Background check violations cost employers an average of $2.6 million in class action settlements, with 73% of lawsuits stemming from three preventable mistakes: improper disclosure format, missing pre-adverse action notices, and inadequate authorization forms. Understanding FCRA compliance isn't optionalâÂÂit's essential for survival in today's litigation-heavy employment landscape.

Key Takeaways

- FCRA Compliance is Non-Negotiable: Violations average $2.6M in class action settlements, with individual penalties ranging from $100-$2,500 per occurrence plus potential criminal liability for willful violations.

- The "Big 3" Violations: 73% of lawsuits stem from three mistakes: improper disclosure format (not standalone), missing pre-adverse action notices, and inadequate authorization forms.

- State Laws Add Complexity: Beyond federal FCRA, 35 states have additional requirementsâÂÂCalifornia's ICRAA and New York's Article 23-A being the strictest with penalties up to $20,000 per violation.

- Technology â Compliance: Automated screening platforms don't guarantee compliance; 45% of employers using ATS systems still commit adverse action timing violations.

- Compliance Training Pays Off - $4âÂÂ$6 ROI per Dollar Spent: Investing in compliance and safety training yields measurable returnsâÂÂstudies suggest organizations save approximately $4 to $6 for every dollar spent by avoiding fines, reducing workplace incidents, and minimizing legal exposure (OSHA, n.d.; SHRM, 2024).

As a human resources specialist, I have witnessed firsthand how compliance with background checks is often viewed as nothing more than administrative paperworkâÂÂuntil something goes wrong. One missed disclosure or ignored pre-adverse action notice can ruin it all: trust, reputation, and financial well-being. The ramifications go beyond financial payouts; they also involve the stress reflected in the eyes of leadership, the interruption of business, and the negative effects on candidate experience. Compliance with the Fair Credit Reporting Act (FCRA) is more than a legal mandateâÂÂit is about protecting people, processes, and organizational goals. To create workplaces with integrity, itâÂÂs critical that we get this right upfront.

Introduction

$2.6 million - the average FCRA class action settlement that employers face when background check violations spiral into lawsuits. In recent years alone, major corporations have paid over $45 million in penalties for seemingly minor compliance oversights that could have been prevented with proper procedures.

This comprehensive guide reveals the exact violations that trigger these massive settlements, provides actionable compliance frameworks, and delivers the tools you need to protect your organization from becoming the next costly headline. Whether you're an HR professional, legal counsel, or business owner, understanding these violations isn't optionalâÂÂit's essential for survival in today's litigation-heavy employment landscape.

Definition: Background Check Violations

Background check violations occur when employers fail to comply with FCRA requirements during pre-employment screening, including improper disclosure, lack of consent, or adverse action non-compliance. These violations can result in penalties ranging from $100-$1,000 per violation, plus potential class action lawsuits averaging $2.6 million in settlements.

Types of Background Check Violations

Background check violations fall into three primary categories: federal FCRA requirements, state-specific laws, and industry regulations. Each layer adds complexity and potential liability, with federal violations forming the foundation of most expensive lawsuits. Understanding these violation types helps employers identify their specific risk exposure and implement targeted compliance strategies.

FCRA Violations: The Federal Foundation

The Fair Credit Reporting Act establishes the baseline requirements that every employer must follow, regardless of state location. These federal violations form the foundation of most lawsuits and carry the heaviest penalties.

- Disclosure Failures represent the most common violation type, occurring when employers combine background check disclosures with employment applications or other documents. The FCRA requires a "clear and conspicuous" standalone disclosure that cannot be buried in multi-page application packets.

- Authorization Issues emerge when employers obtain verbal consent, use outdated authorization forms, or fail to collect proper signatures. Written authorization must be obtained before accessing any consumer report information, and the authorization must be separate from other employment documents.

