.gov/faces/codes_displaySection.xhtml?sectionNum=1950.6&lawCode=CIV - Fair Credit Reporting Act - Federal Trade Commission Guide

https://www.ftc.gov/enforcement/rules/rulemaking-regulatory-reform-proceedings/fair-credit-reporting-act - California Apartment Association - Legal Resources and Compliance Tools

https://www.caanet.org/ - HUD Fair Housing Act - Tenant Rights and Landlord Obligations

https://www.hud.gov/program_offices/fair_housing_equal_opp/fair_housing_act_overview - California Consumer Investigative Reporting Agencies Act - Full Text

https://leginfo.legislature.ca.gov/faces/codes_displayText.xhtml?lawCode=CIV&division=3.&title=1.81.5.

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.