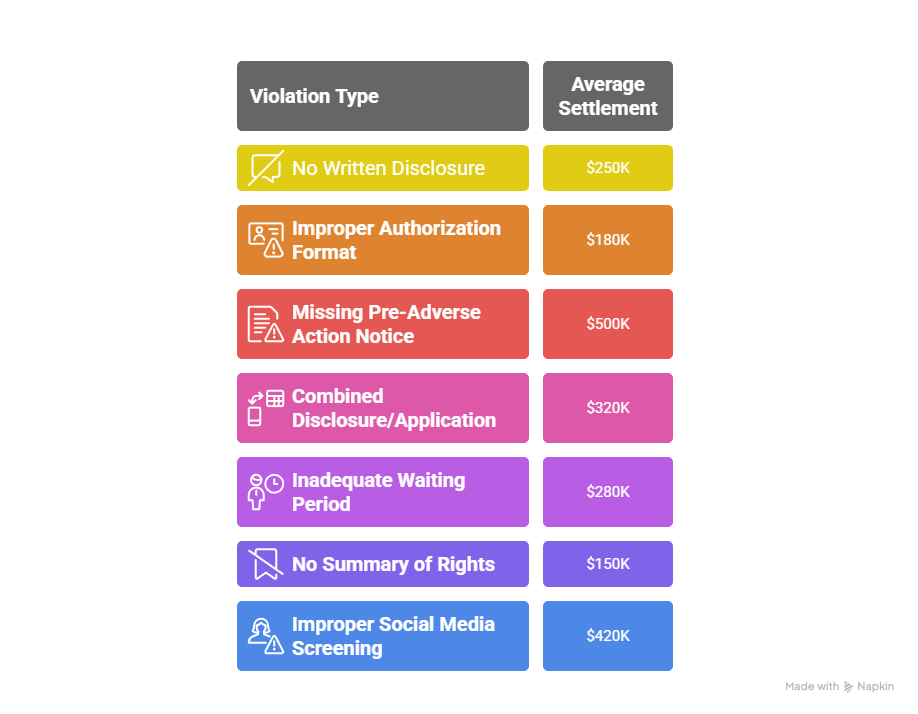

- Adverse Action Non-Compliance triggers when employers fail to follow the two-step adverse action process: providing pre-adverse action notices with required waiting periods, then sending final adverse action letters with proper dispute instructions. FCRA violations carry significant financial consequences, with Section 604 improper disclosure violations averaging $250,000 in settlements, Section 606 no authorization violations averaging $180,000, and Section 615 adverse action failures commanding the highest average settlements at $500,000. These substantial settlement amounts reflect the serious nature of FCRA compliance failures and underscore the importance of properly implementing background check procedures to avoid costly legal exposure.

Understanding these fundamental FCRA requirements is critical since federal violations often serve as the foundation for more complex multi-jurisdictional lawsuits that can exponentially increase financial exposure. The substantial settlement amounts demonstrate that background check violations are not minor compliance issues but serious legal risks that can devastate organizational budgets and operations. Proper implementation of FCRA procedures is essential for preventing these costly violations and protecting against the cascading legal consequences that follow non-compliance.

State-Specific Violations: The Complexity Layer

Thirty-five states have enacted additional background check requirements that exceed federal FCRA standards, creating a complex compliance landscape where employers must navigate multiple legal frameworks simultaneously.

| Law or Regulation | Details |

|---|---|

| California's ICRAA Requirements | California's ICRAA (Investigative Consumer Reporting Agencies Act) imposes stricter disclosure requirements, mandates specific authorization language, and requires additional consumer rights notifications. Violations can result in penalties up to $20,000 per occurrence, significantly exceeding federal maximums. |

| New York's Article 23-A | New York's Article 23-A prohibits employers from inquiring about criminal history until after conditional job offers, requires individualized assessments of criminal convictions, and mandates specific appeal procedures. Non-compliance can void employment decisions and trigger discrimination claims. |

| Ban-the-Box Laws | Ban-the-Box laws in 37 states and 150+ cities create timing restrictions on criminal history inquiries, with violations potentially triggering both FCRA and civil rights lawsuits simultaneously. |

Navigating the complex web of state-specific background check violations requires maintaining compliance systems that address federal, state, and local requirements simultaneously. The potential for overlapping violations means that a single screening error can trigger multiple enforcement actions with compounding penalties that far exceed federal FCRA minimums. Organizations operating across multiple jurisdictions must invest in comprehensive compliance programs or risk facing costly litigation from background check violations that could have been prevented with proper legal guidance and systematic policy implementation.

Industry-Specific Violations: Sector Complications

Certain industries face additional screening requirements that create unique violation risks beyond standard FCRA compliance.

- Transportation Industry: Transportation employers subject to DOT regulations must comply with specialized drug testing, driving record, and safety performance requirements. Violations can result in both FCRA penalties and DOT enforcement actions that threaten operating licenses.

- Healthcare Industry: Healthcare organizations must navigate OIG exclusion list requirements, state licensing verifications, and patient safety regulations. Improper screening can trigger Joint Commission sanctions and Medicare/Medicaid participation restrictions.

- Financial Services Industry: Financial services firms face FINRA background check requirements for registered representatives, with violations potentially resulting in regulatory sanctions and business operation restrictions.

For HR professionals and employers in regulated industries, background check violations can trigger cascading regulatory consequences that extend far beyond FCRA penalties, potentially resulting in multiple enforcement actions and operational disruptions from various regulatory bodies. Organizations in transportation, healthcare, and financial services must develop specialized compliance frameworks that address both federal employment screening laws and their sector's unique regulatory requirements. Investing in industry-specific training and robust monitoring systems can help prevent background check violations that could jeopardize not only individual cases but your organization's ability to operate within your industry's regulatory framework.

The 7 Most Costly Background Check Violations

These seven violation types account for 89% of all FCRA class action settlements, with each representing specific compliance failures that trigger automatic liability. The settlement amounts reflect real lawsuit outcomes from major corporations over the past three years. Understanding these violations helps employers prioritize their compliance efforts and allocate resources to prevent the most expensive mistakes.

Legal Consequences & Real Penalties

FCRA penalties extend far beyond statutory fines, encompassing class action settlements, individual damages, and attorney fees that can destroy businesses. The financial exposure multiplies rapidly when violations affect multiple employees, creating systemic liability that courts view as willful misconduct. Understanding the full penalty structure helps employers grasp the true cost of non-compliance and justify investment in prevention measures.

FCRA Penalty Structure

Understanding the financial exposure from background check violations requires examining both statutory penalties and real-world settlement amounts that demonstrate the true cost of non-compliance.

| Violation Type | Per-Occurrence Fine | Class Action Risk | Criminal Liability |

| Willful | $1,000-$2,500 | High (98%) | Possible |

| Negligent | $100-$1,000 | Medium (65%) | No |

| Knowing False Pretenses | $5,000 + 1 year | N/A | Yes |

Recent Settlement Examples

These settlements represent actual outcomes from major corporations that faced FCRA violations, demonstrating how seemingly minor compliance failures escalate into multi-million dollar lawsuits. Each case provides specific lessons about violation types and their financial consequences. The affected employee numbers show how violations compound across large organizations, multiplying damages exponentially.

| Company | Violation | Settlement | Affected Employees | Key Lesson |

|---|---|---|---|---|

| Target Corporation | Combined disclosure forms with employment applications | $2.8 million | 40,000 | Standalone disclosure requirements cannot be compromised for operational convenience |

| Uber Technologies | Inadequate adverse action procedures for driver screening | $1.9 million | 15,000 | Gig economy classification doesn't eliminate FCRA obligations |

| Whole Foods Market | Improper use of arrest records in hiring decisions | $3.2 million | 28,000 | Conviction-only policies must be consistently applied and documented |

The pattern across these settlements reveals that background check violations create exponential financial risk as organizations scale, with even Fortune 500 companies suffering significant monetary losses from compliance oversights. Organizations of all sizes must recognize that FCRA compliance failures can quickly transform from operational inconveniences into business-threatening financial disasters.

Individual Damages Beyond Statutory Penalties

Employees who successfully prove FCRA violations can recover multiple damage types that significantly exceed statutory minimums:

- Actual damages include lost wages, emotional distress, and career advancement opportunities, with awards commonly ranging from $5,000 to $50,000 per individual.

- Punitive damages for willful violations can multiply awards by 3-10 times, particularly when employers demonstrate deliberate indifference to compliance requirements.

- Attorney fees and costs are recoverable under FCRA, meaning employers often pay opposing counsel fees even in cases involving minimal actual damages.

Understanding the full scope of potential financial exposure from background check violations is essential for HR professionals and employers seeking to protect their organizations from costly litigation. The combination of actual damages, punitive damages, and mandatory attorney fees can result in settlements that far exceed statutory minimums and many companies' risk expectations. By implementing comprehensive FCRA compliance programs and ensuring proper staff training, employers can significantly reduce their exposure to these substantial financial risks. The investment in proactive compliance measures is minimal compared to the potential costs of defending against background check violations and the reputational damage that follows non-compliance.

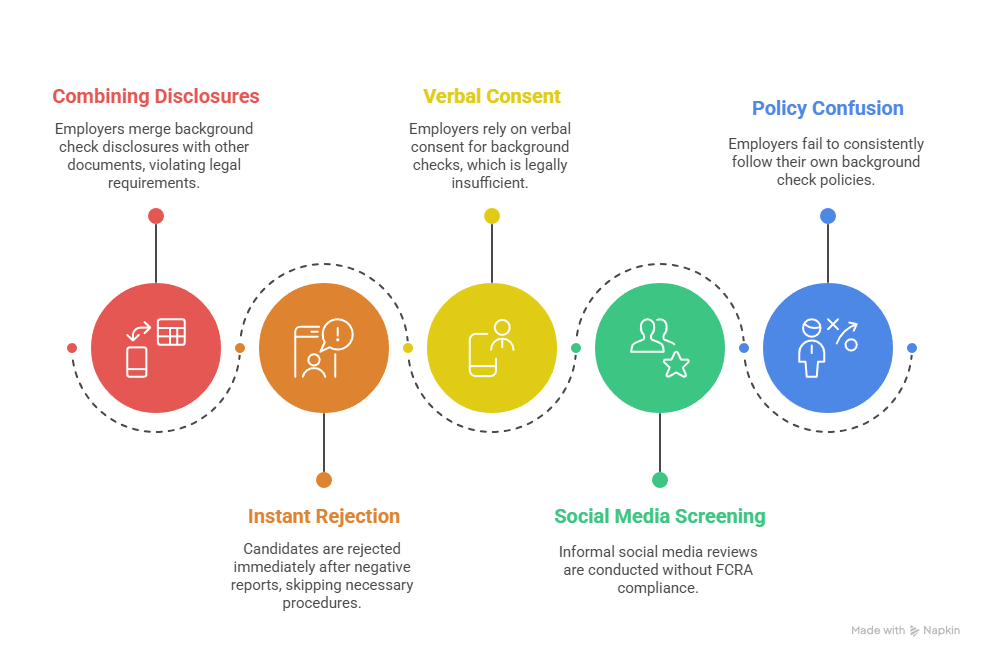

Common Employer Mistakes

Most FCRA violations stem from five predictable mistakes that employers make repeatedly, often due to operational convenience or misunderstanding of legal requirements. These errors appear minor but trigger automatic liability when discovered, creating systematic violations across multiple employees. Recognizing these patterns helps employers identify and eliminate the most dangerous compliance gaps before they become expensive lawsuits.

The "Standalone Disclosure" Trap

The most expensive mistake employers make involves combining background check disclosures with employment applications, job postings, or other documents. Federal courts have consistently ruled that disclosures must appear on completely separate documents with no other content.

| â Non-Compliant Example | â Compliant Solution |

|---|---|

| Including disclosure language within employment applications, employee handbooks, or job postings violates the "clear and conspicuous" requirement and triggers automatic liability. | Create dedicated disclosure documents that contain only background check authorization language and required consumer rights information, with separate signature lines for each purpose. |

The fix requires operational changes to hiring workflows, but the alternativeâÂÂaverage settlements of $250,000 for disclosure violationsâÂÂmakes compliance restructuring a cost-effective investment.

The "Instant Rejection" Mistake

Employers frequently violate adverse action requirements by immediately rejecting candidates after receiving negative background reports, skipping the required pre-adverse action notice and waiting period.

| The Legal Timeline | |

|---|---|

| Day 1 | Receive background report with disqualifying information |

| Days 2âÂÂ3 | Send pre-adverse action notice with report copy and Summary of Rights |

| Days 4âÂÂ8 | Mandatory waiting period (reasonable time for dispute) |

| Day 9+ | Final adverse action letter with dispute instructions |

The "Verbal Consent" Shortcut

Phone interviews and virtual hiring processes have increased reliance on verbal authorization for background checks, creating significant legal exposure since FCRA requires written consent. Employers must collect signed authorization forms (physical or electronic) with proper documentation including date and time stamps for electronic signatures, IP address and device information for virtual signings, and comprehensive retention of authorization records for audit purposes. The convenience of verbal consent never justifies the legal risk, as courts consistently rule that only written authorization satisfies FCRA requirements regardless of hiring format or urgency.

The "Social Media Screening" Trap

Employers increasingly conduct informal social media reviews without proper FCRA compliance, not realizing that third-party social media screening services trigger consumer reporting requirements. While in-house reviews by hiring managers are generally not covered by FCRA, any use of third-party screening services or automated social media tools requires full FCRA compliance including disclosure, authorization, and adverse action procedures. The distinction between permissible internal reviews and regulated third-party screening often confuses employers, leading to violations when they assume all social media screening falls outside FCRA requirements.

The "Background Check Policy" Confusion

Many employers create detailed background check policies but fail to follow them consistently, creating evidence of willful FCRA violations when litigation emerges. Policy consistency requires documented procedures for each screening type, comprehensive training records for all personnel involved in hiring, regular policy updates reflecting law changes, and detailed audit trails demonstrating consistent application across all candidates. Courts view policy inconsistency as evidence of willful misconduct, making documented compliance procedures both a protection and potential liability depending on actual implementation practices.

These five mistakes account for over 80% of FCRA class action lawsuits, yet each one is entirely preventable with proper procedures and training. The patterns repeat across industries because employers prioritize operational convenience over legal compliance, not realizing that shortcuts create systematic violations. Eliminating these common errors transforms background screening from a major liability risk into a competitive advantage that protects both employers and job candidates.

FCRA Compliance Framework & Best Practices

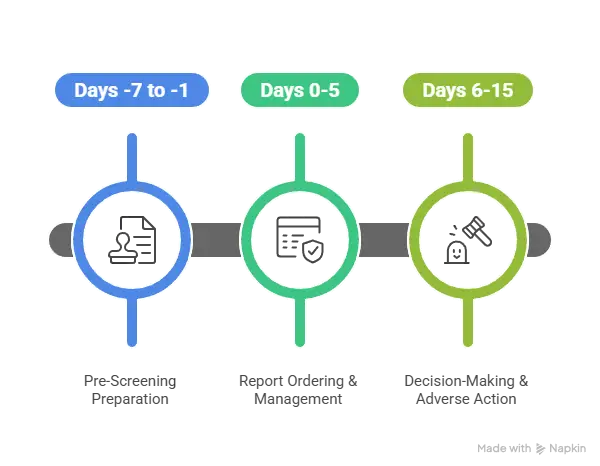

Phase 1: Pre-Screening Preparation (Days -7 to -1)

The foundation of FCRA compliance begins with establishing proper documentation and authorization procedures before ordering any background checks. Creating standalone disclosure documents represents the most critical step, requiring employers to develop separate forms for each screening type that contain only disclosure language and consumer rights information. These forms must be reviewed annually and meet state-specific requirements that often exceed federal minimums.

Obtaining written authorization forms the second pillar of preparation, requiring separate signed authorization for each report type while maintaining electronic signature audit trails. The authorization process must include proper storage procedures and expiration protocols to prevent use of outdated permissions. State-specific requirement verification adds complexity, as employers must cross-reference applicable laws for additional obligations, identify ban-the-box timing restrictions, and document compliance rationale for audit purposes.

Phase 2: Report Ordering & Management (Days 0-5)

Once proper authorization exists, employers must focus on ordering reports from compliant Consumer Reporting Agencies while maintaining strict security protocols. The ordering process requires CRA compliance verification, permissible purpose documentation, and secure transmission protocols that protect consumer information. Clear report retention and destruction schedules must comply with federal and state requirements.

Security protocols demand sophisticated data handling that encrypts background information during transmission and limits access to personnel with legitimate business needs. Comprehensive audit logging for report access ensures proper information handling, while staff training on confidentiality requirements creates a compliance culture. These protocols require regular testing and updates to address emerging cybersecurity threats and evolving privacy regulations.

Phase 3: Decision-Making & Adverse Action (Days 6-15)

The adverse action phase requires precise procedures when potentially disqualifying information is discovered. Pre-adverse action procedures begin with identifying disqualifying information, followed by sending notices that include report copies and Summary of Rights documents. The mandatory five-business-day waiting period provides candidates reasonable time to dispute inaccurate information and cannot be shortened.

Final adverse action processes require meticulous documentation of decision-making rationale to demonstrate consistent policy application across all candidates. The final letter must include clear dispute instructions and CRA contact information, while employers must maintain comprehensive records of all decisions. Implementation of appeal and reconsideration procedures provides additional due process rights while demonstrating commitment to fair hiring practices.

Technology & Prevention Solutions

Modern FCRA compliance requires sophisticated technology solutions that automate complex requirements while maintaining legal accuracy across multiple jurisdictions. These solutions eliminate human error in critical compliance areas like adverse action timing and state-specific disclosure requirements. The investment in compliance technology typically pays for itself within months by preventing a single major violation that could cost hundreds of thousands in settlements.

Essential Platform Features:

- Automated adverse action timeline management

- State-specific disclosure form generation

- Real-time regulatory update integration

- Audit trail documentation and reporting

| Platform Category | Implementation Cost | ROI Timeline | Compliance Rating |

| Enterprise HRIS Integration | $50,000-$200,000 | 6-12 months | High |

| Standalone Compliance Tools | $10,000-$50,000 | 3-6 months | Medium |

| Basic Automation | $2,000-$10,000 | 1-3 months | Low |

The key to successful compliance technology implementation lies in selecting platforms that integrate seamlessly with existing HR workflows while providing comprehensive audit capabilities. Organizations should prioritize solutions that offer real-time updates for changing regulations, as compliance requirements continue evolving across different jurisdictions. Ultimately, the right technology platform transforms FCRA compliance from a manual burden into an automated competitive advantage that protects both legal exposure and employer brand reputation.

Training & Certification Programs

Human error remains the leading cause of FCRA violations, making comprehensive training programs essential for sustainable compliance.

Effective training programs must cover federal FCRA requirements and recent updates, state-specific law variations with timing requirements, practical workflow implementation, and violation recognition protocols. Organizations can pursue several certification paths, including Professional Background Screening Association (PBSA) certification and National Association of Professional Background Screeners (NAPBS) training programs. Many companies also develop internal compliance certification programs alongside continuing education requirements for HR professionals. Regular training updates ensure staff stay current with evolving regulations and maintain competency in complex compliance areas. The investment in comprehensive training typically prevents costly violations while building organizational expertise that supports long-term compliance success.

ROI Analysis: Compliance Investment vs. Violation Costs

The return on investment for FCRA compliance programs demonstrates compelling financial justification, with prevention costs representing a fraction of potential violation exposure. Most mid-sized employers face violation risks exceeding $2 million annually, while comprehensive compliance programs typically cost under $50,000 to implement. This dramatic cost differential makes compliance investment one of the highest-ROI business decisions available to HR leaders.

Prevention Investment Calculator:

- Company size: 100-500 employees

- Annual hires: 200 new employees

- Current manual process risk: High

- Potential violation exposure: $2.4 million

- Compliance technology investment: $25,000

- Training and implementation: $15,000

- Annual compliance ROI: 6,000%

These calculations reflect real-world scenarios where single class action settlements often exceed $2 million, while comprehensive compliance programs protect against systematic violations across entire organizations. The 6,000% ROI demonstrates that even conservative estimates of violation probability make compliance investment financially essential. Beyond direct cost savings, proper compliance eliminates business disruption, reputation damage, and executive liability that accompany major FCRA lawsuits.

The mathematics strongly favor proactive compliance investment over reactive damage control, with every dollar spent on prevention saving an average of $12 in potential violation costs.

Future-Proofing Your Compliance Process

The background screening landscape continues evolving, with new regulations emerging that will impact compliance requirements over the next 2-3 years.

- AI and Machine Learning Screening: The Equal Employment Opportunity Commission has signaled increased scrutiny of automated screening tools, with proposed regulations requiring algorithmic bias testing and disparate impact analysis. Employers using AI-powered screening must prepare for enhanced documentation requirements and potential limitations on automated decision-making.

- Remote Hiring Considerations: Virtual hiring processes create new compliance challenges, particularly around electronic signature validity, identity verification, and cross-jurisdictional screening requirements. Remote work arrangements may trigger screening requirements in multiple states, requiring expanded compliance frameworks.

- Gig Economy Classifications: Recent court decisions have clarified that independent contractor classifications don't eliminate FCRA obligations for companies conducting background screening. Organizations using gig workers must implement full FCRA compliance procedures regardless of employment classification.

Conclusion

Background check violations represent one of the most preventable yet costly risks facing employers today, with the average class action settlement reaching $2.6 million and individual statutory damages mounting quickly at $100-$2,500 per violation. By implementing proper standalone disclosures, meticulous adverse action procedures, and comprehensive compliance frameworks, organizations can transform their screening process from a liability minefield into a competitive advantage. The question isn't whether organizations can afford to invest in FCRA complianceâÂÂit's whether they can afford not to, especially when prevention costs average just 8% of a single violation's potential impact. In today's litigation-heavy employment landscape, proactive compliance isn't just about avoiding penaltiesâÂÂit's about building sustainable hiring practices that protect both employers and job candidates while supporting business growth objectives.

Frequently Asked Questions

Sorting through background check compliance can seem intimidatingâÂÂespecially when stakes are high and the rules are constantly shifting. Whether you're an HR manager, a business owner, or a job candidate wanting to understand your rights, these frequently asked questions are designed to clarify common issues and help you steer clear of expensive missteps. Covering everything from consent obligations to legal timeframes, we've answered the most relevant questions so that you can move forward with confidence and compliance to the law.

What is considered a background check violation?

A background check violation occurs when an employer fails to follow FCRA requirements, including: not providing proper disclosure, failing to get written authorization, not following adverse action procedures, or using information improperly. Violations can result in fines of $100-$2,500 per occurrence plus potential lawsuits.

Can I sue for an illegal background check?

Yes, you can sue for FCRA violations within 2 years (5 years for willful violations). Damages include actual damages (lost wages, emotional distress), statutory damages ($100-$1,000 per violation), punitive damages for willful violations, plus attorney fees and costs.

What are the penalties for FCRA violations?

FCRA penalties include: Negligent violations: $100-$1,000 per violation; Willful violations: $1,000-$2,500 per violation or actual damages (whichever is greater); Class actions: Average $2.6 million settlement; Criminal penalties: Up to $5,000 and/or 1 year imprisonment for knowingly obtaining consumer reports under false pretenses.

How long do I have to file a background check complaint?

You have 2 years from the date you discovered the violation to file an FCRA lawsuit, or 5 years from the date the violation occurred for willful violations. For EEOC complaints related to discriminatory use of background checks, you have 180-300 days depending on your state.

What information requires consent on background checks?

Employers must obtain written consent before accessing: criminal records, credit reports, driving records, education verification, employment history, drug test results, and any other consumer report information. The consent must be on a standalone document, not combined with other forms.

Additional Resources

- Fair Credit Reporting Act (FCRA)

https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act - Background Checks: What Employers Need to Know (EEOC + FTC Guidance)

https://www.eeoc.gov/laws/guidance/background-checks-what-employers-need-know - Ban the Box: U.S. Cities, Counties, and States Adopt Fair Hiring Policies

https://www.nelp.org/publication/ban-the-box-fair-hiring-policies/ - Occupational Safety and Health Administration. (n.d.). Recommended practices for safety and health programs. U.S. Department of Labor. https://www.osha.gov/safety-management

- Society for Human Resource Management. (2024). Measuring the ROI of your training initiatives. https://www.shrm.org/labs/resources/measuring-the-roi-of-your-training-initiatives/

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.